UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

|

|

|

|

|

| KAR AUCTION SERVICES, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| |

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

| |

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

| |

|

(5) |

|

Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| |

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

| |

|

(3) |

|

Filing Party:

|

| |

|

(4) |

|

Date Filed:

|

Table of Contents

2014 Proxy Statement and

Notice of 2015 Annual Meeting

of Stockholders

Table of Contents

|

|

|

|

|

KAR Auction Services, Inc.

13085 Hamilton Crossing Boulevard

Carmel, In 46032 |

|

|

April 23, 2015 |

|

|

Dear Stockholder: |

|

|

On behalf of the Board of Directors, we cordially invite you to attend KAR Auction Services' annual meeting of stockholders. The meeting will be held on June 3, 2015,

at 9:00 a.m., Eastern Daylight Time, at the Renaissance Indianapolis North Hotel, 11925 North Meridian Street, in Carmel, Indiana 46032. As a KAR Auction Services

stockholder, your vote is important. At the meeting, stockholders will vote on a number of important matters. Even if you are planning to attend the annual meeting in person, you are strongly encouraged to vote your shares through one of the methods

described in the enclosed proxy statement. The Board of Directors would appreciate your support on our recommendations for the following proposals: • Election of the ten nominated directors; and • Ratification of the appointment of KPMG LLP as our independent registered public

accounting firm for 2015. We are pleased to take advantage of the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their

stockholders on the Internet. We believe these rules allow us to provide you with the information you need while lowering the costs of delivery and reducing the environmental impact of our annual meeting. The proxy statement contains instructions on

how you can request a paper copy of the proxy statement and annual report. On behalf of the Board of Directors, I would like to express our appreciation for your continued

support of KAR Auction Services. |

|

|

Regards, |

|

|

|

|

|

James P. Hallett |

|

|

Chairman of the Board and Chief Executive Officer |

This

proxy statement is dated April 23, 2015 and is first being distributed to stockholders on or about April 23, 2015.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

|

Table of Contents

13085 Hamilton Crossing Boulevard

Carmel, Indiana 46032

|

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

|

|

|

|

|

|

|

| Time and Date |

|

9:00 a.m., Eastern Daylight Time, on June 3, 2015 |

|

|

|

|

| Place |

|

Renaissance Indianapolis North Hotel

11925 North Meridian Street

Carmel, Indiana 46032 |

|

|

|

|

| Items of Business |

|

Proposal No. 1: To elect ten directors to the Board of Directors. |

|

|

Proposal No. 2: To ratify the appointment of KPMG LLP as our independent registered public accounting firm for 2015. |

|

|

To transact any other business as may properly come before the meeting or any adjournments or postponements thereof. |

|

|

|

|

| Record Date |

|

You are entitled to vote at the annual meeting and at any adjournments or postponements thereof if you were a stockholder of record at the close of business on April 13, 2015. |

|

|

|

|

| Voting by Proxy |

|

Please submit your proxy card as soon as possible so that your shares can be voted at the annual meeting in accordance with your instructions. For specific instructions on voting, please refer to the

instructions on your enclosed proxy card. |

|

|

|

|

|

|

|

| |

|

On Behalf of the Board of Directors, |

|

|

|

April 23, 2015

Carmel, Indiana |

|

Rebecca C. Polak

Executive Vice President,

General Counsel and Secretary |

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

|

Table of Contents

Notice of Internet Availability of Proxy

Materials for the Annual Meeting

The proxy statement for the annual meeting and the annual report to stockholders for the fiscal year ended December 31, 2014,

each of which is being provided to stockholders prior to or concurrently with this notice, are also available to you electronically via the

Internet. We encourage you to review all of the important information contained in the proxy materials before voting. To view the proxy statement and annual report to stockholders on the Internet,

visit the "Investor Relations" section of our website, under the "Proxy Statement" link at www.karauctionservices.com.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

|

Table of Contents

This

summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you

should read the entire proxy statement before voting. For more complete information regarding the Company's 2014 performance, please review the Company's Annual Report on Form 10-K for the year

ended December 31, 2014.

|

|

2015 ANNUAL MEETING OF STOCKHOLDERS |

|

|

|

|

Date and Time: |

|

9:00 a.m., Eastern Daylight Time, on June 3, 2015

|

| Location: |

|

Renaissance Indianapolis North Hotel, 11925 North Meridian Street, Carmel, Indiana 46032 |

|

Record Date: |

|

April 13, 2015

|

| Voting: |

|

Stockholders of record as of the close of business on the record date are entitled to vote. Each share of common stock is entitled to one vote for each director nominee and for each of the other proposals to be voted on

at the 2015 annual meeting of stockholders. |

|

NYSE Symbol: |

|

KAR

|

| Registrar and Transfer Agent: |

|

American Stock Transfer & Trust Company, LLC |

|

ITEMS TO BE VOTED ON AT 2015

ANNUAL MEETING OF STOCKHOLDERS |

|

|

|

| Proposal |

|

Board of Directors'

Recommendation |

• Election of ten directors (Proposal

No. 1) |

|

FOR |

|

|

|

|

|

Name

|

|

Director Since |

|

Independent |

Todd F. Bourell |

|

— |

|

Yes |

Donna R. Ecton |

|

2013 |

|

Yes |

Peter R. Formanek |

|

2009 |

|

Yes |

James P. Hallett (Chief Executive Officer and Chairman of the Board) |

|

2007 |

|

No |

Mark E. Hill |

|

2014 |

|

Yes |

J. Mark Howell |

|

2014 |

|

Yes |

Lynn Jolliffe |

|

2014 |

|

Yes |

Michael T. Kestner |

|

2013 |

|

Yes |

John P. Larson (Lead Independent Director) |

|

2014 |

|

Yes |

Stephen E. Smith |

|

2013 |

|

Yes |

|

|

|

• Ratification of the appointment of

KPMG LLP as our independent registered public accounting firm for 2015 (Proposal No. 2) |

|

FOR |

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

1

|

Table of Contents

|

|

KAR AUCTION SERVICES HIGHLIGHTS |

Business Highlights

For the year ended December 31, 2014, KAR delivered solid growth in volume of total vehicles sold,

revenues and Adjusted EBITDA. Specific highlights for fiscal 2014 included:

Total vehicles sold for our ADESA, Inc. ("ADESA") and Insurance Auto Auctions, Inc. ("IAA") business segments rose approximately 7% to 3.9 million

units.

Net revenue was up 9% to approximately $2.4 billion.

Adjusted EBITDA* rose over 11% to approximately $599 million.

*Adjusted

EBITDA is a non-GAAP measure and is defined and reconciled to the most comparable GAAP measure, net income (loss), in our Annual Report on Form 10-K for the year ended

December 31, 2014 in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations—EBITDA and Adjusted EBITDA."

Net income increased 150% from $67.7 million ($0.48 per diluted share) to $169.3 million ($1.19 per diluted share).

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

2

|

Table of Contents

We increased our dividend to $0.27 per share and announced a two-year, $300 million share repurchase program.

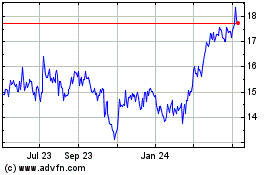

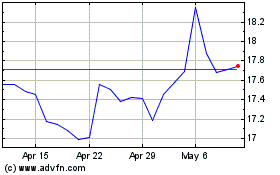

The closing stock price of KAR stock rose over 17% from $29.55 at December 31, 2013 to $34.65 at December 31, 2014. The closing price shown below for each year

is the closing price of a share of KAR Auction Services' common stock on December 31.

Corporate Governance

We are committed to high standards of ethical and business conduct and strong corporate governance practices.

This commitment is highlighted by the practices described below as well as the information contained on our website at www.karauctionservices.com on the "Investor Relations" page under the link

"Corporate Governance":

Annual Elections: Our directors are elected annually for one year terms.

Majority Voting: We maintain a majority voting standard for uncontested director elections with a policy for directors to tender their resignation should a

majority of the votes cast not be in their favor.

Director Independence: Nine of our ten director nominees are independent, and all committees of our Board of Directors are comprised entirely of independent

directors.

Executive Sessions: Our independent directors meet in executive session at regularly scheduled Board of Directors' meetings.

Board Leadership: We have a lead independent director who presides over executive sessions of independent directors and serves as the principal liaison between

the independent directors and the Company's Chief Executive Officer and Chairman of the Board.

Board Diversity: Twenty percent of our Board of Directors is comprised of women.

Board of Directors Risk Oversight: Our Board of Directors provides oversight with respect to risk practices implemented by management, except for the oversight

of risks that have been specifically delegated to a committee of the Board of Directors (in which case the Board of Directors may maintain oversight over such risks through the receipt of reports

from the

committees). The Audit Committee maintains initial oversight over risks related to the integrity of our financial statements; internal controls over financial reporting and disclosure controls and

procedures (including the performance of our internal audit function); the performance of the independent registered public accounting firm; and oversees our responses to ethics issues arising from

our whistleblower hotline. The Compensation Committee maintains oversight over risks related to our compensation practices. The Nominating and Corporate Governance Committee monitors potential risks

relating to the effectiveness of the Board of Directors, notably director succession, composition of the Board of Directors and the principal policies that guide our governance.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

3

|

Table of Contents

Executive Compensation

We maintain a compensation program structured to achieve a close connection between executive pay and company

performance. We believe that this strong pay-for-performance orientation has served us well in recent years, particularly as we've moved forward following the sale by our former equity sponsors of all

of their holdings of our common stock in late 2013. For more information regarding our named executive officer compensation, see "Compensation Discussion and Analysis" and the compensation tables that

follow such section.

- ü

- Pay for

performance alignment: Historically, we have demonstrated close alignment between our total stockholder return (TSR) performance and

the compensation of our Chief Executive Officer, as shown in the chart on page 41.

- ü

- Independent Compensation Committee: All of the members of

our Compensation Committee are independent under NYSE rules.

- ü

- Independent compensation consultants: In 2014, our

Compensation Committee engaged two independent consultants at different points during the year—first, ClearBridge, and then, Semler Brossy.

- ü

- Pay for

performance: The equity awards granted to our named executive officers in 2014 and in 2015 are heavily performance-based, including

restricted stock units that vest based on achievement of total stockholder return, adjusted earnings per share and net income goals.

- ü

- No

dividends or dividend equivalents paid on unvested PRSUs: Dividend equivalents are accrued but not paid on PRSUs until (i) the

performance conditions are satisfied; and (ii) the PRSUs vest after the performance measurement period.

- ü

- Maximum payout caps for annual cash incentive

compensation and PRSUs.

- ü

- Clawback

of certain compensation if restatement and intentional misconduct: In 2014, we adopted a policy providing for the recovery of

incentive compensation in the event we are required to prepare an accounting restatement due to any executive officer's intentional misconduct.

- ü

- No hedging

of KAR securities: In 2014, we adopted a formal policy that prohibits the hedging of Company stock by our directors and officers.

- ü

- No

pledging of KAR securities: As part of our Insider Trading Policy, we prohibit the pledging of Company stock.

- ü

- Moderate

change-in-control benefits: Change-in-control severance benefits are two times base salary and target bonus for the CEO and one times

base salary and target bonus for the executive officers.

- ü

- Limited executive

perquisites.

- ü

-

NEW Robust

equity ownership requirements: In 2015, we adopted stock ownership guidelines that are applicable to non-employee directors and senior executives, including our

named executive officers. The stock ownership guideline for our CEO is 5 times base salary.

- ü

-

NEW Robust

equity retention requirement: In 2015, we adopted an equity retention requirement that is applicable to non-employee directors and senior executives, including

our named executive officers. Our named executive officers are required to hold 100% of net shares of Company stock received under awards granted on or after January 1, 2015 for at least

12 months after vesting, regardless of whether the stock ownership guideline has been met.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

4

|

Table of Contents

13085 Hamilton Crossing Boulevard

Carmel, Indiana 46032

PROXY STATEMENT

|

QUESTIONS AND ANSWERS ABOUT THE PROXY

MATERIALS AND THE ANNUAL MEETING |

|

|

|

|

Q: |

|

Why am I receiving these materials? |

A: |

|

We are providing these proxy materials to you in connection with the solicitation, by the Board of Directors of KAR Auction Services, Inc. (the "Company" or "KAR Auction Services"), of proxies to be voted at the

Company's 2015 annual meeting of stockholders and at any adjournments or postponements thereof. Stockholders are invited to attend the annual meeting to be held on June 3, 2015 beginning at 9:00 a.m., Eastern Daylight Time, at the

Renaissance Indianapolis North Hotel, 11925 North Meridian Street, Carmel, Indiana 46032. Our proxy materials are first being distributed to stockholders on or about April 23, 2015. |

| |

|

|

|

Q: |

|

What proposals will be voted on at the annual meeting? |

A: |

|

There are two proposals scheduled to be voted on at the annual meeting: • To elect ten directors to the Board of Directors; and • To ratify the appointment of KPMG LLP ("KPMG") as our independent registered public accounting firm for 2015. |

| |

|

|

|

Q: |

|

What is the Board of Directors' voting recommendation? |

A: |

|

The Company's Board of Directors recommends that you vote your shares: • "FOR" each of the nominees to the Board of Directors; and • "FOR" the ratification of the appointment

of KPMG as our independent registered public accounting firm for 2015. |

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

5

|

Table of Contents

|

|

|

|

Q: |

|

Who is entitled to vote? |

A: |

|

All shares owned by you as of the record date, which is the close of business on April 13, 2015, may be voted by you. You may cast one vote per share of common stock that you held on the record date. These shares include shares that are: • held directly in your name as the stockholder of record; and •

held for you as the beneficial owner through a broker, bank or other nominee, including shares purchased under the KAR Auction Services, Inc. Employee Stock Purchase Plan (the

"Employee Stock Purchase Plan"). On the record date, KAR Auction Services had 141,800,443 shares of common stock issued and outstanding. |

| |

|

|

|

Q: |

|

What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

A: |

|

Many of our stockholders hold their shares through a broker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially. Stockholder of Record. If your shares are registered directly in your name with the Company's

transfer agent, American Stock Transfer & Trust Company, LLC, you are considered, with respect to those shares, the stockholder of record, and these proxy materials are being sent to you directly by the Company. As the stockholder of

record, you have the right to grant your voting proxy directly to the Company or to vote in person at the annual meeting. You may vote on the Internet, by telephone or by mail, as described below under the heading "How can I vote my shares without

attending the annual meeting?" Beneficial Owner. If your shares are held in a brokerage

account or by a bank or other nominee, you are considered the beneficial owner of shares held in "street name" and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the

stockholder of record. As the beneficial owner, you have the right to direct your broker on how to vote your shares and are also invited to attend the annual meeting. To vote these shares in person at the annual meeting, you must obtain a signed

proxy from the stockholder of record giving you the right to vote the shares. You may also vote by Internet, by telephone or by mail, as described below under "How can I vote my shares without attending the annual meeting?" |

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

6

|

Table of Contents

|

|

|

|

Q: |

|

How can I vote my shares in person at the annual meeting? |

A: |

|

Stockholder of Record. Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. If you choose to vote

your shares in person at the annual meeting, please bring proof of identification. Even if you plan to attend the annual meeting, the Company strongly recommends that you vote your shares in advance as described below so that your vote will be

counted if you later decide not to attend the annual meeting. See "How can I vote my shares without attending the annual meeting?" Beneficial

Owner. Shares held in street name may be voted in person by you only if you obtain an account statement or letter from your bank, broker or other nominee indicating that you are the beneficial

owner of the shares and a legal proxy from the stockholder of record giving you the right to vote the shares. The account statement or letter must show that you were the beneficial owner of shares on April 13, 2015, the record date. |

| |

|

|

|

Q: |

|

How can I vote my shares without attending the annual meeting? |

A: |

|

Whether you hold your shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the annual meeting by voting in one of the following

manners: • Internet. Go to www.proxyvote.com and follow the instructions. You will need the control number included on your proxy card or voting instruction form;

• Telephone. Dial 1-800-690-6903. You will need the control number included on your proxy card or voting instruction form; or • Mail. Complete, date and sign your proxy card or voting instruction card and mail it using the enclosed, pre-paid envelope. If you vote on the Internet or by telephone, you do not need to return your proxy card or voting instruction card. Internet and telephone voting for stockholders will be available 24 hours a day, and will close at 11:59 p.m.,

Eastern Daylight Time, on June 2, 2015. |

| |

|

|

|

Q: |

|

If I am an employee holding shares pursuant to the Employee Stock Purchase Plan, how will my shares be voted? |

A: |

|

Employees holding stock acquired through the Employee Stock Purchase Plan will receive a voting instruction card covering all shares held in their individual account from Computershare, the plan record keeper. The

voting instruction cards have an earlier return date than proxy cards. The record keeper for the Employee Stock Purchase Plan will vote your shares (i) in accordance with the specific instructions on your returned voting instruction card; or

(ii) in its discretion, if you return a signed voting instruction card with no specific voting instructions. |

| |

|

|

|

Q: |

|

What is the quorum requirement for the annual meeting? |

A: |

|

A quorum is necessary to hold the annual meeting. A quorum at the annual meeting exists if the holders of a majority of the Company's capital stock issued and outstanding and entitled to vote at the annual meeting

are present in person or represented by proxy. Abstentions and broker non-votes are counted as present for establishing a quorum. A broker non-vote occurs when a broker does not vote on some matter on the proxy card because the broker does not have

discretionary voting power for that particular item and has not received instructions from the beneficial owner. |

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

7

|

Table of Contents

|

|

|

|

Q: |

|

What happens if I do not give specific voting instructions? |

A: |

|

Stockholder of Record. If you are a stockholder of record and you sign and return a proxy card without giving specific voting instructions, then the proxy

holders will vote your shares in the manner recommended by the Board of Directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a

vote at the annual meeting. Beneficial Owners. If you are a beneficial owner of shares

held in street name and do not provide the organization (e.g., broker or bank) that holds your shares in "street name" with specific voting instructions, the organization that holds your shares may generally vote on routine matters (Proposal

No. 2 (ratification of independent registered public accounting firm)) but cannot vote on non-routine matters (Proposal No. 1 (election of directors)). If the organization that holds your shares does not receive instructions from you on how

to vote your shares on Proposal No. 1, such organization will inform the inspector of election that it does not have the authority to vote on these matters with respect to your shares. This is generally referred to as a "broker non-vote."

Therefore, we urge you to give voting instructions to your broker. Shares represented by such broker non-votes will be counted in determining whether there is a quorum. Because broker non-votes are not considered shares entitled to vote, they will

have no effect on the outcome of any proposal other than reducing the number of shares present in person or by proxy and entitled to vote from which a majority is calculated. |

| |

|

|

|

Q: |

|

Which proposals are considered "routine" or "non-routine?" |

A: |

|

The ratification of the appointment of KPMG as our independent registered public accounting firm for 2015 (Proposal No. 2) is considered a routine matter under applicable rules. A broker or other nominee may generally vote on routine matters,

and therefore no broker non-votes are expected to exist in connection with Proposal No. 2. The election of directors (Proposal No. 1) is considered a non-routine

matter under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposal No. 1. |

| |

|

|

|

Q: |

|

What is the voting requirement to approve each of the proposals? |

A: |

|

Ten director nominees have been nominated for election at the annual meeting. Because this is an uncontested election, the director nominees will be elected by a majority of the votes cast in the election of directors at the annual meeting, either

in person or represented by a properly authorized proxy. This means that a director nominee will be elected to the Company's Board of Directors if the votes cast "FOR" such director nominee exceed the votes cast "AGAINST" him or her. Abstentions and

broker non-votes will have no effect on the outcome of the election of directors. The ratification of the appointment of our independent registered public accounting firm

requires the affirmative vote of a majority of the votes represented at the annual meeting and entitled to vote on the proposal. In accordance with Delaware law, only votes cast "FOR" a matter constitute affirmative votes. A properly executed proxy

marked "ABSTAIN" with respect to the ratification of the appointment of our independent registered public accounting firm will not be voted, although it will be counted for purposes of determining whether there is a quorum. Accordingly, with respect

to Proposal No. 2, abstentions will have the same effect as negative votes or votes "AGAINST" that matter. |

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

8

|

Table of Contents

|

|

|

|

Q: |

|

What does it mean if I receive more than one proxy or voting instruction card? |

A: |

|

It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive. |

| |

|

|

|

Q: |

|

Who will count the vote? |

A: |

|

The votes will be counted by the inspector of election appointed for the annual meeting. |

| |

|

|

|

Q: |

|

Can I revoke my proxy or change my vote? |

A: |

|

Yes. You may revoke your proxy or change your voting instructions at any time prior to the vote at the annual meeting by:

• providing written notice of revocation to the Secretary of the Company at 13085 Hamilton Crossing Boulevard, Carmel, Indiana 46032; • delivering a valid, later-dated proxy or a later-dated vote on the Internet

or by telephone; or

• attending the annual

meeting and voting in person. Please note that your attendance at the annual meeting in person will not cause your previously granted proxy to be revoked unless you vote in

person at the annual meeting to revoke your proxy. If you wish to revoke your proxy, you must do so in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the vote is taken. Shares held in

street name may be voted in person by you at the annual meeting only if you obtain a signed proxy from the record holder giving you the right to vote the shares. |

| |

|

|

|

Q: |

|

Who will bear the cost of soliciting votes for the annual meeting? |

A: |

|

The Board of Directors of the Company is soliciting your proxy to vote your shares of common stock at the annual meeting. KAR Auction Services will pay the entire cost of preparing, assembling, printing, mailing and

distributing these proxy materials. In addition to the distribution of these proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic and facsimile transmission by our directors, officers and

employees, who will not receive any additional compensation for such solicitation activities. The Company also may reimburse brokerage firms and other persons representing beneficial owners of shares of KAR Auction Services' common stock for their

expenses in forwarding solicitation material to such beneficial owners. |

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

9

|

Table of Contents

|

|

|

|

Q: |

|

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? |

A: |

|

The Company has adopted a procedure called "householding" which the Securities and Exchange Commission (the "SEC") has approved. Under this procedure, the Company is delivering a single copy of this proxy statement and the Company's Annual Report to

multiple stockholders who share the same address unless the Company has received contrary instructions from one or more of the stockholders. This procedure reduces the Company's costs. Stockholders who participate in householding will continue to be

able to access and receive separate proxy cards. Upon written or oral request, a separate copy of this proxy statement and the Company's Annual Report will be promptly delivered to any stockholder at a shared address to which the Company delivered a

single copy of any of these documents. If you prefer to receive separate copies of the proxy statement or Annual Report, contact Broadridge Financial Solutions, Inc. by calling 1-800-542-1061 or in writing at 51 Mercedes Way, Edgewood, New York

11717, Attention: Householding Department. In addition, if you currently are a stockholder who shares an address with another stockholder and would like to receive only one

copy of future notices and proxy materials for your household, you may notify your broker if your shares are held in a brokerage account or you may notify us if you hold registered shares. Registered stockholders may notify us by contacting

Broadridge Financial Solutions, Inc. at the above telephone number or address. |

| |

|

|

|

Q: |

|

What is notice and access and why did KAR Auction Services elect to use it? |

A: |

|

We are making the proxy materials available to stockholders electronically via the Internet under the Notice and Access regulations of the SEC. Most of our stockholders will receive a Notice of Electronic

Availability ("Notice") in lieu of receiving a full set of proxy materials in the mail. The Notice includes information on how to access and review the proxy materials, and how to vote, via the Internet. We believe this method of delivery will

decrease costs, expedite distribution of proxy materials to you, and reduce our impact on the environment. Stockholders who receive a Notice but would like to receive a printed copy of the proxy materials in the mail should follow the instructions in

the Notice for requesting such materials. |

| |

|

|

|

Q: |

|

How can I obtain a copy of KAR Auction Services' Annual Report on Form 10-K? |

A: |

|

Copies of the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed with the SEC, are available to stockholders free of charge on KAR Auction Services' website at

www.karauctionservices.com or by writing to KAR Auction Services, Inc., Investor Relations, 13085 Hamilton Crossing Boulevard, Carmel, Indiana 46032. |

| |

|

|

|

Q: |

|

Where can I find the voting results of the annual meeting? |

A: |

|

KAR Auction Services will announce preliminary voting results at the annual meeting and publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the annual

meeting. |

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

10

|

Table of Contents

|

ELECTION OF DIRECTORS:

PROPOSAL NO. 1 |

|

|

DIRECTORS ELECTED ANNUALLY |

Our

Board of Directors has nominated the ten individuals named below to stand for election to the Board of Directors at the annual meeting. Mr. Birtwell, who

currently serves on our Board of Directors, is not standing for re-election at the annual meeting. KAR Auction Services' directors are elected each year by the stockholders at the annual meeting. We

do not have a staggered or classified board. Each director's term will last until the 2016 annual meeting of stockholders and until such director's successor is duly elected and qualified, or such

director's earlier death, resignation or removal. Each director nominee must receive the affirmative vote of a majority of the votes cast in the election of directors at the annual meeting to be

elected (i.e., the number of shares voted "FOR" a director nominee must exceed the number of votes cast "AGAINST" such nominee).

The

Board of Directors is responsible for determining the independence of our directors. Under the NYSE listing standards, a director qualifies as independent if the Board

of Directors affirmatively determines that the director has no material relationship with us. While the focus of the inquiry is independence from management, the Board is required to broadly consider

all relevant facts and circumstances in making an independence determination. Based upon its evaluation, our Board has affirmatively determined that the following directors and director nominees meet

the standards of "independence" established by the NYSE: Ryan M. Birtwell, Todd F. Bourell, Donna R. Ecton, Peter R. Formanek, Mark E. Hill, J. Mark Howell,

Lynn Jolliffe, Michael T. Kestner, John P. Larson and Stephen E. Smith. James P. Hallett, our CEO and Chairman of the Board, is not an independent director.

|

|

BOARD NOMINATIONS AND DIRECTOR NOMINATION PROCESS |

The

Board of Directors is responsible for nominating members for election to the Board of Directors and for filling vacancies on the Board of Directors that may occur

between the annual meetings of stockholders. The Nominating and Corporate Governance Committee is responsible for identifying, screening and recommending candidates to the Board of Directors for board

membership. When formulating its Board of Directors membership recommendations, the Nominating and Corporate Governance Committee may also consider advice and recommendations from others, including

stockholders, as it deems appropriate.

Board

candidates also are selected based upon various criteria including experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability

in light of other commitments, dedication, conflicts of interest and such other relevant factors that the Nominating and Corporate Governance Committee considers appropriate in the context of the

needs of the Board of Directors. Board members are expected to prepare for, attend and participate in all Board of Directors and applicable committee meetings and the Company's annual meetings of

stockholders.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

11

|

Table of Contents

In

accordance with its charter, the Board of Directors also considers candidates for election as a director of the Company recommended by any stockholder, provided that the recommending stockholder

follows the procedures set forth in Section 5 of the Company's Second Amended and Restated By-Laws for nominations by stockholders of persons to serve as directors, including the requirements

of timely notice and certain information to be included in such notice. The Board of Directors generally evaluates such candidates in the same manner by which it evaluates other director candidates

considered by the Board of Directors.

An

employment agreement entered into on February 27, 2012, between the Company and James P. Hallett, the Company's CEO and Chairman of the Board, provides that Mr. Hallett shall be

entitled to serve as a member of the Board of Directors for so long as the employment agreement is in effect.

The

Nominating and Corporate Governance Committee and the Board of Directors believe that diversity along multiple dimensions, including opinions, skills, perspectives,

personal and professional experiences and other differentiating characteristics, is an important element of its nomination recommendations. The Nominating and Corporate Governance Committee has not

identified any specific minimum qualifications which must be met for a person to be considered as a candidate for director. However, Board candidates are selected based upon various criteria including

experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such

other relevant factors that the Nominating and Corporate Governance Committee considers appropriate in the context of the needs of the Board of Directors. Although the Board of Directors does not have

a formal diversity policy, the Nominating and Corporate Governance Committee and Board of Directors review these factors, including diversity, in considering candidates for board membership.

|

INFORMATION REGARDING THE NOMINEES FOR ELECTION TO

THE BOARD OF DIRECTORS |

The

following information is furnished with respect to each nominee for election as a director. Nine of the nominees are currently directors. Each of the nominees has

consented to being named in this proxy statement and to serve as a director if elected. If a nominee is unavailable to serve as a director, your proxies will have the authority and discretion to vote

for another nominee proposed by the Board of Directors, or the Board of Directors may reduce the number of directors to be elected at the annual meeting. The ages of the nominees are as of the date of

the annual meeting, June 3, 2015.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

12

|

Table of Contents

Todd F. Bourell

|

|

|

Independent Director Nominee Age:

45 |

|

Career Highlights

• Managing Partner of WLJ Capital, a public equities investment firm he founded in January 2015. • Partner/Analyst at ValueAct Capital, LLC, a privately held hedge fund, from May 2001

to December 2014. • Global Industry Analyst at

Wellington Management Company, a worldwide private investment management company, from September 2000 to May 2001. •

Partner/Analyst at Peak Investment L.P., a private investment firm, from July 1994 to July 1998. • Served as ValueAct Capital, LLC's representative on the board of directors of several

publicly-traded companies, including Insurance Auto Auctions from October 2003 to May 2005, now a wholly-owned subsidiary of the Company. • Graduate of Harvard College and the University of Pennsylvania (MBA). |

Skills and Qualifications

- ü

- Extensive experience in finance, mergers and acquisitions and investment

management, including experience in evaluating companies' strategies, operations and financial performance.

- ü

- Background provides perspective on institutional investors'

approach to

company performance, capital allocation and corporate governance.

- ü

- Extensive knowledge of IAA's business as a former owner (through ValueAct

Capital) and board member on IAA's board of directors.

- ü

- Public company board experience.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

13

|

Table of Contents

Donna R. Ecton

|

|

|

Independent Director Since December 2013

Age: 68 Board Committee:

Compensation Committee (Chair) |

|

Career Highlights • Chairman and Chief

Executive Officer of EEI Inc., a management consulting firm she founded in July 1998 to provide private equity firms with due diligence and market and operational assessments of companies being considered for acquisition, as well as turnaround

management of troubled portfolio companies. • Director (1994 to 1998) and Chief Operating Officer (1996 to 1998) of PetsMart, Inc. • Chief Executive Officer of a number of companies, including Business Mail Express, Inc. (1995 to 1996), Van Houten North America Inc. and Andes Candies Inc. (1991 to 1994).

• Held senior corporate management positions at

Nutri/System, Inc., Campbell Soup Company and Nordemann Grimm, Inc. • Began career in banking at Chemical Bank and Citibank N.A. in New York City, running the Upper Manhattan middle market lending business and midtown Manhattan's retail banks.

• Previous public company board of director positions have included

Mellon Bank Corporation and Mellon Bank N.A., Mellon PSFS, H&R Block, Inc., Tandy Corporation, Barnes Group Inc. and Vencor, Inc. • Elected to and served on the Harvard University's Board of Overseers.

• Member of the Council on Foreign Relations in New York City.

• Serves on the NYSE Governance Services Advisory

Council. • Graduate of Wellesley College and the

Harvard Graduate School of Business Administration (MBA). Other Current Public Company Directorships: Director of CVR GP,

LLC, the general partner of CVR Partners, LP, a nitrogen fertilizer business, since March 2008. Other Public Company Directorships in Last

Five Years: Former Director and Non-Executive Chairman of the Board of Body Central Corp. (2011 to 2014). |

Skills and Qualifications

- ü

- More than 40 years of operational and management experience,

including as a CEO, with established companies allows Ms. Ecton to provide to our Board of Directors insight into operations, marketing, finance, human resources and strategic planning.

- ü

- Experience in running multiple location businesses not only in the U.S., but

also in Canada, the U.K. and Australia.

- ü

- Significant strategy and risk assessment experience developed in her roles

as a management consultant and as a senior executive of multiple companies.

- ü

- Substantial financial experience gained in her roles as CEO, COO and other

senior executive positions.

- ü

- Current and prior service on the board of directors of public companies,

including several committee chair roles, provides additional perspective to our Board of Directors.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

14

|

Table of Contents

Peter R. Formanek

|

|

|

Independent Director Since December 2009

Age: 71 Board Committee:

Nominating and Corporate Governance Committee |

|

Career Highlights • Active private investor

since 1994. • Co-founder of Autozone, Inc.,

a retailer of auto parts, serving as its President and Chief Operating Officer and a director from 1987 to 1994. •

Served in various roles for Malone & Hyde, a food wholesaler and specialty retailer, from 1969 to 1987. • Began his career as a Woodrow Wilson teaching fellow at the historically black

LeMoyne-Owen College. Serves as a Trustee Emeritus of Lemoyne-Owen College and previously served as a trustee for 28 years.

• Extensive experience serving on boards of publicly traded companies, including former membership on boards of Autozone, Inc., Burger King Holdings, Inc.,

Borders Group, Inc., The Sports Authority, Inc. and Perrigo. • Graduate of University of North Carolina and the Harvard Graduate School of Business Administration (MBA). |

Skills and Qualifications

- ü

- Significant entrepreneurial and operational experience as co-founder and

Chief Operating Officer of Autozone, Inc., one of the largest retailers and distributors of automotive replacement parts and accessories in the United States.

- ü

-

Brings insight on operating a business founded and based on excellent

customer service which is fundamental to the Company's brand and strategy.

- ü

- Substantial financial experience gained in roles at Autozone, Inc.

and Malone & Hyde.

- ü

- Significant knowledge of Company's business and industry; only independent

director nominee who was on our Board of Directors when the Company went public in 2009 which provides historical context.

- ü

- Public company board experience.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

15

|

Table of Contents

James P. Hallett

|

|

|

Director Since April 2007 Age: 62 Chairman of the Board and

CEO |

|

Career Highlights • Chairman of the Company

since December 2014 and Chief Executive Officer since September 2009. • Chief Executive Officer and President of ADESA from April 2007 to September 2009. • President of Columbus Fair Auto Auction, a large independent automobile auction located in Columbus, Ohio, from May 2005 to April 2007.

• After selling his auctions to ADESA in 1996, Mr. Hallett held

various senior executive leadership positions with ADESA between 1996 to 2005, including President and Chief Executive Officer of ADESA. • Founded and owned two automobile auctions in Canada from 1990 to 1996. • Graduate of Algonquin College. • Managed and then owned a number of new car franchise dealerships for 15 years.

• Winner of multiple industry awards, including

NAAA Pioneer of the Year in 2008. • Recognized as

the EY Entrepreneur of the Year 2014 National Services Award Winner and one of Northwood University's 2015 Outstanding Business Leaders. |

Skills and Qualifications

- ü

- Committed and deeply engaged leader with over 20 years of experience

in key leadership roles throughout the Company and over 35 years of experience in the industry.

- ü

- As Chief Executive Officer, Mr. Hallett has a thorough and

in-depth

understanding of the Company's business and industry, including its employees, business units, customers and investors, which provides an additional perspective to our Board of Directors.

- ü

- Utilizes strong communication skills to guide Board discussions and keep our

Board of Directors apprised of significant developments in our business and industry; including our risk management practices, strategic planning and development.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

16

|

Table of Contents

Mark E. Hill

|

|

|

Independent Director Since June 2014 Age: 59 Board Committee:

Nominating and Corporate Governance Committee |

|

Career Highlights • Managing Partner of

Collina Ventures, LLC, a private investment company that invests in software and technology companies, since 2006.

• Co-founder and Chairman of Bluelock, LLC, a privately held infrastructure as a services company, since 2006. • Co-Founder, President and Chief Executive Officer of Baker Hill Corporation, a banking

industry software and services business, from 1985 to 2006. Baker Hill was acquired by Experian, a global information solutions company, in 2005. • Graduate of the University of Notre Dame and Indiana University (MBA). Other Current Public Company Directorships: Lead Independent Director of Interactive Intelligence, a global software business, since

2005. |

Skills and Qualifications

- ü

- Significant executive leadership and management experience leading and

owning a software and technology-based business provides our Board of Directors with expertise in technology, innovation, and strategic investments.

- ü

- Extensive

experience as an investor and mentor to numerous early stage

software and technology companies provides entrepreneurial perspective to the Board.

- ü

- Key leadership experience in numerous business and community service

organizations, including Techpoint, the Central Indiana Community Foundation, the Orr Fellowship and the local Teach for America board.

- ü

- Public company board experience,

including serving as a lead independent

director.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

17

|

Table of Contents

J. Mark Howell

|

|

|

Independent Director Since December 2014

Age: 50 Board Committee:

Audit Committee |

|

Career Highlights • Chief Operating Officer

of Angie's List, Inc., a publicly-traded, United States-based, leading consumer web services business connecting more than three million consumers to highly-rated local service providers via its online marketplace, since March 2013. • President, North America Mobility of Ingram Micro,

Inc., a technology distribution company, from 2012 to 2013. • President, BrightPoint Americas of BrightPoint, Inc., a distributor of mobile devices for phone companies, including Chief Operating Officer, Executive Vice President and Chief Financial

Officer, from 1994 to 2012. BrightPoint, Inc. was sold to Ingram Micro, Inc. in 2012. • Vice President and Corporate Controller of ADESA, Inc. from August 1992 to July 1994. • Audit Staff and Senior Staff at Ernst & Young LLP.

• Graduate of the University of Notre Dame (BBA in

Accounting). |

Skills and Qualifications

- ü

- Extensive senior leadership experience at Internet-based and

technology-driven companies provides valuable insight as an increasing amount of the Company's consigned vehicles are sold online.

- ü

- Provides unique, in-depth knowledge

of ADESA and its industry as a former

employee of ADESA.

- ü

- Substantial financial experience.

- ü

- Certified Public Accountant

with experience in public accounting.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

18

|

Table of Contents

Lynn Jolliffe

|

|

|

Independent Director Since June 2014 Age: 63 Board Committees:

Audit Committee and Compensation Committee |

|

Career Highlights • Executive Vice President,

Global Human Resources of Ingram Micro Inc., a technology distribution company, since June 2007. — Vice President, Human Resources for the North America region from October 2006 to May 2007. — Served as Regional Vice President, Human Resources and Services for Ingram Micro European

Coordination Center from August 1999 to October 2006. • Served in various capacities, including Vice President and Chief Financial Officer with responsibility for human resources, at two Canadian retailers, including Holt Renfrew, from 1985 to 1999. • Graduated from Queens University and University of Toronto (MBA). |

Skills and Qualifications

- ü

- Extensive functional and leadership experience in finance, human resources,

general management.

- ü

- Deep understanding of business drivers from the financial, operational and

people perspective gained from experience in multiple industries across three continents.

- ü

- Diversity in viewpoint and international business experience as she has

lived and worked both in U.S., Canada and abroad.

- ü

- Significant experience with executive compensation decisions and strategies

and policies for the acquisition and development of employee talent.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

19

|

Table of Contents

Michael T. Kestner

|

|

|

Independent Director Since December 2013

Age: 60 Board Committees:

Audit Committee (Chair) |

|

Career Highlights • Chief Financial Officer

of Building Materials Holding Corporation, a building products company, since August 2013. • Partner in FocusCFO, a consulting firm providing part-time CFO services, from April 2012 to August 2013. • Executive Vice President, Chief Financial Officer and a director of Hilite

International Inc., an automotive supplier of powertrain parts, from October 1998 to July 2011. • Chief Financial Officer of Sinter Metals, Inc., a supplier of metal power precision components, from 1995 to 1998. • Served in various capacities at Banc One Capital Partners, Wolfensohn Ventures LP and

as a senior audit manager at KPMG LLP. • Graduated from Southeast Missouri State University. |

Skills and Qualifications

- ü

- Over 20 years as a CFO provides valuable experience and perspective

as Chair of the Audit Committee.

- ü

- Brings experience as the CFO of a large, United States-based company which

includes experience with complex capital structures and related issues.

- ü

- Extensive experience in financial analysis and financial statement

preparation.

- ü

- Management experience in the automotive industry provides him with

additional insight to financial and business matters that are important to the Company.

- ü

- Certified Public Accountant with experience in public accounting.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

20

|

Table of Contents

John P. Larson

|

|

|

Independent Director Since June 2014 Age: 52 Lead Independent Director

Board Committees: Audit Committee and

Compensation Committee |

|

Career Highlights • Chief Executive Officer

of Escort Inc., an automotive electronics manufacturer, from January 2008 to January 2014 and prior to that as President and Chief Operating Officer from June 2007 to January 2008. • Served in a number of capacities at General Motors Company from 1986 to 2007, most

recently serving as General Manager overseeing operations for the Buick, Pontiac and GMC Divisions from January 2005 to May 2007 and as General Director of Finance (CFO) for U.S. Sales, Service and Marketing Operations from 2001 to 2004. • Led General Motors Company's used car remarketing activity

from 1999 to 2000. • Graduated from Northern

Illinois University and Purdue University (M.S., Management). |

Skills and Qualifications

- ü

- Extensive business, management and operational experience as CEO in the

automotive aftermarket and as a senior executive at one of the world's largest automakers, General Motors Company, provides him with perspective into the Company's challenges, operations, and

strategic opportunities.

- ü

- Extensive experience in automotive remarketing, captive finance (GMAC),

rental car program design and automotive dealer activities, as well as an in-depth understanding of the overall automotive business provide him a broad perspective on our industry and key customers.

- ü

- Extensive experience as a senior leader in corporate finance has provided

him with key skills, including financial reporting, accounting and control, business planning and analysis and risk management, that are valuable to the oversight of our business.

- ü

- Strong communication and leadership skills allow Mr. Larson to be an

effective Lead Independent Director and liaison to the other independent directors.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

21

|

Table of Contents

Stephen E. Smith

|

|

|

Independent Director Since December 2013

Age: 66 Board Committees:

Audit Committee and Nominating and Corporate Governance Committee |

|

Career Highlights • Consultant in the

automotive industry since October 2012. • Senior

Vice President, Financial Services of American Honda Finance Corporation, a provider of automobile financing to purchasers, lessees and dealers, from 1985 to October 2012 (including various other positions). • Interim President of the California Council on Economic Education, a not-for-profit

organization that provides training and educational materials to California teachers relating to economics and personal finance, from July 2013 to February 2014. • Graduated from California State University, Northridge. |

Skills and Qualifications

- ü

- Over 25 years of extensive operational and management experience in

the automotive industry with particular insight into the financing and leasing of vehicles.

- ü

- Significant expertise in building and developing consumer and commercial

financial services business, utilizing strategy development, market analysis, problem solving and performance improvement.

- ü

- Considerable financial skill and expertise.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

22

|

Table of Contents

|

|

BOARD OF DIRECTORS STRUCTURE AND CORPORATE GOVERNANCE |

|

|

ROLE OF THE BOARD OF DIRECTORS |

The

Board oversees the Company's Chief Executive Officer and other senior management in the competent and ethical operation of the Company and assures that the long-term

interests of the stockholders are being served. The Company's Corporate Governance Guidelines are available at karauctionservices.com/investor-relations/corporate-governance/guidelines.

Neither

the Company's Second Amended and Restated By-Laws nor the Company's Corporate Governance Guidelines requires that the Company separate the roles of Chairman of the

Board and Chief Executive Officer, and the Board of Directors does not have a policy on whether the same person should serve as both the Chief Executive Officer and Chairman of the Board of Directors,

or if the roles must remain separate. The Board of Directors believes that it should have the flexibility to make these determinations from time to time in the way that it believes best to provide

appropriate leadership for the Company under then-existing circumstances.

At

present, the Board of Directors has chosen to combine the positions of Chief Executive Officer and Chairman of the Board and to appoint a Lead Independent Director. Our Board of Directors believes

that having the same person serve in the roles of Chairman of the Board and Chief Executive Officer is appropriate for the Company at this time, as it fosters clear accountability, effective decision

making and alignment on corporate strategy. Meanwhile, the appointment of a Lead Independent Director ensures that the Company benefits from effective oversight by its independent directors.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

23

|

Table of Contents

In

connection with the appointment of a Lead Independent Director, the Board of Directors adopted a Lead Independent Director Charter, which sets forth a clear mandate and significant authority and

responsibilities, including:

|

|

|

Board Meetings and

Executive Sessions |

|

• The authority to call meetings of the

independent members of the Board. • Presiding at

all meetings of the Board at which the Chairman of the Board is not present, including executive sessions of the independent members of the Board. |

|

|

|

|

|

Communications |

|

• Serves as principal liaison on Board-wide

issues between the independent directors and the Chairman and CEO and facilitates communication generally between and among directors. |

|

|

|

|

|

Agendas |

|

• Reviews, in consultation with the Chairman and

CEO, the agenda for Board meetings. |

|

|

|

|

|

Meeting Schedules |

|

• Reviews, in consultation with the Chairman and

CEO, the meeting schedules to assure there is sufficient time for discussion of all agenda items; reviews, in consultation with the Chairman and CEO, information sent to the Board, including the quality, quantity, appropriateness and timeliness of

such information. |

|

|

|

|

|

Communicating with Stockholders |

|

• If requested by stockholders, ensures that

he/she is available, when appropriate, for consultation and direct communication. |

|

|

|

|

|

Chairman and CEO Performance Evaluation |

|

• Together with the Compensation Committee of

the Board, conducts an annual evaluation of the Chairman and CEO, including an annual evaluation of his or her interactions with the Independent Directors. |

|

|

|

|

|

|

BOARD OF DIRECTORS MEETINGS AND ATTENDANCE |

The

Board of Directors held seven meetings during 2014. All of the incumbent directors attended at least 75% of the meetings of the Board of Directors and Board committees

on which they served during 2014. As stated in our Corporate Governance Guidelines, each director is expected to attend all annual meetings of stockholders. All of our current directors attended last

year's annual meeting of stockholders, in person.

|

|

COMMITTEES OF THE BOARD OF DIRECTORS |

In

2014, the Board of Directors maintained three standing committees: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee.

Each of our committees operates pursuant to a written charter. Copies of the committee charters are available on KAR Auction Services' website at www.karauctionservices.com on the "Investor Relations"

page under the link "Corporate Governance." The information on our website is not part of this proxy statement and is not deemed incorporated by reference into this proxy statement or any other public

filing made with the SEC. A description of each Board committee is set forth below.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

24

|

Table of Contents

Audit Committee

|

|

|

|

|

|

|

Michael T. Kestner

Committee Chair |

|

|

Additional Committee Members: J. Mark Howell, Lynn Jolliffe, John P. Larson and Stephen E. Smith

Other Committee Members in 2014: Robert M. Finlayson served as Chairman for the first half of 2014. Peter R. Formanek and Jonathan P. Ward also served on the Audit

Committee for a portion of 2014. Messrs. Finlayson and Ward completed their directorships as of the date of last year's annual meeting.

Committee Composition Following the Annual Meeting: We expect that the Audit Committee will be comprised of Donna R. Ecton, Lynn Jolliffe, Michael T. Kestner and

Stephen E. Smith, with Mr. Kestner serving as the Chairman.

Meetings Held in 2014: 5

Primary Responsibilities: Our Audit Committee assists the Board of Directors in its oversight of the integrity of our financial statements, our independent

registered public accounting firm's qualifications and independence and the performance of our independent registered public accounting firm. The Audit Committee reviews the audit plans and findings

of our independent registered public accounting firm and our internal audit team and tracks management's corrective action plans where necessary; reviews our financial statements, including any

significant financial items and changes in accounting policies or practices, with our senior management and independent registered public accounting firm; reviews our financial risk and control

procedures, compliance programs and significant tax, legal and regulatory matters; and has the sole discretion to appoint annually our independent registered public accounting firm, evaluate its

independence and performance and set clear hiring policies for employees or former employees of the independent registered public accounting firm.

Independence: Each of Messrs. Kestner, Howell, Larson and Smith and Ms. Jolliffe is "financially literate" under the rules of the NYSE, and each of

Messrs. Kestner, Howell and Larson has been designated as an "audit committee financial expert" as that term is defined by the SEC. In addition, the Board of Directors has determined that each

of the current and former members of the Audit Committee meets, or met during their tenure on the committee, the standards of "independence" established by the NYSE and is "independent" under the

independence standards for audit committee members adopted by the SEC.

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

25

|

Table of Contents

Compensation Committee

|

|

|

|

|

|

|

Donna R. Ecton

Committee Chair |

|

|

Additional Committee Members: Lynn Jolliffe and John P. Larson

Other Committee Members in 2014: Church M. Moore served as Chairman for the first half of 2014. Mr. Moore completed his directorship as of the date of last

year's annual meeting. Peter Formanek served on the Compensation Committee throughout 2014 and as Chairman for the second half of 2014 through March 12, 2015.

Committee Composition Following the Annual Meeting: Following the annual meeting, we expect that the Compensation Committee will be comprised of Donna R. Ecton, J.

Mark Howell, Lynn Jolliffe and John P. Larson, with Ms. Ecton serving as the Chairman.

Meetings Held in 2014: 11

Primary Responsibilities: The Compensation Committee reviews and recommends policies relating to compensation and benefits of our officers and employees. The

Compensation Committee reviews and approves corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these

officers in light of those goals and objectives, and approves the compensation of these officers based on such evaluations. The Compensation Committee also administers the issuance of equity and other

awards under our equity plans.

Independence: All of the current and former members of the Compensation Committee are, or were

during their tenure on the committee, independent under the NYSE rules (including the enhanced independence requirements for Compensation Committee members).

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

26

|

Table of Contents

Nominating and Corporate Governance Committee

|

|

|

|

|

|

|

Ryan M. Birtwell

Committee Chair |

|

|

Additional Committee Members: Peter R. Formanek, Mark E. Hill and Stephen E. Smith

Other Committee Members in 2014: Michael B. Goldberg, Church M. Moore and Jonathan P. Ward served on the Nominating and Corporate Governance Committee during a

portion of 2014. Messrs. Goldberg, Moore and Ward completed their directorships as of the date of last year's annual meeting.

Committee Composition Following the Annual Meeting: Following the annual meeting, we expect that the Nominating and Corporate Governance Committee will be

comprised of Todd F. Bourell, Peter R. Formanek, Mark E. Hill and Stephen E. Smith, with Mr. Hill serving as the Chairman.

Meetings Held in 2014: 3

Primary Responsibilities: The Nominating and Corporate Governance Committee is responsible for making recommendations to the Board of Directors regarding

candidates for directorships and the size and composition of the Board of Directors. In addition, the Nominating and Corporate Governance Committee is responsible for overseeing our Corporate

Governance Guidelines and reporting and making recommendations to the Board of Directors concerning governance matters.

Independence: All of the current and former members of the Nominating and Corporate Governance Committee are, or were during their tenure on the committee,

independent under the NYSE rules.

Board of Directors' Oversight of Risk

Our management is responsible for the management and assessment of risk at the Company, including communication of the most material

risks to the Board of Directors and its committees. The Board of Directors provides oversight with respect to risk practices implemented by management, except for the oversight of risks that have been

specifically delegated to a committee of the Board of Directors. Even when the oversight of a specific area of risk has been delegated to a committee, the Board of Directors may maintain oversight

over such risks through the receipt of reports from the committee chairpersons to the Board of Directors at each regularly scheduled Board of Directors meeting. The Board of Directors and committee

reviews occur principally through the receipt of regular reports from management to the Board of Directors on these areas of risk, and discussions with management regarding risk assessment and risk

management.

At

its regularly scheduled meetings, the Board of Directors generally receives a number of reports which include information relating to risks faced by the Company. The Company's Chief Financial

Officer provides a report on the Company's results of operations, its liquidity position, including an analysis of prospective sources and uses of funds, and the implications to the Company's debt

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

27

|

Table of Contents

covenants

and credit rating, if any. The Chief Executive Officer of each primary business unit provides an operational report, which includes information relating to strategic, operational and

competitive risks. Finally, the Company's General Counsel provides a privileged report which provides information regarding the status of the Company's material litigation and related matters,

including environmental updates and the Company's continuing compliance with applicable laws and regulations. At each regularly scheduled Board of Directors meeting, the Board of Directors also

receives reports from committee chairpersons, which may include a discussion of risks initially overseen by the committees for discussion and input from the Board of Directors. As noted above, in

addition to these regular reports, the Board of Directors receives reports on specific areas of risk from time to time, such as regulatory, cyclical or other risks that are not covered in the regular

reports given to the Board of Directors and described above.

The

Board of Directors' leadership structure, through its committees, also supports its role in risk oversight. The Audit Committee maintains initial oversight over risks related to the integrity of

the Company's financial statements; internal controls over financial reporting and disclosure controls and procedures (including the performance of the Company's internal audit function); the

performance of

the independent registered public accounting firm; and oversees the Company's responses to ethics issues arising from the Company's whistleblower hotline. The Company's Compensation Committee

maintains oversight over risks related to the Company's compensation practices. The Nominating and Corporate Governance Committee monitors potential risks relating to the effectiveness of the Board of

Directors, notably director succession, composition of the Board of Directors and the principal policies that guide the Company's governance.

|

|

CORPORATE GOVERNANCE DOCUMENTS |

The

Board of Directors has adopted the following corporate governance documents:

|

|

|

Document |

|

Purpose/Application |

Code of Business Conduct and Ethics |

|

Applies to all of the Company's employees, officers and directors, including those officers responsible for financial reporting. |

Code of Ethics for Principal Executive and Senior Financial Officers |

|

Applies to the Company's principal executive officer, principal financial and accounting officer and such other persons who are designated by the Board of Directors. |

Corporate Governance Guidelines |

|

Contains general principles regarding the functions of the Board of Directors and its committees. |

Committee Charters |

|

Applies to the following Board committees, as applicable: Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. |

We

expect that any amendments to the codes of ethics, or any waivers of their requirements for executive officers and directors, will be disclosed on the Company's website. The foregoing documents are

available at www.karauctionservices.com under the "Investor Relations" link on the "Corporate Governance" page and in print to any stockholder who requests them. Requests should be made to KAR Auction

Services, Inc., Investor Relations, 13085 Hamilton Crossing Boulevard, Carmel, Indiana 46032. The information on our website is not part of this proxy statement and is not

|

|

KAR AUCTION SERVICES 2015 PROXY STATEMENT

28

|

Table of Contents

deemed

incorporated by reference into this proxy statement or any other public filing made with the SEC.

|

COMPENSATION COMMITTEE INTERLOCKS AND

INSIDER PARTICIPATION |

During

the fiscal year ended December 31, 2014, Messrs. Formanek, Larson and Moore and Mmes. Ecton and Jolliffe served as members of the Compensation

Committee. None of our executive officers serve as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors

or our Compensation Committee. None of the individuals serving as members of the Compensation Committee during 2014 are now or were previously an officer or employee of the Company.

|

|

COMMUNICATIONS WITH THE BOARD OF DIRECTORS |

Any