Filed

pursuant to Rule 424(b)(3)

Registration No. 333-

210387

PROSPECTUS SUPPLEMENT NO. 15

4,156,757 Shares of Common Stock

of

Guided Therapeutics, Inc.

This prospectus supplement supplements and amends

the prospectus dated April 7, 2016, as previously supplemented,

which constitutes part of our registration statement on Form S-1

(No. 333-210387) relating to up to 4,156,757 shares of our common

stock. This prospectus supplement includes our amendment to current

report on Form 8-K filed March 24, 2017.

THIS IS NOT A NEW REGISTRATION OF

SECURITIES.

This

prospectus supplement should be read in conjunction with the

prospectus, which is to be delivered with this prospectus

supplement. This prospectus supplement is qualified by

reference to the prospectus, except to the extent that the

information in this prospectus supplement updates and supersedes

the information contained in the prospectus.

This

prospectus supplement is not complete without, and may not be

delivered or utilized except in connection with, the

prospectus.

Investing in our common stock involves a high degree of risk. We

urge you to carefully read the “Risk Factors” section

beginning on page 4 of the prospectus.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these

securities or determined if this prospectus supplement is truthful

or complete. Any representation to the contrary is a criminal

offense.

The date of this prospectus supplement is March 24,

2017.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K/A

Amendment

No. 1

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

Report (Date of earliest event reported): January 22,

2017

GUIDED THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

0-22179

|

|

58-2029543

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

|

|

|

|

5835 Peachtree Corners East, Suite D

Norcross, Georgia

(Address

of principal executive offices)

|

30092

(Zip

Code)

|

Registrant’s

telephone number, including area code:

(770) 242-8723

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

EXPLANATORY NOTE

Guided

Therapeutics, Inc. (the “Company”) hereby amends its

current report on Form 8-K filed with the U.S. Securities and

Exchange Commission (the “Commission”) on January 26,

2017 ( the “Current Report”). The Company had

previously submitted a request for confidential treatment to the

Commission concerning Exhibit 10.1 to the Current Report, which has

been withdrawn. An unredacted copy of the agreement is

included as Exhibit 10.1 hereto and the disclosure under Item 1.01

of this amendment reflects the unredacted information.

Other

than as expressly set forth above, this amendment does not, and

does not purport to, amend, restate, or update the information

contained in the Current Report, or reflect any events that have

occurred after the Current Report was filed. As a result, the

Current Report, as amended hereby, continues to speak as of the

initial filing date and time of the Current Report.

Item

1.01.

Entry

into a Material Definitive Agreement.

On

January 22, 2017, the Company entered into a license agreement with

Shandong Yaohua Medical Instrument Corporation, or SMI, pursuant to

which the Company granted SMI an exclusive global license to

manufacture the LuViva device and related disposables (subject to a

carve-out for manufacture in Turkey) and exclusive distribution

rights in the Peoples Republic of China, Macau, Hong Kong and

Taiwan. In exchange for the license, SMI will pay a $1.0 million

licensing fee, payable in five installments through October 2017,

underwrite the cost of securing approval of LuViva with the Chinese

Food and Drug Administration, or CFDA, and, once it obtains CFDA

approval, pay $1.90 royalty on each disposable sold in the

territories by purchasing directly from the Company a Controlled

Programmable Chip (CPC), necessary for the operation of disposable

unit. Pursuant to the SMI agreement, SMI must become capable of

manufacturing LuViva in accordance with ISO 13485 for medical

devices by the second anniversary of the SMI agreement, and achieve

CFDA approval by July 22, 2019, or else forfeit the license. During

2017, SMI must purchase no fewer than ten devices at $13,000 each

(with up to four devices pushed to 2018 if there is a delay in

obtaining approval from the CFDA). In the three full calendar years

following CFDA approval, SMI must sell a minimum of 3,500 devices

(500 in the first year, 1,000 in the second, and 2,000 in the

third), and purchase a minimum of 25,200,000 CPC’s from the

Company, resulting in revenues of $47,880,000 to the Company over

the three-year period, or else forfeit the license. As manufacturer

of the devices and disposables, SMI will be obligated to sell each

to the Company at costs no higher than the Company’s current

costs. As partial consideration for, and as a condition to, the

license, and to further align the strategic interests of the

parties, the Company agreed to issue $1.0 million in shares of its

common stock to SMI, in five installments through October 2017, at

a price per share equal to the lesser of the average closing price

for the five days prior to issuance and $1.25.

In

order to facilitate the SMI agreement, immediately prior to its

execution the Company entered into an agreement with Shenghuo

Medical, LLC, regarding the Company’s previous license to

Shenghuo. Under the terms of the new agreement, Shenghuo agreed to

relinquish its manufacturing license and its distribution rights in

SMI’s territories, and to waive its rights under the original

Shenghuo agreement, all for as long as SMI performs under the SMI

agreement. As consideration, the Company has agreed to split with

Shenghuo the licensing fees and net royalties from SMI that we the

Company receive under the SMI agreement. Should the SMI agreement

be terminated, the Company has agreed to re-issue the original

license to Shenghuo under the original terms. The Company’s

COO and director, Mark Faupel, is a shareholder of Shenghuo, and

another director, Richard Blumberg, is a managing member of

Shenghuo.

The

above descriptions are qualified in their entirety by reference to

the SMI agreement and the Shenghuo agreement, attached as Exhibits

10.1 and 10.2, respectively, to this current report and

incorporated herein by reference. A press release further

describing the agreements is attached at Exhibit 99.1 and is

incorporated herein by reference.

This

current report on Form 8-K is neither an offer to sell nor the

solicitation of an offer to buy any securities. The securities

described above have not been registered under the Securities Act

and may not be offered or sold in the United States absent

registration or an exemption from registration under the Securities

Act.

Item

3.02

Unregistered

Sales of Equity Securities

The

information set forth under Item 1.01 is incorporated by reference

into this Item 3.02. The issuance of the securities described under

Item 1.01 pursuant to the SMI agreement has been conducted as a

private placement to “accredited investors” (as that

term is defined under Rule 501 of Regulation D), and is exempt from

registration under the Securities Act of 1933 in reliance upon

Section 4(a)(2) of the Securities Act, as a transaction by an

issuer not involving a public offering.

Item

5.05

Amendments

to the Registrant’s Code of Ethics, or Waiver of a Provision

of the Code of Ethics.

The

information set forth under Item 1.01 is incorporated by reference

into this Item 5.05. On January 15, 2017, each of the disinterested

directors on the Company’s Board of Directors, having

considered the interests of Dr. Faupel and Mr. Blumberg and having

approved the agreement, effectively waived the conflict-of-interest

provisions of the Company’s code of ethics.

Item

9.01

Financial

Statements and Exhibits

|

Number

|

Exhibit

|

|

10.1

|

Agreement,

dated January 22, 2017, between the Company and Shandong Yaohua

Medical Instrument Corporation

|

|

10.2*

|

Agreement,

dated January 22, 2017, between the Company and Shenghuo Medical,

LLC

|

|

99.1*

|

Press

Release, dated January 25, 2017

|

|

|

|

|

*Previously

filed as part of the current report on Form 8-K, filed January 26,

2017.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

GUIDED

THERAPEUTICS, INC.

|

|

|

|

|

|

/s/

Gene S. Cartwright, Ph.D.

|

|

|

By: Gene

S. Cartwright, Ph.D.

|

|

|

President and Chief

Executive Officer

|

|

Date: March

24, 2017

|

|

EXHIBIT

INDEX

|

Number

|

Exhibit

|

|

10.1

|

Agreement,

dated January 22, 2017, between the Company and Shandong Yaohua

Medical Instrument Corporation

|

|

10.2*

|

Agreement,

dated January 22, 2017, between the Company and Shenghuo Medical,

LLC

|

|

99.1*

|

Press

Release, dated January 25, 2017

|

|

|

|

|

*Previously

filed as part of the current report on Form 8-K, filed January 26,

2017.

|

Exhibit

10.1

AGREEMENT

BETWEEN SHANDONG YAOHUA MEDICAL INSTRUMENT

CORPORATION

AND GUIDED THERAPEUTICS, INC.

CONFIDENTIAL,

FINAL 22 JANUARY 2017

This agreement is

dated 22 January, 2017 and is between Guided Therapeutics, Inc., a

Georgia, United States of America corporation (“GTI”),

located at 5835 Peachtree Corners East, Suite D, Norcross, GA

30092, USA and Shandong Yaohua Medical Instrument Corporation,

located at No. 5 Zhuijian Street, High-Tech Development Zone, Laiwu

Shandong, People’s Republic of China

(“SMI”).

WHEREAS GTI has

developed a platform technology for the early detection of disease

that leads to cancer;

WHEREAS GTI’s

first non-invasive cancer detection product is the LuViva®

Advanced Cervical Scan device (the “Device”) and the

related disposable cervical guides (the “Disposables”

and, with the Device, “LuViva). LuViva is in use in Canada,

Latin America, Europe, Turkey, Asia and Africa. GTI owns the

worldwide manufacturing, distribution and intellectual property

(“IP”) rights to LuViva. LuViva is designed

to:

A.

Determine the true

likelihood of treatable cervical disease that may lead to cancer in

women aged 16 years and over who have been screened for cervical

cancer and have an abnormal result.

B.

Be used as a

screening tool both in the developed and developing world where the

Papanicolaou test and/or the Human Papillomavirus Virus tests are

not widely available.

WHEREAS GTI asserts

that they have the rights to license the global manufacturing

rights, excepting the Disposable Cervical guides for the Republic

of Turkey, for LuViva, and the distribution rights and sales rights

for LuViva in the Peoples Republic of China, Macau, Hong Kong and

Taiwan (hereinafter collectively referred to as the

“Jurisdictions”);

WHEREAS SMI is a

medical device company in China with an established distribution

and sales capability and has indicated a capability and willingness

to manufacture for the global market, and distribute and sell

LuViva in the Jurisdictions,

WHEREAS under this

agreement between the Parties, SMI is granted exclusive rights by

GTI for global manufacture as the optimum way to achieve economies

in global manufacturing and exclusive commercialization, both

distribution and sales, of LuViva within the Jurisdictions

(“Global Manufacturing License”)

IT IS HEREBY AGREED

AS FOLLOWS between SMI and GTI that SMI is granted exclusive

manufacturing rights, excepting the Disposable Cervical Guides for

the Republic of Turkey, and exclusive distribution rights and sales

rights for LuViva in the Jurisdictions, subject to the following

terms and conditions.

1.

Payments by SMI and Transfer of Stock

to SMI

:

1. GTI shall

provide payment instructions to SMI for SMI payments to GTI within

5 business days of signing this Agreement.

2. SMI shall

provide disbursement instructions to GTI for distribution of GTI

stock within 15 business days of signing of this

Agreement.

3. Both Parties

will undertake to ensure that the payment or disbursement

instructions are mutually satisfactory and compliant with all

applicable regulations.

B.

SMI shall make

payments to GTI based on the following schedule

●

$50,000 due within

15 business days of signing this Agreement

●

$200,000 due on or

before 20 February 2017*

●

$250,000 due on or

before 30 April 2017

●

$250,000 due on or

before 30 July 2017

●

$250,000 due on or

before 30 October 2017

*To be paid to GTI

providing that GTI provides all documents and data, including

manufacturing transfer plan, product production, guidance

documents, product quality standards, relevant patent certificates,

fixed costs of products, personnel data, etc. as reasonably

required by SMI within 10 business days after GTI receives the

initial payment of USD $50,000. During the first quarter of 2017,

GTI and SMI will agree on the plan and schedule for transfer of

manufacturing.

C.

GTI shall issue

shares of its common stock to SMI or as directed by SMI with each

of the five payments equal in value to the amount of the payment

(e.g $50,000, $200,000 or $250,000) within 30 days after receipt of

payments. The number of shares issued will be calculated at the

lesser of the end of day per share price for the average of five

consecutive days preceding the payment or $1.25 per share. The

shares of stock shall be transferred to SMI or as directed by SMI

within 30 days of SMI’s payment.

a.

Subject to purchase

orders from SMI to GTI, the schedule of minimum orders for 2017

shown in the table below will be maintained in order to maintain

Jurisdiction sales and distribution rights.

|

2017

|

Number of LuViva

Devices

|

Price Per

Device

(by air, CIF

BEIJING; by sea CIF QINGDAO

|

Anticipated

Use

|

|

By 31

March

|

5

|

$13,000

|

- Chinese FDA

Sample (1)

- Clinical Samples

(2)

- Transfer

Manufacturing Sample (1)

- Seed outside PRC

Market (1)

|

|

By 31

December

|

5

|

$13,000

|

- Seed PRC

Commercial Market (4)*

- Sales outside of

PRC (1)

|

*If Chinese Food

and Drug Administration (CFDA) approval is delayed, then these four

device orders can be moved to Q1 2018. If SMI needs to order single

use Cervical Guides or other supplies directly from GTI instead of

manufacturing them in China, the prices shall be pursuant to the

published price list for international distributors adjusted by a

10% discount. For clinical trials, GTI agrees to supply 200

Cervical Guides at no cost.

b.

If additional

orders are placed by SMI to GTI prior to SMI having established its

own manufacturing facility, the devices will be priced as

follows:

|

Quantity

|

Price (by air,

CIF BEIJING; by sea CIF QINGDAO)

|

|

11 –

20

|

$12,500

|

|

21 –

40

|

$12,000

|

|

41 and

greater

|

International

distributor list price

|

3.

Minimum Sales

: People’s

Republic of China (Beginning first full calendar year following

CFDA approval). It is expected that full or partial manufacturing

will occur in China, so that minimum orders will not necessarily

occur, unless agreed by both parties. Notwithstanding the

foregoing, SMI will be responsible for minimum royalty payments

based on the minimum sales of LuViva products as shown in the Table

below.

|

Full year

following CFDA Approval

|

Number of

machines placed or sold

|

Number of tests

per day

|

Days per

week

|

Weeks per

year

|

|

1

|

500

|

30

|

5

|

48

|

|

2

|

1000

|

30

|

5

|

48

|

|

3

|

2000

|

30

|

5

|

48

|

4.

Cost of CFDA Approval

: SMI

shall underwrite the entire cost of securing approval of LuViva

with Chinese FDA.

5.

Manufacturing

:

a.

SMI, shall arrange,

at its sole cost, for a manufacturer in China to build tooling to

support manufacture.

b.

The price payable by GTI for each Device and each packet of

Disposables supplied by the manufacturer for resale by GTI outside

of the Territories will be no higher than the then current internal

costs to GTI for manufacturing the Device and the then current

price paid by GTI to its current supplier of

Disposables.

c.

In the event that this is not possible, the Parties agree to

discuss the following options:

a.

SMI retains the

right to manufacture for China, Hong Kong, Macau and Taiwan, where

SMI has distribution and sales rights.

b.

SMI elects to

manufacture just the Cervical Guides which is anticipated to be

able to be at a lower price in China

c.

SMI buys the

devices and Cervical Guides, or just the devices from

GTI

d.

Other options that may be identified and available to find a

mutually satisfactory solution.

If SMI fails to

achieve manufacturing capabilities for either the Devices and

Disposables in accordance with ISO 13485 for medical devices by 24

months after the date hereof, SMI shall no longer have any rights

to manufacture, distribute or sell LuViva.

6.

Technical Assistance for Manufacturing

and Sales

:

a.

Both GTI and SMI

recognize the need for technical assistance to set up manufacturing

and to establish sales protocols and marketing materials. To that

end, both parties pledge cooperation in helping to establish the

manufacturing and sales in China.

b.

GTI shall provide

the Curricula Vitae or Resume (personal data) of the inventor of

the LuViva technology to SMI

c.

SMI shall send over

its manufacturing expert to GTI at SMI’s expense to learn the

manufacturing process. GTI will be responsible for all in-country

(US) expenses.

d.

GTI shall send over

its technical expert within 10 days of a request or as soon as

reasonably possible from SMI to SMI at GTI’s expense to

assist with the establishment of the manufacturing and sales

protocols in China. SMI will be responsible for all in-country

(China) expenses.

e.

GTI shall provide

technical support and training for product upgrades consistent with

the technical support provided to other international distributors

of LuViva.

7.

Royalties

:

a.

For each single-use

Cervical Guide chip sold by SMI in the Jurisdictions, SMI shall

transfer funds to the Escrow Agent at a rate of $1.90 per chip.in

the amount equaling the number of chips sold. Funds shall be

transferred monthly.

b.

The Parties agree

to reassess these royalty amounts at the end of the second year of

commercial sales in China to determine if an adjustment to the

royalty amounts, up or down, is warranted. Any adjustments to the

royalty amounts must be mutually agreeable.

8.

Commercialization

: If within 18

months of this License’s Effective Date, SMI fails to achieve

commercialization of LuViva (as defined below) in China. SMI shall

no longer have any rights to manufacture, distribute or sell

LuViva.

Commercialization

of LuViva is defined as SMI achieving all of the

following:

a.

Filing an

application with the CFDA for approval of LuViva

b.

Any assembly or

manufacture of the Device or Disposables that begins in

China

c.

Purchase of at

least 10 Devices and associated Disposables for clinical

evaluations and regulatory use and or sales in the Jurisdictions,

according to the schedule described in Section 2.

above.

9.

Best Efforts

: The Rights

described herein must be maintained by diligent development and

commercial efforts. SMI agrees to use its best efforts to maximize

the royalty payments contemplated herein. Both parties agree to

conduct quarterly reviews to mark progress and agree on forecasts

for orders.

10.

Breach or Failure to Perform

:

Under the following circumstances, SMI shall forfeit this License

and shall no longer have any rights to manufacture, distribute or

sell LuViva in the Jurisdictions if SMI is unable to cure in a

timely manner:

a.

A material breach

of any of SMI’s obligations set forth in this

section.

b.

Failure to achieve

CFDA approval within 30 months from the date of this

agreement.

In the event of

Breach or Failure to Perform,

c.

GTI shall provide

written notification of the breach or failure to

perform.

d.

SMI shall be given

a 45 day period in which to cure the breach or failure to

perform.

e.

If the breach or

failure to perform is not cured, SMI shall return to GTI, at

SMI’s cost, all samples, data, hardware, software, regulatory

documents, bench and clinical test results and all other

information pertaining to LuViva in the Jurisdictions

11.

Notices and Communications

: All

notices and other communications required by this Agreement will be

effective upon deposit in the mail, postage prepaid and addressed

to the parties at their respective addresses set forth below until

such notice that a different person or address shall have been

designated:

If to

SMI:

No. 5 Zhuijian

Street, High-Tech Development Zone, Laiwu Shandong,

People’s

Republic of China

If to

GTI:

5835 Peachtree

Corners East, Suite D,

Norcross, GA 30092,

USA

12.

Relationship of Parties

: The

Parties to this Agreement are and shall remain independent

contractors and nothing herein shall be construed to create a

partnership, agency or joint venture between the parties. Each

party shall be responsible for wages, hours and conditions of

employment of its personnel during the term of, and under this

Agreement.

13.

Dispute Resolution

: In the

event a dispute arises out of or in connection with this Agreement,

the parties will attempt to resolve the dispute through friendly

consultation. If the dispute is not resolved within a reasonable

period then any or all outstanding issues may be submitted to

mediation in accordance within any statutory rules of mediation. If

mediation is not successful in resolving he entire dispute or is

unavailable, any outstanding issues will be submitted to final and

binding arbitration in accordance with the laws of the State of

Georgia, United States of America. The arbitrator’s award

will be final, and judgment may be entered upon it by any Court

having jurisdiction within the State of Georgia, United States of

America. Each party shall choose one (1) arbitrator and the

two (2) chosen arbitrators shall select a third arbitrator, who

shall be the Chairman of the Arbitration Panel. As soon as

the mediation process has been unsuccessful, either party may

select an arbitrator by sending the name of the arbitrator, in

writing, to the other party. The party receiving the name of

the said arbitrator shall, within fifteen (15) days of receipt,

select their arbitrator and shall send their selection, in writing,

to the other party. Should that party fail to select their

arbitrator within fifteen (15) days of receipt of the name of the

first party’s arbitrator, the initial party may seek Court

appointment of the receiving party’s arbitrator and the

latter shall be responsible for the initial party’s

reasonable attorney’s fees and costs in connection with the

Court appointment. If the two (2) appointed arbitrators fail

to select the third arbitrator within thirty (30) days from

the appointment of the second arbitrator, either party, or the

parties jointly, may seek Court appointment of the third

arbitrator.

14.

Applicable Law

: All questions

concerning the validity, operation, interpretation and construction

of this Agreement will be governed by and determined in accordance

with the laws of the State of Georgia, United States of

America.

15.

Waivers of Breach

: No waiver by

either Party of any breach of any provision shall constitute a

waiver of any other breach of that provision or any other provision

hereof.

16.

Warrants and Representations

:

Each Party represents and warrants that the terms of this Agreement

are not inconsistent with any other contractual or legal

obligations it may have or with the policies of any institution or

company with which such Party is associated.

17.

Interpretation

: The Parties

have participated jointly in the negotiation and drafting of this

Agreement. In the event of an ambiguity or question of intent or

interpretation arises, this Agreement shall be construed as if

drafted jointly by the parties and no presumption or burden of

proof shall arise favoring or disfavoring any Party by virtue of

the authorship of any the provisions of this

agreement.

18.

Assignment

: SMI may not assign

this Agreement in whole or in part, other than manufacturing,

without GTI’s consent, that shall not be unreasonably be

withheld. SMI may outsource all or parts of the manufacturing at

their discretion, provided that SMI is able to maintain and verify

that the quality of the manufacturing maintains CFDA, ISO 14485 and

other regulatory standards that GTI may rely upon in sourcing

LuViva.

19.

Effective Agreement

: This

Agreement may be signed by the parties via facsimile or electronic

signatures. This Agreement will constitute an effective Agreement

when signed by both Parties.

20.

Entire Agreement

: This

Agreement, sets forth the entire agreement and understanding

between the parties as to the subject matter hereof and merges all

prior discussions between them; and neither party shall be bound by

any conditions, definitions, warranties, understandings or

representations with respect to such subject matter other than as

expressly provided herein. This Agreement may not be modified or

altered except in writing by an instrument duly executed by

authorized officers of both parties.

IN WITNESS WHEREOF

, the parties hereto

have caused this Agreement to be duly executed by their duly

authorized officers as of the

22

day of January,

2017.

GTI

/s/ Gene

Cartwright

Gene

Cartwright

Chief

Executive Officer, Guided Therapeutics Inc.

SMI

/s/ Yaohua

Li

Yaohua

Li

Chairman,

Shandong Yaohua Medical Instrument Corporation

7

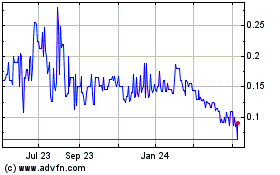

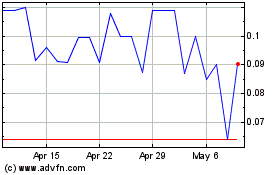

Guided Therapeutics (QB) (USOTC:GTHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Guided Therapeutics (QB) (USOTC:GTHP)

Historical Stock Chart

From Apr 2023 to Apr 2024