TIDMQFI

RNS Number : 9364E

Quadrise Fuels International PLC

16 February 2015

16 February 2015

Quadrise Fuels International plc

("QFI", "Quadrise" or the "Company")

Notice of Interim Results and Business Update

Quadrise, the emerging supplier of MSAR, a low cost alternative

to heavy fuel oil in the shipping, refining and power generation

markets, will announce its unaudited interim results for the six

months ended 31 December 2014 on 30 March 2015 (the "Interim

Results").

The collapse in the oil price since Q4 2014, and related

uncertainty in the energy sector, has clearly affected investor

sentiment. While this has limited relevance for the leading

Quadrise projects and their prospects, the impact on the Quadrise

share price and market capitalisation has been substantial.

For this reason, and in response to shareholder representations,

the board believe it appropriate to issue a limited business update

ahead of the Interim Results.

General - Oil Price Implications

The economics of MSAR production in qualifying refineries remain

sound despite the oil price collapse.

The Quadrise MSAR process adds value in refining by replacing

high value distillates with water and chemicals to create a

substitute for conventional heavy fuel oil. The value-add is driven

primarily by the price difference (spread) between heavy fuel oil

and diesel. Whilst the price spread will tend to narrow when the

oil price falls, historically the rate of reduction has been

limited.

By way of example, very recent detailed assessments undertaken

by QFI with refining companies have confirmed that a 60% reduction

in the heavy fuel oil price has only led to a 20% reduction in the

MSAR value-add, and that the economics of converting to MSAR

production remain compelling even in such apparently adverse

circumstances.

Interestingly the same low MSAR value add impact does not apply

to the larger refinery upgrading programmes which typically involve

over US$1 billion capital spending with up to 4 years lead time.

Current oil price uncertainty has led to a large number of oil and

energy industry project cancellations and postponements as oil

companies re-calibrate their plans and programmes. These responses

can be expected to delay additions to global diesel production

capacity and constrain supply which, in turn, should widen the

future price 'spread' - especially if lower prices leads to

increased diesel demand. These factors, in combination, should

serve to make the economics of MSAR even more attractive to the

refining industry and to the marine and power markets in the medium

term.

Marine

The joint evaluations of several short listed refineries for

MSAR fuel supplies for the LONO programme and associated EU

'roll-out' requirements are proceeding.

Oil price uncertainties have impeded progress but the process is

now substantially advanced with several prospective refining

partners. No commitments have yet been made, and the programme, as

now set, remains dependent on securing the refining partner.

The first objective is to settle "Heads of Terms" - if possible

by end Q1. The associated contracts will be multi-party, multi-year

and without precedent. Without the benefit of a "proven template"

in a risk-averse climate, we expect that finalising final form

contracts may take some time.

As refineries operate in regulated environments consideration

has to be given to permitting of the installation of the MSAR

process by the authorities concerned. The time required for

approvals varies between jurisdictions with project lead time

implications.

Essentially, the direction and stages remain clear, but timing

has been affected by oil market events and other emerging factors

which make it more difficult to be definitive on intermediate

milestones prior to plant commissioning and supply.

To ensure that process plant availability will not be the cause

of any delays, the first of two MSAR manufacturing units ("MMUs")

are currently being fabricated to the Quadrise specification in

Denmark for delivery early Q2 2015.

Kingdom of Saudi Arabia (KSA)

As has been widely reported, a comprehensive review triggered by

the oil price collapse has led to notification that many large

scale KSA oil and energy projects will be downscaled, deferred or

in some cases cancelled.

Unlike many other projects, the MSAR programme requires limited

capital investment, has short lead times and is highly cash

generative. We would therefore expect that in the current climate

the programme would be advanced rather than deferred. QFI has

arranged to meet with senior management in KSA during February. The

intention is to confirm the programme in the current environment

with a view to setting a defined timetable for the "production to

combustion" pilot programme targeting completion during Q1 2016. As

the major power plant operator determines some of the requirements

for the pilot, it has become clear that the programme can only take

place during winter months where demand for power is lower and

excess boiler capacity can be utilised for fuel trials.

South America

The final form report of the Joint Feasibility Study undertaken

with Ecopetrol has been delayed pending advice on revised planning

factors to be applied. This has to do with economic and not

technical evaluation and impacts all Ecopetrol projects. Revised

data is expected before the end of Q1 2015. Once advised and

incorporated it is expected that the report and recommendations

will be presented to the board for consideration and decision.

Quadrise has prepared for the possibility that the project, if

agreed, would take the form of a joint venture requiring funding by

all partners. In the present climate, given the oil price impact on

integrated oil companies, this looks to be even more likely.

Treasury

The Quadrise group had GBP9.8 million in treasury at 31 December

2014 and management continue to operate the Company on a low cost

base. Recent evaluation of the current key programmes and the

associated funding requirements suggests that the Quadrise group

has sufficient cash reserves to meet all currently planned

requirements.

Other Developments

Quadrise has always considered the refining industry to be

itself a potential client for the MSAR process for fuel

substitution within their own operations - especially for on-site

integrated power generation.

While many refineries have substantial power capacity, often

only a portion is used for continuous operations. This often

creates an opportunity to operate the power plant at high load and

sell excess power to the national grid.

In cases where MSAR fuel can substitute for higher value fuels

this could be very advantageous for the refiners who are looking

more closely than ever for opportunities to support their profit

margins.

Indications are that this application could aggregate to a

significant business in it own right and the Company is presently

pursuing a number of opportunities with a view to securing an early

demonstration plant opportunity.

For further information, please refer to the Company's website

at www.quadrisefuels.com or contact:

Quadrise Fuels International Plc +44 (0)20 7031 7321

Ian Williams, Executive Chairman

Hemant Thanawala, Finance Director

Jason Miles, Chief Operating Officer

Nominated Adviser

Smith & Williamson Corporate Finance

Limited +44 (0)20 7131 4000

Dr Azhic Basirov

Ben Jeynes

Broker

Peel Hunt LLP +44 (0)20 7418 8900

Richard Crichton

Ross Allister

Alastair Rae

Public & Investor Relations

Pelham Bell Pottinger +44 (0)20 7861 3232

Philip Dennis

Rollo Crichton-Stuart

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCVXLFFELFXBBK

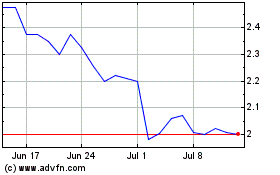

Quadrise (LSE:QED)

Historical Stock Chart

From Mar 2024 to Apr 2024

Quadrise (LSE:QED)

Historical Stock Chart

From Apr 2023 to Apr 2024