QinetiQ Group plc Director/PDMR Shareholding (6372R)

June 30 2015 - 4:30AM

UK Regulatory

TIDMQQ.

RNS Number : 6372R

QinetiQ Group plc

30 June 2015

QinetiQ Group plc

30 June 2015

NOTIFICATION OF TRANSACTIONS OF PERSONS DISCHARGING MANAGERIAL

RESPONSIBILITIES OR THEIR CONNECTED PERSONS

1. Vesting of Award under the QinetiQ Group plc Deferred Annual Bonus Plan ("DAB")

The Company announces that on 29 June 2015 the following

Executive Director acquired Ordinary Shares of 1p each in the

Company ("Shares"), as detailed in the table below, as a result of

the vesting of an award granted on 29 June 2012 under the DAB:

Director Number of Shares Number of Shares Price per share

acquired on vesting sold on 29 June

under the Deferred 2015

Award on 29 June

2015

David Mellors 117,173 117,173 226.57p

--------------------- ----------------- ----------------

The performance conditions were not met in respect of the

Matching Award granted on 29 June 2012 under the DAB over 117,173

Shares and the Matching Award has therefore lapsed.

The DAB operated as follows:

Prior to shareholder approval of the Bonus Banking Plan in 2014,

Executive Directors had a mandatory deferral of 50% of any bonus

earned into a restricted, deferred award of Shares under the DAB.

At the same time, the Company granted a matching award of Shares,

up to a maximum match of 100% of the deferred award. Vesting of the

matching award occurs after three years, subject to the achievement

of EPS-based performance conditions, up to a maximum match of one

Share for each Share deferred.

2. Grant of Award of notional Shares under the QinetiQ Group plc Bonus Banking Plan ("BBP")

QinetiQ Group plc (the "Company") announces that on 30 June 2015

the following Executive Director was granted an award of notional

Ordinary Shares of 1p each in the Company ("Shares"), as detailed

in the table below, under the BBP:

Director Number of notional Shares representing Number of notional Shares

deferred bonus as at 30 June representing deferred bonus

2015 which are not subject to as at 30 June 2015 which are

forfeiture conditions subject to forfeiture conditions

David Mellors 126,726 126,726

--------------------------------------- ----------------------------------

There is no exercise price applicable for the above award. The

notional Shares relate to pre-tax bonus and are based on a market

value of 197p per Share. At the end of each plan year the number of

notional Shares in respect of deferred bonus will be adjusted to

take account of the prevailing share price, performance-related

adjustments and payments, and the deferral of further bonus into

the plan.

The BBP operates as follows:

Each Executive Director has a mandatory deferral of 50% of any

bonus earned into the BBP. The plan operates on a four-year cycle

and performance conditions and targets are set at the beginning of

each plan year.

At the end of each of the first three plan years, (i)

performance against the targets is assessed and the amount of any

bonus is contributed by the Company to the Executive Director's

plan account; and (ii) notional Shares held in the plan account are

valued using a 30 day average share price as at the end of the plan

year. The total value of the plan account is adjusted accordingly,

and 50% of that total value is paid to the Executive Director. The

remaining balance in the Executive Director's plan account is

converted into notional Shares using the 30 day average share price

as at the end of the plan year.

In the fourth year, 100% of the balance is paid in Shares to the

Executive Director.

During the four-year plan period, 50% of the retained balance is

at risk of forfeiture based on a minimum level of performance which

is determined annually in advance by the Remuneration Committee.

The BBP rules contain provisions in respect of malus and

clawback.

As a result of the above transactions, the aggregate number of

Shares held beneficially by the Executive Director across all

accounts (excluding BBP notional Shares which are at risk of

forfeiture) is as follows:

Director Resulting aggregate number Total percentage holding

of Shares held beneficially following notification

(excluding BBP notional

Shares which are at risk

of forfeiture)

David Mellors 425,823 0.07%

----------------------------- -------------------------

This notification is made pursuant to rule 3.1.4R of the FCA

Disclosure Rules and Transparency Rules.

END

For further information:

Jon Messent, Company Secretary, QinetiQ Group plc

David Bishop, Investor Relations, QinetiQ Group plc

Tel: +44 (0) 1252 392000

This information is provided by RNS

The company news service from the London Stock Exchange

END

RDSSDASASFISEEM

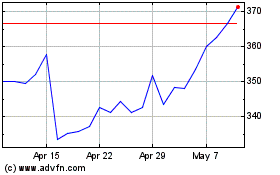

Qinetiq (LSE:QQ.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Qinetiq (LSE:QQ.)

Historical Stock Chart

From Apr 2023 to Apr 2024