SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2014

TRINITY

BIOTECH PLC

(Name of Registrant)

IDA Business

Park

Bray, Co. Wicklow

Ireland

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7):

¨

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

¨

No

x

If “Yes” is marked, indicate

below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Press Release dated July 29, 2014

|

|

|

|

|

|

|

Contact:

|

|

Trinity Biotech plc

|

|

Lytham Partners LLC

|

|

|

|

Kevin Tansley

|

|

Joe Diaz, Joe Dorame & Robert Blum

|

|

|

|

(353)-1-2769800

|

|

602-889-9700

|

|

|

|

E-mail:

kevin.tansley@trinitybiotech.com

|

|

|

Trinity Biotech Announces Quarter 2 Financial Results

25% Increase in Operating Profits

DUBLIN, Ireland (July 29, 2014)….

Trinity Biotech plc (Nasdaq: TRIB), a leading developer and manufacturer of diagnostic products for the

point-of-care and clinical laboratory markets, today announced results for the quarter ended June 30, 2014.

Quarter 2 Results

Total revenues for Q2, 2014 were $26.0m compared to $21.3m in Q2, 2013, which represents an increase of 22%.

Point-of-Care revenues for Q2, 2014 were $4.6m and broadly in line with the comparative quarter last year. Clinical Laboratory revenues increased from $16.7m

to $21.4m, which represents an increase of 27.9% compared to Q2, 2013. This growth was achieved through a combination of acquisition revenues and higher diabetes revenues as partially offset by slightly lower Lyme and Fitzgerald sales.

Revenues for Q2, 2014 by key product area were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2013

Quarter 2

|

|

|

2014

Quarter 2

|

|

|

Increase

|

|

|

|

|

US$’000

|

|

|

US$’000

|

|

|

%

|

|

|

Point-of-Care

|

|

|

4,586

|

|

|

|

4,615

|

|

|

|

0.6

|

%

|

|

Clinical Laboratory

|

|

|

16,726

|

|

|

|

21,390

|

|

|

|

27.9

|

%

|

|

Total

|

|

|

21,312

|

|

|

|

26,005

|

|

|

|

22.0

|

%

|

Gross profit for Q2, 2014 amounted to $12.5m representing a gross margin of 48.1%, which is slightly lower than the 49.0%

achieved in Q2, 2013. This decrease is primarily attributable to the impact of lower margins on Premier instrument sales, but also due to additional costs associated with running two manufacturing facilities in the UK. Production of blood banking

products at these facilities ceased at the end of June and was transferred to other company facilities in the USA and Ireland.

Research and Development

expenses have increased from $0.9m to $1.2m when compared to the equivalent quarter last year. Meanwhile, Selling, General and Administrative (SG&A) expenses have increased over the same period from $5.5m to $6.4m. In both cases, the increase

was primarily due to the impact of the Immco and blood bank screening acquisitions, both of which were undertaken in the second half of 2013.

Operating

profit has increased from $3.7m to $4.6m for the quarter, which equates to an increase of 25% and represents an operating margin of 17.7%.

Financial income was broadly offset by financial expenses resulting in a negligible net expense for the quarter.

This compares to net financial income of approximately $0.4m earned in Q2, 2013. This is due to lower funds being placed on deposit following the utilisation of funds for the Immco and blood banking acquisitions and lower prevailing deposit interest

rates.

The tax charge for Q2, 2014 was $0.3m which equates to an effective tax rate of approximately 6%.

Profit before tax increased from $4.1m to over $4.6m which represents an increase of approximately 12%. Meanwhile, profit after tax increased from $3.8m to

$4.3m, an increase of 13%. EPS for the quarter was 19.0 cents which compares to 17.7 cents for the equivalent period last year.

Earnings before interest,

tax, depreciation, amortisation and share option expense for the quarter was $6.0m. This compares to $5.1m for Q2, 2013.

Recent Developments

Cardiac Update

In quarter 1, 2014 the company

obtained CE marking for the Meritas Troponin I test, our new high sensitivity Troponin product. The product is currently undergoing clinical evaluation in all major European markets in advance of commercial rollout. Meanwhile, for the purpose of FDA

approval, the Meritas Troponin I test is undergoing clinical evaluation at multiple trial sites across the USA. To date, six US trial sites have been enrolling patients for the Acute Coronary Syndrome (ACS) study and over the coming weeks we intend

to increase the number of trial sites to 10. We are currently recruiting ACS patients at a rate of approximately 40 per week. With the additional trial sites coming on line, we envisage that enrolment rates will reach 80 to 100 patients per

week. At this level of recruitment, sufficient ACS data is expected to be available by mid-Q4 2014, with clinical adjudication to follow immediately thereafter and submission to the FDA targeted for the end of 2014. Meanwhile, enrolment for our

Normals (99th percentile) study is progressing according to plan at three trial sites and is expected to be completed well in advance of the ACS trial.

Furthermore, Dr. Fred Apple (Medical Director at Hennepin County Medical Center, Minneapolis and Key Opinion Leader in cardiology) presented the results

of an independent clinical evaluation he has carried out on the Meritas Troponin I product at this week’s AACC annual meeting in Chicago. His results indicate that the Meritas product has a diagnostic accuracy far in advance of any of the

existing point-of-care Troponin tests and indeed in many cases is as good as, if not better than, some of the central laboratory Troponin products currently available on the US market. Dr Apple concludes that this study validates the Meritas

Troponin I test as an appropriate tool for both ruling in and ruling out myocardial infarction in the emergency room setting. Moreover, this study was constructed in a fashion that mirrors the ACS trial required by the FDA. The results of

Dr. Apple’s independent trial, in addition to the results of the trials carried out for CE marking, provide us with a high degree of confidence that the Meritas Troponin product has the necessary performance characteristics to meet and

indeed exceed the FDA’s new stringent performance specifications for Troponin testing.

During the quarter, significant progress has been made in

completing the development of our Meritas BNP product for detection of heart failure. The clinical trials necessary to obtain CE marking are virtually complete and we expect to submit for CE clearance during the month of August. This will be

immediately followed by the commencement of US clinical trials, with FDA submission expected before the end of 2014. Meanwhile, development of our Meritas D-dimer product, a test for Pulmonary Embolism and DVT (deep vein thrombosis) is progressing

very well and according to schedule.

Premier Update

Sales of our diabetes instrument, Premier, continue to perform strongly. During the quarter, 106 instruments were sold or placed with customers. This compares

with 80 instruments for the equivalent period last year. This brings the total sales or placements of instruments for the first half of 2014 to 207. On this basis, we are in line to achieve our target of 460 for the year as a whole.

During the quarter, we also formally launched our new Premier Resolution instrument. This version of the instrument has been specifically designed for the

detection and identification of haemoglobin variants as opposed to A1c (diabetes) testing which is currently undertaken by the existing Premier instrument. Prior to this Trinity had only limited presence in the variant market, being largely

concentrated in the high throughput end of the US market with the Ultra instrument. Going forward Premier Resolution, which will act as a companion instrument for the Premier, will provide greater access to this segment of the market. Following its

launch the first instruments have already been placed in the United Kingdom.

Immco Update

The Immco acquisition has been performing well and has now been fully integrated into the Trinity group. We are particularly pleased with the opportunity that

Sjö™ , Immco’s test for the early detection for Sjögren’s syndrome, represents. Towards the end of the quarter, in conjunction with our partner, Nicox, this test was rolled out nationally in the USA. Prior to this, it has

only been available in a number of selected US markets – where initial indicators had demonstrated that the product was well received and for which there was strong demand. Since then, we have extended Nicox’s rights to this product to

cover all healthcare practitioners in North America – previously it had been limited to the ophthalmic segment of the market.

Sjögren’s

syndrome is a very prevalent though widely under-diagnosed debilitating condition of which dry eye is one of the primary symptoms. Immco’s Sjö™ test is the only approved test for Sjögren’s syndrome in the USA.

Dividend

Shareholder approval for payment of a

dividend of 22 US cents per ADR, was granted at the company’s AGM, which was held on 6 June, 2014. This represents an increase of 10% compared with 20 US cents per ADR paid in 2013. Payment of the dividend was made in July 2014.

Comments

Commenting on the results, Kevin Tansley, Chief

Financial Officer, said “This quarter we achieved impressive profitability growth with operating profit growing by 25% and profit after tax rising by almost 13%. This was achieved notwithstanding increased marketing costs for our new cardiac

product range and increased placements of Premier instruments which tend to have lower margins. In addition, this quarter’s results were impacted by running duplicate facilities in the United Kingdom for our blood bank screening business.

Production at these facilities has now ceased and they will be fully vacated by the end of this month resulting in cost savings from quarter 3 onwards.”

Ronan O’Caoimh, CEO, stated “The clinical trials for our new Troponin I test on the Meritas platform

are now well underway. To date these trials have been progressing more slowly than we would have wanted. This has been solely attributable to slower than expected recruitment of patients for the trials due to the nature of the testing protocol that

we are required to adhere to. In order to avoid any delay in submitting the results to the FDA, we have increased the number of trial sites from the six existing sites to 10 sites in total. Recruitment at the new sites will commence imminently.

Meanwhile, we were very pleased with the performance of the test in Dr. Apple’s Troponin trial results, which were published yesterday at the AACC annual meeting in Chicago. These results, we believe, demonstrated the unparalleled

specificity and sensitivity of the product in the point-of-care environment, thus reinforcing its capability as both a rule in and rule out test.

Meanwhile, our BNP test on the same platform is nearing the completion of its CE marking trials. The results of these trials have been showing excellent

performance and consequently we expect to announce European regulatory approval in the coming weeks. Once this has been achieved we will immediately commence our FDA trials. By their nature these trials will be more straight forward than the

Troponin trials and thus we expect to be in a position to submit this product to the FDA for approval by the end of 2014.

I am also pleased to report

that our Immco product line continues to perform very well. In particular, we believe the company’s Sjö™ test for the early detection of Sjögren’s syndrome represents a significant growth opportunity for the company. The

product has already been well received in a number of test markets in the USA. Consequently, in conjunction with our partner, Nicox, it has now been rolled out nationally in the USA where we believe it will gain significant traction.”

Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties including, but not limited to,

the results of research and development efforts, the effect of regulation by the United States Food and Drug Administration and other agencies, the impact of competitive products, product development commercialisation and technological difficulties,

and other risks detailed in the Company’s periodic reports filed with the Securities and Exchange Commission.

Trinity Biotech develops,

acquires, manufactures and markets diagnostic systems, including both reagents and instrumentation, for the point-of-care and clinical laboratory segments of the diagnostic market. The products are used to detect infectious diseases and to quantify

the level of Haemoglobin A1c and other chemistry parameters in serum, plasma and whole blood. Trinity Biotech sells direct in the United States, Germany, France and the U.K. and through a network of international distributors and strategic partners

in over 75 countries worldwide. For further information please see the Company’s website:

www.trinitybiotech.com

.

Trinity Biotech plc

Consolidated Income Statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(US$000’s except share data)

|

|

Three Months

Ended

June 30,

2014

(unaudited)

|

|

|

Three Months

Ended

June 30,

2013

(unaudited)

|

|

|

Six Months

Ended

June 30,

2014

(unaudited)

|

|

|

Six Months

Ended

June 30,

2013

(unaudited)

|

|

|

Revenues

|

|

|

26,005

|

|

|

|

21,312

|

|

|

|

51,030

|

|

|

|

41,640

|

|

|

Cost of sales

|

|

|

(13,496

|

)

|

|

|

(10,865

|

)

|

|

|

(26,360

|

)

|

|

|

(21,026

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

12,509

|

|

|

|

10,447

|

|

|

|

24,670

|

|

|

|

20,614

|

|

|

Gross profit %

|

|

|

48.1

|

%

|

|

|

49.0

|

%

|

|

|

48.3

|

%

|

|

|

49.5

|

%

|

|

Other operating income

|

|

|

98

|

|

|

|

85

|

|

|

|

248

|

|

|

|

195

|

|

|

Research & development expenses

|

|

|

(1,155

|

)

|

|

|

(924

|

)

|

|

|

(2,192

|

)

|

|

|

(1,779

|

)

|

|

Selling, general and administrative expenses

|

|

|

(6,417

|

)

|

|

|

(5,502

|

)

|

|

|

(12,730

|

)

|

|

|

(10,535

|

)

|

|

Indirect share based payments

|

|

|

(442

|

)

|

|

|

(440

|

)

|

|

|

(897

|

)

|

|

|

(938

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit

|

|

|

4,593

|

|

|

|

3,666

|

|

|

|

9,099

|

|

|

|

7,557

|

|

|

Financial income

|

|

|

42

|

|

|

|

466

|

|

|

|

84

|

|

|

|

943

|

|

|

Financial expenses

|

|

|

(44

|

)

|

|

|

(26

|

)

|

|

|

(64

|

)

|

|

|

(52

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net financing income / (expense)

|

|

|

(2

|

)

|

|

|

440

|

|

|

|

20

|

|

|

|

891

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit before tax

|

|

|

4,591

|

|

|

|

4,106

|

|

|

|

9,119

|

|

|

|

8,448

|

|

|

Income tax expense

|

|

|

(276

|

)

|

|

|

(278

|

)

|

|

|

(391

|

)

|

|

|

(452

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit for the period

|

|

|

4,315

|

|

|

|

3,828

|

|

|

|

8,728

|

|

|

|

7,996

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per ADR (US cents)

|

|

|

19.0

|

|

|

|

17.7

|

|

|

|

38.6

|

|

|

|

36.8

|

|

|

Diluted earnings per ADR (US cents)

|

|

|

18.2

|

|

|

|

16.9

|

|

|

|

36.8

|

|

|

|

34.9

|

|

|

Weighted average no. of ADRs used in computing basic earnings per ADR

|

|

|

22,703,261

|

|

|

|

21,665,259

|

|

|

|

22,584,889

|

|

|

|

21,732,983

|

|

|

Weighted average no. of ADRs used in computing diluted earnings per ADR

|

|

|

23,686,336

|

|

|

|

22,711,752

|

|

|

|

23,720,056

|

|

|

|

22,935,565

|

|

The above financial statements have been prepared in accordance with the principles of International Financial Reporting

Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting).

Trinity Biotech plc

Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

2014

US$ ‘000

(unaudited)

|

|

|

March 31,

2014

US$ ‘000

(unaudited)

|

|

|

Dec 31,

2013

US$ ‘000

(audited)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment

|

|

|

14,784

|

|

|

|

13,841

|

|

|

|

12,991

|

|

|

Goodwill and intangible assets

|

|

|

137,848

|

|

|

|

133,881

|

|

|

|

128,547

|

|

|

Deferred tax assets

|

|

|

9,082

|

|

|

|

7,570

|

|

|

|

7,044

|

|

|

Other assets

|

|

|

1,222

|

|

|

|

1,131

|

|

|

|

1,162

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

|

162,936

|

|

|

|

156,423

|

|

|

|

149,744

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventories

|

|

|

33,109

|

|

|

|

30,864

|

|

|

|

29,670

|

|

|

Trade and other receivables

|

|

|

27,163

|

|

|

|

24,130

|

|

|

|

24,268

|

|

|

Income tax receivable

|

|

|

88

|

|

|

|

493

|

|

|

|

487

|

|

|

Cash and cash equivalents

|

|

|

15,153

|

|

|

|

17,008

|

|

|

|

22,317

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

75,513

|

|

|

|

72,495

|

|

|

|

76,742

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

|

238,449

|

|

|

|

228,918

|

|

|

|

226,486

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY AND LIABILITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to the equity holders of the parent

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

1,202

|

|

|

|

1,187

|

|

|

|

1,170

|

|

|

Share premium

|

|

|

12,097

|

|

|

|

9,731

|

|

|

|

8,842

|

|

|

Accumulated surplus

|

|

|

179,137

|

|

|

|

174,023

|

|

|

|

168,670

|

|

|

Other reserves

|

|

|

3,672

|

|

|

|

4,073

|

|

|

|

4,329

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

196,108

|

|

|

|

189,014

|

|

|

|

183,011

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax payable

|

|

|

1,036

|

|

|

|

998

|

|

|

|

770

|

|

|

Trade and other payables

|

|

|

16,106

|

|

|

|

15,679

|

|

|

|

20,131

|

|

|

Provisions

|

|

|

75

|

|

|

|

75

|

|

|

|

75

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

17,217

|

|

|

|

16,752

|

|

|

|

20,976

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other payables

|

|

|

4,665

|

|

|

|

4,634

|

|

|

|

4,596

|

|

|

Deferred tax liabilities

|

|

|

20,459

|

|

|

|

18,518

|

|

|

|

17,903

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

25,124

|

|

|

|

23,152

|

|

|

|

22,499

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

42,341

|

|

|

|

39,904

|

|

|

|

43,475

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL EQUITY AND LIABILITIES

|

|

|

238,449

|

|

|

|

228,918

|

|

|

|

226,486

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above financial statements have been prepared in accordance with the principles of International Financial Reporting

Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting).

Trinity Biotech plc

Consolidated Statement of Cash Flows

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(US$000’s)

|

|

Three Months

Ended

June 30,

2014

(unaudited)

|

|

|

Three Months

Ended

June 30,

2013

(unaudited)

|

|

|

Six Months

Ended

June 30,

2014

(unaudited)

|

|

|

Six Months

Ended

June 30,

2013

(unaudited)

|

|

|

Cash and cash equivalents at beginning of period

|

|

|

17,008

|

|

|

|

73,095

|

|

|

|

22,317

|

|

|

|

74,947

|

|

|

Operating cash flows before changes in working capital

|

|

|

5,919

|

|

|

|

4,887

|

|

|

|

10,911

|

|

|

|

10,064

|

|

|

Changes in working capital

|

|

|

(4,309

|

)

|

|

|

(2,793

|

)

|

|

|

(9,571

|

)

|

|

|

(5,344

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash generated from operations

|

|

|

1,610

|

|

|

|

2,094

|

|

|

|

1,340

|

|

|

|

4,720

|

|

|

Net Interest and Income taxes received

|

|

|

611

|

|

|

|

367

|

|

|

|

614

|

|

|

|

799

|

|

|

Capital Expenditure & Financing (net)

|

|

|

(4,076

|

)

|

|

|

(5,019

|

)

|

|

|

(9,118

|

)

|

|

|

(9,929

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow

|

|

|

(1,855

|

)

|

|

|

(2,558

|

)

|

|

|

(7,164

|

)

|

|

|

(4,410

|

)

|

|

Dividend payment

|

|

|

—

|

|

|

|

(4,373

|

)

|

|

|

—

|

|

|

|

(4,373

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period

|

|

|

15,153

|

|

|

|

66,164

|

|

|

|

15,153

|

|

|

|

66,164

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The above financial statements have been prepared in accordance with the principles of International Financial Reporting

Standards and the Company’s accounting policies but do not constitute an interim financial report as defined in IAS 34 (Interim Financial Reporting).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

TRINITY BIOTECH PLC

|

|

(Registrant)

|

|

|

|

|

By:

|

|

/s/ Kevin Tansley

|

|

|

|

Kevin Tansley

|

|

|

|

Chief Financial Officer

|

Date: July 29, 2014.

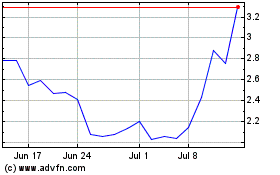

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Trinity Biotech (NASDAQ:TRIB)

Historical Stock Chart

From Apr 2023 to Apr 2024