FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents that we have filed with the Securities and Exchange Commission, or the SEC,

that are incorporated by reference in this accompanying prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and within the meaning of Section 21E

of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are subject to the “safe harbor” created by those sections. These forward-looking statements can generally be identified as such because the context of the

statement will include words such as “may,” “will,” “expect,” “anticipate,” “intend,” “believe,” “hope,” “assume,” “estimate,” “plan,”

“future,” “potential,” “likely,” “unlikely,” “opportunity,” “predict,” “continue,” “should,” or the negative of these terms and similar expressions intended to identify

forward-looking statements. Discussions containing these forward-looking statements may be found, among other places, in “Business” and in “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” incorporated by reference from our most recent Annual Report on Form

10-K

and from our Quarterly Reports on Form

10-Q

for the quarterly periods ended

subsequent to our filing of such Annual Report on Form

10-K,

as well as any amendments thereto reflected in subsequent filings with the SEC. These forward-looking statements include but are not limited to

statements about:

|

|

•

|

|

our ongoing and planned preclinical development and clinical trials;

|

|

|

•

|

|

the timing of and our ability to make regulatory filings and obtain and maintain regulatory approvals for roxadustat, pamrevlumab and our other product candidates;

|

|

|

•

|

|

our intellectual property position;

|

|

|

•

|

|

the potential safety, efficacy, reimbursement, convenience clinical and pharmaco-economic benefits of our product candidates, including in China;

|

|

|

•

|

|

the potential markets for any of our product candidates;

|

|

|

•

|

|

our ability to develop commercial functions;

|

|

|

•

|

|

our ability to operate in China;

|

|

|

•

|

|

expectations regarding clinical trial data;

|

|

|

•

|

|

our results of operations, cash needs, spending of the proceeds from our public offerings, financial condition, liquidity, prospects, growth and strategies; and

|

|

|

•

|

|

the industry in which we operate and the trends that may affect the industry or us.

|

These

forward-looking statements are based largely on our expectations and projections about future events and future trends affecting our business, and are subject to risks and uncertainties that could cause actual results to differ materially from those

anticipated in the forward-looking statements. Before deciding to purchase our common stock, you should carefully consider the risk factors described in the “Risk Factors” section of this prospectus supplement, in addition to the other

information set forth in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein.

In

addition, past financial and/or operating performance is not necessarily a reliable indicator of future performance and you should not use our historical performance to anticipate results or future period trends. We can give no assurances that any

of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition.

Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise

after the filing of this prospectus supplement or documents incorporated by reference herein and therein, that include forward-looking statements.

S-IV

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us, this offering and selected information contained elsewhere in or incorporated by reference into

this prospectus supplement. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more complete understanding of our company and this offering,

you should read and consider carefully the more detailed information included or incorporated by reference in this prospectus supplement, the accompanying prospectus, including the factors described under the heading “Risk Factors”

beginning on page

S-6

of this prospectus supplement.

FibroGen, Inc.

Company Overview

We are a science-based

biopharmaceutical company discovering and developing

first-in-class

therapeutics. Roxadustat

(FG-4592),

our most advanced product

candidate, is an oral small molecule inhibitor of HIF prolyl hydroxylase

(“HIF-PH”)

activity in Phase 3 clinical development for the treatment of anemia in chronic kidney disease (“CKD”).

Pamrevlumab

(FG-3019),

a fully-human monoclonal antibody that inhibits the activity of connective tissue growth factor (“CTGF”) is in Phase 2 clinical development for the treatment of pancreatic

cancer and Duchenne muscular dystrophy (“DMD”) and recently completed a Phase 2 double-blind study in idiopathic pulmonary fibrosis (“IPF”). We have taken a global approach to the development and future commercialization of our

product candidates, and this includes development and commercialization in the People’s Republic of China (“China”). We are capitalizing on our extensive experience in fibrosis and hypoxia inducible factor (“HIF”) biology

and clinical development to advance a pipeline of innovative medicines for the treatment of anemia, fibrotic disease, cancer, corneal blindness and other serious unmet medical needs.

Overview of Roxadustat

Roxadustat is

an internally discovered

HIF-PH

inhibitor that acts by stimulating the body’s natural pathway of erythropoiesis, or red blood cell production. Roxadustat, the first

HIF-PH

inhibitor to enter Phase 3 clinical development, represents a new paradigm for the treatment of anemia in CKD patients, with the potential to offer a safer, more effective, more convenient and more

accessible therapy than the current therapies available for anemia in CKD, such as injectable erythropoiesis stimulating agents (“ESAs”). Roxadustat is currently in Phase 3 global development for the treatment of anemia in patients with

CKD. Over 1,400 subjects participated in 26 completed Phase 1 and 2 clinical studies for roxadustat in North America, Europe and Asia. These studies have demonstrated roxadustat’s potential for a favorable safety and efficacy profile in anemic

CKD patients, both those who are dialysis-dependent

(“DD-CKD”),

including hyporesponsive patients, and those who are not dialysis-dependent

(“NDD-CKD”).

According to IMS Health, 2013 global ESA sales in all anemia indications totaled $8.6 billion. While the use of ESAs to treat anemia in CKD has largely been limited to use in

DD-CKD

patients, we and our partners believe that, as an oral agent with a potentially more favorable safety profile, roxadustat could increase accessibility and expand the market for anemia treatment by penetrating

the

NDD-CKD

market. In the longer term, we believe roxadustat has the potential to address

non-CKD

anemia markets, including chemotherapy-induced anemia, anemia related

to inflammation (such as inflammatory bowel disease, lupus and rheumatoid arthritis, myelodysplastic syndrome (“MDS”), and surgical procedures requiring transfusions).

We, along with our collaboration partners Astellas Pharma Inc. and AstraZeneca AB, have designed a global Phase 3 program to support regulatory approval

of roxadustat in both

NDD-CKD

and

S-1

DD-CKD

patients in the United States (“U.S.”), the European Union (“EU”), Japan and China. Our U.S. and EU Phase 3 program has an

aggregate target enrollment of approximately 10,000 patients worldwide and is the largest Phase 3 clinical program ever conducted for an anemia product candidate. In addition, our Phase 3 program in China has approximately 450 patients participating

and our partner’s Phase 3 program in Japan will study approximately 1,000 additional patients. Our U.S. Phase 3 program is designed for and is incorporating major adverse cardiac event composite safety endpoints that we believe will be required

for approval in the U.S. for all new anemia therapies. These Phase 3 programs are studying multiple patient populations, including patients within the first four months of initiating dialysis, or incident dialysis, and

non-incident,

or stable, dialysis patients and include multiple

NDD-CKD

studies comparing roxadustat against placebo control. We currently anticipate filing the New Drug

Application for roxadustat for the treatment of anemia associated with CKD in the U.S. in 2018.

In January 2017, we reported topline results from

our China Phase 3 studies of roxadustat in CKD anemia. We expect to complete the new drug application submission process for roxadustat in both

NDD-CKD

and

DD-CKD

in

China in the third quarter of 2017.

We received approval, in March 2017 from the China Food and Drug Administration, of our clinical trial

application for a Phase 2/3 pivotal trial of roxadustat in anemia associated with lower risk MDS. We plan to initiate this Phase 2/3 trial in the fourth quarter of 2017. In the U.S., the U.S. Food and Drug Administration accepted our Initial Drug

Application for a Phase 3 clinical trial to evaluate the safety and efficacy of roxadustat in anemia associated with MDS and we plan on initiating this study in the third quarter of 2017. We believe that roxadustat could potentially address the

significant unmet need in these anemia markets.

Overview of Pamrevlumab

We began as a research-based company with the goal of discovering and developing therapeutics for fibrosis and began studying CTGF shortly after its

discovery. Our ongoing internal research, efforts, with collaboration partners, including clinical and

pre-clinical

results, and the work of other investigators have consistently demonstrated elevated CTGF

levels in pathologic fibrotic conditions characterized by sustained production of extracellular matrix (“ECM”), elements that are key molecular components of fibrosis. These efforts indicate that CTGF is a critical common element in the

progression of serious diseases associated with fibrosis.

From our library of fully-human monoclonal antibodies that bind to different parts of the

CTGF protein and block various aspects of CTGF biological activity, we selected pamrevlumab, for which we have exclusive worldwide rights. We believe that pamrevlumab blocks CTGF and inhibits its central role in causing diseases associated with

fibrosis, and thus pamrevlumab may be able to treat a broad array of fibrotic disorders and cancers.

Pamrevlumab

(FG-3019)

is our fully-human monoclonal antibody that inhibits the activity of CTGF, a central mediator and critical common element of the progression of fibrosis and associated serious diseases. We are

currently conducting Phase 2 trials in pancreatic cancer and DMD and recently concluded our Phase 2 double-blind trial in IPF.

IPF is a chronic,

progressive, fatal disease characterized by fibrosis in the lungs resulting in loss of lung function. Despite the availability of new drugs for IPF within the last few years, there remains a need for better and safer treatment options. On

August 7, 2017, we reported topline results from our randomized, double-blind, placebo-controlled Phase 2 clinical trial designed to evaluate the safety and

S-2

efficacy of pamrevlumab in patients with IPF with

mild-to-moderate

disease. We also reported topline results from

two

sub-studies

added to evaluate the safety of combining pamrevlumab with recently approved IPF therapies.

In the double-blind, placebo-controlled

48-week

portion of this study, one hundred-three (103) patients

were randomized (1:1) to receive either 30mg/kg of pamrevlumab or placebo intravenously every 3 weeks. Lung function assessments were conducted at baseline and at weeks 12, 24, 36 and 48. Quantitative HRCT assessments were performed at baseline and

on weeks 24 and 48.

Pamrevlumab met the primary efficacy endpoint of change of forced vital capacity (“FVC”) percent predicted, a measure

of a patient’s lung function as a percentage of the lung volume that would be expected for such patient’s age, race, sex and height. The average decline (least squares mean) in FVC percent predicted from baseline to week 48 was 2.85 in the

pamrevlumab arm as compared to an average decline of 7.17 in the placebo arm, a statistically significant difference of 4.33 (using a linear slope analysis in the Intent to Treat (“ITT”) population).

Pamrevlumab-treated patients had an average decrease (least squares mean) in FVC of 129 ml at week 48 compared to an average decrease of 308 ml in

patients receiving placebo, a statistically significant difference of 178 ml (using a linear slope analysis in the ITT population).

Pamrevlumab was

well tolerated in the placebo-controlled study. The treatment emergent adverse events were comparable between the pamrevlumab and placebo arms and the adverse events in the pamrevlumab arm were consistent with the known safety profile of

pamrevlumab. There were fewer treatment emergent serious adverse events (“TESAEs”) leading to discontinuation of treatment and fewer deaths observed in the pamrevlumab arm versus the placebo arm: (3 deaths (all of which were also TESAEs)

in the pamrevlumab arm versus 6 deaths (of which 5 were also TESAEs) plus an additional 2 TESAEs (for a total of 7 TESAEs) in the placebo arm).

The

double-blind, active-controlled combination

sub-studies

were designed to assess the safety of combining pamrevlumab with standard of care background medication in IPF patients. Study subjects were on stable

doses of pirfenidone or nintedanib for at least 3 months and were randomized 2:1 to receive 30 mg/kg of pamrevlumab or placebo every 3 weeks for 24 weeks.

Thirty-six

(36) patients were enrolled in the

pirfenidone

sub-study

and

twenty-one

(21) patients were enrolled in the nintedanib

sub-study.

Lung function assessments were

conducted at baseline and at weeks 12 and 24.

Pamrevlumab appeared to be well tolerated when given in combination with either pirfenidone or

nintedanib.

The pharmacokinetics (PK) and outcomes data (forced vital capacity (“FVC”)) from our open label Phase 2 study of pamrevlumab

in IPF was used for pharmacokinetic/pharmacodynamic (“PK/PD”) modeling with the objective of optimizing Phase 3 dosing for our IPF program.

The PK/PD and FVC data obtained show that increased exposure to pamrevlumab results in improved FVC outcomes. In particular, achieving trough levels of

plasma pamrevlumab measured immediately before another dose (Cmin) of 150 ug/mL or higher provided better outcomes in this study as measured by FVC. The PK modeling predicts that there is the potential to increase efficacy with increased dose or

frequency of administration. The dose used in our recently completed randomized, double-blind, placebo-controlled Phase 2 study was 30 mg/kg every three weeks. In two other indications, we have utilized doses of up to 45 mg/kg. As pamrevlumab has

been well tolerated in our

S-3

clinical studies, and as we have not identified a maximum tolerated dose to date, we believe there is the potential to pursue higher or more frequent dosing regimens.

Certain cancers have a prominent ECM component that contributes to metastasis and progressive disease. Specifically, ECM is the connective tissue

framework of an organ or tissue; all tumors have ECM. In the case of fibrotic tumors, ECM is more pronounced and there is more fibrosis than in other tumor types. In mouse models of pancreatic cancer, pamrevlumab treatment has demonstrated reduction

of tumor mass, slowing of metastasis and improvement in survival. In an open-label Phase 2 study of pamrevlumab plus gemcitabine and erlotinib, pamrevlumab demonstrated a dose-dependent improvement in one year survival rate.

In June 2017, the U.S. Food and Drug Administration granted Orphan Drug Designation status to pamrevlumab for the treatment of pancreatic cancer. We

continue to expect to report surgical assessment data in the fourth quarter of 2017 or the first quarter of 2018 from our ongoing open-label, randomized (2:1) Phase 2 trial to determine if pamrevlumab in combination with gemcitabine and

nab-paclitaxel,

can convert stage 3 inoperable locally advanced pancreatic cancer to resectable, or operable, cancer.

DMD is an inherited disorder of the dystrophin gene that leads to progressive muscle loss and results in early death due to pulmonary or cardiac

failure. Numerous

pre-clinical

studies including those in the mdx model of DMD suggest that CTGF contributes to the process by which muscle is replaced by fibrosis and fat and that CTGF may also impair muscle

cell differentiation during muscle repair after injury. Pamrevlumab treatment has improved muscle strength and exercise endurance in the mdx model of DMD. We continue to enroll patients in our Phase 2 open-label trial of pamrevlumab in up to 22

non-ambulatory

Duchenne muscular dystrophy patients.

Intellectual Property Update

In May and June of this year, the Opposition Division of the European Patent Office conducted oral proceedings relating to oppositions filed against two

FibroGen European patents, European Patent Nos. 2322155 and 2322153, within our HIF Anemia-related Technologies Patent Portfolio, relating to various uses of HIF prolyl hydroxylase inhibitors that are structural mimetics of

2-oxoglutarate.

(An opposition is a European Patent Office mechanism providing for a third-party challenge to a granted European patent.) The initial decision in the ‘155 case was unfavorable to FibroGen; this

decision is currently under appeal, and the ‘155 European patent is valid and enforceable pending resolution of this appeal. The initial decision in the ‘153 case was favorable to FibroGen, with the European Patent Office maintaining

the patent. An appeal of this decision may yet be filed by one or more parties to the opposition. The ultimate outcomes of these proceedings remain uncertain, and ultimate resolution of each of the appeal proceedings may take two to four years or

longer. While we believe these FibroGen patents will be upheld in relevant part, we note that narrowing or even revocation of either of these patents would not affect our exclusivity for roxadustat or our

freedom-to-operate

with respect to use of roxadustat for the treatment of anemia.

Corporate Information

We were incorporated in 1993 in Delaware. Our headquarters are located at 409 Illinois Street, San Francisco, California 94158 and our telephone number

is (415)

978-1200.

Our website address is www.FibroGen.com. The information contained on, or that can be accessed through, our website is not part of, and is not incorporated into, this prospectus supplement

or the accompanying prospectus.

S-4

“FibroGen,” the FibroGen logo and other trademarks or service marks of FibroGen, Inc.

appearing in this prospectus supplement or the accompanying prospectus are the property of FibroGen, Inc. This prospectus supplement or the accompanying prospectus contain additional trade names, trademarks and service marks of others, which are the

property of their respective owners. We do not intend our use of display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

THE OFFERING

|

|

|

|

|

|

|

|

Common Stock offered by us

|

|

8,000,000 shares

|

|

|

|

|

Common Stock to be outstanding after the offering

|

|

78,969,392 shares

|

|

|

|

|

Underwriters’ option to purchase additional shares

|

|

1,200,000 shares

|

|

|

|

|

Use of Proceeds

|

|

We currently intend to use the net proceeds from this offering to fund the expansion of product development, including our development of pamrevlumab beyond current Phase 2 programs, manufacturing and commercialization activities,

as well as for general corporate purposes. We will have broad discretion over the uses of the net proceeds from this offering. See the section entitled “Use of Proceeds,” below.

|

|

|

|

|

Risk Factors

|

|

See “Risk Factors” beginning on page

S-6

for a discussion of factors you should consider carefully before making an investment decision.

|

|

|

|

|

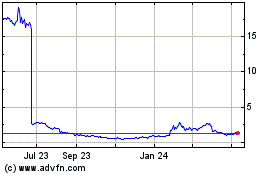

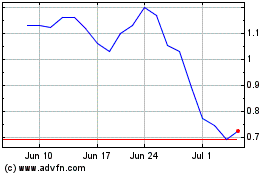

NASDAQ Global Select Market Symbol for our Common Stock

|

|

FGEN

|

The number of shares of our common stock to be outstanding after the offering is based on 70,969,392 shares of our

common stock outstanding as of June 30, 2017 and excludes as of that date:

|

|

•

|

|

13,642,171 shares of common stock issuable upon exercise of outstanding stock options pursuant to our Amended and Restated 2005 Stock Plan (“2005 Plan”) and our 2014 Equity Incentive Plan (“2014

Plan”), with a weighted average exercise price of approximately $13.8584 per share;

|

|

|

•

|

|

4,144,100 shares of common stock available for future award pursuant to the 2005 Plan and the 2014 Plan, as well as any automatic increases in the number of shares of common stock reserved for further issuance under the

2014 Plan;

|

|

|

•

|

|

2,108,899 shares of common stock available for sale under our 2014 Employee Stock Purchase Plan (“ESPP”), as well as any automatic increases in the number of shares of common stock reserved for further

issuance under the ESPP; and

|

|

|

•

|

|

4,430 shares of common stock issuable upon exercise of common stock warrants outstanding, with a weighted average exercise price of approximately $15.00 per share.

|

Unless otherwise stated, all information contained in this prospectus supplement reflects all currency amounts in United States dollars.

S-5

RISK FACTORS

You should consider carefully the risks described below and discussed in the section titled “Risk Factors” contained in our Annual Report

on Form

10-K

for the year ended December 31, 2016 and our Quarterly Report on Form

10-Q

for the three month period ended June 30, 2017, as updated by our

subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act, each of which is incorporated by reference in this prospectus in their entirety, together with other information in this prospectus, and the information

and documents incorporated by reference in this prospectus before you make a decision to invest in our common stock. If any of the following events actually occur, our business, financial condition, results of operations or cash flow could be

harmed. This could cause the trading price of our common stock to decline and you may lose all or part of your investment. The risks below and incorporated by reference in this prospectus are not the only ones we face. Additional risks not currently

known to us or that we currently deem immaterial may also affect our business operations. Please also read carefully the section above titled “Forward-Looking Statements.”

Risks Related to This Offering

We have broad

discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in

the application of the balance of the net proceeds from this offering and could spend the proceeds in ways that do not improve our business, financial condition or results of operations or enhance the value of our common stock. We currently intend

to use the net proceeds from this offering to fund the expansion of product development, including our development of pamrevlumab beyond current Phase 2 programs, manufacturing and commercialization activities, as well as for general corporate

purposes. We will have broad discretion over the uses of the net proceeds from this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds.

The failure by our management to use these funds effectively could result in financial losses that could harm our business, cause the price of our

common stock to decline and delay the development of our product candidates. Pending their use, we may invest the net proceeds from this offering in a manner that does not produce income or that loses value.

Purchasers in this offering will experience immediate and substantial dilution in the tangible net book value of their investment.

If you purchase our common stock in this offering, you will incur an immediate dilution of $33.68 in net tangible book value per share from the price you

paid, based on the public offering price of $40.75 per share. The exercise of outstanding options will result in further dilution. For a further description of the dilution that you will experience immediately after this offering, see the section

titled “Dilution.”

Sales of a substantial amount of shares of our common stock in the public market, particularly sales by our directors and named

executive officers, or the perception that these sales could occur, could cause the market price of our common stock to decline and may make it more difficult for you to sell your common stock at a time and price that you deem appropriate.

Our named executive officers and directors have entered into

lock-up

agreements with the

underwriters under which they have agreed, subject to specific exceptions described in the section titled “Underwriting”, not to sell, directly or indirectly, any shares of common stock without the permission of Goldman Sachs & Co.

LLC, Citigroup Global Markets Inc. and Leerink Partners LLC a period of 60 days following the date of this prospectus supplement. Additionally, we have agreed to a

S-6

lock-up

period of 90 days following the date of this prospectus supplement. We refer to such periods as the

lock-up

periods. When the

lock-up

periods expire, we and our named executive officers and directors subject to a

lock-up

agreement will be able to sell our shares in the public

market. In addition, Goldman Sachs & Co. LLC, Citigroup Global Markets Inc. and Leerink Partners LLC may, in their sole discretion, release all or some portion of the shares subject to

lock-up

agreements

at any time and for any reason during the

lock-up

periods. Sales of a substantial number of such shares upon expiration of the

lock-up

periods, the perception that such

sales may occur, or early release of the

lock-up

agreements, could cause our market price to fall or make it more difficult for you to sell your common stock at a time and price that you deem appropriate.

S-7

USE OF PROCEEDS

We estimate that the net proceeds from the sale of 8,000,000 shares of common stock in this offering, after deducting underwriting discounts and

estimated offering expenses payable by us, will be approximately $309.3 million, or approximately $355.8 million if the underwriters exercise their option to purchase additional shares in full. These numbers are based on the offering price to

the public of $40.75 per share.

We intend to use the net proceeds from this offering to fund the expansion of product development, including our

development of pamrevlumab beyond current Phase 2 programs, manufacturing and commercialization activities, as well as for general corporate purposes, which may include, among other things, funding research and development, clinical trials,

manufacturing, potential regulatory submissions, hiring additional personnel and capital expenditures. We have no current commitments or agreements with respect to any such transactions. We have not determined the amounts we plan to spend on any of

the areas listed above or the timing of these expenditures.

We will have broad discretion in the application of the net proceeds, and investors

will be relying on the judgment of our management regarding the application of the net proceeds of this offering.

S-8

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock and we do not anticipate paying cash dividends in the foreseeable future. We

currently intend to retain all available funds and our earnings, if any, to fund the development and expansion of our business. Future dividends on our common stock, if any, will be at the discretion of our board of directors and will depend on,

among other things, our operations, capital requirements and surplus, general financial condition, contractual restrictions and such other factors that our board of directors may deem relevant.

S-9

CAPITALIZATION

The following table sets forth our cash, cash equivalents and short-term and long-term investments and our capitalization as of June 30, 2017 on:

|

|

•

|

|

an as adjusted basis to give effect to the issuance and sale by us of 8,000,000 shares of common stock in this offering at the public offering price of $40.75 per share, after deducting underwriting discounts

and commissions and estimated offering expenses payable by us.

|

The following information should be read in conjunction with the

consolidated financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus. For more details on how you can obtain the documents incorporated by reference in this prospectus supplement

and the accompanying prospectus, see “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2017

|

|

|

|

|

Actual

|

|

|

As

Adjusted

|

|

|

|

|

(in thousands, except share

and per share data)

|

|

|

Cash, cash equivalents and short-term and long-term investments

|

|

$

|

398,602

|

|

|

$

|

707,938

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock- $0.01 par value—authorized, 125,000 actual and as adjusted; no shares issued and

outstanding, actual and as adjusted

|

|

|

—

|

|

|

|

—

|

|

|

Common stock- $0.01 par value—authorized, 225,000 actual and as adjusted; issued and outstanding,

70,969 actual and 78,969 as adjusted

|

|

|

710

|

|

|

|

790

|

|

|

Additional

paid-in

capital

|

|

|

766,861

|

|

|

|

1,076,117

|

|

|

Accumulated deficit

|

|

|

(536,086

|

)

|

|

|

(536,086

|

)

|

|

Accumulated other comprehensive income (loss)

|

|

|

(1,387

|

)

|

|

|

(1,387

|

)

|

|

|

|

|

|

Total stockholders’ equity

|

|

$

|

230,098

|

|

|

$

|

539,434

|

|

|

Non-controlling

interests

|

|

|

19,271

|

|

|

|

19,271

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

249,369

|

|

|

$

|

558,705

|

|

The number of shares of our common stock to be outstanding after the offering is based on 70,969,392 shares of our

common stock outstanding as of June 30, 2017 and excludes as of that date:

|

|

•

|

|

13,642,171 shares of common stock issuable upon exercise of outstanding stock options pursuant to our Amended and Restated 2005 Stock Plan (“2005 Plan”) and our 2014 Equity Incentive Plan (“2014

Plan”), with a weighted average exercise price of approximately $13.8584 per share;

|

|

|

•

|

|

4,144,100 shares of common stock available for future award pursuant to the 2005 Plan and the 2014 Plan, as well as any automatic increases in the number of shares of common stock reserved for further issuance under the

2014 Plan;

|

|

|

•

|

|

2,108,899 shares of common stock available for sale under our 2014 Employee Stock Purchase Plan (“ESPP”), as well as any automatic increases in the number of shares of common stock reserved for further

issuance under the ESPP; and

|

|

|

•

|

|

4,430 shares of common stock issuable upon exercise of common stock warrants outstanding, with a weighted average exercise price of approximately $15.00 per share.

|

S-10

DILUTION

If you invest in our common stock in this offering, your ownership interest will be diluted to the extent of the difference between the public offering

price per share and the pro forma net tangible book value per share. Our historical net tangible book value as of June 30, 2017 was approximately $249.4 million, or approximately $3.51 per share. Historical net tangible book value per

share is determined by dividing our net tangible book value by the actual number of outstanding shares of common stock. Dilution in historical net tangible book value per share represents the difference between the amount per share paid by

purchasers of shares of common stock in this offering and the pro forma net tangible book value per share of common stock immediately after the closing of this offering.

After giving effect to the sale of 8,000,000 shares of common stock at the public offering price of $40.75 per share, after deducting

estimated offering expenses payable by us and underwriting discounts, our pro forma net tangible book value as of June 30, 2017 would have been approximately $558.7 million, or $7.07 per share of common stock. This would represent an immediate

increase in pro forma net tangible book value of $3.56 per share to existing stockholders and an immediate dilution of $33.68 per share to new investors purchasing shares of common stock in this offering at the public offering price of $40.75 per

share.

The following table illustrates this dilution on a per share basis:

|

|

|

|

|

|

|

|

|

|

|

Public offering price per share

|

|

|

|

|

|

$

|

40.75

|

|

|

Historical net tangible book value per share as of June 30, 2017

|

|

$

|

3.51

|

|

|

|

|

|

|

Increase in historical net tangible book value per share attributable to this offering

|

|

|

3.56

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma net tangible book value per share after giving effect to this offering

|

|

|

|

|

|

|

7.07

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to new investors purchasing our common stock in this offering

|

|

|

|

|

|

$

|

33.68

|

|

|

|

|

|

|

|

|

|

|

|

If the underwriters exercise in full their option to purchase additional shares from us, the adjusted net tangible book

value per share after giving effect to this offering would be $7.55 per share, representing an immediate increase to existing stockholders of $0.48 per share, and immediate dilution to investors in this offering of $33.20 per share.

The number of shares of our common stock to be outstanding after the offering is based on 70,969,392 shares of our common stock outstanding as of

June 30, 2017 and excludes as of that date:

|

|

•

|

|

13,642,171 shares of common stock issuable upon exercise of outstanding stock options pursuant to our 2005 Plan and our 2014 Plan, with a weighted average exercise price of approximately $13.8584 per share;

|

|

|

•

|

|

4,144,100 shares of common stock available for future award pursuant to the 2005 Plan and the 2014 Plan, as well as any automatic increases in the number of shares of common stock reserved for further issuance under the

2014 Plan;

|

|

|

•

|

|

2,108,899 shares of common stock available for sale under our ESPP, as well as any automatic increases in the number of shares of common stock reserved for further issuance under the ESPP; and

|

|

|

•

|

|

4,430 shares of common stock issuable upon exercise of common stock warrants outstanding, with a weighted average exercise price of approximately $15.00 per share.

|

In addition, we may choose to raise additional capital due to market conditions or strategic considerations even if we believe that we have sufficient

funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

S-11

DESCRIPTION OF CAPITAL STOCK

As of the date of this prospectus supplement, our authorized capital stock consists of 225,000,000 shares of common stock, par value $0.01 per share and

125,000,000 shares of preferred stock, par value $0.01 per share. As of June 30, 2017, there were 70,969,392 shares of common stock outstanding and no shares of preferred stock outstanding.

The following summary description of our capital stock is based on the provisions of our amended and restated certificate of incorporation and amended

and restated bylaws and the applicable provisions of the Delaware General Corporation Law, or the DGCL. This information is qualified entirely by reference to the applicable provisions of our amended and restated certificate of incorporation,

amended and restated bylaws and the DGCL. For information on how to obtain copies of our amended and restated certificate of incorporation and amended and restated bylaws, see “Where You Can Find More Information.”

Common Stock

Voting Rights

Each holder of our common stock is entitled to one vote for each share of common stock held on all matters submitted to a vote of stockholders, except as

otherwise expressly provided in our amended and restated certificate of incorporation or required by applicable law. We have not provided for cumulative voting for the election of directors in our amended and restated certificate of incorporation.

Economic Rights

Dividends and

Distributions.

Subject to the prior rights of holders of all classes and series of stock at the time outstanding having prior rights as to dividends, the holders of common stock will be entitled to receive, when, as and if

declared by our board of directors, out of any assets legally available therefor, such dividends as may be declared from time to time by our board of directors.

Liquidation Rights.

In the event of our liquidation, dissolution or

winding-up,

upon the completion of the distributions required with respect to any series of preferred stock that may then be outstanding, the remaining assets legally available for distribution to stockholders shall be distributed ratably among the holders of

common stock and any participating preferred stock outstanding at that time.

Holders of common stock have no preemptive or conversion rights or

other subscription rights. There are no redemption or sinking fund provisions applicable to the common stock.

Preferred Stock

Our amended and restated certificate of incorporation provides that our board of directors may, without further action by our stockholders, fix the

rights, preferences, privileges and restrictions of up to an aggregate of 125,000,000 shares of preferred stock in one or more series and authorize their issuance. These rights, preferences and privileges could include dividend rights, conversion

rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting any series or the designation of such series, any or all of which may be greater than the rights of our common stock. The

issuance of our preferred stock could adversely affect the voting power of holders of our common stock and the likelihood that such holders will receive dividend payments and payments upon liquidation, which could decrease the market price of our

common stock. In addition, the issuance of preferred stock could have the effect of delaying, deferring or

S-12

preventing a change of control or other corporate action. Upon the completion of this offering, no shares of preferred stock will be outstanding, and we have no present plan to issue any shares

of preferred stock.

Anti-Takeover Effects of Provisions of Delaware Law and Our Amended and Restated Certificate of Incorporation and Amended and

Restated Bylaws

Our amended and restated certificate of incorporation and amended and restated bylaws to be in effect upon the completion of

this offering contain certain provisions that could have the effect of delaying, deferring or discouraging another party from acquiring control of us. These provisions and certain provisions of Delaware law, which are summarized below, are expected

to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed, in part, to encourage persons seeking to acquire control of us to negotiate first with our board of directors. We believe that the benefits

of increased protection of our potential ability to negotiate more favorable terms with an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire us.

Section 203 of the Delaware General Corporation Law

We are subject to Section 203 of the Delaware General Corporation Law, which prohibits a Delaware corporation from engaging in any business

combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

|

|

•

|

|

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

•

|

|

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the

transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (1) by persons who are directors and also officers and

(2) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; and

|

|

|

•

|

|

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least

66

2

⁄

3

% of the outstanding voting stock that is not owned by the interested stockholder.

|

In general, Section 203 of the Delaware General Corporation Law defines a “business combination” to include the following:

|

|

•

|

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

•

|

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; and

|

S-13

|

|

•

|

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits by or through the corporation.

|

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and

associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status owned, 15% or more of the outstanding voting stock of the corporation.

The statute could prohibit or delay mergers or other takeover or change in control attempts and, accordingly, may discourage attempts to acquire us even

though such a transaction may offer our stockholders the opportunity to sell their stock at a price above the prevailing market price.

Amended and Restated

Certificate of Incorporation and Amended and Restated Bylaws

Our amended and restated certificate of incorporation provides for our board of

directors to be divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms.

Because our stockholders do not have cumulative voting rights, stockholders holding a majority of the shares of common stock outstanding will be able to elect all of our directors. Our amended and restated certificate of incorporation and our

amended and restated bylaws also provide that directors may be removed by the stockholders only for cause upon the vote of 66

2

⁄

3

% of all then-outstanding shares of capital stock entitled to vote generally at an election of directors. Furthermore, the authorized number of directors may be

changed only by resolution of the board of directors, and vacancies and newly created directorships on the board of directors may, except as otherwise required by law or determined by the board, only be filled by a majority vote of the directors

then serving on the board, even though less than a quorum.

Our amended and restated certificate of incorporation and amended and restated bylaws

provide that all stockholder actions must be effected at a duly called meeting of stockholders and does not contain the right of stockholders to act by written consent without a meeting. Our amended and restated bylaws also provides that only our

chairman of the board, chief executive officer or the board of directors pursuant to a resolution adopted by a majority of the total number of authorized directors may call a special meeting of stockholders.

Our amended and restated bylaws also provides that stockholders seeking to present proposals before a meeting of stockholders to nominate candidates for

election as directors at a meeting of stockholders must provide timely advance notice in writing, and specifies requirements as to the form and content of a stockholder’s notice. Our amended and restated certificate of incorporation and amended

and restated bylaws provide that the stockholders cannot amend many of the provisions described above except by a vote of 66

2

⁄

3

% or more of our outstanding common stock.

The combination

of these provisions makes it more difficult for our existing stockholders to replace our board of directors as well as for another party to obtain control of us by replacing our board of directors. Since our board of directors has the power to

retain and discharge our officers, these provisions could also make it more difficult for existing stockholders or another party to effect a change in management. In addition, the authorization of undesignated preferred stock makes it possible for

our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change our control.

These provisions are intended to enhance the likelihood of continued stability in the composition of our board of directors and its policies and to

discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to reduce our vulnerability to hostile takeovers and

to

discourage certain tactics that may be used in proxy fights. However, such provisions could have the

S-14

effect of discouraging others from making tender offers for our shares and may have the effect of delaying changes in our control or management. As a consequence, these provisions may also

inhibit fluctuations in the market price of our stock that could result from actual or rumored takeover attempts. We believe that the benefits of these provisions, including increased protection of our potential ability to negotiate with the

proponent of an unfriendly or unsolicited proposal to acquire or restructure our company, outweigh the disadvantages of discouraging takeover proposals, because negotiation of takeover proposals could result in an improvement of their terms.

Choice of Forum

Our amended and restated

certificate of incorporation provides that the Court of Chancery of the State of Delaware will be the exclusive forum for any derivative action or proceeding brought on our behalf; any action asserting a breach of fiduciary duty; any action

asserting a claim against us arising pursuant to the Delaware General Corporation Law, our amended and restated certificate of incorporation or our amended and restated bylaws; or any action asserting a claim against us that is governed by the

internal affairs doctrine.

Limitation on Liability and Indemnification of Officers and Directors

Section 145 of the DGCL authorizes a court to award, or a corporation’s board of directors to grant, indemnity to directors and officers under

certain circumstances and subject to certain limitations. The terms of Section 145 of the DGCL are sufficiently broad to permit such indemnification under certain circumstances for liabilities, including reimbursement for expenses incurred,

arising under the Securities Act of 1933, as amended, or the Securities Act.

Our amended and restated certificate of incorporation provides for

indemnification of our directors, officers, employees and other agents to the maximum extent permitted by the DGCL, and our amended and restated bylaws provide for indemnification of our directors, officers, employees and other agents to the maximum

extent permitted by the DGCL.

We have entered into indemnification agreements with our directors and officers whereby we have agreed to indemnify

our directors and officers to the fullest extent permitted by law, including indemnification against expenses and liabilities incurred in legal proceedings to which the director or officer was, or is threatened to be made, a party by reason of the

fact that such director or officer is or was a director, officer, employee or agent of FibroGen, provided that such director or officer acted in good faith and in a manner that the director or officer reasonably believed to be in, or not opposed to,

the best interest of FibroGen. At present, there is no pending litigation or proceeding involving a director or officer of FibroGen regarding which indemnification is sought, nor is the registrant aware of any threatened litigation that may result

in claims for indemnification.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company. Its address is 6201 15

th

Avenue, Brooklyn, New York 11219.

Listing on the NASDAQ Global Select Market

Our common stock is listed on the NASDAQ Global Select Market under the symbol “FGEN”.

S-15

UNDERWRITING

We and the underwriters named below have entered into an underwriting agreement with respect to the shares of common stock being offered. Subject to

certain conditions, each underwriter has severally agreed to purchase the number of shares indicated in the following table. Goldman Sachs & Co. LLC, Citigroup Global Markets Inc., and Leerink Partners LLC are acting as representatives of

each of the underwriters named below.

|

|

|

|

|

|

|

Underwriters

|

|

Number of

Shares

|

|

|

Goldman Sachs & Co. LLC

|

|

|

2,960,000

|

|

|

Citigroup Global Markets Inc.

|

|

|

2,640,000

|

|

|

Leerink Partners LLC

|

|

|

2,400,000

|

|

|

|

|

|

|

|

|

Total

|

|

|

8,000,000

|

|

The underwriters are committed to take and pay for all of the shares being offered, if any are taken, other than the

shares covered by the option described below unless and until this option is exercised.

To the extent that the underwriters sell more than

8,000,000 shares of common stock, the underwriters have an option to buy up to an additional 1,200,000 shares of our common stock from us. They may exercise that option for 30 days from the date of this prospectus supplement. If any shares

are purchased pursuant to this option, the underwriters will severally purchase shares in approximately the same proportion as set forth in the table above.

Discounts and Expenses

The following table

shows the per share and total underwriting discounts to be paid by us to the underwriters. Such amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase 1,200,000 additional shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

No Exercise

|

|

|

Full Exercise

|

|

|

Per Share

|

|

$

|

2.0375

|

|

|

$

|

2.0375

|

|

|

Total

|

|

$

|

16,300,000

|

|

|

$

|

18,745,000

|

|

Shares sold by the underwriters to the public will initially be offered at the public offering price set forth on the

cover of this prospectus supplement. Any shares sold by the underwriters to securities dealers may be sold at a discount of up to $1.22 per share from the public offering price. After the initial offering of the shares, the representatives may

change the offering price and the other selling terms. The offering of the shares by the underwriters is subject to receipt and acceptance and subject to the underwriters’ right to reject any order in whole or in part.

The company estimates that their share of the total expenses of the offering, excluding underwriting discounts, will be approximately $400,000.

Lock-up

Agreements

We and our executive officers and directors have agreed with the underwriters, subject to certain exceptions, not to dispose of or hedge any of the

shares of our common stock or securities convertible into or exchangeable for shares of common stock held by the person executing the agreement during the period from the date of this prospectus continuing through the date 90 days, as it relates to

us, and

S-16

60 days, as it relates to our executive officers and directors, after the date of this prospectus, except with the prior written consent of Goldman Sachs & Co. LLC, Citigroup Markets Inc. and

Leerink Partners LLC. This agreement does not apply to any existing employee benefit plans.

Price Stabilization, Short Positions and Penalty Bids

In connection with the offering, the underwriters may purchase and sell shares of our common stock in the open market. These transactions

may include short sales, stabilizing transactions and purchases to cover positions created by short sales. Short sales involve the sale by the underwriters of a greater number of shares than they are required to purchase in the offering, and a short

position represents the amount of such sales that have not been covered by subsequent purchases. A “covered short position” is a short position that is not greater than the amount of additional shares for which the underwriters’

option described above may be exercised. The underwriters may cover any covered short position by either exercising their option to purchase additional shares or purchasing shares in the open market. In determining the source of shares to cover the

covered short position, the underwriters will consider, among other things, the price of shares available for purchase in the open market as compared to the price at which they may purchase additional shares pursuant to the option described above.

“Naked” short sales are any short sales that create a short position greater than the amount of additional shares for which the option described above may be exercised. The underwriters must cover any such naked short position by

purchasing shares in the open market. A naked short position is more likely to be created if the underwriters are concerned that there may be downward pressure on the price of the common stock in the open market after pricing that could adversely

affect investors who purchase in the offering. Stabilizing transactions consist of various bids for or purchases of common stock made by the underwriters in the open market prior to the completion of the offering.

The underwriters may also impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting

discount received by it because the representatives have repurchased shares sold by or for the account of such underwriter in stabilizing or short covering transactions.

Purchases to cover a short position and stabilizing transactions, as well as other purchases by the underwriters for their own accounts, may have the

effect of preventing or retarding a decline in the market price of our common stock, and together with the imposition of the penalty bid, may stabilize, maintain or otherwise affect the market price of our common stock. As a result, the price of our

common stock may be higher than the price that otherwise might exist in the open market. The underwriters are not required to engage in these activities and may end any of these activities at any time. These transactions may be effected on NASDAQ

NMS, in the

over-the-counter

market or otherwise.

We may enter into

derivative transactions with third parties, or sell securities not covered by this prospectus supplement to third parties in privately negotiated transactions. In connection with those derivatives, the third parties may sell securities covered by

this prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use

securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter or will be identified in a post-effective amendment.

European Economic Area

In relation to each Member State of

the European Economic Area which has implemented the Prospectus Directive (each, a “Relative Member State”) an offer to the public of our common stock may

S-17

not be made in that Relevant Member State, except that an offer to the public in that Relevant Member State of our common stock may be made at any time under the following exemptions under the

Prospectus Directive:

|

|

•

|

|

To any legal entity which is a qualified investor as defined in the Prospectus Directive;

|

|

|

•

|

|

To fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), subject to obtaining the prior consent of the Representatives for any such offer; or

|

|

|

•

|

|

In any other circumstances falling within Article 3(2) of the Prospectus Directive;

|

provided that no such offer or

shares of our common stock shall result in a requirement for the publication by us or any Brazilian placement agent of a prospectus pursuant to Article 3 of the Prospectus Directive.

For the purposes of this provision, the expression an “offer to public” in relation to our common stock in any Relevant Member State means the

communication in any form and by any means of sufficient information on the terms of the offer and our common shares to be offered so as to enable an investor to decide to purchase our common stock, as the same may be varied in that Member State by

any measure implementing the Prospectus Directive in that Member State, the expression “Prospectus Directive” means Directive 2003/71/EC (as amended), including by Directive 2010/73/EU and includes any relevant implementing measure in the

Relevant Member State.

This European Economic Area selling restriction is in addition to any other selling restrictions set out below.

United Kingdom

In the United Kingdom, this

prospectus supplement is only addressed to and directed as qualified investors who are (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the Order); or

(ii) high net worth entities and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). Any investment or

investment activity to which this prospectus supplement relates is available only to relevant persons and will only be engaged with relevant persons. Any person who is not a relevant person should not act or relay on this prospectus supplement or

any of its contents.

Canada

The shares

may be sold in Canada only to purchasers purchasing, or deemed to be purchasing, as principal that are accredited investors, as defined in National Instrument

45-106

Prospectus Exemptions or subsection 73.3(1)

of the Securities Act (Ontario), and are permitted clients, as defined in National Instrument

31-103

Registration Requirements, Exemptions, and Ongoing Registrant Obligations. Any resale of the shares must be

made in accordance with an exemption form, or in a transaction not subject to, the prospectus requirements of applicable securities laws.

Securities legislation in certain provinces or territories of Canada may provide a purchaser with remedies for rescission or damages if this offering

memorandum (including any amendment thereto) contains a misrepresentation, provided that the remedies for rescission or damages are exercised by the purchaser within the time limit prescribed by the securities legislation of the purchaser’s

province or territory. The purchaser should refer to any applicable provisions of the securities legislation of the purchaser’s province or territory of these rights or consult with a legal advisor.

S-18

Pursuant to section 3A.3 of National Instrument

33-105

Underwriting

Conflicts (NI

33-105),

the underwriters are not required to comply with the disclosure requirements of NI

33-105

regarding underwriter conflicts of interest in

connection with this offering.

Hong Kong

The shares may not be offered or sold in Hong Kong by means of any document other than (i) in circumstances which do not constitute an offer to the

public within the meaning of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32 of the Laws of Hong Kong) (“Companies (Winding Up and Miscellaneous Provisions) Ordinance”) or which do not constitute an invitation to

the public within the meaning of the Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) (“Securities and Futures Ordinance”), or (ii) to “professional investors” as defined in the Securities and Futures

Ordinance and any rules made thereunder, or (iii) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies (Winding Up and Miscellaneous Provisions) Ordinance, and no advertisement,

invitation or document relating to the shares may be issued or may be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed

or read by, the public in Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to shares which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional

investors” in Hong Kong as defined in the Securities and Futures Ordinance and any rules made thereunder.

Singapore

This prospectus supplement has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus supplement and

any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the shares may not be circulated or distributed, nor may the shares be offered or sold, or be made the subject of an invitation for

subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined under Section 4A of the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”))

under Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1) of the SFA, or any person pursuant to Section 275(1A) of the SFA, and in accordance with the

conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA, in each case subject to conditions set forth in the SFA.

Where the shares are subscribed or purchased under Section 275 of the SFA by a relevant person which is a corporation (which is not an accredited

investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor, the shares (as defined in

Section 239(1) of the SFA) of that corporation shall not be transferable for 6 months after that corporation has acquired the shares under Section 275 of the SFA except: (1) to an institutional investor under Section 274 of the

SFA or to a relevant person (as defined in Section 275(2) of the SFA), (2) where such transfer arises from an offer in that corporation’s securities pursuant to Section 275(1A) of the SFA, (3) where no consideration is or will be

given for the transfer, (4) where the transfer is by operation of law, (5) as specified in Section 276(7) of the SFA, or (6) as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and

Debentures) Regulations 2005 of Singapore (“Regulation 32”)

Where the shares are subscribed or purchased under Section 275 of the

SFA by a relevant person which is a trust (where the trustee is not an accredited investor (as defined in Section 4A of the

S-19

SFA)) whose sole purpose is to hold investments and each beneficiary of the trust is an accredited investor, the beneficiaries’ rights and interest (howsoever described) in that trust shall

not be transferable for 6 months after that trust has acquired the shares under Section 275 of the SFA except: (1) to an institutional investor under Section 274 of the SFA or to a relevant person (as defined in Section 275(2) of

the SFA), (2) where such transfer arises from an offer that is made on terms that such rights or interest are acquired at a consideration of not less than S$200,000 (or its equivalent in a foreign currency) for each transaction (whether such amount

is to be paid for in cash or by exchange of securities or other assets), (3) where no consideration is or will be given for the transfer, (4) where the transfer is by operation of law, (5) as specified in Section 276(7) of the SFA, or

(6) as specified in Regulation 32.

Japan

The shares have not been and will not be registered under the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended), or

the FIEA. The shares may not be offered or sold, directly or indirectly, in Japan or to or for the benefit of any resident of Japan (including any person resident in Japan or any corporation or other entity organized under the laws of Japan) or to

others for reoffering or resale, directly or indirectly, in Japan or to or for the benefit of any resident of Japan, except pursuant to an exemption from the registration requirements of the FIEA and otherwise in compliance with any relevant laws

and regulations of Japan.

Indemnification

We have agreed to indemnify the several underwriters against certain liabilities, including liabilities under the Securities Act.

Other Relationships

The underwriters and

their respective affiliates are full service financial institutions engaged in various activities, which may include sales and trading, commercial and investment banking, advisory, investment management, investment research, principal investment,

hedging, market making, brokerage and other financial and

non-financial

activities and services. Certain of the underwriters and their respective affiliates have provided, and may in the future provide, a

variety of these services to us or our affiliates and to persons and entities with relationships with us, for which they received or will receive customary fees and expenses.

In the ordinary course of their various business activities, the underwriters and their respective affiliates, officers, directors and employees may

purchase, sell or hold a broad array of investments and actively traded securities, derivatives, loans, commodities, currencies, credit default swaps and other financial instruments for their own account and for the accounts of their customers, and

such investment and trading activities may involve or relate to our assets, securities and/or instruments (directly, as collateral securing other obligations or otherwise) and/or persons and entities with relationships with us. The underwriters and

their respective affiliates may also communicate independent investment recommendations, market color or trading ideas and/or publish or express independent research views in respect of such assets, securities or instruments and may at any time

hold, or recommend to clients that they should acquire, long and/or short positions in such assets, securities and instruments.

S-20

LEGAL MATTERS

Certain legal matters relating to the issuance of the shares of common stock will be passed upon for FibroGen by Cooley LLP, Palo Alto, California.

Perkins Coie LLP, Palo Alto, California, is representing the underwriters in connection with this offering.

EXPERTS

The

financial statements and management’s assessment of the effectiveness of internal control over financial reporting (which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this Prospectus by

reference to the Annual Report on Form

10-K

for the year ended December 31, 2016 have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public

accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND

MORE INFORMATION

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form

S-3

we filed with the SEC under the Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus supplement or the accompanying

prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by

reference therein. For further information with respect to us and the common stock we are offering under this prospectus supplement, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration

statement.

We file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission, or

the SEC. You may read and copy any document we file at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330

for more information about the operation of the public reference room. The SEC maintains an Internet site that contains reports, proxy and information statements and other information

regarding issuers that file electronically with the SEC, including us. The SEC’s Internet site can be found at http://www.sec.gov.

S-21

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to incorporate by reference the information we file with it, which means that we can disclose important information to you by

referring you to another document that we have filed separately with the SEC. You should read the information incorporated by reference because it is an important part of this prospectus supplement and the accompanying prospectus. We incorporate by

reference the following information or documents that we have filed with the SEC (Commission File

No. 001-36740):

|

|

•

|

|

our annual report on Form

10-K,

for the year ended December 31, 2016, or the Annual Report;

|

|

|

•

|

|

the information specifically incorporated by reference into our Annual Report from our definitive proxy statement on Schedule 14A, filed with the SEC on April 24, 2017;

|

|

|

•

|

|

our quarterly reports on Form

10-Q

for the three month periods ended March 31, 2017 and June 30, 2017 filed with the SEC on May 9, 2017 and August 7, 2017,

respectively;

|

|

|

•

|

|

our current reports on Form

8-K

(other than information furnished rather than filed) filed with the SEC on January 30, 2017, February 16, 2017, March 1, 2017,

March 2, 2017, March 31, 2017, April 6, 2017, June 9, 2017 and August 14, 2017; and

|

|

|

•

|

|

the description of our common stock set forth in our registration statement on Form

8-A,

filed with the SEC on November 12, 2014, including any amendments or reports filed

for the purposes of updating this description.

|