TIDMRTC

RNS Number : 7182G

RTC Group PLC

10 August 2016

RTC Group Plc

("RTC", "the Company" or "the Group")

Interim Results for the Six Months Ended 30 June 2016

RTC Group Plc is pleased to announce its interim results for the

six months ended 30 June 2016.

Highlights:

-- Group revenue from continuing operations GBP34.1m (2015: GBP29.5m) up 16%

-- Group profit from operations (before amortisation of intangibles) GBP0.6m (2015: GBP0.5m)

-- Cash inflow from operations GBP1m (2015: GBP0.8m outflow)

-- Basic earnings per share 2.83p (2015: 2.47p)

The Directors propose an interim dividend of 1.1p per share

(2015: 1.0p). The Company has a progressive dividend policy.

Subject to approval of the Directors, the interim dividend will be

paid on the 30 November 2016 to shareholders on the register on 4

November 2016.

Commenting on the results Bill Douie, Chairman, said:

"I am pleased to be able to present another successful half year

for the Group.

During the second half of the year we expect Ganymede to perform

in a consistent manner to the first half and whilst unsettled

political and economic conditions may impact on certain sectors of

the recruitment industry, we remain optimistic of the long-term

opportunities in the infrastructure sectors we support."

The interim report is available on the Company's website

www.rtcgroupplc.co.uk.

S

Enquiries:

RTC Group plc

Bill Douie, Executive Chairman Tel: 01332 861

Andy Pendlebury, CEO 844

Sarah Dye, Group Finance Director

WH Ireland (Nominated Adviser and Broker) Tel: 0113 394

Katy Mitchell / Liam Gribben 6600

About RTC

RTC has three principal trading subsidiaries engaged in the

recruitment of human capital resources and the provision of managed

services.

ATA is one of the UK's leading engineering and technical

recruitment consultancies. Supplying white and blue collar

engineering and technical staff to a broad range of SME clients and

vertical markets.

Ganymede is focussed on the supply and operation of blue collar

contingent labour into safety critical markets.

Global Staffing Solutions (GSS) predominantly provides managed

service solutions for international clients.

RTC also has a hotel and conference centre, the Derby Conference

Centre, that also houses the Group's headquarters.

Chairman's statement

Six months ended 30 June 2016

I am pleased to present the interim report of the Company for

the six months to 30 June 2016 and to report on another successful

half year for the Group.

Ganymede has continued to capture solid growth through its five

year Network Rail contract which commenced in May 2015. ATA has

successfully navigated through the period of market anxiety leading

up to the EU referendum. Our international activities through GSS

in Afghanistan continue to trade as expected and the bulk of the

project to revitalise the Derby Conference Centre (DCC) and our

head office has been completed.

Dividends

The Directors propose an interim dividend of 1.1p per share

(2015: 1.0p). The Company has a progressive dividend policy.

Subject to approval of the Directors, the interim dividend will be

paid on the 30 November 2016 to shareholders on the register on 4

November 2016.

Outlook

During the second half of the year we expect Ganymede to perform

in a consistent manner to the first half and whilst unsettled

political and economic conditions may impact on certain sectors of

the recruitment industry, we remain optimistic of the long-term

opportunities in the infrastructure sectors we support.

W J C Douie 10 August 2016

Chairman

Finance Director's statement

Six months ended 30 June 2016

Revenue and gross margin

In the period ended 30 June 2016, Group revenue increased by 16%

to GBP34.1m (2015: GBP29.5m). Gross profits delivered were similar

to the same period in 2015 with a gross margin of 18% (2015: 21%),

reflecting more emphasis on contract than permanent recruitment in

ATA and price pressure from our main client in GSS as NATO require

elements of our contract with KBR in Afghanistan to be rebid.

Ganymede

Profit from operations were GBP1.1m (2015: GBP0.6m) reflecting a

full half year of the five year contract to supply Network Rail

with contingent labour for maintenance. The gross margin has been

maintained at 16% (2015: 16%) even with ongoing increased

investment in areas such as training and health and safety required

under the contract. Ganymede Energy also continues to perform at

expected levels.

ATA

Profit from operations were GBP0.6m (2015: GBP0.7m). A change of

mix between contract and permanent recruitment has led to a

reduction in gross profit and net margin compared to 2015 with

contract representing 44% of gross profit in 2016 versus 40% in

2015. ATA is intent on building its contract business and this

strategy is on track with contract gross profit increasing year on

year. A slow down in permanent recruitment is predominantly driving

the absolute reduction in gross profit compared to 2015 and this

reflects market conditions and lower than anticipated headcount in

the first half of 2016.

GSS

Profit from operations of GBP0.3m (2015: GBP0.3m) reflects the

fact that contractor numbers are being maintained at similar levels

as last year with overheads carefully managed to offset the

tightening of gross margins resulting from rebidding elements of

our contract in Afghanistan (an ongoing process).

DCC

The results of the first half of 2016 were hit heavily as a

result of a major tenant leaving the site. Following refurbishment,

involving capital expenditure of GBP1m, RTC Group has now occupied

the main building that was vacated. New tenants have been secured

for other buildings on the Derby site and the Business Lounge at

the DCC has been opened.

Taxation

The total tax charge for the period is estimated at GBP60k

(2015: GBP75k). This is lower than would be expected if the

standard tax rate was applied to the profits for the period and the

reasons for this are explained in note 3.

Finance Director's statement

Six months ended 30 June 2016

Earnings per share

The basic earnings per share figure is 2.83p (2015: 2.47p). The

diluted earnings per share 2.71p (2015: 2.35p). Profit before tax

is GBP447k (2015: GBP398k), an increase of 12% on 2015.

Dividends

The Directors propose an interim dividend of 1.1p per share

(2015: 1.0p). The Company has a progressive dividend policy.

Subject to approval of the Directors, the interim dividend will be

paid on the 30 November 2016 to shareholders on the register on 3

November 2016 (ex Div.).

Statement of financial position

The Group statement of financial position has further

strengthened compared to the same point last year with net working

capital increasing to GBP1.4m (2015: GBP1.1m). The ratio of current

assets to current liabilities has improved slightly at 1.2 (2015:

1.1) and the gearing ratio reduced to 1.2 times (2015: 2.1 times).

The gearing ratio in 2015 largely reflecting the timing of GBP2.2m

of customer receipts relating to three key clients that were

overdue at the end of June but received in July. Interest cover is

8.6 times (2015: 10.3 times)

Cash flow

There was a cash inflow from operations of GBP1m (2015: GBP0.8m

outflow) which has been applied to investment in the Derby

site.

Financing

The Group's current bank facilities include an overdraft of

GBP50,000 and a confidential invoice discounting facility of up to

GBP9.0m with HSBC. The Group is currently operating well within its

facility cap.

The Board closely monitors the level of facility utilisation and

availability to ensure that there is sufficient headroom to manage

current operations and support the growth of the business.

The Group continues to be focussed on cash generation and

building a robust statement of financial position to support the

growth of the business.

Sarah Dye 10 August 2016

Group Finance Director

Consolidated statement of comprehensive income

Six months ended 30 June 2016

Six month Six month Year ended

period ended period ended 31 December

30 June 30 June 2015 2015

2016

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

-------------------------- ------- --------------- ---------------------- --------------

Revenue 2 34,062 29,475 64,899

Cost of sales 2 (28,082) (23,442) (52,198)

-------------------------- ------- --------------- ---------------------- --------------

Gross profit 2 5,980 6,033 12,701

Administrative expenses (5,474) (5,592) (11,321)

-------------------------- ------- --------------- ---------------------- --------------

Profit from operations 506 441 1,380

Financing expense (59) (43) (98)

-------------------------- ------- --------------- ---------------------- --------------

Profit before tax 447 398 1,282

Tax expense 3 (60) (75) (172)

-------------------------- ------- --------------- ---------------------- --------------

Net profit and total

comprehensive income

for the year 387 323 1,110

-------------------------- ------- --------------- ---------------------- --------------

Earnings per ordinary

share 5

Basic 2.83p 2.47p 7.85p

-------------------------- ------- --------------- ---------------------- --------------

Diluted 2.71p 2.35p 7.49p

-------------------------- ------- --------------- ---------------------- --------------

Consolidated statement of changes in equity

Six months ended 30 June 2016

Six months ended 30 June 2016

Share Share Own Capital Share Profit Total

capital premium shares redemption based and equity

held reserve payment loss

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2016 (audited) 143 66 (473) 50 54 3,080 2,920

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Profit and

total comprehensive

income for

the period - - - - - 387 387

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Share options

exercised 2 31 - - (4) 4 33

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Share based

payment reserve - - - - 15 - 15

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

At 30 June

2016 (unaudited) 145 97 (473) 50 65 3,471 3,355

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

The following describes the nature and purpose of each reserve

within equity:

Reserve description and purpose

Share capital

Nominal value of share capital subscribed for.

Share premium account

Amount subscribed for share capital in excess of nominal

value.

Capital Redemption Reserve

An amount of money that a company in the UK must keep when it

buys back shares, and which it cannot pay to shareholders as

dividends.

Own shares held

Cost of company's own shares purchased through the EBT Trust

shown as a deduction from equity.

Share based payment reserve

The share based payment reserve comprises the cumulative share

option charge under IFRS 2 less the value of any share options that

have been exercised or have lapsed.

Retained earnings

All other net gains and losses and transactions with owners

(e.g. dividends) not recognised elsewhere.

Consolidated statement of changes in equity

Six months ended 30 June 2016

Six months ended 30 June 2015

Share Share Own Capital Share Profit Total

capital premium shares redemption based and equity

held reserve payment loss

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2015 (audited) 135 - - 50 26 2,230 2,441

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Profit and

total comprehensive

income for

the period - - - - - 323 323

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Dividends - - - - - (135) (135)

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Own shares

purchased in

EBT - - (473) - - - (473)

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Share options

exercised 8 66 - - - - 74

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Share based

payment reserve - - - - - - -

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

At 30 June

2015 (unaudited) 143 66 (473) 50 26 2,418 2,230

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Consolidated statement of changes in equity

Six months ended 30 June 2016

Year ended 31 December 2015

Share Share Own Capital Share Profit Total

capital premium shares redemption based and equity

held reserve payment loss

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2015 135 - - 50 26 2,230 2,441

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Profit and

total comprehensive

income for

the period - - - - - 1,110 1,110

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Dividends - - - - - (272) (272)

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Own shares

purchased - - (473) - - - (473)

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Share options

exercised 8 66 - - (12) 12 74

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Share based

payment reserve - - - - 40 - 40

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

At 31 December

2015 143 66 (473) 50 54 3,080 2,920

----------------------- ---------- ---------- --------- ------------- ---------- --------- ---------

Consolidated statement of financial position

As at 30 June 2016

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2015 Audited

June 2016 June 2015

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------ ---------------

Assets

Non-current

Goodwill 132 132 132

Other intangible assets 670 596 736

Property, plant and equipment 1,274 459 345

Deferred tax asset 16 40 40

---------------------------------------- ------------ ------------ ---------------

2,092 1,227 1,253

Current

Cash and cash equivalents - 158 58

Inventories 11 14 13

Trade and other receivables 10,217 11,212 11,743

---------------------------------------- ------------ ------------ ---------------

Total current assets 10,228 11,384 11,814

Total assets 12,320 12,611 13,067

---------------------------------------- ------------ ------------ ---------------

Liabilities

Current

Trade and other payables (4,758) (5,263) (5,925)

Corporation tax (180) (251) (132)

Current borrowings (3,931) (4,742) (3,982)

---------------------------------------- ------------ ------------ ---------------

Total current liabilities (8,869) (10,256) (10,039)

Non-current liabilities

Creditors falling due after one year

- finance leases - (5) -

Deferred tax liabilities (96) (120) (108)

---------------------------------------- ------------ ------------ ---------------

Net assets 3,355 2,230 2,920

---------------------------------------- ------------ ------------ ---------------

Equity

Share capital 145 143 143

Share premium 97 66 66

Capital redemption reserve 50 50 50

Own shares held (473) (473) (473)

Share based payment reserve 65 26 54

Profit and loss account 3,471 2,418 3,080

Total equity 3,355 2,230 2,920

---------------------------------------- ------------ ------------ ---------------

Consolidated statement of cash flows

Six months ended 30 June 2016

Six month Six month Year ended

period ended period ended 31 December

30 June 30 June 2015 Audited

2016 Unaudited 2015 Unaudited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit from operations 506 441 1,380

Adjustments for:

Depreciation, loss on disposal

and amortisation 150 150 305

Employee equity settled share

options 15 - 40

Change in inventories 2 4 6

Change in trade and other receivables 1,510 (1,944) (2,476)

Change in trade and other payables (1,151) 550 1,212

----------------------------------------- ----------------- ----------------- ---------------

Cash inflow/(outflow) from operations 1,032 (799) 467

Income tax paid - - (226)

Net cash inflow/(outflow) from

operating activities 1,032 (799) 241

----------------------------------------- ----------------- ----------------- ---------------

Cash flows from investing activities

Purchases of property, plant and

equipment (1,013) (77) (260)

Net cash used in investing activities (1,013) (77) (260)

Cash flows from financing activities

Interest payments (59) (43) (98)

Lease purchase payments - (6) (11)

Dividends paid - (135) (272)

Proceeds from exercise of share

options 33 74 74

Purchase of own shares - (473) (473)

----------------------------------------- ----------------- ----------------- ---------------

Net cash outflow from financing

activities (26) (583) (780)

----------------------------------------- ----------------- ----------------- ---------------

Net (decrease) in cash and cash

equivalents from operations (7) (1,459) (799)

----------------------------------------- ----------------- ----------------- ---------------

Total net (decrease) in cash and

cash equivalents (7) (1,459) (799)

----------------------------------------- ----------------- ----------------- ---------------

Cash and cash equivalents at beginning

of period (3,924) (3,125) (3,125)

----------------------------------------- ----------------- ----------------- ---------------

Cash and cash equivalents at end

of period (3,931) (4,584) (3,924)

----------------------------------------- ----------------- ----------------- ---------------

Notes to the interim statement

Six months ended 30 June 2016

1. Accounting policies

a) General information

RTC Group PLC is incorporated and domiciled in England and its

shares are publicly traded on AIM. The registered office address is

The Derby Conference Centre, London Road, Derby, DE24 8UX. The

company's registered number is 02558971. The principal activities

of the Group are described in note 2.

The Board consider the principal risks and uncertainties

relating to the Group for the next six months to be the same as

detailed in our last Annual Report and Accounts to 31 December

2015. The Group's financial risk management objectives and policies

are consistent with those disclosed in the consolidated financial

statements as at and for the year ended 31 December 2015.

b) Basis of preparation

The unaudited interim group financial information of RTC Group

PLC is for the six months ended 30 June 2016 and does not comprise

statutory accounts within the meaning of S.435 of the Companies Act

2006. The unaudited interim group financial statements have been

prepared in accordance with the AIM rules and have not been

reviewed by the Group's auditors. This report should be read in

conjunction with the Group's Annual Report and Accounts for the

year ended 31 December 2015, which have been prepared in accordance

with IFRS's as adopted by the European Union.

These unaudited interim group financial statements were approved

for issue on 10 August 2016. No significant events, other than

those disclosed in this document, have occurred between 30 June

2016 and this date.

c) Comparatives

The comparative figures for the year ended 31 December 2015 do

not constitute statutory accounts within the meaning of S.435 of

the Companies Act 2006, but they have been derived from the audited

financial statements for that year, which have been filed with the

Registrar of Companies. The report of the auditor was unqualified

and did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006 nor a reference to any matters which the auditor

drew attention by way of emphasis of matter without qualifying

their report.

d) Accounting policies

There have been no significant changes in the basis upon which

policies and estimates have been applied, compared to those applied

at 31 December 2015. A full description of our accounting policies

are contained with our 2015 Annual Report available on our

website.

This interim announcement has been prepared in accordance with

the recognition and measurement requirements of International

Financial Reporting Standards issued by the International

Accounting Standards Board, as adopted by the European Union as

effective for periods beginning on or after 1 January 2016.

Notes to the interim statement

Six months ended 30 June 2016

EBT

During the year the company set up an EBT. The EBT is considered

an extension of the company's activities and therefore assets

(except investments in the company's shares) and liabilities which

are the subject of the trust are included in the consolidated

accounts on a line-by-line basis. The cost of shares held by the

EBT is presented as a separate debit reserve within equity entitled

'own shares held'.

2. Segment analysis

The Group is a provider of recruitment services and conferencing

services that is based at the DCC. The recruitment business

comprises three distinct business units - ATA predominantly

servicing the UK SME engineering market and a number of vertical

markets; GSS servicing the international market and Ganymede

supplying labour into safety critical environments, mainly

rail.

Segment information is provided below in respect of ATA, GSS,

Ganymede and the DCC which, as well as being the head office for

the Group, provides hotel and conferencing facilities.

The Group manages the trading performance of each segment by

monitoring operating contribution and centrally manages working

capital, borrowings and equity.

Revenues are generated from permanent and temporary recruitment

in the Recruitment division. Revenue is analysed by origin of

customer/point of invoicing and as such all recruitment division

revenues are supplied in the United Kingdom. Hotel and conferencing

services are wholly provided in the UK at the DCC.

All revenues have been invoiced to external customers. During

2015, one customer in GSS contributed 10% or more of that segment's

revenues being GBP5.1m (2015: GBP5.0m) and one customer in Ganymede

also contributed 10% or more of that segment's revenues being

GBP10.3m (2015: GBP5.4m).

Notes to the interim statement

Six months ended 30 June 2016

The segment information for the reporting period is as

follows:

Six months ended 30 June 2016:

Recruitment Conferencing Total

ATA GSS Ganymede DCC Group

Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- ----------- ------------- ----------- -------------- -----------

External sales

revenue 12,837 5,147 15,486 592 34,062

Cost of sales (10,206) (4,458) (13,063) (355) (28,082)

------------------- ----------- ------------- ----------- -------------- -----------

Gross profit 2,631 689 2,423 237 5,980

Administrative

expenses (1,979) (439) (1,350) (408) (4,176)

Depreciation (36) - (2) (28) (66)

-------------------

Segment profit

from operations 616 250 1,071 (199) 1,738

Amortisation

of intangibles (66)

Central support

and Group costs (1,166)

------------------- ----------- ------------- ----------- -------------- -----------

Profit from operations per statement of

comprehensive income 506

------------------------------------------------------------ -------------- -----------

All assets and liabilities are held in the United Kingdom.

Notes to the interim statement

Six months ended 30 June 2016

Six months ended 30 June 2015:

Recruitment Conferencing Total

ATA GSS Ganymede DCC Group

Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- ----------- ------------- ----------- -------------- -----------

External sales

revenue 12,625 5,079 10,982 789 29,475

Cost of sales (9,606) (4,244) (9,223) (369) (23,442)

------------------- ----------- ------------- ----------- -------------- -----------

Gross profit 3,019 835 1,759 420 6,033

Administrative

expenses (2,258) (560) (1,116) (412) (4,346)

Depreciation (27) - (4) (24) (55)

-------------------

Segment profit

from operations 734 275 639 (16) 1,632

Amortisation

of intangibles (66)

Central support

and Group costs (1,125)

------------------- ----------- ------------- ----------- -------------- -----------

Profit from operations per statement of

comprehensive income 441

------------------------------------------------------------ -------------- -----------

Year ended 31 December 2015:

Recruitment Conferencing Total

ATA GSS Ganymede DCC Group

Audited Audited Audited Audited Audited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- ---------- ------------- ---------- -------------- ----------

External sales

revenue 26,676 9,693 26,682 1,848 64,899

Cost of sales (20,591) (8,205) (22,621) (781) (52,198)

------------------- ---------- ------------- ---------- -------------- ----------

Gross profit 6,085 1,488 4,061 1,067 12,701

Administrative

expenses (4,446) (1,016) (2,448) (826) (8,736)

Depreciation (113) (1) (8) (52) (174)

-------------------

Segment profit

from operations 1,526 471 1,605 189 3,791

Amortisation

of intangibles (132)

Central support

and Group costs (2,279)

------------------- ---------- ------------- ---------- -------------- ----------

Profit from operations per statement of

comprehensive income 1,380

---------------------------------------------------------- -------------- ----------

All assets and liabilities are held in the United Kingdom.

Notes to the interim statement

Six months ended 30 June 2016

3. Income tax

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2015 Audited

June 2016 June 2015

Continuing operations Unaudited Unaudited

GBP'000 GBP'000 GBP'000

------------------------------------------- ------------ ------------ ---------------

Analysis of tax:-

Current tax

UK corporation tax 73 81 172

Adjustment in respect of previous period - (16) 2

------------------------------------------- ------------ ------------ ---------------

73 65 174

Deferred tax (13) 10 (2)

Tax 60 75 172

------------------------------------------- ------------ ------------ ---------------

Factors affecting the tax expense

The tax assessed for the six-month period ended 30 June 2016 is

less than would be expected by multiplying profit on ordinary

activities by the standard rate of corporation tax in the UK of 20%

(2015:20.5%). The differences are explained below:

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2015 Audited

June 2016 June 2015

Unaudited Unaudited

Factors affecting tax expense GBP'000 GBP'000 GBP'000

------------------------------------------- ------------ ------------ ---------------

Result for the year before tax 447 398 1,282

------------------------------------------- ------------ ------------ ---------------

Profit multiplied by standard rate of

tax of 20% (2015: 20.5%) 89 82 260

Non-deductible expenses 4 9 11

Tax credit on exercise of options (23) - (101)

Corporation tax rate change (10) - -

Adjustment in respect of previous period - (16) 2

------------------------------------------- ------------ ------------ ---------------

Tax charge for the year 60 75 172

------------------------------------------- ------------ ------------ ---------------

Notes to the interim statement

Six months ended 30 June 2016

4. Dividends

During the period the company made no dividend payments (2015:

GBP67,558) to its equity shareholders. This represents a payment of

0.0p (2015: 1.0p) per share.

The Directors propose an interim dividend of 1.1p per share

(2015: 1.0p). Subject to approval of the Directors, the interim

dividend will be paid on 30 November 2016 to shareholders on the

register on 4 November 2016.

5. Earnings per share

The calculation of basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

The calculation of diluted earnings per share is based on the

basic earnings per share adjusted to allow for all dilutive

potential ordinary shares.

Basic Diluted

Six month Six month Six month Six month

period ended period ended period ended period ended

30 June 2016 30 June 2015 30 June 2016 30 June 2015

Unaudited Unaudited Unaudited Unaudited

Earnings

GBP'000 387 323 387 323

------------------ --------------- --------------- --------------- ---------------

Basic weighted

average number

of shares 13,679,975 13,053,231 13,679,975 13,053,231

------------------ --------------- --------------- --------------- ---------------

Dilutive

effect of

share options 582,545 665,203

------------------ --------------- --------------- --------------- ---------------

Fully diluted

weighted

average number

of shares 14,262,920 13,718,434

------------------ --------------- --------------- --------------- ---------------

Earnings

per share

(pence) 2.83p 2.47p 2.71p 2.35p

------------------ --------------- --------------- --------------- ---------------

The basic earnings per share at 31 December 2015 was 7.85p and

diluted earnings per share was 7.49p.

Notes to the interim statement

Six months ended 30 June 2016

6. Analysis of changes in net debt

At Cash Other non- At

1 January Flows cash movements 30 June

2016 2016

Audited

Unaudited

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ------------ --------- ----------------- ------------

Overdraft and invoice

discounting arrangements (3,982) 51 - (3,931)

Cash 58 (58) - -

----------------------------- ------------ --------- ----------------- ------------

Net debt (3,924) (7) - (3,931)

----------------------------- ------------ --------- ----------------- ------------

The Group has a working capital facility with HSBC PLC that

allows it to borrow up to 90% of the invoiced trade debtors of ATA,

GSS and Ganymede up to GBP9.0m and an overdraft facility of

GBP50,000.

7. Contingent liabilities

Included in current borrowings are bank overdrafts and an

invoice discounting facility. During the year the Group has used

its bank overdraft and invoice discounting facility, which is

secured by a cross guarantee and debenture over the Group

companies. There have been no defaults or breaches of interest

payable during the current or prior period.

8. Related party transactions

RTC Group Plc is the parent company of the Group that includes

the following trading entities that have been consolidated:

ATA Recruitment Limited

The Derby Conference Centre Limited

Ganymede Solutions Limited

ATA Global Staffing Solutions Limited

The Group, as permitted by the scope paragraph of IAS 24,

Related Party Disclosures, has not disclosed transactions with

other group companies that are eliminated on consolidation in the

Group financial statements.

Transactions with related parties not consolidated

The accounts of Accurate Recruitment and Training Services PBT

Limited (ATA India), a 90% owned subsidiary of the Group, have not

been consolidated as the Directors consider the amounts involved

are not material.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EASPNEAKKEFF

(END) Dow Jones Newswires

August 10, 2016 02:00 ET (06:00 GMT)

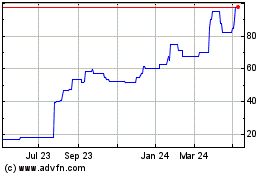

Rtc (LSE:RTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

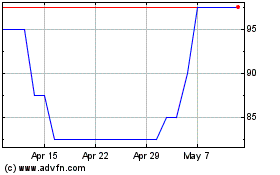

Rtc (LSE:RTC)

Historical Stock Chart

From Apr 2023 to Apr 2024