Renault Faces Cash Call In Russia

February 12 2016 - 10:30AM

Dow Jones News

Renault SA said net profit jumped in 2015 as a stronger European

car market helped counter steep losses at its Russian unit, which

warned Friday it would need a bailout to ward off potential

bankruptcy.

Renault, part owned by the French state, said that global demand

for new cars is set to slow this year, particularly in Europe after

a 9.3% jump in sales last year, with further declines in Brazil and

Russia, two of its most important foreign markets.

Renault is still aiming to lift revenue, profitability and

generate cash flow at its automotive business this year. But it is

facing a deepening crisis at OAO AvtoVAZ, the Russian unit it

controls with Japanese partner Nissan Motor Co.

Renault said it is in talks with other shareholders in AvtoVAZ

about injecting cash into the car manufacturer. Financial support

could take the form of a debt-for-equity swap, Renault said.

Russia's leading auto maker said its net loss for 2015 nearly

tripled compared with the previous year.

AvtoVAZ has been hit hard by an economic contraction in Russia

caused mainly by a plunge in the price of crude oil, the country's

main export. High oil prices had driven a consumer spending boom in

recent years, but the ruble lost half its value against the dollar

in the last two years, driving up inflation and crimping Russians'

spending power.

Russian auto sales slumped 36% last year to 1.6 million

vehicles, according to industry data. General Motors Co. closed its

Russian assembly plant last year.

AvtoVAZ said its net loss for 2015 stood at 73.8 billion rubles

($928 million) compared with 24.9 billion rubles a year earlier.

The company said its operating loss before impairment and

restructuring costs was 24.7 billion rubles last year. Sales of

Avtovaz's Lada sedans fell 31% to just under 269,000, cutting

revenue by 8% to 176.5 billion rubles.

The Russian car maker said that, without aid, "the financial and

market conditions…create a material uncertainty that gives rise to

significant doubt about the group's ability to continue as a going

concern."

The company said it was in discussions on additional loans from

shareholders, which include state-run defense and industrial

conglomerate Rostec Corp., adding that it was confident of

obtaining the extra funds.

AvtoVAZ, which laid off tens of thousands of workers in recent

years, is shifting its staff to a four-day week from the middle of

this month and slashing pay by 20%. Since 2009, staff numbers have

fallen by more than half from over 100,000.

Based in the town of Togliatti on the Volga River some 300 miles

west of Moscow, AvtoVAZ was long the pride of the Soviet auto

industry. After a chaotic decade-and-a-half following the collapse

of the Soviet Union, it was taken over by Rostec, run by a close

ally of Russian President Vladimir Putin, in 2006. Renault bought a

one-quarter stake the next year, before taking a controlling

interest along with Nissan in 2012.

Renault's shares, which initially climbed over 4% after the

release of its improved full-year results, slipped into negative

territory as investors digested the prospect of the company

injecting more funds into its Russian business.

Evercore ISI Arndt Ellinghorst said Renault's troubles in Russia

will hit the company's bottom line in 2016 as the situation in that

country is unlikely to improve this year. On the other hand,

Renault is likely to meet its expansion targets thanks to market

opportunities in China, India and Iran, Mr. Ellinghorst said.

Renault said net profit rose 49% to €2.82 billion euros in 2015

as its revenue rose more than 10% to €45.33 billion, helped in

large part by a robust recovery in the European car market. The

company said its operating profit margin rose to 5.1% from 3.9%

partly from a €527 million reduction in operating costs.

The much improved financial performance at Renault could help

blow away regulatory clouds hanging over the company. Renault is to

recall more than 15,000 vehicles to repair their emissions-control

systems after a government investigation into whether auto makers

have exceeded France's pollution limits.

The French government set up the commission last October, in the

wake of the Volkswagen AG emissions scandal, to test 100 cars under

real driving conditions. Some models made by Renault and several

foreign car brands were among those found to have excessively high

exhaust emissions that didn't correspond to the level of emissions

recorded under laboratory conditions.

Renault has proposed a dividend of €2.40 a share, up from €1.90

last year.

Write to Inti Landauro at inti.landauro@wsj.com and James Marson

at james.marson@wsj.com

(END) Dow Jones Newswires

February 12, 2016 10:15 ET (15:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

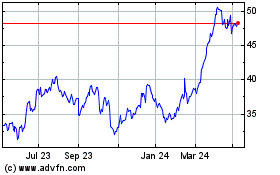

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

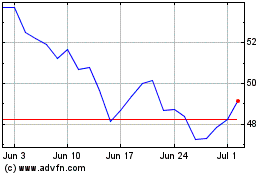

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024