Rabobank Reports 39% Fall in First-Half Profit on Extra Provision

August 18 2016 - 3:08AM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM--Rabobank Group on Wednesday posted a 39% drop in net

profit for the first half of 2016, pulled lower by a provision

related to an interest-rate derivatives mis-selling case in the

Netherlands.

Net profit was 924 million euros ($1.04 billion), from 1.5

billion euros in the same period a year earlier, as the bank took a

541 million euro charge linked to the mis-selling issue. Higher

restructuring costs also weighed on the results, as the bank is

implementing a radical overhaul that will result in thousands of

job losses.

Dutch banks said last month they would join a

government-initiated arrangement to compensate thousands of small

and medium-size businesses who suffered losses on interest-rate

derivatives. The customers said they weren't properly informed

about the risks of these products, a view that was backed by the

Dutch financial markets regulator.

ABN Amro Group NV said this week it took an additional €271

million provision to settle the case, while ING Groep NV has set

aside another 137 million euros. In total, Dutch banks have set

aside more than 1 billion euros.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

August 18, 2016 02:53 ET (06:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

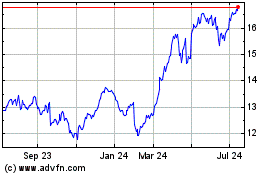

ING Groep NV (EU:INGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

ING Groep NV (EU:INGA)

Historical Stock Chart

From Apr 2023 to Apr 2024