Q1 Earnings Season Gets Underway - Earnings Preview

March 14 2014 - 2:46AM

Zacks

Q1 Earnings Season Gets Underway

We will start counting Tuesday’s earnings announcements from

Adobe Systems (ADBE) and Oracle

(ORCL) as part of 2014 Q1 reporting cycle, though we are still a

few weeks away from the earnings season taking the spotlight.

The market has plenty of domestic economic data to digest this week

in a backdrop of developments in Ukraine and renewed questions

about China’s growth outlook. On the docket this week are a host of

housing, inflation, and manufacturing sector reports, but the focus

will be on the FOMC meeting, particularly Fed Chairwoman Yellen’s

first press conference.

The Fed isn’t expected to spring any surprises on the market. But

with the unemployment rate not too far from the Fed’s 6.5% target,

they will need to move past explicit thresholds without roiling the

markets. This isn’t easy to do, as too vague a threshold leaves

open the risk that the market gets ahead of the Fed in pricing the

eventual monetary tightening. The FOMC could address this issue in

its official statement on Wednesday, but the issue is bound to come

in Janet Yellen’s press event that afternoon.

Beyond the Fed and economic data, we have a number of corporate

bellwethers coming out with 2014 Q1 results (companies with fiscal

quarters ending in February and reporting in March get counted as

part of Q1 tally), which includes besides Oracle,

Nike (NKE), FedEx (FDX),

General Mills (GIS) and KB Home

(KBH).

These Q1 earnings reports aside, we are in the transition phase

between two earnings seasons when the last one hasn’t completely

ended even as the new one is upon us. Of this week’s 80 earnings

announcements, there are only 18 companies with fiscal quarters

ending in February and getting counted towards the Q1 tally; the

rest belong the 2013 Q4 reporting cycle (we have Q4 earnings

reports from 497 S&P 500 companies, as of Friday, March

14th).

Expectations for 2014 Q1

Estimates for 2014 Q1 started coming down at an accelerated pace as

companies predominantly guided lower on the 2013 Q4 earnings calls,

consistent with the trend we have been seeing for more than a year

now. Total Q1 earnings for companies in the S&P 500 are

currently expected to be down -1.5% from the same period last year,

a material decline from the +2.1% growth expected in early January

2014.

The negative revision trend is widespread, but is particularly

notable for the Retail, Basic Materials, Autos, Consumer Staples,

and the Energy sectors, as the chart below shows.

With roughly two-thirds of S&P 500 companies beating earnings

expectations in any reporting cycle, actual Q1 results will almost

certainly be better than these pre-season expectations. But Q1 is

unlikely to repeat the performance of the last few quarters where

we would witness a new all-time earnings total record each quarter.

Total earnings for the S&P 500 are on track to reach $269.4

billion in 2013 Q4 (we still have 3 more companies to report

results before ‘closing the books’ on that quarter). This is a new

all-time quarterly record for total earnings, surpassing the

previous record set in 2013 Q3 at $262.7 billion. Current estimates

for 2014 Q1 aggregate to a quarterly total of $252.4 billion, but

the expectation is for a strong ramp up from Q2 onwards.

Scorecard for 2013 Q4 (as of Friday, March

14th)

With respect to the ‘scorecard’ for 2013 Q4, we are still waiting

for results from 3 S&P 500 members. Total earnings for the 497

S&P 500 members that have reported results are up +9.2%

from the same period last year, with a ‘beat ratio’ of 64.2% and a

median surprise of +2.4%. Total revenues are barely in the positive

column, up only +0.7%, with a revenue ‘beat ratio’ of 55.9% and a

median surprise of +0.6%. While the revenue growth rate in Q4 was

held down by tough comparisons in the Finance sector, the overall

earnings growth rate in the quarter was the highest of 2013.

A big contributor to the strong Q4 earnings growth is easy

comparisons for three companies – Bank of America

(BAC), Verizon (VZ), and

Travelers (TRV). Exclude these three companies and

total earnings growth for the S&P 500 companies that have

reported drops to +5.5% from the ‘headline’ +9.2%, which is about

where growth has been in recent quarters.

For a detailed at the Q4 earnings season and the overall earnings

picture, please check out our weekly Earnings Trends report.

Monday-3/17

- A busy day on the economic calendar, with March Empire State

manufacturing survey and Homebuilder sentiment index coming out

before the open. Also coming out this morning is the February

Industrial Production report.

Tuesday -3/18

- Housing Starts and CPI for February are the notable economic

reports this morning. The two-day FOMC meeting will get underway

today.

- Adobe Systems (ADBE) and

Oracle (ORCL) are the notable earnings reports

today, both after the close.

- Earnings ESP or Expected Surprise Prediction, our proprietary

leading indicator of positive earnings surprises is showing Oracle

coming out with an earning beat.

- Our research shows that companies with Zacks Rank of 1, 2 or 3

and positive Earnings ESP are highly likely to beat EPS estimates.

Oracle has Zacks Rank #3 (Hold) and Earnings ESP of +1.5%.

- To get a better understanding of Zacks Earnings Surprise

Predictor, please click here.

Wednesday-3/19

- The Fed is in focus today, with the FOMC coming out with its

statement and followed by Chairwoman Yellen’s press

conference.

- FedEx (FDX), General Mills

(GIS) and KB Homes (KBH) will report in the

morning, while Jabil Circuit (JBL) and

Guess (GES) will report after the close.

- Earnings ESP is showing General Mills beating EPS expectations.

General Mills has Zacks Rank #3 (Hold) and Earnings ESP of

+1.5%

Thursday -3/20

- In addition to weekly Jobless Claims, we will get the February

Existing Home sales data and the March Philly Fed regional

survey.

- ConAgra (CAG) and Lennar Corp

(LEN) are the notable earnings reports in the morning, while

Nike (NKE) will report after the close.

Friday-3/21

- Not much on the economic calendar, while

Tiffany (TIF) and Darden

Restaurants (DRI) will report earnings results, both in

the morning.

- Tiffany with a Zacks Rank of 3 and Earnings ESP of +0.7% is

expected to come out with a positive earnings surprise.

Here is a list of the 80 companies reporting this week,

including 10 S&P 500 members.

| Company |

Ticker |

Current Qtr |

Year-Ago Qtr |

Last EPS Surprise % |

Report Day |

Time |

| ARES COMMERCIAL |

ACRE |

0.2 |

0.13 |

-46.15 |

Monday |

BTO |

| ALTEVA |

ALTV |

0.13 |

-0.21 |

N/A |

Monday |

AMC |

| APPRICUS BIOSCI |

APRI |

-0.06 |

-0.21 |

10 |

Monday |

AMC |

| ALPHATEC HLDGS |

ATEC |

-0.02 |

-0.01 |

150 |

Monday |

AMC |

| BIOLINE RX LTD |

BLRX |

-0.18 |

-0.3 |

-11.11 |

Monday |

BTO |

| CORENERGY INFRA |

CORR |

0.13 |

N/A |

0 |

Monday |

N/A |

| DTS INC |

DTSI |

N/A |

0.17 |

85.71 |

Monday |

AMC |

| COPEL-ADR PR B |

ELP |

N/A |

-0.18 |

4.88 |

Monday |

N/A |

| FATE THERAPEUTC |

FATE |

-0.29 |

N/A |

-1200 |

Monday |

AMC |

| FIBROCELL SCIEN |

FCSC |

-0.26 |

N/A |

-128.57 |

Monday |

BTO |

| FUTUREFUEL CORP |

FF |

0.2 |

0.15 |

-2.78 |

Monday |

AMC |

| FORTUNA SILVER |

FSM |

0.04 |

0.07 |

-100 |

Monday |

N/A |

| GAIAM INC |

GAIA |

-0.02 |

0.09 |

0 |

Monday |

AMC |

| GENIE ENERGY-B |

GNE |

-0.05 |

0.08 |

100 |

Monday |

AMC |

| HEALTH INS INN |

HIIQ |

0.09 |

N/A |

14.29 |

Monday |

N/A |

| INOVIO PHARMAC |

INO |

-0.03 |

-0.02 |

0 |

Monday |

BTO |

| IMAGEWARE SYS |

IWSY |

-0.02 |

-0.02 |

N/A |

Monday |

AMC |

| JA SOLAR HOLDGS |

JASO |

-0.03 |

-2.65 |

11.9 |

Monday |

BTO |

| KYTHERA BIOPHRM |

KYTH |

-0.69 |

-1.04 |

16.22 |

Monday |

AMC |

| LATAM AIRLINES |

LFL |

0.16 |

0.01 |

80 |

Monday |

AMC |

| LMI AEROSPACE |

LMIA |

0 |

0.38 |

-27.27 |

Monday |

BTO |

| LINDE AG ADR |

LNEGY |

N/A |

0.28 |

N/A |

Monday |

N/A |

| MELA SCIENCES |

MELA |

-0.1 |

-0.19 |

0 |

Monday |

AMC |

| NAVIGATOR HLDGS |

NVGS |

0.25 |

0.23 |

N/A |

Monday |

AMC |

| OFS CAPITAL CRP |

OFS |

0.16 |

N/A |

-21.05 |

Monday |

BTO |

| STERLING CONSTR |

STRL |

-1.47 |

0.01 |

25 |

Monday |

BTO |

| TSAKOS EGY NAVG |

TNP |

-0.08 |

-0.16 |

66.67 |

Monday |

BTO |

| TROVAGENE INC |

TROV |

-0.23 |

-0.1 |

80.65 |

Monday |

AMC |

| TOWERSTREAM CP |

TWER |

-0.1 |

-0.12 |

0 |

Monday |

AMC |

| ADOBE SYSTEMS |

ADBE |

0.12 |

0.22 |

-5.26 |

Tuesday |

AMC |

| ORACLE CORP |

ORCL |

0.67 |

0.63 |

3.13 |

Tuesday |

AMC |

| AERIE PHARMACT |

AERI |

-0.21 |

N/A |

-502.08 |

Tuesday |

AMC |

| GLOBAL B&C HLD |

BRSS |

0.33 |

N/A |

-5.26 |

Tuesday |

AMC |

| CONSOLTD WATER |

CWCO |

0.05 |

0.25 |

-25 |

Tuesday |

BTO |

| DSW INC CL-A |

DSW |

0.29 |

0.34 |

0 |

Tuesday |

BTO |

| FACTSET RESH |

FDS |

1.22 |

0.89 |

-1.61 |

Tuesday |

BTO |

| GLOBAL POWER EQ |

GLPW |

0.36 |

0.51 |

5.26 |

Tuesday |

N/A |

| GTT COMMUNICATN |

GTT |

-0.09 |

-0.02 |

55.56 |

Tuesday |

BTO |

| MOBILE TELE-ADR |

MBT |

0.42 |

0.58 |

40 |

Tuesday |

BTO |

| PAC SUNWEAR CAL |

PSUN |

-0.18 |

-0.17 |

0 |

Tuesday |

AMC |

| RENREN INC-ADR |

RENN |

0.05 |

-0.06 |

22.22 |

Tuesday |

AMC |

| PROSENA HLDG BV |

RNA |

-0.14 |

N/A |

-60 |

Tuesday |

BTO |

| SAEXPLORATN HLD |

SAEX |

0.25 |

N/A |

-6450 |

Tuesday |

AMC |

| TRADE ST RESID |

TSRE |

0.05 |

N/A |

-87.5 |

Tuesday |

AMC |

| VERACYTE INC |

VCYT |

-0.37 |

N/A |

N/A |

Tuesday |

AMC |

| YINGLI GREEN EN |

YGE |

-0.17 |

-0.94 |

0 |

Tuesday |

BTO |

| FEDEX CORP |

FDX |

1.52 |

1.23 |

-4.85 |

Wednesday |

BTO |

| GENL MILLS |

GIS |

0.68 |

0.64 |

-5.68 |

Wednesday |

BTO |

| JABIL CIRCUIT |

JBL |

0.02 |

0.45 |

34.04 |

Wednesday |

AMC |

| ACTUANT CORP |

ATU |

0.32 |

0.35 |

-4.35 |

Wednesday |

BTO |

| BACTERIN INTL |

BONE |

-0.08 |

-0.11 |

-100 |

Wednesday |

AMC |

| CLARCOR INC |

CLC |

0.42 |

0.47 |

-1.43 |

Wednesday |

AMC |

| ELBIT SYSTEMS |

ESLT |

1.46 |

1.62 |

3.94 |

Wednesday |

BTO |

| EVOGENE LTD |

EVGN |

-0.08 |

-0.02 |

N/A |

Wednesday |

BTO |

| FRANCO NV CP |

FNV |

0.22 |

0.33 |

26.32 |

Wednesday |

AMC |

| GUESS INC |

GES |

0.8 |

0.95 |

7.69 |

Wednesday |

AMC |

| KB HOME |

KBH |

0.08 |

-0.16 |

-31.11 |

Wednesday |

BTO |

| HERMAN MILLER |

MLHR |

0.34 |

0.32 |

2.44 |

Wednesday |

AMC |

| SINOVAC BIOTECH |

SVA |

N/A |

-0.08 |

N/A |

Wednesday |

AMC |

| TILLYS INC |

TLYS |

0.18 |

0.32 |

4.76 |

Wednesday |

AMC |

| VERA BRADLEY |

VRA |

0.46 |

0.62 |

8.82 |

Wednesday |

BTO |

| EXONE CO/THE |

XONE |

0.01 |

0.04 |

0 |

Wednesday |

AMC |

| CONAGRA FOODS |

CAG |

0.6 |

0.55 |

12.73 |

Thursday |

BTO |

| LENNAR CORP -A |

LEN |

0.28 |

0.26 |

14.06 |

Thursday |

BTO |

| NIKE INC-B |

NKE |

0.73 |

0.73 |

1.72 |

Thursday |

AMC |

| AMBIT BIOSCIENC |

AMBI |

-0.43 |

N/A |

14.29 |

Thursday |

AMC |

| CATO CORP A |

CATO |

0.13 |

0.27 |

21.43 |

Thursday |

BTO |

| CONSTELLIUM NV |

CSTM |

0.5 |

N/A |

6 |

Thursday |

BTO |

| ENVIVIO INC |

ENVI |

-0.14 |

-0.18 |

21.43 |

Thursday |

AMC |

| IHS INC-A |

IHS |

0.75 |

0.47 |

17.24 |

Thursday |

BTO |

| MARCUS CORP |

MCS |

0 |

-0.01 |

-12.5 |

Thursday |

BTO |

| NEW RESID INV |

NRZ |

0.16 |

N/A |

-16.67 |

Thursday |

BTO |

| RALLY SOFTWARE |

RALY |

-0.31 |

N/A |

14.81 |

Thursday |

AMC |

| SCHOLASTIC CORP |

SCHL |

-0.35 |

-0.63 |

-2.27 |

Thursday |

BTO |

| SHOE CARNIVAL |

SCVL |

0.04 |

0.16 |

5.88 |

Thursday |

AMC |

| SILVER WHEATON |

SLW |

0.25 |

0.5 |

-4.35 |

Thursday |

AMC |

| TIBCO SOFTWARE |

TIBX |

0.11 |

0.09 |

9.38 |

Thursday |

AMC |

| WET SEAL INC -A |

WTSL |

-0.24 |

-0.06 |

0 |

Thursday |

AMC |

| DARDEN RESTRNT |

DRI |

0.82 |

1.02 |

-25 |

Friday |

BTO |

| TIFFANY & CO |

TIF |

1.52 |

1.4 |

25.86 |

Friday |

BTO |

ADOBE SYSTEMS (ADBE): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

CONAGRA FOODS (CAG): Free Stock Analysis Report

DARDEN RESTRNT (DRI): Free Stock Analysis Report

FEDEX CORP (FDX): Free Stock Analysis Report

GUESS INC (GES): Free Stock Analysis Report

GENL MILLS (GIS): Free Stock Analysis Report

JABIL CIRCUIT (JBL): Free Stock Analysis Report

KB HOME (KBH): Free Stock Analysis Report

LENNAR CORP -A (LEN): Free Stock Analysis Report

NIKE INC-B (NKE): Free Stock Analysis Report

ORACLE CORP (ORCL): Free Stock Analysis Report

TIFFANY & CO (TIF): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

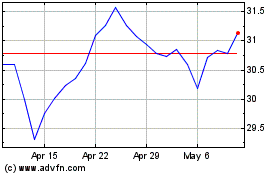

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

ConAgra Brands (NYSE:CAG)

Historical Stock Chart

From Apr 2023 to Apr 2024