UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(Rule 14c-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c) of

the Securities Exchange Act of 1934

Check the appropriate box:

x

Preliminary Information Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d) (2))

¨

Definitive Information Statement

Pangaea Logistics Solutions Ltd.

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

x

|

No fee required

|

|

|

|

|

¨

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

¨

|

Fee previously paid with preliminary materials.

|

|

|

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

|

|

PANGAEA LOGISTICS SOLUTIONS LTD.

109 LONG WHARF

NEWPORT, RI 02840

USA

NOTICE OF SHAREHOLDER ACTION BY WRITTEN CONSENT

To our Shareholders:

NOTICE IS HEREBY GIVEN that the Board of Directors (the “

Board

”) of Pangaea Logistics Solutions Ltd., a Bermuda exempted company (the “

Company

”, “

we

”, “

us

” or “

our

”), has approved, and the holders of an excess of a majority of our outstanding common shares, par value $0.0001 per share (the “

Common Stock

”), have executed a written consent in lieu of a special general meeting approving, for purposes of complying with The NASDAQ Stock Market LLC (“

NASDAQ

”) Listing Rule 5635(c), the issuance of shares of our Common Stock to certain directors, officers and employees of the Company, in connection with the entry into a Stock Purchase Agreement dated as of

June 15, 2017

(the “Stock Purchase Agreement”), by and among the Company and the purchasers party thereto. Also on June 15, 2017, the Company entered into another stock purchase agreement with other institutional investors and accredited investors (the “Agreement”, and together with the Stock Purchase Agreement, the “

Agreements

”) (the “

Transaction

”).

The accompanying Information Statement, which describes the above corporate action in more detail, is being furnished to our shareholders for informational purposes only, pursuant to Section 14C of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), and the rules and regulations prescribed thereunder. Under the Companies Act of 1981 of Bermuda (the “

Companies Act

”) and our bye-laws, shareholder action may be taken by written consent without a meeting. The written consent of the holders of a majority of our outstanding Common Stock is sufficient under the Companies Act and our bye-laws to approve the actions described above. Accordingly, the actions described above will not be submitted to our other shareholders for a vote. Pursuant to Rule 14c-2 under the Exchange Act, these corporate actions will not be effected until at least twenty (20) calendar days after the mailing of the Information Statement to our shareholders.

WE ARE NOT ASKING YOU FOR A PROXY OR CONSENT AND YOU ARE REQUESTED NOT

TO SEND US A PROXY OR CONSENT.

We will first mail the Information Statement on or about

June , 2017

to shareholders of record as of

June 15, 2017

. We urge you to read the Information Statement in its entirety for a description of the Transaction, as defined below.

We will ask brokers and other custodians and nominees to forward this Information Statement to the beneficial holders of the Common Stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in connection with forwarding such materials.

|

|

|

|

|

|

June , 2017

|

|

|

|

|

|

|

/s/ Edward Coll

|

|

|

Name: Edward Coll

|

|

|

Title: Chief Executive Officer

|

PANGAEA LOGISTICS SOLUTIONS LTD.

109 LONG WHARF

NEWPORT, RI 02840

USA

INFORMATION STATEMENT

PURSUANT TO SECTION 14C

OF THE SECURITIES EXCHANGE ACT OF 1934

AND RULE 14c-2 THEREUNDER

NO VOTE OR OTHER ACTION OF SHAREHOLDERS IS REQUIRED IN CONNECTION

WITH THIS INFORMATION STATEMENT.

WE ARE NOT ASKING YOU FOR A PROXY OR CONSENT AND YOU ARE REQUESTED NOT

TO SEND US A PROXY OR CONSENT.

Pangaea Logistics Solutions Ltd., a Bermuda exempted company (the “

Company

”, “

we

”, “

us

” or “

our

”) is sending this Information Statement solely for the purpose of informing our shareholders in the manner required under Regulation 14C of the Securities Exchange Act of 1934, as amended (the “

Exchange Act

”), of the actions taken by the holders of a majority of our outstanding common shares, par value $0.0001 per share (the “

Common Stock

”), by written consent in lieu of a special general meeting. No action is requested or required on your part.

What actions were taken by the written consent in lieu of a special general meeting?

Our Board of Directors (the “

Board

”) has approved, and shareholders holding at least a majority of the issued and outstanding shares of our Common Stock have approved, by written consent in lieu of a special general meeting, for purposes of complying with The NASDAQ Stock Market LLC (“

NASDAQ

”) Listing Rule 5635(c), the issuance of shares of our Common Stock to certain directors, officers and employees of the Company, in connection with the entry into a Stock Purchase Agreement dated as of

June 15, 2017

(the "Stock Purchase Agreement"), by and among the Company and the purchasers party thereto. Also on June 15, 2017, the Company entered into another stock purchase agreement with other institutional investors and accredited investors (the “Agreement”, and together with the Stock Purchase Agreement, the “

Agreements

”) (the “

Transaction

”).

Additional information regarding the Transaction is set forth below under “APPROVAL OF THE TRANSACTION”.

We know of no other matters other than those described in this Information Statement that have been recently approved or considered by the holders of our Common Stock.

How many shares were voted for the actions?

The Transaction was approved by our Board on March 21, 2017, and by our shareholders pursuant to action taken by majority written consent, dated

June 15, 2017

(the “

Record Date

”). The approval of the Transaction by written consent of shareholders in lieu of a special general meeting requires the consent of the holders of at least a majority of our outstanding shares of Common Stock as of the Record Date. As of the Record Date,

37,261,739

shares of our Common Stock were issued and outstanding. Each share of our Common Stock is entitled to one vote. The holders of 31,304,961 shares of our Common Stock, representing approximately 84% of the shares of our Common Stock entitled to vote on the Record Date, executed the written consent.

Under the Companies Act of 1981 of Bermuda (the “

Companies Act

”) and our bye-laws, shareholder action may be taken by written consent without a meeting of shareholders. The written consent of the holders of a majority of our outstanding Common Stock is sufficient under the Companies Act and our bye-laws to approve and adopt the Transaction. Consequently, no further shareholder action is required.

Am I entitled to dissenter’s rights?

The Companies Act does not provide for dissenter’s rights for the Transaction.

APPROVAL OF THE TRANSACTION

The Transaction

Our Board and shareholders have approved and we have entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”), dated as of

June 15, 2017

, by and among the Company and the purchasers party thereto, which includes the issuance of shares of our Common Stock, in connection with the entry into the Stock Purchase Agreement, to certain directors, officers and employees of the Company. Also on June 15, 2017, the Company entered into another stock purchase agreement with other institutional investors and accredited investors (the “Agreement”, and together with the Stock Purchase Agreement, the “

Agreements

”) (the “

Transaction

”).

Background and Reason for the Transaction

As previously reported on our Current Report on Form 8-K, filed with the SEC on June 21, 2017, the Company entered into two stock purchase agreements, both dated June 15, 2017 (the “Agreements”) for the sale of approximately $15 million of its Common Stock, which is exempt from the registration requirements of the Securities Act of 1933, as amended (the "Act"), at a purchase price of $2.25 per share. One agreement was completed with certain directors, officers and employess of the Company (the “Insider Investors”) and the other agreement was completed with other institutional and other accredited investors. The Insider Investors include Robert Seward, Neil A. McLaughlin, Gianni Del Signore, Mark Filanowski, Edward Coll, Carl Claus Boggild, Anthony Laura, Crescendo Partners III, L.P. and Jamarant Capital, who in the aggregate held approximately 50% of our outstanding equity prior to entry into the Agreements. The Stock Purchase Agreement provides for the issuance and sale by the Company to the Insider Investors of an aggregate amount of approximately $5.5 million of Common Stock, of which approximately $4.0 million is being issued as in kind payment of accrued dividends (the “Insider Shares”). The shares of Common Stock issued under both Agreements will represent approximately 17% of the Company’s outstanding Common Stock, which will have the effect of diluting our existing shareholders that are not investors as well as any investors that do not purchase a proportionate number of shares of Common Stock pursuant to the Agreements relative to their current holdings to prevent dilution. Upon completion of the Transaction we expect our aggregate issued and outstanding shares of Common Stock to be approximately 43,661,848 shares.

Interests of Certain of the Company’s Directors, Officers and Employees Participating in the Transaction

The Insider Investors will each purchase shares of the Company’s Common Stock. The following table shows the amount of Shares to be purchased by certain of our directors, executive officers and employees in connection with their participation in the Transaction and the amount of “equity compensation” as interpreted under NASDAQ Listing Rule 5635(c) to such directors and executive officers, and the other Company employees, collectively, as a result of such purchase.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Title

|

|

Number of Common

Shares to be Purchased

|

|

|

Aggregate Difference

Between Market Price

and Purchase Price

(1)

|

|

Robert Seward

|

|

|

4,444

|

|

|

|

$

|

2,222.00

|

|

|

Neil A. McLaughlin

|

|

|

22,222

|

|

|

|

|

11,111.00

|

|

|

Gianni DelSignore

|

|

|

22,222

|

|

|

|

|

11,111.00

|

|

|

Mark Filanowski

|

|

|

44,444

|

|

|

|

|

22,222.00

|

|

|

Edward Coll

|

|

|

842,894

|

|

|

|

|

421,447.00

|

|

|

Carl Claus Boggild

|

|

|

842,894

|

|

|

|

|

421,447.00

|

|

|

Anthony Laura

|

|

|

263,101

|

|

|

|

|

131,550.50

|

|

|

Crescendo Partners III, L.P.

|

|

|

355,556

|

|

|

|

|

177,778.00

|

|

|

Jamarant Capital L.P.

|

|

|

66,667

|

|

|

|

|

33,333.50

|

|

|

|

|

|

2,464,444

|

|

|

|

$

|

1,232,222

|

|

|

|

|

|

(1)

|

The Aggregate Difference Between the Market Price and Purchase Price in this column is calculated by multiplying the number of Insider Shares to be purchased by the difference between the purchase price of

$2.25

per share of Common Stock and the closing market price on

June 15, 2017

of

$2.75

per share of Common Stock.

|

SHAREHOLDER VOTE

Authorization By the Board of Directors and the Majority of Shareholders

Under the Companies Act and our bye-laws, shareholder action may be taken by written consent without a meeting. The written consent of the holders of a majority of our outstanding Common Stock is sufficient under the Companies Act and our bye-laws to approve the actions described above. Under the NASDAQ Listing Rules, the Transaction generally requires the affirmative vote or written consent of a majority of the issued and outstanding shares of Common Stock. On the Record Date, the Company was authorized to issue 100,000,000 shares of Common Stock and there were

37,261,739

shares of Common Stock issued and outstanding with the holders thereof being entitled to cast one vote per share.

On March 21, 2017 and

June 15, 2017

, the Board adopted resolutions approving the parameters of the Transaction. In connection with the adoption of these resolutions, the Board had been informed that holders of a majority of our outstanding shares of Common Stock were in favor of this proposal and would enter into a written consent approving the Transaction. On

June 15, 2017

, the holders of a total of 31,304,961 outstanding shares of our Common Stock, representing 84% of our outstanding shares of Common Stock on the Record Date, consented in writing to the Transaction. The following table lists those holders who consented to the Transaction and provides the number of shares beneficially owned and the percentage interest of outstanding shares for each such holder:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned

|

|

|

Name

|

|

|

Number

|

|

|

Percentage

|

|

|

Edward Coll, CEO and Chairman

|

|

|

7,507,077

|

|

|

|

20.15

|

%

|

|

Carl Claus Boggild, Director

|

|

|

7,417,105

|

|

|

|

19.91

|

%

|

|

Anthony Laura, Director

|

|

|

2,335,382

|

|

|

|

6.27

|

%

|

|

Peter Yu

|

|

|

14,045,397

|

|

|

|

37.69

|

%

|

|

|

|

|

31,304,961

|

|

|

|

84.02

|

%

|

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The following table lists, as of the Record Date, the number of shares of our Common Stock beneficially owned by (i) each person or entity known to us to be the beneficial owner of more than 5% of our outstanding Common Stock; (ii) each of our named executive officers and directors; and (iii) all of our officers and directors as a group. Unless otherwise indicated, the address of each person listed below is in the care of Pangaea Logistics Solutions Ltd., 109 Long Wharf, Newport, RI 02840, USA.

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner

|

|

Amount and

Nature of

Beneficial

Ownership

|

|

Approximate

Percentage of

Beneficial

Ownership

(1)

|

|

|

Directors and Executive Officers:

|

|

|

|

|

|

Edward Coll, CEO and Chairman

(2)

41 Sigourney Road

Portsmouth, RI 02871

|

|

7,507,077

|

|

20.15

|

|

%

|

|

Mark L. Filanowski, COO and Director

71 Arrowhead Way

Darien, CT 06820-5507

|

|

80,113

|

|

0.21

|

|

%

|

|

Gianni DelSignore, CFO

257 Wickham Road

North Kingstown, RI 02852

|

|

52,833

|

|

0.14

|

|

%

|

|

Carl Claus Boggild, Director

(3)

c/o Phoenix Bulk Carriers (US) LLC

109 Long Wharf

Newport, RI 02840

|

|

7,417,105

|

|

19.91

|

|

%

|

|

Anthony Laura, Director

2420 NW 53rd Street

Boca Raton, FL 33496

|

|

2,335,382

|

|

6.27

|

|

%

|

|

Peter Yu

(4)

c/o Cartesian Capital Group, LLC

505 Fifth Avenue, 15th Floor

New York, NY 10017

|

|

14,045,397

|

|

37.69

|

|

%

|

|

Richard T. du Moulin, Director

52 Elm Avenue

Larchmont, NY 10538

|

|

74,956

|

|

.20

|

|

%

|

|

Eric S. Rosenfeld

777 Third Ave. 37th Floor

New York, NY 10017

|

|

431,532

|

|

1.16

|

|

%

|

|

David D. Sgro

777 Third Ave. 37th Floor

New York, NY 10017

|

|

156,498

|

|

.42

|

|

%

|

|

Paul Hong

c/o Cartesian Capital Group, LLC

505 Fifth Avenue, 15th Floor

New York, NY 10017

|

|

-

|

|

-

|

|

%

|

|

All Directors and Officers as a Group

|

|

32,100,893

|

|

86.15

|

|

%

|

|

|

|

|

|

|

|

|

Five Percent Holders:

|

|

|

|

|

|

|

Edward Coll

(2)

|

|

7,507,077

|

|

20.15

|

|

%

|

|

Lagoa Investments

(3)

|

|

7,417,105

|

|

19.91

|

|

%

|

|

Peter Yu

(4)

|

|

14,045,397

|

|

37.69

|

|

%

|

|

Pangaea One (Cayman), L.P.

c/o Cartesian Capital Group, LLC

505 Fifth Avenue, 15th Floor

New York, NY 10017

|

|

3,297,254

|

|

9.02

|

|

%

|

|

Pangaea One Parallel Fund, L.P.

c/o Cartesian Capital Group, LLC

505 Fifth Avenue, 15th Floor

New York, NY 10017

|

|

3,081,156

|

|

8.43

|

|

%

|

|

Anthony Laura, Director

|

|

2,335,382

|

|

6.27

|

|

%

|

|

|

|

|

(1)

|

The beneficial ownership of the common shares by the shareholders set forth in the table is determined in accordance with Rule 13d-3 under the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any common shares as to which the shareholder has sole or shared voting power or investment power and also any common shares that the shareholder has the right to acquire within 60 days. The percentage of beneficial ownership

|

is calculated based on 36,590,417 outstanding common shares. Unless otherwise indicated, we believe that all persons named in the table have sole voting and investment power with respect to all common shares beneficially owned by them.

|

|

|

|

(2)

|

Shares owned by Edward Coll include 120,000 common shares held by three irrevocable trusts for the benefit of his children as well as 25,204 open market purchases, all as to which Mr. Coll has sole or shared voting power or investment power. Accordingly, solely for purposes of reporting beneficial ownership of such shares pursuant to Section 13(d) of the Exchange Act, Mr. Coll may be deemed to be the beneficial owner of these shares.

|

|

|

|

|

(3)

|

Shares owned by Lagoa Investments. Mr. Boggild is the Managing Director of Lagoa Investments and solely for purposes of reporting beneficial ownership of such shares pursuant to Section 13(d) of the Exchange Act, Mr. Boggild may be deemed to be the beneficial owner of the shares held by Lagoa Investments.

|

|

|

|

|

(4)

|

Mr. Yu is a principal officer or director of the entity directly or indirectly controlling the general partner of each of Pangaea One Acquisition Holdings XIV, LLC., Pangaea One (Cayman), L.P., Pangaea One Parallel Fund, L.P., Pangaea One Parallel Fund (B), L.P., Leggonly, L.P., Malemod, L.P., Imfinno, L.P., and Nypsun, L.P. (collectively, the “

Pangaea One Entities

”). Accordingly, solely for purposes of reporting beneficial ownership of such shares pursuant to Section 13(d) of the Exchange Act, Mr. Yu may be deemed to be the beneficial owner of the shares held by the Pangaea One Entities.

|

DESCRIPTION OF CAPITAL STOCK

General

Our constitutional documents provide for the issuance of 100,000,000 shares of Common Stock, par value $0.0001, and 1,000,000 preferred shares, par value $0.0001. The number of our outstanding Common Stock is

37,261,739

shares as of

June 15, 2017

.

Common Shares

The holders of our Common Stock will be entitled to one vote for each share held of record on all matters to be voted on by shareholders. There is no cumulative voting with respect to the election of directors, with the result that the holders of more than 50% of the shares voted for the election of directors can elect all of the directors. Holders of our Common Stock will not have any conversion, preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to our Common Stock.

Preferred Shares

The Company’s memorandum of association and amended and restated bye-laws authorized the issuance of 1,000,000 blank check preferred shares with such designations, rights and preferences as may be determined from time to time by the Board. Accordingly, the Board is empowered, without shareholder approval, to issue preferred shares with dividend, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of our Common Stock. In addition, the preferred shares could be utilized as a method of discouraging, delaying or preventing a change in control of the Company.

Dividends

The payment of dividends is entirely within the discretion of the Board and is contingent upon our revenues and earnings, if any, capital requirements and general financial condition subsequent.

Market Listing

Our Common Stock is listed on NASDAQ under the symbol “PANL”.

EXPENSE OF INFORMATION STATEMENT

The expenses of mailing this Information Statement will be borne by us, including expenses in connection with the preparation and mailing of this Information Statement and all documents that now accompany or may after supplement it. It is contemplated that brokerage houses, custodians, nominees, and fiduciaries will be requested to forward the Information Statement to the beneficial owners of our Common Stock held of record by such persons and that we will reimburse them for their reasonable

expenses incurred in connection therewith. Additional copies of this Information Statement may be obtained at no charge by writing to us at: 109 Long Wharf, Newport, RI 02840, USA.

MISCELLANEOUS

One Information Statement will be delivered to multiple shareholders sharing an address unless we receive contrary instructions from one or more of the shareholders sharing such address. Upon receipt of such notice, we will undertake to promptly deliver a separate copy of this Information Statement to the shareholder at the shared address to which a single copy of the Information Statement was delivered and provide instructions as to how the shareholder can notify us that the shareholder wishes to receive a separate copy of this Information Statement or other communications to the shareholder in the future. In the event a shareholder desires to provide us with such notice, it may be given verbally by telephoning our offices at 401-846-7790 or by mail to our address at 109 Long Wharf, Newport, RI 02840, USA.

We file annual, quarterly and current reports, proxy statements, and registration statements with the SEC. These filings are available to the public over the Internet at the SEC’s website at

http://www.sec.gov

. You may also read and copy any document we file with the SEC without charge at the public reference facility maintained by the SEC at 100 F Street, N.E., Washington, D.C. 20549. You may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference facilities.

|

|

|

|

|

|

June , 2017

|

|

|

|

|

|

|

/s/ Edward Coll

|

|

|

Name: Edward Coll

|

|

|

Title: Chief Executive Officer

|

|

|

|

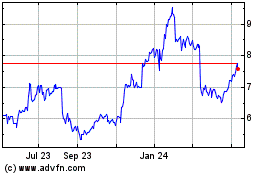

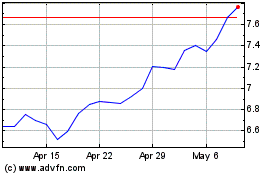

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Apr 2023 to Apr 2024