TIDMQFI

RNS Number : 5205A

Quadrise Fuels International PLC

27 March 2017

27 March 2017

Quadrise Fuels International plc

("Quadrise", "QFI", the "Company" and together with its

subsidiaries the "Group")

Interim Results for the 6 month period ended 31 December

2016

Quadrise Fuels International plc (AIM: QFI), the emerging

supplier of MSAR(R) emulsion technology and fuel, enabling a low

cost alternative to heavy fuel oil (one of the world's largest fuel

markets, comprising over 450 million tons per annum) in the global

shipping, refining, and power generation markets, announces its

interim results for the 6 month ended 31 December 2016.

Operational Highlights

Marine Operational and LONO Trial

Ø Marine Operational and LONO trial commenced in July 2016:

-- Progressed well with positive feedback from Cepsa and Maersk for the duration.

-- MSAR(R) unit operations at Cepsa refinery successfully moved

to 24-hour per day production in January 2017.

-- Current trial suspended as the vessel had been involved in an

incident, totally unrelated to MSAR(R) fuel, requiring it to

undergo an unscheduled dry-dock inspection.

Ø Detailed interim inspection of the engine has been carried out

by Wärtsilä:

-- Interim inspection carried out earlier than scheduled.

-- Initial feedback from engine manufacturer has been positive.

-- Full interim report expected to be delivered within next 6 weeks.

-- Interim LONO from Wärtsilä to be progressed following receipt

of the interim inspection report.

Ø Commercialisation:

-- Maersk confirmed that the interim LONO will provide

sufficient comfort to progress approvals and commercialisation

discussions.

-- The interim inspection and LONO respectively enables

discussions with other potential customers.

Ø Maersk is reviewing options for recommencing and completing

the full LONO trial on a new vessel from Q4 2017 onwards.

Power Operational Trial

Ø Operational trial MoU signed with the Kingdom of Saudi Arabia

client in August 2016:

-- Commencement of the 'Production to Combustion' trial at

designated refinery and power plant facilities within the KSA

currently anticipated to commence in Q4 2017.

-- A KSA delegation undertook a site visit to the MSAR(R) facility at the Cepsa refinery.

-- Opportunities to accelerate the 'Production to Combustion'

trial timetable are being considered.

Other Developments

Ø The MoU with YTL PowerSeraya was extended for another year to

October 2017.

Ø AkzoNobel contracts for the exclusive purchase and supply of

goods and services and for the exclusive joint development of

emulsion fuels were extended to November 2018.

Financial highlights

Ø In November, the Company raised GBP5.25 million through a

Placing and Open Offer of new ordinary shares. The Open Offer was

oversubscribed 2.5 times.

Ø No debt and GBP7.0 million in cash reserves at 31 December

2016 (31 December 2015: GBP6.5 million).

Ø Loss after tax of GBP2.4 million (2015: GBP2.4 million) of

which GBP0.2 million relates to non-cash charges for share

options.

Ø Total assets of GBP11.5 million at 31 December 2016 (2015:

GBP10.8 million).

Ø Accumulated tax losses of approx. GBP43 million, available to

be carried forward against future profits.

Commenting, Mike Kirk, Executive Chairman of QFI, said:

"The performance of MSAR(R) on the marine trial vessel has been

positive and we expect the recent interim inspection to confirm

this. We are now closely engaged with our partners to expedite the

interim LONO. This should put us in a good position to progress

discussions on commercialisation of MSAR(R) within the shipping

industry. At the same time, we are defining the scope and plans for

the resumption of the trial to achieve a full LONO and exploring

options to accelerate the timetable for commencement of the

combustion trial in Saudi Arabia.

Whilst there remain challenges ahead, we strongly believe that

MSAR(R) continues to provide a compelling economic and

environmental case for adoption by both producers and consumers and

continue our efforts with existing clients and the wider target

markets in order to migrate to commercial operations at the

earliest opportunity."

This announcement is inside information for the purposes of

article 7 of Regulation 596/2014.

For further information, please refer to the Company's website

at www.quadrisefuels.com or contact:

Quadrise Fuels International Plc

+44 (0)20 7031

Mike Kirk, Executive Chairman 7321

Hemant Thanawala, Finance Director

Nominated Adviser

Smith & Williamson Corporate Finance

Limited

+44 (0)20 7131

Dr Azhic Basirov 4000

Ben Jeynes

Katy Birkin

Broker

Peel Hunt LLP

+44 (0)20 7418

Richard Crichton 8900

Ross Allister

Chris Burrows

Public & Investor Relations

FTI Consulting

+44 (0)20 3727

Ben Brewerton 1000

Sara Powell

Chairman's Statement

Quadrise Fuels International plc ("Quadrise", "QFI", the

"Company" and together with its subsidiaries the "Group") presents

its unaudited interim results for the six months ended 31 December

2016

Business Overview

This interim report updates shareholders on developments during

the six months ended 31 December 2016, together with material

events and activities taking place after the balance sheet

date.

Quadrise's Unique Offer

Quadrise has developed MSAR(R) as a less expensive, cleaner

synthetic heavy fuel oil ("HFO"). Produced using QFI's proprietary

technology and services, MSAR(R) offers both producers and

consumers of the fuel significant economic and environmental

advantages. MSAR(R) , an oil in water emulsion, is made by mixing

the residual streams from an oil refinery with water and

specialised chemicals in a proprietary production process - instead

of diluting the residuals with high value distillate products

typically used in the production of HFO.

MSAR(R) has superior characteristics compared with HFO:

-- MSAR(R) can be stored and used at lower temperatures than HFO.

-- The small particle size (5-10 microns) of the residue in

MSAR(R) results in virtually complete combustion - leading to

improvements in engine efficiency and significant reductions in

carbon particulates in the exhaust gases.

-- The presence of water in MSAR(R) reduces the combustion

temperatures - leading to significant reductions in nitrogen oxide

("NOx") emissions.

-- MSAR(R) is provided at a lower price than HFO for the equivalent energy output.

-- Producing MSAR(R) allows the refiner to sell the higher value

distillates products that would otherwise be used to dilute the

residue in order to create HFO.

Quadrise is the technology and service partner to both the

producer and the consumer and aims to create value through licence

revenues from the production of fuel and the sale of the chemicals

and MSAR(R) manufacturing systems. The core technology has been

developed jointly with AkzoNobel Surface Chemistry - one of the

world's leading suppliers of speciality chemicals.

For the refiner, the production of MSAR(R) upgrades the low

value residue that is inherent in any oil refining process by

treating it with speciality chemicals and water in a proprietary

production process, rather than diluting it with high value

distillate to create HFO. This releases material volumes of high

value distillate for sale (typically increasing from 50% to 70% of

the overall refinery output) - providing the potential to

significantly increase refining margins. For the consumer, MSAR(R)

is offered at a discount (on an energy equivalent basis) and also

offers environmental and handling benefits, compared with HFO.

The two largest markets for the use of MSAR(R) as a low-cost,

efficient synthetic HFO with environmental advantages are the

marine bunkering and power generation markets. In both cases, it is

necessary to engage with both the producers (refiners) and

consumers (shipping companies and power utilities) to develop the

significant market opportunities. Significant work has been carried

out to demonstrate the proof of concept in these two key end-user

markets and current work is focused on commercial scale trials, the

successful delivery of which will be key milestones towards QFI

developing sustainable commercial revenues.

Marine Bunker Fuel Market

The market for marine bunker fuel is approximately 200 million

tons per annum, with a current value of approximately US$60 billion

(at US$300/mt), with the majority of product delivered via five

large regional bunkering hubs, of which Singapore is the largest.

These hubs are also major regional refining and petrochemical

centres. The demand side is dominated by a relatively small number

of very large shipping companies, with the global leader in

container shipping being Maersk Line A/S ("Maersk"). Quadrise has

been working with Maersk since 2009 and this culminated in the

current operational and letter of no objection ("LONO") trial that

commenced in July 2016, with MSAR(R) being produced at the Compania

Espanola de Petroleos S.A.U. ("Cepsa") Gibraltar San Roque Refinery

in Spain.

During the period, the International Maritime Organization

("IMO") reached a decision on the implementation of new, reduced,

open ocean fuel sulphur standards. These will now be reduced to

0.5% sulphur from 1 January 2020, unless an exhaust gas scrubber is

used. The previous implementation of the 0.1% sulphur standards in

the two designated emission control areas in North America and

Europe in 2015 was generally effected by the use of low-sulphur

marine diesel or derivatives. For the new 2020 open ocean

standards, it is currently anticipated that for most operators, the

most economic compliance option will be the use of "high" sulphur

fuel and exhaust gas scrubbers. However, even relatively modest

increases in demand for low-sulphur marine diesel will lead to an

increase in the spread between diesel and HFO which is the primary

economic driver for MSAR(R) and so will, we believe, be beneficial

for Quadrise, as it will offer increased savings over the use of

HFO with equivalent sulphur content.

Power Generation Market

The use of HFO and crude oil for power generation is a market

worth around US$28 billion per annum and the largest consumers are

in the Middle East and Asia. Quadrise's development in the power

generation market has been focused on the Kingdom of Saudi Arabia

("KSA"), as the scale and nature of the oil and power generation

industries offers an enormous opportunity for both conversion from

fuel oil to MSAR(R) production in very large refineries, and for

the substitution of crude oil and HFO currently used in thermal

power and other large scale applications. Quadrise has been

actively involved with the oil industry in KSA since 2008 and this

culminated with the signing of a memorandum of understanding

("MoU") in August 2016 for a production to combustion trial

commencing in 2017, with production at a designated refinery and

combustion at a designated boiler in a major power station.

Operational Highlights

During the period under review, continued positive progress has

been made on the marine operational trial with the nominated Maersk

vessel successfully burning MSAR(R) on its regular scheduled route,

whilst outside the European Emission Control Area. Around the

beginning of 2017, the vessel was placed on a new route that

initially saw a more rapid accumulation of run hours compared with

2016. Whilst the feedback from Maersk continues to remain positive,

recent operational issues with the trial vessel, totally unrelated

to MSAR(R) , resulted in Quadrise making two announcements, on 2

March 2017 and 13 March 2017 respectively. The first of these

announcements confirmed that there had been an incident that would

require the trial vessel to undergo an unscheduled dry dock visit.

The second announcement, on 13 March 2017, provided a further

update after Quadrise was advised by Maersk that it would not be

possible for the trial to continue on the vessel following the dry

dock visit as it would then be redeployed on a different service

that would not permit further bunkering at Algeciras. As a result,

it was confirmed that the current trial on this vessel would be

suspended once the remaining MSAR(R) fuel on board had been

consumed.

The 13 March 2017 announcement went on to state that Maersk had

confirmed that the trial has been successful to date and that

Wärtsilä would carry out a detailed interim inspection of the trial

vessel's engine to document the performance of MSAR(R) fuel to

date.

Maersk has confirmed that the trial has progressed well and,

subsequent to the last announcement, Wärtsilä has recently

completed the interim inspection of the engine and is now preparing

a report which is currently expected to be issued next month. A

positive conclusion to the Report will enable QFI and Maersk to

progress the issuance of the interim LONO by Wärtsilä to confirm

that the fuel is safe for use in Wärtsilä 2-stroke engines. Maersk

is also reviewing options for continuing the trial aboard another

vessel, although this is unlikely to commence before Q4 2017. So,

whilst the interim inspection was completed in line with the

timetable and an interim LONO should be issued shortly, the

completion of the full LONO trial will now be delayed. It is

important to emphasise that this is due to Maersk's operational

constraints rather than issues with MSAR(R) use - an unavoidable

consequence of operational testing on a commercial vessel in live

service.

Given the current situation, based on all the positive progress

made to date, Quadrise has been working closely with Maersk and

Wärtsilä since 13 March 2017 to obtain clarity around the timing

and scope of the interim LONO from Wärtsilä and the plans and scope

for the resumption of the trial. Maersk has confirmed that an

interim LONO will provide them with sufficient comfort to progress

discussions regarding commercialisation of MSAR(R) , taking into

account a variety of operational and economic factors in addition

to the technical performance of MSAR(R) .

The production of MSAR(R) at the Cepsa refinery has progressed

well during the period - with incremental enhancements to the

MSAR(R) Manufacturing Unit ("MMU") being made which are proving to

be helpful as we build up our operational experience within a

refinery that processes a variety of different crude oils. In

January 2017, we were successfully able to move to a 2-shift

production - operating the MMU on a 24-hour basis to produce the

largest single batch of MSAR(R) to date.

Since the beginning of 2017, we have also been working with

Cepsa to review new opportunities for maximising the MSAR(R)

production capacity at the facility for new customers in the marine

and power sectors and these discussions are progressing well.

In power generation, since the signing of the MoU in the KSA in

August 2016, we have significantly increased our activities in

support of this large-scale production to combustion trial. This

has included regular meetings with all parties and significant

technical and engineering input to our clients and their advisors,

to ensure that they have appropriate and up to date information on

which to base their decisions. An important element of this

engagement has been the ability to host a visit to the MSAR(R)

facility at Cepsa's refinery - demonstrating the ability of

Quadrise to successfully design, procure, commission and operate a

commercial scale MMU in an operating refinery environment. Our

input accelerated sharply from December 2016 onwards and we believe

that this is having a positive impact on project progress, with the

timetable still being based on the KSA trial commencing during the

final quarter of 2017.

Migration to Commercial Operations

It remains our plan to migrate the business to commercial

operations during 2017, pending positive decisions by our clients.

Our base-case planning has always been focused on working with

Maersk to commence early commercial MSAR(R) delivery from the Cepsa

refinery to an expanding number of ships following the issuance of

the LONO by Wärtsilä. Whilst this still remains our key objective,

the recent events highlighted above will have an impact on this

timetable.

For Maersk, it remains the case that a positive interim

inspection and LONO respectively by Wärtsilä is the trigger point

for commencing commercial discussions - with the balance of the

hours to the issue of the full LONO being essentially confirmatory.

A commercial framework has been drafted, and is being used for

outline planning purposes to form the likely basis for any future

discussions and agreements between Quadrise, Cepsa and Maersk.

Maersk's decision will ultimately be taken on several factors,

primarily economic and operational, that will include the economic

and environmental advantages of MSAR(R) in addition to their chosen

approach to compliance with the new IMO open ocean sulphur

standards that come into force in 2020.

In addition to the continuing discussions with Maersk, we have

been increasing our activities with other shipping operators and we

believe that, subject to its scope, an interim LONO from Wärtsilä,

will be a very positive attribute in progressing those activities.

Alongside this, we will be continuing our discussions with a number

of other producers in the major European and Asian bunker hubs and

regional refining centres to provide additional sourcing

opportunities.

Our knowledge of operating on a commercial scale at the Cepsa

refinery is also enabling us to further refine our operating,

quality and development activities to support migration to

commercial operations during 2017. During the period, we continued

to make targeted investments in engineering, operational,

laboratory and business development staff to ensure a smooth

migration to early-stage commercial operations alongside our

various trial activities.

We extended our agreement with the University of Surrey in

November 2016 and this will, in collaboration with our in-house

activities at the Quadrise Research Facility ("QRF"), ensure that

we are able to continue to further improve our understanding of the

complexities of emulsion chemistry so that we can optimise MSAR(R)

formulations to deliver the best balance of cost, shelf-life and

operating performance. The extension of our commercial, supply,

intellectual property and development arrangements with our

technology partner, AkzoNobel Surface Chemistry, to November 2018

are also important in underpinning our early-stage commercial

activities.

Targeted Business Development Programme

Whilst the key trial programmes are an important element of our

business development activities - as they demonstrate our

technology in use on commercial-scale applications - we have an

active business development programme to raise the profile of

Quadrise with refiners, power utilities and shippers in our

targeted markets in Europe, the Middle East and Asia. This includes

a co-ordinated programme of attendance/speaking at relevant

industry conferences and seminars - alongside a series of meetings

with specific companies - co-ordinated by our General Managers in

the refining, marine and power segments. In addition to working

directly with potential producers and consumers, we are also

raising the profile of Quadrise through engagement with key

financial and trade media. To maximise impact and reduce costs,

these meetings/interviews are co-ordinated with attendance at

conferences and prospective client meetings.

As outlined previously, in Asia we continue our relationship

with YTL PowerSeraya and extended the MoU for a further year in

October 2016. Whilst the prospective benefits remain material,

unlocking value is dependent on MSAR(R) production by a major

regional refiner and this is only likely to start when there is a

market for Marine MSAR(R) through the Singapore bunker hub. This

opportunity is being investigated as an integral part of the

commercial roll-out in the marine market.

Our discussions with a number of oil majors and refiners in

Europe, the Middle East and Asia are continuing and plans for

evaluation of sample residues at the QRF from a number of

refineries are an integral part of this process and these are

expected to be progressed during the remainder of 2017. These cover

a range of applications including marine, power and refinery

refuelling.

We have also progressed discussions with several parties looking

to use our technology in novel upstream applications that have

significant long-term potential. We are careful to limit the

resources that we commit to these longer-term applications.

Financial Position

The Group recorded a loss of GBP2.4 million for the six months

to 31 December 2016, including a non-cash share option charge of

GBP0.2 million and consultancy revenue of GBP0.1 million (H1 2015:

GBP2.4 million loss). The production and development costs for the

period under review amounted to GBP1.3 million, most of which

related to the ongoing Marine LONO trial with Maersk.

The Group held cash and cash equivalents of GBP7.0 million as at

31 December 2016. This includes GBP5.0 million (net of costs)

raised through a placing and open offer during the six months'

period then ended. The Group continues to operate on a debt free

basis and continues to maintain a stringent control of costs.

The Group's total assets amounted to GBP11.5 million as at 31

December 2016 (GBP10.8 million as at 31 December 2015). Apart from

the cash and cash equivalents, this included fixed tangible assets

(mainly plant and equipment) of GBP1.1 million and MSAR(R) trade

name of GBP2.9 million.

Outlook

As endorsed by Maersk in the announcement on 13 March 2017, the

performance of MSAR(R) fuel on the trial vessel in normal

commercial service has been positive and we expect the interim

inspection by Wärtsilä to confirm this in the near future. We are

now closely engaged with Maersk and Wärtsilä to expedite the issue

of the report and interim LONO, given the completion of the interim

inspection, as well as defining the scope and plans for the

resumption of the trial on another vessel to achieve a full LONO.

This should put us in a good position to progress discussions with

Maersk on commercialisation of MSAR(R) within the shipping

industry.

We continue to plan to migrate the business to commercial

operations during 2017, pending positive decisions by our clients

and the ability to reach appropriate commercial terms with all

parties for continued production and supply from the Cepsa San

Roque refinery in Spain. The recent events concerning the Maersk

trial vessel may have an impact on the timetable; however, we are

also increasing our activities with other shipping operators as a

result of the positive trial progress to date, and the potential

issuance of an interim LONO.

Alongside this we are also planning for the commencement of the

production to combustion trial in KSA in late 2017 - which will

require significant engineering and operational support during the

design, procurement and commissioning stages - in addition to the

continued support during the extended production campaign to

produce the significant quantities of MSAR(R) fuel required for the

combustion trial.

The generally more stable oil price environment and a predicted

future widening of the marine gas oil/HFO spread is further

underpinning the value that our technology can deliver. Alongside

the general improvement in the oil and product price macro

environment, the IMO decision on the implementation of the lower

open-ocean sulphur standards has resulted in an emerging consensus

that non-compliant fuel and exhaust gas scrubbers are the lowest

cost compliance option for the industry as a whole. This, we

expect, will provide further support to the developing market for

marine MSAR(R) in the medium term. In KSA, the use of MSAR(R) is

closely aligned with the objectives of the Vision 2030 programme -

to increase value delivered within the Kingdom and reduce the

reliance on domestic crude oil consumption.

Whilst the recent challenges in the marine operational and LONO

trial are unfortunate, pending the issuance of the interim LONO,

the ability to fuel and operate a commercial vessel on MSAR(R) has

been established. We have an experienced and committed board and

senior management team that are responding positively to the

challenges and we remain well positioned to deliver value from our

unique technology. We expect our activities during the remainder of

the financial year to provide the firm foundations for this value

to begin to be realised during the second half of 2017.

Mike Kirk

Executive Chairman

24 March 2017

Condensed Consolidated Statement of Comprehensive Income

For the 6 months ended 31 December 2016

Note 6 months 6 months Year ended

ended ended 30 June

31 December 31 December 2016

2016 2015 Audited

Unaudited Unaudited GBP'000

GBP'000 GBP'000

Continuing operations

Revenue 68 2 2

Production and development

costs (1,297) (834) (2,156)

Other administration

expenses (1,029) (1,083) (1,965)

Share option charge (162) (460) (802)

Foreign exchange

gain/(loss) (6) 7 (18)

---------------------------- ----- ------------- ------------- -----------

Operating loss (2,426) (2,368) (4,939)

Finance costs (5) (4) (8)

Finance income 6 19 41

---------------------------- ----- ------------- ------------- -----------

Loss before tax (2,425) (2,353) (4,906)

Taxation - - 149

---------------------------- ----- ------------- ------------- -----------

Total comprehensive

loss for the period

from continuing operations (2,425) (2,353) (4,757)

----------------------------------- ------------- ------------- -----------

Loss per share -

pence

(0.59)

Basic 4 (0.29)p (0.29)p p

(0.59)

Diluted 4 (0.29)p (0.29)p p

---------------------------- ----- ------------- ------------- -----------

Condensed Consolidated Statement of Financial Position

As at 31 December 2016

Note As at As at As at

31 December 31 December 30 June

2016 2015 2016

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant and

equipment 5 1,086 1,043 1,156

Intangible assets 6 2,924 2,924 2,924

Non-current assets 4,010 3,967 4,080

----------------------------- ----- ------------- ------------- ---------

Current assets

Cash and cash equivalents 7,048 6,495 4,268

Trade and other receivables 263 230 297

Prepayments 130 81 120

Stock 69 - -

----------------------------- ----- ------------- ------------- ---------

Current assets 7,510 6,806 4,685

----------------------------- ----- ------------- ------------- ---------

TOTAL ASSETS 11,520 10,773 8,765

----------------------------- ----- ------------- ------------- ---------

Equity and liabilities

Current liabilities

Trade and other payables 638 522 576

--------------------------- --------- --------- ---------

Current liabilities 638 522 576

--------------------------- --------- --------- ---------

Equity attributable

to equity holders

of the parent

Issued share capital 8,622 8,096 8,096

Share premium 73,646 69,216 69,216

Share option reserve 4,398 4,605 4,704

Reverse acquisition

reserve 522 522 522

Accumulated losses (76,306) (72,188) (74,349)

--------------------------- --------- --------- ---------

Total shareholders'

equity 10,882 10,251 8,189

--------------------------- --------- --------- ---------

TOTAL EQUITY AND

LIABILITIES 11,520 10,773 8,765

--------------------------- --------- --------- ---------

Condensed Consolidated Statement of Changes in Equity

For the 6 months ended 31 December 2016

Issued Reverse

share Share Share acquisition Accumulated

capital premium option reserve losses Total

GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000

As at 1

July 2016 8,096 69,216 4,704 522 (74,349) 8,189

Loss and

total comprehensive

loss for

the period - - - - (2,425) (2,425)

Share option

charge - - 162 - - 162

---------------------- --------- ---------- ---------- ------------- -------------- ----------

New shares

issued net

of issue

costs 526 4,430 - - - 4,956

---------------------- --------- ---------- ---------- ------------- -------------- ----------

Transfer

of balances

relating

to expired

share options - - (468) - 468 -

---------------------- --------- ---------- ---------- ------------- -------------- ----------

Shareholders'

equity at

31 December

2016 8,622 73,646 4,398 522 (76,306) 10,882

---------------------- --------- ---------- ---------- ------------- -------------- ----------

Issued Reverse

share Share Share acquisition Accumulated

capital premium option reserve losses Total

GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000

As at 1

July 2015 8,096 69,216 4,210 522 (69,900) 12,144

Loss and

total comprehensive

loss for

the period - - - - (2,353) (2,353)

---------------------- --------- ---------- ---------- ------------- -------------- ------------

Share option

charge - - 460 - - 460

---------------------- --------- ---------- ---------- ------------- -------------- ------------

Transfer

of balances

relating

to expired

share options - - (65) - 65 -

---------------------- --------- ---------- ---------- ------------- -------------- ------------

Shareholders'

equity

at 31 December

2015 8,096 69,216 4,605 522 (72,188) 10,251

---------------------- --------- ---------- ---------- ------------- -------------- ------------

Issued Reverse

share Share Share acquisition Accumulated

capital premium option reserve losses Total

GBP'000 GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000

As at 1

January

2016 8,096 69,216 4,605 522 (72,188) 10,251

Loss and

total comprehensive

loss for

the period - - - - (2,404) (2,404)

Share option

charge - - 342 - - 342

---------------------- --------- ---------- ---------- ------------- -------------- ----------

Transfer

of balances

relating

to expired

share options - - (243) - 243 -

---------------------- --------- ---------- ---------- ------------- -------------- ----------

Shareholders'

equity at

30 June

2016 8,096 69,216 4,704 522 (74,349) 8,189

---------------------- --------- ---------- ---------- ------------- -------------- ----------

Condensed Consolidated Statement of Cash Flows

For the 6 months ended 31 December 2016

Note 6 months 6 months Year ended

ended ended 30 June

31 December 31 December 2016

2016 2015 Audited

Unaudited Unaudited GBP'000

GBP'000 GBP'000

Operating activities

Loss before tax from

continuing operations (2,425) (2,353) (4,906)

Finance costs 5 4 8

Finance income (6) (19) (41)

Depreciation 5 106 64 148

Loss on disposal

of fixed assets - 2 2

Share option charge 162 460 802

Working capital adjustments

Decrease in trade

and other receivables 34 103 36

(Increase)/decrease

in prepayments (10) 157 118

Increase in trade

and other payables 62 100 154

Increase in stock (69) - -

----------------------------- ----- ------------- ------------- -----------

Cash utilised in

operations (2,141) (1,482) (3,679)

----------------------------- ----- ------------- ------------- -----------

Finance costs (5) (4) (8)

Taxation received - - 149

------------- -------------

Net cash outflow

from operating activities (2,146) (1,486) (3,538)

----------------------------- ----- ------------- ------------- -----------

Investing activities

Finance income 6 19 41

Purchase of fixed

assets 5 (36) (399) (596)

Net cash outflow

from investing activities (30) (380) (555)

----------------------------- ----- ------------- ------------- -----------

Financing activities

Issue of ordinary 4,956 - -

share capital

Net cash inflow from 4,956 - -

financing activities

Net increase/(decrease)

in cash and cash

equivalents 2,780 (1,866) (4,093)

Cash and cash equivalents

at the beginning

of the period 4,268 8,361 8,361

----------------------------- ----- ------------- ------------- -----------

Cash and cash equivalents

at the end of the

period 7,048 6,495 4,268

----------------------------- ----- ------------- ------------- -----------

Notes to the Group Condensed Financial Statements

1. General Information

Quadrise Fuels International plc ("QFI", "Quadrise", or the

"Company") and its subsidiaries (together with the Company, the

"Group") are engaged principally in the manufacture and marketing

of emulsified fuel for use in power generation, industrial and

marine diesel engines and steam generation applications. The

Company's ordinary shares are quoted on the AIM market of the

London Stock Exchange.

QFI was incorporated on 22 October 2004 as a limited company

under UK Company Law with registered number 05267512. It is

domiciled and registered at Gillingham House, 38-44 Gillingham

Street, London, SW1V 1HU.

2. Summary of Significant Accounting Policies

2.1 Basis of Preparation

The interim accounts have been prepared in accordance with IAS

34 'Interim financial reporting' and on the basis of the accounting

policies set out in the annual report and accounts for the year

ended 30 June 2016, which have been prepared in accordance with

International Financial Reporting Standards as adopted for use by

the European Union. The interim accounts are unaudited and do not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006.

The same accounting policies, presentation and methods of

computation have been followed in these unaudited interim financial

statements as those which were applied in the preparation of the

Group's annual statements for the year ended 30 June 2016, upon

which the auditors issued an unqualified opinion, and which have

been delivered to the registrar of companies.

The interim accounts have been drawn up using accounting

policies and presentation expected to be adopted in the Group's

full financial statements for the year ended 30 June 2017.

A number of new standards and amendments to standards and

interpretations have been issued but are not yet effective and in

some cases have not yet been adopted by the European Union.

The Directors do not expect that the adoption of these standards

will have a material impact on the financial information of the

Group in future periods.

The interim accounts for the six months ended 31 December 2016

were approved by the Board on 24 March 2017.

The directors do not propose an interim dividend.

3. Segmental Information

For the purpose of segmental information the reportable

operating segment is determined to be the business segment. The

Group principally has one business segment, the results of which

are regularly reviewed by the Board. This business segment is a

business to produce emulsion fuel (or supply the associated

technology to third parties) as a low cost substitute for

conventional HFO for use in power generation plants and industrial

and marine diesel engines.

Geographical Segments

The Group's only geographical segment during the period was the

UK.

4. Loss Per Share

The calculation of loss per share is based on the following loss

and number of shares:

6 months 6 months Year ended

ended ended 30 June

31 December 31 December 2016

2016 2015 Audited

Unaudited Unaudited

Loss for the period

from continuing operations

(GBP'000s) (2,425) (2,353) (4,757)

Weighted average number

of shares:

Basic 830,088,926 809,585,162 809,585,162

Diluted 830,088,926 809,585,162 809,585,162

Loss per share:

----------------------------- ------------- ------------- ------------

Basic (0.29)p (0.29)p (0.59)p

----------------------------- ------------- ------------- ------------

Diluted (0.29)p (0.29)p (0.59)p

----------------------------- ------------- ------------- ------------

Basic loss per share is calculated by dividing the loss for the

period from continuing operations of the Group by the weighted

average number of ordinary shares in issue during the period.

For diluted loss per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

potential dilutive options and warrants over ordinary shares.

Potential ordinary shares resulting from the exercise of share

options and warrants have an anti-dilutive effect due to the Group

being in a loss position. As a result, diluted loss per share is

disclosed as the same value as basic loss per share. The 27.13

million share options issued by the Company and which are

outstanding at the period-end could potentially dilute earnings per

share in the future if exercised when the Group is in a profit

making position.

5. Property, plant and equipment

Leasehold Computer Software Office Plant Total

improvements equipment equipment and

machinery

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

Opening balance

- 1 July 2016 99 89 43 16 1,251 1,498

Additions 8 3 - - 25 36

Disposals - - - - - -

----------------- -------------- ----------- --------- ----------- ----------- --------

Closing balance

- 31 December

2016 107 92 43 16 1,276 1,534

----------------- -------------- ----------- --------- ----------- ----------- --------

Depreciation

Opening balance

- 1 July 2016 (46) (30) (24) (12) (230) (342)

Depreciation

charge for

the period (10) (9) (4) (2) (81) (106)

Disposals - - - - - -

----------------- -------------- ----------- --------- ----------- ----------- --------

Closing balance

- 31 December

2016 (56) (39) (28) (14) (311) (448)

----------------- -------------- ----------- --------- ----------- ----------- --------

Net book value

at 31 December

2016 51 53 15 2 965 1,086

----------------- -------------- ----------- --------- ----------- ----------- --------

Leasehold Computer Software Office Plant Total

improvements equipment equipment and

machinery

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

Opening balance

- 1 July 2015 99 70 43 16 682 910

Additions - 5 - - 394 399

Disposals - - - - (6) (6)

----------------- -------------- ----------- --------- ----------- ----------- --------

Closing balance

- 31 December

2015 99 75 43 16 1,070 1,303

----------------- -------------- ----------- --------- ----------- ----------- --------

Depreciation

Opening balance

- 1 July 2015 (26) (14) (15) (9) (136) (200)

Depreciation

charge for

the period (9) (8) (4) (2) (41) (64)

Disposals - - - - 4 4

----------------- -------------- ----------- --------- ----------- ----------- --------

Closing balance

- 31 December

2015 (35) (22) (19) (11) (173) (260)

----------------- -------------- ----------- --------- ----------- ----------- --------

Net book value

at 31 December

2015 64 53 24 5 897 1,043

----------------- -------------- ----------- --------- ----------- ----------- --------

Leasehold Computer Software Office Plant Total

improvements equipment equipment and

machinery

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

Opening balance

- 1 July 2015 99 70 43 16 682 910

Additions - 19 - - 577 596

Disposals - - - - (8) (8)

----------------- -------------- ----------- --------- ----------- ----------- --------

Closing balance

- 30 June

2016 99 89 43 16 1,251 1,498

----------------- -------------- ----------- --------- ----------- ----------- --------

Depreciation

Opening balance

- 1 July 2015 (26) (14) (15) (9) (136) (200)

Depreciation

charge for

the year (20) (16) (9) (3) (100) (148)

Disposals - - - - 6 6

----------------- -------------- ----------- --------- ----------- ----------- --------

Closing balance

- 30 June

2016 (46) (30) (24) (12) (230) (342)

----------------- -------------- ----------- --------- ----------- ----------- --------

Net book value

at 30 June

2016 53 59 19 4 1,021 1,156

----------------- -------------- ----------- --------- ----------- ----------- --------

6. Intangible Assets

QCC royalty MSAR(R) Technology

payments trade and know-how Total

name

Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000

Cost

Opening balance

- 1 July 2016 7,686 3,100 25,901 36,687

Additions - - - -

----------------- ------------ ---------- -------------- ----------

Closing balance

- 31 December

2016 7,686 3,100 25,901 36,687

----------------- ------------ ---------- -------------- ----------

Amortisation

and Impairment

Opening balance

- 1 July 2016 (7,686) (176) (25,901) (33,763)

Amortisation - - - -

Closing balance

- 31 December

2016 (7,686) (176) (25,901) (33,763)

----------------- ------------ ---------- -------------- ----------

Net book value

at 31 December

2016 - 2,924 - 2,924

----------------- ------------ ---------- -------------- ----------

QCC royalty MSAR(R) Technology

payments trade and know-how Total

name

Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000

Cost

Opening balance

- 1 July 2015 7,686 3,100 25,901 36,687

Additions - - - -

----------------- ------------ ---------- -------------- ----------

Closing balance

- 31 December

2015 7,686 3,100 25,901 36,687

----------------- ------------ ---------- -------------- ----------

Amortisation

and Impairment

Opening balance

- 1 July 2015 (7,686) (176) (25,901) (33,763)

Amortisation - - - -

Closing balance

- 31 December

2015 (7,686) (176) (25,901) (33,763)

----------------- ------------ ---------- -------------- ----------

Net book value

at 31 December

2015 - 2,924 - 2,924

----------------- ------------ ---------- -------------- ----------

QCC royalty MSAR(R) Technology

payments trade and know-how Total

name

Audited Audited Audited Audited

GBP'000 GBP'000 GBP'000 GBP'000

Cost

Opening balance

- 1 July 2015 7,686 3,100 25,901 36,687

Additions - - - -

------------------ ------------ --------- -------------- ---------

Closing balance

- 30 June 2016 7,686 3,100 25,901 36,687

------------------ ------------ --------- -------------- ---------

Amortisation

and Impairment

Opening balance

- 1 July 2015 (7,686) (176) (25,901) (33,763)

Amortisation - - - -

Closing balance

- 30 June 2016 (7,686) (176) (25,901) (33,763)

------------------ ------------ --------- -------------- ---------

Net book value

at 30 June 2016 - 2,924 - 2,924

------------------ ------------ --------- -------------- ---------

Intangibles comprise intellectual property with a cost of

GBP36.69m, including assets of finite and indefinite life. QCC

royalty payments of GBP7.69m and the MSAR(R) trade name of GBP3.10m

are termed as assets having indefinite life as it is assessed that

there is no foreseeable limit to the period over which the assets

are expected to generate net cash inflows for the Group. The assets

with indefinite life are not amortised. The remaining intangibles

amounting to GBP25.90m, primarily made up of technology and

know-how, are considered as finite assets and are now fully

amortised. The Group does not have any internally generated

intangibles.

The Group tests intangible assets annually for impairment, or

more frequently if there are indications that they might be

impaired. As at 30 June 2016, the QCC royalty payments asset was

fully impaired and the MSAR(R) trade name asset had a net book

value of GBP2.924m. For the six month period to 31 December 2016,

there was no indication that the MSAR(R) trade name asset may be

impaired.

As a result, the Directors concluded that no impairment is

necessary for the six month period to 31 December 2016.

7. Available for Sale Investments

31 December 31 December 30 June

2016 2015 2016

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Unquoted securities

Opening balance - - -

Changes in fair value - - -

Impairment charge - - -

---------------------- ------------ ------------ ---------

Closing balance - - -

---------------------- ------------ ------------ ---------

Unquoted securities represent the Group's investment in Quadrise

Canada Corporation ("QCC"), Paxton Corporation ("Paxton"), Optimal

Resources Inc. ("ORI") and Porient Fuels Corporation ("Porient"),

all of which are incorporated in Canada.

At the statement of financial position date, the Group held a

20.44% share in the ordinary issued capital of QCC, a 3.75% share

in the ordinary issued capital of Paxton, a 9.54% share in the

ordinary issued capital of ORI and a 16.86% share in the ordinary

issued capital of Porient.

QCC is independent of the Group and is responsible for its own

policy-making decisions. There have been no material transactions

between QCC and the Group during the period or any interchange of

managerial personnel. As a result, the Directors do not consider

that they have significant influence over QCC and as such this

investment is not accounted for as an associate.

The Group has no immediate intention to dispose of its available

for sale investments unless a beneficial opportunity to realise

these investments arises.

Given that there is no active market in the shares of any of

above companies, the Directors have determined the fair value of

the unquoted securities at 31 December 2016. In this regard, the

Directors considered other factors such as past equity placing

pricing and assessment of risked net present value of the

enterprises to arrive at their conclusion on any impairment for all

of the unquoted securities.

The shares in each of these companies were valued at CAD $nil on

1 July 2016. Shareholder communications received during the period

to 31 December 2016 indicate that the business models for each of

these companies remain highly uncertain, with minimal possibility

of any material value being recovered from their asset base. On

that basis, the directors have determined that the investments

should continue to remain valued at CAD $nil at 31 December

2016.

8. Related Party Transactions

Non-Executive Director Laurence Mutch is also a director of

Laurie Mutch & Associates Limited, which has provided

consulting services to the Group. The total fees charged for the

six month period to 31 December 2016 amounted to GBP28k (for the

six month period to 31 December 2015: GBP23k). The balance payable

at 31 December 2016 was GBP7.9k (as at 30 June 2016: GBP12k).

QFI defines key management personnel as the Directors of the

Company. There are no transactions with Directors, other than their

remuneration or disclosed above.

9. Seasonality

The operations of the Group are not affected by seasonal

fluctuations.

10. Commitments and Contingencies

The Group and the Company have entered into a commercial lease

for office rental. This lease expires on 25(th) March 2019, and

there are no restrictions placed on the Group or Company by

entering into this lease. The minimum future lease payments for the

non-cancellable lease are as follows:

31 December 31 December 30 June

2016 GBP'000 2015 2016

GBP'000 GBP'000

Office premises:

One year 106 106 106

Two to five years 131 237 187

After five years - - -

The Group has no contingent liabilities as at the statement of

financial position date.

11. Events After the End of the Reporting Period

The Company put out 2 announcements on the 2(nd) and 13(th)

March 2017, respectively. The first of these confirmed that there

had been an incident that would require the Maersk trial vessel to

undergo an unscheduled dry-dock visit and the second announcement

on the 13(th) March provided a further update after Quadrise was

advised by Maersk that:

-- Maersk is continuing its efforts to move the trial vessel to a suitable dry dock;

-- Following this dry dock, the new vessel route deployed would

not permit further bunkering at Algeciras due to schedule

limitations;

-- The current trial on this vessel would be suspended once the

remaining MSAR(R) fuel had been consumed.

Subsequent to the announcements above, an interim inspection of

the engine has been carried out by Wärtsilä to document the

performance of MSAR(R) fuel to date.

12. Copies of the Interim Accounts

Copies of the interim accounts are available on the Company's

website at www.quadrisefuels.com and from the Company's registered

office, Gillingham House, 38-44 Gillingham Street, London, SW1V

1HU.

The company news service from the London Stock Exchange

END

IR BRGDXBBDBGRS

(END) Dow Jones Newswires

March 27, 2017 02:00 ET (06:00 GMT)

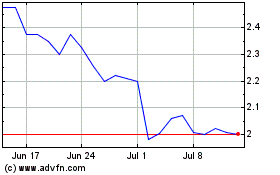

Quadrise (LSE:QED)

Historical Stock Chart

From Mar 2024 to Apr 2024

Quadrise (LSE:QED)

Historical Stock Chart

From Apr 2023 to Apr 2024