By Heather Gillers and Nick Timiraos

The Puerto Rican government failed to pay almost half of $2

billion in bond payments due Friday, marking the commonwealth's

first-ever default on its constitutionally guaranteed debt.

Gov. Alejandro García Padilla defended the historic decision by

highlighting the island's tense relationship with Wall Street firms

that own its debt.

Some of these firms stand to lose money as a result of Friday's

nonpayment. Major insurers backing Puerto Rico's debt could also be

forced to pay out as much as hundreds of millions of dollars to

bondholders.

Puerto Rico had become over many years "a colony of Wall

Street," Mr. García Padilla told reporters in San Juan on Friday.

"We are starting the process of putting it back in the hands of

Puerto Ricans."

President Barack Obama signed legislation Thursday that

addressed the island's debt crisis but didn't provide any mechanism

to avoid Friday's default. Instead, the law gives the island a stay

against creditor litigation.

Of the $779 million in general obligation debt the commonwealth

failed to pay Friday, about half could translate into missed

payments for bondholders. The three major bond insurers active in

Puerto Rico are expected to cover as much as $358 million.

Puerto Rico's Government Development Bank also skipped payments

on some other bonds with weaker guarantees.

One creditor affected by Friday's actions is Eaton Vance

Management, which holds a few million dollars in general obligation

debt. But "for us it's a non-event," said Craig Brandon, Eaton

Vance's co-director of municipal investments, because the firm

expects to receive full principal and interest payments from

insurers.

Much of Puerto Rico's debt is held by hedge funds and municipal

bond mutual funds such as Oppenheimer Funds Inc. Oppenheimer's

total Puerto Rico debt has a face value of $7 billion, including

nearly $6 billion of uninsured bonds.

An Oppenheimer spokeswoman declined to comment on possible

losses, saying the firm looks forward "to working with all

stakeholders to help get Puerto Rico on a long-term sustainable

path while protecting the interests of our shareholders."

The municipal bond fund with the second-largest amount of Puerto

Rico debt is Franklin Templeton Inc., which holds $2.7 billion in

face value, most of it uninsured. A spokeswoman declined to

comment.

Municipal bond defaults are rare. The last time a state-level

issuer defaulted on general obligation debt was when Arkansas did

so in 1933.

The default was widely anticipated, and bond prices on Puerto

Rico debt remained largely unchanged Friday, with benchmark

uninsured general obligation bonds trading at 67.5 cents on the

dollar. In contrast, many insured general obligation bonds

continued to trade around 100 cents on the dollar.

News of the default was tempered by the passage of the

restructuring legislation. The law authorizes the creation of a

federally appointed fiscal control board in Puerto Rico, which

establishes a framework for a more orderly debt workout. The board

is tasked with restoring economic growth to the island and will

have considerable power to approve debt restructuring.

The restructuring legislation prevents creditors from asking a

court to force bond payments to be made ahead of essential

services. Without such a safeguard, the island's debt crisis would

have grown "much worse and might have been unsolvable," said

Treasury Secretary Jacob Lew on Wednesday.

Congress spent months working on the bipartisan bill that was

propelled through the Senate by concerns of a looming legal battle.

Voluntary talks with general obligation bondholders broke down in

recent weeks, and a group of hedge funds sued the island last week

over a local debt-moratorium law, saying the island was legally

required to pay them ahead of essential public services.

A separate group of hedge funds filed a motion Friday in a

lawsuit against Puerto Rico's governor, asking to be exempted from

the stay on lawsuits contained in the federal restructuring

legislation. The motion said the funds hold more than $750 million

in Government Development Bank debt, which Puerto Rico defaulted on

in May.

Three large bond insurers are bracing for payouts as a result of

Friday's events. National Public Finance Guarantee Corp. backs $173

million in general obligation debt that Puerto Rico was supposed to

pay Friday, the company has disclosed.

Assured Guaranty Ltd. has reported that it backs $184 million in

general obligation bond payments coming due in the third quarter of

2016, much of which was due Friday.

Ambac Financial Group backs only about $1 million in general

obligation debt due Friday, but Chief Executive Officer Nader

Tavakoli said in a televised appearance Friday that the bond

insurer expected to pay between $45 million and $50 million in

claims. Much of it will likely cover payments on the island's

Infrastructure Financing Authority debt, which Puerto Rico also

didn't make.

Mr. Tavakoli said in the interview that he hopes the fiscal

control board created under the restructuring legislation will

include "the right kinds of business people, growth-oriented

business people," who will focus on fiscal and structural reforms

for Puerto Rico, rather than on cutting payments to

bondholders.

Assured Guaranty said in a statement that it is well prepared to

handle defaults in Puerto Rico. "Our liquidity and capital position

are very strong," the statement said. National Public Finance

Guarantee, a unit of MBIA, declined to comment.

The island has been in a recession for most of the past decade

and has seen a large drop in its population as residents, who are

U.S. citizens, leave for the mainland.

Write to Heather Gillers at heather.gillers@wsj.com and Nick

Timiraos at nick.timiraos@wsj.com

(END) Dow Jones Newswires

July 01, 2016 18:57 ET (22:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

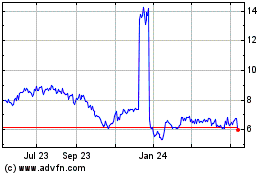

MBIA (NYSE:MBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

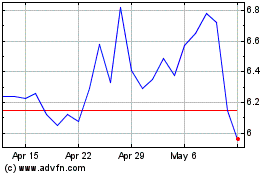

MBIA (NYSE:MBI)

Historical Stock Chart

From Apr 2023 to Apr 2024