|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

(To the Prospectus dated September 23, 2016)

|

Registration No. 333-213777

|

Series A Convertible Preferred Stock

Class D-1 Warrants to Purchase Shares

of Common Stock

Pursuant to this prospectus

supplement and the accompanying prospectus, Northwest Biotherapeutics, Inc. (the “Company,” “we” or “us”)

is offering (the “Series A Preferred Offering”) for sale, directly to selected investors, 7,058,235 shares of our Series

A Convertible Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), each convertible into 10

shares of our common stock, par value $0.001, per share (the “Common Stock”) and Class D-1 Common Stock Purchase Warrants

to purchase up to 70,582,351 shares of Common Stock at an exercise price of $0.22 per share (the “Class D-1 Warrants”

or, the “Warrants”).

Prior to this offering

of Series A Preferred Stock, we have not issued any shares of preferred stock although 40 million such shares are authorized under

our Articles in addition to the 450 million of shares of Common Stock authorized under our Articles.

The Series A Preferred

Stock will be convertible from and after the date on which the Company has sufficient shares of Common Stock authorized and available

for issuance to satisfy its obligation to deliver Common Stock upon conversion of the Series A Preferred Stock, but in any event

not later than June 1, 2018 (such date, the “Series A Convertibility Date”).

The number of shares

of Common Stock available for issuance in connection with Series A Preferred Stock conversions will depend upon ongoing expirations

of warrants, upon certain negotiations currently under way with respect to outstanding warrants, and upon the number of authorized

shares, among other factors.

Similarly, the Class

D-1 Warrants will be exercisable from and after the date on which the Company has sufficient shares of Common Stock authorized

and available for issuance to satisfy its obligation to deliver Common Stock upon exercise of these Warrants. The Class D-1 Warrants

will be exercisable for two years from the date they become exercisable.

We will receive gross

proceeds of approximately $12.0 million from the Series A Preferred Offering.

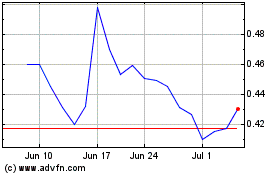

Our Common Stock is

traded on the OTCQB tier of the OTC Markets under the symbol “NWBO”. On December 1, 2017, the closing sale price of

our Common Stock was $0.28 per share. Certain of our warrants are traded on the OTCQB tier of the OTC Markets under the symbol

“NWBOW”. There is no established public trading market for the Series A Preferred Stock or the Class D-1 Warrants included

in this offering, and we do not expect a market for such securities to develop.

Investing in our

securities involves a high degree of risk. See “Risk Factors” beginning on page S-3 of this prospectus supplement and

on page 3 of the accompanying prospectus and the risk factors contained in the documents incorporated by reference herein for a

discussion of certain risks that should be considered in connection with an investment in our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether

this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal

offense.

|

|

|

Per Share

(1)

|

|

|

Total

|

|

|

Offering price per share of Series A Preferred Stock

|

|

$

|

1.70

|

|

|

$

|

12,000,000.00

|

|

|

Proceeds to us, after estimated expenses, for the Series A Preferred Stock

|

|

|

|

|

|

$

|

11,900,000.00

|

|

(1)

No additional consideration

will be received for issuance of the Class D-1 Warrants.

The date of this prospectus supplement is

December 4, 2017.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

About

This Prospectus supplement

On September 23, 2016,

we filed with the Securities and Exchange Commission, or “SEC”, a registration statement on Form S-3 (File No. 333-213777)

utilizing a shelf registration process relating to the securities described in this prospectus supplement. Under this shelf registration

process, we may, from time to time, sell up to $150 million in the aggregate of common stock, preferred stock, warrants, various

series of debt securities, share purchase contracts, share purchase units, and warrants to purchase any of such securities, either

individually or in units.

Under this shelf registration

process, we are offering to sell Series A Preferred Stock, Common Stock issuable upon the conversion of the Series A Preferred

Stock, Warrants, and shares of Common Stock issuable upon exercise of the Warrants using this prospectus supplement and the accompanying

prospectus. In this prospectus supplement, we provide you with specific information about the securities that we are selling in

this offering. Both this prospectus supplement and the accompanying prospectus include important information about us, our securities

being offered and other information you should know before investing. This prospectus supplement also adds, updates and changes

information contained in the accompanying prospectus. You should read this prospectus supplement and the accompanying prospectus

as well as additional information described under “Incorporation of Certain Information by Reference” on page S-11

of this prospectus supplement before investing in our securities.

This prospectus supplement

describes the specific terms of an offering of our securities and also adds to and updates information contained in the accompanying

prospectus and the documents incorporated by reference into the accompanying prospectus. The second part, the accompanying prospectus,

provides more general information. If the information in this prospectus supplement is inconsistent with the accompanying prospectus

or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the

information in this prospectus supplement.

In making your investment

decision, you should rely only on the information contained or incorporated by reference in this prospectus supplement and the

accompanying prospectus and any relevant free writing prospectus. We have not authorized anyone to provide you with any other information.

If you receive any information not authorized by us, you should not rely on it. We are not making an offer to sell the securities

in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained or incorporated

by reference in this prospectus supplement or the accompanying prospectus or any relevant free writing prospectus is accurate as

of any date other than its respective date.

It is important for

you to read and consider all of the information contained in this prospectus supplement and the accompanying prospectus in making

your investment decision. We include cross-references in this prospectus supplement and the accompanying prospectus to captions

in these materials where you can find additional related discussions. The table of contents in this prospectus supplement provides

the pages on which these captions are located. You should read both this prospectus supplement and the accompanying prospectus,

together with the additional information described in the sections entitled “Where You Can Find More Information” and

“Incorporation of Certain Information by Reference” of this prospectus supplement, before investing in our securities.

We are offering to

sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution of

this prospectus supplement and the accompanying prospectus and the offering of the securities in certain jurisdictions may be restricted

by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus

must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution of

this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying

prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any

securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it

is unlawful for such person to make such an offer or solicitation.

Our primary executive

offices are located at 4800 Montgomery Lane, Suite 800, Bethesda, MD 20814, and our telephone number is (240) 497-9024. Our website

address is http://www.nwbio.com. The information contained on our website is not a part of, and should not be construed as being

incorporated by reference into, this prospectus supplement or the accompanying prospectus supplement.

Unless the context

otherwise requires, “Northwest,” the “company,” “we,” “us,” “our” and

similar names refer to Northwest Biotherapeutics, Inc.

Prospective investors

may rely only on the information contained in this prospectus supplement. We have not authorized anyone to provide prospective

investors with different or additional information. This prospectus supplement is not an offer to sell nor is it seeking an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus

supplement is correct only as of the date of this prospectus supplement, regardless of the time of the delivery of this prospectus

supplement or any sale of these securities

.

Cautionary

Statement Regarding Forward-Looking Statements

The SEC encourages

companies to disclose forward-looking information so that investors can better understand a company’s future prospects and

make informed investment decisions. This prospectus supplement, the accompanying prospectus and the documents we have filed with

the SEC that are incorporated herein and therein by reference contain such forward-looking statements within the meaning of Section

27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, included or incorporated

in this prospectus regarding our strategy, future operations, financial position, future revenues, projected costs, prospects,

plans and objectives of management are forward-looking statements.

The words “anticipates,”

“believes,” “estimates,” “expects,” “intends,” “may,” “plans,”

“projects,” “will,” “would” and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we actually will

achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance

on our forward-looking statements. There are a number of important factors that could cause our actual results to differ materially

from those indicated by these forward-looking statements. These important factors include the factors that we identify in the documents

we incorporate by reference in this prospectus supplement and the prospectus, as well as other information we include or incorporate

by reference in this prospectus supplement and the prospectus. Many factors could affect our actual results, including those factors

described under “Risk Factors” in our Form 10-K for the year ended December 31, 2016, incorporated by reference herein.

You should read these factors and other cautionary statements made in this prospectus supplement and the accompanying prospectus

and the documents incorporated herein by reference. We do not assume any obligation to update any forward-looking statements made

by us. Numerous factors could cause our actual results to differ materially from those described in forward-looking statements,

including, among other things:

|

|

·

|

risks related to our abilities to carry out intended manufacturing expansions;

|

|

|

·

|

our ability to raise additional capital;

|

|

|

·

|

risks related to our ability to enroll patients in clinical trials and complete the trials on a

timely basis;

|

|

|

·

|

risks related to the progress, timing and results of clinical trials and research and development

efforts involving our product candidates generally;

|

|

|

·

|

uncertainties about the clinical trials process;

|

|

|

·

|

uncertainties about the timely performance of third parties;

|

|

|

·

|

risks related to whether our products will demonstrate safety and efficacy;

|

|

|

·

|

risks related to our commercialization efforts and commercial opportunity for our DCVax product;

|

|

|

·

|

risks related to the submission of applications for and receipt of regulatory clearances and approvals;

|

|

|

·

|

risks related to our plans to conduct future clinical trials or research and development efforts;

|

|

|

·

|

risks related to our ability to carry out our Hospital Exemption program (in Germany);

|

|

|

·

|

risks related to our dependence upon key personnel and the need for additional financing;

|

|

|

·

|

risks related to possible reimbursement and pricing;

|

|

|

·

|

uncertainties about estimates of the potential market opportunity for our product candidates;

|

|

|

·

|

uncertainties about our estimated expenditures and projected cash needs;

|

|

|

·

|

uncertainties about our expectations about partnering, licensing and marketing; and

|

|

|

·

|

the use of proceeds from this offering.

|

Please also see the

discussion of risks and uncertainties under “Risk Factors” beginning on page 3 of the accompanying prospectus, in our

most recent Annual Report on Form 10-K, and in our other reports filed with the SEC, incorporated herein by reference.

You should not place

undue reliance on any forward-looking statements, which are based on current expectations. Furthermore, forward-looking statements

speak only as of the date they are made. If any of these risks or uncertainties materialize, or if any of our underlying assumptions

are incorrect, our actual results may differ significantly from the results that we express in or imply by any of our forward-looking

statements. These and other risks are detailed in this prospectus supplement, in the accompanying prospectus, in the documents

that we incorporate by reference into this prospectus supplement and the accompanying prospectus and in other documents that we

file with the Securities and Exchange Commission. We do not undertake any obligation to publicly update or revise these forward-looking

statements after the date of this prospectus supplement to reflect future events or circumstances. We qualify any and all of our

forward-looking statements by these cautionary factors.

In light of these assumptions,

risks and uncertainties, the results and events discussed in the forward-looking statements contained in this prospectus supplement

or the accompanying prospectus or in any document incorporated herein or therein by reference might not occur. Investors are cautioned

not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus supplement or

the accompanying prospectus or the date of the document incorporated by reference herein or therein. We are not under any obligation,

and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. All subsequent forward-looking statements attributable to us or to any person

acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

Prospectus

Supplement Summary

This summary highlights

certain information about this offering and selected information contained elsewhere in or incorporated by reference into this

prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information

that you should consider before deciding whether to invest in shares of our preferred stock and warrants. For a more complete understanding

of our Company and this offering, we encourage you to read and consider carefully the more detailed information in this prospectus

supplement and the accompanying prospectus, including the information incorporated by reference into this prospectus supplement

and the accompanying prospectus, and the information referred to under the heading “RISK FACTORS” in this prospectus

supplement on page S-3 and on page 3 of the accompanying prospectus, and in the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus.

|

Securities offered

|

|

In the aggregate, 7,058,235 shares of Series

A Preferred Stock, which are convertible into 70,582,350 shares of Common Stock, and Class D-1 Warrants to purchase up to 70,582,351

shares of Common Stock are offered hereby.

See “DESCRIPTION OF SECURITIES”

on page S-6 for a description of the securities offered by this prospectus supplement.

|

|

Description of Series A Preferred Stock

|

|

From and after the Series A Convertibility

Date, each share of Series A Preferred Stock will be convertible at the holder’s option, at any time and from time to time,

into 10 shares of Common Stock, subject to adjustment as provided for in the Series A Preferred Stock Certificate of Designations

(the “Series A Certificate of Designations”). Upon such conversion, the shares of Series A Preferred Stock so converted

shall no longer be deemed to be outstanding, and all rights of the holder with respect to such shares of Series A Preferred Stock

shall immediately terminate, except the right to receive shares of Common Stock and any other amounts payable pursuant to the Series

A Certificate of Designations.

The number of shares of Common Stock available

for issuance in connection with Series A Preferred Stock conversions will depend upon ongoing expirations of warrants, upon certain

negotiations currently under way with respect to outstanding warrants, and upon the number of authorized shares, among other factors.

From and after the Series A Convertibility

Date, we will have the right, at any time and from time to time in our sole discretion, to cause some or all of the Series A Preferred

Stock to be automatically converted into shares of Common Stock (without any action on behalf of the holders and whether or not

the shares of Series A Preferred Stock (in the case of uncertificated shares) or the certificates representing the shares of Series

A Preferred Stock are surrendered).

We may not effect any conversion of the Series A Preferred Stock, and a holder will not have the right

to convert any Series A Preferred Stock, if, as a result of the conversion, the holder, together with its affiliates, would beneficially

own more than 9.9% of the total number of shares of Common Stock then issued and outstanding, which is referred to herein as the

“Beneficial Ownership Limitation.”

|

|

How to Exercise Warrants

|

|

The

Class D-1 Warrants are not currently exercisable and will become exercisable only when shares of Common Stock are available for

issuance upon exercise. The Warrants will be evidenced by warrant certificates and may be exercised by completing the notice of

exercise form (each, an “Exercise Notice”) on the back of the warrant certificate and delivering it, together with

payment of the exercise price, to Northwest Biotherapeutics, Inc., at the email address indicated by the company or by postal

mail to 4800 Montgomery Lane, Suite 800, Bethesda, MD 20814, Attention: Chief Executive Officer. Payment of the exercise price

of the Warrants must be made by wire transfer or, in certain circumstances, by cashless exercise.

|

|

Other Terms of Warrants

|

|

The Class D-1 Warrant entitles

the holder to purchase Common Stock at a price of $0.22 per share and will expire two years from the date they become exercisable

and may not be exercised after that date.

The number of shares issuable upon the

exercise of the Warrants and the exercise price per share will be proportionally adjusted in the event of a stock split, stock

dividend, combination, or recapitalization of the Common Stock. See “DESCRIPTION OF SECURITIES.”

|

|

Risk Factors

|

|

Investing

in our Series A Preferred Stock, Warrants and Common Stock involves a high degree of risk. Please read the information contained

in and incorporated by reference under the heading “RISK FACTORS” beginning on page S-3 of this prospectus supplement

and page 3 of the accompanying prospectus, and under similar headings in the other documents, including our Annual Report on Form

10-K and our Quarterly Reports on Form 10-Q, that are incorporated by reference into this prospectus supplement and the accompanying

prospectus

|

|

Use of Proceeds

|

|

We estimate that the net proceeds from

the Series A Preferred Offering will be approximately $11.9 million.

We intend to use the net proceeds from

this offering for general corporate purposes, which may include working capital, capital expenditures, research and development

expenditures, regulatory affairs expenditures, clinical trial expenditures and acquisitions of new technologies and investments.

See “USE OF PROCEEDS” on page S-5 of this prospectus supplement.

|

|

Market for the Securities

|

|

None of the securities offered hereby are listed on any exchange. Our Common Stock is listed on the OTCQB tier of the OTC Markets under the symbol “NWBO”. Certain of our warrants are also listed on the OTCQB tier of the OTC Markets under the symbol “NWBOW”. There is no established public trading market for the Series A Preferred Stock or the Class D-1 Warrants in this offering, and we do not expect a market for such securities to develop.

|

Risk

Factors

Investing in our

securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the

risk factors below and in the accompanying prospectus and the risks and uncertainties and assumptions discussed under the heading

“Risk Factors” included in our most recent annual report on Form 10-K and our quarterly reports on Form 10-Q, which

are on file with the SEC and are incorporated herein by reference, and which may be amended, supplemented or superseded from time

to time by other reports we file with the SEC in the future. There may be other unknown or unpredictable economic, business, competitive,

regulatory or other factors that could have material adverse effects on our future results. If any of these risks actually occurs,

our business, business prospects, financial condition or results of operations could be seriously harmed. This could cause the

trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully

the section above entitled “Cautionary Statement Regarding Forward-Looking Statements.”

Risks Related to our Operations

The business of the

Company is subject to a number of risks. A description of the risks related to our business and our industry is set forth under

the caption “Risk Factors—Risks Related to Our Operations” in our recent annual report on Form 10-K and most

recent Form 10-Q, as may be amended, supplemented or superseded from time to time by other reports we file with the SEC, each of

which is incorporated herein by reference.

Risks Related to the Offered Securities

The Series A Preferred Stock

will convert into Common Stock and the Class D-1 Warrants will be exercisable for the purchase of Common Stock, only in limited

circumstances.

Following this offering,

there can be no assurance that any investor will be able to convert their shares of Series A Preferred Stock into shares of Common

Stock or exercise their Class D-1 Warrants for the purchase of Common Stock. The ability of holders of Series A Preferred Stock

and Class D-1 Warrants to convert their preferred shares and exercise their warrants, is conditioned on the authorization and availability

of a sufficient number of shares of Common Stock for issuance under our Certificate of Incorporation (the “Certificate of

Incorporation”) in respect of the shares of Common Stock underlying the Series A Preferred Stock and Class D-1 Warrants,

respectively.

The market price of our common

stock is volatile and can be adversely affected by several factors.

The share prices of

publicly traded biotechnology and emerging pharmaceutical companies, particularly companies without consistent product revenues

and earnings, can be highly volatile and are likely to remain highly volatile in the future. The price which investors may realize

in sales of their shares of our common stock may be materially different than the price at which our common stock is quoted, and

will be influenced by a large number of factors, some specific to us and our operations, and some unrelated to our operations.

Such factors may cause the price of our stock to fluctuate frequently and substantially. Such factors may include large purchases

or sales of our common stock, shorting of our stock, positive or negative events, commentaries or publicity relating to our company,

management or products, or other companies, management or products, including other immune therapies for cancer or immune therapies

or cancer therapies generally, positive or negative events relating to healthcare and the overall pharmaceutical and biotech sector,

the publication of research by securities analysts and changes in recommendations of securities analysts, legislative or regulatory

changes, and/or general economic conditions. In the past, shareholder litigation, including class action litigation, has been brought

against other companies that experienced volatility in the market price of their shares and/or unexpected or adverse developments

in their business. Whether or not meritorious, litigation brought against a company following such developments can result in substantial

costs, divert management’s attention and resources, and harm the company’s financial condition and results of operations.

Our Common Stock is considered

a “penny stock” and may be difficult to sell.

The SEC has adopted regulations

which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share

or an exercise price of less than $5.00 per share and that is not listed on a national securities exchange, subject to specific

exemptions. Historically, the price of our Common Stock has fluctuated greatly. As of the date of this filing, the market price

of our common stock is less than $5.00 per share and our common stock is not listed on a national securities exchange, and is therefore

a “penny stock” according to SEC rules. The “penny stock” rules impose additional sales practice requirements

on broker-dealers who sell securities to persons other than established customers and accredited investors (generally those with

assets in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 together with their spouse). For transactions covered

by these rules, the broker-dealer must make a special suitability determination for the purchase of securities and have received

the purchaser’s written consent to the transaction before the purchase. Additionally, for any transaction involving a penny

stock, unless exempt, the broker-dealer must deliver, before the transaction, a disclosure schedule prescribed by the SEC relating

to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered

representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent price information

on the limited market in penny stocks. These additional burdens imposed on broker-dealers may restrict the ability or decrease

the willingness of broker-dealers to sell our common stock, and may result in decreased liquidity for our common stock and increased

transaction costs for sales and purchases of our common stock as compared to other securities.

The requirements of the Sarbanes-Oxley

Act of 2002 and other U.S. securities laws impose substantial costs and may drain our resources and distract our management.

We are subject to certain

of the requirements of the Sarbanes-Oxley Act of 2002 in the U.S., as well as the reporting requirements under the Exchange Act.

The Exchange Act requires, among other things, filing of annual reports on Form 10-K, quarterly reports on Form 10-Q and periodic

reports on Form 8-K, following the occurrence of certain material events, with respect to our business and financial condition.

The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal

controls over financial reporting. We have identified a number of material weaknesses in our internal controls, as described in

our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q incorporated by reference in this prospectus supplement.

Meeting the requirements of the Exchange Act and the Sarbanes-Oxley Act may strain our resources and may divert management’s

attention from other business concerns, both of which may have a material adverse effect on our business.

We do not intend to pay any

cash dividends in the foreseeable future and, therefore, any return on your investment in our common stock must come from increases

in the market price of our common stock.

We have not paid any

cash dividends on our common stock to date in our history, and we do not intend to pay cash dividends on our common stock in the

foreseeable future. We intend to retain future earnings, if any, for reinvestment in the development and expansion of our business.

Also, any credit agreements which we may enter into with institutional lenders may restrict our ability to pay dividends. Therefore,

any return on your investment in our capital stock must come from increases in the fair market value and trading price of our common

stock. Such increases in the trading price of our stock may not occur.

Our Certificate of Incorporation

and Bylaws and Delaware law, have provisions that could discourage, delay or prevent a change in control.

Our Certificate of

Incorporation and Bylaws (the “Bylaws”) and Delaware law contain provisions which could make it more difficult for

a third-party to acquire us, even if closing such a transaction would be beneficial to our stockholders. We are authorized to issue

up to 40,000,000 shares of preferred stock. This preferred stock may be issued in one or more series, the terms of which may be

determined at the time of issuance by our Board of Directors without further action by stockholders. The terms of any series of

preferred stock may include voting rights (including the right to vote as a series on particular matters), preferences as to dividend,

liquidation, conversion and redemption rights and sinking fund provisions. The issuance of any preferred stock could materially

adversely affect the rights of the holders of our common stock, and therefore, reduce the value of our common stock. In particular,

specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with, or sell our assets

to, a third-party and thereby preserve control by the present management.

Provisions of our Certificate

of Incorporation and Bylaws and Delaware law also could have the effect of discouraging potential acquisition proposals or tender

offers or delaying or preventing a change in control, including changes a stockholder might consider favorable. Such provisions

may also prevent or frustrate attempts by our stockholders to replace or remove our management. In particular, the Certificate

of Incorporation and Bylaws and Delaware law, as applicable, among other things:

|

|

·

|

provide the Board of Directors with the ability to alter the Bylaws without stockholder approval;

|

|

|

·

|

establish staggered terms for board members;

|

|

|

·

|

place limitations on the removal of directors; and

|

|

|

·

|

provide that vacancies on the Board of Directors may be filled by a majority of directors in office,

although less than a quorum.

|

We are also subject

to Section 203 of the Delaware General Corporation Law which, subject to certain exceptions, prohibits “business combinations”

between a publicly held Delaware corporation and an “interested stockholder,” which is generally defined as a stockholder

who becomes a beneficial owner of 15% or more of a Delaware corporation’s voting stock for a three-year period following

the date that such stockholder became an interested stockholder.

A substantial number of shares

of common stock may be sold in the market, which may depress the market price for our common stock.

Sales of a substantial

number of shares of our common stock in the public market could cause the market price of our common stock to decline. A substantial

majority of the outstanding shares of our common stock are freely tradable without restriction or further registration under the

Securities Act.

Use

Of Proceeds

We estimate that the

net proceeds from the Series A Preferred Offering will be approximately $11.9 million, after deducting estimated offering expenses

payable by us.

We intend to use the

net proceeds from the Series A Preferred Offering for general corporate purposes, which may include working capital, capital expenditures,

research and development expenditures, regulatory affairs expenditures, clinical trial expenditures, and acquisitions of new technologies

and investments.

We have not yet determined

the amount of net proceeds to be used specifically for any of the foregoing purposes. Accordingly, our management will have significant

discretion and flexibility in applying the net proceeds from this offering. Pending any use, as described above, we intend to invest

the net proceeds in high-quality, short-term, interest-bearing securities.

If all Class D-1 Warrants

issued in this offering are exercised in the future for cash, we estimate that the gross proceeds from such exercise would be approximately

$15.5 million. There can be no assurance that any Class D-1 Warrants will be exercised in the future, or that we will ever realize

additional proceeds from such warrants.

Dividend

Policy

We have never declared

or paid cash dividends on our capital stock. We currently intend to retain our future earnings, if any, for use in our business

and therefore do not anticipate paying cash dividends in the foreseeable future. Payment of future dividends, if any, will be at

the discretion of our board of directors after taking into account various factors, including our financial condition, operating

results, current and anticipated cash needs and plans for expansion.

Dilution

In purchasing shares

of Series A Preferred Stock in this offering, assuming conversion of all issued and outstanding shares of Series A Preferred Stock

into shares of Common Stock, the buyer’s interest will be diluted to the extent of the difference between the offering price

per share and the net tangible book value per share of our Common Stock after this offering. Our net tangible book value as of

September 30, 2017 was ($42.8 million), or ($0.14) per share of Common Stock. “Net tangible book value” is total assets

minus the sum of liabilities and intangible assets. “Net tangible book value per share” is net tangible book value

divided by the total number of shares of Common Stock outstanding.

After giving effect

to the sale by us of 70,582,350 shares of our Common Stock underlying the Series A Preferred Stock upon conversion of the Series

A Preferred Stock into shares of Common Stock (an equivalent per share price of $0.17 per share of Common Stock), and no exercise

of the Warrants and after deducting estimated offering expenses payable by us, our net tangible book value as of September 30,

2017 would have been approximately $(42.2) million, or $(0.08) per share of Common Stock. This amount represents $0.06 increase

in net tangible book value per share to existing stockholders and an immediate dilution of $0.25 per share to purchasers in this

offering.

The following table illustrates the dilution:

|

Price per share of Common Stock underlying the Series A Preferred Stock

|

|

|

|

|

|

$0.17

|

|

Net tangible book value per share as of September 30, 2017

|

|

$

|

(0.14

|

)

|

|

|

|

Increase in net tangible book value per share after this offering

|

|

$

|

0.06

|

|

|

|

|

Pro forma net tangible book value per share after this offering

|

|

|

|

|

|

$(0.08)

|

|

Dilution per share in the Series A Preferred Offering

|

|

|

|

|

|

$0.25

|

The above table is based on 309,675,000

common shares outstanding as of September 30, 2017. We did not have any shares of preferred stock outstanding on that date, although

40 million shares of preferred stock are authorized under our Articles. The above table excludes, as of that date:

|

|

•

|

Shares of our Common Stock that have been reserved in connection with 11,343,117 outstanding

options, which have a weighted average exercise price of $0.25 per share; and

|

|

|

•

|

Shares of our Common Stock that have been reserved in connection with 178,967,112

outstanding warrants, which have a weighted average

exercise price of $0.84 per share. The number of such

warrants has decreased since September

30, 2017 due to ongoing expirations and other factors.

|

The

number of shares of Common Stock available for issuance in connection with Series A Preferred Stock conversions will depend

upon ongoing expirations of warrants, upon certain negotiations currently under way with respect to outstanding warrants, and

upon the number of authorized shares, among other factors.

To the

extent that any outstanding options or warrants are exercised, or we otherwise issue additional shares of Common Stock in the future,

at a price less than the public offering price, there will be further dilution to the investor.

Description

of Securities

In this offering, we

are offering 7,058,235 shares of Series A Preferred Stock, convertible in the aggregate into 70,582,350 shares of Common Stock,

and Warrants to purchase up to 70,582,351 shares of Common Stock.

Concurrent with the

closing of this Series A offering, we also have exchanged previously issued warrants for the purchase of 6,686,342 shares of our Common Stock, exercisable

at $0.26 per share, for Class D-1 Warrants for the purchase of 11,792,482 shares of our Common Stock, exercisable at $0.22 per

share, and 120,590 shares of Series A Preferred Stock. Such securities are being exchanged and issued to certain investors in consideration

of approximately $2,000,000 in additional investments received by the Company in this offering.

General

Under our

Certificate of Incorporation, we have authority to issue 450,000,000 shares of common stock, par value $0.001 per share, and

40,000,000 shares of preferred stock, par value $0.001 per share. As of September 30, 2017, there were 309,675,000 shares of

Common Stock issued and outstanding and no shares of preferred stock outstanding. All shares of Common Stock will, when

issued upon conversion of the Series A Preferred Stock and upon the exercise of the outstanding Class D-1 Warrants offered

pursuant to this prospectus, be duly authorized, fully paid and non-assessable.

Series A Preferred

Stock

Out of the 40 million

authorized and unissued shares of preferred stock of the Company, the Series A Certificate of Designations established the Series

A Preferred Stock, consisting of 15,000,000 shares, par value $0.001 per share. The following summary of certain terms and provisions

of the Series A Preferred Stock offered in this offering is subject to, and qualified in its entirety by reference to the terms

and provisions set forth in our Certificate of Designations of Series A Convertible Preferred Stock, which is attached as an exhibit

to our Current Report on Form 8-K filed with the SEC for purposes of updating our Certificate of Incorporation, which is incorporated

by reference into the registration statement of which this prospectus supplement and the accompanying prospectus form a part.

Ranking and Liquidation

Preference

The Series A Preferred

Stock shall, with respect to rights upon an acquisition of the Company, sale of all or substantially all assets of the Company,

other business combination or liquidation, dissolution or winding up of the affairs of the Company (collectively, a “Liquidation

Event”) rank senior and prior to the Common Stock of the Company. In the event of a Liquidation Event, each holder of Series

A Preferred Stock shall, with respect to each share of Series A Preferred Stock owned by such holder, be entitled to receive, out

of funds of the Company legally available therefor, before any payment or distribution of any assets of the Company shall be made

or set apart for holders of the Common Stock, an amount per share of Series A Preferred Stock equal to, at the election of the

relevant such holder, either (a) $1.70 or (b) the amount such holder would have received had such holder, immediately prior to

such Liquidation Event, converted such share of Series A Preferred Stock into shares of Common Stock as set forth in the Series

A Certificate of Designations.

Maturity

The Series A Preferred

Stock has no stated maturity, is not subject to any sinking fund or mandatory redemption and will remain outstanding indefinitely

unless converted, redeemed, repurchased or otherwise acquired by the Company and retired or converted into our Common Stock by

the holders of the Series A Preferred Stock, pursuant to the terms of the Series A Certificate of Designations.

Voting Rights and

Transferability

On any matter presented

to the stockholders of the Company for their action at any meeting of stockholders of the Company (or by written consent of stockholders

in lieu of a meeting), each holder shall be entitled to cast 10 votes for each Series A Preferred Stock share held by such holder

as of the record date for determining stockholders entitled to vote on such matter. Notwithstanding the foregoing, holders shall

not be entitled to vote shares of Series A Preferred Stock on any matter for which the holders of Common Stock are then entitled

to vote as a separate class pursuant to Section 242(b)(2) of the Delaware General Corporation Law (including any amendment to the

Certificate of Incorporation to increase or decrease the authorized number of shares of Common Stock unless the class vote on such

matter has been eliminated pursuant to the Certificate of Incorporation). Except as otherwise required by law or other provisions

of the Certificate of Incorporation or the Series A Certificate of Designations, holders of shares of Series A Preferred Stock

shall vote together with the holders of Common Stock as a single class (together with any other capital stock entitled to vote

thereon) and shall be entitled to notice of any stockholders’ meeting in accordance with the bylaws of the Company as in

effect from time to time.

On or before the earlier

of (i) the date on which the holders of the Company’s Common Stock approve, at a shareholder meeting of the Company, an increase

in the maximum number of shares authorized for issuance or (ii) June 1, 2018, (the “Series A Preferred Stock Voting Period

End Date”), the Series A Preferred Stock shall not be directly or indirectly assignable or transferable by any holder thereof,

and no holder of Series A Preferred Stock shall at any time, directly or indirectly, sell, assign, transfer or otherwise dispose

of any shares of Series A Preferred Stock or any economic or voting interests or rights associated therewith, except as specifically

authorized by the Company’s Board of Directors in its sole discretion.

Conversion

Each Series A

Preferred Stock share shall be convertible into 10 shares of Common Stock on the terms set forth in the subscription

agreement, exchange agreement or other agreement and Certificate of Designations pursuant to which the Series A Preferred

Stock is issued, subject in each case to adjustment as provided for in the Series A Certificate of Designations. Upon such

conversion, the shares of Series A Preferred Stock so converted shall no longer be deemed to be outstanding, and all rights

of the holder with respect to such shares of Series A Preferred Stock shall immediately terminate, except the right to

receive the shares of Common Stock and any other amounts payable pursuant to the Series A Certificate of Designations.

From and after the

date on which the Company has sufficient shares of Common Stock authorized and available for issuance to satisfy its obligations

to deliver Common Stock upon conversion of some or all of the Series A Preferred Stock, but in any event not later than June 1,

2018 (such date, the “Series A Convertibility Date”), e

ach

holder will be entitled to convert some or all of their Series A Preferred Stock, at any time and from time to time

, into

a number of duly authorized, validly issued, fully paid and non-assessable units as set forth in the Series A Certificate of Designations.

From and after the

Series A Convertibility Date, the Company shall have the right, at any time and from time to time, in its sole discretion, to cause

some or all of the Series A Preferred Stock to be automatically converted (without any action on behalf of the holders and whether

or not the shares of Series A Preferred Stock (in the case of uncertificated shares) or the certificates representing the shares

of Series A Preferred Stock are surrendered), into a number of duly authorized, validly issued, fully paid and non-assessable units

as set forth in the Series A Certificate of Designations. The Company may exercise this right by delivering written notice thereof

to the applicable holder of shares of Series A Preferred Stock.

Voting Agreements

In connection with the offering of Series A Preferred Stock hereby, the purchasers of our Series A Preferred

Stock are required to enter into voting agreements with us pursuant to which they will agree to vote in favor of certain proposals

put before our stockholders for a shareholder vote by our Board of Directors with respect to any amendment of the Company’s

Certificate of Incorporation as the Board of Directors may deem necessary or appropriate to increase the Company’s authorized

common stock and/or preferred stock. Pursuant to such voting agreements, the holders of the Series A Preferred Stock agreed to

appear or otherwise to be counted as present at any meeting of stockholders, whether annual or special, and to respond to each

request by the Company to vote all their shares of Common Stock, issuable upon conversion of the Series A Preferred Stock or cause

such shares to be voted at such meeting in favor of the proposals described therein. The voting agreements and the respective terms

thereof will terminate at the end of the Series A Preferred Stock Voting Period End Date.

Limitations on Conversion

The number of shares

of Common Stock that may be acquired by a holder of Series A Preferred Stock upon conversion of any portion of the Series A Preferred

Stock will be limited to the extent necessary to ensure that, following such conversion, the total number of Common Stock then

beneficially owned by such holder and its affiliates and any other persons whose beneficial ownership of Common Stock would be

aggregated with the holder’s for purposes of Section 13(d) of the Exchange Act does not exceed 9.9% of the total number of

issued and outstanding shares of Common Stock (including for such purpose the Common Stock issuable upon such conversion).

Class D Warrants

Each Class D-1 Warrant

will entitle the holder to purchase one share of Common Stock at a price of $0.22 per share, subject to adjustment as described

below under “Adjustment of the Number of Shares and Exercise Price.”

How to Exercise Warrants

The Warrants may be

exercised by delivery of an Exercise Notice, in the form attached to the warrant certificates, to us and payment of the exercise

price. The Exercise Notice form attached to the warrant certificate must be signed by the warrant holder. Except as described in

the paragraph below, payment of the exercise price of the Warrants must be made in cash by wire transfer.

Warrant holders may,

to the extent provided for in their warrants, deliver to us an Exercise Notice cancelling all or a portion of the Warrants being

exercised in lieu of paying the exercise price in cash, and receive upon such exercise the “net number” of shares of

Common Stock determined according to a formula based on the total number of shares with respect to which the Warrants are being

exercised, the average of the volume weighted average price for our Common Stock for the ten consecutive trading days immediately

preceding the date that the applicable Exercise Notice is received, and the exercise price of the Warrants.

No fractional shares

of Common Stock will be issued upon the exercise of the Warrants. Instead, the Company will pay a sum in cash equal to the product

resulting from multiplying the then current fair market value of one share of Common Stock by the fractional share otherwise issuable.

Limitations on Exercise

The Class D Warrants

are not currently exercisable and will become exercisable only when shares of Common Stock are available for issuance upon exercise.

We cannot assure you that this condition will be satisfied and, until such time as the condition is satisfied, the Class D Warrants

cannot be exercised for Common Stock.

Expiration Date of Warrants

The Class D-1 Warrants

will expire two years after the date they become exercisable and may not be exercised after that date.

Transferability

On or before the 80th

day after the conclusion of the Company’s 2017 annual meeting of stockholders (the “Class D-1 Warrants Voting Period

End Date”), the Class D-1 Warrants shall not be directly or indirectly assignable or transferable by any holder thereof,

and no holder of Class D-1 Warrants shall at any time, directly or indirectly, sell, assign, transfer or otherwise dispose of any

Class D-1 Warrants or any economic or voting interests or rights associated therewith, except as specifically authorized by the

Company’s Board of Directors in its sole discretion.

After the Class D-1

Warrants Voting Period End Date, the Warrants may be transferred by the warrant holder upon surrender of the warrant certificate

to us together with the appropriate instruments of transfer. The Warrants may be transferred independent of the preferred shares

with which they are being issued.

Adjustment of the Number of Shares

and Exercise Price

In the event of changes

in the Common Stock by reason of stock dividends, splits, recapitalizations, reclassifications, combinations or exchanges of shares,

separations, reorganizations, liquidations, or the like, the aggregate number of shares issuable upon exercise under the Class

D-1 Warrants and the exercise price thereof shall be correspondingly adjusted to give the holder of the Class D-1 Warrants, on

exercise for the same aggregate exercise price, the same shares as the holder would have owned had the Class D-1 Warrants been

exercised prior to the event and had the holder continued to hold such shares until after the event requiring adjustment. The form

of the Class D-1 Warrants need not be changed because of any adjustment in the number of shares issuable upon exercise subject

to the Class D-1 Warrants. Notwithstanding anything in the Class D-1 Warrants to the contrary, no adjustment will be made to the

exercise price of the Class D-1 Warrants, such that the exercise price would be less than the then current par value of outstanding

shares of Common Stock.

No Rights as Shareholders

The Warrants do not

confer upon the warrant holders the right to vote or to receive dividends or to consent or to receive notice as shareholders in

respect of any meeting of shareholders for the election of directors or any other matter, or any other rights whatsoever as our

shareholders, except as set forth in warrants.

The forgoing description

of the Class D-1 Warrants is only a summary and does not purport to be a complete description of all of the terms of the Class

D-1 Warrants. The foregoing summary is qualified in all respects by the terms of the forms of the Warrants, which will be filed

as exhibits to a Current Report on Form 8-K to be filed by us in connection with the offering made hereby.

Common Stock

The following is a

description of the material terms and provisions of our Common Stock. It may not contain all the information that is important

to you. You can access complete information by referring to our Certificate of Incorporation, as amended and our Bylaws, as amended,

copies of which are filed as exhibits to the registration statement of which this prospectus forms a part.

Dividends

Subject to the prior

rights of any series of preferred stock which may from time to time be outstanding, the holders of our Common Stock are entitled

to receive such dividends, if any, as may be declared from time to time by our board of directors out of legally available funds.

In the event we are liquidated, dissolved or our affairs are wound up, after we pay or make adequate provision for all of our known

debts and liabilities, each holder of Common Stock will receive distributions pro rata out of assets that we can legally use to

pay distributions, subject to any rights that are granted to the holders of any class or series of preferred stock. As of the date

of this prospectus, we have not declared or paid any cash dividends on our shares of Common Stock.

Voting Rights

Holders of Common Stock

are entitled to one vote per share and do not have cumulative voting rights. An election of directors by our stockholders is determined

by a plurality of the votes cast by the stockholders entitled to vote on the election.

Other Rights

Subject to the preferential

rights of any other class or series of stock, all shares of Common Stock have equal dividend, distribution, liquidation and other

rights, and have no preference, appraisal or exchange rights. Furthermore, holders of Common Stock have no conversion, sinking

fund or redemption rights, or preemptive rights to subscribe for any of our securities.

Transfer Agent

The transfer agent

and registrar for our Common Stock is Computershare Trust Company, N.A. Its address is P.O. Box 30170, College Station, Texas 77842

and its phone number is (866) 282-9695.

Listing

Our Common Stock is traded

on the OTCQB tier of the OTC Markets under the symbol “NWBO”.

Plan

Of Distribution

We are selling the

Series A Preferred Stock, Class D-1 Warrants and the Common Stock issuable upon conversion of the Series A Preferred Stock, respectively,

and exercise of the Class D-1 Warrants, directly to the holders thereof, and we are not engaging a placement or other agent to

solicit investors or facilitate the issuance, conversion or exercise of such securities.

EXPERTS

The audited financial

statements incorporated by reference in this prospectus have been so incorporated by reference in reliance upon the report of Marcum

LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing in giving

said report.

Where

You Can Find More Information

We are subject to the

reporting requirements of the Securities Exchange Act of 1934, as amended, and file annual, quarterly and current reports, proxy

statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the

SEC’s public reference facilities at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You can request copies of these

documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for more information

about the operation of the public reference facilities. SEC filings are also available at the SEC’s website at http://www.sec.gov.

Our Common Stock is listed on the OTCQB tier of the OTC Markets, and you can read and inspect our filings at the offices of the

Financial Industry Regulatory Authority, Inc. at 1735 K Street, Washington, D.C. 20006.

This prospectus supplement

and the accompanying prospectus are only part of a registration statement on Form S-3 that we filed with the SEC under the Securities

Act of 1933, as amended, and therefore omits certain information contained in the registration statement. We have also filed exhibits

and schedules with the registration statement that are excluded from this prospectus supplement and the accompanying prospectus,

and you should refer to the applicable exhibit or schedule for a complete description of any statement referring to any contract

or other document. You may inspect a copy of the registration statement, including the exhibits and schedules, without charge,

at the public reference room or obtain a copy from the SEC upon payment of the fees prescribed by the SEC.

Incorporation

of Certain Information By Reference

The SEC allows us

to “incorporate by reference” information that we file with them. Incorporation by reference allows us to disclose

important information to you by referring you to those other documents. The information incorporated by reference is an important

part of this prospectus supplement and the accompanying prospectus, and information that we file later with the SEC will automatically

update and supersede this information. We filed a registration statement on Form S-3 under the Securities Act of 1933, as amended,

with the SEC with respect to the securities being offered pursuant to this prospectus supplement and the accompanying prospectus.

This prospectus supplement and the accompanying prospectus omit certain information contained in the registration statement, as

permitted by the SEC. You should refer to the registration statement, including the exhibits, for further information about us

and the securities being offered pursuant to this prospectus supplement and the accompanying prospectus. Statements in this prospectus

supplement and the accompanying prospectus regarding the provisions of certain documents filed with, or incorporated by reference

in, the registration statement are not necessarily complete and each statement is qualified in all respects by that reference.

Copies of all or any part of the registration statement, including the documents incorporated by reference or the exhibits, may

be obtained upon payment of the prescribed rates at the offices of the SEC listed above in “Where You Can Find More Information.”

The documents we are incorporating by reference are:

|

|

•

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed on April 17, 2017;

|

|

|

|

|

|

|

•

|

Our Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2017, June 30, 2017 and September 30, 2017, filed on May 15, 2017, August 21, 2017 and November 20, 2017, respectively;

|

|

|

|

|

|

|

•

|

Our Current Reports on Form 8-K filed with the SEC on January 19, 2017, February 8, 2017, March 7, 2017, March 10, 2017, March 23, 2017 (both filings), April 5, 2017, April 7, 2017, April 25, 2017, May 26, 2017, May 31, 2017, June 13, 2017, June 19, 2017, June 27, 2017, July 21, 2017, July 26, 2017, August 7, 2017 (both filings), August 8, 2017, September 22, 2017 (with regards to the first filing only), October 16, 2017 and November 21, 2017;

|

|

|

|

|

|

|

•

|

All of our filings pursuant to the Exchange Act after the date of filing this prospectus supplement and prior to completion of the offering of securities being made hereby; and

|

|

|

|

|

|

|

•

|

The description of our Common Stock contained in our Registration Statement on Form 8-A filed on November 14, 2012, including any amendments or reports filed for the purpose of updating that description.

|

In addition, all documents

(other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed in such forms that are related

to such items unless such Form 8-K expressly provides to the contrary) subsequently filed by us pursuant to Section 13(a), 13(c),

14 or 15(d) of the Securities Exchange Act of 1934, as amended, before the date our offering is terminated or completed are deemed

to be incorporated by reference into, and to be a part of, this prospectus supplement and the accompanying prospectus.

Any statement contained

in this prospectus supplement or the accompanying prospectus or in a document incorporated or deemed to be incorporated by reference

into this prospectus supplement or the accompanying prospectus will be deemed to be modified or superseded for purposes of this

prospectus supplement and the accompanying prospectus to the extent that a statement contained in any subsequently filed document

that is deemed to be incorporated by reference into this prospectus supplement and the accompanying prospectus modifies or supersedes

the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a

part of this prospectus supplement and the accompanying prospectus.

We will furnish without

charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference, including exhibits

to these documents. You should direct any requests for documents to Northwest Biotherapeutics, Inc., 4800 Montgomery Lane, Suite

800, Bethesda, MD 20814, (240) 497-9024.

You should rely only

on information contained in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus and

any other prospectus supplement. We have not authorized anyone to provide you with information different from that contained in

this prospectus supplement and the accompanying prospectus or incorporated by reference in this prospectus supplement and the accompanying

prospectus. We are not making offers to sell the securities offered hereby in any jurisdiction in which such an offer or solicitation

is not authorized or in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is

unlawful to make such offer or solicitation.

Series A Convertible Preferred Stock

Class D-1 Warrants to Purchase Shares

of Common Stock

Prospectus Supplement

dated December 4, 2017

PROSPECTUS

Northwest Biotherapeutics, Inc.

$150,000,000

of

Common Stock

Preferred Stock

Warrants

Debt Securities

Share Purchase Contracts

Share Purchase Units

Units

This prospectus relates

to common stock, preferred stock, warrants, debt securities, share purchase contracts, share purchase units, and units comprised

of the foregoing that we may sell from time to time in one or more offerings up to a total dollar amount of $150,000,000 on terms

to be determined at the time of sale. We may also offer common stock or preferred stock upon conversion of debt securities, common

stock upon conversion of preferred stock, common stock, preferred stock or debt securities upon the exercise of warrants, or common

stock upon execution of a share purchase contract. We will provide specific terms of these securities in supplements to this prospectus.

You should read this prospectus and any supplement carefully before you invest. This prospectus may not be used to offer and sell

securities unless accompanied by a prospectus supplement for those securities.

Our common stock is

listed on The Nasdaq Capital Market under the symbol “NWBO.” On October 13, 2016, the last reported sale price of our

common stock was $0.46. We recommend that you obtain current market quotations for our common stock and warrants prior to making

an investment decision.

These securities may

be sold directly by us, through dealers or agents designated from time to time, to or through underwriters or through a combination

of these methods. See “Plan of Distribution” in this prospectus. We may also describe the plan of distribution for

any particular offering of these securities in any applicable prospectus supplement. If any agents, underwriters or dealers are

involved in the sale of any securities in respect of which this prospectus is being delivered, we will disclose their names and

the nature of our arrangements with them in a prospectus supplement. The net proceeds we expect to receive from any such sale will

also be included in a prospectus supplement.

As of October 13, 2016,

the aggregate market value of our outstanding common stock held by non-affiliates, or the public float, was $35,889,608.50, which

was calculated based on 78,020,888 shares of outstanding common stock held by non-affiliates and on a price per share of $0.46,

the closing price of our common stock on October 13, 2016. Pursuant to General Instruction I.B.6 of Form S-3, in no event will

we sell securities in a public primary offering with a value exceeding more than one-third of our “public float” (the

market value of our common stock held by our non-affiliates) in any 12-month period so long as our public float remains below $75,000,000.

We have not sold any of our common stock or securities convertible into our common stock during the 12 calendar months prior to

and including the date of this prospectus pursuant to Instruction I.B.6.

Investing in our

securities involves a high degree of risk. See “Risk Factors” beginning on page 3.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may

not be used to consummate sales of securities unless it is accompanied by a prospectus supplement.

The date of this prospectus is October 18,

2016

TABLE OF CONTENTS

Important Notice about the Information

Presented in this Prospectus

You should rely

only on the information contained or incorporated by reference in this prospectus or any applicable prospectus supplement. We have

not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. For further information, see the section of this prospectus entitled “Where You Can

Find More Information.” We are not making an offer to sell these securities in any jurisdiction where the offer or sale is

not permitted.

You should not assume

that the information appearing in this prospectus or any applicable prospectus supplement is accurate as of any date other than

the date on the front cover of this prospectus or the applicable prospectus supplement, or that the information contained in any

document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless

of the time of delivery of this prospectus or any prospectus supplement or any sale of a security. Our business, financial condition,

results of operations and prospects may have changed since such dates. Neither this prospectus nor any accompanying supplement

shall constitute an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or

in which the person making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such

offer or solicitation

.

About

This Prospectus

This prospectus is

part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”), using a “shelf”

registration process. Under this shelf registration process, we may sell any combination of the securities described in this prospectus

in one or more offerings up to a total dollar amount of $150,000,000. This prospectus provides you with a general description of

the securities we may offer. Each time we sell securities, we will provide a prospectus supplement that will contain specific information

about the securities being offered and the terms of that offering. The prospectus supplement may also add to, update or change

information contained in this prospectus.

As permitted by the

rules and regulations of the SEC, the registration statement, of which this prospectus forms a part, includes additional information

not contained in this prospectus. You may read the registration statement and other reports we file with the SEC on the SEC’s

web site or at the SEC’s offices, each as further describe below under the heading “Where You Can Find More Information.”

Unless otherwise expressly

provided or the context otherwise requires, the terms “Northwest Biotherapeutics,” “the Company,” “our

company,” “we,” “us,” “our” and similar names refer collectively to Northwest Biotherapeutics,

Inc. and its subsidiaries.

About

Northwest BIOTHERAPEUTICS, Inc.

We are a biotechnology

company focused on developing immunotherapy products to treat cancers more effectively than current treatments, without toxicities

of the kind associated with chemotherapies, and, through a proprietary batch manufacturing process, on a cost-effective basis,

initially in both the United States and Europe (the two largest medical markets in the world).

We have developed a

platform technology, DCVax®, which uses activated dendritic cells to mobilize a patient's own immune system to attack their

cancer. The DCVax technology is expected to be applicable to all types of solid tumor cancers, and is embodied in several distinct

product lines. One of the product lines (DCVax®-L) is designed to cover all solid tumor cancers in which the tumors can be

surgically removed. Another product line (DCVax®-Direct) is designed for all solid tumor cancers which are considered inoperable

and cannot be surgically removed. We believe the broad applicability of DCVax to many cancers provides multiple opportunities for

commercialization and partnering.

Our DCVax platform

technology involves dendritic cells, the master cells of the immune system, and is designed to reinvigorate and educate the immune

system to attack cancers. The dendritic cells are able to mobilize the overall immune system, which includes T cells, B cells and

antibodies, natural killer cells and many others. Such mobilization of the overall immune system provides a broader attack on the

cancer than mobilizing just a particular component, such as T cells alone, or a particular antibody alone. Likewise, our DCVax

technology is designed to attack the full set of biomarkers, or antigens, on a patient’s cancer, rather than just a particular

selected target or several targets. Clinical experience indicates that when just one or a few biomarkers on a cancer are targeted

by a drug or other treatment, sooner or later the cancer usually develops a way around that drug, and the drug stops working. We

believe that mobilizing all agents of the immune system, and targeting all biomarkers on the patient’s cancer, contributes

to the effectiveness of DCVax.

The DCVax Technology

Our platform technology,

DCVax®, is a personalized immune therapy which consists of a therapeutic vaccine that uses a patient’s own dendritic

cells, or DCs, the master cells of the immune system, as the therapeutic agent. The patient’s DCs are obtained through a

blood draw, or leukapheresis. The DCs are then activated and loaded with biomarkers (“antigens”) from the patient’s

own tumor. The loading of biomarkers into the DCs “educates” the DCs about

what

to attack. The activated, educated

DCs are then isolated with very high purity and constitute the DCVax personalized vaccine.

We believe that injection

of DCVax-L into the patient, through a simple intra-dermal injection in the upper arm, can initiate a potent immune response against

cancer cells, mobilizing the overall immune system and doing so in the way nature intended, with the numerous immune agents acting

in their normal roles and in combination with each other.

Importantly, each activated,

educated dendritic cell has a large multiplier effect, mobilizing hundreds of T cells and other immune cells. As a result, small

doses of such dendritic cells can mobilize large and sustained immune responses. Also very importantly, dendritic cells activate

diverse populations of T cells (i.e., T cells targeted at a variety of different biomarker targets on the patient’s cancer).

In contrast, T cell based therapies employ T cells aimed at just one biomarker target on the cancer, similar to targeted drugs.

DCVax Product Lines

We have developed several

different product lines based on the DCVax technology, to address multiple different cancers and different patient situations.

There are two main components to each DCVax product: the immune cells (dendritic cells) and the cancer biomarker targets (antigens).

All of our DCVax product

lines are made from the patient’s own dendritic cells. The dendritic cells are freshly isolated, and newly matured and activated.

We believe that the existing dendritic cells in a cancer patient have already been compromised by the cancer, and we believe that

is one of the reasons other vaccines aimed at the existing dendritic cells in patients have largely failed. However, the patient’s