Prospectus Filed Pursuant to Rule 424(b)(7) (424b7)

June 11 2015 - 5:01PM

Edgar (US Regulatory)

|

|

Filed pursuant to Rule 424(b)(7) |

|

|

Registration Number 333-161633 |

PROSPECTUS SUPPLEMENT NO. 2

(to Prospectus dated October 9, 2009)

12,000,000 Shares

ARRAY BIOPHARMA INC.

COMMON STOCK

The following information amends and supplements information contained in the prospectus, dated October 9, 2009, relating to the offer and sale of up to 12,000,000 shares of our common stock issuable upon the exercise of warrants to purchase shares of common stock by the selling security holder listed in the table on page S-1, including their transferees, pledgees or donees or their respective successors. This prospectus supplement should be read in conjunction with the prospectus, and is qualified by reference to the prospectus, except to the extent that the information that is presented herein supersedes the information contained in the prospectus. This prospectus supplement is not complete without, and may only be delivered or utilized in connection with, the prospectus, including any amendments or supplements thereto.

An investment in our securities involves a high degree of risk. You should carefully consider the “Risk Factors” referenced on page 1 of the prospectus dated October 9, 2009 as well as the information that is incorporated by reference in the prospectus from our most recent annual report on Form 10-K and our other filings made with the Securities and Exchange Commission or that may be contained in any supplements to the prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is June 11, 2015.

SELLING SECURITY HOLDERS

The following information is being provided to update the selling stockholder table in the prospectus to reflect transfers of warrants to purchase up to an aggregate of 12,000,000 shares of our common stock by Deerfield Private Design Fund, L.P., Deerfield Private Design International, L.P., Deerfield Partners, L.P. and Deerfield International Master Fund, L.P. to OTA LLC.

The shares offered by this prospectus supplement may be offered from time to time, in whole or in part, by the selling security holder or its transferees, pledgees or donees or their respective successors. The following table sets forth the name of the selling security holder, the number of shares of common stock the selling security holder beneficially owns prior to this offering, the number of shares which may be offered for resale pursuant to this prospectus and the number of shares and percentage that would be owned by the selling security holder after the completion of this offering. The selling security holder may sell some, all or none of its shares. We do not know how long the selling security holder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling security holder regarding the sale of any of the shares. For purposes of the table below, we have assumed that the selling security holder exercised the warrants in full pursuant to a cash exercise (without giving effect to any limitations on exercise) and sells all of such shares. This table is prepared based on information supplied to us by the selling security holder and reflects holdings as of June 1, 2015.

|

|

|

Shares of

Common Stock |

|

Shares of |

|

Shares of Common Stock |

|

|

|

|

Beneficially |

|

Common Stock |

|

Beneficially Owned After the |

|

|

|

|

Owned Prior to |

|

Being Offered |

|

Offering (1) |

|

|

Selling Security Holder (2) |

|

the Offering |

|

(3) |

|

Shares |

|

Percentage |

|

|

|

|

|

|

|

|

|

|

|

|

|

OTA LLC |

|

— |

|

12,000,000 |

|

12,000,000 |

|

8.46 |

% |

|

(1) |

Calculated pursuant to Rule 13d-3 of the Securities Exchange Act of 1934, as amended. Under Rule 13d-3(d), shares not outstanding which are subject to options, warrants, rights or conversion privileges exercisable within 60 days are deemed outstanding for the purpose of calculating the number and percentage owned by such person, but not deemed outstanding for the purpose of calculating the percentage owned by each other person listed. As of June 1, 2015, we had 141,872,770 shares of common stock outstanding. |

|

|

|

|

(2) |

Ira Leventhal, a senior managing director of the selling shareholder, has voting and investment control over the reported securities. |

|

|

|

|

(3) |

The share amounts shown in this column in the table above represents shares of common stock issuable upon the exercise of warrants. |

S-1

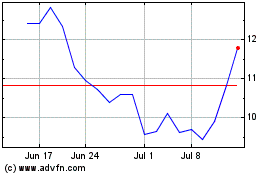

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

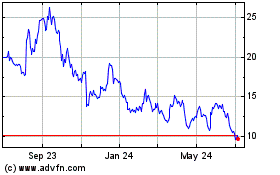

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Apr 2023 to Apr 2024