Filed Pursuant to Rule 424(b)(3)

Registration No. 333-200608

Dear Oiltanking Partners, L.P. Unitholders:

On November 11, 2014, Enterprise Products Partners L.P. (“Enterprise”), Enterprise Products Holdings LLC (“Enterprise

GP”), which is the general partner of Enterprise, EPOT MergerCo LLC (“MergerCo”), which is a wholly owned subsidiary of Enterprise, Oiltanking Partners, L.P. (“Oiltanking”), and OTLP GP, LLC (“Oiltanking GP”),

which is the general partner of Oiltanking, entered into an Agreement and Plan of Merger (the “merger agreement”). Pursuant to the merger agreement, MergerCo will merge with and into Oiltanking (the “merger”), with Oiltanking

surviving the merger as an indirect wholly owned subsidiary of Enterprise, and all outstanding common units representing limited partner interests in Oiltanking at the effective time of the merger (“Oiltanking common units”) held by the

“Oiltanking public unitholders” (which consist of Oiltanking unitholders other than Enterprise and its subsidiaries) will be cancelled and converted into the right to receive common units representing limited partner interests in

Enterprise (“Enterprise common units”) based on an exchange ratio of 1.30 Enterprise common units for each Oiltanking common unit. No fractional Enterprise common units will be issued in the merger, and Oiltanking public unitholders will,

instead, receive cash in lieu of fractional Enterprise common units, if any.

Pursuant to the merger agreement and Oiltanking’s

partnership agreement, a majority of the outstanding Oiltanking common units must vote in favor of the proposal in order for it to be approved. Pursuant to a support agreement between Oiltanking, Enterprise and Enterprise Products Operating LLC

(“EPO”) executed in connection with the merger agreement, Enterprise and EPO have agreed to vote any Oiltanking common units owned by them or their subsidiaries in favor of adoption of the merger agreement and the merger, including the

54,799,604 Oiltanking common units currently directly owned by EPO (representing approximately 66% of the outstanding Oiltanking common units), at any meeting of Oiltanking unitholders, which is sufficient to approve the merger agreement and the

merger under the merger agreement and Oiltanking’s partnership agreement. Oiltanking has scheduled a special meeting of its unitholders to vote on the merger agreement and the merger on February 13, 2015 at 8:00 a.m., local time, at 1100

Louisiana Street, 10th Floor, Houston, Texas 77002. Regardless of the number of units you own or whether you plan to attend the meeting, it is important that your common units be represented and voted at the meeting. Voting instructions are set

forth inside this proxy statement/prospectus.

The Conflicts Committee (“Oiltanking Conflicts Committee”) of the

Oiltanking GP board of directors (the “Oiltanking Board”) has determined unanimously that the merger agreement and the transactions contemplated thereby are advisable, fair and reasonable to and in the best interests of Oiltanking and the

Oiltanking unaffiliated unitholders, and it approved the merger agreement, the execution, delivery and performance by Oiltanking of the merger agreement and the transactions contemplated thereby, which constituted “Special Approval” under

Oiltanking’s partnership agreement. The Oiltanking Conflicts Committee also recommended that the Oiltanking Board approve the merger agreement, the execution, delivery and performance by Oiltanking of the merger agreement and the transactions

contemplated thereby and submit the merger agreement to the Oiltanking unitholders for approval at a meeting, and further recommended that the holders of Oiltanking common units approve the merger agreement and the merger. The Oiltanking Board has

determined unanimously that the merger agreement and the transactions contemplated thereby are fair and reasonable to and in the best interests of Oiltanking and the holders of Oiltanking common units, approved the merger agreement, the execution,

delivery and performance by Oiltanking of the merger agreement and the transactions contemplated thereby, directed that the merger agreement be submitted to the Oiltanking unitholders for approval at a meeting of such unitholders for the purpose of

approving the merger agreement and the merger and recommended that the holders of Oiltanking common units approve the merger agreement and the merger.

This proxy statement/prospectus provides you with detailed information about the proposed merger and related matters. Oiltanking

encourages you to read the entire document carefully. In particular, please read “Risk Factors” beginning on page 31 of this proxy statement/prospectus for a discussion of risks relevant to the merger and

Enterprise’s business following the merger.

Enterprise’s common units are listed on the New York Stock Exchange

(“NYSE”) under the symbol “EPD,” and Oiltanking’s common units are listed on the NYSE under the symbol “OILT.” The last reported sale price of Enterprise’s common units on the NYSE on January 8, 2015 was

$34.44. The last reported sale price of Oiltanking common units on the NYSE on January 8, 2015 was $44.47.

Laurie H. Argo

President and Chief Executive Officer

OTLP GP, LLC

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued under this proxy statement/prospectus or has determined if this document is truthful or complete. Any representation to

the contrary is a criminal offense.

All information in this document concerning Enterprise has been furnished by Enterprise. All

information in this document concerning Oiltanking has been furnished by Oiltanking. Enterprise has represented to Oiltanking, and Oiltanking has represented to Enterprise, that the information furnished by and concerning it is true and correct in

all material respects.

This proxy statement/prospectus is dated January 9, 2015 and is being first mailed to Oiltanking unitholders on or

about January 15, 2015.

Houston, Texas

January 9, 2015

Notice of

Special Meeting of Unitholders

To the Unitholders of Oiltanking Partners, L.P.:

A special meeting of unitholders of Oiltanking Partners, L.P. (“Oiltanking”) will be held on February 13, 2015 at 8:00 a.m., local

time, at 1100 Louisiana Street, 10th Floor, Houston, Texas 77002, for the following purposes:

| |

• |

|

To consider and vote upon the approval of the Agreement and Plan of Merger dated as of November 11, 2014, by and among Enterprise Products Partners L.P. (“Enterprise”), Enterprise Products Holdings LLC,

EPOT MergerCo LLC, Oiltanking and OTLP GP, LLC (“Oiltanking GP”), as it may be amended from time to time (the “merger agreement”), and the merger contemplated by the merger agreement (the “merger”); and

|

| |

• |

|

To transact such other business as may properly be presented at the meeting or any adjournments or postponements of the meeting. |

Pursuant to the merger agreement and Oiltanking’s partnership agreement, a majority of the outstanding common units representing limited

partner interests in Oiltanking (the “Oiltanking common units”) must vote in favor of the proposal in order for it to be approved. Failures to vote, abstentions and broker non-votes will have the same effect as a vote against the proposal

for purposes of the vote by the Oiltanking unitholders required under the merger agreement and Oiltanking’s partnership agreement.

Pursuant to a support agreement (the “support agreement”) between Oiltanking, Enterprise and Enterprise Products Operating LLC

(“EPO”), a wholly owned subsidiary of Enterprise, executed in connection with the merger agreement, Enterprise and EPO have agreed to vote any Oiltanking common units owned by them or their subsidiaries in favor of adoption of the merger

agreement and the merger at any meeting of Oiltanking unitholders. EPO currently owns 54,799,604 Oiltanking common units representing approximately 66% of the outstanding Oiltanking common units), which is sufficient to approve the merger agreement

and the merger under the merger agreement and Oiltanking’s partnership agreement.

The Conflicts Committee (“Oiltanking

Conflicts Committee”) of the Oiltanking GP board of directors (the “Oiltanking Board”) has determined unanimously that the merger agreement and the transactions contemplated thereby are advisable, fair and reasonable to and in the

best interests of Oiltanking and the Oiltanking unaffiliated unitholders, and it approved the merger agreement, the execution, delivery and performance by Oiltanking of the merger agreement and the transactions contemplated thereby, which

constituted “Special Approval” under Oiltanking’s partnership agreement. The Oiltanking Conflicts Committee also recommended that the Oiltanking Board approve the merger agreement, the execution, delivery and performance by Oiltanking

of the merger agreement and the transactions contemplated thereby and submit the merger agreement to the Oiltanking unitholders for approval at a meeting, and further recommended that the holders of Oiltanking common units approve the merger

agreement and the merger. The Oiltanking Board has determined unanimously that the merger agreement and the transactions contemplated thereby are fair and reasonable to and in the best interests of Oiltanking and the holders of Oiltanking common

units, approved the merger agreement, the execution, delivery and performance by Oiltanking of the merger agreement and the transactions contemplated thereby, directed that the merger agreement be submitted to the Oiltanking unitholders for approval

at a meeting of such unitholders for the purpose of approving the merger agreement and the merger and recommended that the holders of Oiltanking common units approve the merger agreement and the merger.

Only unitholders of record at the close of business on January 2, 2015 are entitled to notice of and to vote at the meeting and any

adjournments or postponements of the meeting. A list of unitholders entitled to vote at the meeting will be available for inspection at Oiltanking’s offices in Houston, Texas for any purpose relevant to the meeting during normal business hours

for a period of 10 days before the meeting and at the meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE

MEETING, PLEASE VOTE OR SUBMIT YOUR PROXY IN ONE OF THE FOLLOWING WAYS. If you hold your units in the name of a bank, broker or other nominee, you should follow the instructions provided by your bank, broker or nominee when voting your

Oiltanking common units. If you hold your units in your own name, you may vote by:

| |

• |

|

using the toll-free telephone number shown on the proxy card; |

| |

• |

|

using the Internet website shown on the proxy card; or |

| |

• |

|

marking, signing, dating and promptly returning the enclosed proxy card in the postage-paid envelope. It requires no postage if mailed in the United States. |

By order of the Board of Directors of OTLP GP, LLC, as the general partner of Oiltanking Partners, L.P.

Laurie H. Argo

President and Chief Executive Officer

OTLP GP, LLC

IMPORTANT NOTE ABOUT THIS PROXY STATEMENT/PROSPECTUS

This proxy statement/prospectus, which forms part of a registration statement on Form S-4 filed with the Securities and Exchange Commission,

which is referred to as the “SEC” or the “Commission,” constitutes a proxy statement of Oiltanking under Section 14(a) of the Securities Exchange Act of 1934, as amended, which is referred to as the “Exchange Act,”

with respect to the solicitation of proxies for the special meeting of Oiltanking unitholders to, among other things, approve the merger agreement and the merger. This proxy statement/prospectus is also a prospectus of Enterprise under

Section 5 of the Securities Act of 1933, as amended, which is referred to as the “Securities Act,” for Enterprise common units that will be issued to Oiltanking unitholders in the merger pursuant to the merger agreement.

As permitted under the rules of the SEC, this proxy statement/prospectus incorporates by reference important business and financial

information about Enterprise and Oiltanking from other documents filed with the SEC that are not included in or delivered with this proxy statement/prospectus. Please read “Where You Can Find More Information” beginning on page 142. You

can obtain any of the documents incorporated by reference into this document from the SEC’s website at http://www.sec.gov. This information is also available to you without charge upon your request in writing or by telephone from

Enterprise or Oiltanking, as the case may be, at the following addresses and telephone numbers:

|

|

|

| Enterprise Products Partners L.P.

1100 Louisiana Street, 10th Floor

Attention: Investor Relations

Houston, Texas 77002 Telephone:

(713) 381-6500 |

|

Oiltanking Partners, L.P.

1100 Louisiana Street, 10th Floor

Attention: Investor Relations

Houston, Texas 77002 Telephone:

(713) 381-6500 |

Please note that copies of the documents provided to you will not include exhibits, unless the exhibits are

specifically incorporated by reference into the documents or this proxy statement/prospectus.

You may obtain certain of these

documents at Enterprise’s website, www.enterpriseproducts.com, by selecting “Investors” and then selecting “SEC Filings,” and at Oiltanking’s website, www.oiltankingpartners.com, by selecting

“Investor Relations” and then selecting “SEC Filings.” Information contained on Oiltanking’s and Enterprise’s websites is expressly not incorporated by reference into this proxy statement/prospectus.

In order to receive timely delivery of requested documents in advance of the Oiltanking special meeting of unitholders, your request should

be received no later than February 5, 2015. If you request any documents, Enterprise or Oiltanking will mail them to you by first class mail, or another equally prompt means, within one business day after receipt of your request.

Enterprise and Oiltanking have not authorized anyone to give any information or make any representation about the merger, Enterprise or

Oiltanking that is different from, or in addition to, that contained in this proxy statement/prospectus or in any of the materials that have been incorporated by reference into this proxy statement/prospectus. Therefore, if anyone distributes this

type of information, you should not rely on it. If you are in a jurisdiction where offers to exchange or sell, or solicitations of offers to exchange or purchase, the securities offered by this proxy statement/prospectus or the solicitation of

proxies is unlawful, or you are a person to whom it is unlawful to direct these types of activities, then the offer presented in this proxy statement/prospectus does not extend to you. The information contained in this proxy statement/prospectus

speaks only as of the date of this proxy statement/prospectus, or in the case of information in a document incorporated by reference, as of the date of such document, unless the information specifically indicates that another date applies. All

information in this document concerning Enterprise has been furnished by Enterprise. All information in this document concerning Oiltanking has been furnished by Oiltanking. Enterprise has represented to Oiltanking, and Oiltanking has represented to

Enterprise, that the information furnished by and concerning it is true and correct in all material respects.

PROXY STATEMENT/PROSPECTUS

TABLE OF CONTENTS

i

ii

iii

DEFINITIONS

The following terms have the meanings set forth below for purposes of this proxy statement/prospectus, unless the context otherwise indicates:

| |

• |

|

“Enterprise” means Enterprise Products Partners L.P., a Delaware limited partnership. |

| |

• |

|

“Enterprise Board” means the board of directors of Enterprise GP. |

| |

• |

|

“Enterprise GP” means Enterprise Products Holdings LLC, a Delaware limited liability company and the general partner of Enterprise. |

| |

• |

|

“Enterprise unaffiliated unitholders” means Enterprise unitholders other than those controlling, controlled by or under common control with Enterprise GP. |

| |

• |

|

“EPCO” means Enterprise Products Company, a Texas corporation. |

| |

• |

|

“EPO” means Enterprise Products Operating LLC, a Texas limited liability company. |

| |

• |

|

“MergerCo” means EPOT MergerCo LLC, a Delaware limited liability company and wholly owned subsidiary of Enterprise. |

| |

• |

|

“Oiltanking” means Oiltanking Partners, L.P., a Delaware limited partnership. |

| |

• |

|

“Oiltanking Board” means the board of directors of Oiltanking GP. |

| |

• |

|

“Oiltanking Conflicts Committee” means the Conflicts Committee of the Oiltanking Board. |

| |

• |

|

“Oiltanking GP” means OTLP GP, LLC, a Delaware limited liability company and the general partner of Oiltanking. |

| |

• |

|

“Oiltanking public unitholders” means the Oiltanking unitholders other than Enterprise and its subsidiaries. |

| |

• |

|

“Oiltanking unaffiliated unitholders” means the Oiltanking unitholders other than Enterprise and its affiliates, Oiltanking and its subsidiaries, and the directors and executive officers of Oiltanking GP.

|

| |

• |

|

“Special Approval” under Oiltanking’s partnership agreement means the approval of a majority of the members of the Oiltanking Conflicts Committee. |

1

QUESTIONS AND ANSWERS ABOUT THE MERGER AND THE SPECIAL MEETING

Important Information and Risks. The following are brief answers to some questions that you may have

regarding the proposed merger and the proposal being considered at the special meeting of Oiltanking unitholders. You should read and consider carefully the remainder of this proxy statement/prospectus, including the Risk Factors beginning on page

31 and the attached Annexes, because the information in this section does not provide all of the information that might be important to you. Additional important information and descriptions of risk factors are also contained in the documents

incorporated by reference in this proxy statement/prospectus. Please read “Where You Can Find More Information” beginning on page 142.

| Q: |

Why am I receiving these materials? |

| A: |

Enterprise and Oiltanking have agreed to combine by merging MergerCo, a wholly owned subsidiary of Enterprise, with and into Oiltanking, with Oiltanking surviving the merger. The merger cannot be completed without the

approval of the Oiltanking unitholders. |

| Q: |

Who is soliciting my proxy? |

| A: |

Oiltanking GP, on behalf of the Oiltanking Conflicts Committee and the Oiltanking Board, is sending you this proxy statement/prospectus in connection with its solicitation of proxies for use at Oiltanking’s special

meeting of unitholders. Certain directors and officers of Oiltanking GP and certain employees of EPCO and its affiliates who provide services to Oiltanking may also solicit proxies on Oiltanking’s behalf by mail, telephone, fax or other

electronic means, or in person. |

| Q: |

What is the proposed transaction? |

| A: |

Enterprise and Oiltanking have agreed to combine by merging MergerCo with and into Oiltanking, under the terms of a merger agreement that is described in this proxy statement/prospectus and attached as

Annex A to this proxy statement/prospectus. As a result of the merger, each outstanding Oiltanking common unit held by Oiltanking public unitholders will be converted into the right to receive 1.30 common units representing limited

partner interests in Enterprise (“Enterprise common units”). |

The merger will become effective on the date and at

the time that the certificate of merger is filed with the Secretary of State of the State of Delaware, or a later date and time if set forth in the certificate of merger. Throughout this proxy statement/prospectus, this is referred to as the

“effective time” of the merger.

| Q: |

Why are Enterprise and Oiltanking proposing the merger? |

| A: |

Enterprise and Oiltanking believe that the merger will benefit both Enterprise and Oiltanking unitholders by combining the two entities into a single partnership that is better positioned to compete in the marketplace.

|

Please read “The Merger — Recommendation of the Oiltanking Conflicts Committee and the Oiltanking Board and

Reasons for the Merger” and “The Merger — Enterprise’s Reasons for the Merger.”

| Q: |

What will happen to Oiltanking as a result of the merger? |

| A: |

As a result of the merger, MergerCo will merge with and into Oiltanking, and Oiltanking will survive as an indirect wholly owned subsidiary of Enterprise. |

| Q: |

What will Oiltanking unitholders receive in the merger? |

| A: |

If the merger is completed, Oiltanking public unitholders will be entitled to receive 1.30 Enterprise common units in exchange for each Oiltanking

common unit owned. This exchange ratio is fixed and will not be adjusted, regardless of any change in price of either Enterprise common units or Oiltanking common units prior to completion of the merger. If the exchange ratio would result in an

Oiltanking unitholder being entitled to receive a fraction of an Enterprise common unit, that unitholder will receive cash from Enterprise |

2

| |

in lieu of such fractional interest in an amount equal to such fractional interest multiplied by the average of the closing price of Enterprise common units for the ten consecutive New York Stock

Exchange (“NYSE”) full trading days ending at the close of trading on the last NYSE full trading day immediately preceding the day the merger closes. For additional information regarding exchange procedures, please read “The Merger

Agreement — Exchange of Certificates; Fractional Units.” |

| Q: |

Where will my units trade after the merger? |

| A: |

Enterprise common units will continue to trade on the NYSE under the symbol “EPD.” Oiltanking common units will no longer be publicly traded. |

| Q: |

What will Enterprise common unitholders receive in the merger? |

| A: |

Enterprise common unitholders will simply retain the Enterprise common units they currently own. They will not receive any additional Enterprise common units in the merger. |

| Q: |

What happens to my future distributions? |

| A: |

Once the merger is completed and Oiltanking common units are exchanged for Enterprise common units, when distributions are approved and declared by Enterprise GP and paid by Enterprise, former Oiltanking unitholders

will receive distributions on the Enterprise common units they receive in the merger in accordance with Enterprise’s partnership agreement. Because the special meeting is scheduled to take place after the record dates for the distributions on

both Enterprise and Oiltanking common units for the quarter ended December 31, 2014, to be declared and paid in February 2015, Oiltanking unitholders will receive fourth quarter distributions on their Oiltanking common units and not on

Enterprise common units received in the merger. Oiltanking unitholders will not receive distributions from both Oiltanking and Enterprise for the same quarter. For additional information, please read “Market Prices and Distribution

Information.” |

Current Enterprise common unitholders will continue to receive distributions on their common units in

accordance with Enterprise’s partnership agreement and at the discretion of the Enterprise Board. For a description of the distribution provisions of Enterprise’s partnership agreement, please read “Comparison of the Rights of

Enterprise and Oiltanking Unitholders.”

The current annualized distribution rate for each Oiltanking common unit is $1.0900 (based on

the quarterly distribution rate of $0.2725 for each Oiltanking common unit paid on November 14, 2014 with respect to the third quarter of 2014). Based on the exchange ratio, the annualized distribution rate for each Oiltanking common unit

exchanged for 1.30 Enterprise common units would be approximately $1.8980 (based on the quarterly distribution rate of $0.3650 per Enterprise common unit paid on November 7, 2014 with respect to the third quarter of 2014). Accordingly, based on

current distribution rates and the 1.30 exchange ratio, an Oiltanking unitholder would initially receive approximately 74% more in quarterly cash distributions on an annualized basis after giving effect to the merger. For additional information,

please read “Comparative Per Unit Information” and “Market Prices and Distribution Information.”

| Q: |

If I am a holder of Oiltanking common units represented by a unit certificate, should I send in my certificates representing Oiltanking common units now? |

| A: |

No. After the merger is completed, Oiltanking unitholders who hold their units in certificated form will receive written instructions for exchanging their certificates representing Oiltanking common units. Please do not

send in your certificates representing Oiltanking common units with your proxy card. If you own Oiltanking common units in “street name,” the merger consideration should be credited by your broker to your account within a few days

following the closing date of the merger. |

3

| Q: |

What constitutes a quorum? |

| A: |

The presence in person or by proxy at the special meeting of the holders of a majority of Oiltanking’s outstanding common units on the record date will constitute a quorum and will permit Oiltanking to conduct the

proposed business at the special meeting. Your units will be counted as present at the special meeting if you: |

| |

• |

|

are present in person at the meeting; or |

| |

• |

|

have submitted a properly executed proxy card or properly submitted your proxy by telephone or Internet. |

Proxies received but marked as abstentions will be counted as units that are present and entitled to vote for purposes of determining the

presence of a quorum. If an executed proxy is returned by a broker or other nominee holding units in “street name” indicating that the broker does not have discretionary authority as to certain units to vote on the proposals (a

“broker non-vote”), such units will be considered present at the meeting for purposes of determining the presence of a quorum but cannot be included in the vote; therefore, broker non-votes have the same effect as a vote against the merger

for purposes of the vote required under the merger agreement and Oiltanking’s partnership agreement.

| Q: |

What is the vote required of Oiltanking unitholders to approve the merger agreement and the merger? |

| A: |

Pursuant to the merger agreement and Oiltanking’s partnership agreement, holders of a majority of the outstanding Oiltanking common units must affirmatively vote in favor of the proposal in order for it to be

approved. Failures to vote, abstentions and broker non-votes will have the same effect as a vote against the merger proposal for purposes of the vote required under the merger agreement and Oiltanking’s partnership agreement. Your vote is

important. |

Pursuant to a support agreement between Oiltanking, Enterprise and EPO executed in connection with the merger

agreement, Enterprise and EPO have agreed to vote any Oiltanking common units owned by them or their subsidiaries in favor of adoption of the merger agreement and the merger, including the 54,799,604 Oiltanking common units currently directly owned

by EPO (representing approximately 66% of the outstanding Oiltanking common units), at any meeting of Oiltanking unitholders, which is sufficient to approve the merger agreement and the merger under the merger agreement and Oiltanking’s

partnership agreement.

| Q: |

When do you expect the merger to be completed? |

| A: |

A number of conditions must be satisfied before Enterprise and Oiltanking can complete the merger, including approval of the merger agreement and the merger by the common unitholders of Oiltanking. Although Enterprise

and Oiltanking cannot be sure when all of the conditions to the merger will be satisfied, Enterprise and Oiltanking expect to complete the merger as soon as practicable following the Oiltanking special meeting (assuming the merger proposal is

approved by the common unitholders). For additional information, please read “The Merger Agreement — Conditions to the Merger.” |

| Q: |

What is the recommendation of the Oiltanking Conflicts Committee and the Oiltanking Board? |

| A: |

The Oiltanking Conflicts Committee and the Oiltanking Board recommend that you vote FOR the merger proposal. |

On November 11, 2014, the Oiltanking Conflicts Committee determined unanimously that the merger agreement and the merger are advisable,

fair and reasonable to and in the best interests of Oiltanking and the Oiltanking unaffiliated unitholders and recommended that the merger, the merger agreement and the transactions contemplated thereby be approved by the Oiltanking Board and the

Oiltanking unitholders.

The Oiltanking Board determined that the merger agreement and merger are fair and reasonable to and in the best

interests of Oiltanking and the Oiltanking common unitholders, approved the merger agreement and the merger and recommended that the Oiltanking unitholders vote in favor of the merger proposal.

4

| Q: |

What are the expected U.S. federal income tax consequences to Oiltanking public unitholders as a result of the transactions contemplated by the merger agreement? |

| A: |

It is anticipated that for U.S. federal income tax purposes no gain or loss should be recognized by Oiltanking public unitholders solely as a result of the merger, other than gain resulting from either (i) any

decrease in an Oiltanking public unitholder’s share of partnership liabilities pursuant to Section 752 of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”) or (ii) any cash received in lieu of any

fractional Enterprise common units. |

Please read “Risk Factors — Tax Risks Related to the Merger” and

“Material U.S. Federal Income Tax Consequences of the Merger — Tax Consequences of the Merger to Oiltanking and the Oiltanking Public Unitholders.”

| Q: |

What are the expected U.S. federal income tax consequences for an Oiltanking public unitholder of the ownership of Enterprise common units after the merger is completed? |

| A: |

Each Oiltanking public unitholder who becomes an Enterprise unitholder as a result of the merger will, as is the case for existing Enterprise common unitholders, be allocated such unitholder’s distributive share of

Enterprise’s income, gains, losses, deductions and credits. In addition to U.S. federal income taxes, such a holder will be subject to other taxes, including state and local income taxes, unincorporated business taxes, and estate, inheritance

or intangibles taxes that may be imposed by the various jurisdictions in which Enterprise conducts business or owns property or in which the unitholder is resident. Please read “U.S. Federal Income Tax Consequences of Ownership of Enterprise

Common Units.” |

| Q: |

Are Oiltanking unitholders entitled to appraisal rights? |

| A: |

No. Oiltanking unitholders do not have appraisal rights under applicable law or contractual appraisal rights under Oiltanking’s partnership agreement or the merger agreement. |

| Q: |

How do I vote my common units if I hold my common units in my own name? |

| A: |

After you have read this proxy statement/prospectus carefully, please respond by completing, signing and dating your proxy card and returning it in the enclosed postage-paid envelope, or by submitting your proxy by

telephone or the Internet as soon as possible in accordance with the instructions provided under “The Special Unitholder Meeting — Voting Procedures — Voting by Oiltanking Unitholders” beginning on page 40. |

| Q: |

If my Oiltanking common units are held in “street name” by my broker or other nominee, will my broker or other nominee vote my common units for me? |

| A: |

No. Your broker cannot vote your Oiltanking common units held in “street name” for or against the merger proposal unless you tell the broker or other nominee how you wish to vote. To tell your broker or other

nominee how to vote, you should follow the directions that your broker or other nominee provides to you. Please note that you may not vote your Oiltanking common units held in “street name” by returning a proxy card directly to Oiltanking

or by voting in person at the special meeting of Oiltanking unitholders unless you provide a “legal proxy,” which you must obtain from your broker or other nominee. If you do not instruct your broker or other nominee on how to vote your

Oiltanking common units, your broker or other nominee may not vote your Oiltanking common units, which will have the same effect as a vote against the merger for purposes of the vote required under the merger agreement and Oiltanking’s

partnership agreement. You should therefore provide your broker or other nominee with instructions as to how to vote your Oiltanking common units. |

| Q: |

What if I do not vote? |

| A: |

If you do not vote in person or by proxy or if you abstain from voting, or a broker non-vote is made, it will have the same effect as a vote against the merger proposal for purposes of the vote required under the merger

agreement and Oiltanking’s partnership agreement. If you sign and return your proxy card but do not indicate how you want to vote, your proxy will be counted as a vote in favor of the merger proposal. |

5

| Q: |

Who can attend and vote at the special meeting of Oiltanking unitholders? |

| A: |

All Oiltanking unitholders of record as of the close of business on January 2, 2015, the record date for the special meeting of Oiltanking unitholders, are entitled to receive notice of and vote at the special meeting

of Oiltanking unitholders. |

| Q: |

When and where is the special meeting? |

| A: |

The special meeting will be held on February 13, 2015, at 8:00 a.m., local time, at 1100 Louisiana Street, 10th Floor, Houston, Texas 77002. |

| Q: |

If I am planning to attend the special meeting in person, should I still vote by proxy? |

| A: |

Yes. Whether or not you plan to attend the special meeting, you should vote by proxy. Your common units will not be voted if you do not vote by proxy and do not vote in person at the special meeting. |

| Q: |

Can I change my vote after I have submitted my proxy? |

| A: |

Yes. If you own your common units in your own name, you may revoke your proxy at any time prior to its exercise by: |

| |

• |

|

giving written notice of revocation to the chief executive officer of Oiltanking GP at or before the special meeting; |

| |

• |

|

appearing and voting in person at the special meeting; or |

| |

• |

|

properly completing and executing a later dated proxy and delivering it to the chief executive officer of Oiltanking GP at or before the special meeting. |

Your presence without voting at the meeting will not automatically revoke your proxy, and any revocation during the meeting will not affect

votes previously taken.

| Q: |

What should I do if I receive more than one set of voting materials for the special meeting of Oiltanking unitholders? |

| A: |

You may receive more than one set of voting materials for the special meeting of Oiltanking unitholders and the materials may include multiple proxy cards or voting instruction cards. For example, you will receive a

separate voting instruction card for each brokerage account in which you hold units. If you are a holder of record registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card

and voting instruction card that you receive according to the instructions on it. |

| Q: |

Whom do I call if I have further questions about voting, the meeting or the merger? |

| A: |

Oiltanking unitholders may call Oiltanking’s Investor Relations department at (713) 381-6500. If you would like additional copies, without charge, of this proxy statement/prospectus or if you have questions

about the merger, including the procedures for voting your units, you should contact American Stock Transfer & Trust Company, LLC, which is assisting Oiltanking as tabulation agent in connection with the merger, at (800) 937-5449.

|

6

SUMMARY

This summary highlights some of the information in this proxy statement/prospectus. It may not contain all of the information that is

important to you. To understand the merger fully and for a more complete description of the terms of the merger, you should read carefully this document, the documents incorporated by reference, and the Annexes to this document, including the full

text of the merger agreement included as Annex A. Please also read “Where You Can Find More Information.”

The Merger Parties’ Businesses (page 90)

Enterprise Products Partners L.P.

Enterprise is a publicly traded Delaware limited partnership, the common units of which are listed on the NYSE under the ticker symbol

“EPD.” Enterprise was formed in April 1998 to own and operate certain natural gas liquids (“NGLs”) related businesses of EPCO. Enterprise is a leading North American provider of midstream energy services to producers and

consumers of natural gas, NGLs, crude oil, petrochemicals and refined products. Enterprise’s midstream energy asset network links producers of natural gas, NGLs and crude oil from some of the largest supply basins in the United States, Canada

and the Gulf of Mexico with domestic consumers and international markets. Enterprise’s assets include approximately: 52,000 miles of onshore and offshore pipelines; 220 million barrels (“MMBbls”) of storage capacity for NGLs,

petrochemicals, refined products and crude oil; 14 billion cubic feet (“Bcf”) of natural gas storage capacity; 24 natural gas processing plants; 22 NGL and propylene fractionators; six offshore hub platforms located in the Gulf of Mexico;

a butane isomerization complex; NGL import and LPG export terminals; and octane enhancement and high-purity isobutylene production facilities.

Enterprise’s midstream energy operations include: natural gas gathering, treating, processing, transportation and storage; NGL

transportation, fractionation, storage, and import and export terminaling; crude oil and refined products transportation, storage and terminaling; offshore production platforms; petrochemical transportation and services; and a marine transportation

business that operates primarily on the United States inland and Intracoastal Waterway systems and in the Gulf of Mexico.

Enterprise is

owned 100% by its limited partners from an economic perspective. Enterprise is managed and controlled by Enterprise GP, which has a non-economic general partner interest in Enterprise. Enterprise GP is a wholly owned subsidiary of Dan Duncan LLC

(“DDLLC”), a private affiliate of EPCO. Enterprise conducts substantially all of its business through its operating company, Enterprise Products Operating LLC (“EPO”).

Enterprise’s principal executive offices are located at 1100 Louisiana Street, 10th Floor, Houston, Texas 77002, and its telephone number

is (713) 381-6500.

Oiltanking Partners, L.P.

Oiltanking is a publicly traded Delaware limited partnership, the common units of which are listed on the NYSE under the ticker symbol

“OILT.” Oiltanking engages in the terminaling, storage and transportation of crude oil, refined petroleum products and liquefied petroleum gas. Through its wholly owned subsidiaries, Oiltanking Houston, L.P., a Texas limited partnership

(“OTH”) and Oiltanking Beaumont Partners, L.P., a Delaware limited partnership (“OTB”), Oiltanking owns and operates storage and terminaling assets located along the United States Gulf Coast on the Houston Ship Channel and in

Beaumont, Texas.

Oiltanking’s principal executive offices are located at 1100 Louisiana Street, 10th Floor, Houston, Texas 77002,

and its telephone number is (713) 381-6500.

7

Relationship of Enterprise and Oiltanking (page 93)

Enterprise and Oiltanking are currently under common control. At October 1, 2014, Oiltanking was owned 98.0% by its limited partners and

2.0% by its general partner, Oiltanking GP. On October 1, 2014, Enterprise acquired, directly or through its wholly owned subsidiaries, Oiltanking’s general partner and approximately 66% of the limited partner interests in Oiltanking, or

54,799,604 units (including 38,899,802 Oiltanking common units issued upon the conversion of subordinated units on November 17, 2014). Oiltanking GP and the 66% of Oiltanking’s common units are currently owned by an indirect wholly owned

subsidiary of Enterprise.

Enterprise is controlled by DDLLC and EPCO. EPCO and DDLLC are each controlled by three voting trustees,

pursuant to the EPCO Inc. Voting Trust Agreement dated April 26, 2006 (the “EPCO Voting Trust Agreement”) and the Dan Duncan LLC Voting Trust Agreement dated April 26, 2006 (the “DDLLC Voting Trust Agreement”),

respectively. The current EPCO voting trustees are Randa Duncan Williams, Ralph S. Cunningham and Richard H. Bachmann. The current DDLLC voting trustees are also Ms. Williams, Dr. Cunningham and Mr. Bachmann.

Neither Oiltanking nor Enterprise has any employees. All of the operating functions and general and administrative support services of

Oiltanking and Enterprise are provided by employees of EPCO pursuant to an administrative services agreement (“ASA”) or by other service providers.

Some of the executive officers of Enterprise GP are directors of Oiltanking GP, including Bryan F. Bulawa, William Ordemann and Michael C.

Smith, and some employees of Enterprise GP are directors or executive officers of Oiltanking GP, including Laurie H. Argo and Robert D. Sanders. For information about the common executive officers and employees of Enterprise GP and Oiltanking GP,

and these executive officers’ relationships with EPCO and its affiliates and the resulting interests of Oiltanking GP directors and officers in the merger, please read “Certain Relationships; Interests of Certain Persons in the

Merger.”

Structure of the Merger and Related Transactions (page 66)

Pursuant to the merger agreement, at the effective time of the merger, a wholly owned subsidiary of Enterprise will merge with and into

Oiltanking, with Oiltanking surviving the merger as an indirect wholly owned subsidiary of Enterprise, and each outstanding common unit of Oiltanking held by Oiltanking public unitholders will be cancelled and converted into the right to receive

1.30 Enterprise common units. This merger consideration represents a 5.6% premium to the closing price of Oiltanking common units based on the closing prices of Oiltanking common units and Enterprise common units on September 30, 2014, the last

trading day before Enterprise announced its initial proposal to acquire all of the Oiltanking common units owned by the public. Relative to the respective closing prices for Enterprise and Oiltanking common units on November 10, 2014, the day

before the parties entered into the merger agreement, the 1.30 exchange ratio represents a 10.4% premium to Oiltanking unitholders.

In

connection with the merger, EPO will not receive any consideration for the continuation of its limited partner interests in Oiltanking, Oiltanking GP will not receive any consideration for the continuation of its general partner interests or

incentive distribution rights in Oiltanking, and Enterprise will be admitted as a limited partner of Oiltanking and be issued a number of Oiltanking common units equal to the number of Oiltanking common units held by Oiltanking public unitholders

prior to the effective time.

If the exchange ratio would result in an Oiltanking public unitholder being entitled to receive a fraction

of an Enterprise common unit, then such Oiltanking public unitholder will receive cash from Enterprise in lieu of such fractional interest in an amount equal to such fractional interest multiplied by the average of the closing price of Enterprise

common units for the ten consecutive NYSE full trading days ending at the close of trading on the last NYSE full trading day immediately preceding the day the merger closes.

8

Once the merger is completed and Oiltanking common units held by Oiltanking public

unitholders are exchanged for Enterprise common units (and cash in lieu of fractional units, if applicable), when distributions are declared by the general partner of Enterprise and paid by Enterprise, former Oiltanking public unitholders will

receive distributions on their Enterprise common units in accordance with Enterprise’s partnership agreement. For a description of the distribution provisions of Enterprise’s partnership agreement, please read “Comparison of the

Rights of Enterprise and Oiltanking Unitholders.”

As of December 31, 2014, there were 1,937,324,817 Enterprise common units and

83,128,494 Oiltanking common units outstanding. Based on the 28,328,890 Oiltanking common units outstanding at such date that are owned by Oiltanking public unitholders and eligible for exchange into Enterprise common units pursuant to the merger

agreement, Enterprise expects to issue approximately 36,827,557 Enterprise common units in connection with the merger.

Based on the

$40.30 closing price of Enterprise common units on November 10, 2014 (the last full trading day before Enterprise and Oiltanking entered into and announced the merger agreement), the exchange ratio of 1.30 Enterprise common units for each

outstanding Oiltanking common unit, and the 28,328,890 Oiltanking common units owned by Oiltanking public unitholders, the value of the merger consideration to be received by such holders was approximately $1.4 billion, or $52.39 for each Oiltanking

common unit.

Support Agreement (page 65)

In connection with the merger agreement, Oiltanking, Enterprise and EPO entered into the support agreement dated as of November 11, 2014.

Pursuant to the support agreement, Enterprise and EPO have agreed to vote any Oiltanking common units owned by them or their subsidiaries in favor of adoption of the merger agreement and the merger at any meeting of Oiltanking unitholders. In

addition, pursuant to the support agreement, EPO granted an irrevocable proxy to a member of the Oiltanking Conflicts Committee to vote such units accordingly. EPO currently owns directly 54,799,604 Oiltanking common units representing approximately

66% of the outstanding Oiltanking common units. The support agreement will terminate upon the completion of the merger, the termination of the merger agreement, the Oiltanking Conflicts Committee making a change in recommendation or the written

agreement of EPO, Enterprise and Oiltanking.

Directors and Officers of Enterprise GP and Oiltanking GP (page 99)

DDLLC, the sole member of Enterprise GP, has the power to appoint and remove all of the directors of Enterprise GP. Enterprise GP has indirect

power to cause the appointment or removal of the directors of Oiltanking GP, an indirect wholly owned subsidiary of Enterprise. DDLLC is controlled by the DDLLC voting trustees under the DDLLC Voting Trust Agreement. Each of the executive officers

of Enterprise GP is currently expected to remain an executive officer of Enterprise GP following the merger. The DDLLC voting trustees have not yet determined whether any directors of Oiltanking GP will serve as directors of Enterprise GP following

the merger. In connection with Enterprise’s acquisition of Oiltanking GP on October 1, 2014, F. Christian Flach, a former Oiltanking GP director, was appointed as a director of Enterprise GP. In the absence of any changes, we expect the

current directors of Enterprise GP to continue as directors following the merger.

The following individuals are currently executive

officers of Enterprise GP, and those persons signified with an asterisk (*) also currently serve as directors of Oiltanking GP.

9

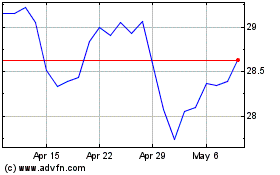

Market Prices of Enterprise Common Units and Oiltanking Common

Units Prior to Announcing the Proposed Merger (page 29)

Enterprise’s common units are traded on the NYSE under the ticker symbol

“EPD.” Oiltanking’s common units are traded on the NYSE under the ticker symbol “OILT.” The following table shows the closing prices of Enterprise common units and Oiltanking common units on September 30, 2014 (the last

full trading day before Enterprise announced its initial proposal to acquire all of the Oiltanking common units owned by the public) and on November 10, 2014 (the last full trading day before Enterprise and Oiltanking entered into and announced

the merger agreement).

|

|

|

|

|

|

|

|

|

| Date/Period |

|

Enterprise

Common Units |

|

|

Oiltanking

Common Units |

|

| September 30, 2014 |

|

$ |

40.30 |

|

|

$ |

49.59 |

|

| November 10, 2014 |

|

$ |

37.73 |

|

|

$ |

44.42 |

|

The Special Unitholder Meeting (page 40)

Where and when: The Oiltanking special unitholder meeting will take place at 1100 Louisiana Street, 10th Floor, Houston, Texas 77002 on

February 13, 2015 at 8:00 a.m., local time.

What you are being asked to vote on: At the Oiltanking meeting, Oiltanking

unitholders will vote on the approval of the merger agreement and the merger. Oiltanking unitholders also may be asked to consider other matters as may properly come before the meeting. At this time, Oiltanking knows of no other matters that will be

presented for the consideration of its unitholders at the meeting.

Who may vote: You may vote at the Oiltanking meeting if

you owned Oiltanking common units at the close of business on the record date, January 2, 2015. On that date, there were 83,128,494 Oiltanking common units outstanding. You may cast one vote for each outstanding Oiltanking common unit that you owned

on the record date.

What vote is needed: Under the merger agreement and Oiltanking’s partnership agreement, holders of

a majority of the outstanding Oiltanking common units must affirmatively vote in favor of the proposal in order for it to be approved. Enterprise and EPO have agreed to vote any Oiltanking common units owned by them or their subsidiaries in favor of

adoption of the merger agreement and the merger at any meeting of Oiltanking unitholders. EPO currently directly owns 54,799,604 Oiltanking common units (representing approximately 66% of the outstanding Oiltanking common units), which is sufficient

to approve the merger agreement and the merger under the merger agreement and Oiltanking’s partnership agreement.

Recommendation to Oiltanking Unitholders (page 51)

The members of the Oiltanking Conflicts Committee considered the benefits of the merger and the related transactions as well as the associated

risks and determined unanimously that the merger agreement and the merger are advisable, fair and reasonable to, and in the best interests of, Oiltanking and the Oiltanking unaffiliated unitholders. The Oiltanking Conflicts Committee also

recommended that the merger agreement and the merger be approved by the Oiltanking Board and the Oiltanking unitholders. The Oiltanking Board has also approved the merger agreement and the merger and recommends that the Oiltanking unitholders vote

to approve the merger agreement and the merger.

10

Oiltanking unitholders are urged to review carefully the background and reasons for the

merger described under “The Merger” and the risks associated with the merger described under “Risk Factors.”

Oiltanking’s Reasons for the Merger (page 51)

The Oiltanking Conflicts Committee considered many factors in making its

determination and recommendation that the merger agreement and the merger are fair and reasonable to and in the best interests of Oiltanking and the Oiltanking unitholders. The Oiltanking Conflicts Committee viewed the following factors, among

others described in greater detail under “The Merger — Recommendation of the Oiltanking Conflicts Committee and the Oiltanking Board and Reasons for the Merger,” as being generally positive or favorable in coming to its determination

and its related recommendations:

| |

• |

|

The exchange ratio of 1.30 Enterprise common units for each Oiltanking common unit in the merger, which represented a premium of: |

| |

• |

|

approximately 5.6% based on the respective closing prices of Enterprise common units and Oiltanking common units on September 30, 2014 (the day before the merger was originally proposed); and |

| |

• |

|

approximately 10.4% based on the respective closing prices of Enterprise common units and Oiltanking common units on November 10, 2014 (the day before the merger agreement was approved and executed).

|

| |

• |

|

The pro forma increase of approximately 74% in quarterly cash distributions expected to be received by Oiltanking unitholders based upon the 1.30 exchange ratio and quarterly cash distribution rates paid by Oiltanking

and Enterprise in November 2014 with respect to the quarter ended September 30, 2014. |

| |

• |

|

In connection with the merger, Oiltanking unitholders will receive common units representing limited partner interests in Enterprise, which have substantially more liquidity than Oiltanking common units because of the

Enterprise common units’ significantly larger average daily trading volume, as well as Enterprise having a broader investor base and a larger public float. |

| |

• |

|

The committee’s belief that the current and prospective growth prospects for Oiltanking if it continues as a stand-alone public entity are more limited following

Enterprise’s acquisition of Oiltanking GP. |

| |

• |

|

The committee’s belief that the merger provides Oiltanking unitholders with an opportunity to benefit from unit price appreciation and increased distributions through ownership of Enterprise common units, which

should benefit from Enterprise’s much larger and more diversified asset and cash flow base and lower dependence on individual capital projects and from Enterprise’s greater ability to compete for future acquisitions and finance organic

growth projects. |

| |

• |

|

The delivery by Jefferies LLC (“Jefferies”) of an opinion to the Oiltanking Conflicts Committee on November 11, 2014 to the effect that, as of that date and based upon and subject to the various

assumptions, considerations, qualifications and limitations set forth in the written opinion, the exchange ratio to be offered to the holders of Oiltanking common units pursuant to the merger agreement was fair, from a financial point of view, to

the Oiltanking unaffiliated unitholders. |

| |

• |

|

The committee’s belief that the merger and the exchange ratio present the best opportunity to maximize value for Oiltanking’s unitholders and is superior to Oiltanking remaining as a standalone public entity.

|

The Oiltanking Conflicts Committee considered the following factors to be generally negative or unfavorable in making its

determination and recommendations:

| |

• |

|

Because the exchange ratio is fixed, the possibility that the Enterprise common unit price could decline relative to the Oiltanking common unit price prior to closing, reducing the value of the securities received by

Oiltanking public unitholders in the merger. |

11

| |

• |

|

The risk that potential benefits sought in the merger might not be fully realized. |

| |

• |

|

The risk that the merger might not be completed in a timely manner, or that the merger might not be consummated as a result of a failure to satisfy the conditions contained in the merger agreement, and that a failure to

complete the merger could negatively affect the trading price of the Oiltanking common units. |

| |

• |

|

The Oiltanking Conflicts Committee was not authorized to, and did not, conduct an auction process or other solicitation of interest from third parties for the acquisition of Oiltanking. Because Enterprise indirectly

controls Oiltanking, it was unrealistic to pursue a third party acquisition proposal or offer for the assets or control of Oiltanking, and it was unlikely that the Oiltanking Conflicts Committee could have conducted a meaningful auction for the

acquisition of the assets or control of Oiltanking. Enterprise, in the merger proposal, previously had asserted that it was interested only in acquiring the Oiltanking common units it did not already own and that it was not interested in disposing

of its controlling interest in Oiltanking to a third party at such time. |

| |

• |

|

Certain members of management of Oiltanking GP and the Oiltanking Board may have interests that are different from those of the Oiltanking unaffiliated unitholders. |

Overall, the Oiltanking Conflicts Committee believed that the advantages of the merger outweighed the negative factors.

Opinion of the Oiltanking Conflicts Committee’s Financial Advisor (page 55)

In connection with the merger, the Oiltanking Conflicts Committee retained Jefferies as its financial advisor. On November 11, 2014,

Jefferies rendered to the Oiltanking Conflicts Committee its oral opinion, subsequently confirmed in writing, that, as of such date and based upon and subject to the various assumptions, considerations, qualifications and limitations set forth in

the written opinion, the exchange ratio to be offered to the holders of Oiltanking common units pursuant to the merger agreement was fair, from a financial point of view, to the Oiltanking unaffiliated unitholders. The full text of the written

opinion of Jefferies, which sets forth, among other things, the assumptions made, procedures followed, matters considered and limitations on the scope of the review undertaken by Jefferies in rendering its opinion, is attached as Annex B to

this proxy statement/prospectus and is incorporated herein by reference in its entirety. The opinion was directed to the Oiltanking Conflicts Committee and addresses only the fairness, from a financial point of view and as of the date of the

opinion, to the Oiltanking unaffiliated unitholders, of the exchange ratio to be offered to the holders of Oiltanking common units pursuant to the merger agreement. The opinion does not address any other aspect of the merger and does not constitute

a recommendation as to how any holder of Oiltanking common units should vote on the merger or any matter relating thereto.

Certain Relationships; Interests of Certain Persons in the Merger (page 93)

Oiltanking has extensive and ongoing relationships with Enterprise and its affiliates. Enterprise represented 12%, 13%, 29% and 30% of

Oiltanking’s revenues during 2011, 2012, 2013 and the nine months ended September 30, 2014, respectively.

Enterprise and EPO,

both of which have agreed to vote in favor of the merger and the merger agreement, currently beneficially own approximately 66% of Oiltanking’s outstanding common units. Other than this 66% ownership, the directors, executive officers and other

affiliates of Enterprise collectively own or control less than 1% of Oiltanking’s outstanding common units.

Certain current

executive officers of Oiltanking GP are current employees of EPCO. A number of EPCO employees who provide services to Oiltanking also provide services to Enterprise, often serving in the same positions. Enterprise GP also has indirect power to cause

the appointment or removal of the directors of

12

Oiltanking GP, an indirect wholly owned subsidiary of Enterprise. Oiltanking has an extensive and ongoing relationship with EPCO, which provides all administrative services to both Enterprise and

its subsidiaries, including Oiltanking and its subsidiaries, pursuant to an administrative services agreement.

Further, Oiltanking

GP’s directors and executive officers have interests in the merger that may be different from, or in addition to, your interests as a unitholder of Oiltanking, including:

| |

• |

|

All of the directors and executive officers of Oiltanking GP will receive continued indemnification for their actions as directors and executive officers. |

| |

• |

|

Certain directors of Oiltanking GP, none of whom is a member of the Oiltanking Conflicts Committee, own Enterprise common units. |

| |

• |

|

Some of Oiltanking GP’s directors, none of whom is a member of the Oiltanking Conflicts Committee, also serve as officers of Enterprise GP, have certain duties to the limited partners of Enterprise and are

compensated, in part, based on the performance of Enterprise. In addition to serving as a director of Oiltanking GP, Mr. Bulawa also serves as the Senior Vice President and Treasurer of Enterprise GP; Mr. Ordemann serves as a Group Senior

Vice President of Enterprise GP; Mr. Sanders serves as Senior Vice President of Asset Optimization of Enterprise GP; and Mr. Smith serves as a Group Senior Vice President of Enterprise GP. |

| |

• |

|

One of Oiltanking GP’s officers also serves as an officer of Enterprise GP, and is compensated, in part, based on the performance of Enterprise. In addition to serving as President and Chief Executive Officer of

Oiltanking GP, Ms. Argo serves as a Senior Vice President of Enterprise GP. |

Each of the executive officers and

directors of Enterprise GP is currently expected to remain an executive officer or director of Enterprise GP following the merger.

The Merger Agreement (page 66)

The merger agreement is attached to this proxy statement/prospectus as Annex A and is

incorporated by reference into this document. You are encouraged to read the merger agreement because it is the legal document that governs the merger.

What Needs to Be Done to Complete the Merger

Enterprise and Oiltanking will complete the merger only if the conditions set forth in the merger agreement are satisfied or, in some cases,

waived. The obligations of Enterprise and Oiltanking to complete the merger are subject to, among other things, the following conditions:

| |

• |

|

the approval of the merger agreement and the merger by the affirmative vote or consent of holders (as of the record date for the Oiltanking special meeting) of a majority of the outstanding Oiltanking common units held

by Oiltanking unitholders; |

| |

• |

|

the making of all required filings and the receipt of all required governmental consents, approvals, permits and authorizations from any applicable governmental authorities prior to the merger effective time, except

where the failure to obtain such consent, approval, permit or authorization would not be reasonably likely to result in a material adverse effect (as defined in the merger agreement) on Oiltanking or Enterprise; |

| |

• |

|

the absence of any order, decree, injunction or law that enjoins, prohibits or makes illegal the consummation of any of the transactions contemplated by the merger agreement, and any action, proceeding or investigation

by any governmental authority seeking to restrain, enjoin, prohibit or delay such consummation; |

13

| |

• |

|

the continued effectiveness of the registration statement of which this proxy statement/prospectus is a part; and |

| |

• |

|

the approval for listing on the NYSE of Enterprise common units to be issued in the merger, subject to official notice of issuance. |

Enterprise’s obligation to complete the merger is further subject to the following conditions:

| |

• |

|

the representations and warranties of each of Oiltanking and Oiltanking GP set forth in the merger agreement being true and correct in all material respects, and Oiltanking and Oiltanking GP having performed all of

their obligations under the merger agreement in all material respects; |

| |

• |

|

Enterprise having received an opinion of Andrews Kurth LLP, counsel to Enterprise (“Andrews Kurth”), as to the treatment of the merger for U.S. federal income tax purposes and as to certain other tax matters;

and |

| |

• |

|

no material adverse effect (as defined in the merger agreement) having occurred with respect to Oiltanking. |

Oiltanking’s obligation to complete the merger is further subject to the following conditions:

| |

• |

|

the representations and warranties of each of Enterprise and Enterprise GP set forth in the merger agreement being true and correct in all material respects, and Enterprise and Enterprise GP having performed all of

their obligations under the merger agreement in all material respects; |

| |

• |

|

Oiltanking having received an opinion of Vinson & Elkins L.L.P., counsel to Oiltanking (“Vinson & Elkins”), as to the treatment of the merger for U.S. federal income tax purposes and as to

certain other tax matters; and |

| |

• |

|

no material adverse effect (as defined under the merger agreement) having occurred with respect to Enterprise. |

Each of Enterprise and Oiltanking (with the consent of the Oiltanking Conflicts Committee and the Oiltanking Board) may choose to complete the

merger even though any condition to its obligation has not been satisfied if the necessary unitholder approval has been obtained and the law allows it to do so.

No Solicitation

Oiltanking GP and Oiltanking have agreed that they will not, and they will use their commercially reasonable best efforts to cause their

representatives not to, directly or indirectly, initiate, solicit, knowingly encourage or knowingly facilitate any inquiries or the making or submission of any proposal that constitutes, or may reasonably be expected to lead to, an acquisition

proposal, or participate in any discussions or negotiations regarding, or furnish to any person any non-public information with respect to, any acquisition proposal, unless the Oiltanking Conflicts Committee, after consultation with its outside

legal counsel and financial advisors, determines in its good faith judgment that such acquisition proposal constitutes or is likely to result in a superior proposal and the failure to do so would be inconsistent with its duties under

Oiltanking’s partnership agreement and applicable law. Please read “The Merger Agreement — Covenants — No Solicitation; Acquisition Proposals; Change in Recommendation” for more information about what constitutes an

acquisition proposal and a superior proposal.

Change in Recommendation

The Oiltanking Conflicts Committee is permitted to withdraw, modify or qualify in any manner adverse to Enterprise its recommendation of the

merger agreement and the merger or publicly approve or recommend, or publicly propose to approve or recommend, any acquisition proposal, referred to in this proxy statement/

14

prospectus as a “change in recommendation,” in certain circumstances. Specifically, if, prior to receipt of Oiltanking unitholder approval, the Oiltanking Conflicts Committee concludes

in its good faith judgment, after consultation with its outside legal counsel and financial advisors, that a failure to change its recommendation would be inconsistent with its duties under Oiltanking’s partnership agreement and applicable law,

the Oiltanking Conflicts Committee may determine to make a change in recommendation.

Termination of the Merger Agreement

Enterprise and Oiltanking can agree to terminate the merger agreement by mutual written consent at any time without completing the

merger, even after the Oiltanking unitholders have approved the merger agreement and the merger. In addition, either party may terminate the merger agreement on its own upon written notice to the other without completing the merger if:

| |

• |

|

the merger is not completed on or before March 31, 2015; |

| |

• |

|

any legal prohibition to completing the merger has become final and non-appealable, provided that the terminating party is not in breach of its covenant to use commercially reasonable best efforts to complete the merger

promptly; or |

| |

• |

|

any condition to the terminating party’s obligation to close the merger cannot be satisfied. |

Enterprise may terminate the merger agreement at any time if (i) Oiltanking determines not to, or otherwise fails to, hold the Oiltanking

special meeting because of a change in recommendation pursuant to the merger agreement, (ii) Oiltanking does not obtain the necessary unitholder approval at the Oiltanking special meeting or (iii) an Oiltanking change in recommendation

occurs.

Oiltanking may terminate the merger agreement if (i) Oiltanking determines not to, or otherwise fails to, hold the

Oiltanking special meeting because of a change in recommendation pursuant to the merger agreement or (ii) Oiltanking does not obtain the necessary unitholder approval at the Oiltanking special meeting.

The Oiltanking Conflicts Committee, on behalf of Oiltanking, may terminate the merger agreement (i) upon written notice to Enterprise, in

the event that an Oiltanking change in recommendation occurs or (ii) at any time prior to the Oiltanking special meeting, if Oiltanking receives an acquisition proposal from a third party, the Oiltanking Conflicts Committee concludes in its

good faith judgment that such acquisition proposal constitutes a superior proposal, the Oiltanking Conflicts Committee has made a change in recommendation pursuant to the merger agreement with respect to such superior proposal, Oiltanking has not

knowingly and intentionally breached the no solicitation covenants contained in the merger agreement, and the Oiltanking Conflicts Committee concurrently approves, and Oiltanking concurrently enters into, a definitive agreement with respect to such

superior proposal.

Material U.S. Federal Income Tax Consequences of the Merger (page 121)

Tax matters associated with the merger are complicated. The U.S. federal income tax consequences of the merger to an Oiltanking public

unitholder will depend on such unitholder’s own situation. The tax discussions in this proxy statement/prospectus focus on the U.S. federal income tax consequences generally applicable to individuals who are residents or citizens of the United

States that hold their Oiltanking common units as capital assets, and these discussions have only limited application to other unitholders, including those subject to special tax treatment. Oiltanking public unitholders are urged to consult their

tax advisors for a full understanding of the U.S. federal, state, local and foreign tax consequences of the merger that will be applicable to them.

Oiltanking expects to receive an opinion from Vinson & Elkins to the effect that no gain or loss should be recognized by the

Oiltanking public unitholders to the extent Enterprise common units are received as a result of the merger, other than gain resulting from either (i) any decrease in partnership liabilities pursuant to Section 752

15

of the Internal Revenue Code, or (ii) any cash received in lieu of any fractional Enterprise common units. Enterprise expects to receive an opinion from Andrews Kurth to the effect that no

gain or loss should be recognized by Enterprise unaffiliated unitholders as a result of the merger (other than gain resulting from any decrease in partnership liabilities pursuant to Section 752 of the Internal Revenue Code). Opinions of

counsel, however, are subject to certain limitations and are not binding on the Internal Revenue Service, or “IRS,” and no assurance can be given that the IRS would not successfully assert a contrary position regarding the merger and the

opinions of counsel.

The U.S. federal income tax consequences described above may not apply to all holders of Enterprise common units and

Oiltanking common units. Please read “Material U.S. Federal Income Tax Consequences of the Merger” beginning on page 121 for a more complete discussion of the U.S. federal income tax consequences of the merger.

Other Information Related to the Merger

No Dissenters’ or Appraisal Rights (page 63)

Oiltanking unitholders do not have dissenters’ or appraisal rights under applicable Delaware law or contractual appraisal rights under

Oiltanking’s partnership agreement or the merger agreement.

Antitrust and Regulatory Matters (page 63)

The merger is subject to both state and federal antitrust laws. Under the rules applicable to partnerships, no filing is required under the

Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the “HSR Act”). However, Enterprise has received an initial inquiry letter relating to its acquisition of Oiltanking GP and existing ownership interests in Oiltanking, and Enterprise or

Oiltanking may receive additional inquiries or requests for information concerning the proposed merger and related transactions from the Federal Trade Commission (“FTC”), the Antitrust Division of the Department of Justice

(“DOJ”), or individual states, or the FTC or DOJ could take such action under the antitrust laws as it deems necessary or desirable in the public interest.

Listing of Common Units to be Issued in the Merger (page 64)

Enterprise expects to obtain approval to list on the NYSE the Enterprise common units to be issued pursuant to the merger agreement, which

approval is a condition to the merger.

Accounting Treatment (page 64)

The proposed merger will be accounted for in accordance with Accounting Standards Codification 810, Consolidations — Overall —

Changes in Parent’s Ownership Interest in a Subsidiary, which is referred to as ASC 810. Changes in Enterprise’s ownership interest in Oiltanking, while Enterprise retains its controlling financial interest in Oiltanking, will be

accounted for as an equity transaction and no gain or loss will be recognized as a result of the proposed merger. The proposed merger represents Enterprise’s acquisition of the noncontrolling interests in Oiltanking.

Comparison of the Rights of Enterprise and Oiltanking Unitholders (page 105)

Oiltanking unitholders will own Enterprise common units following the completion of the merger, and their rights associated with Enterprise

common units will be governed by, in addition to Delaware law, Enterprise’s partnership agreement, which differs in a number of respects from Oiltanking’s partnership agreement.

16

Pending Litigation (page 64)

On November 20, 2014, Matthew Ellis, a purported unitholder of Oiltanking, filed a complaint in the United States District Court of the

Southern District of Texas, Houston Division, as a putative class action on behalf of the unitholders of Oiltanking, captioned Matthew Ellis v. Bryan Bulawa, William Ordemann, Robert D. Sanders, Michael C. Smith, Gregory C. King, D. Mark Leland,

Thomas M. Hart III, Oiltanking Partners, L.P., OTLP GP LLC, Enterprise Products Partners L.P., Enterprise Products Holdings LLC, Enterprise Products Operating LLC and EPOT MergerCo LLC, Civil Action No. 4:14-cv-3343. On December 12, 2014, the

plaintiff filed a motion to dismiss without prejudice and the court issued a notice of dismissal of this case.

On December 23, 2014,

Mathew Ellis and Chaile Steinberg, purported unitholders of Oiltanking, filed a complaint in the Court of Chancery of the State of Delaware, as a putative class action on behalf of the Oiltanking unitholders, captioned Mathew Ellis and Chaile

Steinberg v. OTLP GP, LLC, Oiltanking Holding Americas, Inc., Oiltanking GMBH, Marquard & Bahls AG, Kenneth F. Owen, Christian Flach, Enterprise Products Partners L.P. and Enterprise Products Holdings LLC, Case No. 10495. This new Ellis

complaint alleges, among other things, that Oiltanking GP breached the implied covenant of good faith and fair dealing, that Oiltanking GP has breached the Oiltanking partnership agreement, and that other defendants have aided and abetted Oiltanking