UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED

MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number

811-21593

Kayne Anderson MLP Investment Company

(Exact name of registrant as specified in charter)

717 Texas

Avenue, Suite 3100,

Houston, Texas 77002

(Address of principal executive offices) (Zip code)

David

Shladovsky, Esq.

KA Fund Advisors, LLC,

717 Texas Avenue, Suite 3100,

Houston, Texas 77002

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 493-2020

Date of fiscal year end: November 30, 2012

Date of reporting period: February 29, 2012

TABLE OF CONTENTS

Item 1:

Schedule of Investments

KAYNE ANDERSON MLP INVESTMENT COMPANY

SCHEDULE OF INVESTMENTS

FEBRUARY 29, 2012

(amounts in 000’s, except number of option contracts)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

|

|

|

|

|

No. of

Shares/Units

|

|

|

Value

|

|

|

Long-Term Investments — 167.1%

|

|

|

|

|

|

|

|

|

|

Equity Investments

(1)

— 164.3%

|

|

|

|

|

|

|

|

|

|

Midstream MLP

(2)

— 110.8%

|

|

|

|

|

|

|

|

|

|

Boardwalk Pipeline Partners, LP

|

|

|

1,032

|

|

|

$

|

28,046

|

|

|

Buckeye Partners, L.P.

|

|

|

1,405

|

|

|

|

84,033

|

|

|

Buckeye Partners, L.P. — Class B Units

(3)(4)

|

|

|

865

|

|

|

|

47,087

|

|

|

Chesapeake Midstream Partners, L.P.

|

|

|

1,325

|

|

|

|

37,830

|

|

|

Copano Energy, L.L.C.

|

|

|

1,533

|

|

|

|

56,994

|

|

|

Crestwood Midstream Partners LP

|

|

|

1,826

|

|

|

|

52,663

|

|

|

Crestwood Midstream Partners LP — Class C

Units

(3)(4)

|

|

|

1,134

|

|

|

|

29,990

|

|

|

Crosstex Energy, L.P.

|

|

|

1,200

|

|

|

|

20,637

|

|

|

DCP Midstream Partners, LP

|

|

|

2,024

|

|

|

|

98,567

|

|

|

El Paso Pipeline Partners, L.P.

|

|

|

4,345

|

|

|

|

159,336

|

|

|

Enbridge Energy Partners, L.P.

|

|

|

3,715

|

|

|

|

120,916

|

|

|

Energy Transfer Partners, L.P.

|

|

|

1,736

|

|

|

|

82,294

|

|

|

Enterprise Products Partners L.P.

|

|

|

7,396

|

|

|

|

383,685

|

|

|

Exterran Partners, L.P.

|

|

|

2,878

|

|

|

|

68,064

|

|

|

Global Partners LP

|

|

|

1,974

|

|

|

|

43,398

|

|

|

Holly Energy Partners, L.P.

|

|

|

387

|

|

|

|

23,725

|

|

|

Inergy Midstream, L.P.

|

|

|

1,064

|

|

|

|

22,547

|

|

|

Magellan Midstream Partners, L.P.

|

|

|

2,316

|

|

|

|

169,457

|

|

|

MarkWest Energy Partners, L.P.

|

|

|

3,920

|

|

|

|

234,456

|

|

|

Niska Gas Storage Partners LLC

|

|

|

1,671

|

|

|

|

15,772

|

|

|

NuStar Energy L.P.

|

|

|

301

|

|

|

|

18,283

|

|

|

Oiltanking Partners, L.P.

|

|

|

460

|

|

|

|

14,890

|

|

|

ONEOK Partners, L.P.

|

|

|

2,397

|

|

|

|

139,520

|

|

|

PAA Natural Gas Storage, L.P.

|

|

|

1,124

|

|

|

|

21,577

|

|

|

Plains All American Pipeline, L.P.

(5)

|

|

|

3,161

|

|

|

|

261,423

|

|

|

Regency Energy Partners LP

|

|

|

6,393

|

|

|

|

169,425

|

|

|

Rose Rock Midstream, L.P.

|

|

|

315

|

|

|

|

7,514

|

|

|

Spectra Energy Partners, L.P.

|

|

|

596

|

|

|

|

19,673

|

|

|

Targa Resources Partners L.P.

|

|

|

1,873

|

|

|

|

79,682

|

|

|

TC PipeLines, LP

|

|

|

190

|

|

|

|

8,810

|

|

|

Tesoro Logistics LP

|

|

|

502

|

|

|

|

18,339

|

|

|

Transmontaigne Partners L.P.

|

|

|

393

|

|

|

|

13,632

|

|

|

Western Gas Partners L.P.

|

|

|

1,156

|

|

|

|

52,921

|

|

|

Williams Partners L.P.

|

|

|

2,509

|

|

|

|

156,076

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,761,262

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MLP Affiliate

(2)

— 15.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enbridge Energy Management, L.L.C.

(4)

|

|

|

2,161

|

|

|

|

72,961

|

|

|

Kinder Morgan Management, LLC

(4)

|

|

|

3,900

|

|

|

|

312,700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

385,661

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General Partner MLP

(2)

— 11.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alliance Holdings GP L.P.

|

|

|

1,706

|

|

|

|

85,825

|

|

|

Energy Transfer Equity, L.P.

|

|

|

4,425

|

|

|

|

192,422

|

|

|

NuStar GP Holdings, LLC

|

|

|

74

|

|

|

|

2,592

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

280,839

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KAYNE ANDERSON MLP INVESTMENT COMPANY

SCHEDULE OF INVESTMENTS

FEBRUARY 29, 2012

(amounts in 000’s, except number of option

contracts)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

|

|

|

|

|

|

|

No. of

Shares/Units

|

|

|

Value

|

|

|

Shipping MLP — 9.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Product Partners L.P.

|

|

|

|

|

|

|

|

|

|

|

2,841

|

|

|

$

|

21,221

|

|

|

Golar LNG Partners LP

|

|

|

|

|

|

|

|

|

|

|

92

|

|

|

|

3,419

|

|

|

Navios Maritime Partners L.P.

|

|

|

|

|

|

|

|

|

|

|

1,950

|

|

|

|

31,258

|

|

|

Teekay LNG Partners L.P.

|

|

|

|

|

|

|

|

|

|

|

1,879

|

|

|

|

73,645

|

|

|

Teekay Offshore Partners L.P.

|

|

|

|

|

|

|

|

|

|

|

3,223

|

|

|

|

94,734

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

224,277

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Midstream — 7.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

El Paso Corporation

(6)

|

|

|

|

|

|

|

|

|

|

|

656

|

|

|

|

18,232

|

|

|

Kinder Morgan, Inc.

|

|

|

|

|

|

|

|

|

|

|

854

|

|

|

|

30,095

|

|

|

ONEOK, Inc.

|

|

|

|

|

|

|

|

|

|

|

421

|

|

|

|

34,808

|

|

|

Plains All American GP LLC — Unregistered

(3)(5)

|

|

|

|

|

|

|

|

|

|

|

24

|

|

|

|

47,538

|

|

|

Targa Resources Corp.

|

|

|

|

|

|

|

|

|

|

|

276

|

|

|

|

12,280

|

|

|

The Williams Companies, Inc.

|

|

|

|

|

|

|

|

|

|

|

1,588

|

|

|

|

47,440

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

190,393

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Upstream MLP & Income Trust— 4.5%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BreitBurn Energy Partners L.P.

|

|

|

|

|

|

|

|

|

|

|

1,597

|

|

|

|

30,111

|

|

|

Chesapeake Granite Wash Trust

|

|

|

|

|

|

|

|

|

|

|

533

|

|

|

|

14,807

|

|

|

Legacy Reserves L.P.

|

|

|

|

|

|

|

|

|

|

|

535

|

|

|

|

15,437

|

|

|

LRR Energy, L.P.

|

|

|

|

|

|

|

|

|

|

|

243

|

|

|

|

4,912

|

|

|

Memorial Production Partners LP

|

|

|

|

|

|

|

|

|

|

|

318

|

|

|

|

5,908

|

|

|

Mid-Con Energy Partners, LP

|

|

|

|

|

|

|

|

|

|

|

338

|

|

|

|

8,214

|

|

|

SandRidge Permian Trust

|

|

|

|

|

|

|

|

|

|

|

1,028

|

|

|

|

24,930

|

|

|

VOC Energy Trust

|

|

|

|

|

|

|

|

|

|

|

344

|

|

|

|

7,459

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

111,778

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coal MLP — 3.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alliance Resource Partner, L.P.

|

|

|

|

|

|

|

|

|

|

|

12

|

|

|

|

883

|

|

|

Penn Virginia Resource Partners, L.P.

|

|

|

|

|

|

|

|

|

|

|

3,063

|

|

|

|

76,382

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

77,265

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Propane MLP — 2.4%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inergy, L.P.

|

|

|

|

|

|

|

|

|

|

|

3,510

|

|

|

|

61,290

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other — 0.1%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Clearwater Trust

(3)(5)(7)

|

|

|

|

|

|

|

|

|

|

|

N/A

|

|

|

|

3,250

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Equity Investments (Cost — $2,408,532)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,096,015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

Rate

|

|

|

Maturity

Date

|

|

|

Principal

Amount

|

|

|

|

|

|

Debt Investments — 2.8%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Midstream — 1.6%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Crestwood Holdings Partners, LLC

|

|

|

(8)

|

|

|

|

10/1/16

|

|

|

$

|

5,549

|

|

|

|

5,660

|

|

|

Crestwood Midstream Partners LP

|

|

|

7.750

|

%

|

|

|

4/1/19

|

|

|

|

11,750

|

|

|

|

11,927

|

|

|

Niska Gas Storage Partners LLC

|

|

|

8.875

|

|

|

|

3/15/18

|

|

|

|

24,000

|

|

|

|

23,160

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40,747

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KAYNE ANDERSON MLP INVESTMENT COMPANY

SCHEDULE OF INVESTMENTS

FEBRUARY 29, 2012

(amounts in 000’s, except number of option

contracts)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description

|

|

Interest

Rate

|

|

|

Maturity

Date

|

|

|

Principal

Amount

|

|

|

Value

|

|

|

Upstream — 0.7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BreitBurn Energy Partners L.P.

|

|

|

7.875

|

%

|

|

|

4/15/22

|

|

|

$

|

2,250

|

|

|

$

|

2,368

|

|

|

Eagle Rock Energy Partners, L.P.

|

|

|

8.375

|

|

|

|

6/1/19

|

|

|

|

975

|

|

|

|

1,009

|

|

|

Linn Energy, LLC

|

|

|

6.250

|

|

|

|

11/1/19

|

|

|

|

13,500

|

|

|

|

13,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,877

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Coal MLP — 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Penn Virginia Resource Partners, L.P.

|

|

|

8.250

|

|

|

|

4/15/18

|

|

|

|

6,250

|

|

|

|

6,531

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other — 0.2%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calumet Specialty Products Partners, L.P.

|

|

|

9.375

|

|

|

|

5/1/19

|

|

|

|

4,000

|

|

|

|

4,190

|

|

|

Calumet Specialty Products Partners, L.P.

|

|

|

9.375

|

|

|

|

5/1/19

|

|

|

|

2,000

|

|

|

|

2,095

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,285

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Energy Debt Investments (Cost — $68,794)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70,440

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Long-Term Investments (Cost — $2,477,326)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,166,455

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No. of

Contracts

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Call Option Contracts Written

(9)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Midstream

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

El Paso Pipeline Partners, L.P., call option expiring 4/20/12

@ $37.50 (Premiums

Received — $88)

|

|

|

|

|

|

|

|

|

|

|

1,000

|

|

|

|

(50

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revolving Credit Facility

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(76,000

|

)

|

|

Senior Unsecured Notes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(775,000

|

)

|

|

Mandatory Redeemable Preferred Stock at Liquidation Value

|

|

|

|

|

|

|

|

|

|

|

|

(260,000

|

)

|

|

Deferred Tax Liability

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(645,606

|

)

|

|

Other Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(200,244

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,956,900

|

)

|

|

Other Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

283,187

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities in Excess of Other Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,673,713

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets Applicable to Common Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

2,492,742

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Unless otherwise noted, equity investments are common units/common shares.

|

|

(2)

|

Includes limited liability companies.

|

|

(3)

|

Fair valued securities, restricted from public sale.

|

|

(4)

|

Distributions are paid-in-kind.

|

|

(5)

|

Kayne Anderson MLP Investment Company (the “Company”) believes that it is an affiliate of the Clearwater Trust, Plains All American Pipeline, L.P. and Plains

All American GP LLC.

|

|

(6)

|

Security or a portion thereof is segregated as collateral on option contracts written.

|

|

(7)

|

The Company owns an interest in the Creditors Trust of Miller Bros. Coal, LLC (“Clearwater Trust”) consisting of a coal royalty interest.

|

|

(8)

|

Floating rate first lien senior secured term loan. Security pays interest at a rate of LIBOR + 850 basis points, with a 2% LIBOR floor (10.50% as of

February 29, 2012).

|

|

(9)

|

Security is non-income producing.

|

From time to time, certain of the Company’s investments may be restricted as to resale. For instance,

private investments that are not registered under the Securities Act of 1933, as amended, cannot be offered for public sale in a non-exempt transaction without first being registered. In other cases, certain of the Company’s investments have

restrictions such as lock-up agreements that preclude the Company from offering these securities for public sale.

At February 29, 2012, the

Company held the following restricted investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment

|

|

Security

|

|

Acquisition

Date

|

|

Type of

Restriction

|

|

Number

of

Units,

Principal ($)

(in

000’s)

|

|

|

Cost

Basis

|

|

|

Fair

Value

|

|

|

Percent

of

Net

Assets

|

|

|

Percent

of

Total

Assets

|

|

|

Level 3 Investments

(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Buckeye Partners, L.P.

|

|

Class B Units

|

|

(2)

|

|

(3)

|

|

|

865

|

|

|

|

45,006

|

|

|

$

|

47,087

|

|

|

|

1.9

|

%

|

|

|

1.0

|

%

|

|

Clearwater Trust

|

|

Trust Interest

|

|

(4)

|

|

(5)

|

|

|

1

|

|

|

|

3,266

|

|

|

|

3,250

|

|

|

|

0.1

|

|

|

|

0.1

|

|

|

Crestwood Midstream Partners LP

|

|

Class C Units

|

|

4/1/11

|

|

(3)

|

|

|

1,134

|

|

|

|

26,007

|

|

|

|

29,990

|

|

|

|

1.2

|

|

|

|

0.7

|

|

|

Plains All American GP LLC

(6)

|

|

Common Units

|

|

(2)

|

|

(5)

|

|

|

24

|

|

|

|

33,040

|

|

|

|

47,538

|

|

|

|

1.9

|

|

|

|

1.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

$

|

107,319

|

|

|

$

|

127,865

|

|

|

|

5.1

|

%

|

|

|

2.9

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 2 Investments

(7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BreitBurn Energy Partners L.P.

|

|

Senior Notes

|

|

1/10/12

|

|

(3)

|

|

$

|

2,250

|

|

|

$

|

2,231

|

|

|

$

|

2,368

|

|

|

|

0.1

|

%

|

|

|

0.1

|

%

|

|

Crestwood Holdings Partners LLC

|

|

Bank Loan

|

|

9/29/10

|

|

(5)

|

|

|

5,549

|

|

|

|

5,458

|

|

|

|

5,660

|

|

|

|

0.2

|

|

|

|

0.1

|

|

|

Crestwood Midstream Partners LP

|

|

Senior Notes

|

|

(2)

|

|

(3)

|

|

|

11,750

|

|

|

|

11,739

|

|

|

|

11,926

|

|

|

|

0.5

|

|

|

|

0.3

|

|

|

Linn Energy, LLC

|

|

Senior Notes

|

|

2/28/12

|

|

(3)

|

|

|

13,500

|

|

|

|

13,499

|

|

|

|

13,500

|

|

|

|

0.5

|

|

|

|

0.3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

$

|

32,927

|

|

|

$

|

33,454

|

|

|

|

1.3

|

%

|

|

|

0.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total of all restricted securities

|

|

|

|

|

|

|

|

|

|

|

|

$

|

140,246

|

|

|

$

|

161,319

|

|

|

|

6.4

|

%

|

|

|

3.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Securities are valued using inputs reflecting the Company’s own assumptions.

|

|

(2)

|

Securities acquired at various dates throughout the fiscal year ended November 30, 2011.

|

|

(3)

|

Unregistered or restricted security of a publicly tracked company.

|

|

(4)

|

On September 28, 2010, the Bankruptcy Court finalized the plan of reorganization of Clearwater. As part of the plan of reorganization, the Company received an

interest in the Clearwater Trust consisting of cash and a coal royalty interest as consideration for its unsecured loan to Clearwater.

|

|

(5)

|

Unregistered security of a private company or trust.

|

|

(6)

|

In determining the fair value for Plains All American GP, LLC (“PAA GP”), the Company’s valuation is based on publicly available information. Robert V.

Sinnott, the CEO of Kayne Anderson Capital Advisors, L.P. (“KACALP”), sits on PAA GP’s board of directors. Certain private investment funds managed by KACALP may value its investment in PAA GP based on non-public information, and, as

a result, such valuation may be different than the Company’s valuation.

|

|

(7)

|

These securities have a fair market value determined by the mean of the bid and ask prices provided by an agent or syndicate bank, principal market maker or an

independent pricing service. These securities have limited trading volume and are not listed on a national exchange.

|

At February 29, 2012, the cost basis of investments for federal income tax purposes was $2,313,393. At February 29, 2012, gross unrealized appreciation and depreciation of investments for federal income

tax purposes were as follows:

|

|

|

|

|

|

|

Gross unrealized appreciation of investments

|

|

$

|

1,860,389

|

|

|

Gross unrealized depreciation of investments

|

|

|

(7,326

|

)

|

|

|

|

|

|

|

|

Net unrealized appreciation

|

|

$

|

1,853,063

|

|

|

|

|

|

|

|

The identified cost basis of federal tax purposes is estimated based on information available from the Company’s

portfolio companies. In some cases, this information is very limited. Accordingly, the actual cost basis may prove higher or lower than the estimated cost basis included above.

As required by the Fair Value Measurement and Disclosures of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification, the Company has performed an analysis of all

assets and liabilities measured at fair value to determine the significance and character of all inputs to their fair value determination.

The fair value hierarchy prioritizes the inputs to valuation techniques used to measure fair value into the

following three broad categories. Note that the valuation levels below are not necessarily an indication of the risk or liquidity associated with the underlying investment.

|

|

•

|

|

Level 1

— Quoted unadjusted prices for identical instruments in active markets traded on a national exchange to which the Company has

access at the date of measurement.

|

|

|

•

|

|

Level 2

— Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are

not active; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 2 inputs are those in markets for which there are few transactions, the prices are not current, little

public information exists or instances where prices vary substantially over time or among brokered market makers.

|

|

|

•

|

|

Level 3

— Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. Unobservable

inputs are those inputs that reflect the Company’s own assumptions that market participants would use to price the asset or liability based on the best available information.

|

The following table presents the Company’s assets measured at fair value on a recurring basis at February 29, 2012. The Company presents these

assets by security type and description on its Schedule of Investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

Quoted Prices in

Active

Markets

(Level 1)

|

|

|

Prices with

Other

Observable Inputs

(Level 2)

|

|

|

Unobservable

Inputs

(Level 3)

|

|

|

Assets at Fair Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity investments

|

|

$

|

4,096,015

|

|

|

$

|

3,968,150

|

|

|

$

|

—

|

|

|

$

|

127,865

|

|

|

Debt investments

|

|

|

70,440

|

|

|

|

—

|

|

|

|

70,440

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets at fair value

|

|

$

|

4,166,455

|

|

|

$

|

3,968,150

|

|

|

$

|

70,440

|

|

|

$

|

127,865

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities at Fair Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Call option contracts written

|

|

$

|

50

|

|

|

$

|

—

|

|

|

$

|

50

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Company did not have any liabilities that were measured at fair value on a recurring basis using significant

unobservable inputs (Level 3) at February 29, 2012 or at November 30, 2011. For the three months ended February 29, 2012, there were no transfers between Level 1 and Level 2.

The following table presents the Company’s assets measured at fair value on a recurring basis using significant unobservable inputs

(Level 3) for the three months ended February 29, 2012.

|

|

|

|

|

|

|

|

|

Equity

Investments

|

|

|

Balance — November 30, 2011

|

|

$

|

164,129

|

|

|

Purchases

|

|

|

—

|

|

|

Issuances

|

|

|

1,427

|

|

|

Transfers out

|

|

|

(40,711

|

)

|

|

Realized gains (losses)

|

|

|

—

|

|

|

Unrealized gains, net

|

|

|

3,020

|

|

|

|

|

|

|

|

|

Balance — February 29, 2012

|

|

$

|

127,865

|

|

|

|

|

|

|

|

The $3,020 of unrealized gains presented in the table above for the three months ended February 29, 2012 related to

investments that are still held at February 29, 2012.

The issuances of $1,427 relate to additional units received from Buckeye Partners,

L.P. (Class B Units) and Crestwood Midstream Partners LP (Class C Units). The Company’s investments in the common units of Teekay Offshore Partners L.P., which is noted as a transfer out of Level 3 in the table above, became

readily marketable during the three months ended February 29, 2012.

As required by the Derivatives and Hedging Topic of the FASB Accounting Standards Codification, the

following are the derivative instruments and hedging activities of the Company.

The following table sets forth the fair value

of the Company’s derivative instruments.

|

|

|

|

|

|

|

Derivatives Not Accounted for as

Hedging Instruments

|

|

Statement of Assets and Liabilities Location

|

|

Fair Value as of

February 29, 2012

|

|

Call options

|

|

Call option contracts written

|

|

$(50)

|

The following table set forth the effect of the Company’s derivative instruments.

|

|

|

|

|

|

|

|

|

Derivatives Not Accounted for

as

Hedging Instruments

|

|

Location of Gains/(Losses) on

Derivatives Recognized in Income

|

|

For the Three Months

Ended

February 29, 2012

|

|

|

|

Net Realized

Gains/(Losses)

on

Derivatives

Recognized

in

Income

|

|

Change in

Unrealized

Gains/(Losses) on

Derivatives

Recognized

in

Income

|

|

Call options

|

|

Options

|

|

$356

|

|

$(55)

|

Securities valuation policies and other investment related disclosures are hereby incorporated by reference to the

Company’s annual report previously filed with the Securities and Exchange Commission on form N-CSR on February 7, 2012 with a file number 811-21593.

Other information regarding the Company is available in the Company’s most recent annual report. This information is also available on the Company’s website at www.kaynefunds.com; or on the

website of the Securities and Exchange Commission, www.sec.gov.

Item 2: Controls and Procedures

(a) As of a date within 90 days from the filing date of this report, the principal executive officer and principal financial

officer concluded that the registrants disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the Act)), were effective based on their evaluation of the disclosure controls and

procedures required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities and Exchange Act of 1934, as amended.

(b) There were no changes in the registrants internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the registrants last fiscal quarter that have

materially affected, or are reasonably likely to materially affect, the registrants internal control over financial reporting.

Item

3:

Exhibits

1. The certifications of the registrant as required by Rule 30a-2(a) under the Act are

exhibits to this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly

caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

KAYNE ANDERSON MLP INVESTMENT COMPANY

|

|

|

|

/

S

/ K

EVIN

S. M

C

C

ARTHY

|

|

Name: Kevin S. McCarthy

Title: Chairman of the Board of Directors,

|

|

President and Chief Executive Officer

|

|

Date: April 27, 2012

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act

of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

/

S

/ K

EVIN

S. M

C

C

ARTHY

|

|

Name: Kevin S. McCarthy

Title: Chairman of the Board of Directors,

|

|

President and Chief Executive Officer

|

|

Date: April 27, 2012

|

|

|

|

/

S

/ T

ERRY

A. H

ART

|

|

Name: Terry A. Hart

Title:

Chief Financial Officer and Treasurer

|

|

Date: April 27, 2012

|

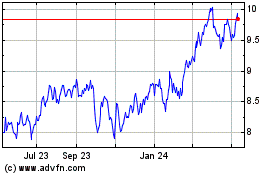

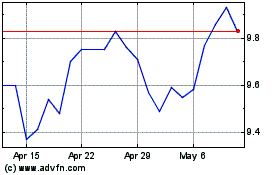

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kayne Anderson Energy In... (NYSE:KYN)

Historical Stock Chart

From Apr 2023 to Apr 2024