R1 RCM Inc. (“R1” or the “Company”) (NASDAQ:RCM), a leading

provider of revenue cycle management and physician advisory

services to healthcare providers, today announced results for the

three months ended September 30, 2017.

Third Quarter 2017 Results:

- GAAP net services revenue of $123.2 million, up $23.8 million

sequentially

- GAAP net loss of $3.6 million, better by $3.1 million

sequentially

- Adjusted EBITDA of $3.1 million, better by $6.4 million

sequentially

- Free cash flow of $11.7 million, compared to ($9.0) million in

the second quarter of 2017

“We’re pleased to report our fifth consecutive quarter of

revenue growth, and more importantly, a turn to positive adjusted

EBITDA and free cash flow,” said Joe Flanagan, President and Chief

Executive Officer of R1. “Our core revenue cycle business and our

physician advisory services offering are both executing well. Our

competitive position is strong, and we continue to make

improvements to our offering to enhance our value proposition and

positioning in the market.”

“I’m very pleased with the execution that drove our results for

the third quarter,” added Chris Ricaurte, Chief Financial Officer

and Treasurer of R1. “With the progress we have made onboarding new

business, we remain on track to exit 2017 at an annualized revenue

run rate of approximately $650 million.”

2017 OutlookFor 2017, R1 currently expects to

generate:

- Revenue of between $425 million and $450 million

- GAAP operating loss of $25 million to $30 million

- Adjusted EBITDA of $0 to positive $5 million

Conference Call and Webcast DetailsR1’s

management team will host a conference call today at 4:30 p.m.

Eastern Time to discuss its financial results and business outlook.

To participate, please dial 877-880-5884 (631-601-2894 outside the

U.S. and Canada) using conference code number 3793709. A live

webcast and replay of the call will be available at the Investor

Relations section of the Company’s web site at r1rcm.com.

Non-GAAP Financial MeasuresIn order to provide

a more comprehensive understanding of the information used by R1’s

management team in financial and operational decision making, the

Company supplements its GAAP consolidated financial statements with

certain non-GAAP financial measures, which are included in this

press release.

For the three and nine months ended September 30, 2017: As

of January 1, 2017, the Company adopted Accounting Standards Update

("ASU") No. 2014-09, Revenue from Contracts with Customers (Topic

606). Subsequent to adoption of Topic 606, the non-GAAP financial

measure referenced in the press release is adjusted EBITDA.

Adjusted EBITDA is defined as GAAP net income before net interest

income, income tax provision, depreciation and amortization

expense, share-based compensation expense, and severance &

certain other items.

For the three and nine ended September 30, 2016: Prior to

the adoption of Topic 606, non-GAAP financial measures utilized by

the company included gross cash generated from customer contracting

activities, and net cash generated from customer contacting

activities. Gross cash generated from customer contracting

activities was defined as GAAP net services revenue, plus the

change in deferred customer billings. Accordingly, gross cash

generated from customer contracting activities is the sum of (i)

invoiced or accrued net operating fees, (ii) cash collections on

incentive fees and (iii) other services fees. Net cash

generated from customer contracting activities was defined as net

income before net interest income, income tax provision,

depreciation and amortization expense, share-based compensation

expense, and severance and certain other items. Deferred customer

billings included the portion of both (i) invoiced or accrued net

operating fees and (ii) cash collections of incentive fees, in each

case, that have not met our revenue recognition criteria. Deferred

customer billings are included in the detail of our customer

liabilities and customer liabilities - related party balance in the

consolidated balance sheets available in the Company’s Quarterly

Report on Form 10-Q for the three months ended September 30,

2016.

Our board and management team use non-GAAP measures as (i) one

of the primary methods for planning and forecasting overall

expectations and for evaluating actual results against such

expectations and (ii) a performance evaluation metric in

determining achievement of certain executive incentive compensation

programs, as well as for incentive compensation programs for

employees.

Table 4 presents a reconciliation of GAAP net income to adjusted

EBITDA, and GAAP net income to net cash generated from customer

contracting activities. Table 9 presents a reconciliation of GAAP

operating income guidance to non-GAAP adjusted EBITDA guidance.

Adjusted EBITDA and net cash generated from customer contracting

activities are non-GAAP measures and should be considered in

addition to, but not as a substitute for, the information prepared

in accordance with GAAP.

Free cash flow is defined as cash flow from operations less

capital expenditures.

Forward Looking StatementsThis press release

includes information that may constitute “forward-looking

statements,” made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements relate to future, not past, events and often address our

expected future growth, plans and performance or forecasts. These

forward-looking statements are often identified by the use of words

such as “anticipate,” “believe,” “designed,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “plan,” “predict,” “project,”

“target,” “will,” or “would,” and similar expressions or

variations, although not all forward-looking statements contain

these identifying words. Such forward-looking statements are based

on management’s current expectations about future events as of the

date hereof and involve many risks and uncertainties that could

cause our actual results to differ materially from those expressed

or implied in our forward-looking statements. Subsequent events and

developments, including actual results or changes in our

assumptions, may cause our views to change. We do not undertake to

update our forward-looking statements except to the extent required

by applicable law. Readers are cautioned not to place undue

reliance on such forward-looking statements. All forward-looking

statements included herein are expressly qualified in their

entirety by these cautionary statements. Our actual results and

outcomes could differ materially from those included in these

forward-looking statements as a result of various factors,

including, but not limited to our ability to successfully

integrate transitioned Ascension employees, our ability to

achieve or maintain profitability and retain existing customers or

acquire new customers, risks associated with the implementation of

our technologies or services with our customers or implementation

costs that exceed our expectations, fluctuations in our quarterly

results of operations and cash flows, as well as the factors

discussed under the heading “Risk Factors” in our annual report on

Form 10-K for the year ended December 31, 2016, our 2017 quarterly

reports on Form 10-Q and any other periodic reports that the

Company files with the Securities and Exchange Commission.

About R1 RCMR1 serves as the one revenue cycle

management partner for select hospitals and healthcare systems

regardless of their payment models, patient engagement strategies

or settings of care. The company uses a proven operating

model based on the R1 Performance StackSM designed to fit

seamlessly into any healthcare organization’s infrastructure and to

enhance the patient experience, improve provider economics and

provide revenue predictability. To learn more, visit r1rcm.com.

Contact:R1 RCM Inc.Investor and Media

Relations:Atif Rahim312.324.5476investorrelations@r1rcm.com

| Table 1 |

| R1 RCM Inc. |

| Condensed Consolidated Balance

Sheets |

| (In millions) |

| |

|

|

|

|

| |

|

September 30, |

|

December 31, |

| |

|

2017 |

|

2016 |

| |

|

(Unaudited) |

|

|

|

Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash

equivalents |

|

$ |

142.8 |

|

|

$ |

181.2 |

|

| Accounts

receivable, net |

|

7.7 |

|

|

4.0 |

|

| Accounts

receivable, net - related party |

|

18.0 |

|

|

1.8 |

|

| Prepaid income

taxes |

|

0.9 |

|

|

3.8 |

|

| Prepaid expenses

and other current assets |

|

16.1 |

|

|

13.8 |

|

| Total current

assets |

|

185.5 |

|

|

204.6 |

|

| Property, equipment and

software, net |

|

50.2 |

|

|

32.8 |

|

| Non-current deferred

tax assets |

|

105.8 |

|

|

169.9 |

|

| Restricted cash

equivalents |

|

1.5 |

|

|

1.5 |

|

| Other assets |

|

11.4 |

|

|

6.3 |

|

| Total assets |

|

$ |

354.4 |

|

|

$ |

415.1 |

|

| |

|

|

|

|

|

Liabilities |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

6.9 |

|

|

$ |

7.9 |

|

| Current portion

of customer liabilities |

|

0.9 |

|

|

69.7 |

|

| Current portion

of customer liabilities - related party |

|

20.1 |

|

|

14.2 |

|

| Accrued

compensation and benefits |

|

29.2 |

|

|

24.8 |

|

| Other accrued

expenses |

|

16.1 |

|

|

18.5 |

|

| Total current

liabilities |

|

73.2 |

|

|

135.1 |

|

| Non-current portion of

customer liabilities |

|

0.3 |

|

|

1.0 |

|

| Non-current portion of

customer liabilities - related party |

|

9.1 |

|

|

110.0 |

|

| Other non-current

liabilities |

|

12.2 |

|

|

9.7 |

|

| Total liabilities |

|

$ |

94.8 |

|

|

$ |

255.8 |

|

| |

|

|

|

|

| Preferred Stock |

|

184.7 |

|

|

171.6 |

|

| Stockholders’

equity: |

|

|

|

|

| Common stock |

|

1.2 |

|

|

1.2 |

|

| Additional paid-in

capital |

|

339.8 |

|

|

349.2 |

|

| Accumulated

deficit |

|

(204.3 |

) |

|

(304.7 |

) |

| Accumulated other

comprehensive loss |

|

(2.2 |

) |

|

(2.8 |

) |

| Treasury stock |

|

(59.6 |

) |

|

(55.2 |

) |

| Total stockholders’

equity (deficit) |

|

74.9 |

|

|

(12.3 |

) |

| Total liabilities and

stockholders’ equity (deficit) |

|

$ |

354.4 |

|

|

$ |

415.1 |

|

| Table 2 |

| R1 RCM Inc. |

| Consolidated Statements of

Operations |

| (In millions, except share and per share

data) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

(Unaudited) |

|

(Unaudited) |

| RCM services: net

operating fees |

|

104.6 |

|

|

49.0 |

|

|

255.4 |

|

|

300.3 |

|

| RCM services: incentive

fees |

|

7.5 |

|

|

68.5 |

|

|

20.2 |

|

|

166.5 |

|

| RCM services:

other |

|

2.8 |

|

|

3.8 |

|

|

9.8 |

|

|

8.3 |

|

| Other services

fees |

|

8.3 |

|

|

4.2 |

|

|

24.1 |

|

|

11.3 |

|

| Net services

revenue |

|

123.2 |

|

|

125.5 |

|

|

309.5 |

|

|

486.4 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Cost of

services |

|

111.8 |

|

|

47.4 |

|

|

289.1 |

|

|

137.6 |

|

| Selling, general

and administrative |

|

15.1 |

|

|

16.2 |

|

|

41.6 |

|

|

58.4 |

|

| Other |

|

1.4 |

|

|

0.5 |

|

|

2.6 |

|

|

20.0 |

|

| Total operating

expenses |

|

128.3 |

|

|

64.1 |

|

|

333.3 |

|

|

216.0 |

|

| Income (loss) from

operations |

|

(5.1 |

) |

|

61.4 |

|

|

(23.8 |

) |

|

270.4 |

|

| Net interest

income |

|

— |

|

|

0.1 |

|

|

0.1 |

|

|

0.2 |

|

| Income (loss) before

income tax provision |

|

(5.1 |

) |

|

61.5 |

|

|

(23.7 |

) |

|

270.6 |

|

| Income tax provision

(benefit) |

|

(1.5 |

) |

|

24.1 |

|

|

(5.1 |

) |

|

106.6 |

|

| Net income (loss) |

|

(3.6 |

) |

|

37.4 |

|

|

(18.6 |

) |

|

164.0 |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) per

common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.08 |

) |

|

$ |

0.18 |

|

|

$ |

(0.31 |

) |

|

$ |

0.62 |

|

| Diluted |

|

$ |

(0.08 |

) |

|

$ |

0.18 |

|

|

$ |

(0.31 |

) |

|

$ |

0.62 |

|

| Weighted average shares

used in calculating net income (loss) per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

102,225,422 |

|

|

100,934,561 |

|

|

102,022,129 |

|

|

99,870,685 |

|

| Diluted |

|

102,225,422 |

|

|

102,176,280 |

|

|

102,022,129 |

|

|

101,018,450 |

|

| Table 3 |

| R1 RCM Inc. |

| Condensed Consolidated Statements of Cash

Flows |

| (In millions) |

| |

|

|

|

|

| |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

2016 |

| |

|

(Unaudited) |

| Operating

activities |

|

|

|

|

| Net income (loss) |

|

$ |

(18.6 |

) |

|

$ |

164.0 |

|

| Adjustments to

reconcile net income (loss) to net cash used in operations: |

|

|

|

|

|

Depreciation and amortization |

|

11.5 |

|

|

7.3 |

|

|

Share-based compensation |

|

8.2 |

|

|

25.2 |

|

| Loss on

disposal |

|

0.2 |

|

|

— |

|

| Provision

(recovery) for doubtful receivables |

|

0.1 |

|

|

0.1 |

|

| Deferred

income taxes |

|

(5.6 |

) |

|

106.5 |

|

| Changes

in operating assets and liabilities: |

|

|

|

|

|

Accounts receivable and related party

accounts receivable |

|

(15.4 |

) |

|

1.2 |

|

|

Prepaid income taxes |

|

3.0 |

|

|

0.2 |

|

|

Prepaid expenses and other assets |

|

(6.7 |

) |

|

(7.9 |

) |

|

Accounts payable |

|

0.3 |

|

|

(1.4 |

) |

|

Accrued compensation and benefits |

|

4.3 |

|

|

8.3 |

|

|

Other liabilities |

|

(0.3 |

) |

|

3.0 |

|

|

Customer liabilities and customer liabilities -

related party |

|

14.7 |

|

|

(375.8 |

) |

| Net cash used in

operating activities |

|

(4.3 |

) |

|

(69.3 |

) |

| Investing

activities |

|

|

|

|

| Purchases

of property, equipment, and software |

|

(30.1 |

) |

|

(10.4 |

) |

| Proceeds

from maturation of short-term investments |

|

— |

|

|

1.0 |

|

| Net cash used in

investing activities |

|

(30.1 |

) |

|

(9.4 |

) |

| Financing

activities |

|

|

|

|

| Series A

convertible preferred stock and warrant issuance, net of issuance

costs |

|

— |

|

|

178.7 |

|

| Exercise

of vested stock options |

|

— |

|

|

0.1 |

|

| Purchase

of treasury stock |

|

(2.0 |

) |

|

(2.0 |

) |

| Shares

withheld for taxes |

|

(2.4 |

) |

|

— |

|

| Net cash (used in)

provided by financing activities |

|

(4.4 |

) |

|

176.8 |

|

| Effect of exchange rate

changes in cash |

|

0.4 |

|

|

0.3 |

|

| Net increase (decrease)

in cash and cash equivalents |

|

(38.4 |

) |

|

98.4 |

|

| Cash and cash

equivalents, at beginning of period |

|

181.2 |

|

|

103.5 |

|

| Cash and cash

equivalents, at end of period |

|

$ |

142.8 |

|

|

$ |

201.9 |

|

| Table 4 |

| R1 RCM Inc. |

| Reconciliation of GAAP to

Non-GAAP |

| (In millions) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

2017 vs. 2016 Change |

|

Nine Months Ended September 30, |

|

2017 vs. 2016 Change |

| |

|

2017 |

|

2016 |

|

Amount |

|

% |

|

2017 |

|

2016 |

|

Amount |

|

% |

| |

|

(Unaudited) |

|

|

|

|

|

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RCM

services: net operating fees |

|

104.6 |

|

|

49.0 |

|

|

55.6 |

|

|

113.5 |

% |

|

255.4 |

|

|

300.3 |

|

|

(44.9 |

) |

|

(15.0 |

)% |

| RCM

services: incentive fees |

|

7.5 |

|

|

68.5 |

|

|

(61.0 |

) |

|

(89.1 |

)% |

|

20.2 |

|

|

166.5 |

|

|

(146.3 |

) |

|

(87.9 |

)% |

| RCM

services: other |

|

2.8 |

|

|

3.8 |

|

|

(1.0 |

) |

|

(26.3 |

)% |

|

9.8 |

|

|

8.3 |

|

|

1.5 |

|

|

18.1 |

% |

| Other

services fees |

|

8.3 |

|

|

4.2 |

|

|

4.1 |

|

|

97.6 |

% |

|

24.1 |

|

|

11.3 |

|

|

12.8 |

|

|

113.3 |

% |

|

Net Services Revenue |

|

123.2 |

|

|

125.5 |

|

|

(2.3 |

) |

|

(1.8 |

)% |

|

309.5 |

|

|

486.4 |

|

|

|

(176.9 |

) |

|

(36.4 |

)% |

|

Change in deferred customer billings (non-GAAP) |

|

n.a. |

|

(65.8 |

) |

|

n.m. |

|

n.m. |

|

n.a. |

|

(347.5 |

) |

|

n.m. |

|

n.m. |

|

Gross cash generated from customer contracting activities

(non-GAAP) |

|

n.a. |

|

59.7 |

|

|

n.m. |

|

n.m. |

|

n.a. |

|

138.9 |

|

|

n.m. |

|

n.m. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

(3.6 |

) |

|

37.4 |

|

|

(41.0 |

) |

|

(109.6 |

)% |

|

(18.6 |

) |

|

164.0 |

|

|

(182.6 |

) |

|

(111.3 |

)% |

|

Net interest income |

|

— |

|

|

(0.1 |

) |

|

0.1 |

|

|

(100.0 |

)% |

|

(0.1 |

) |

|

|

(0.2 |

) |

|

0.1 |

|

|

(50.0 |

)% |

|

Income tax provision (benefit) |

|

(1.5 |

) |

|

24.1 |

|

|

(25.6 |

) |

|

(106.2 |

)% |

|

(5.1 |

) |

|

106.6 |

|

|

(111.7 |

) |

|

(104.8 |

)% |

|

Depreciation and amortization expense (GAAP) |

|

4.5 |

|

|

2.7 |

|

|

1.8 |

|

|

66.7 |

% |

|

11.5 |

|

|

7.3 |

|

|

4.2 |

|

|

57.5 |

% |

|

Share-based compensation expense (GAAP) |

|

2.4 |

|

|

4.8 |

|

|

(2.4 |

) |

|

(50.0 |

)% |

|

8.2 |

|

|

23.5 |

|

|

(15.3 |

) |

|

(65.1 |

)% |

|

Other (GAAP) |

|

1.4 |

|

|

0.5 |

|

|

0.9 |

|

|

180.0 |

% |

|

2.6 |

|

|

20.0 |

|

|

(17.4 |

) |

|

(87.0 |

)% |

|

Adjusted EBITDA (non-GAAP) |

|

3.1 |

|

|

69.4 |

|

|

(66.3 |

) |

|

(95.5 |

)% |

|

(1.6 |

) |

|

321.2 |

|

|

(322.8 |

) |

|

(100.5 |

)% |

|

Change in deferred customer billings (non-GAAP) |

|

n.a. |

|

(65.8 |

) |

|

n.m. |

|

n.m. |

|

n.a. |

|

(347.5 |

) |

|

n.m. |

|

n.m. |

| Net cash

generated from customer contracting activities

(non-GAAP) |

|

n.a. |

|

3.6 |

|

|

n.m. |

|

n.m. |

|

n.a. |

|

(26.4 |

) |

|

n.m. |

|

n.m. |

n.m. - not meaningfuln.a. - Due to the adoption of Topic 606 as

of January 1, 2017, the non-GAAP measure of gross and net cash

generated from customer contracting activities, that was utilized

by the Company in 2016, is not applicable for 2017. Gross and net

cash generated from customer contracting activities have been

provided for the three and nine months ended September 30,

2016 as they are the most comparable metric to net services revenue

and adjusted EBTIDA for the three and nine months ended

September 30, 2017.

Due to rounding, numbers presented in this document may not add

up precisely to the totals provided.

| Table 5 |

| R1 RCM Inc. |

| Share-Based Compensation Expense Allocation

Details |

| (In millions) |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

| Cost of services |

$ |

1.2 |

|

|

$ |

1.3 |

|

|

$ |

3.3 |

|

|

$ |

4.8 |

|

| Selling, general and

administrative |

1.2 |

|

|

3.5 |

|

|

4.8 |

|

|

18.7 |

|

| Other |

— |

|

|

— |

|

|

0.1 |

|

|

1.8 |

|

| Total share-based

compensation expense |

$ |

2.4 |

|

|

$ |

4.8 |

|

|

$ |

8.2 |

|

|

$ |

25.3 |

|

| Table 6 |

| R1 RCM Inc. |

| Depreciation and Amortization Expense

Allocation Details |

| (In millions) |

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

| Cost of services |

$ |

4.0 |

|

|

$ |

2.6 |

|

|

$ |

10.4 |

|

|

$ |

6.9 |

|

| Selling, general and

administrative |

0.5 |

|

|

0.1 |

|

|

1.1 |

|

|

0.4 |

|

| Total depreciation and

amortization expense |

$ |

4.5 |

|

|

$ |

2.7 |

|

|

$ |

11.5 |

|

|

$ |

7.3 |

|

| Table 7 |

| R1 RCM Inc. |

| Reconciliation of GAAP Net Services Revenue to

Non-GAAP Gross Cash Generated from Customer Contracting

Activities |

| (In millions) |

| |

Three Months Ended September 30,

2016 |

|

Nine Months Ended September 30,

2016 |

| |

Net Services Revenue |

Change in deferred customer

billings |

Gross cash generated |

|

Net Services Revenue |

Change in deferred customer

billings |

Gross cash generated |

| RCM services: net

operating fees |

49.0 |

|

(2.9 |

) |

46.1 |

|

|

300.3 |

|

(205.5 |

) |

94.8 |

|

| RCM services: incentive

fees |

68.5 |

|

(61.0 |

) |

7.5 |

|

|

166.5 |

|

(142.7 |

) |

23.8 |

|

| RCM services:

other |

3.8 |

|

(2.0 |

) |

1.8 |

|

|

8.3 |

|

0.7 |

|

9.0 |

|

| Other services

fees |

4.2 |

|

0.1 |

|

4.3 |

|

|

11.3 |

|

— |

|

11.3 |

|

| Total |

125.5 |

|

(65.8 |

) |

59.7 |

|

|

486.4 |

|

(347.5 |

) |

138.9 |

|

(1) Due to the adoption of Topic 606 as of January 1, 2017, the

non-GAAP measure of gross cash generated from customer contracting

activities that was utilized by the Company in 2016 is not

applicable for 2017. Gross cash generated from customer contracting

activities has been provided for the three and nine months ended

September 30, 2016 as it is the most comparable metric to net

services revenue for the three and nine months ended

September 30, 2017.Due to rounding, numbers presented in this

document may not add up precisely to the totals provided.

| Table 8 |

| R1 RCM Inc. |

| Condensed Consolidated Non-GAAP Financial

Information |

| (In millions) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

(Unaudited) |

|

(Unaudited) |

| RCM services: net

operating fees |

|

104.6 |

|

|

46.1 |

|

|

255.4 |

|

|

94.8 |

|

| RCM services: incentive

fees |

|

7.5 |

|

|

7.5 |

|

|

20.2 |

|

|

23.8 |

|

| RCM services:

other |

|

2.8 |

|

|

1.8 |

|

|

9.8 |

|

|

9.0 |

|

| Other services

fees |

|

8.3 |

|

|

4.3 |

|

|

24.1 |

|

|

11.3 |

|

| Net services

revenue (GAAP) (2017), Gross cash generated from customer

contracting activities (non-GAAP) (2016) (2) |

|

123.2 |

|

|

59.7 |

|

|

309.5 |

|

|

138.9 |

|

| |

|

|

|

|

|

|

|

|

| Operating expenses (1)

: |

|

|

|

|

|

|

|

|

| Cost of services

(non-GAAP) |

|

106.6 |

|

|

43.5 |

|

|

275.4 |

|

|

125.9 |

|

| Selling, general

and administrative (non-GAAP) |

|

13.4 |

|

|

12.6 |

|

|

35.7 |

|

|

39.3 |

|

|

Sub-total |

|

120.0 |

|

|

56.1 |

|

|

311.1 |

|

|

165.2 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA

(non-GAAP) (2017), Net cash generated from customer contracting

activities (non-GAAP) (2016) (2) |

|

$ |

3.1 |

|

|

$ |

3.6 |

|

|

$ |

(1.6 |

) |

|

$ |

(26.4 |

) |

(1) Excludes share-based compensation, depreciation and

amortization and other costs(2) Due to the adoption of Topic 606 as

of January 1, 2017, the non-GAAP measure of gross and net cash

generated from customer contracting activities that were utilized

by the Company in 2016 are not applicable for 2017. Gross and net

cash generated from customer contracting activities have been

provided for the three and nine months ended September 30,

2016 as they are the most comparable metric to net services revenue

and adjusted EBITDA, respectively, for the three and nine months

ended September 30, 2017.Due to rounding, numbers presented in

this document may not add up precisely to the totals provided.

| Table 9 |

| R1 RCM Inc. |

| Reconciliation of GAAP Operating Income

Guidance to non-GAAP Adjusted EBITDA Guidance |

| (In millions) |

| |

GAAP Operating Income Guidance |

($25) - ($30) |

|

| |

Plus: |

|

|

| |

Depreciation and amortization expense |

~$13 |

|

| |

Share-based compensation expense |

~$13 |

|

| |

Severance and other costs |

~$5 |

|

| |

Adjusted EBITDA Guidance |

$0 - $5 |

|

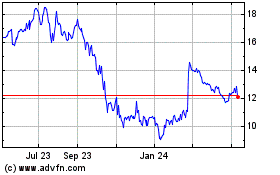

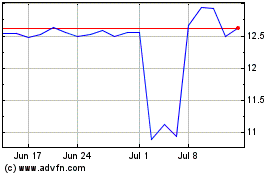

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Apr 2023 to Apr 2024