Rail Executives Gathering to Address Investor Concerns

September 05 2015 - 5:59AM

Dow Jones News

By Laura Stevens

Railroads have been losing steam this year, weighed down by

falling commodity volumes, and there is little hope of improvement

on the track.

Rail executives from CSX Corp., Norfolk Southern Corp. and Union

Pacific Corp. this week will address investor concerns at a time

when an economic slowdown in China is fueling worries about global

economic growth. Those executives and others will be appearing

Wednesday and Thursday at the Cowen Group Inc.'s Global

Transportation Conference in Boston.

"Rails have become a lot more reliant upon commodities to fuel

growth, much more so than in years past. Consequently, China does

play a role," said Mark Levin, a rail analyst with BB&T Capital

Markets. "Commodity price moves are largely dictated by China's

consumption."

Coal demand has fallen 9% for rails so far this year as more

power plants switch to natural gas. Declining oil prices turned the

boom in shipping crude-by-rail into a bust, with petroleum and

related product shipments down 5% this year. And the railroads'

metal business is hurting, too, as natural-gas and oil producers

need fewer pipes for drilling and imports become cheaper.

As a result, rail stocks are down an average 26% so far this

year, according to BB&T Capital Markets, erasing last year's

22% increase. Since the start of July, the stocks are down about

9%, BB&T Capital said.

The decline in rail volumes has hit profits, too. Norfolk

Southern in July reported a 23% drop in second-quarter profit to

$433 million, adding that declining revenue from coal, crude oil

and fuel surcharges would pressure results for the second half of

the year. Union Pacific's profits dropped 7% to $1.2 billion in the

same quarter.

While CSX reported that cost-cutting helped fuel a 4.5% rise in

its quarterly profit, it issued a similar warning on coal.

Executives speaking at the Cowen conference are also likely to

highlight efforts to scale back their networks to accommodate lower

volumes and cost-cutting measures like furloughing employees and

storing trains.

The rails are likely to provide a better "understanding of where

they are getting the rail costs in line with the volume," said

David Vernon, an analyst with Sanford C. Bernstein & Co. "If

the volume starts to moderate and finds the floor, they should be

able to catch up with it."

Much of the problem stems from booms in cargo last year, when

traffic volumes increased 4.5% across the board and railroads

scrambled to add resources to accommodate the gains and to keep

cargo moving. But as energy prices declined this year, volumes were

hit, raising the question of whether pricing can hold up.

Railroads have been competing with trucking for intermodal

volume, or the transportation of trailers and containers. That type

of volume is up 2.6% so far this year, but as fuel prices fall,

trucking has become more competitive with rails.

Still, rail "pricing is still very strong, and even

accelerating," said Justin Long, a Stephens Inc. analyst who met

with the major railroads in recent days. "From a service

perspective, too, things are getting better."

The Week Ahead looks at coming corporate events.

Write to Laura Stevens at laura.stevens@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 05, 2015 05:44 ET (09:44 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

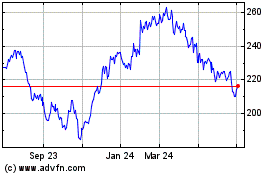

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

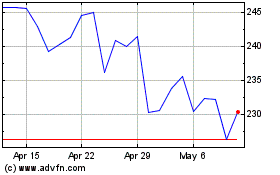

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Apr 2023 to Apr 2024