Q2 Holdings, Inc. Announces Closing of Follow-on Public Offering & Full Exercise of Underwriters' Option to Purchase Addition...

March 06 2015 - 6:49PM

Business Wire

Q2 Holdings, Inc. (NYSE: QTWO), a provider of secure,

cloud-based virtual banking solutions, today announced the closing

of its previously announced underwritten public offering of

5,890,705 shares (including 768,352 shares that were offered and

sold pursuant to the full exercise of the underwriters' option to

purchase additional shares) at a price to the public of $19.75 per

share. Q2 sold 1,757,290 shares of common stock and certain

existing stockholders of Q2 sold 4,133,415 shares of common stock.

Q2 did not receive any proceeds from the sale of the shares by the

selling stockholders.

J.P. Morgan, Morgan Stanley and Stifel served as joint

book-running managers for the offering and Raymond James, Canaccord

Genuity and Needham & Company acted as co-managers.

A registration statement relating to these securities was filed

with the SEC and became effective on February 26, 2015. The

offering was made only by means of a prospectus. A copy of the

prospectus related to the offering may be obtained from J.P. Morgan

Securities LLC, c/o: Broadridge Financial Solutions, 1155 Long

Island Avenue, Edgewood, New York 11717, or by telephone at (866)

803-9204; Morgan Stanley & Co. LLC, Attention: Prospectus

Department, 180 Varick Street, 2nd Floor, New York, NY 10014, or by

telephone at (866) 718-1649; or Stifel, Nicolaus & Company,

Incorporated, Attention: Prospectus Dept., One Montgomery Street,

Suite 3700, San Francisco, California 94104, or by telephone at

(415) 364-2720.

This press release shall not constitute an offer to sell or

solicitation of any offer to buy, nor shall there be any sale of,

these securities in any state or jurisdiction in which such offer,

solicitation or sales would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Q2:

Q2 is a leading provider of secure, cloud-based virtual banking

solutions headquartered in Austin, Texas. Q2 enables regional and

community financial institutions, or RCFIs, to deliver a robust

suite of integrated virtual banking services and engage more

effectively with their retail and commercial account holders who

expect to bank anytime, anywhere and on any device. Q2 solutions

are often the most frequent point of interaction between its RCFI

customers and their account holders. As such, Q2 purpose-built its

solutions to deliver a compelling, consistent user experience

across digital channels and drive the success of its customers by

extending their local brands, enabling improved account holder

retention and creating incremental sales opportunities.

Media Contact:Red Fan CommunicationsKathleen Lucente,

512-551-9253Cell:

512-217-6352kathleen@redfancommunications.comorInvestor Contact:Q2

Holdings, Inc.Bob Gujavarty,

512-439-3447bobby.gujavarty@q2ebanking.com

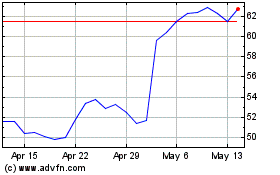

Q2 (NYSE:QTWO)

Historical Stock Chart

From Mar 2024 to Apr 2024

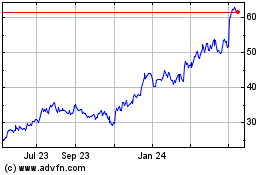

Q2 (NYSE:QTWO)

Historical Stock Chart

From Apr 2023 to Apr 2024