QUARTERLY HIGHLIGHTS

- Net income improved to $16.67 million,

15.13% over the second quarter of 2016 and diluted net income per

common share improved to $0.64 from the prior year’s quarter of

$0.56.

- Return on average assets of 1.20% and

return on average common shareholders’ equity of 9.59%.

- Net charge-offs of $0.94 million and

nonperforming assets to loans and leases of 0.66%.

- Average loans and leases grew $203.17

million or 4.95% from the second quarter of 2016.

- Average deposits grew $154.57 million

or 3.59% from the second quarter of 2016.

- Net interest income increased $3.57

million or 8.44% from the second quarter of 2016.

- Noninterest income increased $1.84

million or 8.25% from the second quarter of 2016 (increased 5.86%

excluding leased equipment depreciation).

- Noninterest expenses increased $1.07

million or 2.68% from the second quarter of 2016 (relatively flat

excluding leased equipment depreciation).

1st Source Corporation (NASDAQ: SRCE), parent company of 1st

Source Bank, today reported a record high net income of $16.67

million for the second quarter of 2017, an increase of 15.13%

compared to $14.48 million reported in the second quarter a year

ago, bringing the 2017 year-to-date net income to $32.88 million

compared to $28.30 million in 2016, an increase of 16.18%. The

year-to-date net income comparison was positively impacted by gains

on the sale of investment securities available-for-sale of $1.94

million net of an other than temporary impairment loss of $0.19

million and gains on the sale of fixed assets and leased equipment

of $0.59 million. These increases were partially offset by the

writedown of fixed assets of $0.41 million and a contribution to

the 1st Source Foundation of $0.50 million.

Diluted net income per common share for the second quarter of

2017 was also a record high at $0.64, versus $0.56 in the second

quarter of 2016. Diluted net income per common share for the first

half of 2017 was $1.26 compared to the $1.08 earned a year

earlier.

At its July 2017 meeting, the Board of Directors approved a cash

dividend of $0.19 per common share. The cash dividend is payable to

shareholders of record on August 7, 2017 and will be paid on August

15, 2017. This brings year-to-date dividends in 2017 to $0.56 per

common share, an increase of 3.70% compared to $0.54 per common

share at the same time last year.

According to Christopher J. Murphy III, Chairman, “We are very

pleased with our record net income in the second quarter as 1st

Source Corporation continues to experience healthy growth in loans

and leases and deposits. Credit quality remains stable with

year-to-date net charge-offs of $367,000 or 0.02% of average loans

and leases. Average loans and leases were up a solid 4.95% for the

quarter compared to the same period a year ago. Average deposits

have held steady with a 3.59% increase from this time last year.

Net interest income has increased 8.44% from the second quarter

2016, along with noninterest income increasing 8.25% while

noninterest expense growth was held to a 2.68% increase over the

same quarter of 2016.”

“In April, we announced an exciting partnership with the South

Bend Cubs. 1st Source Bank has a five-year sponsorship of the South

Bend Cubs’ Performance Center located at Four Winds Field. This

collaboration is an investment for the bank intended to produce new

primary relationships and opportunities for growth in our home

market.”

“Moreover, we recently completed the reopening of the North

Calumet banking center on July 17, 2017. This new branch is a

significant rebuild and an enhancement to the client experience and

our service offerings in the Valparaiso market.”

“As always, we will continue to help our clients achieve

security, build wealth and realize their dreams,” Mr. Murphy

concluded.

SECOND QUARTER 2017 FINANCIAL

RESULTS

Loans

Average loans and leases of $4.31 billion increased $203.17

million, or 4.95% in the second quarter of 2017 from the year ago

quarter and have increased $121.05 million from the first quarter.

Year-to-date average loans and leases of $4.25 billion increased

$191.32 million, or 4.72% from the first six months of 2016.

Deposits

Average deposits of $4.45 billion grew $154.57 million, or 3.59%

for the quarter ended June 30, 2017 from the year ago quarter and

have increased $156.01 million, or 3.63% compared to the first

quarter. Average deposits for the first six months of 2017 were

$4.38 billion, an increase of $150.56 million or 3.56% from the

same period a year ago.

Net Interest Income and Net Interest Margin

Second quarter 2017 net interest income of $45.86 million

increased $3.57 million, or 8.44% from the second quarter a year

ago and increased $2.13 million, or 4.88% from the first

quarter.

For the first six months of 2017, tax-equivalent net interest

income was $90.51 million, an increase of $6.00 million, or 7.11%

compared to the same period a year ago.

Second quarter 2017 net interest margin was 3.53%, an

improvement of 12 basis points from the 3.41% for the same period

in 2016 and increased 4 basis points from the 3.49% in the first

quarter. Second quarter 2017 net interest margin on a fully

tax-equivalent basis was 3.57%, an increase of 12 basis points from

the 3.45% for the same period in 2016 and improved 4 basis points

from the 3.53% in the first quarter.

Net interest margin for the first six months of 2017 was 3.51%,

an increase of 10 basis points from the 3.41% for the same period

in 2016. Net interest margin on a fully tax-equivalent basis for

the first six months of 2017 was 3.55%, an increase of 10 basis

points from the 3.45% for the same period in 2016.

Noninterest Income

Noninterest income increased $1.84 million or 8.25% and $3.52

million or 8.01% in the three and six month periods ended June 30,

2017, respectively over the same periods a year ago. The growth in

noninterest income during the second quarter and first six months

of 2017 from the same periods a year ago was mainly due to gains on

the sale of available-for-sale equity securities, higher equipment

rental income related to an increase in the average equipment

rental portfolio and increased trust and wealth advisory fees,

which was offset by reduced partnership gains, resulting from the

liquidation of an investment during 2016, lower mutual fund income

and monogram fund income and decreased customer swap fees. The rise

in noninterest income from the first quarter of 2017 was primarily

a result of higher equipment rental income related to an increase

in the average equipment rental portfolio, increased trust and

wealth advisory fees and an improvement in mortgage banking income

offset by a reduction in gains on the sale of available-for-sale

equity securities and lower insurance contingent commissions.

Noninterest Expense

Noninterest expense increased $1.07 million or 2.68% and $1.49

million or 1.84% for the three and six months ended June 30, 2017,

respectively over the comparable periods a year ago. Excluding

depreciation on leased equipment, noninterest expenses were

relatively flat for the second quarter and first six months of

2017. The increase in noninterest expense from the same quarter a

year ago was primarily due to higher depreciation on leased

equipment, increased professional fees and marketing promotions,

offset by reduced group insurance claims, lower FDIC insurance

assessments and gains on the sale of leased equipment. The increase

in noninterest expense for the first six months of 2017 compared to

the first six months of 2016 was mainly due to higher depreciation

on leased equipment, increased charitable contributions and

marketing promotions, and increased professional fees, offset by

lower FDIC insurance assessments, reduced group insurance claims,

fewer writedowns on fixed assets and gains on the sale of leased

equipment.

Credit

The reserve for loan and lease losses as of June 30, 2017 was

2.10% of total loans and leases compared to 2.13% at March 31, 2017

and 2.20% at June 30, 2016. Net charge-offs of $0.94 million were

recorded for the second quarter of 2017 compared with net

recoveries of $0.11 million in the same quarter a year ago and

$0.58 million of net recoveries in the first quarter. Year-to-date

net charge-offs of $0.37 million have been recorded in 2017,

compared to net recoveries of $0.32 million for the first half of

2016.

The ratio of nonperforming assets to loans and leases was 0.66%

as of June 30, 2017, comparable to the 0.49% on June 30, 2016 and

the 0.63% on March 31, 2017.

Capital

As of June 30, 2017, the common equity-to-assets ratio was

12.29%, compared to 12.47% at March 31, 2017 and 12.30% a year ago.

The tangible common equity-to-tangible assets ratio was 10.98% at

June 30, 2017 and 11.11% at March 31, 2017 compared to 10.90% a

year earlier. The Common Equity Tier 1 ratio, calculated under

banking regulatory guidelines, was 12.43% at June 30, 2017 compared

to 12.69% at March 31, 2017 and 12.20% a year ago.

ABOUT 1ST SOURCE CORPORATION

1st Source common stock is traded on the NASDAQ Global Select

Market under “SRCE” and appears in the National Market System

tables in many daily newspapers under the code name “1st Src.”

Since 1863, 1st Source has been committed to the success of the

communities it serves. For more information, visit

www.1stsource.com.

1st Source serves the northern half of Indiana and southwest

Michigan and is the largest locally controlled financial

institution headquartered in the area. While delivering a

comprehensive range of consumer and commercial banking services

through its community bank offices, 1st Source has distinguished

itself with highly personalized services. 1st Source Bank also

competes for business nationally by offering specialized financing

services for new and used private and cargo aircraft, automobiles

for leasing and rental agencies, medium and heavy duty trucks, and

construction equipment. The Corporation includes 79 banking

centers, 23 1st Source Bank Specialty Finance Group locations

nationwide, eight Wealth Advisory Services locations and ten 1st

Source Insurance offices.

FORWARD LOOKING STATEMENTS

Except for historical information contained herein, the matters

discussed in this document express “forward-looking statements.”

Generally, the words “believe,” “contemplate,” “seek,” “plan,”

“possible,” “assume,” “expect,” “intend,” “targeted,” “continue,”

“remain,” “estimate,” “anticipate,” “project,” “will,” “should,”

“indicate,” “would,” “may” and similar expressions indicate

forward-looking statements. Those statements, including statements,

projections, estimates or assumptions concerning future events or

performance, and other statements that are other than statements of

historical fact, are subject to material risks and uncertainties.

1st Source cautions readers not to place undue reliance on any

forward-looking statements, which speak only as of the date

made.

1st Source may make other written or oral forward-looking

statements from time to time. Readers are advised that various

important factors could cause 1st Source’s actual results or

circumstances for future periods to differ materially from those

anticipated or projected in such forward-looking statements. Such

factors, among others, include changes in laws, regulations or

accounting principles generally accepted in the United States; 1st

Source’s competitive position within its markets served; increasing

consolidation within the banking industry; unforeseen changes in

interest rates; unforeseen downturns in the local, regional or

national economies or in the industries in which 1st Source has

credit concentrations; and other risks discussed in 1st Source’s

filings with the Securities and Exchange Commission, including its

Annual Report on Form 10-K, which filings are available from the

SEC. 1st Source undertakes no obligation to publicly update or

revise any forward-looking statements.

NON-GAAP FINANCIAL MEASURES

The accounting and reporting policies of 1st Source conform to

generally accepted accounting principles (“GAAP”) in the United

States and prevailing practices in the banking industry. However,

certain non-GAAP performance measures are used by management to

evaluate and measure the Company’s performance. Although these

non-GAAP financial measures are frequently used by investors to

evaluate a financial institution, they have limitations as

analytical tools, and should not be considered in isolation, or as

a substitute for analyses of results as reported under GAAP. These

include taxable-equivalent net interest income (including its

individual components), net interest margin (including its

individual components), the efficiency ratio, tangible common

equity-to-tangible assets ratio and tangible book value per common

share. Management believes that these measures provide users of the

Company’s financial information a more meaningful view of the

performance of the interest-earning assets and interest-bearing

liabilities and of the Company’s operating efficiency. Other

financial holding companies may define or calculate these measures

differently.

Management reviews yields on certain asset categories and the

net interest margin of the Company and its banking subsidiaries on

a fully taxable-equivalent (“FTE”) basis. In this non-GAAP

presentation, net interest income is adjusted to reflect tax-exempt

interest income on an equivalent before-tax basis. This measure

ensures comparability of net interest income arising from both

taxable and tax-exempt sources. Net interest income on a FTE basis

is also used in the calculation of the Company’s efficiency ratio.

The efficiency ratio, which is calculated by dividing non-interest

expense by total taxable-equivalent net revenue (less securities

gains or losses and lease depreciation), measures how much it costs

to produce one dollar of revenue. Securities gains or losses and

lease depreciation are excluded from this calculation to better

match revenue from daily operations to operational expenses.

Management considers the tangible common equity-to-tangible assets

ratio and tangible book value per common share as useful

measurements of the Company’s equity.

See the table marked “Reconciliation of Non-GAAP Financial

Measures” for a reconciliation of certain non-GAAP financial

measures used by the Company with their most closely related GAAP

measures.

(charts attached)

1st SOURCE CORPORATION 2nd QUARTER 2017 FINANCIAL

HIGHLIGHTS (Unaudited - Dollars in thousands, except per share

data)

Three Months Ended Six Months

Ended June 30, March 31, June

30, June 30, June 30,

2017 2017 2016

2017 2016 AVERAGE BALANCES Assets $

5,586,192 $ 5,437,247 $ 5,343,630 $ 5,512,131 $ 5,276,697 Earning

assets 5,205,508 5,075,410 4,986,635 5,140,819 4,925,204

Investments 836,915 839,283 804,856 838,093 799,853 Loans and

leases 4,308,276 4,187,231 4,105,111 4,248,088 4,056,772 Deposits

4,454,975 4,298,964 4,300,402 4,377,400 4,226,838 Interest bearing

liabilities 3,882,915 3,747,752 3,709,706 3,815,706 3,658,357

Common shareholders’ equity 697,229 683,647 659,092 690,476 654,344

INCOME STATEMENT DATA Net interest income $ 45,861 $

43,727 $ 42,293 $ 89,588 $ 83,582 Net interest income - FTE(1)

46,319 44,188 42,753 90,507 84,503 Provision for loan and lease

losses 2,738 1,000 2,049 3,738 3,024 Noninterest income 24,136

23,307 22,297 47,443 43,924 Noninterest expense 41,105 41,119

40,034 82,224 80,739 Net income 16,669 16,206 14,479 32,875 28,297

PER SHARE DATA Basic net income per common share $

0.64 $ 0.62 $ 0.56 $ 1.26 $ 1.08 Diluted net income per common

share 0.64 0.62 0.56 1.26 1.08 Common cash dividends declared 0.19

0.18 0.18 0.37 0.36 Book value per common share 26.96 26.46 25.59

26.96 25.59 Tangible book value per common share(1) 23.73 23.22

22.32 23.73 22.32 Market value - High 50.78 49.11 34.83 50.78 34.83

Market value - Low 43.58 42.15 30.32 42.15 27.01 Basic weighted

average common shares outstanding 25,927,032 25,903,397 25,853,537

25,915,280 25,888,534 Diluted weighted average common shares

outstanding 25,927,032 25,903,397 25,853,537 25,915,280 25,888,534

KEY RATIOS Return on average assets 1.20 % 1.21 %

1.09 % 1.20 % 1.08 % Return on average common shareholders’ equity

9.59 9.61 8.84 9.60 8.70 Average common shareholders’ equity to

average assets 12.48 12.57 12.33 12.53 12.40 End of period tangible

common equity to tangible assets(1) 10.98 11.11 10.90 10.98 10.90

Risk-based capital - Common Equity Tier 1(2) 12.43 12.69 12.20

12.43 12.20 Risk-based capital - Tier 1(2) 13.58 13.88 13.41 13.58

13.41 Risk-based capital - Total(2) 14.88 15.18 14.73 14.88 14.73

Net interest margin 3.53 3.49 3.41 3.51 3.41 Net interest margin -

FTE(1) 3.57 3.53 3.45 3.55 3.45 Efficiency ratio: expense to

revenue 58.72 61.34 61.98 60.00 63.32 Efficiency ratio: expense to

revenue - adjusted(1) 54.66 57.81 58.76 56.20 60.50 Net charge offs

to average loans and leases 0.09 (0.06 ) (0.01 ) 0.02 (0.02 ) Loan

and lease loss reserve to loans and leases 2.10 2.13 2.20 2.10 2.20

Nonperforming assets to loans and leases 0.66 0.63 0.49 0.66 0.49

June 30, March 31, December 31,

September 30, June 30, 2017

2017 2016 2016

2016 END OF PERIOD BALANCES Assets $ 5,687,230 $

5,501,526 $ 5,486,268 $ 5,447,911 $ 5,379,938 Loans and leases

4,381,314 4,234,862 4,188,071 4,179,417 4,152,763 Deposits

4,482,036 4,336,976 4,333,760 4,377,038 4,325,084 Reserve for loan

and lease losses 91,914 90,118 88,543 88,897 91,458 Goodwill and

intangible assets 83,848 83,960 84,102 84,244 84,386 Common

shareholders’ equity 699,202 685,934 672,650 670,259 661,756

ASSET QUALITY Loans and leases past due 90 days or more $

178 $ 344 $ 416 $ 611 $ 275 Nonaccrual loans and leases 15,923

18,090 19,907 19,922 12,579 Other real estate 710 916 704 551 452

Repossessions 13,052 8,121 9,373 8,089 7,619 Equipment owned under

operating leases 21 27 34

43 107 Total nonperforming assets

$ 29,884 $ 27,498 $ 30,434

$ 29,216 $ 21,032 (1) See

“Reconciliation of Non-GAAP Financial Measures” for more

information on this performance measure/ratio. (2) Calculated under

banking regulatory guidelines.

1st SOURCE CORPORATION

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION (Unaudited -

Dollars in thousands)

June 30,

March 31, December 31, June 30,

2017 2017 2016

2016

ASSETS

Cash and due from banks $ 63,473 $ 58,429 $ 58,578 $ 58,944 Federal

funds sold and interest bearing deposits with other banks 12,561

33,687 49,726 14,297 Investment securities available-for-sale

850,314 836,682 850,467 814,258 Other investments 24,238 22,458

22,458 21,973 Mortgages held for sale 16,204 8,409 15,849 15,924

Loans and leases, net of unearned discount: Commercial and

agricultural 876,404 843,757 812,264 759,175 Auto and light truck

512,021 430,489 411,764 457,586 Medium and heavy duty truck 290,687

290,167 294,790 273,674 Aircraft 787,516 783,523 802,414 822,842

Construction equipment 539,097 512,545 495,925 484,354 Commercial

real estate 720,078 723,623 719,170 715,932 Residential real estate

and home equity 526,592 522,772 521,931 506,369 Consumer

128,919 127,986 129,813

132,831

Total loans and leases 4,381,314 4,234,862

4,188,071 4,152,763 Reserve for loan and lease losses

(91,914 ) (90,118 ) (88,543 ) (91,458 )

Net

loans and leases 4,289,400 4,144,744 4,099,528 4,061,305

Equipment owned under operating leases, net 144,509 127,323 118,793

119,312 Net premises and equipment 54,783 55,167 56,708 54,506

Goodwill and intangible assets 83,848 83,960 84,102 84,386 Accrued

income and other assets 147,900 130,667

130,059 135,033

Total assets

$ 5,687,230 $ 5,501,526 $

5,486,268 $ 5,379,938

LIABILITIES

Deposits: Noninterest-bearing demand $ 979,801 $ 966,903 $ 991,256

$ 944,626 Interest-bearing deposits: Interest-bearing demand

1,519,419 1,418,395 1,471,526 1,391,823 Savings 832,341 839,257

814,326 779,899 Time 1,150,475 1,112,421

1,056,652 1,208,736

Total

interest-bearing deposits 3,502,235

3,370,073 3,342,504 3,380,458

Total deposits 4,482,036 4,336,976

4,333,760 4,325,084 Short-term

borrowings: Federal funds purchased and securities sold under

agreements to repurchase 148,109 176,079 162,913 161,826 Other

short-term borrowings 158,474 103,666

129,030 44,150

Total short-term

borrowings 306,583 279,745

291,943 205,976 Long-term debt and mandatorily

redeemable securities 70,438 85,479 74,308 64,738 Subordinated

notes 58,764 58,764 58,764 58,764 Accrued expenses and other

liabilities 70,207 54,628 54,843

63,620

Total liabilities

4,988,028 4,815,592 4,813,618

4,718,182

SHAREHOLDERS’

EQUITY

Preferred stock; no par value

Authorized 10,000,000 shares; none issued

or outstanding

— — — — Common stock; no par value

Authorized 40,000,000 shares; issued

28,205,674 shares at June 30, 2017, March 31, 2017, December 31,

2016, and June 30, 2016, respectively

436,538 436,538 436,538 436,538 Retained earnings 314,889 303,009

290,824 270,744 Cost of common stock in treasury (2,270,350,

2,282,044, 2,329,909, and 2,342,904 shares at June 30, 2017, March

31, 2017, December 31, 2016, and June 30, 2016, respectively)

(54,662 ) (54,940 ) (56,056 ) (56,357 ) Accumulated other

comprehensive income 2,437 1,327

1,344 10,831

Total shareholders’ equity

699,202 685,934 672,650

661,756

Total liabilities and shareholders’

equity $ 5,687,230 $ 5,501,526

$ 5,486,268 $ 5,379,938

1st

SOURCE CORPORATION CONSOLIDATED STATEMENTS OF INCOME

(Unaudited - Dollars in thousands, except per share amounts)

Three Months Ended Six Months Ended June

30, March 31, June 30, June

30, June 30, 2017

2017 2016 2017

2016 Interest income: Loans and leases $ 48,032 $ 44,884 $

43,891 $ 92,916 $ 86,627 Investment securities, taxable 3,370 3,514

3,040 6,884 6,120 Investment securities, tax-exempt 677 683 697

1,360 1,389 Other 319 291 309

610 600

Total interest

income 52,398 49,372 47,937

101,770 94,736 Interest expense:

Deposits 4,511 3,734 3,790 8,245 7,561 Short-term borrowings 272

227 119 499 280 Subordinated notes 1,055 1,055 1,055 2,110 2,110

Long-term debt and mandatorily redeemable securities 699

629 680 1,328

1,203

Total interest expense 6,537

5,645 5,644 12,182

11,154

Net interest income 45,861 43,727

42,293 89,588 83,582 Provision for loan and lease losses

2,738 1,000 2,049 3,738

3,024

Net interest income after provision

for loan and lease losses 43,123 42,727

40,244 85,850 80,558

Noninterest income: Trust and wealth advisory 5,627 5,001

5,108 10,628 9,731 Service charges on deposit accounts 2,464 2,239

2,276 4,703 4,383 Debit card 2,986 2,750 2,816 5,736 5,415 Mortgage

banking 1,304 947 1,115 2,251 2,161 Insurance commissions 1,310

1,767 1,233 3,077 2,796 Equipment rental 7,586 6,832 6,517 14,418

12,590 Gains (losses) on investment securities available-for-sale

465 1,285 (209 ) 1,750 (199 ) Other 2,394

2,486 3,441 4,880 7,047

Total noninterest income 24,136

23,307 22,297 47,443

43,924 Noninterest expense: Salaries and employee benefits

20,712 21,345 21,194 42,057 42,545 Net occupancy 2,368 2,594 2,307

4,962 4,808 Furniture and equipment 5,108 4,793 4,811 9,901 9,601

Depreciation - leased equipment 6,296 5,680 5,444 11,976 10,545

Professional fees 1,672 1,077 1,190 2,749 2,409 Supplies and

communication 1,345 1,250 1,374 2,595 2,882 FDIC and other

insurance 573 623 911 1,196 1,790 Business development and

marketing 1,501 1,652 1,025 3,153 2,005 Loan and lease collection

and repossession 329 636 385 965 812 Other 1,201

1,469 1,393 2,670

3,342

Total noninterest expense 41,105

41,119 40,034 82,224

80,739 Income before income taxes 26,154 24,915

22,507 51,069 43,743 Income tax expense 9,485

8,709 8,028 18,194 15,446

Net income $ 16,669 $ 16,206

$ 14,479 $ 32,875 $

28,297 Per common share: Basic net income per common share

$ 0.64 $ 0.62 $ 0.56

$ 1.26 $ 1.08 Diluted net income per

common share $ 0.64 $ 0.62 $

0.56 $ 1.26 $ 1.08 Cash

dividends $ 0.19 $ 0.18 $ 0.18

$ 0.37 $ 0.36 Basic weighted

average common shares outstanding 25,927,032

25,903,397 25,853,537 25,915,280

25,888,534 Diluted weighted average common shares

outstanding 25,927,032 25,903,397

25,853,537 25,915,280 25,888,534

1st SOURCE CORPORATION DISTRIBUTION OF

ASSETS, LIABILITIES AND SHAREHOLDERS’ EQUITY INTEREST RATES

AND INTEREST DIFFERENTIAL (Unaudited - Dollars in thousands)

Three Months Ended

June 30, 2017 March 31, 2017 June

30, 2016 Average

Balance

InterestIncome/Expense

Yield/

Rate

Average

Balance

InterestIncomeExpense

Yield/

Rate

Average

Balance

InterestIncome/Expense

Yield/

Rate

ASSETS

Investment securities

available-for-sale: Taxable $ 707,373 $ 3,370 1.91 % $ 708,249 $

3,514 2.01 % $ 678,849 $ 3,040 1.80 % Tax exempt(1) 129,542 983

3.04 % 131,034 994 3.08 % 126,007 1,012 3.23 % Mortgages held for

sale 11,325 115 4.07 % 8,155 81 4.03 % 11,100 110 3.99 % Loans and

leases, net of unearned discount(1) 4,308,276 48,069 4.48 %

4,187,231 44,953 4.35 % 4,105,111 43,926 4.30 % Other investments

48,992 319 2.61 % 40,741

291 2.90 % 65,568

309 1.90 % Total earning assets(1) 5,205,508 52,856

4.07 % 5,075,410 49,833 3.98 % 4,986,635 48,397 3.90 % Cash and due

from banks 61,801 59,967 60,786 Reserve for loan and lease losses

(91,044 ) (90,222 ) (90,107 ) Other assets 409,927

392,092

386,316

Total assets $ 5,586,192

$ 5,437,247 $

5,343,630

LIABILITIES AND

SHAREHOLDERS’ EQUITY

Interest-bearing deposits 3,503,444 4,511 0.52 % 3,345,670 3,734

0.45 % 3,380,208 3,790 0.45 % Short-term borrowings 236,716 272

0.46 % 267,823 227 0.34 % 204,828 119 0.23 % Subordinated notes

58,764 1,055 7.20 % 58,764 1,055 7.28 % 58,764 1,055 7.22 %

Long-term debt and mandatorily redeemable securities 83,991

699 3.34 % 75,495

629 3.38 % 65,906 680

4.15 % Total interest-bearing liabilities 3,882,915 6,537

0.68 % 3,747,752 5,645 0.61 % 3,709,706 5,644 0.61 %

Noninterest-bearing deposits 951,531 953,294 920,194 Other

liabilities 54,517 52,554 54,638 Shareholders’ equity

697,229 683,647

659,092

Total liabilities and shareholders’ equity $

5,586,192 $ 5,437,247

$ 5,343,630

Less: Fully tax-equivalent adjustments (458 )

(461 ) (460 ) Net interest income/margin (GAAP-derived)(1)

$ 45,861 3.53 % $

43,727 3.49 % $ 42,293

3.41 % Fully tax-equivalent adjustments 458 461 460 Net

interest income/margin - FTE(1) $ 46,319

3.57 % $ 44,188

3.53 % $ 42,753 3.45 % (1)

See “Reconciliation of Non-GAAP Financial Measures” for more

information on this performance measure/ratio.

1st SOURCE

CORPORATION DISTRIBUTION OF ASSETS, LIABILITIES AND

SHAREHOLDERS’ EQUITY INTEREST RATES AND INTEREST

DIFFERENTIAL (Unaudited - Dollars in thousands)

Six

Months Ended June 30, 2017 June 30, 2016

Average

Balance

InterestIncome/Expense

Yield/

Rate

Average

Balance

InterestIncome/Expense

Yield/

Rate

ASSETS

Investment securities

available-for-sale: Taxable $ 707,809 $ 6,884 1.96 % $ 675,419 $

6,120 1.82 % Tax exempt(1) 130,284 1,977 3.06 % 124,434 2,025 3.27

% Mortgages held for sale 9,748 196 4.05 % 10,119 205 4.07 % Loans

and leases, net of unearned discount(1) 4,248,088 93,022 4.42 %

4,056,772 86,707 4.30 % Other investments 44,890

610 2.74 % 58,460 600

2.06 % Total earning assets(1) 5,140,819 102,689 4.03

% 4,925,204 95,657 3.91 % Cash and due from banks 60,889 59,818

Reserve for loan and lease losses (90,635 ) (89,476 ) Other assets

401,058 381,151

Total assets $ 5,512,131

$ 5,276,697

LIABILITIES AND

SHAREHOLDERS’ EQUITY

Interest-bearing deposits 3,424,992 8,245 0.49 % 3,317,235 7,561

0.46 % Short-term borrowings 252,183 499 0.40 % 218,153 280 0.26 %

Subordinated notes 58,764 2,110 7.24 % 58,764 2,110 7.22 %

Long-term debt and mandatorily redeemable securities 79,767

1,328 3.36 % 64,205

1,203 3.77 % Total interest-bearing

liabilities 3,815,706 12,182 0.64 % 3,658,357 11,154 0.61 %

Noninterest-bearing deposits 952,408 909,603 Other liabilities

53,541 54,393 Shareholders’ equity 690,476

654,344

Total liabilities and shareholders’ equity $

5,512,131 $ 5,276,697

Less: Fully tax-equivalent

adjustments (919 ) (921 ) Net interest income/margin

(GAAP-derived)(1) $ 89,588 3.51

% $ 83,582 3.41 % Fully

tax-equivalent adjustments 919 921 Net interest income/margin -

FTE(1) $ 90,507 3.55 %

$ 84,503 3.45 % (1) See

“Reconciliation of Non-GAAP Financial Measures” for more

information on this performance measure/ratio.

1st SOURCE

CORPORATION RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (Unaudited - Dollars in thousands, except per share

data)

Three Months

Ended Six Months Ended June 30, March 31,

June 30, June 30, June 30,

2017 2017 2016

2017 2016

Calculation of

Net Interest Margin

(A) Interest income (GAAP) $ 52,398 $ 49,372 $ 47,937 $ 101,770 $

94,736 Fully tax-equivalent adjustments: (B) - Loans and leases 152

150 145 302 285 (C) - Tax exempt investment securities

306 311 315 617

636 (D) Interest income - FTE (A+B+C) 52,856

49,833 48,397 102,689 95,657 (E) Interest expense (GAAP) 6,537

5,645 5,644 12,182 11,154 (F) Net interest income (GAAP)

(A-E) 45,861 43,727 42,293

89,588 83,582 (G) Net

interest income - FTE (D-E) 46,319 44,188

42,753 90,507 84,503

(H) Annualization factor 4.011 4.056 4.022 2.017 2.011 (I)

Total earning assets $ 5,205,508 $ 5,075,410 $ 4,986,635 $

5,140,819 $ 4,925,204 Net interest margin (GAAP-derived) (F*H)/I

3.53 % 3.49 % 3.41 % 3.51 % 3.41 % Net interest margin - FTE

(G*H)/I 3.57 % 3.53 % 3.45 % 3.55 % 3.45 %

Calculation of

Efficiency Ratio

(F) Net interest income (GAAP) $ 45,861 $ 43,727 $ 42,293 $ 89,588

$ 83,582 (G) Net interest income - FTE 46,319 44,188 42,753 90,507

84,503 (J) Plus: noninterest income (GAAP) 24,136 23,307 22,297

47,443 43,924 (K) Less: gains/losses on investment securities and

partnership investments (477 ) (1,314 ) (743 ) (1,791 ) (1,853 )

(L) Less: depreciation - leased equipment (6,296 )

(5,680 ) (5,444 ) (11,976 ) (10,545 )

(M) Total net revenue (GAAP) (F+J) 69,997

67,034 64,590 137,031

127,506 (N) Total net revenue - adjusted

(G+J–K–L) 63,682 60,501 58,863

124,183 116,029 (O) Noninterest

expense (GAAP) 41,105 41,119 40,034 82,224 80,739 (L)

Less:depreciation - leased equipment (6,296 ) (5,680 ) (5,444 )

(11,976 ) (10,545 ) (P) Less: contribution expense limited

to gains on investment securities in (K) —

(462 ) — (462 ) — (Q)

Noninterest expense - adjusted (O–L–P) 34,809 34,977 34,590 69,786

70,194 Efficiency ratio (GAAP-derived) (O/M) 58.72 % 61.34 % 61.98

% 60.00 % 63.32 % Efficiency ratio - adjusted (Q/N) 54.66 % 57.81 %

58.76 % 56.20 % 60.50 %

End of Period June 30,

March 31, June 30,

2017 2017 2016

Calculation of

Tangible Common Equity-to-Tangible Assets Ratio

(R) Total common shareholders’ equity (GAAP) $ 699,202 $ 685,934 $

661,756 (S) Less: goodwill and intangible assets

(83,848 ) (83,960 ) (84,386 ) (T) Total

tangible common shareholders’ equity (R–S) $ 615,354

$ 601,974 $ 577,370 (U) Total assets

(GAAP) 5,687,230 5,501,526 5,379,938 (S) Less: goodwill and

intangible assets (83,848 ) (83,960 ) (84,386

) (V) Total tangible assets (U–S) $ 5,603,382

$ 5,417,566 $ 5,295,552 Common

equity-to-assets ratio (GAAP-derived) (R/U) 12.29 % 12.47 % 12.30 %

Tangible common equity-to-tangible assets ratio (T/V) 10.98 % 11.11

% 10.90 %

Calculation of

Tangible Book Value per Common Share

(R) Total common shareholders’ equity (GAAP) $ 699,202 $ 685,934 $

661,756 (W) Actual common shares outstanding

25,935,324 25,923,630 25,862,770

Book value per common share (GAAP-derived) (R/W)*1000 $ 26.96 $

26.46 $ 25.59 Tangible common book value per share (T/W)*1000 $

23.73 $ 23.22 $ 22.32

The NASDAQ Stock Market National Market Symbol: “SRCE” (CUSIP

#336901 10 3)Please contact us at shareholder@1stsource.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170720005978/en/

1st Source CorporationAndrea Short, 574-235-2000

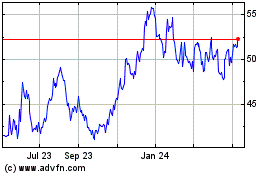

1st Source (NASDAQ:SRCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

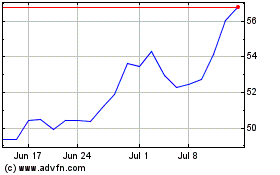

1st Source (NASDAQ:SRCE)

Historical Stock Chart

From Apr 2023 to Apr 2024