UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2016

Commission File Number 000-50142

SPI Energy

Co., Ltd.

(Exact name of registrant as specified in its charter)

7F/B Block, 1st Building, Jinqi Plaza

No. 2145 Jinshajiang Road, Putuo District

Shanghai, P.R. China

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K

if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T

Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which

the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or

other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission

filing on EDGAR.

On January 4, 2016, Solar Power, Inc., a California corporation (“SPI”), completed

a corporate reorganization (the “Merger”), resulting in SPI Energy Co., Ltd., an exempted company incorporated under the laws of the Cayman Islands (“SPI Energy”), becoming the publicly held parent company of SPI and SPI becoming

a wholly-owned subsidiary of SPI Energy, pursuant to the Second Amended and Restated Agreement and Plan of Merger and Reorganization, dated as of October 30, 2015 by and among SPI, SPI Energy and SPI Merger Sub, Inc. (the “Merger

Agreement”). The Merger Agreement was approved by the stockholders of SPI through consent solicitation. The Merger Agreement was filed with SPI Energy’s Registration Statement on Form F-4 initially filed with the Securities and

Exchange Commission (the “SEC”) on May 11, 2015, as amended (the “Registration Statement”) and the consent solicitation statement/prospectus filed with the SEC on November 6, 2015 (the “Prospectus”). On

January 4, 2016, SPI and SPI Energy issued a press release announcing the completion of the Merger. The press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Prior to the Merger, shares of SPI’s common stock were registered pursuant to Section 12(g) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), and listed on the OTCBB under the symbol “SOPW.” As a result of the Merger, (i) each ten (10) issued and outstanding shares of SPI’s common stock (other than any shares

of SPI’s common stock that were “Dissenting Shares” as defined in the Merger Agreement) acquired prior to the time when the Registration Statement became effective were converted into the right to receive one American depositary

share, representing ten (10) SPI Energy ordinary shares, and (ii) issued and outstanding shares of SPI’s common stock (other than any shares of SPI’s common stock that were “Dissenting Shares” as defined in the Merger

Agreement) acquired after the time when the Registration Statement became effective received SPI Energy ordinary shares. The American depositary shares are quoted on the OTCBB under the symbol “SRGYY.” SPI expects to file a Form 15

with the SEC to terminate the registration of the shares of its common stock and suspend its reporting obligations under Sections 13 and 15(d) of the Exchange Act.

This report is being filed for the purpose of establishing SPI Energy as the successor issuer pursuant to Rule 12g-3 under the Exchange

Act. Pursuant to Rule 12g-3(a) under the Exchange Act, the ordinary shares of SPI Energy, as successor issuer, are deemed registered under Section 12(g) of the Exchange Act.

As of January 4, 2016, SPI Energy, together with its subsidiaries, own and conduct SPI’s business in substantially the same manner

as it was conducted by SPI and its subsidiaries prior to the Merger. SPI Energy is managed by substantially the same board of directors and executive officers that managed SPI prior to the Merger, with the directors to serve until such time as they

are removed from office by ordinary resolution of the shareholders or by a resolution of the board of directors.

In connection with the

completion of the Merger, SPI Energy expects to enter into indemnification agreements with each of its directors, executive officers and other officers and employees (including officers and employees of its subsidiaries) who currently have

indemnification agreement with SPI. The indemnification agreements provide for indemnification and advancement of defense expenses by SPI Energy and include related provisions intended to facilitate the indemnitee’s receipt of such benefits. A

form of the indemnification agreement was filed with the Registration Statement and is incorporated herein by reference.

As part of the

Merger, SPI Energy assumed all of SPI’s rights and obligations under SPI’s 2006 Equity Incentive Plan, and the obligations of SPI under or with respect to the contracts or agreements as described in the Merger Agreement.

2

As of January 4, 2016, in connection with and effective upon completion of the Merger, the

rights of shareholders of SPI Energy will be governed by its memorandum of association and articles of association, as amended and restated from time to time, and the Companies Law (2013 Revision) of the Cayman Islands (“Companies Law”)

and the common law of the Cayman Islands.

DESCRIPTION OF SHARE CAPITAL OF SPI ENERGY

The following description of the material terms of SPI Energy’s ordinary shares following the Merger includes a summary of specified

provisions of the memorandum of association and articles of association of SPI Energy that came into effect upon completion of the Merger. This description is qualified by reference to the amended and restated form of memorandum of association and

articles of association of SPI Energy, which were filed with the Registration Statement and the Prospectus and are incorporated by reference into this report. You are encouraged to read the relevant provisions of the Companies Law and SPI

Energy’s memorandum and articles of association, as amended and restated from time to time, as they relate to the following summary.

Authorized

Share Capital

SPI Energy is authorized to issue 50,000,000,000 shares of a par value of US$0.000001 each. The board of directors of

SPI Energy is authorized to issue these shares in different classes and series and, with respect to each class or series, to determine the designations, powers, preferences, privileges and other rights, including dividend rights, conversion rights,

terms of redemption and liquidation preferences, any or all of which may be greater than the powers and rights associated with the ordinary shares, at such times and on such other terms as they think proper.

As of the close of business on October 26, 2015, SPI Energy had one ordinary share issued and outstanding and no preference shares issued

and outstanding. Upon completion of the Merger, SPI Energy issued approximately 639,065,172 ordinary shares in the Merger and the one ordinary share issued and outstanding prior to the Merger was repurchased and cancelled.

Ordinary Shares

General

All of SPI Energy’s outstanding ordinary shares will be issued credited as fully paid and non-assessable. SPI Energy’s ordinary

shares are issued in registered form, and are issued when registered in SPI Energy’s register of members. SPI Energy’s shareholders who are non-residents of the Cayman Islands may freely hold and transfer their ordinary shares.

Dividends

The holders of SPI

Energy’s ordinary shares are entitled to such dividends as may be declared by SPI Energy’s board of directors, subject to the Companies Law and the memorandum and articles of association of SPI Energy, as amended and restated from time to

time. Under Cayman Islands law, dividends may be declared and paid only out of funds legally available therefor, namely out of either profit or share premium account, provided that a dividend may not be paid if this would result in SPI Energy being

unable to pay its debts as they fall due in the ordinary course of business.

3

Register of Members

Under Cayman Islands law, SPI Energy must keep a register of members and there shall be entered therein:

| |

(a) |

the names and addresses of the members, a statement of the shares held by each member, and of the amount paid or agreed to be considered as paid, on the shares of each member; |

| |

(b) |

the date on which the name of any person was entered on the register as a member; and |

| |

(c) |

the date on which any person ceased to be a member. |

Under Cayman Islands law, the register of

members of SPI Energy is prima facie evidence of the matters set out therein (i.e., the register of members will raise a presumption of fact on the matters referred to above unless rebutted) and a member registered in the register of members shall

be deemed as a matter of Cayman Islands law to have legal title to the shares as set against its name in the register of members. Upon the closing of the Merger, the register of members was immediately updated to record and give effect to the issue

of shares by SPI Energy that underlie the American depositary shares. Once SPI Energy’s register of members has been updated, the shareholders recorded in the register of members will be deemed to have legal title to the shares set against

their name in the register of members. If the name of any person is incorrectly entered in or omitted from SPI Energy’s register of members, or if there is any default or unnecessary delay in entering on the register the fact of any person

having ceased to be a member of SPI Energy, the person or member aggrieved (or any member of SPI Energy or SPI Energy itself) may apply to the Grand Court of the Cayman Islands for an order that the register be rectified, and the Court may either

refuse such application or it may, if satisfied of the justice of the case, make an order for the rectification of the register.

Voting Rights

Each holder of ordinary shares is entitled to one vote on all matters upon which the ordinary shares are entitled to vote on a

show of hands or, on a poll, each holder is entitled to have one vote for each share registered in his name on the register of members. Voting at any meeting of shareholders is by show of hands unless a poll is demanded. A poll may be demanded by

the chairman of SPI Energy’s board of directors or by any one or more shareholders holding at least one-tenth of the paid-up shares given a right to vote at the meeting or one-tenth of the votes attaching to the issued and outstanding ordinary

shares in SPI Energy entitled to vote at general meetings, present in person or by proxy.

A quorum required for a general meeting of

shareholders consists of one or more shareholders who hold in aggregate at least one-third of the votes attaching to the issued and outstanding ordinary shares in SPI Energy entitled to vote at general meetings, present in person or by proxy or, if

a corporation or other non-natural person, by its duly authorized representative. Although not required by the Companies Laws or SPI Energy’s amended and restated memorandum and articles of association, SPI Energy expects to hold

shareholders’ meetings annually and such meetings may be convened by SPI Energy’s board of directors on its own initiative or upon a request to the directors by shareholders holding in aggregate at least one-third of SPI Energy’s

shares that carry the right to vote at general meetings. Advance notice of at least 14 days is required for the convening of SPI Energy’s annual general meeting and other shareholders meetings.

An ordinary resolution to be passed by the shareholders requires the affirmative vote of a simple majority of the votes attaching to the

ordinary shares cast by those shareholders entitled to vote who are present in person or by proxy in a general meeting, while a special resolution requires the affirmative vote of no less than two-thirds of the votes attaching to the ordinary shares

cast by those shareholders entitled to vote who are present in person or by proxy in a general meeting.

4

Transfer of Ordinary Shares

Subject to the restrictions of SPI Energy’s articles of association, as applicable, any of SPI Energy’s shareholders may transfer all

or any of his or her ordinary shares by an instrument of transfer in the usual or common form or any other form approved by SPI Energy’s board.

SPI Energy’s board of directors may, in its absolute discretion, decline to register any transfer of any ordinary share which is not

fully paid up or on which SPI Energy has a lien. SPI Energy’s directors may also decline to register any transfer of any ordinary share unless:

| |

• |

|

the instrument of transfer is lodged with SPI Energy, accompanied by the certificate for the ordinary shares to which it relates and such other evidence as SPI Energy’s board of directors may reasonably require to

show the right of the transferor to make the transfer; |

| |

• |

|

the instrument of transfer is in respect of only one class of ordinary shares; |

| |

• |

|

the instrument of transfer is properly stamped, if required; |

| |

• |

|

in the case of a transfer to joint holders, the number of joint holders to whom the ordinary share is to be transferred does not exceed four; or |

| |

• |

|

the ordinary shares transferred are free of any lien in favor of SPI Energy. |

If SPI

Energy’s directors refuse to register a transfer they shall, within two months after the date on which the instrument of transfer was lodged, send to each of the transferor and the transferee notice of such refusal. The registration of

transfers may, on 14 days’ notice being given by advertisement in such one or more newspapers or by electronic means, be suspended and the register closed at such times and for such periods as SPI Energy’s board of directors may from

time to time determine; provided, however, that the registration of transfers shall not be suspended and the register shall not be closed for more than 30 days in any year.

Liquidation

On a winding up of

SPI Energy, if the assets available for distribution among its shareholders shall be more than sufficient to repay the whole of the share capital at the commencement of the winding up, the surplus will be distributed among its shareholders in

proportion to the par value of the shares held by them at the commencement of the winding up, subject to a deduction from those shares in respect of which there are monies due, of all monies payable to SPI Energy for unpaid calls or otherwise. If

SPI Energy’s assets available for distribution are insufficient to repay all of the paid-up capital, the assets will be distributed so that the losses are borne by its shareholders in proportion to the par value of the shares held by them.

Calls on Ordinary Shares and Forfeiture of Ordinary Shares

SPI Energy’s board of directors may from time to time make calls upon shareholders for any amounts unpaid on their ordinary shares in a

notice served to such shareholders at least 14 days prior to the specified time of payment. The ordinary shares that have been called upon and remain unpaid are subject to forfeiture.

5

Redemption, Repurchase and Surrender of Ordinary Shares

SPI Energy may issue shares on terms that are subject to redemption, at SPI Energy’s option or at the option of the holders, on such terms

and in such manner as may be determined before the issue of such shares, by SPI Energy’s board of directors or by a special resolution of SPI Energy’s shareholders. SPI Energy may also repurchase any of its shares provided that the manner

and terms of such purchase have been approved by its board of directors or are otherwise authorized by its memorandum and articles of association. Under the Companies Law, the redemption or repurchase of any share may be paid out of SPI

Energy’s profits or out of the proceeds of a fresh issue of shares made for the purpose of such redemption or repurchase, or out of capital (including share premium account and capital redemption reserve) if SPI Energy can, immediately

following such payment, pay its debts as they fall due in the ordinary course of business. In addition, under the Companies Law no such share may be redeemed or repurchased (a) unless it is fully paid up, (b) if such redemption or

repurchase would result in there being no shares outstanding, or (c) if the company has commenced liquidation. In addition, SPI Energy may accept the surrender of any fully paid share for no consideration.

Variations of Rights of Shares

All or any of the special rights attached to any class of shares may, subject to the provisions of the Companies Law, be varied either with the

written consent of the holders of a majority of the issued shares of that class or with the sanction of an ordinary resolution passed at a general meeting of the holders of the shares of that class.

Inspection of Books and Records

Holders of SPI Energy’s ordinary shares have no general right under Cayman Islands law to inspect or obtain copies of SPI Energy’s

list of shareholders or its corporate records. However, SPI Energy will provide its shareholders with annual audited financial statements.

Changes

in Capital

SPI Energy may from time to time by ordinary resolution:

| |

• |

|

increase its share capital by such sum, to be divided into shares of such classes and amount, as the resolution shall prescribe; |

| |

• |

|

consolidate and divide all or any of its share capital into shares of a larger amount than its existing shares; |

| |

• |

|

convert all or any of its paid up shares into stock and reconvert that stock into paid up shares of any denomination; |

| |

• |

|

sub-divide its existing shares, or any of them into shares of a smaller amount that is fixed by the amended and restated memorandum and articles of association; and |

| |

• |

|

cancel any shares which, at the date of the passing of the resolution, have not been taken or agreed to be taken by any person and diminish the amount of its share capital by the amount of the shares so cancelled.

|

Subject to Companies Law and confirmation by the Grand Court of the Cayman Islands on an application by SPI Energy for an

order confirming such reduction, SPI Energy may by special resolution reduce its share capital and any capital redemption reserve in any manner authorized by law.

6

Issuance of Additional Preferred Shares

SPI Energy’s amended and restated memorandum and articles of association authorizes SPI Energy’s board of directors to issue

additional ordinary shares from time to time as its board of directors shall determine, to the extent of available authorized but unissued shares.

SPI Energy’s amended and restated memorandum and articles of association authorizes SPI Energy’s board of directors to establish

from time to time one or more series of preferred shares and to determine, with respect to any series of preferred shares, the terms and rights of that series, including:

| |

• |

|

the designation of the series; |

| |

• |

|

the number of shares of the series; |

| |

• |

|

the dividend rights, dividend rates, conversion rights, voting rights; and |

| |

• |

|

the rights and terms of redemption and liquidation preferences. |

SPI Energy’s board of

directors may issue preferred shares without action by its shareholders to the extent authorized but unissued. In addition, the issuance of preferred shares may be used as an anti-takeover device without further action on the part of the

shareholders. Issuance of these shares may dilute the voting power of holders of ordinary shares.

Exempted Company

SPI Energy is an exempted company duly incorporated with limited liability under the Companies Law. The Companies Law distinguishes between

ordinary resident companies and exempted companies. Any company, the objects of which are to conduct business mainly outside of the Cayman Islands, may apply to be registered as an exempted company. The requirements for an exempted company are

essentially the same as for an ordinary company except for certain exemptions and privileges, including (a) an exempted company does not have to file an annual return of its shareholders with the Registrar of Companies, (b) an exempted

company is not required to open its register of members for inspection, (c) an exempted company does not have to hold an annual general meeting, (d) an exempted company may issue no par value, negotiable or bearer shares, and (e) an

exempted company may register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands.

Transfer Agent

The transfer agent and registrar for SPI Energy’s ordinary shares is Maples Fund Services (Cayman) Limited.

7

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

| |

|

|

|

SPI Energy Co., Ltd. |

|

|

|

|

| Date: January 4, 2016 |

|

|

|

By: |

|

/s/ Amy Jing Liu |

|

|

|

|

|

|

Name: |

|

Amy Jing Liu |

|

|

|

|

|

|

Title: |

|

Chief Financial Officer |

8

EXHIBIT INDEX

|

|

|

| Exhibit Number |

|

Description |

|

|

| 99.1 |

|

Press Release entitled SPI and SPI Energy Complete Reorganization Merger, dated January 4, 2016 |

9

Exhibit 99.1

SPI and SPI Energy Complete Reorganization Merger

Shanghai, China—January 4, 2016— Solar Power, Inc. (“SPI” or the “Company”), a global provider of photovoltaic (PV) solutions

for business, residential, government and utility customers and investors, and SPI Energy Co., Ltd., a company incorporated under the laws of the Cayman Islands (“SPI Energy”), today announced the merger (the “Merger”) to

reorganize the Company as a Cayman Islands company has been completed.

Pursuant to the Second Amended and Restated Agreement and Plan of Merger and

Reorganization, dated October 30, 2015, each ten issued and outstanding shares of the Company’s common stock acquired prior to 3:00 P.M. EST, November 5, 2015 were converted into the right to receive one American depositary share

(“ADS”), representing ten SPI Energy ordinary shares; and issued and outstanding shares of the common stock of the Company acquired after 3:00 P.M. EST, November 5, 2015 were converted into the right to receive SPI Energy ordinary

shares. SPI Energy’s ADSs will be quoted on the OTC Markets under the symbol “SRGYY” effective January 4, 2016.

SPI Energy is in the

process of applying for listing of the ADSs on the Nasdaq Capital Market and expects to complete that process in early 2016.

About Solar Power, Inc.

Solar Power, Inc. (“SPI” or the “Company”) is a global provider of photovoltaic (PV) solutions for business, residential,

government and utility customers and investors. SPI focuses on the downstream PV market including the development, financing, installation, operation and sale of utility-scale and residential solar power projects in China, Japan, Europe and North

America. The Company operates an innovative online energy e-commerce and investment platform, www.solarbao.com, which enables individual and institutional investors to purchase innovative PV-based investment and other products; as well as

www.solartao.com, a B2B e-commerce platform offering a range of PV products for both upstream and downstream suppliers and customers. The Company has its operating headquarters in Shanghai and maintains global

operations in Asia, Europe, North America and Australia.

For additional information visit: www.spisolar.com, www.solarbao.com or www.solartao.com.

About SPI Energy Co., Ltd. (OTCBB: SRGYY)

SPI Energy

Co., Ltd. is a newly formed exempted company incorporated under the laws of the Cayman Islands. An “exempted” company under the laws of the Cayman Islands is one which receives such registration as a result of satisfying the Registrar

of Companies in the Cayman Islands that it conducts its operations mainly outside of the Cayman Islands and is as a result exempted from complying with certain provisions of the Cayman Islands Companies Law. As a result of the Merger, the former SPI

directors and officer will continue to serve as such with SPI Energy and SPI Energy will continue to conduct SPI’s prior business at their current locations and facilities.

Safe Harbor Statement

This release contains certain

“forward-looking statements”, including statements regarding listing of ADSs on Nasdaq. These statements are forward-looking in nature and subject to risks and uncertainties that may cause actual results to differ materially. All

forward-looking statements included in this release are based upon information available to the Company and SPI Energy as of the date of this release, which may change, and the Company and SPI Energy undertake no obligation to update or revise any

forward-looking statements, except as may be required under applicable securities law.

Contact:

Amy Liu, (800) 548-8767

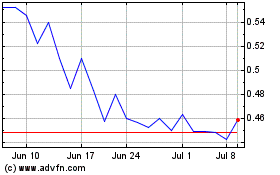

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

SPI Energy (NASDAQ:SPI)

Historical Stock Chart

From Apr 2023 to Apr 2024