Qualcomm Posts 24% Profit Drop -- Update

January 27 2016 - 7:17PM

Dow Jones News

By Don Clark and Tess Stynes

Qualcomm Inc. said its earnings fell 24% in the most recent

quarter, the latest sign that slowing sales of high-end smartphones

from Apple Inc. and others are hurting component suppliers.

The San Diego-based chip maker, which also has been facing

headwinds in its patent-licensing business, on Wednesday issued a

forecast for the current quarter that fell short of some Wall

Street expectations.

But Qualcomm executives stressed that earnings and revenue for

the fiscal first quarter ended in December were above its own

recent projections.

"We delivered a better quarter than we said we were going to

deliver," said CEO Steve Mollenkopf in an interview.

In another development, Qualcomm disclosed Wednesday that LG

Electronics Inc. contends that it paid the chip maker too much

under its patent licensing deal and seeks compensation through an

arbitration proceeding. Qualcomm said it believes LG's claims are

without merit but added that it is deferring recognition of

licensing revenue from the South Korean company for the moment.

Qualcomm, the biggest maker of processors and modem chips used

in mobile phones, gets more than half of its profit from royalty

payments by handset makers to use its cellular patents. Its

licensing practices have prompted antitrust probes in South Korea,

Taiwan and the U.S., while European authorities have been

investigating its chip sales tactics.

Qualcomm has insisted that its practices are legal and it is

cooperating with investigators.

The company has grappled with other issues in the past year,

include pressure from activist Jana Partners LLC to consider

options that included dividing the chip business from the

patent-licensing business. The company ordered a major cost-cutting

program but in December ruled out a breakup.

Qualcomm also faces weaker demand for high-end phones from the

likes of Apple and Samsung Electronics Inc. Apple on Tuesday

reported that iPhone sales grew at their slowest pace since it

introduced the device in 2007. Apple forecast that revenue in the

current quarter will decline for the first time in 13 years,

signaling an end to its recent period of hypergrowth.

Adding to the pressures on Qualcomm, Samsung and some other

handset makers in 2015 shied away from using the chip maker's

flagship Snapdragon processor. Mr. Mollenkopf said he was pleased

with demand for the latest version of that product line, the

Snapdragon 820, with more than 100 devices in development or

already using the chip.

Much of Qualcomm's fortune lately has been tied to smartphone

demand in China, the biggest market for those devices. Mr.

Mollenkopf said sales of premium phones are "a bit softer" there.

"But we are continuing to see unit growth," he said.

Still, Qualcomm's total chip sales are running below prior

levels. The company projected chip shipments of 175 million to 195

million in the second quarter ending in March, down as much 25%

from the 233 million reported for the year-earlier period.

For the quarter ended Dec. 27, Qualcomm reported 242 million

chip shipments, compared with its estimates of between 225 million

and 245 million.

Net income totaled $1.5 billion, or 99 cents a share, up from

$1.97 billion, or $1.17 a share, a year earlier. On an adjusted

basis that excludes asset-sale gains and other one-time items,

per-share earnings fell to 97 cents from $1.34 a year ago. Revenue

decreased 19% to $5.78 billion.

Qualcomm previously had projected adjusted per-share profit of

80 cents to 90 cents and revenue of $5.2 billion to $6 billion.

For the three-month period ending in March, Qualcomm forecast

per-share earnings of 90 cents to $1 and revenue of $4.9 billion to

$5.7 billion. Analysts polled by Thomson Reuters expected per-share

profit of $1.01 and revenue of $5.68 billion.

Write to Don Clark at don.clark@wsj.com and Tess Stynes at

tess.stynes@wsj.com

(END) Dow Jones Newswires

January 27, 2016 19:02 ET (00:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

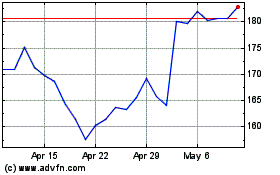

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024