Quadrise Fuels International PLC Open Offer (5121M)

October 14 2016 - 2:00AM

UK Regulatory

TIDMQFI

RNS Number : 5121M

Quadrise Fuels International PLC

14 October 2016

NEITHER THIS ANNOUNCEMENT NOR ANY PART OF IT CONSTITUTES AN

OFFER TO SELL OR ISSUE OR THE SOLICITATION OF AN OFFER TO BUY,

SUBSCRIBE OR ACQUIRE ANY SECURITIES IN ANY JURISDICTION IN WHICH

ANY SUCH OFFER OR SOLICITATION WOULD BE UNLAWFUL AND THE

INFORMATION CONTAINED HEREIN IS NOT FOR PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF IRELAND, SOUTH AFRICA OR

ANY JURISDICTION IN WHICH SUCH PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL.

14 October 2016

Quadrise Fuels International plc

("Quadrise", "QFI", the "Company" and together with its

subsidiaries the "Group")

Open Offer to raise up to approximately GBP1 million

Quadrise Fuels International plc (AIM: QFI) is the emerging

supplier of MSAR(R) emulsion technology and fuel, enabling a

low-cost alternative to heavy fuel oil (one of the world's largest

fuel markets, comprising over 450 million tonnes per annum) in the

global shipping, refining, power generation markets.

The Company announced on 12 October 2016 a successful placing of

GBP4.25 million and the intention to undertake a non-underwritten

open offer to enable Shareholders to participate in a further issue

of new equity in the Company at the Issue Price in order to raise

up to, approximately, a further GBP1.0 million ("Open Offer").

A circular setting out full details of the Open Offer, including

the terms and conditions and details on how to accept the Open

Offer, (the "Circular") and an accompanying Application Form (for

Qualifying Non-CREST Shareholders) have been posted to Shareholders

today.

A copy of the Circular will be made available today on the

Company's website at www.quadrisefuels.com.

Open Offer

On announcement of the Placing, the Directors stated that it was

appropriate, given the longstanding support that Shareholders,

including a large number of individual shareholders, have provided

to the Company over an extended period, that existing Shareholders

were provided with the opportunity to participate in the further

issue of new equity in the Company at the same price as was

available to institutional and other investors under the

Placing.

Accordingly, the Company is now making the Open Offer to

Qualifying Shareholders of up to 10,119,814 New Ordinary Shares of

1p each ("Open Offer Shares") to raise up to, approximately, a

further GBP1.0 million at the Issue Price of 10 pence per Open

Offer Share on the basis of 1 Open Offer Share for every 80

Existing Ordinary Shares held on the record date, being the close

of business on 13 October 2016 (the "Record Date") (the "Open

Offer"). The Issue Price represents a discount of approximately

14.0 percent to the closing mid-market price of 11.625 pence per

Existing Ordinary Share on 11 October 2016, being the last

practicable date prior to the announcement of the Placing and

proposed Open Offer.

The Open Offer Shares and the Placing Shares will together

represent approximately 6.1 percent of the Enlarged Share Capital

(assuming full take up of the Open Offer Shares under the Open

Offer).

The Placing and Open Offer is expected to raise total gross

proceeds of approximately GBP5.25 million, should the Open Offer be

fully subscribed. The terms of the Open Offer are described in the

Circular and the Directors currently believe that the funds raised

as a result will be sufficient to take the Group to the stage where

it is generating net positive cash from continuing operations.

Qualifying Shareholders subscribing for their full entitlement

under the Open Offer may also request further Open Offer Shares

through the Excess Application Facility further described in the

Circular. Admission of the Open Offer Shares is expected to take

place on 1 November 2016.

In order to maximise the number of Open Offer Shares available

under the Open Offer to Qualifying Shareholders, the Directors have

confirmed that they and their affiliates will not take up any

Ordinary Shares which may have been offered to them as part of the

Open Offer and will not subscribe for any Open Offer Shares. The

Open Offer Entitlements which could otherwise have been available

to the Directors and their affiliates under the Open Offer will be

made available to Qualifying Shareholders under the Excess

Application Facility.

Capitalised terms used but not otherwise defined in this

announcement bear the meanings ascribed to them in the

Circular.

The Open Offer is conditional upon:

(i) the Placing and Open Offer Agreement being unconditional in

all respects and not having been terminated in accordance with its

terms; and

(ii) the admission of the Open Offer Shares becoming effective

by not later than 8.00 a.m. on 1 November 2016.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Record Date for Open Offer 6.00 p.m. on

13 October 2016

Announcement of the Open Offer 7.00 a.m. on

14 October 2016

Publication and posting of the 14 October 2016

Circular and Application Form

Existing Ordinary Shares marked 8.00 a.m. on

'ex' by London Stock Exchange 14 October 2016

Open Offer Entitlements and Excess as soon as practicable

CREST Open Offer Entitlements credited after 8.00 a.m.

to stock accounts in CREST of Qualifying on 17 October

CREST Shareholders 2016

Expected time and date First Admission 18 October 2016

effective and dealings in Placing

Shares commence on AIM

Expected date for CREST accounts 18 October 2016

credited in respect of Placing

Shares

Recommended latest time for requesting 4.30 p.m. on

withdrawal of Open Offer Entitlements 24 October 2016

and Excess CREST Open Offer Entitlements

from CREST

Latest time for depositing Open 3.00 p.m. on

Offer Entitlements and Excess CREST 25 October 2016

Open Offer Entitlements into CREST

Latest time for splitting Application 3.00 p.m. on

Forms (to satisfy bona fide market 26 October 2016

claims only)

Latest time and date for receipt 11.00 a.m. on

of completed Application Forms 28 October 2016

and payment in full under the Open

Offer and settlement of relevant

CREST instructions (as appropriate)

Expected date of announcement of 31 October 2016

the results of the Open Offer

Share certificates dispatched for 1 November 2016

the Placing Shares by

Expected time and date Second Admission 1 November 2016

effective and dealings in Open

Offer Shares commence on AIM

CREST accounts credited in respect 1 November 2016

of Open Offer Shares

Share certificates dispatched for 15 November 2016

the Open Offer Shares by

For further information, please refer to the Company's website

at www.quadrisefuels.com or contact:

Quadrise Fuels International Plc

+44 (0)20 7031

Mike Kirk, Executive Chairman 7321

Hemant Thanawala, Finance Director

Jason Miles, Chief Operating Officer

Nominated Adviser

Smith & Williamson Corporate Finance

Limited

+44 (0)20 7131

Dr Azhic Basirov 4000

Ben Jeynes

Katy Birkin

Broker

Peel Hunt LLP

+44 (0)20 7418

Richard Crichton 8900

Ross Allister

Chris Burrows

Public & Investor Relations

FTI Consulting

+44 (0)20 3727

Ben Brewerton 1000

This information is provided by RNS

The company news service from the London Stock Exchange

END

IOEMJBPTMBTBBJF

(END) Dow Jones Newswires

October 14, 2016 02:00 ET (06:00 GMT)

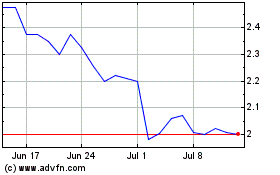

Quadrise (LSE:QED)

Historical Stock Chart

From Mar 2024 to Apr 2024

Quadrise (LSE:QED)

Historical Stock Chart

From Apr 2023 to Apr 2024