Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

|

|

|

|

|

|

|

Filed by the Registrant

ý

|

|

Filed by a Party other than the Registrant

o

|

|

Check the appropriate box:

|

|

o

|

|

Preliminary Proxy Statement

|

|

o

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

ý

|

|

Definitive Proxy Statement

|

|

o

|

|

Definitive Additional Materials

|

|

o

|

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

|

|

|

|

Amphenol Corporation

|

(Name of Registrant as Specified in its Charter)

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

ý

|

|

No fee required.

|

o

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

o

|

|

Fee paid previously with preliminary materials.

|

o

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Table of Contents

|

|

|

NOTICE OF 2017 ANNUAL MEETING

and

PROXY STATEMENT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CORPORATION

|

|

|

|

|

AMPHENOL CORPORATION

358 HALL AVENUE

WALLINGFORD, CONNECTICUT 06492

|

|

Table of Contents

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE

11:00 a.m., Thursday, May 18, 2017

PLACE

Amphenol Corporation

World Headquarters

Conference Center

358 Hall Avenue

Wallingford, CT 06492

(203) 265-8900

AGENDA

-

1.

-

To

elect eight directors as named for terms indicated in the Proxy Statement.

-

2.

-

To

ratify the selection of Deloitte & Touche LLP as independent accountants.

-

3.

-

To

conduct an advisory vote on compensation of named executive officers.

-

4.

-

To

conduct an advisory vote on the frequency of future advisory votes on compensation of named executive officers.

-

5

-

To

ratify and approve the 2017 Stock Purchase and Option Plan for Key Employees of Amphenol and Subsidiaries.

-

6.

-

To

transact such other business as may properly come before the meeting and any postponements or adjournments thereof.

By Order of the Board of Directors

Lance E. D'Amico

Vice President, Secretary and General Counsel

April 17, 2017

—IMPORTANT—

PLEASE COMPLETE, DATE, SIGN AND RETURN

THE ACCOMPANYING PROXY WHETHER OR

NOT YOU PLAN TO ATTEND THE MEETING

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to Be Held on May 18, 2017: The Proxy Statement and Annual Report to

Stockholders for the fiscal year ended December 31, 2016 are available at

www.edocumentview.com/APH.

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

ii

Table of Contents

2017 Proxy Summary

This summary highlights selected information contained elsewhere in this proxy statement. This summary does not contain

all of the information that you should consider, and you should read the entire proxy statement and the 2016 Amphenol Annual Report to Stockholders carefully before voting.

Annual Meeting of Stockholders

|

|

|

|

|

• Time and Date

|

|

11:00 a.m., Thursday, May 18, 2017

|

• Place

|

|

Amphenol Corporation

World Headquarters,

Conference Center

358 Hall Avenue

Wallingford, CT 06492

|

• Record Date

|

|

March 20, 2017

|

• Voting

|

|

Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and for each of the other proposals to be voted on.

|

Meeting Agenda and Voting Matters

|

|

|

|

|

|

|

|

|

|

|

|

Board Vote

Recommendation

|

|

Page References

(for more detail)

|

|

Election of Eight Directors

|

|

FOR EACH DIRECTOR NOMINEE

|

|

6-17

|

Other Management Proposals

|

|

|

|

|

•

|

|

Ratification of Deloitte & Touche LLP as independent accountants

|

|

FOR

|

|

22-24

|

•

|

|

Advisory vote on compensation of named executive officers

|

|

FOR

|

|

25-51

|

•

|

|

Advisory vote on frequency of future advisory votes on compensation of named executive officers

|

|

EVERY 1 YEAR

|

|

52

|

•

|

|

To ratify and approve the 2017 Stock Purchase and Option Plan for Key Employees of Amphenol and Subsidiaries

|

|

FOR

|

|

53-55

|

iii

Table of Contents

Director Nominees

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee Memberships*

|

|

|

|

|

|

Director

Tenure

|

|

Principal

Occupation

|

|

Experience/

Qualifications

|

|

|

|

Other Public

Company Boards

|

|

|

Name

|

|

Independent

|

|

AC

|

|

CC

|

|

EC

|

|

NCGC

|

|

PC

|

|

|

Ronald P. Badie

|

|

Since 2004

|

|

Former Vice Chairman of

|

|

- Leadership

|

|

Y

|

|

X,F

|

|

|

|

C

|

|

|

|

X

|

|

|

Nautilus, Inc.

|

|

|

|

|

|

|

Deutsche Bank Alex. Brown

|

|

- Finance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- M&A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stanley L. Clark

|

|

Since 2005

|

|

Lead Trustee and Senior

|

|

- Leadership

|

|

Y

|

|

X

|

|

X

|

|

|

|

|

|

C

|

|

|

|

|

|

|

|

|

|

Advisor of Goodrich, LLC

|

|

- Finance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Global

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Industry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David P. Falck

|

|

Since 2013

|

|

Executive Vice President

|

|

- Leadership

|

|

Y

|

|

X

|

|

X

|

|

|

|

C

|

|

|

|

|

|

|

|

(Presiding Director)

|

|

|

|

and General Counsel

|

|

- Compliance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pinnacle West Capital

|

|

- Risk

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporation

|

|

Management

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- M&A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Edward G. Jepsen

|

|

1989-1997;

|

|

CEO and Chairman of Coburn

|

|

- Leadership

|

|

Y

|

|

C,F

|

|

|

|

|

|

X

|

|

X

|

|

|

.

|

|

|

|

|

Since 2005

|

|

Technologies, Inc.

|

|

- Finance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Global

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Industry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin H. Loeffler

|

|

Since 1987

|

|

Former CEO of Amphenol

|

|

- Leadership

|

|

Y

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Chairman)

|

|

|

|

Corporation

|

|

- Global

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Industry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Technology

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John R. Lord

|

|

Since 2004

|

|

Former CEO and

|

|

- Leadership

|

|

Y

|

|

|

|

C

|

|

X

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

Chairman of

|

|

- Global

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carrier Corporation

|

|

- Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. Adam Norwitt

|

|

Since 2009

|

|

President and CEO of

|

|

- Leadership

|

|

N

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amphenol Corporation

|

|

- Global

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Industry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- M&A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diana G. Reardon

|

|

Since 2015

|

|

Former CFO of Amphenol

|

|

- Leadership

|

|

N

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

|

|

|

|

|

|

Corporation

|

|

- Finance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Global

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Industry

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

AC

-

Audit

Committee

-

C

-

Chair

-

CC

-

Compensation

Committee

-

EC

-

Executive

Committee

-

F

-

Financial

Expert

-

NCGC

-

Nominating/Corporate

Governance Committee

-

PC

-

Pension

Committee

-

*

-

Note

that Randall D. Ledford continues as a director through the 2017 Annual Meeting. Mr. Ledford will not stand for re-election after his term expires at the

Annual Meeting. Mr. Ledford currently serves as a member of the Compensation Committee, Executive Committee and Nominating/Corporate Governance Committee.

|

|

|

|

|

Attendance

|

|

In 2016, each of the Company's director nominees attended 100% of the Board and the Committee meetings on which such nominee sits.

|

Governance

The Company's most current Governance Principles, the Code of Business Conduct and Ethics and the Charters of the Audit Committee, the

Compensation Committee and the Nominating/Corporate Governance Committee of the Board can be accessed via the Company's website at

www.amphenol.com

by

clicking on "Investors", then "Governance", then the desired Principles, Code or Charter. A printed copy

iv

Table of Contents

will

also be provided to any stockholder of the Company free of charge upon written request to the Company, c/o Secretary, Amphenol Corporation, 358 Hall Avenue, Wallingford, Connecticut 06492.

Executive Compensation

At the 2016 annual meeting of stockholders, the Company's stockholders cast a non-binding advisory vote regarding the compensation of the

Company's named executive officers as disclosed in the proxy statement for that meeting. The Company's stockholders overwhelmingly approved the proposal with more than 97% of the shares voted being

cast in favor of the proposal. These programs and policies remain intact, as described in detail beginning on page 25. The Company's core management compensation programs include base salary,

an annual performance-based incentive plan payment opportunity, annual stock option awards (with 20% vesting each year over a five year period, except that vesting may be accelerated or continued in

cases of death, disability, retirement or a change in control), insurance benefits and retirement benefits.

Compensation

programs for the named executive officers emphasize at-risk, performance-based elements. Fixed compensation elements, including base salary, retirement benefits and other

compensation are designed to be market competitive for purposes of retention, and to a lesser extent, recruitment. However, it is intended that a larger part of the named executive officers'

compensation be geared to reward performance that generates long-term stockholder value.

For

the Company's Chief Executive Officer, fixed compensation elements including salary, retirement benefits and "all other compensation" comprised approximately 16% of his total 2016

compensation. His at-risk compensation linked to increasing stockholder value comprised approximately 84% of his total 2016 compensation. These at-risk elements include stock options granted at market

price which only increase in value if the Company's share price increases after the grant date (the value ascribed to the options for purposes of calculating percentages in this paragraph is the grant

date fair value calculated in accordance with ASC Topic 718, as further described in footnote (1) to the Summary Compensation Table on page 37). The other at-risk compensation is

incentive plan compensation which historically has required year-over-year EPS growth before any amount is paid in addition to other considerations designed to motivate the Chief Executive Officer to

generate long-term stockholder value, and rewards the Chief Executive Officer when Company revenues and EPS grow. For the Company's other named executive officers as a group, fixed compensation

elements comprised approximately 25% of total 2016 compensation while at-risk compensation comprised approximately 75% of total 2016 compensation. As with the Chief Executive Officer, the fixed

compensation elements for the other named executive officers include salary, retirement benefits and "all other compensation", while the at-risk items include stock options and incentive plan

compensation linked to goals that encourage growth in revenues and either EPS or operating income.

The

Board believes this compensation program is a valuable and appropriate tool which contributes to the Company's continuing success.

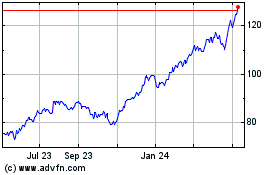

2016 Performance Highlights

In 2016, the Company achieved new records in sales, earnings per share (EPS) and operating cash flow, all while sustaining industry-leading

sales growth. Sales grew 13% to $6.3 billion and adjusted diluted EPS grew 12% to $2.72 (adjustments to GAAP financial measures are explained in more detail on page 31). The Company's

level of profitability was strong, with adjusted net income as a percentage of sales exceeding 13% and adjusted operating margins reaching 19.8%. Our financial strength was clearly reflected in the

Company's cash generation, with more than $1 billion in operating cash flow and $887 million in free cash flow, reconfirming the strength and discipline of the Amphenol organization.

Most importantly, we continued to put our financial resources to work creating growth opportunities for

v

Table of Contents

the

Company and value for our shareholders, through investments in new products and capabilities, acquiring new companies, increasing our dividend and repurchasing the Company's stock.

Investor Outreach

Amphenol has continued to engage with key stockholders to discuss, among other items, governance issues to ensure that management and the Board

understand and address issues that are important to the Company's stockholders. Through these engagements the Company has obtained valuable feedback. Partly in response to this feedback, in 2016, the

Board adopted an amendment to the Company's By-Laws that, among other things, implemented "proxy access", which, subject to the requirements of the By-Laws, permits any stockholder or group of up to

20 stockholders that beneficially owns at least 3% of the Company's outstanding common stock continuously for three years to nominate candidates for election to the Board and to require the Company to

list such nominees in the Company's proxy statement.

The

adoption of "proxy access" is consistent with the Board's prior actions to provide that the Company adheres to evolving corporate governance best practices, which have included

lowering the threshold to call special meetings of stockholders from 50% to 25%; declassifying the Board and providing for the annual election of directors; allowing stockholders to act by written

consent; and eliminating supermajority voting requirements in the Company's Articles of Incorporation and By-Laws.

The

Company has also continued to engage key stockholders to discuss other important topics, such as compensation practices and programs.

Other Company Proposals

1.

Ratification of selection of Deloitte & Touche as independent accountants.

As a matter of good

governance, the Board is asking stockholders to ratify the selection of Deloitte & Touche LLP as the Company's independent accountants.

2.

Advisory vote to approve compensation of named executive officers.

The Board is asking stockholders to

approve, on an advisory basis, the compensation of the Company's named executive officers. The Board

recommends a FOR vote because it believes the compensation policies and practices of the Company, as described in the Compensation Discussion and Analysis beginning on page 25, have been and

continue to be effective in helping to achieve the Company's goals of rewarding leadership excellence and sustained financial and operating performance, aligning the named executive officers'

long-term interest with those of the stockholders and motivating these executives to remain with the Company for long and productive careers.

3.

Advisory vote on the frequency of future advisory votes on compensation of named executive officers.

The

Board is asking stockholders to approve, on an advisory basis, that future advisory votes on compensation of named executive officers should occur every year. Stockholders will be able to specify one

of four choices for this proposal on the proxy card: one year, two years, three years or abstain. The Board is recommending that the stockholders vote for holding the advisory vote on executive

compensation every year.

4.

Ratification and approval of the 2017 Stock Purchase and Option Plan for Key Employees of Amphenol and

Subsidiaries.

The Board is asking stockholders to approve the 2017 Stock Purchase and Option Plan of Amphenol Corporation and its Subsidiaries pursuant to which

30,000,000 options will be authorized for issuance. The Board believes granting stock options is a valuable tool contributing to the Company's continuing success and is recommending that stockholders

approve the plan.

vi

Table of Contents

2018 Annual Meeting

|

|

|

|

Deadline for stockholder proposals to be included

in the proxy statement for the 2018 annual meeting

of stockholders.

|

|

December 18, 2017

|

vii

Table of Contents

PROXY STATEMENT

This Proxy Statement (first mailed to stockholders on or about April 17, 2017) is furnished to the holders of the Class A Common

Stock, par value $.001 per share ("Common Stock"), of Amphenol Corporation (the "Company" or "Amphenol") in connection with the solicitation of proxies for use at the Annual Meeting of Stockholders to

be held in the Conference Center at the Company's Corporate Headquarters at 358 Hall Avenue, Wallingford, Connecticut 06492 (telephone (203) 265-8900) at 11:00 a.m. on Thursday,

May 18, 2017 (the "Annual Meeting").

RECORD DATE

The Board of Directors of the Company (the "Board") has fixed the close of business on March 20, 2017 as the Record Date for the 2017

Annual Meeting (the "Record Date"). Only stockholders of record at the Record Date are entitled to notice of and to vote at the Annual Meeting and any postponements or adjournments thereof, in person

or by proxy. At the Record Date, there were 305,388,648 shares of Common Stock outstanding.

PROXIES

The proxy accompanying this Proxy Statement is solicited on behalf of the Board for use at the Annual Meeting and any postponements or

adjournments thereof. Each holder of Common Stock is entitled to one vote for each share of Common Stock held at the Record Date. The holders of record, present in person or by proxy, of a majority of

the issued and outstanding shares of Common Stock shall constitute a quorum. Abstentions and broker non-votes are counted as present for quorum purposes.

Shares

will be voted in accordance with stockholder instructions. If a stockholder returns a signed proxy card that omits voting instructions for some or all matters to be voted on, the

proxy holders will vote on all uninstructed matters in accordance with the recommendations of the Board. In addition, if a stockholder has returned a signed proxy card, the proxy holders will have,

and intend to exercise, discretion to vote shares in accordance with their best judgment on any matters not identified in the Proxy Statement on which a vote is taken at the Annual Meeting. At

present, the Company is not aware of any such matter.

For

stockholders that hold their shares through an account with a broker and do not give voting instructions on a matter, under the rules of the New York Stock Exchange, the broker is

permitted to vote in its discretion only on Proposal 2 (ratification of selection of the independent accountants) and is required to withhold its vote on each of the other proposals, the withholding

of which is referred to as a "broker non-vote."

1

Table of Contents

The

following table illustrates votes required, and the impact of abstentions and broker non-votes.

|

|

|

|

|

|

|

|

|

Proposal

|

|

Required Vote

|

|

Impact of Abstentions

|

|

Impact of Broker Non-Votes

|

|

|

1. Election of directors

|

|

Votes "For" a nominee exceed votes "Against" that nominee.

|

|

No impact on outcome.

|

|

Not counted as votes cast; no impact on outcome.

|

|

|

|

2. Ratification of selection of the independent accountants

|

|

Approval by a majority of the votes cast.

|

|

No impact on outcome.

|

|

Not expected; not counted as votes cast; no impact on outcome.

|

|

|

|

3. Advisory vote on compensation of named executive officers

|

|

Approval by a majority of the votes cast.

|

|

No impact on outcome.

|

|

Not counted as votes cast; no impact on outcome.

|

|

|

|

4. Advisory vote on frequency of future votes on compensation of named executive officers

|

|

Plurality of the votes cast.

|

|

No impact on outcome.

|

|

Not counted as votes cast; no impact on outcome.

|

|

|

|

5.Ratify and approve the 2017 Stock Option Plan of Amphenol Corporation and its Subsidiaries

|

|

Approval by a majority of the votes cast.

|

|

Effect of a vote "Against."

|

|

Not counted as votes cast; no impact on outcome.

|

|

|

A

proxy may be revoked. For shares that are held in "street name", the stockholder must follow the directions provided by its bank, broker or other intermediary for revoking or modifying

voting instructions. For shares that are registered in the stockholder's own name, the proxy may be revoked by written notification to the Company Secretary prior to its exercise and providing

relevant name and

account information, submitting a new proxy card with a later date (which will override the earlier proxy) or voting in person at the Annual Meeting.

Votes

on each of the proposals other than election of directors and approval of the 2017 Stock Option Plan of Amphenol Corporation and its Subsidiaries are advisory and therefore not

binding on the Company. However, the Board will consider the outcome of these votes in its future deliberations.

The

inspectors of election appointed for the Annual Meeting with the assistance of the Company's transfer agent, Computershare Trust Company, N.A., will tabulate the votes.

The

Company pays the cost of preparing, printing, assembling and mailing this proxy soliciting material. The Company has engaged the firm of Georgeson LLC to assist in the

distribution of this Notice of 2017 Annual Meeting and Proxy Statement and will pay Georgeson its out of pocket expenses for such services. The Company will reimburse brokerage houses and other

custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. Georgeson LLC has also been retained to assist

in soliciting proxies for a fee not expected to exceed $8,000, plus distribution costs and other costs and expenses. Proxies may also be solicited from some stockholders personally, by mail, e-mail,

telephone or other means of communication by the Company's officers and regular employees who are not specifically employed for proxy solicitation purposes and who will not receive any additional

compensation.

2

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Listed in the following table are those stockholders known to Amphenol to be the beneficial owners of more than five percent of the Company's

Common Stock as of December 31, 2016.

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership

|

|

Percent of Class

|

|

|

FMR LLC

245 Summer Street

Boston, MA 02210

|

|

|

39,549,815

|

(1)

|

|

12.8

|

%

|

|

The Vanguard Group.

100 Vanguard Blvd.

Malvern, PA 19355

|

|

|

28,879,505

|

(2)

|

|

9.4

|

%

|

|

Capital World Investors

333 South Hope Street

Los Angeles, CA 90071

|

|

|

24,970,090

|

(3)

|

|

8.1

|

%

|

|

BlackRock, Inc.

55 East 52

nd

Street

New York, NY 10055

|

|

|

19,903,891

|

(4)

|

|

6.5

|

%

|

|

The Bank of New York Mellon Corporation

225 Liberty Street

New York, NY 10286

|

|

|

15,929,341

|

(5)

|

|

5.2

|

%

|

-

(1)

-

The

Schedule 13G filed by such beneficial owner on February 14, 2017 for the year ended December 31, 2016 indicates that it has (i) sole

voting power over 3,941,470 shares, (ii) shared voting power over 0 shares, (iii) sole dispositive power over 39,549,815 shares and (iv) shared dispositive power over 0 shares.

-

(2)

-

The

Schedule 13G filed by such beneficial owner on February 9, 2017 for the year ended December 31, 2016 indicates that it has (i) sole

voting power over 484,582 shares, (ii) shared voting power over 66,723 shares, (iii) sole dispositive power over 28,331,350 shares and (iv) shared dispositive power over 548,155

shares.

-

(3)

-

The

Schedule 13G filed by such beneficial owner on February 13, 2017 for the year ended December 31, 2016 indicates that it has (i) sole

voting power over 24,970,090 shares, (ii) shared voting power over 0 shares, (iii) sole dispositive power over 24,970,090 shares and (iv) shared dispositive power over 0 shares.

-

(4)

-

The

Schedule 13G filed by such beneficial owner on January 19, 2017 for the year ended December 31, 2016 indicates that it has (i) sole

voting power over 16,889,331 shares, (ii) shared voting power over 25,178 shares, (iii) sole dispositive power over 19,878,713 shares and (iv) shared dispositive power over 25,178

shares.

-

(5)

-

The

Schedule 13G filed by such beneficial owner on February 3, 2017 for the year ended December 31, 2016 indicates that it has (i) sole

voting power over 12,926,237 shares, (ii) shared voting power over 9,486 shares, (iii) sole dispositive power over 13,786,685 shares and (iv) shared dispositive power over

2,138,102 shares.

3

Table of Contents

SECURITY OWNERSHIP OF MANAGEMENT

Set forth below is certain information with respect to beneficial ownership of the Company's Common Stock as of April 3, 2017 by each

director, the named executive officers (listed in the Summary Compensation Table on page 37) and by all executive officers and directors of the Company as a group. Except as otherwise noted,

the individuals listed in the table below have the sole power to vote or transfer the shares reflected in the table.

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

|

Amount and

Nature of

Beneficial

Ownership

|

|

Percent of

Class

|

|

|

Ronald P. Badie

|

|

|

48,292(2)(3)

|

|

|

*

|

|

|

Stanley L. Clark

|

|

|

35,092(2)(3)

|

|

|

*

|

|

|

David P. Falck

|

|

|

11,630(2)

|

|

|

*

|

|

|

Edward G. Jepsen

|

|

|

235,092(2)

|

|

|

*

|

|

|

Craig A. Lampo

|

|

|

429,000(4)

|

|

|

*

|

|

|

Randall D. Ledford

|

|

|

7,326(2)

|

|

|

*

|

|

|

Martin H. Loeffler

|

|

|

468,758(2)

|

|

|

*

|

|

|

John R. Lord

|

|

|

43,092(2)

|

|

|

*

|

|

|

R. Adam Norwitt(1)

|

|

|

3,369,663

|

|

|

1.10

|

%

|

|

Zachary W. Raley

|

|

|

706,400(4)

|

|

|

*

|

|

|

Diana G. Reardon

|

|

|

808,000(4)

|

|

|

*

|

|

|

Richard Schneider

|

|

|

348,324(4)

|

|

|

|

|

|

Luc Walter

|

|

|

328,800(4)

|

|

|

*

|

|

|

All executive officers and directors of the Company as a group (21 persons)

|

|

|

7,666,369

|

|

|

2.51

|

%

|

-

*

-

Less

than one percent.

-

(1)

-

The

share ownership amounts for Mr. Norwitt in this table include 321,663 shares, of which 227,671 shares are held in trusts over which he has sole voting

power and 93,992 are owned directly; and 3,048,000 shares which are not owned by Mr. Norwitt but which would be issuable upon the exercise of stock options pursuant to the 2000 Stock Purchase

and Option Plan for Key Employees of Amphenol and Subsidiaries and the 2009 Stock Purchase and Option Plan for Key Employees of Amphenol and Subsidiaries, which are exercisable or would be exercisable

within 60 days of April 3, 2017.

-

(2)

-

The

share ownership amounts in this table include 45,877, 12,677, 9,215, 212,677, 4,911, 446,343 and 40,677 shares which are owned directly by Messrs. Badie,

Clark, Falck, Jepsen, Ledford, Loeffler and Lord, respectively. Of the 212,677 shares of Common Stock owned by Mr. Jepsen reflected in this table, 200,000 have been pledged as security.

Pursuant to the pledge arrangement, Mr. Jepsen has the power to vote or direct the voting of the shares and he has the power to dispose or direct the disposition of the shares. The table also

includes 20,000 shares which are not owned by each of Messrs. Clark, Jepsen and Loeffler, but which would be issuable to each upon the exercise of stock options pursuant to the Amended 2004

Stock Option Plan for Directors of Amphenol Corporation (the "Directors' Stock Option Plan") which are exercisable or would be exercisable within 60 days of April 3, 2017. Additionally,

this table includes 2,415 shares of restricted stock owned by each of Messrs. Badie, Clark, Falck, Jepsen, Ledford, Loeffler and Lord, all of which vest within 60 days of April 3,

2017.

-

(3)

-

The

share ownership amounts for Messrs. Badie and Clark reflected in this table do not include any shares of the Company's Common Stock which may be issued

pursuant to the Amphenol Corporation Directors' Deferred Compensation Plan (the "Directors' Deferred Compensation Plan") described under the caption "Director Compensation for the 2016 Fiscal Year"

beginning on page 15. Mr. Badie

4

Table of Contents

was

appointed to the Board on July 21, 2004 and the cumulative balance in his Directors' Deferred Compensation account as of April 1, 2017, including credit for dividends, is 19,587 unit

shares. Mr. Clark was appointed to the Board on January 27, 2005 and the cumulative balance in his Directors' Deferred Compensation account as of April 1, 2017, including credit

for dividends, is 17,219 unit shares. Commencing with the fourth quarter 2009, Messrs. Badie and Clark elected to receive their quarterly director's fees in cash in lieu of shares. As long as

the election to receive quarterly director's fees in cash in lieu of shares continues, the cumulative balance in each of Messrs. Badie and Clark's Director's Deferred Compensation account will

only increase by the number of shares credited for dividends.

-

(4)

-

The

share ownership amounts in this table include 25,000, 63,524 and 100,000 shares owned by Messrs. Lampo, Schneider and Walter, respectively, as well as

808,000, 404,000, 706,400, 284,800 and 228,800 shares, which are not owned by Ms. Reardon and Messrs. Lampo, Raley, Schneider and Walter, respectively, but which would be issuable upon

the exercise of stock options pursuant to the 2000 Stock Purchase and Option Plan for Key Employees of Amphenol and Subsidiaries and the 2009 Stock Purchase and Option Plan for Key Employees of

Amphenol and Subsidiaries which are exercisable or would be exercisable within 60 days of April 3, 2017.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires that the Company's executive officers and directors, and any persons who

own more than 10% of the Common Stock, file reports of initial ownership of the Company's Common Stock and subsequent changes in that ownership with the Securities and Exchange Commission ("SEC") and

furnish the Company with copies of all forms they file pursuant to Section 16(a). As a practical matter, the Company seeks to assist its directors and officers by monitoring transactions and

completing and filing reports on their behalf.

Based

solely upon a review of the filings with the SEC and written representations from directors and executive officers that no other reports were required, the Company believes that

during fiscal year 2016 all executive officers and directors of the Company filed all required reports on a timely basis.

5

Table of Contents

PROPOSAL 1. ELECTION OF DIRECTORS

The Restated Certificate of Incorporation and the By-Laws of the Company, taken together, provide for a Board consisting of not less than three

or more than 15 directors. Currently, the number of directors of the Company is nine. Randall D. Ledford is not standing for re-election after his term expires at the Annual Meeting. The Company

thanks Mr. Ledford for his dedicated service. Our directors are elected annually. Action will be taken at the Annual Meeting for the re-election of eight directors: Ronald P. Badie, Stanley L.

Clark, David P. Falck, Edward G. Jepsen, Martin H. Loeffler, John R. Lord, R. Adam Norwitt and Diana G. Reardon for a term of one year that will expire at the 2018 Annual Meeting. Action will also be

taken immediately prior to the Annual Meeting to reduce the number of directors from nine to eight effective as of the time of the Annual Meeting. The Board is currently engaged in a search for an

additional independent director, and expects to increase the number of directors back to nine at the time a qualified candidate is identified and appointed to the Board.

It

is intended that the proxies delivered pursuant to this solicitation will be voted in favor of the election of Messrs. Badie, Clark, Falck, Jepsen, Loeffler, Lord, Norwitt and

Ms. Reardon, except in cases of proxies bearing contrary instructions. In the event that any of these nominees should become unavailable for election for any presently unforeseen reason, the

persons named in the proxy will have the right to use their discretion to vote for a substitute.

Certain

information regarding all directors, including individual experience, qualifications, attributes and skills that led the Board to conclude that the director should serve on the

Board is set forth below. The Company's goal is to assemble a Board that works together and with management to deliver long term stockholder value. The Company believes that the nominees and directors

set forth below, each of whom is currently a director of the Company, possess the skills and experience necessary to guide the Company in the best interests of its stockholders. The Company's current

Board consists of individuals with proven records of success in their chosen professions and with the Company. They all have high integrity and keen intellect. They are collegial yet independent in

their thinking, and have demonstrated the willingness to make the time commitment necessary to be informed about the Company and its relevant industry, including its customers, suppliers, competitors,

stockholders and management. Members of the Board also have extensive experience in leadership, the management of public companies, risk assessment, accounting and finance, mergers and acquisitions,

technology and global business practices and operations.

The

following information details offices held and other business directorships of public companies during the past five years of each of the proposed director nominees. Beneficial

ownership of equity securities of the current directors and the proposed director nominees is shown under the caption "Security Ownership of Management" on page 4.

6

Table of Contents

DIRECTOR NOMINEES

|

|

|

|

|

Ronald P. Badie

|

|

Mr. Badie, age 74, has been a Director since 2004. Mr. Badie retired from Deutsche Bank Alex. Brown (now Deutsche Bank Securities) in 2002, at which time he was vice chairman. He also held several executive positions with its predecessor,

Bankers Trust Company. From 2004 to the present, he has acted as a Senior Advisor to Hadley Partners, a firm providing M&A advisory, private placement and financial advisory services. Mr. Badie's extensive experience in the investment

banking industry is extremely valuable to the Company, in particular with respect to his insight into merger & acquisition and capital markets related matters. He is Chairman of the Executive Committee and is a member of the Audit Committee

and the Pension Committee. Mr. Badie currently serves as Director and member of the nominating and corporate governance committee, the compensation committee and the audit committee of Nautilus, Inc. In the past five years, but not

currently, Mr. Badie served as director, chairman of the nominating/corporate governance committee and a member of the compensation and audit committees of Obagi Medical Products, Inc.

|

|

Stanley L. Clark

|

|

Mr. Clark, age 73, has been a Director since 2005. Mr. Clark is Lead Trustee and Senior Advisor of Goodrich, LLC, where he also served as chief executive officer and trustee from 2001 until 2014. This role has provided him excellent

insight into a broad range of markets and investment perspectives as well as financial analysis, which are of particular value in his roles as Chairman of the Pension Committee and as a member of the Audit Committee. He gained significant experience

in general management of a complex manufacturing organization as chief executive officer of Simplex Time Recorder Company from 1998 to 2001 and director from 1996 to 2001, chief operating officer from 1996 to 1998 and group vice president from 1994

to 1996. Prior to working at Simplex Time Recorder Company, he held various positions with Raytheon Company over a period of 17 years, including service as the corporate group vice president for the commercial electronics group and as a director

of New Japan Radio Company, a joint venture between Raytheon Company and Japan Radio. Mr. Clark also served four years in the United States Navy. He brings to the Board international experience as well as an understanding of the aerospace and

defense industry, important markets for the Company. Mr. Clark is Chairman of the Pension Committee and is a member of the Audit Committee and the Compensation Committee.

|

|

David P. Falck

|

|

Mr. Falck, age 64, has been a Director since 2013. Mr. Falck has more than 35 years of experience as a legal advisor to public and private companies. Mr. Falck has been Executive Vice President and General Counsel of Pinnacle

West Capital Corporation and its primary subsidiary, Arizona Public Service Company where he has overseen all facets of the company's legal affairs since 2009. From 2007 to 2009, he was senior vice president, law for New Jersey-based Public Service

Enterprise Group Inc. and served as a member of its executive group. From 1987 to 2007, Mr. Falck was a partner in the New York office of Pillsbury Winthrop Shaw Pittman LLP where he provided strategic advice for a range of clients in

the manufacturing, energy and telecommunications industries in the U.S. and abroad, including the Company. His well developed legal and financial acumen bring great value to the Company, in particular with respect to corporate governance, mergers and

acquisitions, financing, compliance, and legal matters. Mr. Falck is Chairman of the Nominating/Corporate Governance Committee and is a member of the Audit Committee and the Compensation Committee. Mr. Falck also serves as the Board's

Presiding Director.

|

|

|

|

|

7

Table of Contents

|

|

|

|

|

Edward G. Jepsen

|

|

Mr. Jepsen, age 73, has been a Director since 2005. Mr. Jepsen also served as a Director of the Company from 1989 through 1997. Mr. Jepsen has been Chairman and Chief Executive Officer of Coburn Technologies, Inc., a manufacturer

and marketer of lens processing systems and equipment for the ophthalmic industry, since December 2010. Mr. Jepsen was employed as a non-executive Advisor to the Company from 2005 through his retirement in 2006. He was executive vice president

and chief financial officer of the Company from 1989 through 2004. During his time as chief financial officer of the Company, Mr. Jepsen gained a deep familiarity with the operations, markets, technologies and other business matters of the

Company, and in particular a comprehensive understanding of the Company related to accounting, auditing and controls. In addition, Mr. Jepsen brings to the Board significant experience in public accounting and auditing acquired as a partner at

PricewaterhouseCoopers LLP prior to joining the Company. Mr. Jepsen is Chairman of the Audit Committee and is a member of the Nominating/Corporate Governance Committee and Pension Committee. In the past five years, but not currently,

Mr. Jepsen also served as a director and chairman of the audit and finance committee and member of the nominating/corporate governance committee of ITC Holdings Corp.

|

|

Martin H. Loeffler

|

|

Mr. Loeffler, age 72, has been a Director since 1987 and Chairman of the Board since 1997. He had been an employee of the Company for 37 years when he retired in December 2010. He was executive chairman of the Company from 2009 to 2010,

chief executive officer of the Company from 1996 to 2008 and president of the Company from 1987 to 2007. Prior to assuming the position of president, he oversaw the Company's international operations, and prior to that served in general management

and operations roles in several European countries. He has a technology background with a PhD in physics and experience as a researcher in the field of semiconductors. His leadership, market knowledge, technology background, international and other

business experience are of tremendous value to the Company.

|

|

|

|

|

8

Table of Contents

|

|

|

|

|

John R. Lord

|

|

Mr. Lord, age 73, has been a Director since 2004. Mr. Lord served as the non-executive chairman of Carrier Corporation from 2000 through 2006. Mr. Lord was president and chief executive officer of Carrier Corporation, a division of

United Technologies Corporation, from 1995 until his retirement in 2000. Mr. Lord served in a variety of other executive and general management roles at United Technologies between 1975 and 1995. During his more than 25 year career at

United Technologies, Mr. Lord gained significant manufacturing, general management, and global management experience, including spending three years based in Asia, one of the Company's most important regions. He was also very involved in

personnel development at United Technologies, providing him with insight into management development and compensation issues which is of great value to the Company. He is Chairman of the Compensation Committee and is a member of the Executive

Committee and of the Nominating/Corporate Governance Committee.

|

|

R. Adam Norwitt

|

|

Mr. Norwitt, age 47, has been a Director since 2009, and an employee of the Company or its subsidiaries for approximately 18 years. He has been President since 2007 and Chief Executive Officer since 2009. Mr. Norwitt was chief

operating officer of the Company from 2007 through 2008. He was senior vice president and group general manager, worldwide RF and microwave products division of the Company during 2006 and vice president and group general manager, worldwide RF and

microwave products division of the Company from 2004 until 2006. Prior thereto, Mr. Norwitt served as group general manager, general manager and business development manager with various operating groups in the Company, including approximately

five years resident in Asia. Mr. Norwitt has a juris doctor degree and trained as a corporate lawyer prior to joining the Company. He also has an MBA degree. He has studied in the United States, Taiwan, China and France. His vision, leadership,

market knowledge, merger & acquisition experience, international exposure and other business experience are of significant value to the Company.

|

|

Diana G. Reardon

|

|

Ms. Reardon, age 57, has been a Director since 2015, and an employee of the Company for approximately 29 years. In addition to serving the Company as a Director, she continues as an employee, acting as Senior Advisor. She was executive

vice president from 2010 to 2015, senior vice president from 2004 to 2009, and chief financial officer from 2004 to 2015. She was vice president in 2004, controller of the Company from 1994 through 2004 and treasurer of the Company from 1992 through

2004. During her tenure with the Company, Ms. Reardon has been deeply involved with the operations, markets and other business matters of the Company, including the acquisition program during her time as Chief Financial Officer. She has a

comprehensive understanding of the Company including, in particular, its financial, accounting and auditing systems, policies, procedures and controls and growth strategy. Her breadth of knowledge about the Company and its finances are extremely

valuable to the Company. In addition, Ms. Reardon brings to the Board significant experience in public accounting and auditing acquired as a manager at PricewaterhouseCoopers LLP prior to joining the Company.

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR

EACH OF THE

NOMINEES FOR ELECTION TO THE BOARD OF DIRECTORS.

9

Table of Contents

THE BOARD OF DIRECTORS AND THE COMMITTEES OF THE BOARD

Governance Principles

Amphenol Corporation's Corporate Governance Principles meet or exceed the Listing Standards of the New York Stock Exchange (the "NYSE Listing

Standards"), including guidelines for determining director independence and reporting concerns to non-employee directors and the Audit Committee of the Board. The Company's most current Governance

Principles, the Code of Business Conduct and Ethics and the Charters of the Audit Committee, the Compensation Committee and the Nominating/Corporate Governance Committee of the Board are reviewed at

least annually and revised as warranted. Amphenol Corporation's Code of Business Conduct and Ethics applies to all employees, directors and officers of the Company and its subsidiaries. The

principles, code and charters can be accessed via the Company's website at

www.amphenol.com

by clicking on "Investors", then "Governance" then the

desired principles, code or charter. A printed copy of the Company's most current Governance Principles, the Code of Business Conduct and Ethics and the charters of the Audit Committee, the

Compensation Committee and the Nominating/Corporate Governance Committee of the Board will also be provided to any stockholder of the Company free of charge upon written request to the Secretary of

the Company, Amphenol Corporation, 358 Hall Avenue, Wallingford, Connecticut 06492.

Director Independence

The Board has adopted the definition of "independent director" set forth in the NYSE Listing Standards to assist it in making determinations of

independence. In addition to applying these guidelines, the Board will consider all relevant facts and circumstances in making an independence determination. The Board has determined that all of the

directors are independent of the Company and its management with the exception of Mr. Norwitt and Ms. Reardon who are considered inside directors because of their current employment with

the Company.

Leadership Structure

Mr. Loeffler is Chairman of the Board and Mr. Falck is the Board's Presiding Director. As Presiding Director, Mr. Falck has

the authority to call, schedule and chair executive

sessions of the independent directors. After each Board meeting, committee meeting and executive session the Chairman and Presiding Director communicate with the Chief Executive Officer to provide

feedback and to effectuate the decisions and recommendations of the directors.

The

Board of Directors has determined that at the present time, its current leadership structure, including a Presiding Director, a Chairman of the Board who retired from employment with

the Company in 2010 after 37 years of service and a Chief Executive Officer who is an inside director, is appropriate and allows the Board to fulfill its duties effectively and efficiently

based on the Company's current needs. The Presiding Director and independent Chairman of the Board provide a means for the Board to effectively operate independently of the Company's management as

necessary or desirable. This structure also allows the Board to draw upon the skills and extensive experience of a Chairman, who can ensure that the other directors' attention is devoted to the issues

of greatest importance to the Company and its stockholders, while permitting the Chief Executive Officer to continue to set the strategic direction and drive the ongoing business operations and

finances of the Company, all in consultation with the Board of Directors.

10

Table of Contents

Board of Directors Summary Information

The following table sets forth basic information about the current structure of the Board including summary information for the nominees to the

Board.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee Memberships

|

|

|

|

|

|

|

Name

|

|

Director

Tenure

|

|

Independent

|

|

Audit

Committee

|

|

Compensation

Committee

|

|

Executive

Committee

|

|

Nominating/

Corporate

Governance

Committee

|

|

Pension

Committee

|

|

Current Service

on Other

Public Company

Boards

|

|

Board Nominee

at 2017

Annual Meeting

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Martin H. Loeffler

(Chairman)

|

|

Since 1987

|

|

X

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald P. Badie

|

|

Since 2004

|

|

X

|

|

X *

|

|

|

|

Chair

|

|

|

|

X

|

|

Nautilus, Inc.

|

|

Yes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stanley L. Clark

|

|

Since 2005

|

|

X

|

|

X

|

|

X

|

|

|

|

|

|

Chair

|

|

|

|

Yes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David P. Falck

(Presiding Director)

|

|

Since 2013

|

|

X

|

|

X

|

|

X

|

|

|

|

Chair

|

|

|

|

|

|

Yes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Randall D. Ledford

|

|

Since 2015

|

|

X

|

|

|

|

X

|

|

X

|

|

X

|

|

|

|

|

|

No

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Edward G. Jepsen

|

|

1989-1997 Since 2005

|

|

X

|

|

Chair *

|

|

|

|

|

|

X

|

|

X

|

|

|

|

Yes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

John R. Lord

|

|

Since 2004

|

|

X

|

|

|

|

Chair

|

|

X

|

|

X

|

|

|

|

|

|

Yes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. Adam Norwitt

|

|

Since 2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diana G. Reardon

|

|

Since 2015

|

|

|

|

|

|

|

|

|

|

|

|

X

|

|

|

|

Yes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committees

The Board has five standing committees: the Audit Committee, the Compensation Committee, the Executive Committee, the Pension Committee and the

Nominating/Corporate Governance Committee. The Board has determined that all the members of the Audit Committee, the Compensation Committee, the Executive Committee and the Nominating/Corporate

Governance Committee are independent and satisfy the relevant SEC and the New York Stock Exchange independence requirements for the members of such committees. The Board has determined that all

members of the Pension Committee are independent, except for Ms. Reardon.

Audit Committee.

The Audit Committee operates under a written charter adopted by the Board. As described more fully in its

charter, the principal oversight duties of the Audit

Committee include the following: (1) review reports on the evaluation of the Company's internal controls for financial reporting and the Company's annual audited and quarterly unaudited

financial statements and related disclosures therein under "Management's Discussion and Analysis of Financial Condition and Results of Operations"; (2) review the Company's earnings press

releases; (3) select, engage, evaluate and replace, if deemed necessary, the independent auditors and approve all audit engagement fees and terms and pre-approve all permissible tax and other

non-audit services; (4) review the qualifications, performance and independence of the Company's independent auditors; (5) review and approve the scope of the annual audit of the

Company's financial statements; (6) review the scope and coverage of the Company's internal audit plan; (7) review the results of internal audits and the procedures for maintaining

internal controls; (8) review the integrity of the Company's financial reporting processes and the selection and quality of the Company's accounting principles; (9) review critical

accounting principles and practices and applicable legal and regulatory standards and principles and their effect on the financial statements of the Company; (10) review significant audit

issues identified by the Company's internal audit function or the Company's independent auditors and the Company's responses thereto; (11) review accounting adjustments noted or proposed by the

Company's independent auditors, reports on the Company's internal controls, and material written communications with the independent auditors; (12) review and discuss the Company's

11

Table of Contents

guidelines

and policies for risk assessment and management; (13) establish hiring policies for employees of the Company's independent auditors; (14) establish procedures for the receipt,

retention and treatment of employee concerns regarding questionable accounting or auditing matters; and (15) sustain a constructive dialogue with the independent auditors about significant

matters relevant to the audit of

the financial statements of the Company and of internal control over financial reporting. See also "Report of the Audit Committee" on page 22. The members of the Audit Committee are Ronald P.

Badie, Stanley L. Clark, David P. Falck and Edward G. Jepsen (Chairman), each of whom is an independent director as defined under the NYSE Listing Standards. The Board of Directors has determined that

Messrs. Badie and Jepsen are audit committee financial experts as defined by the applicable rules of the SEC and the NYSE Listing Standards, and that each of the members of the Audit Committee

is sufficiently proficient in reading and understanding the Company's financial statements to serve on the Audit Committee.

Compensation Committee.

The Compensation Committee establishes the principles related to the compensation programs of the

Company. It approves compensation guidelines, reviews the role

and performance of executive officers and key management employees of the Company and its subsidiaries, approves the base compensation, incentive plan target and award and the allocation of stock

option awards, if any, for the Chief Executive Officer and reviews and approves the recommendations of the Chief Executive Officer for base compensation and adjustments in base compensation, incentive

plan targets and allocations and stock option awards, if any, for the direct reports to the Chief Executive Officer as well as the Company's other top 20 most highly compensated employees. See also

the "Compensation Discussion and Analysis" on page 25 and the "Compensation Committee Report" on page 36. The Compensation Committee has the authority to retain and solicit the advice of

compensation advisors. The members of the Compensation Committee are Stanley L. Clark, David P. Falck, Randall D. Ledford and John R. Lord (Chairman).

Executive Committee.

The Executive Committee is empowered to exercise the powers and authority of the full Board in the

management of the business and affairs of the Company, subject

at all times to the supervision and control of the full Board. The Board has granted the Executive Committee the broadest authority permitted by the General Corporation Law of the State of Delaware.

The Executive Committee meets as necessary and all actions of the Committee are presented for ratification and approval of the full Board, as necessary and appropriate, at the next regularly scheduled

quarterly meeting of the Board. The members of the Executive Committee are Ronald P. Badie (Chairman), Randall D. Ledford and John R. Lord.

Pension Committee.

The Pension Committee administers the Company's various defined contribution 401(k) plans and U.S.

pension plan. The Pension Committee has oversight

responsibility for funding and investments in the U.S. pension plan and consults with the Chief Financial Officer and the Treasurer of the Company at least annually and with the actuarial consultants

and other advisors and the trustee and investment managers of the assets of the Company's U.S. pension plan as it deems necessary and appropriate. The Pension Committee reviews the liabilities, assets

and investments of the Company's U.S. pension plan as a Committee at least semi-annually. It also ensures there is an appropriate selection of diverse investments for employees of the Company

participating in the various defined contribution 401(k) plans. The members of the Pension Committee are Ronald P. Badie, Stanley L. Clark (Chairman), Edward G. Jepsen and Diana G. Reardon.

Nominating/Corporate Governance Committee.

The Nominating/Corporate Governance Committee's principal duties include the

following: (1) assisting the Board in identifying appropriate individuals

qualified to serve as directors of the Company and evaluating the qualifications of such individuals; (2) selecting, or recommending that the Board select, the candidates for all directorships

to be filled by the Board or by the stockholders; (3) developing and recommending to the Board a set of corporate governance guidelines applicable to the Company; and (4) overseeing and

discussing, as necessary and appropriate, a plan for the continuity and development of senior management of the Company. The

12

Table of Contents

Nominating/Corporate

Governance Committee also oversees the annual evaluation of and the compensation of the Board. The members of the Nominating/Corporate Governance Committee are David P. Falck

(Chairman), Randall D. Ledford, Edward G. Jepsen and John R. Lord.

The

Nominating/Corporate Governance Committee will consider candidates for Board membership suggested by its members and other Board members, as well as by management and stockholders. A

stockholder may recommend any person for consideration as a nominee for director by writing to the Nominating/Corporate Governance Committee of the Board of Directors, c/o Secretary, Amphenol

Corporation, 358 Hall Avenue, Wallingford, CT 06492. Recommendations must be received by December 31, 2017 to be considered for inclusion in the Proxy Statement for the 2018 Annual Meeting of

Stockholders, and must comply with the requirements in the Company's by-laws. Recommendations must include the name and address of the stockholder making the recommendation, a representation that the

stockholder is a holder of record of Common Stock, biographical information about the individual recommended and any other information the stockholder believes would be helpful to the

Nominating/Corporate Governance Committee in its evaluation of the individual being recommended by the stockholder as a nominee for director.

Potential

candidates for the Board will be evaluated by the Nominating/Corporate Governance Committee with reference to the following factors:

-

•

-

character, judgment, personal and professional ethics, integrity and values;

-

•

-

business, financial and/or other applicable experience;

-

•

-

familiarity with national and international issues affecting the Company's business;

-

•

-

depth of experience, skills and knowledge complementary to the Board and the Company's business; and

-

•

-

ability and willingness to devote sufficient time to effectively carry out the duties and responsibilities of a director of the Company.

The

Board believes that an important component of a Board is diversity including not only background, skills, experience, and expertise, but also gender, race and culture. To the extent

used, search firms retained by the Nominating/Corporate Governance Committee to assist in identifying qualified candidates will be specifically advised to seek diverse candidates from traditional and

non-traditional environments, including women and minorities. The Nominating/Corporate Governance Committee may also consider such other relevant factors as it deems appropriate. The Committee will

make a recommendation to the full Board as to any persons it believes should be nominated by the Board, and the Board will determine the nominees after considering the recommendation and report of the

Committee. The process for considering candidates recommended by a stockholder for Board membership will be no different than the process for candidates recommended by members of the

Nominating/Corporate Governance Committee, other members of the Board or management.

The

full Board meets at least annually with the Nominating/Corporate Governance Committee to review and discuss the Nominating/Corporate Governance Committee's self-evaluation including

its performance as measured against the Charter of the Nominating/Corporate Governance Committee and the continuing effectiveness of its Charter as well as the corporate governance guidelines that it

is responsible for developing and recommending to the Board.

Meetings of the Board and Committees

During 2016 there were five formal meetings of the Board and eleven actions taken by unanimous written consent of the Board, six formal meetings

and one action by unanimous written consent of the Audit Committee, two formal meetings and ten actions by unanimous written consent of the Compensation Committee and two formal meetings and one

action by unanimous written consent of the

13

Table of Contents

Pension

Committee. The Executive Committee met informally from time to time in person and via telephone conference calls to discuss several potential transactions and acted on two matters by unanimous

written consent. The Nominating/Corporate Governance Committee had two formal meetings. The Nominating/Corporate Governance Committee also met informally in person and via telephone conference calls

from time to time to discuss, among other things, additions to and potential vacancies on the Board and/or Committees of the Board, potential nominee directors for election, various officer