Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-220800

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount To Be

Registered

|

|

Proposed Maximum

Offering Price Per

Share

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

|

|

|

|

Voting Common Stock, par value $0.0001 per share

|

|

38,000,000

|

|

$1.16

|

|

$44,080,000

|

|

$5,487.96

|

|

|

Table of Contents

PROSPECTUS SUPPLEMENT

(To Prospectus dated October 4, 2017)

38,000,000 Shares

GLOBALSTAR, INC.

VOTING COMMON STOCK, PAR VALUE $0.0001

All of the 38,000,000 shares of voting common stock ("Common Stock") of Globalstar, Inc. are being sold by FL Investment Holdings LLC, an

affiliate of Thermo Capital Partners LLC (the "selling stockholder"). We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholder. The selling

stockholder is controlled by our Chairman and Chief Executive Officer, James Monroe III.

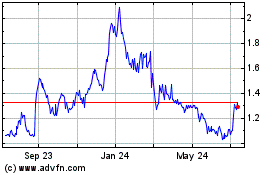

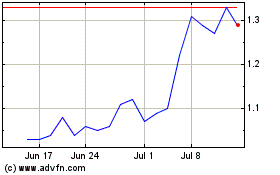

The Common Stock of Globalstar is listed on the New York Stock Exchange American ("NYSE American") under the symbol "GSAT." The last reported sale price of our Common Stock on December 7, 2017

was $1.27 per share.

Investing in our Common Stock involves risks. See the sections entitled "Risk Factors" on page S-4 of this prospectus supplement

and on page 7 of the accompanying prospectus.

The underwriter has agreed to purchase the shares of our Common Stock from the selling stockholder at a price of $1.16 per share, which will result in proceeds

to the selling stockholder, before expenses, of $44,080,000. The underwriter may offer the shares of our Common Stock from time to time in one or more transactions on the NYSE American, in the

over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices. See

"Underwriting."

Neither the U.S. Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this

prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares to purchasers on or about December 12, 2017.

MORGAN STANLEY

December 7, 2017

Table of Contents

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

None of we, the selling stockholder and the underwriter has authorized anyone to provide you with different information or to make any representations other than

those contained or incorporated by reference into this prospectus supplement, the accompanying prospectus or in any free writing prospectus we have prepared. This prospectus supplement and the

accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus supplement and the accompanying prospectus in any

jurisdiction in which it is unlawful to make such offer or solicitation.

You should not assume that the information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

and therein is accurate as of any date other than the date on the front cover of those documents. Our business, financial condition, results of operations and prospects may have changed since that

date.

S-i

Table of Contents

For investors outside the United States: None of we, the selling stockholder and the underwriter has done anything that would permit this offering or possession

or distribution of this prospectus supplement and the accompanying prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform

yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus supplement and the accompanying prospectus outside of the United States.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus, dated October 4, 2017, are part of a registration statement on

Form S-3, which we refer to as the Registration Statement, that we filed with the Securities and Exchange Commission, or the SEC, using the "shelf" registration process, and that was deemed

automatically effective on October 4, 2017. Under this "shelf" registration process, we or one or more selling stockholders may from time to time sell any combination of securities described in

the accompanying prospectus in one or more offerings.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of the offering and also supplements, adds to and updates information

contained in the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The second part is the accompanying prospectus, which provides more general

information, some of which may not apply to the securities offered hereby. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is

a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference

therein, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a

later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the

earlier statement.

This

prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be

filed or will be incorporated by reference as exhibits to the Registration Statement of which this prospectus supplement and the accompanying prospectus are a part, and you may obtain copies of those

documents as described below under the section entitled "Where You Can Find Additional Information."

Unless

stated otherwise, references in this prospectus supplement and the accompanying prospectus to "Globalstar," "we," "us," or "our" refer to Globalstar, Inc., a Delaware

corporation. References to the underwriter mean the underwriter named on the cover of this prospectus supplement.

This

prospectus supplement, the accompanying prospectus, and the information incorporated herein and therein by reference include trademarks, service marks and trade names owned by us or

other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus supplement or the accompanying prospectus are the property of their respective

owners.

Be

aware that any representations, warranties, covenants or similar provisions contained in agreements filed as an exhibit to documents incorporated by reference herein were made solely

for the benefit of the parties to such agreements. In each case, these provisions were specifically negotiated between the parties and, in some cases, are intended chiefly to allocate risk. As such,

you should in no case rely on any such provision in deciding whether to invest, as such provisions speak only as of the date given and do not necessarily reflect the current state of our business or

financial condition.

S-ii

Table of Contents

The

industry and market data contained or incorporated by reference in this prospectus supplement and the accompanying prospectus are based either on our management's own estimates or on

independent industry publications, reports by market research firms or other published independent sources. Although we believe these sources are reliable, we have not independently verified the

information and cannot guarantee its accuracy and completeness, as industry and market data are subject to change and cannot always be verified with complete certainty due to limits on the

availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. Accordingly,

you should be aware that the industry and market data contained or incorporated by reference in this prospectus supplement and the accompanying prospectus, and estimates and beliefs based on such

data, may not be reliable. Unless otherwise indicated, all information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus concerning our industry in

general or any segment thereof, including information regarding our general expectations and market opportunity, is based on management's estimates using internal data, data from industry related

publications, consumer research and marketing studies and other externally obtained data.

You

should read carefully any information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus or any free writing prospectus we may

provide to you in connection with this offering before deciding to invest. Neither we nor the underwriter are making any representation to you regarding the legality of an investment in the securities

by you under applicable law. Neither we nor the underwriter are making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. Persons outside the United States

who come into possession of this prospectus supplement, the accompanying prospectus or any free writing prospectus we may provide must inform themselves about, and observe any restrictions relating

to, the offering of the securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United States.

Neither we nor the underwriter have authorized anyone to provide you with additional or different information. Neither we nor the underwriter are making an offer

of the securities in any state where the offer is not permitted. You should not assume that the information contained in or incorporated by reference in this prospectus supplement or the accompanying

prospectus is accurate as of any date other than the dates of this prospectus supplement or the accompanying prospectus or that any information we have incorporated by reference is accurate as of any

date other than the date of the

document incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since those dates.

S-iii

Table of Contents

THE COMPANY

Overview

Mobile Satellite Services Business

Globalstar, Inc. ("we," "us" or the "Company") provides Mobile Satellite Services ("MSS") including voice and data communications

services globally via satellite. By providing wireless communications services in areas not served or underserved by terrestrial wireless and wireline networks and in circumstances where terrestrial

networks are not operational due to natural or man-made disasters, we seek to meet our customers' increasing desire for connectivity. We offer voice and data communication services over our network of

in-orbit satellites and our active ground stations ("gateways"), which we refer to collectively as the Globalstar System.

We

currently provide the following communications services via satellite. These services are available only with equipment designed to work on our

network:

-

•

-

two-way voice communication and data transmissions ("Duplex") using mobile or fixed devices; and

-

•

-

one-way data transmissions ("Simplex") using a mobile or fixed device that transmits its location and other information to a central monitoring

station, including certain SPOT and Simplex products.

Our

constellation of Low Earth Orbit ("LEO") satellites includes second-generation satellites, which were launched and placed into service during the years 2010 through 2013 after a

$1.1 billion investment, and certain first-generation satellites. We designed our second-generation satellites to last twice as long in space, have 40% greater capacity and be built at a

significantly lower cost compared to our first-generation satellites. We achieved this longer life by increasing the solar array and battery capacity, using a larger fuel tank, adding redundancy for

key satellite equipment, and improving radiation specifications and additional lot level testing for all susceptible electronic components, in order to account for the accumulated dosage of radiation

encountered during a 15-year mission at the operational altitude of the satellites. The second-generation satellites use passive S-band antennas on the body of the spacecraft providing additional

shielding for the active amplifiers which are located inside the spacecraft, unlike the first-generation amplifiers that were located on the outside as part of the active antenna array. Each satellite

has a high degree of on-board subsystem redundancy, an on-board fault detection system and isolation and recovery for safe and quick risk mitigation.

Due

to the specific design of the Globalstar System (and based on customer input), we believe that our voice quality is the best among our peer group. We define a successful level of

service for our customers by their ability to make uninterrupted calls of average duration for a system-wide average number of minutes per month. Our goal is to provide service levels and call success

rates equal to or better than our MSS competitors so our products and services are attractive to potential customers. We define voice quality as the ability to easily hear, recognize and understand

callers with imperceptible delay in the transmission. By this measure, we believe that our system outperforms geostationary ("GEO") satellites used by some of our competitors. Due to the difference in

signal travel distance, GEO satellite signals must travel approximately 42,000 additional nautical miles, which introduces considerable delay and signal degradation to GEO calls. For our competitors

using cross-linked satellite architectures, which require multiple inter-satellite connections to complete a call, signal degradation and delay can result in compromised call quality as compared to

that experienced over the Globalstar System.

We

designed our second-generation ground network, when combined with our second-generation products, to provide our customers with enhanced future services featuring increased data

speeds of up to 256 kbps, with initial services up to 72 kbps, as well as increased capacity. The second-generation ground network is an Internet protocol multimedia subsystem ("IMS") based solution

providing such industry standard services as voice, Internet, email and short message services ("SMS").

S-1

Table of Contents

We

compete aggressively on price. We offer a range of price-competitive products to the industrial, governmental and consumer markets. We expect to retain our position as a

cost-effective, high quality leader in the MSS industry. Our next-generation products under development include Duplex, SPOT and Simplex products, including:

Like

the original Sat-Fi, the next-generation Sat-Fi will be designed to allow smartphones, laptops and tablets with Wi-Fi to connect to the Globalstar network for voice and data services outside

terrestrial network coverage areas, and is expected to be the first product to operate using our second-generation ground infrastructure resulting in higher speeds, enhanced capacity and improved

performance

-

•

-

Two-way SPOT

We

are designing the next SPOT device with a new keyboard functionality to allow subscribers to send and receive SMS messages along with the traditional tracking and SOS functions to continue to

appeal to consumers.

-

•

-

Simplex

Partnering

with existing companies, we are developing IoT-focused Simplex products to connect into existing user bases and accelerate deployment of a Globalstar IoT product suite. We expect the new

solar-powered devices will be designed to support larger and more frequent data transmission capabilities to enable a longer field life than existing devices. The new solar-powered devices are also

expected to take advantage of our network's ability to support over 10 billion transmissions daily assuming an average message size of 90 characters. We are also developing machine-to-machine

("M2M") products that support two-way communications allowing for both tracking and control of assets in our coverage footprint.

Our

satellite communications business, by providing critical mobile communications to our subscribers, serves principally the following markets: recreation and personal; government;

public safety and disaster relief; oil and gas; maritime and fishing; natural resources, mining and forestry; construction; utilities; and transportation. Currently, we believe there are billions of

people who live, work or play in areas not connected by cellular service and over two-thirds of the world's landmass is without reliable connectivity.

Our

products and services are sold through a variety of independent agents, dealers and resellers, and IGOs. We also have distribution relationships with a number of "Big Box" and online

retailers and other similar distribution channels.

Licensed Spectrum Overview

We have access to a world-wide allocation of radio frequency spectrum through the international radio frequency tables administered by the

International Telecommunications Union ("ITU"). In the United States, the Federal Communications Commission ("FCC") has authorized us to operate our first-generation satellites in 25.225 MHz of radio

spectrum comprising two blocks of non-contiguous radio frequencies in the 1.6/2.4 GHz band commonly referred to as the "Big LEO" Spectrum Band. We licensed and registered our second-generation

satellites in France. In March 2011, we obtained all authorizations necessary from the FCC to operate our domestic gateways with our second-generation satellites.

Terrestrial Authority for Globalstar's Licensed 2.4GHz Spectrum

In December 2016, the FCC unanimously adopted a Report and Order permitting us to provide terrestrial broadband services over 11.5 MHz of our

licensed Mobile Satellite Services spectrum at 2483.5 to 2495 MHz, covering a population ("POPs") of approximately 320 million people, representing

S-2

Table of Contents

3.7 billion

MHz POPs. As provided in that Report & Order, we filed applications to modify our existing MSS licenses in April 2017 in order to obtain the terrestrial authorization

permitted in the Report & Order. The FCC placed our applications on public notice in May with a comment cycle that ended in July 2017. In August 2017, the FCC granted Globalstar's MSS license

modification application and granted Globalstar authority to provide terrestrial broadband services over its satellite spectrum. The FCC modified Globalstar's space station authorization to include a

terrestrial low-power network using authorized Big LEO mobile-satellite service spectrum. We will need to comply with certain conditions in order to provide terrestrial broadband service under our MSS

licenses, including obtaining FCC certifications for our equipment that will utilize this spectrum authority. We believe our MSS spectrum position provides potential for harmonized terrestrial

authority across many international regulatory domains. We are seeking similar approvals in various foreign jurisdictions and have applied for licenses in countries serving 375 million

consumers, or approximately 6.2 billion MHz POPs. Additionally, we are working with regulators in countries representing an aggregate population of another approximately 425 million. We

expect this effort to continue for the foreseeable future. In November 2017, the Botswana Communications Regulator Authority has granted terrestrial authority to Globalstar's Botswana subsidiary to

provide terrestrial mobile broadband services over 16.5 MHz of S-band spectrum at 2483.5 to 2500 MHz.

We

expect our terrestrial authority will allow future partners to develop high-density dedicated, small cell deployments using the TD-LTE protocol that eliminates the need for paired

spectrum. Conventional commercial spectrum allocations must meet minimum population coverage requirements, which effectively prohibits the exclusive use of most carrier spectrum for dedicated small

cell. In addition, low frequency carrier spectrum is not physically well suited to high-density small cell topologies, while mmWave spectrum is sub-optimal given range and attenuation limitations. We

believe our license in the 2.4 GHz band, holds physical, regulatory, and ecosystem qualities that distinguish us from other current and anticipated allocations, and is well positioned to balance

favorable range, capacity and attenuation characteristics.

-

•

-

Propagation and Interference—The 2.4 GHz propagation characteristics are favorable for small cell applications, and our FCC license

category provides protection from interference.

-

•

-

Small Cell Exclusivity—We believe our regulatory flexibility will help allow the development of resources exclusively to small cell

applications with dedicated high quality spectrum, which are expected to use low cost device transceivers. Historically, sharing spectrum across both macro and small cell layers introduced

interference limitations that compromise network performance.

-

•

-

Rapid LTE Ecosystem—Our spectrum is compatible with existing chipset architectures.

Our Corporate Information

In 2004, we completed the acquisition of the business and assets of Globalstar, L.P. Thermo Capital Partners LLC, which owns and

operates companies in diverse business sectors and is referred to in this prospectus supplement, together with its affiliates, as "Thermo," became our principal owner in this transaction. Thermo has

invested over $650 million in us since 2004. We were formed as a Delaware limited liability company in November 2003 and were converted into a Delaware corporation in March 2006.

Our

principal executive offices are located at 300 Holiday Square Blvd., Covington, Louisiana 70433 and our telephone number is (985) 335-1500. Our website address is

www.globalstar.com. The information contained in, or that can be accessed through, our website is not part of this prospectus supplement.

S-3

Table of Contents

RISK FACTORS

Investing in our Common Stock involves a high degree of risk. Before you make your investment decision, you should

carefully consider and read carefully all of the following risks as well as the risks and uncertainties described in the section entitled "Risk Factors" beginning on page 7 of the accompanying

prospectus, as well as other risks, uncertainties and information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, as well as the risks described

below. In particular, we urge you to consider carefully the risks and uncertainties discussed in "Part II—Item 1A—Risk Factors" of our Quarterly Reports on

Form 10-Q filed November 2, 2017, as such risk factors may be updated by our annual, quarterly and current reports that we may file with the SEC after the date of this prospectus

supplement and that are incorporated by reference in this prospectus supplement and the accompanying prospectus. The occurrence of any of these risks may cause you to lose all or part of your

investment in the offered securities. However, the selected risks described below and incorporate by reference herein are not the only risks facing us. Additional risks and uncertainties not currently

known to us or those we currently view to be immaterial may also materially and adversely affect our business, financial condition or operating results. In such a case, the trading price of the common

stock could decline and you may lose all or part of your investment in us.

This

prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein also contain forward-looking statements and estimates that involve

risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of specific factors, including the risks and uncertainties

described in the accompanying prospectus and the documents incorporated by reference in this prospectus supplement.

Risk Factors relating to the Offering

None of the proceeds from the sale of our Common Stock in this offering will be available to fund our

operations.

We will not receive any proceeds from the sale of our Common Stock in this offering. The selling stockholder will receive all proceeds from the

sale of shares in this offering. Consequently, none of the proceeds from such sale will be available to fund our operations, capital expenditures or acquisition opportunities or any other purpose. See

"Use of Proceeds" and "Selling Stockholders."

A significant portion of our total outstanding shares are restricted from immediate resale but may be sold

into the market in the near future, which could cause the market price of our Common Stock to drop significantly, even if our business is performing well.

Sales of a substantial number of our Common Stock in the public market could occur at any time. These sales, or the perception in the market

that the holders of a large number of shares intend to sell shares, could reduce the market price of our Common Stock. We had 1,259,238,687 shares of Common Stock outstanding as of December 4,

2017. This includes the shares that the selling stockholder is selling in this offering, which may be resold in the public market immediately without restriction, unless purchased by our affiliates.

Of the remaining shares, shares held by our directors, executive officers and Thermo Capital Partners LLC and its affiliate entities that own stock in us are subject to a contractual lock-up

with the underwriters for this offering for a period of 90 days or 75 days as applicable from the date of this prospectus supplement but the lock-up is subject to certain restrictions.

See "Underwriting." These shares can be sold, subject to any applicable volume limitations under federal securities laws, after the earlier of the expiration of the lock-up period or release from the

lock-up by Morgan Stanley & Co. LLC in its sole discretion. These sales of our Common Stock could cause the market price of our Common Stock to decline. In addition, the market

price of our Common Stock could be further negatively affected by resales of our Common Stock by the underwriter or its affiliates, or other short sales of our Common Stock.

S-4

Table of Contents

If securities analysts do not publish research or reports about our business or if they downgrade our company

or our sector, the price of our Common Stock could decline.

The trading market for our Common Stock depends in part on the research and reports that industry or financial analysts publish about us, our

business and our industry. We do not influence or control the reporting of these analysts. If one or more of the analysts who do cover us downgrade or provide a negative outlook on Globalstar or our

industry, change their views regarding the stock of any of our competitors or other companies in our industry, or publish inaccurate or unfavorable research about our business, the price of our Common

Stock could decline. If one or more of these analysts ceases coverage of Globalstar or fails to publish reports on us regularly, we could lose visibility in the market, which in turn could cause the

price of our Common Stock to decline.

FCC rules and regulations limit ownership by certain non-U.S. persons or by persons with interests in other

media properties.

The acquisition and ownership of our securities, directly or indirectly, by certain non-U.S. persons could cause us to be in violation of the

foreign investment limitations of the Communications Act of 1934, as amended. Separately, under the FCC's media ownership rules, a direct or indirect owner of our securities could violate the FCC's

structural media ownership limitations if that person owned or acquired an "attributable" interest in certain other television stations nationally or in certain types of media properties in the same

market as one or more of our broadcast stations. These restrictions may decrease the liquidity and value of our Common Stock by reducing the pool of potential investors in our company and making the

acquisition of control of us by third parties more difficult. In addition, these restrictions could adversely affect our ability to attract additional equity financing in the future or consummate an

acquisition using shares of our Common Stock.

S-5

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INFORMATION

Certain statements contained in or incorporated by reference into this prospectus supplement and accompanying prospectus, other than purely

historical information, including, but not limited to, estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which

those statements are based, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally are identified by the

words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result," and similar

expressions, although not all forward-looking statements contain these identifying words. These forward-looking statements are based on current expectations and assumptions that are subject to risks

and uncertainties which may cause actual results to differ materially from the forward-looking statements. Forward-looking statements, such as the statements regarding our ability to develop and

expand our business (including our ability to monetize our spectrum rights), our anticipated capital spending, our ability to manage costs, our ability to exploit and respond to technological

innovation, the effects of laws and regulations (including tax laws and regulations) and legal and regulatory changes (including regulation related to the use of our spectrum), the opportunities for

strategic business combinations and the effects of consolidation in our industry on us and our competitors, our anticipated future revenues, our anticipated financial resources, our expectations about

the future operational performance of our satellites (including their projected

operational lives), the expected strength of and growth prospects for our existing customers and the markets that we serve, commercial acceptance of new products, problems relating to the ground-based

facilities operated by us or by independent gateway operators, worldwide economic, geopolitical and business conditions and risks associated with doing business on a global basis and other statements

contained in this prospectus supplement and accompanying prospectus regarding matters that are not historical facts, involve predictions. Risks and uncertainties that could cause or contribute to such

differences include, without limitation, those in the section titled "Risk Factors" of this prospectus supplement.

Discussions

containing these forward-looking statements may be found, among other places, in "Business" and "Management's Discussion and Analysis of Financial Condition and Results of

Operations" incorporated by reference from our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well as any amendments thereto reflected in subsequent

filings with the SEC or in any Current Report on Form 8-K. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. While we believe that we have a reasonable

basis for each forward-looking statement contained in this prospectus supplement, we caution you that these statements are based on a combination of facts and factors currently known by us and our

projections of the future, about which we cannot be certain. As a result of these factors, we cannot assure you that the forward-looking statements in this in this prospectus supplement and the

accompanying prospectus or documents incorporated by reference herein and therein will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may

be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we

will achieve our objectives and plans in any specified time frame, or at all. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this

prospectus supplement. You should read this prospectus supplement, the accompanying prospectus, the registration statement of which this prospectus supplement and the accompanying prospectus is a part

and the documents incorporated by reference herein and therein completely and with the understanding that our actual future results may be materially different from what we expect.

S-6

Table of Contents

The

discussion incorporated by reference into this prospectus supplement of plans to seek approval for spectrum in a future band class are forward-looking, are subject to significant

business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company, and are based upon assumptions with respect to future decisions,

which are subject to change. There is no assurance that the Company will obtain such approval, seek such approval or even initiate the process for such approval. Nothing in this prospectus supplement

should be regarded as a representation that the Company will obtain such approval, seek such approval or even initiate the process for such approval and the Company undertakes no duty to pursue such

approval.

We

undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any

further disclosures we make on related subjects in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, as well as any amendments thereto.

S-7

Table of Contents

USE OF PROCEEDS

The selling stockholder will receive all of the net proceeds from the sale of shares of our Common Stock offered by it pursuant to this

prospectus supplement. We will not receive any proceeds from the sale of these shares of our Common Stock. The selling stockholder will pay the underwriting commissions and discounts and expenses in

connection with the offering.

We

have been informed by the selling stockholder that the sale of the shares of our Common Stock pursuant to this prospectus supplement is made for tax planning purposes.

S-8

Table of Contents

SELLING STOCKHOLDER

The following table sets forth information as of December 4, 2017 with respect to the ownership of our Common Stock by the selling

stockholder. The amounts and percentages of shares beneficially owned are reported on the basis of rules and regulations of the SEC governing the determination of beneficial ownership of securities.

Under SEC rules, a person is deemed to be a "beneficial owner" of a security if that person has or shares voting power or investment power, which

includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire

beneficial ownership within 60 days. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person's ownership percentage, but not for purposes of

computing any other person's percentage. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of

securities as to which such person has no economic interest.

Percentage

computations are based on 1,259,238,687 shares of our Common Stock outstanding as of December 4, 2017.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially

Owned Prior

to Offering

|

|

|

|

Shares Beneficially

Owned After

Offering

|

|

|

|

Number of Shares

Offered Hereby

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

%

|

|

Number

|

|

%

|

|

|

FL Investment Holding LLC

(1)

|

|

|

709,012,217

|

|

|

56.3

|

%

|

|

38,000,000

|

|

|

671,012,217

|

|

|

53.3

|

%

|

-

(1)

-

The

share amounts reflect beneficial ownership of our Common Stock by James Monroe III and his affiliates, as described below. The address of Mr. Monroe, FL

Investment Holdings LLC, Thermo Funding II LLC and Globalstar Satellite, L.P. is 1735 Nineteenth Street, Denver, CO 80202. This number includes 38,640,750 shares held by FL

Investment Holdings LLC, 669,552,909 shares by Thermo Funding II LLC, and 618,558 shares held by Globalstar Satellite, L.P. Under SEC rules, Mr. Monroe also

beneficially owns 200,000 shares issuable pursuant to vested options. Mr. Monroe controls, either directly or indirectly, each of Globalstar Satellite, L.P., FL Investment

Holdings LLC and Thermo Funding II LLC and, therefore, is deemed the beneficial owner of the Common Stock held by these entities.

S-9

Table of Contents

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS

The following is a discussion of material U.S. federal income tax considerations relating to the purchase, ownership and disposition of our

Common Stock by Non-U.S. Holders (as defined below) that purchase such Common Stock pursuant to this offering and hold such Common Stock as a capital asset. This discussion is based on the U.S.

Internal Revenue Code of 1986, as

amended (the "Code"), U.S. Treasury regulations promulgated or proposed thereunder, and administrative and judicial interpretations thereof, all as in effect on the date hereof and all of which are

subject to change, possibly with retroactive effect, or to different interpretation. This discussion does not address all of the U.S. federal income tax considerations that may be relevant to specific

Non-U.S. Holders in light of their particular circumstances or to Non-U.S. Holders subject to special treatment under U.S. federal income tax law (such as banks, insurance companies, dealers in

securities or other Non-U.S. Holders that generally mark their securities to market for U.S. federal income tax purposes, foreign governments, international organizations, tax-exempt entities, certain

former citizens or residents of the United States, or Non-U.S. Holders that hold our Common Stock as part of a straddle, hedge, conversion or other integrated transaction). This discussion does not

address any U.S. state or local or non-U.S. tax considerations or any U.S. federal gift or alternative minimum tax considerations.

As

used in this discussion, the term "Non-U.S. Holder" means a beneficial owner of our Common Stock that, for U.S. federal income tax purposes,

is:

-

•

-

an individual who is neither a citizen nor a resident of the United States;

-

•

-

a corporation (or other entity treated as a corporation) that is not created or organized in or under the laws of the United States, any state

thereof, or the District of Columbia;

-

•

-

an estate that is not subject to U.S. federal income tax on income from non-U.S. sources which is not effectively connected with the conduct of

a trade or business in the United States; or

-

•

-

a trust unless (i) a court within the United States is able to exercise primary supervision over its administration and one or more U.S.

persons have the authority to control all of its substantial decisions or (ii) it has in effect a valid election under applicable U.S. Treasury regulations to be treated as a U.S. person.

If

an entity treated as a partnership for U.S. federal income tax purposes invests in our Common Stock, the U.S. federal income tax considerations relating to such investment will depend

in part upon the status and activities of such entity and the particular partner. Any such entity should consult its own tax advisor regarding the U.S. federal income tax considerations applicable to

it and its partners relating to the purchase, ownership and disposition of our Common Stock.

PERSONS

CONSIDERING AN INVESTMENT IN OUR COMMON STOCK SHOULD CONSULT THEIR OWN TAX ADVISORS REGARDING THE U.S. FEDERAL, STATE AND LOCAL AND NON-U.S. INCOME, ESTATE AND OTHER TAX

CONSIDERATIONS RELATING TO THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK IN LIGHT OF THEIR PARTICULAR CIRCUMSTANCES.

Distributions on Common Stock

If we make a distribution of cash or other property (other than certain

pro rata

distributions

of our Common Stock or rights to acquire our Common Stock) with respect to a share of our Common Stock, the distribution generally will be treated as a dividend to the extent it is paid from our

current or accumulated earnings and profits (as determined under U.S. federal income tax principles). If the amount of such distribution exceeds our current and accumulated earnings and profits, such

excess generally will be treated first as a tax-free return of capital to the extent of the Non-U.S. Holder's adjusted tax basis in such share of our Common Stock (together with a corresponding

reduction in such tax basis), and then as

S-10

Table of Contents

capital

gain (which will be treated in the manner described below under "Sale, Exchange or Other Disposition of Common Stock"). Distributions treated as dividends on our Common Stock that are paid to

or for the account of a Non-U.S. Holder generally will be subject to U.S. federal withholding tax at a rate of 30%, or at a lower rate if provided by an applicable tax treaty and the Non-U.S. Holder

provides the documentation (generally, Internal Revenue Service ("IRS") Form W-8BEN or W-8BEN-E) required to claim benefits under such tax treaty to the applicable withholding agent. Even if

our current or accumulated earnings and profits are less than the amount of the distribution, the applicable withholding agent may elect to treat the entire distribution as a dividend for U.S. federal

withholding tax purposes. Each Non-U.S. Holder should consult its own tax advisor regarding U.S. federal withholding tax on distributions, including such Non-U.S. Holder's eligibility for a lower rate

and the availability of a refund of any excess U.S. federal tax withheld.

If,

however, a dividend is effectively connected with the conduct of a trade or business in the United States by a Non-U.S. Holder, such dividend generally will not be subject to the 30%

U.S. federal withholding tax if such Non-U.S. Holder provides the appropriate documentation (generally, IRS Form W-8ECI) to the applicable withholding agent. Instead, such Non-U.S. Holder

generally will be subject to U.S. federal income tax on such dividend in substantially the same manner as a U.S. person (except as provided by an applicable tax treaty). In addition, a Non-U.S. Holder

that is treated as a corporation for U.S. federal income tax purposes may be subject to a branch profits tax at a rate of 30% (or a lower rate if provided by an applicable tax treaty) on its

effectively connected income for the taxable year, subject to certain adjustments.

The

foregoing discussion is subject to the discussion below under "—FATCA Withholding" and "—Information Reporting and Backup Withholding."

Sale, Exchange or Other Disposition of Common Stock

A Non-U.S. Holder generally will not be subject to U.S. federal income tax on any gain recognized on the sale, exchange or other disposition of

our Common Stock unless:

-

(i)

-

such

gain is effectively connected with the conduct of a trade or business in the United States by such Non-U.S. Holder, in which event such Non-U.S. Holder

generally will be subject to U.S. federal income tax on such gain in substantially the same manner as a U.S. person (except as provided by an applicable tax treaty) and, if it is treated as a

corporation for U.S. federal income tax purposes, may also be subject to a branch profits tax at a rate of 30% (or a lower rate if provided by an applicable tax treaty);

-

(ii)

-

such

Non-U.S. Holder is an individual who is present in the United States for 183 days or more during the taxable year of such sale, exchange or other

disposition and certain other conditions are met, in which event such gain (net of certain U.S. source losses) generally will be subject to U.S. federal income tax at a rate of 30% (except as provided

by an applicable tax treaty); or

-

(iii)

-

we

are or have been a "United States real property holding corporation" for U.S. federal income tax purposes at any time during the shorter of (x) the

five-year period ending on the date of such sale, exchange or other disposition and (y) such Non-U.S. Holder's holding period with respect to such Common Stock, and certain other conditions are

met.

Generally,

a corporation is a "United States real property holding corporation" if the fair market value of its United States real property interests equals or exceeds 50% of the sum of

the fair market value of its worldwide real property interests and its other assets used or held for use in a trade or business (all as determined for U.S. federal income tax purposes). We believe

that we presently are not, and we do not presently anticipate that we will become, a United States real property holding corporation.

The

foregoing discussion is subject to the discussion below under "—FATCA Withholding" and "—Information Reporting and Backup Withholding."

S-11

Table of Contents

FATCA Withholding

Under the Foreign Account Tax Compliance Act provisions of the Code and related U.S. Treasury guidance ("FATCA"), a withholding tax of 30% will

be imposed in certain circumstances on payments of (i) dividends on our Common Stock and (ii) on or after January 1, 2019, gross proceeds from the sale or other disposition of our

Common Stock. In the case of payments made to a "foreign financial institution" (such as a bank, a broker, an investment fund or, in certain cases, a holding company), as a beneficial owner or as an

intermediary, this tax generally will be imposed, subject to certain exceptions, unless such institution (i) has agreed to (and does) comply with the requirements of an agreement with the

United States (an "FFI Agreement") or (ii) is required by (and does comply with) applicable foreign law enacted in connection with an intergovernmental agreement between the United States and a

foreign jurisdiction (an "IGA") to, among other things, collect and provide to the U.S. tax authorities or other relevant tax authorities certain information regarding U.S. account holders of such

institution and, in either case, such institution provides the withholding agent with a certification as to its FATCA status. In the case of payments made to a foreign entity that is not a financial

institution (as a beneficial owner), the tax generally will be imposed, subject to certain exceptions, unless such entity provides the withholding agent with a certification as to its FATCA status

and, in certain cases, identifies any "substantial" U.S. owner (generally, any specified U.S. person that directly or indirectly owns more than a specified percentage of such entity). If our Common

Stock is held through a foreign financial institution that has agreed to comply with the requirements of an FFI Agreement or is subject to similar requirements under applicable foreign law enacted in

connection

with an IGA, such foreign financial institution (or, in certain cases, a person paying amounts to such foreign financial institution) generally will be required, subject to certain exceptions, to

withhold tax on payments made to (i) a person (including an individual) that fails to provide any required information or documentation or (ii) a foreign financial institution that has

not agreed to comply with the requirements of an FFI Agreement and is not subject to similar requirements under applicable foreign law enacted in connection with an IGA. Each Non-U.S. Holder should

consult its own tax advisor regarding the application of FATCA to the ownership and disposition of our Common Stock.

Information Reporting and Backup Withholding

Amounts treated as payments of dividends on our Common Stock paid to a Non-U.S. Holder and the amount of any U.S. federal tax withheld from such

payments generally will be reported annually to the IRS and to such Non-U.S. Holder by the applicable withholding agent.

The

information reporting and backup withholding rules that apply to payments of dividends to certain U.S. persons generally will not apply to payments of dividends on our Common Stock

to a Non-U.S. Holder if such Non-U.S. Holder certifies under penalties of perjury that it is not a U.S. person (generally by providing an IRS Form W-8BEN or W-8BEN-E to the applicable

withholding agent) or otherwise establishes an exemption.

Proceeds

from the sale, exchange or other disposition of our Common Stock by a Non-U.S. Holder effected outside the United States through a non-U.S. office of a non-U.S. broker generally

will not be subject to the information reporting and backup withholding rules that apply to payments to certain U.S. persons, provided that the proceeds are paid to the Non-U.S. Holder outside the

United States. However, proceeds from the sale, exchange or other disposition of our Common Stock by a Non-U.S. Holder effected through a non-U.S. office of a non-U.S. broker with certain specified

U.S. connections or of a U.S. broker generally will be subject to these information reporting rules (but generally not to these backup withholding rules), even if the proceeds are paid to such

Non-U.S. Holder outside the United States, unless such Non-U.S. Holder certifies under penalties of perjury that it is not a U.S. person (generally by providing an IRS Form W-8BEN or W-8BEN-E

to the applicable withholding agent) or otherwise establishes an exemption. Proceeds from the sale, exchange or other disposition of our Common Stock by a Non-U.S. Holder effected through a U.S.

office of a broker generally will be subject to these information reporting and backup withholding rules unless such Non-U.S. Holder certifies under penalties of perjury

S-12

Table of Contents

that

it is not a U.S. person (generally by providing an IRS Form W-8BEN or W-8BEN-E to the applicable withholding agent) or otherwise establishes an exemption.

Backup

withholding is not an additional tax. Any amounts withheld under the backup withholding rules generally will be allowed as a refund or a credit against a Non-U.S. Holder's U.S.

federal income tax liability if the required information is furnished by such Non-U.S. Holder on a timely basis to the IRS.

U.S. Federal Estate Tax

Shares of our Common Stock owned or treated as owned by an individual Non-U.S. Holder at the time of such Non-U.S. Holder's death will be

included in such Non-U.S. Holder's gross estate for U.S. federal estate tax purposes and may be subject to U.S. federal estate tax unless an applicable estate tax treaty provides otherwise.

S-13

Table of Contents

CERTAIN ERISA CONSIDERATIONS

The following is a summary of certain considerations associated with the purchase of our Common Stock by employee benefit plans that are subject

to Title I of ERISA, plans, individual retirement accounts and other arrangements that are subject to Section 4975 of the Code or provisions under any federal, state, local, non-U.S. or other

laws or regulations that are similar to such provisions of ERISA or the Code (collectively, "Similar Laws"), and entities whose underlying assets are considered to include "plan assets" of any such

plan, account or arrangement (each, a "Plan").

General Fiduciary Matters

ERISA and the Code impose certain duties on persons who are fiduciaries of a Plan subject to Title I of ERISA or Section 4975 of the Code

(an "ERISA Plan") and prohibit certain transactions involving the assets of an ERISA Plan and its fiduciaries or other interested parties. Under ERISA and the Code, any person who exercises any

discretionary authority or control over the administration of such an ERISA Plan or the management or disposition of the assets of such an ERISA Plan, or who renders investment advice for a fee or

other compensation to such an ERISA Plan, is generally considered to be a fiduciary of the ERISA Plan.

In

considering an investment in our Common Stock of a portion of the assets of any Plan, a fiduciary should determine whether the investment is in accordance with the documents and

instruments governing the Plan and the applicable provisions of ERISA, the Code or any Similar Law relating to a fiduciary's duties to the Plan including, without limitation, the prudence,

diversification, delegation of control and prohibited transaction provisions of ERISA, the Code and any other applicable Similar Laws.

Prohibited Transaction Issues

Section 406 of ERISA and Section 4975 of the Code prohibit ERISA Plans from engaging in specified transactions involving plan

assets with persons or entities who are "parties in interest," within the meaning of ERISA, or "disqualified persons," within the meaning of Section 4975 of the Code, unless an exemption is

available. A party in interest or disqualified person who engaged in a non-exempt prohibited transaction may be subject to excise taxes and other penalties and liabilities under ERISA and the Code. In

addition, the fiduciary of the ERISA Plan that engaged in such a non-exempt prohibited transaction may be subject to penalties and liabilities under ERISA and the Code. The acquisition and/or holding

of our Common Stock by an ERISA Plan with respect to which we or the underwriter is considered a party in interest or a disqualified person may constitute or result in a direct or indirect prohibited

transaction under Section 406 of ERISA and/or Section 4975 of the Code, unless the investment is acquired and is held in accordance with an applicable statutory, class or individual

prohibited transaction exemption. In this regard, the U.S. Department of Labor has issued prohibited transaction class exemptions, or "PTCEs," that may apply to the acquisition and holding of our

Common Stock. These class exemptions include, without limitation, PTCE 84-14 respecting transactions determined by independent qualified professional asset managers, PTCE 90-1 respecting insurance

company pooled separate accounts, PTCE 91-38 respecting bank collective investment funds, PTCE 95-60 respecting life insurance company general accounts and PTCE 96-23 respecting transactions

determined by in-house asset managers, although there can be no assurance that all of the conditions of any such exemptions will be satisfied.

Because

of the foregoing, our Common Stock should not be purchased or held by any person investing "plan assets" of any Plan, unless such purchase and holding will not constitute a

non-exempt prohibited transaction under ERISA and the Code or similar violation of any applicable Similar Laws.

Representation

Accordingly, by acceptance of our Common Stock, each purchaser and subsequent transferee of our Common Stock will be deemed to have represented

and warranted that either (i) no portion of the assets

S-14

Table of Contents

used

by such purchaser or transferee to acquire and hold our Common Stock constitutes assets of any Plan or (ii) the purchase and holding of our Common Stock by such purchaser or transferee

will not constitute a non-exempt prohibited transaction under Section 406 of ERISA or Section 4975 of the Code or similar violation under any applicable Similar Laws.

Additionally,

if any purchaser or subsequent transferee of our Common Stock is using assets of any ERISA Plan to acquire or hold our Common Stock, such purchaser and subsequent

transferee will be deemed to represent that (i) none of us, the underwriter, and any of our or its affiliates has acted as the ERISA Plan's fiduciary, or has been relied upon for any advice,

with respect to the purchaser or transferee's decision to acquire, hold, sell, exchange, vote or provide any consent with respect to, our Common Stock and none of us, the underwriter, and any of our

or its affiliates shall at any time be relied upon as the ERISA Plan's fiduciary with respect to any decision to acquire, continue to hold, sell, exchange, vote or provide any consent with respect to,

our Common Stock and (ii) the decision to invest in our Common Stock has been made at the recommendation or direction of an "independent fiduciary" ("Independent Fiduciary") within the meaning

of U.S. Code of Federal Regulations 29 C.F.R. Section 2510.3-21(c), as amended from time to time (the "Fiduciary Rule"), who (a) is independent of us and the underwriter;

(b) is capable of evaluating investment risks independently, both in general and with respect to particular transactions and investment strategies (within the meaning of the Fiduciary Rule);

(c) is a fiduciary (under ERISA and/or Section 4975 of the Code) with respect to the purchaser or transferee's investment in our Common Stock and is responsible for exercising

independent judgment in evaluating the investment in our Common Stock; (d) is either (A) a bank as defined in Section 202 of the Investment Advisers Act of 1940, as amended (the

"Advisers Act"), or similar institution that is regulated and supervised and subject to periodic examination by a state or federal agency of the United States; (B) an insurance carrier which is

qualified under the laws of more than one state of the United States to perform the services of managing, acquiring or disposing of assets of such an ERISA Plan; (C) an investment adviser

registered under the Advisers Act or, if not registered as an investment adviser under the Advisers Act by reason of paragraph (1) of Section 203A of the Advisers Act, is

registered as an investment adviser under the laws of the state (referred to in such paragraph (1)) in which it maintains its principal office and place of business; (D) a broker dealer

registered under the Securities Exchange Act of 1934, as amended; and/or (E) an Independent Fiduciary (not described in clauses (A), (B), (C) or (D) above) that holds or

has under management or control total assets of at least $50 million, and will at all times that such purchaser or transferee holds our Common Stock hold or have under management or control

total assets of at least $50 million; and (e) is aware of and acknowledges that (I) none of us, the underwriter and any of our or its affiliates is undertaking to provide

impartial investment advice, or to give advice in a fiduciary capacity, in connection with the purchaser's or transferee's investment in our Common Stock, and (II) we, the underwriter and our

and its affiliates have a financial interest in the purchaser's or transferee's investment in our Common Stock on account of the fees and other remuneration we or they expect to receive in connection

with transactions contemplated hereunder. Notwithstanding the foregoing, any ERISA Plan which is an individual retirement account that is not represented by an Independent Fiduciary shall not be

deemed to have made the representation in clause (ii)(d) above.

The

foregoing discussion is general in nature and is not intended to be all inclusive. Due to the complexity of these rules and the penalties that may be imposed upon persons involved in

non-exempt prohibited transactions, it is particularly important that fiduciaries, or other persons considering purchasing our Common Stock on behalf of, or with the assets of, any Plan, consult with

their counsel regarding the potential applicability of ERISA, Section 4975 of the Code and any Similar Laws to such investment and whether an exemption would be applicable to the purchase and

holding of our Common Stock.

S-15

Table of Contents

UNDERWRITING

Under the terms and subject to the conditions in an underwriting agreement dated the date of this prospectus, the underwriter named below has

agreed to purchase, and the selling stockholder has agreed to sell to it the number of shares indicated below:

|

|

|

|

|

|

|

Underwriter

|

|

Number of Shares

|

|

|

Morgan Stanley & Co. LLC

|

|

|

38,000,000

|

|

The

underwriter is offering the shares of our Common Stock subject to their acceptance of the shares from the selling stockholder. The underwriting agreement provides that the

obligations of the underwriter to pay for and accept delivery of the shares of our Common Stock offered by this prospectus supplement and the accompanying prospectus are subject to the approval of

certain legal matters by its counsel and to certain other conditions. The underwriter is obligated to take and pay for all of the shares of our Common Stock offered by this prospectus supplement if

any such shares are taken. The offering of the shares by the underwriter is subject to receipt and acceptance and subject to the underwriter's right to reject any order in whole or in part.

The

underwriter may offer the shares of Common Stock from time to time for sale in one or more transactions on the NYSE American, in the over-the-counter market, through negotiated

transactions or otherwise at market prices prevailing at the time of sale or at negotiated prices. The underwriter may effect such transactions by selling shares of Common Stock to or through dealers,

and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriter and/or purchasers of shares of Common Stock for whom they may act as agents or to

whom they may sell as principal. The difference between the price at which the underwriter purchases shares and the price at which the underwriter resells such shares may be deemed underwriting

compensation.

The

selling shareholder will pay offering expenses, which are approximately $100,000, and all of the underwriting discounts and commissions. We have agreed to reimburse the underwriter

for expenses relating to clearance of this offering with the Financial Industry Regulatory Authority up to $30,000.

The

underwriter has informed us that it does not intend sales to discretionary accounts to exceed 5% of the total number of shares of our Common Stock offered by it.

Our

Common Stock is listed on the NYSE American under the trading symbol "GSAT."

We,

all our directors and executive officers and Thermo Capital Partners LLC and its affiliated entities that own stock in us (including the selling shareholder) have agreed that,

without the prior written consent of the underwriter, we and they will not, during the period beginning on the date the lock-up agreements were executed and ending 90 days, or, in the case of

the directors (other than James Monroe III and James F. Lynch) and executive officers (other than James Monroe III), 75 days, in each case, after the date of this prospectus supplement (the

"restricted period"):

-

•

-

offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option,

right or warrant to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any shares of Common Stock or any securities convertible into or exercisable or exchangeable for shares

of Common Stock;

-

•

-

enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the

Common Stock; or

-

•

-

publicly disclose the initiation of doing any of the foregoing;

whether

any such transaction described in the first two clauses above is to be settled by delivery of Common Stock or such other securities, in cash or otherwise.

S-16

Table of Contents

We

have also agreed not the file any registration statement with the SEC relating to the offering of any shares of Common Stock or any securities convertible into or exercisable or

exchangeable for shares of Common Stock. In addition, our directors and executive officers have agreed that, without the prior written consent of the underwriter, they will not, during the restricted

period, make any demand for or exercise any right with respect to, the registration of any shares of our Common Stock or any security convertible into or exercisable or exchangeable for our Common

Stock.

The

restrictions described in the immediately preceding paragraph to do not apply to:

-

•

-

the sale of shares of Common Stock pursuant to the underwriting agreement;

-

•

-

transactions relating to shares of Common Stock or other securities acquired in open market transactions after the completion of this offering,

provided that no filing under Section 16(a) of the Exchange Act shall be required or shall be voluntarily made in connection with subsequent sales of Common Stock or other securities acquired

in such open market transactions; or

-

•

-

transfers of shares of Common Stock or any security convertible into Common Stock as a bona fide gift or distributions of shares of Common

Stock or any security convertible into Common Stock to members, limited partners, stockholders or holders of similar equity interests of, or to any other affiliate or entity controlled or managed by,

or under common control or management with, the donor; provided that in the case of any transfer or distribution pursuant to this clause, (i) each donee or distributee shall agree to be bound

by these same restrictions until the expiration of the restricted period and (ii) no filing under Section 16(a) of the Exchange Act or other public announcement, reporting a reduction in

beneficial ownership of shares of Common Stock, shall be required or shall be voluntarily made during the restricted period;

-

•

-

the issuance by the Company of shares of Common Stock upon the exercise of an option or a warrant or the conversion of a security outstanding

on the date of this prospectus supplement of which the underwriter has been advised in writing; or

-

•

-

the establishment of a trading plan pursuant to Rule 10b5-1 under the Exchange Act for the transfer of shares of Common Stock, provided

that (i) such plan does not provide for the transfer of Common Stock during the restricted period and (ii) to the extent a public announcement or filing under the Exchange Act, if any,

is required or voluntarily made regarding the establishment of such plan, such announcement or filing shall include a statement to the effect that no transfer of Common Stock may be made under such

plan during the restricted period.

-

•

-

for certain of our officers only, the transfer of shares of our Common Stock to the Company upon the exercise of options or warrants, on a

"cashless" or "net exercise" basis or to cover tax withholding obligations of the undersigned in connection with such exercise;

provided

that no filing

under Section 16(a) of the Exchange Act or other public announcement shall be required or shall be voluntarily made during the restricted period (other than a filing on Form 4 that

clearly indicates such transfer was made in order to satisfy "cashless," "net exercise" or tax withholding obligations in connection with the exercise of shares of Common Stock).

The

underwriter, in its sole discretion, may release our Common Stock and other securities subject to the lock-up agreements described above in whole or in part at any time with or

without notice.

In

order to facilitate the offering of our Common Stock, the underwriter may engage in transactions that stabilize, maintain or otherwise affect the price of our Common Stock.

Specifically, the underwriter may sell more shares than they are obligated to purchase under the underwriting agreement, creating a short position. The underwriter must close out any short position by

purchasing shares in the open market. A short position is more likely to be created if the underwriter is concerned that there may be downward pressure on the price of our Common Stock in the open

market after pricing that could adversely affect investors who purchase in this offering. As an additional means of facilitating this offering, the underwriter

S-17

Table of Contents

may

bid for, and purchase, shares of our Common Stock in the open market to stabilize the price of our Common Stock. These activities may raise or maintain the market price of our Common Stock above

independent market levels or prevent or retard a decline in the market price of our Common Stock. The underwriter is not required to engage in these activities and may end any of these activities at

any time.

We,

the selling stockholder and the underwriter have agreed to indemnify each other against certain liabilities, including liabilities under the Securities Act.

A

prospectus in electronic format may be made available on websites maintained by the underwriter participating in this offering. The underwriter may agree to allocate a number of shares

of our Common Stock for sale to its online brokerage account holders. Internet distributions will be allocated by the underwriter that may make internet distributions on the same basis as other

allocations.

The

underwriter and its affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking,

financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriter and its affiliates have, from time to time,

performed, and may in the future perform, various financial advisory and investment banking services for us, for which they received or will receive customary fees and expenses.

In

addition, in the ordinary course of its various business activities, the underwriter and its respective affiliates may make or hold a broad array of investments and actively trade

debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for its own account and for the accounts of its customers and may at any time hold long

and short positions in such securities and instruments. Such investment and securities activities may involve our securities and instruments. The underwriter and its affiliates may also make

investment recommendations or publish or express independent research views in respect of such securities or instruments and may at any time hold, or recommend to clients that they acquire, long or

short positions in such securities and instruments.

Selling Restrictions

European Economic Area

This prospectus supplement and the accompanying prospectus have been prepared on the basis that any offer of shares of our Common Stock in any

Member State of the European Economic Area which has implemented the Prospectus Directive (each, a "Relevant Member State") will be made pursuant to an exemption under the Prospectus Directive from

the requirement to publish a prospectus for offers of shares of our Common Stock. Accordingly, any person making or intending to make an offer in that Relevant Member State of shares of our Common

Stock which are the subject of the offering contemplated in this prospectus supplement or the accompanying prospectus may only do so (i) in circumstances in which no obligation arises for us or

the underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive in relation to such offer. Neither we nor the underwriter have authorized, nor do we or they authorize,

the making of any offer of shares of our Common Stock in circumstances in which an obligation arises for us or the underwriter to publish a prospectus for such offer. The expression "Prospectus

Directive" means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing

measure in the Relevant Member State and the expression "2010 PD Amending Directive" means Directive 2010/73/EU.

In

relation to each Relevant Member State, the underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in

that Relevant Member State (the "Relevant Implementation Date") it has not made and will not make an offer of shares of our Common Stock which are the subject of the offering contemplated by this

prospectus supplement to the public in that Relevant Member State, except that it may, with effect from and including the Relevant

S-18

Table of Contents

Implementation

Date, make an offer of such shares of our Common Stock to the public in that Relevant Member State:

-

(a)

-

to

any legal entity which is a qualified investor as defined in the Prospectus Directive;

-

(b)

-

to

fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), as permitted under the Prospectus Directive,

subject to obtaining the prior consent of the representatives for any such offer; or

-

(c)

-

in

any other circumstances falling within Article 3(2) of the Prospectus Directive,

provided

that no such offer of shares of our Common Stock shall result in a requirement for the publication by us or the underwriter of a prospectus pursuant to Article 3 of the Prospectus

Directive.

Each

person in a Relevant Member State who receives any communication in respect of, or who acquires any shares of our Common Stock under, the offers to the public contemplated in this

prospectus supplement will be deemed to have represented, warranted and agreed to and with the underwriter that:

-

(a)

-

it

is a qualified investor within the meaning of the law in that Relevant Member State implementing Article 2(1)(e) of the Prospectus Directive; and

-

(b)

-

in

the case of any shares of our Common Stock acquired by it as a financial intermediary, as that term is used in Article 3(2) of the Prospectus Directive,