Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

June 28 2017 - 4:09PM

Edgar (US Regulatory)

Filed

Pursuant to Rule 424(b)(3)

Registration

No.: 333-216155

June 28, 2017

MEDIGUS

LTD.

PROSPECTUS

SUPPLEMENT NO. 2

TO

PROSPECTUS DATED APRIL 3, 2017,

This

prospectus supplement supplements our prospectus dated April 3, 2017, or the Prospectus, relating to the offer and sale of 2,3396,887

American Depositary Shares, or ADSs, representing 119,844,350 ordinary shares, par value NIS 0.10 per share, or the Ordinary Shares,

which are issuable upon the exercise of outstanding Series A warrants, Series B warrants and warrants issued to the placement

agent in our public offering, or the Placement Agent Warrants, which closed on March 29, 2017, pursuant to a prospectus dated

March 23, 2017.

Each

Series A warrant is exercisable into one American Depository Share, or ADS, representing 50 Ordinary Shares, at an exercise price

of $3.50 per ADS, collectively, the Series A Warrants. Series A Warrants are exercisable either immediately (or, at the election

of the purchaser, six months following the issuance date) and until five years from the date on which they were issued. Each Series

B warrant is exercisable into one ADS at an exercise price of $0.01 per ADS, collectively, the Series B Warrants. Series B Warrants

are exercisable immediately until exercised in full. Each Placement Agent Warrant is exercisable immediately and until five years

from the date on which it was issued at an exercise of $4.375 per ADS.

We

will receive all of the proceeds from the exercise of the Series A Warrants, the Series B Warrants and the Placement Agent Warrants,

collectively the Warrants.

We

will not receive any proceeds from any such sale of the ADS to be issued as a result of the exercise of the Warrants.

This prospectus

supplement is being filed to include the information set forth in the report of foreign private issuer on Form 6-K furnished

with the U.S. Securities and Exchange Commission on June 28, 2017, which is set forth below. This prospectus supplement should

be read in conjunction with the Prospectus, which is to be delivered with this prospectus supplement.

The ADSs trade on The NASDAQ Capital

Market, or NASDAQ, under the symbol “MDGS.” On June 27, 2017, the last reported sale price of the ADSs on NASDAQ was

$ 2.23 per ADS. Our Ordinary Shares trade on the Tel Aviv Stock Exchange Ltd., or TASE, under the symbol “MDGS.” On

June 27, 2017, the last reported sale price of our ordinary shares on the TASE was NIS 0.16, or $0.046 per share (based on the

exchange rate reported by the Bank of Israel on such date). There is currently no established public trading market for the Series

A Warrants and Series B Warrants. The Series A Warrants and Series B Warrants are not and will not be listed for trading on any

national securities exchange.

Investing

in our securities involves a high degree of risk. Before investing in any of our securities, you should read the discussion of

material risks in investing in our common stock. See “Risk Factors” on page 14 of the Prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

* * * * *

The

board of directors of Medigus Ltd., or the Company, has resolved to adopt the corporate governance exemption set forth in Regulation

5D of the Israeli Companies Regulations (Reliefs for Public Companies whose Shares are Listed on a Stock Exchange Outside of Israel),

2000, or the Regulation. Upon adoption of the exemption in accordance with the Regulation, a public company with

securities listed on certain foreign exchanges, including the NASDAQ Capital Market, that satisfies the applicable foreign country

laws and regulations that apply to companies organized in that country relating to the appointment of independent directors and

composition of audit and compensation committees and has no controlling shareholder is exempt from the requirement to appoint

external directors or comply with the audit committee and compensation committee composition requirements under the Israeli Companies

Law. Per our board of directors’ resolution we comply with the NASDAQ Listing Rules in connection with a majority of independent

directors on the board of directors and in connection with the composition of each of the audit committee and the compensation

committee, in lieu of such requirements of the Israeli Companies Law.

Effective

as of June 28, 2017, and our adoption of the exemption under the Regulation, our external directors in office, Ms. Efrat Venkert

and Mr. Eitan Machover, are no longer classified as such under the Israeli Companies Law. The transition rules set

forth in the Regulation provide that such directors have the right to remain in office as our directors at their option after

the exemption under the Regulation are adopted until the earlier of such directors’ original end of term of office or the

second annual meeting of shareholders after the adoption of the exemption under the Regulation, which in the case of Ms. Efrat

Venkert and Mr. Eitan Machover is until the date of our annual meeting of shareholders in 2018. In addition, in order to comply

with the requirement of a majority of independent directors, Ms. Anat Naschitz has stepped down from our board of directors effective

June 28, 2017. Ms. Anat Naschitz’s resignation is solely connected with the Company’s adoption of the aforementioned

exemption and not due to any disagreements or other Company-related issues.

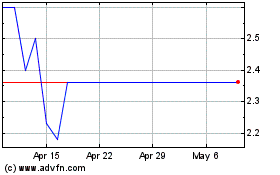

Medigus (NASDAQ:MDGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

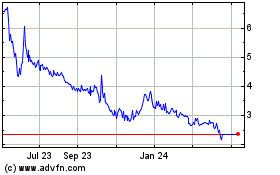

Medigus (NASDAQ:MDGS)

Historical Stock Chart

From Apr 2023 to Apr 2024