|

Supplement No. 1 dated August 7, 2017

to

Prospectus Supplement dated March 22,

2017

|

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-213777

|

|

(To the Prospectus dated September 23, 2016)

|

|

18,843,692 Shares of Common Stock

Class A Warrants to Purchase 21,632,769

Shares of Common Stock

Class B Warrants to Purchase 21,632,769

Shares of Common Stock

Class C Warrants to Purchase 10,000,000

Shares of Common Stock

Series A Warrants to Purchase 13,527,000

Shares of Common Stock

This prospectus supplement

(“Supplement”) modifies, supersedes and supplements information contained in, and should be read in conjunction with,

that certain prospectus supplement, dated March 22, 2017 (the “Prospectus Supplement”) and should be read in conjunction

with such Prospectus Supplement, and the prospectus dated September 23, 2016, each of which are to be delivered with this Supplement

to Prospectus Supplement. We are filing this Supplement because we agreed with certain holders (the “Holders”) of our

Class B Common Stock Purchase Warrants (the “Class B Warrants”) to amend the exercise price of the Class B Warrants

held by such Holders (the “Amended Class B Warrants”) for the purchase of up to 13,527,000 shares of our common stock,

par value $0.001 per share (the “Common Stock”) to $0.20 per share. The Amended Class B Warrants were originally exercisable

at $1.00 per share of Common Stock. The Amended Class B Warrants were initially exercisable for three months from the date of issuance,

however, subsequent to their issuance, we and the Holders of the Amended Class B Warrants agreed to extend the maturity of such

warrants. As amended to date, the expiration date of the Amended Class B Warrants is August 24, 2017.

In consideration for

the Holders of the Amended Class B Warrants agreeing to exercise the Amended Class B Warrants, we are also issuing the Holders

a new class of Series A Common Stock Purchase Warrants (the “Series A Warrants”) of the Company pursuant to this Supplement

to purchase up to 13,527,000 shares of Common Stock at an exercise price of $0.27 per share. The Series A Warrants will have terms

substantially similar to the Class B Warrants offered hereby, except that the Series A Warrants expire on the fifth year anniversary

of the date of issuance. Our Common Stock is traded on the OTCQB tier of the OTC Markets under the symbol “NWBO”. Our

Warrants are traded on the OTCQB tier of the OTC Markets under the symbol “NWBOW”. On August 4, 2017, the closing sale

price of our common stock was $0.24 per share.

Investing in our

securities involves a high degree of risk. See “Risk Factors” beginning on page S-4 of this Supplement and page S-2

of the accompanying prospectus and the documents incorporated by reference herein for a discussion of information that should be

considered in connection with an investment in our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether

this Supplement or the accompanying prospectus supplement and prospectus is truthful or complete. Any representation to the contrary

is a criminal offense.

The date of this supplement to prospectus

supplement is August 7, 2017

TABLE OF CONTENTS

Supplement No. 1 to Prospectus Supplement

About

this Supplement No. 1 to Prospectus Supplement

On March 22, 2017,

we filed a Prospectus Supplement in accordance with Rule 424(b)(5) of the Securities Act. We offered for sale, directly to selected

investors, 18,843,692 shares (the “Shares”) of our common stock par value $0.001, per share (the “Common Stock”)

at a price of $0.26 per share, Class A Common Stock Purchase Warrants (the “Class A Warrants”) to purchase up to 21,632,769

shares of Common Stock at an exercise price of $0.26 per share, Class B Warrants to purchase up to 21,632,769 shares of Common

Stock at an exercise price of $1.00 per share and pre-funded Class C Common Stock Purchase Warrants (the “Class C Warrants”)

to purchase 10,000,000 shares of Common Stock at the full exercise price of $0.26 per share, of which $0.25 per share was prepaid

at closing. The sale of shares, Class A Warrants, Class B Warrants and the Class C Warrants pursuant to the March 22, 2017

Prospectus Supplement closed on March 22, 2017.

The purpose of this

Supplement to the March 22, 2017 Prospectus Supplement is to disclose the amendment of the exercise price of the Amended Class

B Warrants to $0.20 per share and the amendment of the expiration date of the Amended Class B Warrants to August 24, 2017, and

to reflect the issuance of the new Series A Warrants.

On September 23, 2016,

we filed with the Securities and Exchange Commission, or “SEC”, a registration statement on Form S-3 (File No. 333-213777)

utilizing a shelf registration process relating to the securities described in this prospectus supplement. Under this shelf registration

process, we may, from time to time, sell up to $150 million in the aggregate of common stock, preferred stock, warrants, various

series of debt securities, share purchase contracts, share purchase units, and warrants to purchase any of such securities, either

individually or in units.

The prospectus supplement

is part of a registration statement, and the amendments thereto, that we have filed with the Securities and Exchange Commission

on September 23, 2016 (Registration File No. 333-213777) utilizing a “shelf” registration process, which registration

statement, as amended, was declared effective on October 18, 2016.

Under this shelf registration

process, we offered to sell Common Stock, Class A Warrants, Class B Warrants, Class C Warrants and underlying shares of Common

Stock issuable upon exercise of their respective warrants using the accompanying prospectus supplement and prospectus. In this

Supplement, we provide you with specific additional information about the securities that we sold in the offering and the new Series

A Warrants. This Supplement and the accompanying prospectus supplement and prospectus include important information about us, our

securities being offered and other information you should know before investing. This Supplement, also adds, updates and changes

information contained in the accompanying prospectus supplement and prospectus. You should read this Supplement and the accompanying

prospectus supplement and prospectus, as well as additional information described under “Incorporation of Certain Documents

by Reference” on page S-5 of this Supplement, before investing in our securities.

Our primary executive

offices are located at 4800 Montgomery Lane, Suite 800, Bethesda, MD 20814, and our telephone number is (240) 497-9024. Our website

address is http://www.nwbio.com. The information contained on our website is not a part of, and should not be construed as being

incorporated by reference into, this Supplement or the accompanying prospectus supplement and prospectus.

Unless otherwise expressly

provided or the context otherwise requires, the terms “Northwest Biotherapeutics,” “the Company,” “our

company,” “we,” “us,” “our” and similar names refer collectively to Northwest Biotherapeutics,

Inc. and its subsidiaries.

Prospective investors

may rely only on the information contained in this Supplement to prospectus supplement and the accompanying prospectus supplement

and prospectus. We have not authorized anyone to provide prospective investors with different or additional information. This Supplement

and the accompanying prospectus supplement and prospectus do not constitute an offer to sell nor are they seeking an offer to buy

these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this Supplement is

correct only as of the date of this Supplement, regardless of the time of the delivery of this Supplement or any sale of these

securities.

Cautionary

Statement Regarding Forward-Looking Statements

The SEC encourages

companies to disclose forward-looking information so that investors can better understand a company’s future prospects and

make informed investment decisions. This Supplement, the prospectus supplement and the prospectus and the documents we have filed

with the SEC that are incorporated herein and therein by reference contain such forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). All statements, other than statements of historical facts, included or

incorporated in this prospectus regarding our strategy, future operations, financial position, future revenues, projected costs,

prospects, plans and objectives of management are forward-looking statements.

The words “anticipates,”

“believes,” “estimates,” “expects,” “intends,” “may,” “plans,”

“projects,” “will,” “would” and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. We cannot guarantee that we actually will

achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance

on our forward-looking statements. There are a number of important factors that could cause our actual results to differ materially

from those indicated by these forward-looking statements. These important factors include the factors that we identify in the documents

we incorporate by reference in this Supplement, the prospectus supplement and the prospectus, as well as other information we include

or incorporate by reference in this Supplement, the prospectus supplement and the prospectus. Many factors could affect our actual

results, including those factors described under “Risk Factors” in our Form 10-K for the year ended December 31, 2016,

incorporated by reference herein. You should read these factors and other cautionary statements made in this Supplement and the

accompanying prospectus supplement and prospectus and the documents incorporated herein by reference. We do not assume any obligation

to update any forward-looking statements made by us. Numerous factors could cause our actual results to differ materially from

those described in forward-looking statements, including, among other things:

|

|

·

|

risks related to our abilities to carry out intended manufacturing expansions;

|

|

|

·

|

our ability to raise additional capital;

|

|

|

·

|

risks related to our ability to enroll patients in clinical trials and complete the trials on a

timely basis;

|

|

|

·

|

risks related to the progress, timing and results of clinical trials and research and development

efforts involving our product candidates generally;

|

|

|

·

|

uncertainties about the clinical trials process;

|

|

|

·

|

uncertainties about the timely performance of third parties;

|

|

|

·

|

risks related to whether our products will demonstrate safety and efficacy;

|

|

|

·

|

risks related to our commercialization efforts and commercial opportunity for our DCVax product;

|

|

|

·

|

risks related to the submission of applications for and receipt of regulatory clearances and approvals;

|

|

|

·

|

risks related to our plans to conduct future clinical trials or research and development efforts;

|

|

|

·

|

risks related to our ability to carry out our Hospital Exemption program (in Germany);

|

|

|

·

|

risks related to our dependence upon key personnel and the need for additional financing;

|

|

|

·

|

risks related to possible reimbursement and pricing;

|

|

|

·

|

uncertainties about estimates of the potential market opportunity for our product candidates;

|

|

|

·

|

uncertainties about our estimated expenditures and projected cash needs;

|

|

|

·

|

uncertainties about our expectations about partnering, licensing and marketing; and

|

|

|

·

|

the use of proceeds from this offering.

|

Please also see the

discussion of risks and uncertainties under “Risk Factors” beginning on page 3 of the prospectus, in our most recent

Annual Report on Form 10-K, and in our other reports filed with the SEC incorporated herein by reference.

You should not place

undue reliance on any forward-looking statements, which are based on current expectations. Furthermore, forward-looking statements

speak only as of the date they are made. If any of these risks or uncertainties materialize, or if any of our underlying assumptions

are incorrect, our actual results may differ significantly from the results that we express in or imply by any of our forward-looking

statements. These and other risks are detailed in this Supplement, the accompanying prospectus supplement and prospectus, in the

documents that we incorporate by reference into this Supplement and the accompanying prospectus supplement and prospectus and in

other documents that we file with the Securities and Exchange Commission. We do not undertake any obligation to publicly update

or revise these forward-looking statements after the date of this Supplement to reflect future events or circumstances. We qualify

any and all of our forward-looking statements by these cautionary factors.

In light of these assumptions,

risks and uncertainties, the results and events discussed in the forward-looking statements contained in this Supplement or the

accompanying prospectus supplement and prospectus or in any document incorporated herein or therein by reference might not occur.

Investors are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this

Supplement or the accompanying prospectus supplement or prospectus or the date of the document incorporated by reference herein

or therein. We are not under any obligation, and we expressly disclaim any obligation, to update or alter any forward-looking statements,

whether as a result of new information, future events or otherwise, except as required by law. All subsequent forward-looking statements

attributable to us or to any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section.

Risk

Factors

Investing in our

common stock involves risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and

uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent annual report

on Form 10-K and most recent Form 10-Q, which are on file with the SEC and are incorporated herein by reference, and which may

be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. There may be other

unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects

on our future results. If any of these risks actually occurs, our business, business prospects, financial condition or results

of operations could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss

of all or part of your investment. Please also read carefully the section above entitled “Cautionary Statement Regarding

Forward-Looking Statements.”

Plan

of Distribution

We are selling the

shares of Common Stock issuable upon exercise of the Amended Class B Warrants and the new Series A Warrants directly to the holders

thereof, and we are not engaging a placement or other agent to solicit investors or facilitate the exercise of the Amended Class

B Warrants or the issuance of the new Series A Warrants. H.C. Wainwright & Co., LLC acted as placement agent in connection

with the offering of the securities made by the accompanying prospectus supplement.

Where

You Can Find More Information

We are subject to the

reporting requirements of the Securities Exchange Act of 1934, as amended, and file annual, quarterly and current reports, proxy

statements and other information with the SEC. You may read and copy these reports, proxy statements and other information at the

SEC’s public reference facilities at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You can request copies of these

documents by writing to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for more information

about the operation of the public reference facilities. SEC filings are also available at the SEC’s website at http://www.sec.gov.

Our common stock is listed on the OTCQB tier of the OTC Markets, and you can read and inspect our filings at the offices of the

Financial Industry Regulatory Authority, Inc. at 1735 K Street, Washington, D.C. 20006.

This Supplement and

the accompanying prospectus supplement and prospectus are only part of a registration statement on Form S-3 that we filed with

the SEC under the Securities Act of 1933, as amended, and therefore omits certain information contained in the registration statement.

We have also filed exhibits and schedules with the registration statement that are excluded from this Supplement and the accompanying

prospectus supplement and prospectus, and you should refer to the applicable exhibit or schedule for a complete description of

any statement referring to any contract or other document. You may inspect a copy of the registration statement, including the

exhibits and schedules, without charge, at the public reference room or obtain a copy from the SEC upon payment of the fees prescribed

by the SEC.

Incorporation

of Certain Information By Reference

The SEC allows us to

“incorporate by reference” information that we file with them. Incorporation by reference allows us to disclose important

information to you by referring you to those other documents. The information incorporated by reference is an important part of

this Supplement and the accompanying prospectus supplement and prospectus, and information that we file later with the SEC will

automatically update and supersede this information. We filed a registration statement on Form S-3 under the Securities Act of

1933, as amended, with the SEC with respect to the securities being offered pursuant to this Supplement and the accompanying prospectus

supplement and prospectus. This Supplement and the accompanying prospectus supplement and prospectus omit certain information contained

in the registration statement, as permitted by the SEC. You should refer to the registration statement, including the exhibits,

for further information about us and the securities being offered pursuant to this Supplement and the accompanying prospectus supplement

and prospectus. Statements in this Supplement and the accompanying prospectus supplement and prospectus regarding the provisions

of certain documents filed with, or incorporated by reference in, the registration statement are not necessarily complete and each

statement is qualified in all respects by that reference. Copies of all or any part of the registration statement, including the

documents incorporated by reference or the exhibits, may be obtained upon payment of the prescribed rates at the offices of the

SEC listed above in “Where You Can Find More Information.” The documents we are incorporating by reference are:

|

|

•

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed on April 17, 2017;

|

|

|

|

|

|

|

•

|

Our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2017, filed on May 15, 2017;

|

|

|

|

|

|

|

•

|

Our Current Reports on Form 8-K filed with the SEC on January 19, 2017, February 8, 2017, March 7, 2017, March

10, 2017, March 23, 2017 (both filings), April 5, 2017, April 7, 2017, April 25, 2017, May 26, 2017, May 31, 2017, June 13, 2017,

June 19, 2017, June 27, 2017, July 21, 2017, July 26, 2017, and August 7, 2017 (both filings);

|

|

|

|

|

|

|

•

|

All of our filings pursuant to the Exchange Act after the date of filing this Supplement and prior to completion of the offering of securities being made hereby; and

|

|

|

|

|

|

|

•

|

The description of our common stock contained in our Registration Statement on Form 8-A filed on November 14, 2012, including any amendments or reports filed for the purpose of updating that description.

|

In addition, all documents

(other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed in such forms that are related

to such items unless such Form 8-K expressly provides to the contrary) subsequently filed by us pursuant to Section 13(a), 13(c),

14 or 15(d) of the Securities Exchange Act of 1934, as amended, before the date our offering is terminated or completed are deemed

to be incorporated by reference into, and to be a part of, this Supplement and the accompanying prospectus supplement and prospectus.

Any statement contained

in this Supplement or the accompanying prospectus supplement and prospectus or in a document incorporated or deemed to be incorporated

by reference into this Supplement or the accompanying prospectus supplement and prospectus will be deemed to be modified or superseded

for purposes of this Supplement and the accompany prospectus supplement and prospectus to the extent that a statement contained

in any subsequently filed document that is deemed to be incorporated by reference into this Supplement and the accompanying prospectus

supplement and prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except

as so modified or superseded, to constitute a part of this Supplement and the accompanying prospectus supplement and prospectus.

We will furnish without

charge to you, on written or oral request, a copy of any or all of the documents incorporated by reference, including exhibits

to these documents. You should direct any requests for documents to Northwest Biotherapeutics, Inc., 4800 Montgomery Lane, Suite

800, Bethesda, MD 20814, (240) 497-9024.

You should rely only

on information contained in, or incorporated by reference into, this Supplement and the accompanying prospectus supplement and

prospectus and any other prospectus supplement. We have not authorized anyone to provide you with information different from that

contained in this Supplement and the accompanying prospectus supplement and prospectus or incorporated by reference in this Supplement

and the accompanying prospectus supplement and prospectus. We are not making offers to sell the securities offered hereby in any

jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation

is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

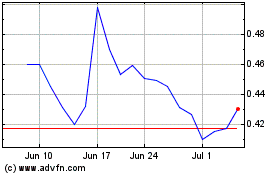

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Apr 2023 to Apr 2024