Filed pursuant to Rule 424(b)(3)

Registration No. 333-221087

PROSPECTUS

38,899,668

Shares of

Common Stock

The selling stockholders of Bellerophon Therapeutics, Inc. (“Bellerophon,” “we,” “us” or the “Company”) listed beginning on page

6

of this prospectus may offer and resell under this prospectus (i) up to

19,449,834

shares of our common stock and (ii) up to

19,449,834

shares of our common stock issuable upon exercise of warrants acquired by certain of the selling stockholders under the Purchase Agreement (defined below) (the “Warrants”). The selling stockholders acquired the shares of common stock and the Warrants from us pursuant to a Securities Purchase Agreement (the “Purchase Agreement”), dated

September 26, 2017

, by and among the Company and the investors listed therein (the “Investors”).

We are registering the resale of the shares of common stock covered by this prospectus as required by the Registration Rights Agreement we entered into with the Investors on

September 26, 2017

. The selling stockholders will receive all of the proceeds from any sales of the shares offered hereby. We will not receive any of the proceeds, but we will incur expenses in connection with the offering. To the extent the Warrants are exercised for cash, if at all, we will receive the exercise price of the Warrants.

The selling stockholders may sell these shares through public or private transactions at market prices prevailing at the time of sale or at negotiated prices. The timing and amount of any sale are within the sole discretion of the selling stockholders. Our registration of the shares of common stock covered by this prospectus does not mean that the selling stockholders will offer or sell any of the shares. For further information regarding the possible methods by which the shares may be distributed, see “Plan of Distribution” beginning on page

8

of this prospectus.

Our common stock is listed on The NASDAQ Global Market under the symbol “BLPH.” The last reported sale price of our common stock on

November 6, 2017

was

$1.35

per share.

Investing in our common stock is highly speculative and involves a significant degree of risk. Please consider carefully the specific factors set forth under “

Risk Factors

” beginning on page

4

of this prospectus and in our filings with the Securities and Exchange Commission.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

November 6, 2017

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the selling stockholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or shares of common stock are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the documents incorporated by reference therein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under “Where You Can Find Additional Information” and “Information Incorporated by Reference” in this prospectus.

We have not authorized anyone to give any information or to make any representation to you other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our shares of common stock other than the shares of our common stock covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

Unless we have indicated otherwise, or the context otherwise requires, references in this prospectus to “Bellerophon,” the “Company,” “we,” “us” and “our” refer to Bellerophon Therapeutics, Inc.

PROSPECTUS SUMMARY

This summary description about us and our business highlights selected information contained elsewhere in this prospectus or incorporated by reference into this prospectus. It does not contain all the information you should consider before investing in our securities. Important information is incorporated by reference into this prospectus. To understand this offering fully, you should read carefully the entire prospectus, including “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements,” together with the additional information described under “Information Incorporated by Reference.”

Overview

We are a clinical-stage therapeutics company focused on developing innovative products at the intersection of drugs and devices that address significant unmet medical needs in the treatment of cardiopulmonary diseases. Our focus is the continued development of our nitric oxide therapy for patients with pulmonary hypertension, or PH, using our proprietary delivery system, INOpulse, with pulmonary arterial hypertension, or PAH, representing the lead indication. Our INOpulse platform is based on our proprietary pulsatile nitric oxide delivery device.

In February 2016, we announced positive data from the final analysis of our Phase 2 long-term extension clinical trial of INOpulse for PAH, which was Part 2 of our Phase 2 clinical trial of INOpulse for PAH. The data indicates a sustainability of benefit to PAH patients who received INOpulse therapy at the 75 mcg/kg of ideal body weight/hour dose for an average of greater than 12 hours per day and were on long-term oxygen therapy, or LTOT. After reaching agreement with the U.S. Food and Drug Administration, or FDA, and the European Medicines Agency, or EMA, on our Phase 3 protocol, we are moving forward with Phase 3 development. In September 2015, the FDA issued a Special Protocol Assessment, or SPA, for our Phase 3 PAH program for INOpulse, which will include two confirmatory clinical trials. The first of the two Phase 3 trials, or INOvation-1, has been initiated. During January 2017, we received confirmation from the FDA of its acceptance of all of our proposed modifications to our Phase 3 program. Under the newly modified Phase 3 program, the ongoing INOvation-1 study, and a second confirmatory randomized withdrawal study with approximately 40 patients who will be crossing over from the INOvation-1 study, can serve as the two adequate and well-controlled studies to support a NDA filing for INOpulse in PAH subjects on LTOT. Both studies include an interim analysis approximately half-way through each study to assess for efficacy and futility. The interim analysis for the INOvation-1 study also includes a potential sample size reassessment.

We completed a randomized, placebo-controlled, double-blind, dose-confirmation Phase 2 clinical trial of INOpulse for PH-COPD in July 2014. We received results from this trial, and have initiated further Phase 2 testing to demonstrate the potential benefit on exercise capacity. In September 2015, an oral presentation of late-breaking data from a clinical trial sponsored by us was presented at the European Respiratory Society International Congress 2015 in Amsterdam. The data showed that INOpulse improved vasodilation in patients with PH-COPD. In July 2016, the results were published in the International Journal of COPD in an article titled "Pulmonary vascular effects of pulsed inhaled nitric oxide in COPD patients with pulmonary hypertension." During September 2017, we shared results of our Phase 2 PH-COPD study (n=10) designed to evaluate the acute effects of pulsed inhaled nitric oxide, or iNO, on vasodilation as well as the chronic effect on hemodynamics and exercise tolerance. The data results showed a statistically significant and clinically meaningful increases in six-minute walk distance, or 6MWD, and a statistically significant and clinically meaningful decrease in systolic pulmonary arterial pressure, or sPAP. The therapy was well tolerated with no related safety concerns.

We have begun our clinical program in interstitial lung disease, based on feedback from the medical community and the large unmet medical need. During May 2017, we announced completion of our Phase 2 study using INOpulse therapy to treat PH associated with idiopathic pulmonary fibrosis, or PH-IPF. The clinical data showed that INOpulse was associated with clinically meaningful improvements in hemodynamics and exercise capacity in difficult-to-treat PH-IPF patients. The PH-IPF study was a proof of concept study (n=4) designed to evaluate the ability of iNO to provide selective vasodilation as well as to assess the potential for improvement in hemodynamics and exercise capacity in PH-IPF patients. The study met its primary endpoint showing an average of 15.3% increase in blood vessel volume (p<0.001) during acute inhalation of iNO as well as showing a significant association between ventilation and vasodilation, demonstrating the ability of INOpulse to provide selective vasodilation to the better ventilated areas of the lung. The study showed consistent benefit in hemodynamics with a clinically meaningful average reduction of 14% in systolic pulmonary arterial pressure (sPAP) with acute exposure to iNO. The study also assessed the chronic effects of iNO on exercise capacity showing an average 75 meter improvement in 6MWD and consistent improvement of approximately 80 m% in composite endpoints of 6MWD and oxygen saturation with four weeks of treatment. The study assessed both the iNO 75 and iNO 30 dose, supporting iNO 30 as a potentially safe and effective dose. During August 2017, we announced FDA acceptance of our investigation new drug application for our Phase 2b study using INOpulse therapy in a broad population of patients with pulmonary fibrosis, or PF, both with and without PH.

In addition, other opportunities for the application of our INOpulse platform include the following indications: chronic thromboembolic PH, or CTEPH, PH associated with sarcoidosis and PH associated with pulmonary edema from high altitude sickness.

We have devoted all of our resources to our therapeutic discovery and development efforts, including conducting clinical trials for our product candidates, protecting our intellectual property and the general and administrative support of these operations. We have devoted significant time and resources to developing and optimizing our drug delivery system, INOpulse, which operates through the administration of nitric oxide as brief, controlled pulses that are timed to occur at the beginning of a breath.

To date, we have generated no revenue from product sales. We expect that it will be several years before we commercialize a product candidate, if ever.

Risks Associated with Our Business

Our business and our ability to implement our business strategy are subject to numerous risks, as more fully described in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, incorporated herein by reference. You should read these risks before you invest in our securities. We may be unable, for many reasons, including those that are beyond our control, to implement our business strategy. In particular, risks associated with our business include:

|

|

|

|

•

|

We have incurred significant losses since inception. We expect to incur losses over the next several years and may never achieve or maintain profitability.

|

|

|

|

|

•

|

Our very limited operating history may make it difficult for you to evaluate the success of our business to date and to assess our future viability.

|

|

|

|

|

•

|

We will need substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts. Moreover, if we are unable to obtain additional funds on a timely basis, there will be substantial doubt about our ability to continue as a going concern and increased risk of insolvency and loss of investment by our stockholders.

|

|

|

|

|

•

|

We are dependent on the success of our INOpulse product candidates and our ability to develop, obtain marketing approval for and successfully commercialize these product candidates. If we are unable to develop, obtain marketing approval for or successfully commercialize our product candidates, either alone or through a collaboration, or experience significant delays in doing so, our business could be materially harmed.

|

|

|

|

|

•

|

We rely on Ikaria, as our single source supplier, for our supply of nitric oxide for the clinical trials of INOpulse. Ikaria's inability to continue manufacturing adequate supplies of nitric oxide, or its refusal to supply us with commercial quantities of nitric oxide on commercially reasonable terms, or at all, could result in a disruption in the supply of, or impair our ability to market, INOpulse.

|

|

|

|

|

•

|

Clinical trials involve a lengthy and expensive process with an uncertain outcome. We may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of our product candidates.

|

|

|

|

|

•

|

Our product candidates currently in development are exclusively licensed from third parties, and we may enter into additional agreements to in-license technology from third parties. If current or future licensors terminate the applicable license, or fail to maintain or enforce the underlying patents, our competitive position and market share will be harmed.

|

|

|

|

|

•

|

We may seek to enter into collaborations with third parties for the development and commercialization of our product candidates. If we fail to enter into such collaborations, or such collaborations are not successful, we may not be able to capitalize on the market potential of our product candidates.

|

|

|

|

|

•

|

If we are unable to obtain and maintain patent protection for our technology and products or if the scope of the patent protection obtained is not sufficiently broad, our competitors could develop and commercialize technology and products similar or identical to ours, and our ability to successfully commercialize our technology and products may be impaired.

|

|

|

|

|

•

|

Our principal stockholders have substantial control over us, which could limit your ability to influence the outcome of key transactions, including any change of control.

|

Corporate Information

We were incorporated under the laws of the State of Delaware on October 17, 2013 under the name Ikaria Development LLC. We changed our name to Bellerophon Therapeutics LLC on January 27, 2014. On February 12, 2015, we converted from a Delaware limited liability company into a Delaware corporation and changed our name to Bellerophon Therapeutics, Inc. We currently have three wholly-owned subsidiaries: Bellerophon BCM LLC, a Delaware limited liability company; Bellerophon Pulse Technologies LLC, a Delaware limited liability company; and Bellerophon Services, Inc., a Delaware corporation. Our website address is www.bellerophon.com. The information contained on, or that can be accessed through, our website does not constitute part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Our executive offices are located at 184 Liberty Corner Road, Suite 302, Warren, New Jersey 07059, and our telephone number is (908) 574-4770.

THE OFFERING

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock

that May be Offered by the

Selling Stockholders

|

|

Up to 38,899,668 shares of common stock.

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of the common stock by the selling stockholders. However, if all of the Warrants were exercised for cash, we would receive gross proceeds of approximately $24.2 million. We currently intend to use such proceeds, if any, for general corporate purposes, including manufacturing expenses, clinical trial expenses, research and development expenses and general and administrative expenses.

|

|

|

|

|

Offering Price

|

|

The selling stockholders may sell all or a portion of their shares through public or private transactions at prevailing market prices or at privately negotiated prices.

|

|

|

|

|

NASDAQ Global Market Symbol

|

|

BLPH

|

|

|

|

|

Risk Factors

|

|

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 4 of this prospectus, and any other risk factors described in the documents incorporated by reference herein, for a discussion of certain factors to consider carefully before deciding to invest in our common stock.

|

Throughout this prospectus, when we refer to the shares of our common stock being registered on behalf of the selling stockholders for offer and sale, we are referring to the shares of common stock sold to the selling stockholders, as well as the shares of common stock issuable upon exercise of the Warrants, each as described under “The Private Placement” and “Selling Stockholders.” When we refer to the selling stockholders in this prospectus, we are referring to the selling stockholders identified in this prospectus and, as applicable, their donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer.

RISK FACTORS

Investing in our securities involves a high degree of risk. You should carefully consider and evaluate all of the information contained in this prospectus, the accompanying prospectus and in the documents we incorporate by reference into this prospectus and accompanying prospectus before you decide to purchase our securities. In particular, you should carefully consider and evaluate the risks and uncertainties described under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. Any of the risks and uncertainties set forth in that report, as updated by annual, quarterly and other reports and documents that we file with the SEC and incorporate by reference into this prospectus or any prospectus, could materially and adversely affect our business, results of operations and financial condition, which in turn could materially and adversely affect the value of any securities offered by this prospectus. As a result, you could lose all or part of your investment.

THE PRIVATE PLACEMENT

On

September 26, 2017

, we entered into the Purchase Agreement with Puissance Capital Management, L.P. (“Puissance”), Venrock Healthcare Capital Partners ("Venrock"), and certain other accredited investors (together with Puissance and Venrock, the “Investors”), pursuant to which we sold an aggregate of

19,449,834

units (the “Units”) having an aggregate purchase price of

$23.4 million

, each such Unit consisting of (i) one share (the “Shares”) of our common stock and (ii) a Warrant to purchase one share of our common stock (the “Private Placement”). The purchase price per Unit was

$1.205

. Subject to certain ownership limitations, the Warrants will be initially exercisable commencing six months from the issuance date at an exercise price equal to

$1.2420

per full share of Common Stock, subject to adjustments as provided under the terms of the Warrants. The Warrants will be exercisable for a period of

5 years

from the initial exercise date.

In connection with the Offering, we entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors, pursuant to which we are obligated, among other things, to (i) file a registration statement with the U.S. Securities and Exchange Commission (the “SEC”) within 30 days following the closing of the Offering for purposes of registering the Shares and the shares of common stock issuable upon exercise of the Warrants for resale by the Investors, (ii) use its commercially reasonable efforts to have the registration statement declared effective as soon as practicable after filing, and in any event no later than 90 days after the closing of the Offering (or 120 days after the closing of the Offering if the registration statement is reviewed by the SEC), and (iii) maintain the registration until all registrable securities may be sold pursuant to Rule 144 under the Securities Act, without restriction as to volume. The Registration Rights Agreement contains customary terms and conditions for a transaction of this type, including certain customary cash penalties on the Registrant for its failure to satisfy specified filing and effectiveness time periods.

The foregoing descriptions of the Purchase Agreement, the Registration Rights Agreement and the form of Warrant are not complete and are subject to and qualified in their entirety by reference to the Purchase Agreement, the Registration Rights Agreement and the form of Warrant, respectively, copies of which are attached as Exhibits 10.1, 10.2 and 4.1 to the Current Report on Form 8-K dated

September 27, 2017

, respectively, and are incorporated herein by reference.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve substantial risks and uncertainties. All statements, other than statements of historical facts, contained in this prospectus, including statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, are forward-looking statements. The words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

The forward-looking statements in this prospectus include, among other things, statements about:

|

|

|

|

•

|

the timing of the ongoing and expected clinical trials of our product candidates, including statements regarding the timing of completion or analysis of the trials and the respective periods during which the results of the trials will become available;

|

|

|

|

|

•

|

our ability to obtain adequate financing to meet our future operational and capital needs;

|

|

|

|

|

•

|

the timing of and our ability to obtain marketing approval of our product candidates, and the ability of our product candidates to meet existing or future regulatory standards;

|

|

|

|

|

•

|

our ability to comply with government laws and regulations;

|

|

|

|

|

•

|

our commercialization, marketing and manufacturing capabilities and strategy;

|

|

|

|

|

•

|

our estimates regarding the potential market opportunity for our product candidates;

|

|

|

|

|

•

|

the timing of or our ability to enter into partnerships to market and commercialize our product candidates;

|

|

|

|

|

•

|

the rate and degree of market acceptance of any product candidate for which we receive marketing approval;

|

|

|

|

|

•

|

our intellectual property position;

|

|

|

|

|

•

|

our estimates regarding expenses, future revenues, capital requirements and needs for additional funding and our ability to obtain additional funding;

|

|

|

|

|

•

|

the success of competing treatments;

|

|

|

|

|

•

|

our competitive position; and

|

|

|

|

|

•

|

our expectations regarding the time during which we will be an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012.

|

You should also consider carefully the statements set forth in the sections titled "Risk Factors" or elsewhere in this prospectus, in the accompanying prospectus and in the documents incorporated or deemed incorporated herein or therein by reference, which address various factors that could cause results or events to differ from those described in the forward-looking statements. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. We have no plans to update these forward-looking statements.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the common stock by the selling stockholders named in this prospectus. The selling stockholders will receive all of the proceeds from this offering.

Pursuant to conditions set forth in the Warrants, the Warrants are exercisable under certain circumstances on a cashless basis, and should a selling stockholder elect to exercise on a cashless basis we will not receive any proceeds from the sale of common stock issued upon the cashless exercise of the Warrant. The holders of the Warrants are not obligated to exercise their Warrants, and we cannot predict whether holders of the Warrants will choose to exercise all or any of their Warrants or if they will do so for cash or on a cashless basis. However, if all of the Warrants were exercised for cash, we would receive gross proceeds of approximately

$24.2 million

. We currently intend to use such proceeds, if any, for general corporate purposes, including manufacturing expenses, clinical trial expenses, research and development expenses and general and administrative expenses.

SELLING STOCKHOLDERS

This prospectus relates to the sale or other disposition of up to

38,899,668

shares of our common stock and shares of common stock issuable to the selling stockholders upon exercise of the Warrants by the selling stockholders named below, and their donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer. The shares of common stock covered hereby were issued by us in the Private Placement. See “The Private Placement” beginning on page

4

of this prospectus.

The table below sets forth information as of

November 6, 2017

, to our knowledge, for the selling stockholders and other information regarding the beneficial ownership (as determined under Section 13(d) of the Exchange Act and the rules and regulations thereunder) of the shares of common stock held by the selling stockholders. The second column lists the number of shares of common stock and percentage beneficially owned by the selling stockholders as of

November 6, 2017

. The third column lists the maximum number of shares of common stock that may be sold or otherwise disposed of by the selling stockholders pursuant to the registration statement of which this prospectus forms a part. The selling stockholders may sell or otherwise dispose of some, all or none of their shares. Pursuant to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any shares of our common stock as to which a stockholder has sole or shared voting power or investment power, and also any shares of our common stock which the stockholder has the right to acquire within 60 days of

November 6, 2017

. The percentage of beneficial ownership for the selling stockholders is based on

55,179,788

shares of our common stock outstanding as of

November 6, 2017

and the number of shares of our common stock issuable upon exercise or conversion of convertible securities that are currently exercisable or convertible or are exercisable or convertible within 60 days of

November 6, 2017

beneficially owned by the applicable selling stockholder. Except as described below, to our knowledge, none of the selling stockholders has been an officer or director of ours or of our affiliates within the past three years or has any material relationship with us or our affiliates within the past three years. Our knowledge is based on information provided by the selling stockholders in connection with the filing of this prospectus, as well as information obtained from relevant Schedule 13D and 13G filings.

The shares of common stock being covered hereby may be sold or otherwise disposed of from time to time during the period the registration statement of which this prospectus is a part remains effective, by or for the account of the selling stockholders. After the date of effectiveness of such registration statement, the selling stockholders may have sold or transferred, in transactions covered by this prospectus or in transactions exempt from the registration requirements of the Securities Act, some or all of their common stock.

Information about the selling stockholders may change over time. Any changed information will be set forth in an amendment to the registration statement or supplement to this prospectus, to the extent required by law.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock

Beneficially Owned

Before this Offering

|

|

Number of

Shares of

Common Stock

Being Offered

|

|

Shares of Common Stock

To Be Beneficially Owned

Upon Completion of this Offering

|

|

Selling Stockholder

|

|

Number

|

|

|

|

Percentage(1)

|

|

|

|

Percentage

|

|

New Mountain Entities (9)

|

|

15,138,486

|

|

|

(2

|

)

|

|

27.4

|

%

|

|

9,128,630

|

|

|

10,574,171

|

|

|

19.2

|

%

|

|

Puissance Capital Management (9)

|

|

8,298,755

|

|

|

(3

|

)

|

|

15.0

|

%

|

|

16,597,510

|

|

|

—

|

|

|

—

|

%

|

|

Linde (9)

|

|

5,271,796

|

|

|

(4

|

)

|

|

9.6

|

%

|

|

3,443,984

|

|

|

3,549,804

|

|

|

6.4

|

%

|

|

Venrock Healthcare Capital Partners

|

|

4,149,378

|

|

|

(5

|

)

|

|

7.5

|

%

|

|

8,298,756

|

|

|

—

|

|

|

—

|

%

|

|

Naseem Amin (10)

|

|

1,964,598

|

|

|

(6

|

)

|

|

3.5

|

%

|

|

912,864

|

|

|

1,508,166

|

|

|

2.7

|

%

|

|

Jonathan Peacock (11)

|

|

1,650,487

|

|

|

(7

|

)

|

|

2.9

|

%

|

|

497,924

|

|

|

1,401,525

|

|

|

2.5

|

%

|

|

Jens Luehring (10)

|

|

83,991

|

|

|

(8

|

)

|

|

*

|

|

|

20,000

|

|

|

73,991

|

|

|

*

|

|

*Less than one percent

|

|

|

|

(1)

|

Based on a denominator equal to the sum of (i)

55,179,788

shares of our common stock outstanding on

November 6, 2017

and (ii) the number of shares of our common stock issuable upon exercise or conversion of convertible securities that are currently exercisable or convertible or are exercisable or convertible within 60 days of

November 6, 2017

beneficially owned by the applicable selling stockholder.

|

|

|

|

|

(2)

|

Consists of 1,080,819 shares held by Allegheny New Mountain Partners, L.P., 249,714 shares held by New Mountain Affiliated Investors II, L.P., 11,969,851 shares held by New Mountain Partners II (AIV-A), L.P. and 1,838,102 shares held by New Mountain Partners II (AIV-B), L.P.. The New Mountain Entities currently hold warrants to purchase 5,714,286 shares of common stock. The warrants may be exercised at any time on or after the issuance thereof and for a five-year period thereafter; provided, however, pursuant to their terms, the warrants are only exercisable to the extent that the holders thereof (together with the holders’ affiliates, and any other persons acting as a group) would beneficially own no more than 4.99% of the outstanding shares of common stock after exercise. The shares of common stock that the New Mountain Entities have the right to acquire upon exercise of the warrants are not deemed to be currently beneficially owned because of the limitations of ownership as described above. The general partner of each of the New Mountain Entities is New Mountain Investments II, L.L.C. and the manager of each of the New Mountain Entities is New Mountain Capital L.L.C. Steven Klinsky is the managing member of New Mountain Investments II, L.L.C. Adam Weinstein, a member of our Board, is a member of New Mountain Investments II, L.L.C. New Mountain Investments II, L.L.C. has decision-making power over the disposition and voting of shares of portfolio investments of each of the New Mountain Entities. New Mountain Capital, L.L.C. also has voting power over the shares of portfolio investments of the New Mountain Entities in its role as the investment advisor. New Mountain Capital, L.L.C. is a wholly-owned subsidiary of New Mountain Capital Group, L.L.C. New Mountain Capital Group, L.L.C. is 100% owned by Steven Klinsky. Since New Mountain Investments II, L.L.C. has decision-making power over the New Mountain Entities, Mr. Klinsky may be deemed to beneficially own the shares that the New Mountain Entities hold of record or may be deemed to beneficially own. Mr. Klinsky, Mr. Weinstein, New Mountain Investments II, L.L.C. and New Mountain Capital, L.L.C. disclaim beneficial ownership over the shares held by the New Mountain Entities, except to the extent of their pecuniary interest therein. The address of the New Mountain Entities is c/o New Mountain Capital, L.L.C., 787 Seventh Avenue, 48th Floor, New York, New York 10019.

|

|

|

|

|

(3)

|

Consists of 8,298,755 shares held by Puissance Cross-Border Opportunities III LLC. The general partner of Puissance Cross-Border Opportunities III LLC is Puissance Capital Fund (GP) LLC. Puissance Capital Management LP serves as the investment manager of Puissance Cross-Border Opportunities III LLC. Puissance Capital Management (GP) LLC serves as the general partner to Puissance Capital Management LP. Theodore Wang serves as the managing member of both Puissance Capital Management (GP) LLC and Puissance Capital Management LP. Mr. Wang may be deemed to beneficially own the shares that Puissance Capital Management hold of record or may be deemed to beneficially own. The address of Puissance Capital Management is 950 Third Avenue, 25th Floor, New York, NY 10022.

|

|

|

|

|

(4)

|

Consists of 5,271,796 shares held by Linde North America, Inc., an indirect wholly-owned subsidiary of Linde AG. Linde North America, Inc. currently hold a warrant to purchase 1,920,000 shares of common stock. The warrant may be exercised at any time on or after the issuance thereof and for a five-year period thereafter; provided, however, pursuant to its terms, the warrant is only exercisable to the extent that the holder thereof (together with the holder's affiliates, and any other persons acting as a group) would beneficially own no more than 4.99% of the outstanding shares of common stock after exercise. The shares of common stock that Linde North America, Inc. have the right to acquire upon exercise of the warrant are not deemed to be currently beneficially owned because of the limitations of ownership as described above. Jens Luehring, a member of our Board, is a director and chief financial officer of Linde North America, Inc. Mr. Luehring disclaims beneficial ownership of all shares held by Linde, except to the extent of his pecuniary interest therein, if any. The address of Linde North America, Inc. is 200 Somerset Corporate Blv, Suite 7000, Bridgewater, NJ 08807.

|

|

|

|

|

(5)

|

Consists of 2,952,442 shares held by Venrock Healthcare Capital Partners II, LP and 1,196,936 shares held by VHCP Co-Investment Holdings II, LLC. Venrock Healthcare Capital Partners II, LP and VHCP Co-Investment Holdings II, LLC are collectively, Venrock Healthcare Capital Partners with an address of 3340 Hillview Avenue, Palo Alto, CA 94304.

|

|

|

|

|

(6)

|

Consists of (i) 1,230,314 shares of common stock held by the selling stockholder and (ii) 714,285 shares of common stock issuable upon exercise of warrants held by the selling stockholder and (iii) 19,999 shares of common stock issuable upon exercise of options held by the selling stockholder.

|

|

|

|

|

(7)

|

Consists of (i) 815,351 shares of common stock held by the selling stockholder and (ii) 285,715 shares of common stock issuable upon exercise of warrants held by the selling stockholder and (iii) 549,421 shares of common stock issuable upon exercise of options held by the selling stockholder.

|

|

|

|

|

(8)

|

Consists of (i) 80,658 shares of common stock held by the selling stockholder and (ii) 3,333 shares of common stock issuable upon exercise of options held by the selling stockholder.

|

|

|

|

|

(9)

|

New Mountain, Puissance and Linde are affiliates of the Company.

|

|

|

|

|

(10)

|

Naseem Amin, M.D. and Jens Luehring are independent directors of the Company.

|

|

|

|

|

(11)

|

Jonathan Peacock is the Chairman of the Company's Board of Directors

|

PLAN OF DISTRIBUTION

The selling stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock or interests in shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling stockholders may use any one or more of the following methods when disposing of shares or interests therein:

|

|

|

|

•

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

•

|

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

|

|

•

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

•

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

•

|

privately negotiated transactions;

|

|

|

|

|

•

|

short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC;

|

|

|

|

|

•

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

|

|

•

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

|

|

•

|

a combination of any such methods of sale; and

|

|

|

|

|

•

|

any other method permitted by applicable law.

|

The selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other successors-in-interest as selling stockholders under this prospectus. The selling stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of our common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling stockholders from the sale of the common stock offered by them will be the purchase price of the common stock less discounts or commissions, if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through agents. We will not receive any of the proceeds from this offering. Upon any exercise of the Warrants by payment of cash, however, we will receive the exercise price of the Warrants.

The selling stockholders also may resell all or a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule.

The selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale of the shares may be underwriting discounts and commissions under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To the extent required, the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement of which this prospectus is a part.

In order to comply with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through registered or licensed brokers or dealers. In addition, in some states the common stock may not be sold unless it has been registered or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable we will make copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We will pay all expenses of the registration of the shares of common stock pursuant to the Registration Rights Agreement, including, without limitation, SEC filing fees and expenses of compliance with state securities or “blue sky” laws; provided, however, that each selling stockholder will pay all underwriting discounts and selling commissions, if any and any related legal expenses incurred by it. We will indemnify the selling stockholders against certain liabilities, including some liabilities under the Securities Act, in accordance with the Registration Rights Agreement, or the selling stockholders will be entitled to contribution. We may be indemnified by the selling stockholders against civil liabilities, including liabilities under the Securities Act, that may arise from any written information furnished to us by the selling stockholders specifically for use in this prospectus, in accordance with the Registration Rights Agreement, or we may be entitled to contribution.

We have agreed with the selling stockholders to keep the registration statement of which this prospectus is a part effective until the earlier of (i) such time as all of the shares covered by this prospectus have been disposed of pursuant to and in accordance with the registration statement or (ii) the date on which all of the shares may be sold without restriction pursuant to Rule 144 of the Securities Act.

LEGAL MATTERS

The validity of the shares of common stock offered in this prospectus has been passed upon for us by Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., New York, New York.

EXPERTS

The consolidated financial statements of Bellerophon Therapeutics, Inc. (formerly Bellerophon Therapeutics LLC) and subsidiaries as of December 31, 2016 and 2015, and for each of the years in the three-year period ended December 31, 2016, have been incorporated by reference herein and in the registration statement in reliance upon the report of KPMG LLP,

independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We are subject to the information requirements of the Exchange Act and we therefore file periodic reports, proxy statements and other information with the SEC relating to our business, financial statements and other matters. The reports, proxy statements and other information we file may be inspected and copied at prescribed rates at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website that contains reports, proxy and information statements and other information regarding issuers like us that file electronically with the SEC. The address of the SEC’s website is http://www.sec.gov.

This prospectus constitutes part of a registration statement filed under the Securities Act with respect to the shares of common stock covered hereby. As permitted by the SEC’s rules, this prospectus omits some of the information, exhibits and undertakings included in the registration statement. You may read and copy the information omitted from this prospectus but contained in the registration statement, as well as the periodic reports and other information we file with the SEC, at the public reference room and website of the SEC referred to above. You may also access our filings with the SEC on our website, which is located at http://www.bellerophon.com/. The information contained on our website is not part of this prospectus.

Statements contained in this prospectus as to the contents of any contract or other document are not necessarily complete, and in each instance we refer you to the copy of the contract or other document filed or incorporated by reference as an exhibit to the registration statement or as an exhibit to our Exchange Act filings, each such statement being qualified in all respects by such reference.

INFORMATION INCORPORATED BY REFERENCE

We are allowed to incorporate by reference information contained in documents that we file with the SEC. This means that we can disclose important information to you by referring you to those documents and that the information in this prospectus is not complete and you should read the information incorporated by reference for more detail. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus.

We incorporate by reference the documents listed below and any future filings we will make with the SEC under Section 13(a), 13(c), 14 or 15 (d) of the Exchange Act (i) after the date of the initial filing of the registration statement of which this prospectus is a part and prior to effectiveness of such registration statement and (ii) from the date of this prospectus but prior to the termination of the offering of the securities covered by this prospectus (other than Current Reports or portions thereof furnished under Item 2.02 or 7.01 of Form 8-K):

|

|

|

|

•

|

our annual report on Form 10-K for the year ended December 31, 2016, filed with the SEC on March 13, 2017 (as amended by Amendment No. 1 on Form 10-K/A filed on March 17, 2017);

|

|

|

|

|

•

|

our Definitive Proxy Statement on Schedule 14A, filed with the SEC on March 20, 2017;

|

|

|

|

|

•

|

our quarterly reports on Form 10-Q for the quarters ended March 31, 2017, and June 30, 2017, filed with the SEC on May 15, 2017 and August 7, 2017, respectively;

|

|

|

|

|

•

|

our current reports on Form 8-K and 8-K/A filed with the SEC on January 6, 2017, March 16, 2017, May 2, 2017, May 5, 2017, May 12, 2017, September 14, 2017, September 15, 2017, and September 27, 2017 (excluding any information deemed furnished pursuant to Item 2.02 or Item 7.01 of any Current Report on Form 8-K); and

|

|

|

|

|

•

|

the description of our common stock contained in our registration statement on Form 8-A, filed with the SEC on February 10, 2015, including all amendments and reports filed for the purpose of updating such description.

|

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that is incorporated by reference in this prospectus but not delivered with this prospectus, including exhibits that are specifically incorporated by reference in such documents. You may request a copy of such documents, which will be

provided to you at no cost, by writing or telephoning us at the following address or telephone number: Investor Relations, Bellerophon Therapeutics, Inc., 184 Liberty Corner Road, Suite 302, Warren, NJ 07059 or call (908) 574-4770.

38,899,668

Shares of

Common Stock

PROSPECTUS

November 6, 2017

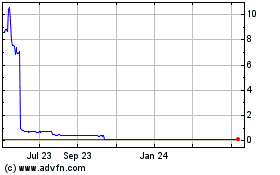

Bellerophon Therapeutics (NASDAQ:BLPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bellerophon Therapeutics (NASDAQ:BLPH)

Historical Stock Chart

From Apr 2023 to Apr 2024