Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

January 07 2016 - 4:18PM

Edgar (US Regulatory)

Filed pursuant to

Rule 424(b)(3)

Registration No. 333-207365

PROSPECTUS SUPPLEMENT NO. 2

(to Prospectus dated October 19, 2015)

Antero Midstream Partners LP

12,898,000 Common Units

Representing Limited Partner Interests

This prospectus supplement is being filed to update and supplement information contained in the prospectus dated October 19, 2015, covering the offer and resale of common units by the selling unitholders identified on page 16 of the prospectus, with information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on January 7, 2016.

This prospectus supplement updates and supplements the information in the prospectus and is not complete without, and may not be delivered or utilized except in combination with, the prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the prospectus and if there is any inconsistency between the information in the prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our common units involves risks. Please read “Risk Factors” beginning on page 7 of the prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated January 7, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): January 4, 2016

Antero Midstream Partners LP

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-36719 |

|

46-4109058 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

1615 Wynkoop Street

Denver, Colorado 80202

(Address of Principal Executive Offices)

(Zip Code)

Registrant’s telephone number, including area code: (303) 357-7310

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 7, 2016, Antero Midstream Partners LP (the “Partnership”) announced that the Board of Directors (the “Board”) of Antero Resources Midstream Management LLC, the general partner (the “General Partner”) of the Partnership, appointed Michael N. Kennedy as the Chief Financial Officer of the General Partner, effective January 4, 2016. Mr. Kennedy will replace Glen C. Warren, Jr., who has served as President, Chief Financial Officer and Secretary and as a director of the General Partner since February 2014. Mr. Warren will continue to serve as President and Secretary and as a director of the General Partner. Mr. Kennedy is concurrently being appointed as the Senior Vice President—Finance of Antero Resources Corporation (“Antero”), which owns approximately 66.5% of the Partnership’s outstanding common and subordinated units.

Mr. Kennedy, age 41, has served as Vice President—Finance of the General Partner since February 2014. Mr. Kennedy has also served as Vice President—Finance of Antero since August 2013. Mr. Kennedy was Executive Vice President and Chief Financial Officer of Forest Oil Corporation (“Forest”) from 2009 to 2013. From 2001 until 2009, Mr. Kennedy held various financial positions of increasing responsibility within Forest. From 1996 to 2001, Mr. Kennedy was an auditor with Arthur Andersen LLP focusing on the Natural Resources industry. Mr. Kennedy holds a B.S. in Accounting from the University of Colorado at Boulder.

Mr. Kennedy (i) has no familial relationships with any director or other executive officer of the General Partner and (ii) is not a party to any related person transaction with the Partnership. There are no arrangements or understandings between Mr. Kennedy and any other persons pursuant to which Mr. Kennedy was appointed as Chief Financial Officer of the General Partner.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ANTERO MIDSTREAM PARTNERS LP |

|

|

|

|

|

|

By: |

Antero Resources Midstream Management LLC, |

|

|

|

its general partner |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ GLEN C. WARREN, JR. |

|

|

|

Name: |

Glen C. Warren, Jr. |

|

|

|

Title: |

President, Chief Financial Officer and Secretary |

Date: January 7, 2016

3

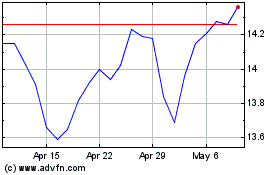

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Mar 2024 to Apr 2024

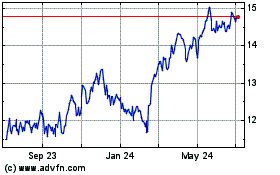

Antero Midstream (NYSE:AM)

Historical Stock Chart

From Apr 2023 to Apr 2024