|

Prospectus

Supplement

|

Filed

Pursuant to Rule 424b(5)

|

|

(To

prospectus dated November 5, 2013)

|

Registration

File No. 333-191869

|

Up

to $2,000,000 of Shares of Common Stock

PEDEVCO

Corp.

We have

entered into an At Market Issuance Sales Agreement, or sales

agreement, with National Securities Corporation, or NSC, relating

to shares of our common stock offered by this prospectus supplement

and the accompanying prospectus. In accordance with the terms of

the sales agreement, we may offer and sell shares of our common

stock from time to time through NSC, acting as agent, having an

aggregate offering price of up to $2,000,000.

Our

common stock is listed on the NYSE MKT under the symbol

“PED.” On September 27, 2016, the last reported sales

price of our common stock was $0.21.

Sales

of our common stock, if any, under this prospectus supplement and

the accompanying prospectus, may be made in sales deemed to be

“at the market offerings” as defined in Rule 415

promulgated under the Securities Act of 1933, as amended, or the

Securities Act, including sales made directly on or through the

NYSE MKT, the existing trading market for our common stock, sales

made to or through a market maker other than on an exchange or

otherwise, in negotiated transactions at market prices prevailing

at the time of sale or at prices related to such prevailing market

prices, and/or any other method permitted by law. NSC will act as a

sales agent using commercially reasonable efforts consistent with

its normal trading and sales practices, on mutually agreed terms

between NSC and us. There is no arrangement for funds to be

received in any escrow, trust or similar arrangement.

The

compensation to NSC for sales of common stock sold pursuant to the

sales agreement is equal to 3.0% of the gross proceeds we receive

from the sales of our common stock. In connection with the sale of

the common stock on our behalf, NSC may be deemed to be an

“underwriter” within the meaning of the Securities Act,

and the compensation of NSC may be deemed to be underwriting

commissions or discounts. We have also agreed to provide

indemnification and contribution to NSC with respect to certain

liabilities, including liabilities under the Securities

Act.

The

aggregate market value of our outstanding common stock held by

non-affiliates, or public float, is approximately $10.2 million,

based on approximately 49.85 million shares of outstanding common

stock, of which approximately 9.07 million shares are held by

affiliates, and a price of $0.25 per share, which was the closing

price of our common stock on the NYSE MKT on August 25, 2016. We

have sold no securities pursuant to General Instruction I.B.6 of

Form S-3 during the prior 12 calendar month period that ends on and

includes the date of this prospectus supplement. Pursuant to

General Instruction I.B.6 of Form S-3, in no event will we sell

securities in public primary offerings on Form S-3 with a value

exceeding more than one-third of our public float in any 12

calendar month period so long as our public float remains below

$75.0 million.

Investing

in our securities involves a high degree of risk. Please read the

information contained in, and incorporated by reference under, the

heading “

Risk

Factors

” beginning on page S-10 of this prospectus

supplement, and under similar headings in the other documents that

are filed after the date hereof and incorporated by reference into

this prospectus.

The net

proceeds from sales under this prospectus supplement will be used

as described under “

Use of

Proceeds.

”

You should carefully read and consider the

information under “

Forward-Looking

Statements

” and “

Risk Factors

” beginning

on pages S-9 and S-10 of this prospectus supplement and on pages 17

and 11 of the accompanying prospectus, respectively.

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

determined that this prospectus supplement or the accompanying

prospectus is accurate or complete. Any representation to the

contrary is a criminal offense.

National Securities Corporation

The

date of this prospectus supplement is September 29,

2016

TABLE

OF CONTENTS

Prospectus

Supplement

|

|

Page

|

|

|

|

|

About

This Prospectus Supplement

|

S-1

|

|

Prospectus

Supplement Summary

|

S-3

|

|

The

Offering

|

S-8

|

|

Forward-Looking

Statements

|

S-9

|

|

Risk

Factors

|

S-10

|

|

Use of

Proceeds

|

S-14

|

|

Price

Range of Common Stock

|

S-15

|

|

Dividend

Policy

|

S-15

|

|

Dilution

|

S-15

|

|

Plan of

Distribution

|

S-17

|

|

Legal

Matters

|

S-18

|

|

Experts

|

S-18

|

|

Where

You Can Find More Information

|

S-18

|

|

Incorporation of

Certain Documents by Reference

|

S-19

|

Prospectus

|

|

Page

|

|

|

|

|

About

This Prospectus

|

1

|

|

Prospectus

Summary

|

2

|

|

Securities

Registered Hereby That We May Offer

|

9

|

|

Risk

Factors

|

11

|

|

Forward-Looking

Statements

|

17

|

|

Use of

Proceeds

|

18

|

|

Description of

Capital Stock

|

18

|

|

Description of

Preferred Stock

|

22

|

|

Description of

Warrants

|

23

|

|

Description of

Units

|

26

|

|

Plan of

Distribution

|

27

|

|

Legal

Matters

|

30

|

|

Experts

|

30

|

|

Where

You Can Find More Information

|

31

|

|

Incorporation of

Certain Documents by Reference

|

32

|

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus, dated

November 5, 2013, are part of a registration statement on Form S-3

(File No. 333-191869) that we filed with the Securities and

Exchange Commission (the “

SEC

”), utilizing a

“

shelf

”

registration process on October 23, 2013 and that was declared

effective on November 5, 2013. Under this process, we may sell from

time to time in one or more offerings up to an aggregate of

$100,000,000 in our securities described in the accompanying

prospectus.

You

should rely only on the information contained or incorporated by

reference into this prospectus supplement, the accompanying

prospectus and any free writing prospectus. We have not, and NSC

has not, authorized anyone to provide you with different

information. If anyone provides you with different or additional

information, you should not rely on it. We are not, and NSC is not,

making an offer to sell these securities in any state or

jurisdiction where the offer or sale is not permitted. You should

not assume that the information contained in this prospectus

supplement, the accompanying prospectus and any free writing

prospectus is accurate on any date subsequent to the date set forth

on the front of the document or that any information we have

incorporated by reference is correct on any date subsequent to the

date of the document incorporated by reference, even though this

prospectus supplement, the accompanying prospectus and any free

writing prospectus is delivered or securities are sold on a later

date. We have filed with the SEC a registration statement on Form

S-3 with respect to the securities offered hereby. This prospectus

supplement and the accompanying prospectus do not contain all of

the information set forth in the registration statement, parts of

which are omitted in accordance with the rules and regulations of

the SEC. For further information with respect to us and the

securities offered hereby, reference is made to the registration

statement and the exhibits that are a part of the registration

statement. We will disclose any material changes in our affairs in

a post-effective amendment to the registration statement and the

accompanying prospectus of which this prospectus supplement is a

part, a future prospectus supplement, a free writing prospectus or

a future filing with the Securities and Exchange Commission

incorporated by reference in this prospectus supplement. It is

important for you to read and consider all the information

contained in this prospectus supplement and the accompanying

prospectus, including the documents incorporated by reference

therein, in making your investment decision.

This

document is in two parts. The first part is this prospectus

supplement, which adds to and updates information contained in the

accompanying prospectus and the documents incorporated by reference

into the accompanying prospectus. The second part is the

accompanying prospectus, which gives more general information, some

of which may not apply to this offering of Shares. This prospectus

supplement adds, updates and changes information contained in the

accompanying prospectus and the information incorporated by

reference. To the extent the information contained in this

prospectus supplement differs or varies from the information

contained in the accompanying prospectus or any document

incorporated by reference, the information in this prospectus

supplement shall control.

We further note that the

representations, warranties and covenants made by us or the

underwriter in any agreement that is filed as an exhibit to any

document that is incorporated by reference in the accompanying

prospectus were made solely for the benefit of the parties to such

agreement, including, in some cases, for the purpose of allocating

risk among the parties to such agreements, and should not be deemed

to be a representation, warranty or covenant to you. Moreover, such

representations, warranties or covenants were accurate only as of

the date when made. Accordingly, such representations, warranties

and covenants should not be relied on as accurately representing

the current state of our affairs.

We and NSC take no responsibility for,

and can provide no assurance as to the reliability of, any other

information that others may give you. We are not, and NSC is not,

making an offer to sell these securities in any jurisdiction where

the offer or sale is not permitted.

Persons outside the United States who come into possession of this

prospectus supplement or the accompanying prospectus must inform

themselves about, and observe any restrictions relating to, the

offering of the securities and the distribution of this prospectus

supplement and accompanying prospectus outside of the United

States.

Our

logo and other trade names, trademarks, and service marks of

PEDEVCO Corp. appearing in this prospectus supplement and the

accompanying prospectus are the property of our company. Other

trade names, trademarks, and service marks appearing in this

prospectus supplement and the accompanying prospectus are the

property of their respective holders.

The

market data and certain other statistical information used

throughout this prospectus supplement and the accompanying

prospectus are based on independent industry publications,

government publications and other published independent sources.

Although we believe that these third-party sources are reliable and

that the information is accurate and complete, we have not

independently verified the information. Some data is also based on

our good faith estimates. While we believe the market data included

in this prospectus supplement, the accompanying prospectus and the

information incorporated herein and therein by reference is

generally reliable and is based on reasonable assumptions, such

data involves risks and uncertainties and is subject to change

based on various factors, including those contained in and

incorporated by reference under the heading “

Risk Factors

” beginning

on page S-10 of this prospectus supplement and on page 11 of the

accompanying prospectus, and under similar headings in the other

documents that are filed after the date hereof and incorporated by

reference into this prospectus supplement.

All

references to “we”, “our”,

“us”, the “Company”, and

“PEDEVCO” in this prospectus supplement mean PEDEVCO

Corp. and all entities owned or controlled by us except where it is

made clear that the term means only the parent company. The term

“you” refers to a prospective investor.

“Securities Act” means the Securities Act of 1933, as

amended; “Exchange Act” means the Securities Exchange

Act of 1934, as amended; and “SEC” or the

“Commission” means the United States Securities and

Exchange Commission.

Please

carefully read this prospectus supplement, the prospectus, any free

writing prospectus and any pricing supplement, in addition to the

information contained in the documents we refer to under the

headings “

Where You

Can Find More Information

” and

“

Incorporation of

Certain Documents by Reference

”, on pages S-18 and

S-19, respectively.

|

|

|

|

|

|

|

|

|

|

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights material information found in more

detail elsewhere in, or incorporated by reference in, this

prospectus supplement. It does not contain all of the information

you should consider. As such, before you decide to buy our common

stock, in addition to the following summary, we urge you to

carefully read this entire prospectus supplement and documents

incorporated by reference herein, and any other prospectus

supplements or free writing prospectuses, especially the risks of

investing in our common stock as discussed under

“

Risk

Factors.

” The following summary is qualified in its

entirety by the detailed information appearing elsewhere in this

prospectus supplement.

Overview

We

are an energy company engaged primarily in the acquisition,

exploration, development and production of oil and natural gas

shale plays in the Denver-Julesberg Basin (“D-J Basin”)

in Colorado, which contains hydrocarbon bearing deposits in several

formations, including the Niobrara, Codell, Greenhorn, Shannon,

J-Sand, and D-Sand. As of June 30, 2016, we held approximately

11,784 net D-J Basin acres located in Weld County, Colorado through

our wholly-owned operating subsidiary, Red Hawk Petroleum, LLC

(“Red Hawk”), which asset we refer to as our “D-J

Basin Asset.” As of June 30, 2016, we hold interests in 61

gross (17.4 net) wells in our D-J Basin Asset, of which 14 gross

(12.5 net) wells are operated by Red Hawk and currently producing,

25 gross (4.9 net) wells are non-operated and 22 wells have an

after-payout interest.

On December 29, 2015, the Company entered into an

Agreement and Plan of Merger and Reorganization (as amended to

date, the “GOM Merger Agreement”) with White Hawk

Energy, LLC (“White Hawk”) and GOM Holdings, LLC

(“GOM”), each a Delaware limited liability company. The

GOM Merger Agreement provides for the

Company’s

acquisition of GOM

through an exchange of (i) an aggregate of 1,551,552 shares of our

restricted common stock and (ii) 698,448 restricted shares of our

to-be-designated Series B Convertible Preferred Stock (which will

be convertible into common stock on a 1,000:1 basis)(the

“Consideration Shares”), for 100% of the limited

liability company membership units of GOM (the “GOM

Units”), with the GOM Units being received by White Hawk and

GOM receiving the Consideration Shares from the Company (the

“GOM Merger”).

On February 29, 2016, the parties entered into an

amendment to the GOM Merger Agreement, which amended the merger

agreement in order to provide GOM additional time to meet certain

closing conditions contemplated by the GOM Merger Agreement, and on

April 25, 2016, the parties further amended the merger agreement to

remove the deadline for closing the merger and agreed to work

expeditiously in good faith toward closing. The Company and GOM

continue to move forward with the merger, and the Company is

hopeful that closing will occur as early as the end of the third

quarter of 2016, subject to satisfaction of closing

conditions.

Below

is the total production volumes and total revenue net to the

Company for the six months ended June 30, 2016 and 2015

attributable to our D-J Basin Asset, including the calculated

production volumes and revenue numbers for our D-J Basin Asset held

indirectly through Condor Energy Technology, LLC

(“Condor”), a joint venture owned 20% by the Company

(which ownership interest the Company divested in February 2015),

that would be net to our interest if reported on a consolidated

basis and production realized from our recent D-J Basin Acquisition

beginning February 23, 2015 (described in greater detail below in

“D-J Basin Asset Acquisition”).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three

Months Ended

June

30,

2016

|

|

Three

Months Ended

June

30,

2015

|

|

|

|

Oil volume (barrels

(Bbl))

|

|

29,167

|

|

36,220

|

|

|

|

Gas volume

(thousand cubic feet (Mcf))

|

|

56,973

|

|

67,951

|

|

|

|

Volume equivalent

(barrel of oil equivalent (Boe)) (1)

|

|

38,663

|

|

47,545

|

|

|

|

Revenue

(000’s)

|

|

$1,203

|

|

$1,787

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Represents

percentage of voting power based on 49,849,297 shares of common

stock and 66,625 shares of Series A Convertible Preferred Stock

outstanding as of September 27, 2016, and excludes voting power to

be acquired upon exercise of outstanding options or warrants or

other convertible securities.

Oil

and Gas Properties

We believe that the D-J Basin shale play represents among the

most promising unconventional oil and natural gas plays in the U.S.

We plan to continue to opportunistically seek additional acreage

proximate to our currently held core acreage. Our strategy is to be

the operator, directly or through our subsidiaries and joint

ventures, in the majority of our acreage so we can dictate the pace

of development in order to execute our business plan. The majority

of our capital expenditure budget for the period from January 2016

to December 2016 will be focused on the development of these

formations. However, if the Company consummates its

merger with GOM, the Company will work with GOM to prepare a

projected drilling and completion schedule and budget, with

the final schedule and budget anticipated to be disclosed by the

Company if the GOM Merger is consummated and once they

are available, which could impact our current 2016 drilling and

completion plans.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unless otherwise noted,

the following table presents summary data for our leasehold acreage

in our core D-J Basin Asset as of December 31, 2015 and our

drilling capital budget with respect to this acreage from January

1, 2016 to December 31, 2016,

of which $5.1 million has been deployed to acquire

interests in 2.1 net short lateral wells

. If commodity prices

do not increase significantly, we may delay drilling activities.

The ultimate amount of capital we will expend may fluctuate

materially based on, among other things, market conditions,

commodity prices, asset monetizations, the success of our drilling

results as the year progresses, availability of capital and whether

we consummate the GOM Merger. In the event the GOM Merger is

consummated, the Company plans to expand this development plan to

incorporate development of assets held by GOM, with the final

schedule and budget anticipated to be disclosed by the Company once

they are available.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Drilling

Capital Budget

January

1, 2016 - December 31,

2016

|

|

|

|

Current

Core Assets:

|

|

Net

Acres

|

|

Acre

Spacing

|

|

Potential

Gross -Drilling

Locations

(1)

|

|

Net

Wells (2)

|

|

Gross

Costs per Well (3)

|

|

Capital

Cost to

the

Company (2)(3)

|

|

|

|

D-J Basin

Asset

|

|

11,784

|

|

80

|

|

147

|

|

|

|

|

|

|

|

|

|

Long

lateral

|

|

|

|

|

|

|

|

6.4

|

|

|

|

|

|

|

|

Short

lateral

|

|

|

|

|

|

|

|

2.1

|

|

$

2,600,000

|

|

$

5,557,510

|

|

|

|

Total

Assets

|

|

11,784

|

|

|

|

147

|

|

8.5

|

|

|

|

$

35,637,510

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

Potential gross

drilling locations are conservatively calculated using 80 acre

spacing, and not taking into account additional wells that could be

drilled as a result of forced pooling in Niobrara, Colorado, where

the D-J Basin Asset is located, which allows for forced pooling,

and which may create more potential gross drilling locations than

acre spacing alone would otherwise indicate.

|

|

|

|

|

|

|

|

(2) The

Company has deployed $5.1 million in capital to date in 2016 to

acquire interests in 2.1 net short lateral wells, which are

included in the “Net Wells” and “Capital Cost to

the Company” figures.

|

|

|

|

|

|

|

|

(3)

Costs per well are

gross costs while capital costs presented are net to our working

interests.

|

|

|

|

|

|

|

|

D-J Basin Asset

We directly hold all of

our interests in the D-J Basin Asset through our wholly-owned

subsidiary, Red Hawk. These interests are located in Weld County,

Colorado. Red Hawk is currently the operator of 14 gross (12.5 net)

wells located in our D-J Basin Asset. Our D-J Basin Asset acreage

is shown in the map below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Information

Additional

information about us can be obtained from the documents

incorporated by reference herein. See “

Where You Can Find More

Information

” beginning on page S-18.

Our

Contact Information

Our

principal office is located at 4125 Blackhawk Plaza Circle, Suite

201, Danville, California 94506. Our phone number is (855)

733-2685. Our website address is

www.pacificenergydevelopment.com

.

Information on our website or any other website is not, and will

not be, a part of this prospectus supplement or the accompanying

prospectus and is not, and will not be, incorporated by reference

into this prospectus supplement or the accompanying

prospectus.

|

|

|

|

|

|

THE

OFFERING

|

Issuer:

|

|

PEDEVCO

Corp.

|

|

|

|

|

|

Common stock offered hereby:

|

|

Shares of our

common stock having an aggregate offering price of up to $2.0

million.

In no event will

we sell securities with a value exceeding more than one-third of

our “public float” (the market value of our common

stock and any other equity securities that we may issue in the

future that are held by non-affiliates) in any 12-calendar month

period.

|

|

|

|

|

|

Common stock to be outstanding after this offering:

|

|

Up to 9,523,809

shares, assuming sales at a price of $0.21 per share, which was the

closing price of our common stock on the NYSE MKT on September 27,

2016. The actual number of shares issued will vary depending on the

sales price under this offering.

|

|

|

|

|

|

Manner of offering:

|

|

“At the

market offering” that may be made from time to time through

our sales agent, National Securities Corporation. See the section

captioned “Plan of Distribution” beginning on page S-17

of this prospectus supplement.

|

|

|

|

|

|

Use of proceeds:

|

|

We intend to use

the net proceeds from this offering, if any, to fund development

and for working capital and general corporate purposes, including

general and administrative expenses. See the section captioned

“Use of Proceeds” beginning on page S-14 of this

prospectus supplement.

|

|

|

|

|

|

Risk factors:

|

|

An investment in

our common stock involves a significant degree of risk. You should

read the “Risk Factors” section beginning on page S-10

of this prospectus supplement and in the documents incorporated by

reference in this prospectus supplement and the accompanying

prospectus for a discussion of factors to consider before deciding

to purchase shares of our common stock.

|

|

|

|

|

|

NYSE MKT Symbol:

|

|

PED

|

Unless

otherwise indicated,

our

common stock and other securities, and the other information based

thereon, is as of September 27, 2016 and the number of shares of

common stock outstanding after the offering, assumes the sale of

9,523,809 shares of common stock at an assumed offering price of

$0.21 per share, the last reported sale price of our common stock

on the NYSE MKT on September 27, 2016, and excludes as of such

date:

|

●

|

4,418,890 shares of

common stock that are issuable upon the exercise of outstanding

options, with exercise prices ranging from $0.22 to $67.20 per

share, with a weighted-average exercise price of $0.61 per

share;

|

|

●

|

12,566,079 shares

of common stock that are issuable upon the exercise of outstanding

warrants to purchase capital stock, with exercise prices ranging

from $1.25 to $2.34 per share, with a weighted-average exercise

price of $0.81 per share;

|

|

|

|

|

●

|

66,625

shares of Series A Convertible Preferred Stock that have the right

to convert into 66,625,000 shares of common stock; and

|

|

●

|

10,000,000 shares

of common stock that are authorized for future awards under our

employee equity incentive plans, of which 683,830 shares

remain available for future awards.

|

Additionally,

unless otherwise stated, all information in this prospectus

supplement:

|

●

|

assumes

no exercise of outstanding options and warrants to purchase common

stock, no issuance of shares available for future issuance under

our equity compensation plans, and no conversion of our convertible

preferred stock or other convertible securities; and

|

|

●

|

reflects all

currency in United States dollars.

|

FORWARD-LOOKING

STATEMENTS

Certain

information included in this prospectus supplement, the prospectus,

any free writing prospectus we may file, the documents or

information incorporated by reference herein, other reports filed

by us under the Securities Exchange Act and any other written or

oral statement by or on our behalf contain forward-looking

statements and information that are based on management’s

beliefs, expectations and conclusions, drawn from certain

assumptions and information currently available.

This

prospectus supplement, the accompanying prospectus, any free

writing prospectus we may file, and the documents or information

incorporated by reference herein contain forward-looking statements

within the meaning of Section 27A of the Securities Act, Section

21E of the Exchange Act, and the Private Securities Litigation

Reform Act of 1995, as amended. These forward-looking statements

are subject to risks and uncertainties and other factors that may

cause our actual results, performance or achievements to be

materially different from the results, performance or achievements

expressed or implied by the forward-looking statements. You should

not unduly rely on these statements. Forward-looking statements may

include statements about our:

|

●

|

business

strategy;

|

|

●

|

reserves;

|

|

●

|

technology;

|

|

●

|

cash

flows and liquidity;

|

|

●

|

financial strategy,

budget, projections and operating results;

|

|

●

|

oil and

natural gas realized prices;

|

|

●

|

timing

and amount of future production of oil and natural

gas;

|

|

●

|

availability of oil

field labor;

|

|

●

|

the

amount, nature and timing of capital expenditures, including future

exploration and development costs;

|

|

●

|

availability and

terms of capital;

|

|

●

|

drilling of

wells;

|

|

●

|

government

regulation and taxation of the oil and natural gas

industry;

|

|

●

|

marketing of oil

and natural gas;

|

|

●

|

exploitation

projects or property acquisitions;

|

|

●

|

costs

of exploiting and developing our properties and conducting other

operations;

|

|

●

|

general

economic conditions;

|

|

●

|

competition in the

oil and natural gas industry;

|

|

●

|

effectiveness of

our risk management activities;

|

|

●

|

environmental

liabilities;

|

|

●

|

counterparty credit

risk;

|

|

●

|

developments in

oil-producing and natural gas-producing countries;

|

|

●

|

future

operating results;

|

|

●

|

planned

combination transaction with GOM Holdings, LLC; and

|

|

●

|

estimated future

reserves and the present value of such reserves.

|

We

identify forward-looking statements by use of terms such as

“may,” “will,” “expect,”

“anticipate”, “estimate”,

“hope”, “plan”, “believe”,

“predict”, “envision”,

“intend”, “continue”,

“potential”, “should”,

“confident”, “could” and similar words and

expressions, although some forward-looking statements may be

expressed differently. You should be aware that our actual results

could differ materially from those contained in the forward-looking

statements. You should consider carefully the statements included

in and incorporated by reference in this prospectus supplement and

accompanying prospectus and any free writing prospectus, which

describe factors that could cause our actual results to differ from

those set forth in the forward-looking statements.

The

above statements are not the exclusive means of identifying

forward-looking statements herein. Although forward-looking

statements contained or incorporated by reference in this

prospectus supplement reflect our good faith judgment, such

statements can only be based on facts and factors currently known

to us. Consequently, forward-looking statements are inherently

subject to risks and uncertainties, including known and unknown

risks and uncertainties incidental to the exploration for, and the

acquisition, development, production and marketing of oil and

natural gas, and actual outcomes may differ materially from the

results and outcomes discussed in the forward-looking

statements.

Important factors

that could cause actual results to differ materially from the

forward-looking statements include, but are not limited

to:

●

changes in

production volumes and worldwide demand, including economic

conditions that might impact demand;

●

volatility of

commodity prices for oil and natural gas;

●

the impact of

governmental policies and/or regulations, including changes in

environmental and other laws, the interpretation and enforcement

related to those laws and regulations, liabilities arising

thereunder and the costs to comply with those laws and

regulations;

●

changes in

estimates of proved reserves;

●

inaccuracy of

reserve estimates and expected production rates;

●

risks incidental to

the production of oil and natural gas;

●

our future cash

flows, liquidity and financial condition;

●

competition in the

oil and gas industry;

●

availability and

cost of capital;

●

impact of

environmental events, governmental and other third-party responses

to such events, and our ability to insure adequately against such

events;

●

cost of pending or

future litigation;

●

the effect that

acquisitions we may pursue have on our capital

expenditures;

●

purchase price or

other adjustments relating to asset acquisitions or dispositions

that may be unfavorable to us;

●

our ability to

retain or attract senior management and key technical employees;

and

●

success of

strategic plans, expectations and objectives for our future

operations.

Forward-looking

statements speak only as of the date of this prospectus supplement

or the date of any document incorporated by reference in this

prospectus supplement or any free writing prospectus, as

applicable. Except to the extent required by applicable law or

regulation, we do not undertake any obligation to update

forward-looking statements to reflect events or circumstances after

the date of this prospectus supplement or any free writing

prospectus or to reflect the occurrence of unanticipated

events.

You

should also consider carefully the statements under and

incorporated by reference in “

Risk Factors

” in this

prospectus supplement and the prospectus, and other sections of

this prospectus supplement, and the documents we incorporate by

reference or file as part of any free writing prospectus, which

address additional facts that could cause our actual results to

differ from those set forth in the forward-looking

statements. We caution investors not to place significant

reliance on the forward-looking statements contained in this

prospectus supplement, any free writing prospectus, and the

documents we incorporate by reference. We undertake no obligation

to publicly update or review any forward-looking statements,

whether as a result of new information, future developments or

otherwise, except as otherwise required by law.

RISK

FACTORS

Before

making an investment decision, you should consider the

“

Risk

Factors

”

discussed in the section entitled

“

Risk

Factors

”

contained under Item 1A of Part I of our most recent annual report

on Form 10-K, under “

Risk

Factors

” under

Item 1A of Part II of our subsequent quarterly reports on Form

10-Q, and all other information contained in this prospectus

supplement and the accompanying prospectus and incorporated by

reference in this prospectus supplement and the accompanying

prospectus, and in any free writing prospectus, as the same may be

amended, supplemented or superseded from time to time by our

subsequent filings and reports under the Securities Act or the

Exchange Act. For more information, see “

Incorporation

of Certain Documents by Reference

”

beginning on page

S-19. The market or trading price of our securities could

decline due to any of these risks. In addition, please read

“

Forward-Looking

Statements

” beginning on page S-9 of this prospectus

supplement, where we describe additional uncertainties associated

with our business and the forward-looking statements included or

incorporated by reference in this prospectus

supplement.

The

securities offered herein are highly speculative and should only be

purchased by persons who can afford to lose their entire investment

in us. You should carefully consider the following risk factors and

the aforementioned risk factors that are incorporated herein by

reference and other information in this prospectus supplement

before deciding to become a holder of our common stock. The risks

and uncertainties described in these incorporated documents and

described below are not the only risks and uncertainties that we

face. Additional risks and uncertainties not presently known to us

may also impair our business operations. If any of these risks

actually occur, our business and financial results could be

negatively affected to a significant extent. In that event, the

trading price of our common stock could decline, and you may lose

all or part of your investment in our common stock.

Risks Related To This Offering

Management will have broad discretion as to the use of the proceeds

from this offering and may not use the proceeds

effectively.

Because

we have not designated the amount of net proceeds from this

offering to be used for any particular purpose, our management will

have broad discretion as to the application of the net proceeds

from this offering and could use them for purposes other than those

contemplated at the time of the offering. Our management may use

the net proceeds for corporate purposes that may not improve our

financial condition or market value.

Resales of

our common stock in the public market during this offering by our

stockholders may cause the market price of our common stock to

fall.

We

may issue common stock from time to time in connection with this

offering. This issuance from time to time of these new shares of

our common stock, or our ability to issue these shares of common

stock in this offering, could result in resales of our common stock

by our current stockholders concerned about the potential dilution

of their holdings. In turn, these resales could have the effect of

depressing the market price for our common stock.

The shares of common stock offered under this prospectus supplement

and the accompanying prospectus may be sold in “at the market

offerings,” and investors who buy shares at different times

will likely pay different prices.

Investors

who purchase shares under this prospectus supplement and the

accompanying prospectus at different times will likely pay

different prices, and so may experience different outcomes in their

investment results. We will have discretion, subject to market

demand, to vary the timing, prices, and numbers of shares sold, and

there is no minimum or maximum sales price. Investors may

experience declines in the value of their shares as a result of

share sales made at prices lower than the prices they

paid.

We currently have an illiquid and volatile market for our common

stock, and the market for our common stock is and may remain

illiquid and volatile in the future.

We currently have a highly sporadic,

illiquid and volatile market for our common stock, which market is

anticipated to remain sporadic, illiquid and volatile in the

future.

Factors that could affect our stock price or

result in fluctuations in the market price or trading volume of our

common stock include:

|

●

|

our

actual or anticipated operating and financial performance and

drilling locations, including reserve estimates;

|

|

●

|

quarterly

variations in the rate of growth of our financial indicators, such

as net income per share, net income and cash flows, or those of

companies that are perceived to be similar to us;

|

|

●

|

changes

in revenue, cash flows or earnings estimates or publication of

reports by equity research analysts;

|

|

●

|

speculation in the

press or investment community;

|

|

●

|

public

reaction to our press releases, announcements and filings with the

SEC;

|

|

●

|

sales

of our common stock by us or other shareholders, or the perception

that such sales may occur;

|

|

●

|

the

limited amount of our freely tradable common stock available in the

public marketplace;

|

|

●

|

general

financial market conditions and oil and natural gas industry market

conditions, including fluctuations in commodity

prices;

|

|

●

|

the

realization of any of the risk factors presented in this prospectus

supplement, the accompanying prospectus and the filings

incorporated by reference herein and therein;

|

|

●

|

the

recruitment or departure of key personnel;

|

|

●

|

commencement of, or

involvement in, litigation;

|

|

●

|

the

prices of oil and natural gas;

|

|

●

|

the

success of our exploration and development operations, and the

marketing of any oil and natural gas we produce;

|

|

●

|

changes

in market valuations of companies similar to ours; and

|

|

●

|

domestic and

international economic, legal and regulatory factors unrelated to

our performance.

|

Our common stock is listed on the NYSE

MKT under the symbol “PED.” Our stock price may be

impacted by factors that are unrelated or disproportionate to our

operating performance.

The stock markets in general

have experienced extreme volatility that has often been unrelated

to the operating performance of particular companies. These broad

market fluctuations may adversely affect the trading price of our

common stock. Additionally,

general economic, political and market

conditions, such as recessions, interest rates or international

currency fluctuations may adversely affect the market price of our

common stock. Due to the limited volume of our shares which trade,

we believe that our stock prices (bid, ask and closing prices) may

not be related to our actual value, and not reflect the actual

value of our common stock. Shareholders and potential investors in

our common stock should exercise caution before making an

investment in us.

Additionally, as a

result of the illiquidity of our common stock, investors may not be

interested in owning our common stock because of the inability to

acquire or sell a substantial block of our common stock at one

time. Such illiquidity could have an adverse effect on the market

price of our common stock. In addition, a shareholder may not be

able to borrow funds using our common stock as collateral because

lenders may be unwilling to accept the pledge of securities having

such a limited market. We cannot assure you that an active trading

market for our common stock will develop or, if one develops, be

sustained.

An active liquid trading market for our common stock may not

develop in the future.

Our

common stock currently trades on the NYSE MKT, although our common

stock’s trading volume is very low. Liquid and active

trading markets usually result in less price volatility and more

efficiency in carrying out investors’ purchase and sale

orders. However, our common stock may continue to have limited

trading volume, and many investors may not be interested in owning

our common stock because of the inability to acquire or sell a

substantial block of our common stock at one time. Such illiquidity

could have an adverse effect on the market price of our common

stock. In addition, a shareholder may not be able to borrow funds

using our common stock as collateral because lenders may be

unwilling to accept the pledge of securities having such a limited

market. We cannot assure you that an active trading market for our

common stock will develop or, if one develops, be

sustained.

We do not presently intend to pay any cash dividends on or

repurchase any shares of our common stock.

We do

not presently intend to pay any cash dividends on our common stock

or to repurchase any shares of our common stock. Any payment of

future dividends will be at the discretion of the Board of

Directors and will depend on, among other things, our earnings,

financial condition, capital requirements, level of indebtedness,

statutory and contractual restrictions applying to the payment of

dividends and other considerations that our Board of Directors

deems relevant. Cash dividend payments in the future may only be

made out of legally available funds and, if we experience

substantial losses, such funds may not be available. Accordingly,

you may have to sell some or all of your common stock in order to

generate cash flow from your investment, and there is no guarantee

that the price of our common stock that will prevail in the market

will ever exceed the price paid by you.

We are subject to the Continued Listing Criteria of the NYSE MKT

and our failure to satisfy these criteria may result in delisting

of our common stock.

Our common stock is currently listed on the NYSE

MKT. In order to maintain this listing, we must maintain certain

share prices, financial and share distribution targets, including

maintaining a minimum amount of shareholders’ equity and a

minimum number of public shareholders. In addition to these

objective standards, the NYSE MKT may delist the securities of any

issuer if, in its opinion, the issuer’s financial condition

and/or operating results appear unsatisfactory; if it appears that

the extent of public distribution or the aggregate market value of

the security has become so reduced as to make continued listing on

the NYSE MKT inadvisable; if the issuer sells or disposes of

principal operating assets or ceases to be an operating company; if

an issuer fails to comply with the NYSE MKT’s listing

requirements; if an issuer’s common stock sells at what the

NYSE MKT considers a “low selling price” (generally

trading below $0.20 per share for an extended period of time) and

the issuer fails to correct this via a reverse split of shares

after notification by the NYSE MKT (provided that issuers can also

be delisted if any shares of the issuer trade below $0.06 per

share); or if any other event occurs or any condition exists which

makes continued listing on the NYSE MKT, in its opinion,

inadvisable.

If

the NYSE MKT delists our common stock, investors may face material

adverse consequences, including, but not limited to, a lack of

trading market for our securities, reduced liquidity, decreased

analyst coverage of our securities, and an inability for us to

obtain additional financing to fund our operations.

If we are delisted from the NYSE MKT, your ability to sell your

shares of our common stock may be limited by the penny stock

restrictions, which could further limit the marketability of your

shares.

If

our common stock is delisted, it could come within the definition

of “penny stock” as defined in the Exchange Act and

could be covered by Rule 15g-9 of the Exchange Act. That

Rule imposes additional sales practice requirements on

broker-dealers who sell securities to persons other than

established customers and accredited investors. For transactions

covered by Rule 15g-9, the broker-dealer must make a special

suitability determination for the purchaser and receive the

purchaser’s written agreement to the transaction prior to the

sale. Consequently, Rule 15g-9, if it were to become

applicable, would affect the ability or willingness of

broker-dealers to sell our securities, and accordingly would affect

the ability of stockholders to sell their securities in the public

market. These additional procedures could also limit our ability to

raise additional capital in the future.

Due to the fact that our common stock is listed on the NYSE MKT, we

are subject to financial and other reporting and corporate

governance requirements which increase our costs and

expenses.

We are currently required to file annual and quarterly information

and other reports with the Securities and Exchange Commission that

are specified in Sections 13 and 15(d) of the Exchange Act.

Additionally, due to the fact that our common stock is listed on

the NYSE MKT, we are also subject to the requirements to maintain

independent directors, comply with other corporate governance

requirements and are required to pay annual listing and stock

issuance fees. These obligations require a commitment of additional

resources including, but not limited, to additional expenses, and

may result in the diversion of our senior management’s time

and attention from our day-to-day operations. These obligations

increase our expenses and may make it more complicated or time

consuming for us to undertake certain corporate actions due to the

fact that we may require NYSE approval for such transactions and/or

NYSE rules may require us to obtain shareholder approval for such

transactions.

You will experience immediate dilution in the book value per share

of the common stock you purchase.

The offering prices per share in this

offering may exceed the net tangible book value per share of our

common stock. Assuming that an aggregate of

9,523,809

shares of our common stock

are sold at a price of

$0.21

per share pursuant to this

prospectus, which was the last reported sale price of our common

stock on the NYSE MKT on September

27,

2016, for aggregate gross proceeds of

$2.0 million, and excluding the deduction of commissions and

estimated aggregate offering expenses payable by us, you would

experience immediate dilution of

$0.05

per share, representing the

difference between our as adjusted net tangible book value per

share as of June 30, 2016 after giving effect to this offering and

the assumed offering price. The exercise of outstanding stock

options and warrants may result in further dilution of your

investment. See the section entitled “

Dilution

”

beginning on page S-15

below for a more detailed illustration

of the dilution you would incur if you participate in this

offering.

You may experience future dilution as a result of future equity

offerings or other equity issuances.

We may

in the future issue additional shares of our common stock or other

securities convertible into or exchangeable for our common stock.

We cannot assure you that we will be able to sell shares or other

securities in any other offering or other transactions at a price

per share that is equal to or greater than the price per share paid

by investors in this offering. The price per share at which we sell

additional shares of our common stock or other securities

convertible into or exchangeable for our common stock in future

transactions may be higher or lower than the price per share

paid by any investors

in this

offering.

In

addition, we have a significant number of stock options and

warrants outstanding. To the extent that outstanding stock options

or warrants have been or may be exercised or other shares issued,

investors purchasing our common stock in this offering may

experience further dilution.

Future sales of our common stock could cause our stock price to

decline.

If our shareholders sell substantial amounts of our common stock in

the public market, the market price of our common stock could

decrease significantly. The perception in the public market that

our shareholders might sell shares of our common stock could also

depress the market price of our common stock. Up to $100,000,000 in

total aggregate value of securities have been registered by us on a

“shelf” registration statement on Form S-3 (File No.

333-191869) that we filed with the Securities and Exchange

Commission on October 23, 2013, and which was declared effective on

November 5, 2013. To date, an aggregate of $17,888,000 in

securities have been sold by us under the Form S-3, leaving

$82,112,000 in securities which will be eligible for sale in the

public markets from time to time, when sold and issued by us,

subject to the requirements of Form S-3, which limits us, until

such time, if ever, as our public float exceeds $75 million, from

selling securities in a public primary offering under Form S-3 with

a value exceeding more than one-third of the aggregate market value

of the common stock held by non-affiliates of the Company every

twelve months. Additionally, if our existing shareholders sell, or

indicate an intention to sell, substantial amounts of our common

stock in the public market, the trading price of our common stock

could decline significantly. The market price for shares of our

common stock may drop significantly when such securities are sold

in the public markets. A decline in the price of shares of our

common stock might impede our ability to raise capital through the

issuance of additional shares of our common stock or other equity

securities.

USE

OF PROCEEDS

Except

as described in any free writing prospectus that we may authorize

to be provided to you, we currently intend to use the net proceeds

from this offering, if any, to fund development and working

capital, and for general corporate purposes. Because there is no

minimum offering amount required as a condition to close this

offering, the actual total public offering amount, commissions and

proceeds to us, if any, are not determinable at this

time.

The amounts and timing of our actual expenditures will depend on

numerous factors. We may find it necessary or advisable to use

portions of the net proceeds for other purposes, and we will have

broad discretion in the application and allocation of the net

proceeds from this offering. Pending the use of the net

proceeds from this offering as described above, we intend to invest

the proceeds in investment grade, interest-bearing

instruments.

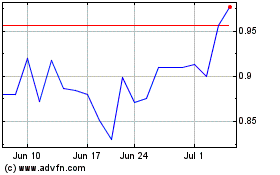

PRICE

RANGE OF COMMON STOCK

Our common stock is listed on the NYSE

MKT under the ticker symbol

“PED.”

The

following high and low per share sale prices of our common stock,

reflects inter-dealer prices, without retail mark-up, mark-down or

commission and may not represent actual

transactions.

|

Quarter

Ended

|

|

|

|

|

|

|

|

March 31,

2016

|

$

0.32

|

$

0.15

|

|

June 30,

2016

|

0.41

|

0.16

|

|

September 30, 2016

(through September 27, 2016)

|

0.32

|

0.16

|

|

|

|

|

|

March 31,

2015

|

$

0.95

|

$

0.31

|

|

June 30,

2015

|

0.78

|

0.42

|

|

September 30,

2015

|

0.48

|

0.22

|

|

December 31,

2015

|

0.31

|

0.10

|

|

|

|

|

|

March 31,

2014

|

$

2.83

|

$

1.84

|

|

June 30,

2014

|

2.44

|

1.65

|

|

September 30,

2014

|

2.24

|

1.41

|

|

December 31,

2014

|

1.72

|

0.38

|

As of

September 27, 2016, we had 911 holders of record of our common

stock. The actual number of stockholders is greater than this

number of record holders and includes stockholders who are

beneficial owners but whose shares are held in street name by

brokers and other nominees.

For a

description of our common stock, see “

Description of Capital

Stock

” in the accompanying prospectus dated November

5, 2013.

DIVIDEND POLICY

We have

never declared or paid any dividends on our common stock and do not

anticipate that we will pay dividends in the foreseeable future.

Any payment of cash dividends on our common stock in the future

will be dependent upon the amount of funds legally available, our

earnings, if any, our financial condition, our anticipated capital

requirements and other factors that the board of directors may

think are relevant. However, we currently intend for the

foreseeable future to follow a policy of retaining all of our

earnings, if any, to finance the development and expansion of our

business and, therefore, do not expect to pay any dividends on our

common stock in the foreseeable future.

DILUTION

If you

invest in our common stock offered hereby, your ownership interest

will be diluted to the extent of the difference between the

offering price per share of common stock in this offering and the

net tangible book value per share of our common stock immediately

after this offering. Net tangible book value per share represents

total tangible assets less total liabilities, divided by the number

of shares of common stock outstanding. Dilution in net tangible

book value per share represents the difference between the amount

per share paid by purchasers of shares in this offering and the net

tangible book value per share of common stock immediately after the

closing of this offering.

After

giving effect to the sale of our common stock pursuant to this

prospectus in the aggregate amount of $2.0 million at an assumed

offering price of $0.21 per share, the last reported sale price of

our common stock on the NYSE MKT on September 27, 2016, and

excluding the deduction of commissions and estimated aggregate

offering expenses payable by us, our net tangible book value as of

June 30, 2016 would have been $9.36 million, or $0.16 per share of

common stock. This represents an immediate increase in the net

tangible book value of $0.01 per share to our existing stockholders

and an immediate dilution in net tangible book value of $0.05 per

share to new investors. The following table illustrates this per

share dilution:

|

Assumed offering

price per share:

|

$

0.21

|

|

Historical net

tangible book value per share at June 30, 2016

|

$

0.15

|

|

Increase per share

attributable to investors purchasing shares in this

offering:

|

$

0.01

|

|

As adjusted net

tangible book value per share as of June 30, 2016 after giving

effect to this offering:

|

$

0.16

|

|

Dilution per share

to new investors purchasing shares in this offering:

|

$

0.05

|

The

foregoing table is based on 49,768,007 shares of our common stock

outstanding as of June 30, 2016.

The

table above assumes for illustrative purposes that an aggregate of

9,523,809 shares of our common stock are sold pursuant to this

prospectus supplement at a price of $0.21 per share, the last

reported sale price of our common stock on the NYSE MKT on

September 27, 2016, for aggregate gross proceeds of $2.0 million.

The shares sold in this offering, if any, will be sold from time to

time at various prices. An increase of $0.05 per share in the price

at which the shares are sold from the assumed offering price to

$0.26 per share, assuming all of our common stock in the aggregate

amount of $2.0 million is sold at that price, would result in an

adjusted net tangible book value per share after the offering of

$0.16 per share and would increase the dilution in net tangible

book value per share to new investors in this offering to $0.10 per

share, excluding the deduction of commissions and estimated

aggregate offering expenses payable by us. A decrease of $0.05 per

share in the price at which the shares are sold from the assumed

offering price to $0.16 per share, assuming all of our common stock

in the aggregate amount of $2.0 million is sold at that price,

would result in an adjusted net tangible book value per share after

the

offering of $0.15

per share and would decrease the dilution in net tangible book

value per share to new investors in this offering to $0.01 per

share, excluding the deduction of commissions and estimated

aggregate offering expenses payable by us. This information is

supplied for illustrative purposes only.

To the

extent that any of our outstanding options or warrants are

exercised, our convertible preferred stock is converted, we grant

additional options under our stock option plans or grant additional

warrants, we issue additional convertible securities, or we issue

additional shares of common stock in the future, there may be

further dilution to new investors.

PLAN

OF DISTRIBUTION

We have

entered into an At Market Issuance Sales Agreement, or sales

agreement, with National Securities Corporation, or NSC, under

which we may issue and sell shares of our common stock having

aggregate sales proceeds of up to $2,000,000 from time to time

through NSC acting as agent. Sales of our common stock, if any,

under this prospectus supplement may be made in sales deemed to be

“at the market offerings” as defined in Rule 415

promulgated under the Securities Act of 1933, as amended, including

sales made directly on or through the NYSE MKT, the existing

trading market for our common stock, sales made to or through a

market maker other than on an exchange or otherwise, in negotiated

transactions at market prices prevailing at the time of sale or at

prices related to such prevailing market prices, and/or any other

method permitted by law.

NSC

will offer our common stock subject to the terms and conditions of

the sales agreement as agreed upon by us and NSC. Each time we wish

to issue and sell common stock under the sales agreement, we will

notify NSC of the number of shares to be issued, the dates on which

such sales are anticipated to be made and any minimum price below

which sales may not be made. Once we have so instructed NSC, unless

NSC declines to accept the terms of such notice, NSC has agreed to

use its commercially reasonable efforts consistent with its normal

trading and sales practices to sell such shares up to the amount

specified on such terms. The obligations of NSC under the sales

agreement to sell our common stock are subject to a number of

conditions that we must meet.

The

settlement between us and NSC is generally anticipated to occur on

the third trading day following the date on which the sale was

made. Sales of our common stock as contemplated in this prospectus

will be settled through the facilities of The Depository Trust

Company or by such other means as we and NSC may agree upon. There

is no arrangement for funds to be received in an escrow, trust or

similar arrangement.

We will

pay NSC a commission equal to 3.0% of the gross proceeds we receive

from the sales of our common stock. We also agreed to reimburse NSC

for legal expenses incurred by it up to $30,000 in the aggregate,

payable in three (3) installments as follows: (i) $10,000 on the

date of the sales agreement; (ii) $10,000 on the date that is

thirty (30) days from the date of the sales agreement; and (iii)

the balance due (not to exceed $10,000) on the date that is sixty

(60) days from the date of the sales agreement. Because there is no

minimum offering amount required as a condition to close this

offering, the actual total public offering amount, commissions and

proceeds to us, if any, are not determinable at this

time.

In

connection with the sale of the common stock on our behalf, NSC

may, and will with respect to sales effected in an “at the

market offering,” be deemed to be an

“underwriter” within the meaning of the Securities Act

of 1933, as amended, and the compensation of NSC may, and will with

respect to sales effected in an “at the market

offering

,

” be

deemed to be underwriting commissions or discounts. We have agreed

to provide indemnification and contribution to NSC with respect to

certain civil liabilities, including liabilities under the

Securities Act. We estimate that the total expenses for the

offering, excluding compensation payable to NSC under the terms of

the sales agreement, will be less than $50,000.

The

offering of our common stock pursuant to the sales agreement will

terminate upon the earlier of (i) the sale of all of our common

stock provided for in this prospectus supplement, or (ii)

termination of the sales agreement as permitted

therein.

This

summary of the material provisions of the sales agreement does not

purport to be a complete statement of its terms and conditions. A

copy of the sales agreement has been filed with the SEC as an

exhibit to a Current Report on Form 8-K and is incorporated by

reference into the registration statement of which this prospectus

supplement is a part. See “Where You Can Find More

Information” beginning on page S-18 below.

To the

extent required by Regulation M under the Exchange Act, NSC will

not engage in any market making activities involving our common

stock while the offering is ongoing under this prospectus

supplement.

NSC may

distribute this prospectus supplement electronically.

LEGAL

MATTERS

The

validity of the issuance of the securities offered hereby will be

passed upon by The Loev Law Firm, PC, Bellaire, Texas

.

Certain legal matters in connection with this offering will be

passed upon for NSC by Duane Morris LLP, Newark, New

Jersey.

EXPERTS

GBH

CPAs, PC, independent registered public accounting firm, has

audited our consolidated financial statements included in our

Annual Report on Form 10-K for the year ended December 31, 2015, as

set forth in their report (

which

report expresses an unqualified opinion and includes an explanatory

paragraph relating to the Company’s ability to continue as a

going concern)

, which is incorporated by reference in this

prospectus supplement and elsewhere in the registration statement.

Our financial statements are incorporated by reference in reliance

on GBH CPAs, PC’s reports, given on their authority as

experts in accounting and auditing.

Certain

of our oil and gas reserve estimates that are incorporated herein

by reference were based upon a report prepared by South Texas

Reservoir Alliance LLC, an independent professional engineering

firm specializing in the technical evaluation of oil and gas assets

and estimates of future net income. These estimates are included

and incorporated by reference herein in reliance on the authority

of such firm as an expert in such matters.

No

expert or counsel named in this prospectus as having prepared or

certified any part of this prospectus or having given an opinion

upon the validity of the securities being registered or upon other

legal matters in connection with the registration or offering of

the securities was employed on a contingency basis, or had, or is

to receive, in connection with the offering, a substantial

interest, direct or indirect, in the registrant or any of its

parents or subsidiaries. Nor was any such person connected with the

registrant or any of its parents or subsidiaries as a promoter,

managing or principal underwriter, voting trustee, director,

officer or employee.

WHERE

YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and current

reports, proxy statements and other information with the SEC. Our

SEC filings are available to the public over the Internet at the

SEC’s web site at www.sec.gov and on the

“

Investors,

”

“

SEC

Filings

” page

of our website at

www.pacificenergydevelopment.com

.

Information on our website is not part of this prospectus

supplement or the accompanying prospectus, and we do not desire to

incorporate by reference such information herein. You may also read

and copy any document we file with the SEC at the SEC’s

Public Reference Room at 100 F Street N.E., Washington, D.C. 20549.

You can also obtain copies of the documents upon the payment of a

duplicating fee to the SEC. Please call the SEC at 1-800-SEC-0330

for further information on the operation of the Public Reference

Room. The SEC maintains an Internet site that contains reports,

proxy and information statements, and other information regarding

issuers that file electronically with the SEC like us. Our SEC

filings are also available to the public from the SEC’s

website at

http://www.sec.gov

.

This

prospectus supplement is part of the registration statement and

prospectus contained therein and does not contain all of the

information included in the registration statement or prospectus.

Whenever a reference is made in this prospectus supplement or the

accompanying prospectus to any of our contracts or other documents,

the reference may not be complete and, for a copy of the contract

or document, you should refer to the exhibits that are a part of

the registration statement. You should rely only on the information

contained or incorporated by reference in this prospectus

supplement, the accompanying prospectus and any supplement or

amendment hereto. We have not authorized anyone to provide you with

information different from that contained in this prospectus

supplement and the accompanying prospectus. The securities offered

under this prospectus supplement and the accompanying prospectus

are offered only in jurisdictions where offers and sales are

permitted. The information contained in this prospectus supplement

and the accompanying prospectus, and any free writing prospectus,

is accurate only as of the date of this prospectus supplement, the

accompanying prospectus and any such free writing prospectus,

regardless of the time of delivery of this prospectus supplement,

the accompanying prospectus, or any free writing prospectus, or any

sale of the securities.

This

prospectus supplement, the accompanying prospectus and any free

writing prospectus, constitute a part of a registration statement

we filed with the SEC under the Securities Act. This prospectus

supplement, the accompanying prospectus and any free writing

prospectus, do not contain all of the information set forth in the

registration statement, certain parts of which are omitted in

accordance with the rules and regulations of the SEC. For further

information with respect to the Company and the Shares, reference