RBS Agrees to $5.5 Billion Settlement Over Sale of Mortgage Securities During Crisis

July 12 2017 - 9:33AM

Dow Jones News

By Max Colchester

LONDON -- Royal Bank of Scotland Group PLC on Wednesday agreed

to pay $5.5 billion to the U.S. Federal Housing Finance Agency to

settle a probe into its sale of toxic mortgage-backed securities in

the run up to the financial crisis.

RBS said in a statement that it had already set aside funds to

cover most of the cost of the settlement. The 71% U.K. government

owned bank will have to take an additional charge of $196 million

which will be realized in its coming results in August.

RBS had set aside $8.3 billion to cover a range of allegations

linked to its role in packaging and selling on subprime mortgages

in the lead up to the financial crisis. The bank still faces probes

from several U.S. agencies including a criminal and civil

investigation by the U.S. Department of Justice.

Settling these probes is a major hurdle for RBS as it continues

its slow return to private hands. U.K. government officials have

said they would not sell down the government's stake until they

have clarity on the size of the U.S. fines RBS may face. RBS warned

Wednesday that "further substantial provisions and costs may be

recognized...depending upon the final outcomes."

Under the settlement, RBS will pay the FHFA $5.5 billion but is

eligible for a $754 million reimbursement under indemnification

agreements with third parties.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

July 12, 2017 09:18 ET (13:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

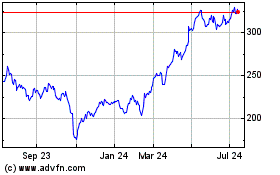

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024