TIDMQQ.

RNS Number : 9262P

QinetiQ Group plc

12 June 2015

12 June 2015

QINETIQ GROUP PLC

Availability of Annual Report and Accounts 2015 and Notice of

2015 Annual General Meeting

QinetiQ Group plc has today published the following

documents:

-- QinetiQ 2015 Annual Report and Accounts;

-- Notice of 2015 Annual General Meeting; and

-- Chairman's Letter to Shareholders.

The documents are available to view or download from the

Company's website at www.qinetiq.com/investors.

In compliance with Listing Rule 9.6.1, copies of the above

documents, together with a copy of the Form of Proxy for the 2015

Annual General Meeting, have been submitted to the National Storage

Mechanism and will shortly be available for inspection at

www.morningstar.co.uk/uk/NSM.

These documents are today being posted or otherwise made

available to shareholders.

The 2015 Annual General Meeting will be held at 11.00 am on

Wednesday, 22 July 2015 at Pennyhill Park Hotel, London Road,

Bagshot, Surrey GU19 5EU.

In compliance with paragraph 6.3.5 of the Disclosure and

Transparency Rules, the information in respect of Principal Risks

and Uncertainties, Related Party Transactions and the Directors'

Responsibility Statement, contained in the Appendix, is extracted

from the Annual Report and Accounts and should be read in

conjunction with the Group's preliminary results announcement of 21

May 2015 (the 'Preliminary Results') which can be viewed on the

Company's website at www.qinetiq.com/investors. The information in

the Appendix and the Preliminary Results together constitute the

material required by DTR 6.3.5 to be communicated in unedited full

text through a Regulatory Information Service. This is not a

substitute for reading the full Annual Report and Accounts. Page

and note references in the Appendix refer to page numbers and notes

in the 2015 Annual Report and Accounts.

Enquiries:

Jon Messent - Company Secretary, QinetiQ Group plc

Telephone +44 (0) 1252 392000

Press Office, QinetiQ Group plc

Telephone +44 (0) 1252 393500

David Bishop - Investor Relations, QinetiQ Group plc

Telephone +44 (0) 7920 108675

APPENDIX

PRINCIPAL RISKS AND UNCERTAINTIES

UNDERSTANDING AND MANAGING OUR RISKS

TheBoard recognises that QinetiQ operates in variedbusiness

environments and that risk management must reflectboth the need to

take risk and to avoid harm. Boardlevel oversight is discharged

throughtwo committees, the Audit Committee, which focuseson risks

wherethe primary impactis financial, and the Risk & CSR

Committee, which focuseson risks where the primaryimpact is

non-financial; both committees retain visibility of both the

financial and non-financial risks.

TheBoard agrees and reviews its toleranceof risk through

establishing a clear risk appetiteand setting appropriate

delegations ofauthority to the executive and senior leaders. The

Board'srisk appetite is set to provideboundaries and guidance to

supportexecutives and senior leaders in their decision-making and

allow operational flexibility. Local decision-making is

supportedwithin defined delegationof authority and the Board

requires all employees to abide by relevant legal requirements as a

minimum.

Our Areas of risk:

1 - Risks relating to strategy:

-- Defence and security spending

-- Complex market characteristics and contract profile

-- Trading in a global market

-- Emerging and reputational risk

-- US Foreign ownership regulations

2 - Risks relating to people:

-- Recruitment and retention

-- Breaches of security and IT systems failure

-- Significant breach of relevant laws and regulations

3 - Risks relating to financial management and markets:

-- Defined benefit pension obligations

-- Tax legislation

-- Exchange rates

-- Inflation, credit and interest rates

Risk appetitewithin QinetiQfocuses onthose criticalrisk

areasnecessary to achieve our strategic goals. Three categories of

appetite are defined as follows:

-- Hungry:Willing to consider all delivery options and eager to

be innovative and to choose options offering potentially higher

business rewards, with a mature understanding of inherent risk

-- Balanced:Preference for delivery options that have a low or

moderate degree of residual risk and where successful delivery also

provides an acceptable level of reward and value for money

-- Cautious: Avoidance of risk and uncertainty is the key

objective, a greaterlevel of controland mitigation may be

required.Significantly greaterreturns expectedfor commercial

opportunities to offset risk

Within thecontext ofthe core,'Explore' and'Test forValue'

strategy,the Board'scommercial appetiteis:

-- Hungry for opportunities relating to increased market share

where we have provendelivery, existing and potential new

customers

-- Balanced for opportunities that translate proven deliveryinto

new markets or new capability/delivery into existingcustomers or

that commit QinetiQ to unlimitedor excessive liabilities

-- Cautious for opportunities that involve new capability or

delivery into new markets and any other opportunity into a new

country outside the US and UK

The Boardagrees andreviews itstolerance of risk through

appropriate delegations of authority to the executive and senior

leaders.

The management of risk is key to ensuring QinetiQ is successful

indelivering its objectives, whilst protecting the interests of its

stakeholders. QinetiQ's risk management methods and processes

provide a frameworkwhich allows:

-- Risk identification: identification of risks and

opportunities relevantto the Group'sobjectives

-- Risk analysis: assessment of risks in terms of likelihood and impact

-- Risk evaluation: determine and prioritisewhich risks need treatment

-- Risk treatment: appropriate management strategies put in place

-- Monitor and review: monitoring and oversight ofrisk management

TheGroup Risk Register consists of material risks relating to

effective delivery of our strategy. These risks may emerge as

risksor be presentthrough the aggregation or interlinking of risks.

Our reputation is a highly valuable asset and reputational impact

is considered as a factorin assessing overall risk impact. The

Group Risk Registeris reviewed by the executive and the Board. In

addition the risk owners present an update of current status and

mitigating actions by rotation throughout the year.

Key risk Associated Description and Likelihood/Impact Mitigation Associated Responsibility Risk

strategic impact KPIs appetite

priority

Defence Customers -- The Group's Medium/High -- The Group -- Customer -- Business Hungry

and security revenue is services satisfaction Development

spending predominantly the UK defence Director

derived from domains of Air, -- Strategic

government Land, Maritime Business

customers in the and Joint Forces Director

defence and security as well as - Defence

sector. 70% of adjacent

the Group's revenue sectors. This

comes directly provides a degree

from contracts of portfolio

with the UK diversification.

Government The Group will

and 7% comes continue to

directly monitor

from contracts expenditure

with the US changes

Government. in its traditional

-- Any reduction markets and will

in government adjust business

defence and security activities where

spending in either appropriate.

the UK or the -- The MOD has

US could have made considerable

an adverse impact progress in

on the Group's balancing

financial its equipment

performance. budget. In defence

-- The financial research, where

burden on both QinetiQ is the

UK and US Government private sector

budgets from the market leader,

current economic spending was

downturn may lead stabilising

to reduced spending at about GBP400m

in the markets p.a. due to the

in which the Group 1.2% floor on

operates. R&T spend (pre

-- This could SDSR).

be exacerbated -- QinetiQ

by the Comprehensive monitors

Spending Review and responds to

(CSR) as well potential

as the next opportunities

Strategic arising from the

Defence and Security MOD's actions

Review (SDSR) to deliver

expected to follow improved

the 2015 General value for money

Election. The by making

SDSR is expected proactive

to take place proposals that

in the next 12 deliver the

months. The total desired

amount, and outcome.

subdivision -- QinetiQ expects

of, UK defence that the SDSR

spending post process will

SDSR may be enable

different consultation

to the current between

budget. The Group's Government and

main contracts industry to ensure

are exposed to UK defence

spend on Test priorities

& Evaluation and are properly

Research & considered.

Technology, -- Further

both of which investment

are expected to in the pursuit

be studied in of international

the SDSR. opportunities

-- The Group's assists in the

US products business diversification

(approximately away from the

GBP60m annual dependency on

revenue) has been UK and US

largely funded Government

through overseas spending.

contingency budgets -- US products

which are expected (such as unmanned

to decline as systems) are

the US withdraws targeted

from Afghanistan. to be funded

through

Programs of Record

(i.e. in the US

Base budget) in

approx 2017.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Complex Customers -- The aerospace, Medium/High -- QinetiQ seeks -- Customer -- Business Balanced

market defence and security to focus on areas satisfaction Development

characteris-tics markets are highly within these Director

and contract competitive. The markets -- Strategic

profile Group's performance in which its deep Business

may be adversely customer Director

affected should understanding, - Defence

it not be able domain knowledge,

to compete in technical

the markets in expertise

which it aims and platform

to operate. independence

-- Following the provide a strong

Currie Review, proposition and

the Defence Reform a significant

Act and the Single advantage in

Source Regulations competitive

are now in place. bidding.

The Single Source -- QinetiQ and

Regulations Office defence industry

(SSRO) is partners have

established been fully engaged

with a Chairman with the MOD in

and Board appointed. the development

The 'Yellow Book', of the new 'Orange

a legally binding Book' framework

framework, has and its practical

been replaced application.

by the 'Orange QinetiQ

Book' for how and defence

single sourced industry

work must be partners have

contracted been consulted

to ensure that by the SSRO on

a fair and the draft

reasonable Statutory

price is paid Guidance, due

for goods and to be published

services procured early in 2015.

in the absence -- The contracts

of competition. and orders

-- This could pipeline

have an adverse is regularly

impact on the reviewed

Group's financial by senior

performance. The operational

'Baseline Profit management.

Rate' for single -- The nature

sourced work has of many of the

been set at 10.6% services provided

for 2016 (2015: under fixed-price

10.7%) This arrangements is

percentage often for a

is reviewed defined

annually. amount of effort

The new regulations or resource rather

apply to new single than firm

source contracts deliverables

over GBP5m in and, as a result,

value from April mitigates the

2015. Approximately risk of costs

33% of EMEA Services escalating. The

revenue is derived Group ensures

from single sourced that its

work, excluding fixed-price

the non-tasking bids and projects

element of the are reviewed for

LTPA contract. early detection

-- The ongoing and management

'transformation' of issues which

of the UK MOD's may result in

Defence Equipment cost over-run

and Support (DE&S) or excessive

organisation has delivery

now adopted a risk.

model of 'bespoke

trading entity'

rather than

Government-Owned

Contractor-Operated,

which was the

intended model.

DE&S has hired

'Managed Service

Providers' (MSPs),

companies to help

drive the

transformation

programme to improve

programme delivery

and implement

new systems and

processes as it

looks to reduce

costs.

-- Some of the

Group's revenue

is derived from

contracts that

have a fixed price.

There is a risk

that the costs

required for the

delivery of a

contract could

be higher than

those agreed in

the contract as

a result of the

performance of

new or developed

products,

operational

over-runs or

external

factors. Any

significant

increase in costs

which cannot be

passed on to a

customer may reduce

the profitability

of a contract

or even result

in a contract

becoming loss

making.

-- Many of the

Group's contracts

have terms, not

unusual in defence,

that provide for

unlimited

liabilities

for the Group,

or termination

rights for the

customer, often

without cause.

-- The timing

of orders receipts

could have a

material

impact on the

Group's performance

in a given reporting

period as the

amounts payable

under some

government

contracts can

be significant.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Complex Customers -- Organisational Medium/High -- QinetiQ takes -- Customer -- Strategic Balanced

market Conflicts of proactive steps satisfaction Business

characteris-tics Interest to manage any Director

and contract (OCI) may occur potential OCI - Defence

profile where the Group and maintain its

(continued) provides services ability to provide

to both a defence independent

end-user customer advice.

as well as those QinetiQ operates

within the defence under the MOD's

supply chain. generic formal

compliance regime

and applies a

rigorous

compliance

process.

-- Where QinetiQ

wishes to operate

on both the advice

and supply chain

side of an

opportunity

we do so only

after receiving

approval from

the MOD.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Complex Customers -- The Group is Medium/High -- In February -- Customer -- LTPA Hungry

market reliant on a limited 2013 the Group satisfaction Director

characteris-tics number of major signed the LTPA

and contract customers. A for a third

profile material five-year

(continued) element of the period with the

Group's revenue MOD. The next

is derived from scheduled

one contract. 're-pricing'

The Long Term break point is

Partnering Agreement in 2018.

(LTPA) is a 25-year -- The Group

contract to provide continues

test, evaluation, to achieve strong

and training customer

services performance

to the MOD. The and satisfaction

original contract levels, and

was signed in significantly

2003. The LTPA exceeded the

operates under agreed

five-year periods minimum

with specific performance

programmes, targets rating of 80%

and performance in 2014.

measures set for -- The Group has

each period. achieved

-- In 2015 the significant

LTPA directly cost savings for

contributed 26% the MOD on

of the Group's delivered

revenue and services, and

supported is on track to

a further 17% exceed the GBP700m

through tasking of savings

services using originally

LTPA managed projected to be

facilities. delivered over

the life of the

contract.

-- The Group

expects

to engage with

the MOD regarding

the study of

future

plans for

test and

evaluation

services within

the SDSR.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Recruit-ment Employees -- The Group Low/High -- The Group -- Health -- Business Balanced

and retention operates conducts and Unit

in many specialised regular activities Safety Managing

engineering, to identify key -- Voluntary Directors

technical roles and employee

and scientific personnel. turnover

domains. Succession plans -- Employee

-- The lack of are in place satisfaction

graduates in the looking -- % of

science, technology, internally at graduates

engineering and candidates ready and

mathematics (STEM) now or in need apprentices

domains leads of development

to future skills to fill particular

shortage. roles and

-- Key capabilities externally

and competencies to identify people

may be lost through QinetiQ may wish

failure to recruit to attract.

and retain employees -- QinetiQ has

due to internal made improvements

factors, as well in employee

as macro factors engagement

across the sector and conducts an

affecting the annual

desirability, satisfaction

intake and training survey.

of engineers, -- STEM outreach

scientists and from primary

technicians. school

age through to

work experience

and graduate

opportunities.

-- QinetiQ is

leading industry

in The 5% Club,

a campaign to

increase the

recruitment

of graduates and

apprentices.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Breaches The way -- The Group High/High -- Data security -- -- Business Cautious

of security we work operates is assured through Underlying Unit

and IT in a highly a multi-layered operating Managing

systems regulated approach that profit Directors

failure IT environment. provides a -- Profit -- Functional

-- The data held hardened after Directors

by QinetiQ is environment, tax

confidential and including --

needs to be secure, robust physical Underlying

against a background security EPS

of increasing arrangements --

cyber threat. and data Underlying

-- A breach of resilience operating

data security strategies. cash flow

or IT systems -- Comprehensive

failure could internal and

have an adverse external

impact on our testing of

customers' potential

operations, vulnerabilities

resulting in is conducted along

significant with 24/7

reputational damage, monitoring.

as well as the -- The Group

possibility of engages

exclusion from with US and UK

some types of Government

government contracting

contracts. audit agencies,

-- The Group's to enable them

financial systems to test relevant

are required to financial systems

be adequate to and data, and

support US and implements any

UK Government recommended

contracting improvement

regulations. plans.

-- Information

systems are

designed

with consideration

to single points

of failure and

the removal of

risk of minor

and major system

failures.

-- The Group

maintains

business

continuity

plans that cover

geographical

assets

as well as the

technical

capability

of employees.

These plans cover

a range of

scenarios

(including loss

of access to IT)

and are regularly

tested.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Trading Growth -- QinetiQ operates Low/Medium -- While the Group -- Orders -- Business Cautious

in a orientation internationally. has a growing -- Organic Unit

global Risks include: geographical revenue Managing

market regulation and footprint, growth Directors

administration its traditional --

changes, taxation activities are International

policy, political confined to the Business

instability, civil UK and the US. Development

unrest, and -- Relationships Director

differences or contracts in

in culture. new markets are

-- Negative events assessed for their

could disrupt inherent risks,

some of the Group's using our

operations and International

have a material Business Risk

impact on its Assessment

future financial process,

performance. before being

formally

agreed. This

allows

opportunities

to be reviewed

at different

levels

of management

according to their

inherent risk.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Significant The way -- The Group Low/High -- The Group has -- -- Business Cautious

breach we work operates robust policy, Underlying Unit

of in highly regulated procedures and operating Managing

relevant environments and training in place profit Directors

laws recognises that to ensure that -- Profit -- Functional

and its operations it meets all after Directors

regulations have the potential current tax

to have an impact regulations; for --

on a variety of example Underlying

stakeholders. role-specific EPS

-- Failure to safety training --

comply with and business Underlying

particular ethics operating

regulations could training which cash flow

result in a is mandatory for -- Health

combination Board members and

of fines, penalties, and all employees Safety

civil or criminal across the Group.

action. -- The QinetiQ

-- In addition, Code of Conduct

failure may also defines clear

lead to suspension expectation for

or debarment from the Group and

government its employees;

contracts, for example it

as well as states that the

reputational Group does not

damage to the tolerate bribery

QinetiQ brand. and corruption

-- Key areas of and will comply

focus for the with relevant

Group include international

the following: trade regulations.

-- Safety liability -- The Group

of products, manages

services the effective

and advice. identification,

-- Workplace and measurement and

occupational health, control of

safety and regulatory

environmental risk.

matters. -- Local

-- Bribery and management

ethics. continuously

-- International monitor

trade controls. local laws.

Professional

advice is sought

when engaging

in new territories

to ensure that

the Group complies

with local and

international

regulations.

-- Accreditation

to external

standards;

for example safety

and environmental

systems continue

to be accredited

to international

standards;

external

authorisation

for regulated

design and

maintenance

services in the

aviation sector.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Defined The way -- The Group Medium/High -- Scheme -- Profit -- Group Balanced

benefit we work operates performance after Treasurer

pension a defined benefit is reviewed tax

obligations (DB) pension scheme regularly --

which is closed by Group Underlying

to future accrual. management EPS

-- At the year in conjunction --

end the DB pension with the scheme's Underlying

scheme was a independent operating

liability Trustee. cash flow

of GBP39.4m under -- External

an IAS 19 basis. actuarial

-- The size of and investment

the deficit may advice is

be materially regularly

affected by a taken to ensure

number of factors, the best interests

including inflation, of both the Group

investment returns, and the scheme

changes in interest members.

rates and -- The Group works

improvements in collaboration

in life expectancy with the Trustees

of members. to agree an

-- Any change investment

to the deficit strategy that

may require the progressively

Group to increase de-risks the

the cash scheme

contributions as the funding

to the scheme, level improves.

which would reduce -- The Company

the Group's cash continues to pay

available for the deficit

other purposes. recovery

payments

outstanding

from the 2011

valuation. Company

contributions

to the scheme

are expected to

continue at GBP13m

per annum until

2018.

-- The scheme

was closed to

future accrual

on 31 October

2013.

-- At the year

end 45% of the

inflation risk

is hedged and

20% of interest

rate risk hedged,

measured on a

gilts basis. A

5% inflation cap

protects GBP264m

of pensioner

liabilities

for ten years

to 2025.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

Tax legislation The way -- QinetiQ is High/High -- External advice -- Profit -- Group Balanced

we work liable to pay and consultation after Tax

tax in the countries are sought on tax Manager

in which it potential changes --

operates, in tax legislation Underlying

principally the in the UK, the EPS

UK and the US. US and elsewhere

-- Changes in as necessary

tax legislation enabling

in these countries the Group to plan

could have an for and manage

adverse impact potential changes.

on the level of -- The Group is

tax paid on profits currently actively

generated by the engaging with

Group. industry, MOD

-- In the UK, and industry

R&D Expenditure bodies

Credits (RDEC) regarding the

were introduced treatment of RDEC.

from 1 April 2013 -- The Group has

and will be GBP291.6m of UK

mandatory tax losses carried

from 1 April 2016, forward as at

replacing the 31 March 2015

R&D super deduction. (2014: GBP213.9m).

Until that date,

QinetiQ expects

to claim the super

deduction while

the treatment

of RDEC for MOD

single source

contracts remains

under discussion

between industry

and the Government.

------------ --------------------- ------------------ ------------------- ------------- --------------- ---------

RELATED PARTY TRANSACTIONS

This statement is extracted from note 17 in respect of

non-current investments which can be found on page 115 of the

Annual Report and Accounts.

During the year ended 31 March 2015 there were sales to

associates of GBP3.0m (2014: GBP3.3m). At the year end there were

outstanding receivables from associates of GBP0.3m (2014:

GBP0.1m).

DIRECTORS' RESPONSIBILITY STATEMENT

This statement is in compliance with DTR 4.1.12 and relates to

and is extracted from page 89 of the Annual Report and Accounts and

is signed by order of the Board by Jon Messent, Company Secretary.

Details of the Board of Directors of QinetiQ Group plc can be found

on pages 58 and 59 of the Annual Report and Accounts.

Responsibility is for the full Annual Report and Accounts and not

the extracted information presented in this announcement or in the

Preliminary Results.

Responsibility statement of the Directors in respect of the

Annual Report

The Directors in office as at the date of this report confirm

that to the best of their knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company, and the undertakings included in the consolidation

taken as a whole; and

-- the Directors' report includes a fair review of the

development and performance of the business, and the position of

the Company and the undertakings included in the consolidation

taken as a whole, together with a description of the principal

risks and uncertainties that they face.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSFBMBTMBABBJA

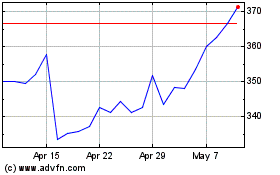

Qinetiq (LSE:QQ.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Qinetiq (LSE:QQ.)

Historical Stock Chart

From Apr 2023 to Apr 2024