TIDMRTC

RNS Number : 9546T

RTC Group PLC

24 July 2015

RTC Group Plc

("RTC", "the Company" or "the Group")

Interim Results for the Six Months Ended 30 June 2015

RTC Group Plc is pleased to announce its interim results for the

six months ended 30 June 2015.

Highlights:

-- Group revenue from continuing operations GBP29.5m (2014: GBP25.3m)

-- Group profit from operations (before amortisation of intangibles) GBP507k (2014: GBP467k)

-- Cash outflow from operations GBP0.8m (2014: GBP1.4m inflow)

-- Basic earnings per share 2.36p (2014: 2.32p)

The Directors propose an interim dividend of 1.0p per share

(2014: 0.5p). The Company has a progressive dividend policy.

Subject to approval of the Directors, the interim dividend will be

paid on the 30 November 2015 to shareholders on the register on 6

November 2015.

Commenting on the results Bill Douie, Chairman, said:

"I am pleased to report that the Group has performed in line

with expectations for the half year.

Ganymede's core contract to provide contingent labour for

Network Rail for maintenance is not expected to be impacted by any

rescheduling of Network Rail Infrastructure Projects and early

volumes on the new contract are in line with expectations.

The new staff in ATA have settled in well and market conditions

are buoyant.

GSS has delivered a solid performance from new and existing

contracts and it is anticipated new business levels will increase

in the second half of the year.

We remain confident that for the full year the Group will

perform in line with current market expectations."

The interim report is available on the Company's website

www.rtcgroupplc.co.uk.

ENDS

Enquiries:

RTC Group plc

Bill Douie, Executive Chairman Tel: 01332 861

Andy Pendlebury, CEO 844

Sarah Dye, Group Finance Director

WH Ireland (Nominated Adviser and Broker) Tel: 0113 394

Katy Mitchell / Liam Gribben 6600

About RTC

RTC has three principal trading subsidiaries engaged in the

recruitment of human capital resources and the provision of managed

services.

ATA is one of the UK's leading engineering and technical

recruitment consultancies. Supplying white and blue collar

engineering and technical staff to a broad range of SME clients and

vertical markets.

Ganymede is focussed on the supply and operation of blue collar

contingent labour into safety critical markets.

Global Staffing Solutions (GSS) predominantly provides managed

service solutions for international clients.

Chairman's statement

Six months ended 30 June 2015

I am pleased to present the interim report of the Company for

the six months to 30 June 2015.

Group

Trading in the first six months of 2015 was in line with

expectations and on a like for like basis profits from operations

have increased by 8.6% (excluding amortisation of intangibles

relating to the acquisition of RIG Energy in December 2014). This

is despite the fact that during the period we incurred significant

start-up costs in preparation for the commencement of our recently

awarded five year contract with Network Rail. These costs included

enhancement of our management team and the establishment of

additional locations to support recruitment in new regions won

under the contract.

Recruitment

All our recruitment businesses have performed as expected in the

first half with Ganymede enjoying a full six month contribution

from its new Energy division and initial investment and

mobilisation for the five year Network Rail contract all but

complete.

Ganymede was awarded the contract to supply contingent labour to

Network Rail for track maintenance on 25 February 2015 and on 20

March 2015 we confirmed that the contract had been signed.

During the second half of 2014, we took the opportunity to

enhance the number of consultants in ATA. The rewards from that

investment began to come through in the second half of 2014 and

have continued into 2015, and given the continuing positive

economic environment in the UK, we are continuing with our strategy

to invest in additional headcount in what is a very competitive

market.

For GSS, the drawing to a close of NATO involvement in

Afghanistan has reduced the headcount to a planned level that is

expected to be maintained throughout 2015 and current indications

suggest this will continue throughout 2016. In addition to our core

contract in Afghanistan, we have secured a number of smaller

contracts in the region and we continue to pursue other

opportunities for our 'Ethical Managed Service Solution'

overseas.

Business levels for the Derby Conference centre (DCC) were

consistent with the equivalent period in 2014.

Change of emphasis for the DCC

Over the next twelve months, we expect to engage in extensive

improvement and re-organisation of the premises on the Derby site

to accommodate the Company's current and planned growth and to

facilitate a move away from party and wedding events in favour of

more business related customer activities and an increase in

providing flexible office accommodation for local businesses.

Management and Board

During the period, Non-Executive Director, Tim Jackson, left the

Company to pursue other projects in the charitable sector. In his

time with us Tim played an important role in the strategic

development of the Group. I and the Board thank Tim for his

contribution and wish him well for the future. We have initiated

the search for a replacement.

Long-term strategic reward programme

During the period the Company bought back 675,581 Ordinary

Shares to enable it to implement its long term strategic reward

programme to incentivise key employees as the Group enters the next

phase of its exciting growth plan. The shares are being held in an

Employee Benefit Trust (EBT).

Dividends

The Directors propose an interim dividend of 1.0p per share

(2014: 0.5p). The Company has a progressive dividend policy.

Subject to approval of the Directors, the interim dividend will be

paid on the 30 November 2015 to shareholders on the register on 6

November 2015.

Outlook

Ganymede's core contract to provide contingent labour for

Network Rail for maintenance is not expected to be impacted by any

rescheduling of Network Rail Infrastructure Projects and early

volumes on the new contract are in line with expectations.

The new staff in ATA have settled in well and market conditions

are buoyant.

GSS has delivered a solid performance from new and existing

contracts and it is anticipated new business levels will increase

in the second half of the year.

We remain confident that for the full year the Group will

perform in line with market expectations.

W J C Douie 24 July 2015

Chairman

Finance Director's statement

Six months ended 30 June 2015

Revenue and gross margin

In the period ended 30 June 2015, Group revenue increased to

GBP29.5m (2014:GBP25.3m) with all Group companies performing to

expectations. Overall gross margin increased slightly to 20.5%

(2014: 20.0%).

Profit from operations

Overall group profit from operations was GBP441k (2014:

GBP467k). Like for like profit from operations was GBP507k, an

increase of 8.6% on 2014 (excluding the amortisation of intangibles

relating to the acquisition of RIG Energy Limited in 2014).

ATA

The headcount investments made in ATA during the latter part of

2014 coupled with the positive UK economy have delivered

encouraging results. Profit from operations is up 46% at GBP734k

(2014: GBP502k). Gross margin is also showing improvement at 23.9%

(2014: 22%).

Ganymede

A significant up-front investment programme was required for the

five year contract to supply Network Rail with contingent labour

for maintenance. This investment programme, together with the

contract mobilisation has largely been completed. As a result the

impact of the contract on the first half results is not significant

and the increase in profit from operations to GBP639k (2014:

GBP510k) predominantly reflects the inclusion of Ganymede Energy,

coupled with consistent levels of activity from other clients.

Despite the investment required for the Network Rail contract,

gross margin has been maintained near 2014 levels at 16% (2014:

16.5%).

GSS

Profit from operations of GBP275k (2014: GBP463k) reflects the

planned reduction of contractor numbers in Afghanistan following

the drawdown of NATO involvement. Continuing efficiencies in

managing that core contract are reflected in an improved gross

margin of 16.4% (2013: 15.7%).

Taxation

The total tax charge for the period is estimated at GBP75k

(2014: GBP92k).

Earnings per share

The basic earnings per share figure is 2.36p (2014: 2.32p). The

diluted earnings per share 2.34p (2014: 2.14p). Profit before tax

is GBP398k (2014: GBP405k).

Dividends

During the period the company paid an interim dividend of

GBP67,558 (2014: GBPNil) to its equity shareholders. This

represents a payment of 1.0p (2014: nil) per share.

The Directors propose an interim dividend of 1.0p per share

(2014: 0.5p). The Company has a progressive dividend policy.

Subject to approval of the Directors, the interim dividend will be

paid on the 30 November 2015 to shareholders on the register on 6

November 2015.

Purchase of own shares and formation of EBT

During the period the Company purchased 675,581 Ordinary Shares

to implement a long term strategic reward programme to incentivise

key employees as the Group enters the next phase of its exciting

growth plan. The Company established an EBT to hold the shares. The

EBT is considered an extension of the Company's activities and

therefore assets (except investments in the Company's shares) and

liabilities which are the subject of the trust are included in the

consolidated accounts on a line-by-line basis. The cost of shares

held by the EBT is presented as a separate debit reserve within

equity named 'Own Shares Held'.

Statement of financial position

The Group statement of financial position has further

strengthened compared to the same point last year with net working

capital increasing to GBP6.6m (2014: GBP1.6m) due to the increased

activity on the Network Rail contract and increased revenue in

ATA.

The ratio of current assets to current liabilities dipped

slightly to 1.1 (2014: 1.2) and the gearing ratio rose to 2.1 times

(2014: 1.2 times) largely reflecting the timing of GBP2.2m of

customer receipts relating to three key clients that were overdue

at the end of June but received in July. Customer receipts in the

first two weeks of July were GBP1.6m higher than the two weeks

prior to that date.

Interest cover has increased to 10.3 times (2014: 7.5

times).

Cash flow

There was a cash outflow from operations of GBP0.8m (2014:

GBP1.4m inflow). The outflow is predominantly a result of the

timing of customer receipts noted above, the up-front investment

required to mobilise the new network rail contract and the purchase

of own shares.

Financing

The Group's current bank facilities include an overdraft of

GBP50,000 and a confidential invoice discounting facility of up to

GBP7.0m with HSBC. The Group is currently operating well within its

facility cap and has negotiated a 0.25% reduction on its discount

margin.

The Board closely monitors the level of facility utilisation and

availability to ensure that there is sufficient headroom to manage

current operations and support the growth of the business.

The Group continues to be focussed on cash generation and

building a robust statement of financial position to support the

growth of the business.

Sarah Dye 24 July 2015

Group Finance Director

Consolidated statement of comprehensive income

Six months ended 30 June 2015

Six month Six month Year ended

period ended period ended 31 December

30 June 30 June 2014 2014

2015

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

-------------------------- ------- ---------------------- ---------------------- --------------

Revenue 2 29,475 25,268 50,932

Cost of sales 2 (23,442) (20,225) (40,756)

-------------------------- ------- ---------------------- ---------------------- --------------

Gross profit 2 6,033 5,043 10,176

Administrative expenses (5,592) (4,576) (9,067)

-------------------------- ------- ---------------------- ---------------------- --------------

Profit from operations 441 467 1,109

Financing expense (43) (62) (91)

-------------------------- ------- ---------------------- ---------------------- --------------

Profit before tax 398 405 1,018

Tax expense 3 (75) (92) (218)

-------------------------- ------- ---------------------- ---------------------- --------------

Net profit and total

comprehensive income

for the year 323 313 800

-------------------------- ------- ---------------------- ---------------------- --------------

Earnings per ordinary

share 7

Basic 2.36p 2.32p 5.92p

-------------------------- ------- ---------------------- ---------------------- --------------

Diluted 2.34p 2.14p 5.42p

-------------------------- ------- ---------------------- ---------------------- --------------

Consolidated statement of changes in equity

Six months ended 30 June 2015

Six months ended 30 June 2015

Share Share Own Capital Share Profit Total

capital premium shares redemption based and equity

held reserve payment loss

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2015 (audited) 135 - - 50 26 2,230 2,441

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Profit and

total comprehensive

income for

the period - - - - - 323 323

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Dividends - - - - - (136) (136)

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Own shares

purchased in

EBT - - (472) - - - (472)

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Share options

exercised 8 66 - - - - 74

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Share based

payment reserve - - - - - - -

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

At 30 June

2015 (unaudited) 143 66 (472) 50 26 2,417 2,230

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Six months ended 30 June 2014

Share Share Capital Share Accumulated Total

capital premium redemption based losses equity

reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2014

(audited) 135 2,468 50 18 (970) 1,701

---------------------- ---------- ---------- ------------- ---------- ------------- ---------

Profit and total

comprehensive

income for the

period - - - - 313 313

---------------------- ---------- ---------- ------------- ---------- ------------- ---------

Share based payment

reserve - - - 8 - 8

---------------------- ---------- ---------- ------------- ---------- ------------- ---------

At 30 June 2014

(unaudited) 135 2,468 50 26 (657) 2,022

---------------------- ---------- ---------- ------------- ---------- ------------- ---------

Consolidated statement of changes in equity

Six months ended 30 June 2015

Year ended 31 December 2014

Share Share Capital Share Profit and Total

capital premium redemption based loss equity

reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2014

(audited) 135 2,468 50 18 (970) 1,701

---------------------- ---------- ---------- ------------- ---------- ------------ ---------

Profit and total

comprehensive

income for the

year - - - - 800 800

---------------------- ---------- ---------- ------------- ---------- ------------ ---------

Dividends - - - - (68) (68)

---------------------- ---------- ---------- ------------- ---------- ------------ ---------

Share premium

cancellation - (2,468) - - 2,468 -

---------------------- ---------- ---------- ------------- ---------- ------------ ---------

Share based payment

reserve - - - 8 - 18

---------------------- ---------- ---------- ------------- ---------- ------------ ---------

At 31 December

2014 (audited) 135 - 50 26 2,230 2,441

---------------------- ---------- ---------- ------------- ---------- ------------ ---------

The share based payment reserve comprises the cumulative share

option charge under IFRS 2 less the value of any share options that

have been exercised or have lapsed.

Consolidated statement of financial position

As at 30 June 2015

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2014 Audited

June 2015 June 2014

Unaudited Unaudited

Note GBP'000 GBP'000 GBP'000

--------------------------------- ------ ------------ ------------ ---------------

Assets

Non-current

Goodwill 132 - 132

Other intangible assets 596 - 662

Property, plant and equipment 459 389 466

Deferred tax asset 4 40 70 62

--------------------------------- ------ ------------ ------------ ---------------

1,227 459 1,322

Current

Cash and cash equivalents 158 69 41

Inventories 14 12 19

Trade and other receivables 11,212 8,193 9,267

--------------------------------- ------ ------------ ------------ ---------------

Total current assets 11,384 8,274 9,327

Total assets 12,611 8,733 10,649

--------------------------------- ------ ------------ ------------ ---------------

Liabilities

Current

Trade and other payables (5,263) (4,141) (4,713)

Corporation tax (251) (147) (186)

Current borrowings (4,742) (2,406) (3,166)

--------------------------------- ------ ------------ ------------ ---------------

Total current liabilities (10,256) (6,694) (8,065)

Non-current liabilities

Creditors falling due after one year

- finance leases (5) - (132)

Deferred tax liabilities 5 (120) (17) (11)

--------------------------------- ------ ------------ ------------ ---------------

Net assets 2,230 2,022 2,441

--------------------------------- ------ ------------ ------------ ---------------

Equity

Share capital 143 135 135

Share premium 66 2,468 -

Own shares held (472) - -

Capital redemption reserve 50 50 50

Share based payment reserve 26 26 26

Profit and loss account 2,417 (970) 2,230

Total equity 2,230 1,709 2,441

--------------------------------- ------ ------------ ------------ ---------------

Consolidated statement of cash flows

Six months ended 30 June 2015

Six month Six month Year ended

period ended period ended 31 December

30 June 30 June 2014 Audited

2015 Unaudited 2014 Unaudited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit from operations 441 467 1,109

Adjustments for:

Depreciation, loss on disposal

and amortisation 150 107 217

Employee equity settled share

options - 8 8

Change in inventories 4 3 (4)

Change in trade and other receivables (1,944) 934 734

Change in trade and other payables 550 (89) 207

----------------------------------------- ----------------- ----------------- ---------------

Cash (outflow)/inflow from operations (799) 1,430 2,271

Income tax paid - - (80)

Net cash (outflow)/inflow from

operating activities (799) 1,430 2,191

----------------------------------------- ----------------- ----------------- ---------------

Cash flows from investing activities

Purchases of property, plant and

equipment (77) (65) (245)

Acquisition of business - cash

paid - - (875)

Debt acquired on acquisition - - (391)

----------------------------------------- ----------------- ----------------- ---------------

Net cash used in investing activities (77) (65) (1,511)

Cash flows from financing activities

Interest payments (43) (62) (91)

Lease purchase payments (6) (5) (11)

Dividends paid (136) - (68)

Proceeds from exercise of share

options 74 - -

Purchase of own shares (472) - -

----------------------------------------- ----------------- ----------------- ---------------

Net cash outflow from financing

activities (583) (67) (170)

----------------------------------------- ----------------- ----------------- ---------------

Net (decrease)/increase in cash

and cash equivalents from operations (1,459) 1,298 510

----------------------------------------- ----------------- ----------------- ---------------

Total net (decrease) / increase

in cash and cash equivalents (1,459) 1,298 (360)

----------------------------------------- ----------------- ----------------- ---------------

Cash and cash equivalents at beginning

of period (3,125) (3,635) (3,635)

----------------------------------------- ----------------- ----------------- ---------------

Cash and cash equivalents at end

of period (4,584) (2,337) (3,125)

----------------------------------------- ----------------- ----------------- ---------------

Notes to the interim statement

Six months ended 30 June 2015

1. Accounting policies

a) General information

RTC Group PLC is incorporated and domiciled in England and its

shares are publicly traded on AIM. The registered office address is

The Derby Conference Centre, London Road, Derby, DE24 8UX. The

company's registered number is 02558971. The principal activities

of the Group are described in note 2.

The Board consider the principal risks and uncertainties

relating to the Group for the next six months to be the same as

detailed in our last Annual Report and Accounts to 31 December

2014. The Group's financial risk management objectives and policies

are consistent with those disclosed in the consolidated financial

statements as at and for the year ended 31 December 2014.

b) Basis of preparation

The unaudited interim group financial information of RTC Group

PLC is for the six months ended 30 June 2015 and does not comprise

statutory accounts within the meaning of S.435 of the Companies Act

2006. The unaudited interim group financial statements have been

prepared in accordance with the AIM rules and have not been

reviewed by the Group's auditors. This report should be read in

conjunction with the Group's Annual Report and Accounts for the

year ended 31 December 2014, which have been prepared in accordance

with IFRS's as adopted by the European Union.

These unaudited interim group financial statements were approved

for issue on 24 July 2015. No significant events, other than those

disclosed in this document, have occurred between 30 June 2015 and

this date.

c) Comparatives

The comparative figures for the year ended 31 December 2014 do

not constitute statutory accounts within the meaning of S.435 of

the Companies Act 2006, but they have been derived from the audited

financial statements for that year, which have been filed with the

Registrar of Companies. The report of the auditor was unqualified

and did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006 nor a reference to any matters which the auditor

drew attention by way of emphasis of matter without qualifying

their report.

d) Accounting policies

Other than the set up of the Employee Benefit Trust (EBT)

explained below, there have been no significant changes in the

basis upon which estimates have been determined, compared to those

applied at 31 December 2014 and no change in estimate has had a

material effect on the current period.

This interim announcement has been prepared in accordance with

the recognition and measurement requirements of International

Financial Reporting Standards issued by the International

Accounting Standards Board, as adopted by the European Union as

effective for periods beginning on or after 1 January 2015.

EBT

During the year the company set up an EBT. The EBT is considered

an extension of the company's activities and therefore assets

(except investments in the company's shares) and liabilities which

are the subject of the trust are included in the consolidated

accounts on a line-by-line basis. The cost of shares held by the

EBT is presented as a separate debit reserve within equity entitled

'own shares held'.

2. Segment analysis

The Group is a provider of recruitment services and conferencing

services that is based at the Derby Conference Centre (DCC). The

recruitment business comprises three distinct business units - ATA

predominantly servicing the UK SME engineering market and a number

of vertical markets; GSS servicing the international market and

Ganymede supplying labour into safety critical environments, mainly

rail.

Segment information is provided below in respect of ATA, GSS,

Ganymede and the DCC which, as well as being the head office for

the Group, provides hotel and conferencing facilities.

The Group manages the trading performance of each segment by

monitoring operating contribution and centrally manages working

capital, borrowings and equity.

Revenues are generated from permanent and temporary recruitment

in the Recruitment division. Revenue is analysed by origin of

customer/point of invoicing and as such all recruitment division

revenues are supplied in the United Kingdom. Hotel and conferencing

services are wholly provided in the UK at the DCC.

All revenues have been invoiced to external customers. During

2015, one customer in GSS contributed 10% or more of that segment's

revenues being GBP5.0m (2014: GBP6.9m) and one customer in Ganymede

also contributed 10% or more of that segment's revenues being

GBP5.4m (2014: GBP3.4m).

The segment information for the reporting period is as

follows:

Six months ended 30 June 2015:

Recruitment Conferencing Total

ATA GSS Ganymede DCC Group

Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- ----------- ------------- ----------- -------------- -----------

External sales

revenue 12,625 5,079 10,982 789 29,475

Cost of sales (9,606) (4,244) (9,223) (369) (23,442)

------------------- ----------- ------------- ----------- -------------- -----------

Gross profit 3,019 835 1,759 420 6,033

Administrative

expenses (2,258) (560) (1,116) (412) (4,346)

Depreciation (27) - (4) (24) (55)

-------------------

Segment profit

from operations 734 275 639 (16) 1,632

Amortisation

of intangibles (66)

Group costs (1,125)

-----------

Profit from operations per statement of

comprehensive income 441

-----------

Notes to the interim statement

Six months ended 30 June 2015

Six months ended 30 June 2014:

<--------- Recruitment --------> Conferencing Total

ATA GSS Ganymede DCC Group

Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- ------------ ------------- ----------- -------------- -----------

External sales

revenue 11,139 7,040 6,291 798 25,268

Cost of sales (8,683) (5,937) (5,252) (353) (20,225)

------------------- ------------ ------------- ----------- -------------- -----------

Gross profit 2,456 1,103 1,039 445 5,043

Administrative

expenses (1,928) (639) (524) (416) (3,507)

Depreciation (26) (1) (5) (39) (71)

------------------- ------------ ------------- ----------- -------------- -----------

Segment profit

from operations 502 463 510 (10) 1,465

Group costs (998)

-----------

Profit from operations per statement of

comprehensive income 467

-----------

Year ended 31 December 2014:

<-------- Recruitment --------> Conferencing

ATA GSS Ganymede DCC Total Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- ----------- ----------- ----------- -------------- -------------

External sales

revenue 23,867 12,772 12,534 1,759 50,932

Cost of sales (18,703) (10,815) (10,446) (792) (40,756)

------------------- ----------- ----------- ----------- -------------- -------------

Segment gross

profit 5,164 1,957 2,088 967 10,176

Administrative

expenses (3,858) (1,064) (1,130) (802) (6,854)

Depreciation (128) - (9) (69) (206)

Segment profit

from operations 1,178 893 949 96 3,116

Group costs (2,007)

-------------

Profit from operations per statement of

comprehensive income 1,109

-------------

All assets and liabilities are held in the United Kingdom.

3. Income tax

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2014 Audited

June 2015 June 2014

Continuing operations Unaudited Unaudited

GBP'000 GBP'000 GBP'000

------------------------------------------- ------------ ------------ ---------------

Analysis of tax:-

Current tax

UK corporation tax 81 52 185

Adjustment in respect of previous period (16) - (15)

------------------------------------------- ------------ ------------ ---------------

65 52 170

Deferred tax

Origination and reversal of temporary

differences 22 40 48

Intangible asset permanent difference (12)

Tax 75 92 218

------------------------------------------- ------------ ------------ ---------------

Factors affecting the tax expense

The tax assessed for the six month period ended 30 June 2015 is

less than would be expected by multiplying profit on ordinary

activities by the standard rate of corporation tax in the UK of

20.5% (2014: 21.5%). The differences are explained below:

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2014 Audited

June 2015 June 2014

Unaudited Unaudited

Factors affecting tax expense GBP'000 GBP'000 GBP'000

------------------------------------------- ------------ ------------ ---------------

Result for the year before tax 398 405 1,018

------------------------------------------- ------------ ------------ ---------------

Profit multiplied by standard rate of

tax of 20.5% (2014: 21.5%) 82 87 214

Non-deductible expenses 21 5 23

Intangible asset permanent difference (12)

Utilisation of losses - - (29)

Adjustment in respect of previous period (16) - 10

------------------------------------------- ------------ ------------ ---------------

Tax charge for the year 75 92 218

------------------------------------------- ------------ ------------ ---------------

4. Deferred tax asset

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2014 Audited

June 2015 June 2014

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

At 1 January 62 110 110

Charge to the profit or loss for the

year (22) (40) (48)

----------------------------------------------- ------------ ------------ ---------------

At 30 June 40 70 62

----------------------------------------------- ------------ ------------ ---------------

The deferred tax asset is analysed as:

Depreciation in excess of capital allowances 40 64 62

Tax losses carried forward - 6 -

----------------------------------------------- ------------ ------------ ---------------

40 70 62

----------------------------------------------- ------------ ------------ ---------------

Unrecognised

Tax losses carried forward 83 83 83

----------------------------------------------- ------------ ------------ ---------------

5. Deferred tax liability

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2014 Audited

June 2015 June 2014

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

At 1 January 132 - -

Charge to the profit or loss for the (12) - -

year

Addition in year - - 132

----------------------------------------- ------------ ------------ ---------------

At 30 June 120 - 132

----------------------------------------- ------------ ------------ ---------------

The deferred tax liability is analysed

as:

Liability arising on intangible assets 120 - 132

120 - 132

----------------------------------------- ------------ ------------ ---------------

6. Dividends

During the period the company paid an interim dividend of

GBP67,558 (2014: GBPnil) to its equity shareholders. This

represents a payment of 1.0p (2014: nil) per share.

The Directors propose an interim dividend of 1.0p per share

(2014: 0.5p). Subject to approval of the Directors, the interim

dividend will be paid on 30 November 2015 to shareholders on the

register on 6 November.

7. Earnings per share

The calculation of basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

The calculation of diluted earnings per share is based on the

basic earnings per share adjusted to allow for all dilutive

potential ordinary shares.

Basic Diluted

Six month Six month Total group Six month Six month Total group

period period year ended period period year ended

ended ended 31 December ended ended 31 December

30 June 30 June 2014 30 June 30 June 2014

2015 2014 2015 2014

Unaudited Unaudited Audited Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Earnings GBP'000 323 313 800 323 313 800

-------------------- ------------ ------------ -------------- ------------ ------------ --------------

Weighted average

number of shares 13,663,126 13,511,626 13,511,626 13,820,904 14,633,961 14,747,458

-------------------- ------------ ------------ -------------- ------------ ------------ --------------

Earnings per

share (pence) 2.36p 2.32p 5.92p 2.34p 2.14p 5.42p

-------------------- ------------ ------------ -------------- ------------ ------------ --------------

A total of 675,581 own shares held in the EBT have been excluded

from the weighted average number of shares above.

8. Analysis of changes in net debt

At Cash Other non- At

Flows cash movements

1 January 30 June

2015

2015

(Audited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ------------ --------- ----------------- --------------

Overdraft and invoice

discounting arrangements (3,166) (1,576) - (4,742)

Cash 41 117 - 158

---------------------------- ------------ --------- ----------------- --------------

Net debt (3,125) (1,459) - (4,584)

---------------------------- ------------ --------- ----------------- --------------

The Group has a working capital facility with HSBC PLC that

allows it to borrow up to 90% of the invoiced trade debtors of ATA,

GSS and Ganymede up to GBP7.0m and an overdraft facility of

GBP50,000.

9. Contingent liabilities

Included in current borrowings are bank overdrafts and an

invoice discounting facility. During the year the Group has used

its bank overdraft and invoice discounting facility, which is

secured by a cross guarantee and debenture over the Group

companies. There have been no defaults or breaches of interest

payable during the current or prior period.

10. Related party transactions

RTC Group Plc is the parent company of the Group that includes

the following trading entities that have been consolidated:

ATA Recruitment Limited

The Derby Conference Centre Limited

Ganymede Solutions Limited

ATA Global Staffing Solutions Limited

The Group, as permitted by the scope paragraph of IAS 24,

Related Party Disclosures, has not disclosed transactions with

other group companies that are eliminated on consolidation in the

Group financial statements.

Transactions with related parties not consolidated

The accounts of Accurate Recruitment and Training Services PBT

Limited (ATA India), a 90% owned subsidiary of the Group, have not

been consolidated as the Directors consider the amounts involved

are not material.

During the period ended 30 June 2015 ATA India invoiced ATA

Global Staffing Solutions Limited GBP26,544 (2014: GBP30,637) in

respect of recruitment support services provided.

At the 30 June 2015 ATA Global Staffing Solutions Limited owed

ATA India GBP2,461 (2014: GBP4,131) in respect of recruitment

support services provided.

At 30 June 2015 ATA Recruitment Limited was owed GBP13,205

(2014: GBP13,205) by ATA India.

At 30 June 2015 RTC Group PLC was owed GBP8,819 (2014: GBP8,819)

by ATA India.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGUGUMUPAGQW

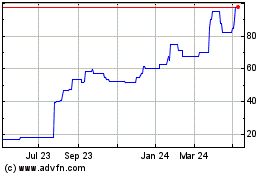

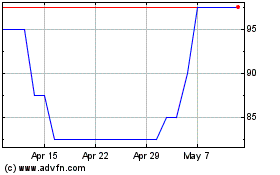

Rtc (LSE:RTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rtc (LSE:RTC)

Historical Stock Chart

From Apr 2023 to Apr 2024