RBS Must Add $2.5 Billion in Capital After Failing BOE Stress Test --2nd Update

November 30 2016 - 5:13AM

Dow Jones News

By Margot Patrick and Max Colchester

LONDON-- Royal Bank of Scotland Group PLC must add around GBP2

billion ($2.5 billion) in capital after failing a Bank of England

stress test Wednesday, sending its shares down 4%.

The annual health checks also exposed weaknesses at two other

banks, Barclays PLC and Standard Chartered PLC, but neither bank

needs to change its capital plans.

The central bank said overall the U.K.'s banking system is in

strong shape and could still keep lending to businesses and

households even under a five-year scenario of economic turmoil

roughly akin to the financial crisis. The hypothetical scenario for

the test, issued last March, didn't cover the impact of Britain

leaving the European Union, but the results gave a snapshot of how

the country's banks would fare in a severe U.K. recession.

The annual tests measure the health of seven lenders--RBS,

Barclays, Standard Chartered, HSBC Holdings PLC, Lloyds Banking

Group PLC, Santander U.K. and Nationwide Building Society. The

scenarios change each year and provide a road map for British

banks' capital plans, including their ability to pay dividends.

They are watched by analysts and investors, but so far haven't

taken on the significance of similar annual tests of big banks by

the Federal Reserve.

RBS, still 73%-government owned since bailouts in 2008 and 2009,

will outline a new strategic plan early next year as it continues

to face headwinds from low interest rates and potentially vast

fines from U.S. authorities over the sale of toxic mortgage-backed

securities. The plan should raise more than the GBP2 billion

capital shortfall identified by the Bank of England.

On Wednesday, RBS said that it would further cut costs and

assets to meet regulatory requirements. However, the bank warned

that "additional management actions may be required until RBS's

balance sheet is sufficiently resilient to stressed scenarios."

The results are another blow to RBS, which is already wading

through a vast restructuring program. Dividends haven't been paid

out since the government bailout and still look someway over the

horizon. RBS is also contending with a host of regulatory issues,

including having to spinoff part of its branch network to meet

European state-aid rules after the taxpayer rescue.

Even before the results of the stress test, the bank's

management had warned that it wouldn't hit medium-term earnings

targets and would need to revise plans in the wake of the June

Brexit vote. During a recent earnings call RBS Chief Executive Ross

McEwan said that his team would present a new plan alongside

full-year results in February.

Barclays and Standard Chartered also stumbled in parts of the

test, but won't have to take any new steps. Barclays has already

announced plans to thicken its capital cushion, including by

reducing its stake in its Africa unit, while Standard Chartered has

bolstered its capital since the end of 2015.

Write to Margot Patrick at margot.patrick@wsj.com and Max

Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

November 30, 2016 04:58 ET (09:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

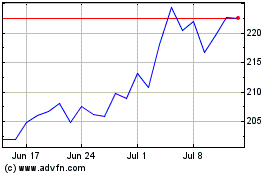

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

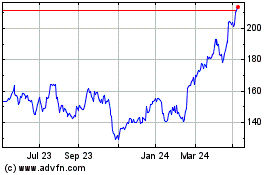

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024