Filed Pursuant to Rule 424(b)(2)

File No. 333-202840

|

|

|

|

|

|

|

Product Supplement No. EQUITY INDICES

LIRN-1

(To Series K Prospectus Supplement dated March 18, 2015

and Prospectus dated March 18, 2015)

May 22,

2017

|

|

|

|

|

Leveraged Index Return Notes

®

“LIRNs

®

” Linked to One or More Equity Indices

|

|

•

|

|

LIRNs are unsecured senior debt securities issued by Wells Fargo & Company (“

Wells Fargo

”). Any payments due on LIRNs, including any repayment of principal, will be subject to the credit risk

of Wells Fargo.

|

|

|

|

•

|

|

LIRNs do not guarantee the return of principal at maturity, and we will not pay interest on LIRNs. Instead, the return on LIRNs will be based on the performance of an underlying “

Market Measure,

” which

will be an equity index or a basket of equity indices.

|

|

|

|

•

|

|

LIRNs provide an opportunity to earn a multiple of the positive performance of the Market Measure, and may provide limited protection against the risk of losses. You will be exposed to any negative performance of the

Market Measure below the Threshold Value (as defined below) on a 1-to-1 basis. If specified in the applicable term sheet, your LIRNs may be “Capped LIRNs.” In the case of Capped LIRNs, the Redemption Amount will not exceed a specified cap

(the “

Capped Value

”).

|

|

|

|

•

|

|

If the value of the Market Measure increases from its Starting Value to its Ending Value (each as defined below), you will receive at maturity a cash payment per unit (the “

Redemption Amount

”) that

equals the principal amount plus a multiple of that increase, and in the case of Capped LIRNs, up to the Capped Value.

|

|

|

|

•

|

|

If the value of the Market Measure does not change or decreases from its Starting Value to its Ending Value but not below the Threshold Value, then the Redemption Amount will equal the principal amount. However, if the

Ending Value is less than the Threshold Value, you will be subject to 1-to-1 downside exposure to the decrease of the Market Measure below the Threshold Value. In such a case, you may lose all or a significant portion of the principal amount of your

LIRNs.

|

|

|

|

•

|

|

This product supplement describes the general terms of LIRNs, the risk factors to consider before investing, the general manner in which they may be offered and sold, and other relevant information.

|

|

|

|

•

|

|

For each offering of LIRNs, we will provide you with a pricing supplement (which we refer to as a “

term sheet

”) that will describe the specific terms of that offering, including the specific Market

Measure, the Capped Value, if applicable, the Threshold Value, and certain risk factors. The term sheet will identify, if applicable, any additions or changes to the terms specified in this product supplement.

|

|

|

|

•

|

|

LIRNs will be issued in denominations of whole units. Unless otherwise set forth in the applicable term sheet, each unit will have a principal amount of $10. The term sheet may also set forth a minimum number of units

that you must purchase.

|

|

|

|

•

|

|

Unless otherwise specified in the applicable term sheet, LIRNs will not be listed on a securities exchange or quotation system.

|

|

|

|

•

|

|

Merrill Lynch, Pierce, Fenner & Smith Incorporated (“

MLPF&S

”) and one or more of its affiliates may act as our agents to offer LIRNs and will act in a principal capacity in such role.

|

|

The LIRNs are not deposits or other obligations of a depository institution and are not insured by the Federal Deposit

Insurance Corporation, the Deposit Insurance Fund or any other governmental agency of the United States or any other jurisdiction.

The LIRNs have complex features and investing in the LIRNs involves risks not associated with an investment in

conventional debt securities. Potential purchasers of LIRNs should consider the information in “Risk Factors” beginning on

page PS-6

of this product supplement. You may lose all or a significant

portion of your investment in LIRNs.

None of the Securities and Exchange Commission (the

“

SEC

”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this product supplement, the prospectus supplement, or

the prospectus. Any representation to the contrary is a criminal offense.

Merrill Lynch & Co.

TABLE OF CONTENTS

LIRNs

®

and “Leveraged Index Return Notes

®

” are registered service marks of Bank of America Corporation, the parent corporation of MLPF&S.

PS-2

SUMMARY

The information in this “Summary” section is qualified in its entirety by the more detailed explanation set forth elsewhere in this

product supplement, the prospectus supplement, and the prospectus, as well as the applicable term sheet. Neither we nor MLPF&S have authorized any other person to provide you with any information different from the information set forth in these

documents. If anyone provides you with different or inconsistent information about the LIRNs, you should not rely on it.

Key Terms:

|

|

|

|

|

|

|

General:

|

|

LIRNs are senior debt securities issued by Wells Fargo, and are not guaranteed or insured by the FDIC or secured by collateral. They rank equally with all of our other

unsecured senior debt from time to time outstanding.

Any payments due on LIRNs, including any repayment of principal, are subject to our credit risk.

|

|

|

|

The return on LIRNs will be based on the performance of a

Market Measure and there is no guaranteed return of principal at maturity. Therefore, you may lose all or a significant portion of your investment if the value of the Market Measure decreases from the Starting Value to an Ending Value that is less

than the Threshold Value.

|

|

|

|

Each issue of LIRNs will mature on the date set forth in

the applicable term sheet. We cannot redeem LIRNs at any earlier date. We will not make any payments on LIRNs until maturity, and you will not receive any interest payments.

|

|

|

|

|

Market

Measure:

|

|

The Market Measure may consist of one or more of the following:

|

|

|

•

|

|

U.S. broad-based equity indices;

|

|

|

•

|

|

U.S. sector or style-based equity indices;

|

|

|

•

|

|

non-U.S. or global equity indices; or

|

|

|

•

|

|

any combination of the above.

|

|

|

|

The Market Measure may consist of a group, or

“

Basket

,” of the foregoing. We refer to each equity index included in any Basket as a “

Basket Component

.” If the Market Measure to which your LIRNs are linked is a Basket, the Basket Components will be set forth in

the applicable term sheet.

|

|

|

|

|

Market

Measure

Performance:

|

|

The performance of the Market Measure will be measured according to the percentage change of the Market Measure from its

Starting Value to its Ending Value.

|

|

|

Unless otherwise specified in the applicable term sheet:

|

|

|

The “

Starting Value

” will equal the closing level of the Market Measure on the date when the LIRNs are priced for initial sale to the public (the

“

pricing date

”).

|

|

|

|

If the Market Measure consists of a Basket, the Starting

Value will be equal to 100. See “Description of LIRNs—Basket Market Measures.”

|

|

|

|

The “

Threshold Value

” will be a value of

the Market Measure that equals a specified percentage (100% or less) of the Starting Value. The Threshold Value will be determined on the pricing date and set forth in the term sheet. If the Threshold Value is equal to 100% of the Starting Value,

you will be exposed to any decrease in the value of the Market Measure from the Starting Value to the Ending Value on a

1-to-1

basis, and you may lose all of your

investment in LIRNs.

|

|

|

|

The “

Ending Value

” will equal the average

of the closing levels of the Market Measure

|

PS-3

|

|

|

|

|

|

|

|

|

on each calculation day during the Maturity Valuation Period (each as defined below).

|

|

|

|

|

|

|

If a Market Disruption Event (as defined below) occurs and is continuing on a calculation day, or if certain other events occur, the calculation agent will determine the

Ending Value as set forth in the section “Description of LIRNs—The Starting Value and the Ending Value—Ending Value.”

|

|

|

|

|

|

|

If the Market Measure consists of a Basket, the Ending Value will be determined as described in “Description of LIRNs—Basket Market Measures—Ending Value of

the Basket.”

|

|

|

|

|

Participation

Rate:

|

|

The rate at which investors participate in any increase in the value of the Market Measure, as calculated below. The Participation Rate will be equal to or greater than 100%,

and will be set forth in the applicable term sheet. If the Participation Rate is 100%, your participation in any upside performance of the Market Measure will not be leveraged.

|

|

|

|

|

Capped Value:

|

|

For Capped LIRNs, the maximum Redemption Amount. Any positive return on the Capped LIRNs is limited to the amount represented by the Capped Value specified in the applicable

term sheet. We will determine the applicable Capped Value on the pricing date of each issue of Capped LIRNs.

|

|

|

|

|

Redemption

Amount at

Maturity:

|

|

At maturity, you will receive a Redemption Amount that is greater than the principal amount if the value of the Market Measure increases from the Starting Value to the Ending

Value. In the case of Capped LIRNs, the Redemption Amount will not exceed the Capped Value. If the value of the Market Measure does not change or decreases from the Starting Value to the Ending Value but not below the Threshold Value, then the

Redemption Amount will equal the principal amount. If the Ending Value is less than the Threshold Value, you will be subject to 1-to-1 downside exposure to the decrease of the Market Measure below the Threshold Value, and will receive a Redemption

Amount that is less than the principal amount.

|

|

|

|

|

|

|

Any payments due on the LIRNs, including repayment of principal, are subject to our credit risk as issuer of LIRNs.

|

|

|

|

|

|

|

The Redemption Amount, denominated in U.S. dollars, will be calculated as follows:

|

|

|

|

|

PS-4

|

|

|

|

|

|

|

|

|

|

Principal at

Risk:

|

|

You may lose all or a significant portion of the principal amount of the LIRNs. Further, if you sell your LIRNs prior to maturity, you may find that the market value per LIRN

is less than the price that you paid for the LIRNs.

|

|

|

|

|

Calculation

Agents:

|

|

The calculation agents will make all determinations associated with the LIRNs. Unless otherwise set forth in the applicable term sheet, we or one of our affiliates may act as

the calculation agent, or we may appoint MLPF&S or one of its affiliates to act as calculation agent for the LIRNs. Alternatively, we (or one of our affiliates) and MLPF&S (or one of its affiliates) may act as joint calculation agents for

LIRNs. See the section entitled “Description of LIRNs—Role of the Calculation Agent.”

|

|

|

|

|

Agents:

|

|

MLPF&S and one or more of its affiliates will act as our agents in connection with each offering of LIRNs and will receive an underwriting discount based on the number of

units of LIRNs sold. None of the agents is your fiduciary or adviser solely as a result of the making of any offering of LIRNs, and you should not rely upon this product supplement, the term sheet, or the accompanying prospectus or prospectus

supplement as investment advice or a recommendation to purchase LIRNs.

|

|

|

|

|

Listing:

|

|

Unless otherwise specified in the applicable term sheet, the LIRNs will not be listed on a securities exchange or quotation system.

|

This product supplement relates only to LIRNs and does not relate to any equity index that comprises the

Market Measure described in any term sheet. You should read carefully the entire prospectus, prospectus supplement, and product supplement, together with the applicable term sheet, to understand fully the terms of your LIRNs, as well as the tax and

other considerations important to you in making a decision about whether to invest in any LIRNs. In particular, you should review carefully the section in this product supplement entitled “Risk Factors,” which highlights a number of risks

of an investment in LIRNs, to determine whether an investment in LIRNs is appropriate for you. If information in this product supplement is inconsistent with the prospectus or prospectus supplement, this product supplement will supersede those

documents. However, if information in any term sheet is inconsistent with this product supplement, that term sheet will supersede this product supplement.

Neither we nor any agent is making an offer to sell LIRNs in any jurisdiction where the offer or sale is not permitted. This product

supplement and the accompanying prospectus supplement and prospectus are not an offer to sell these LIRNs to anyone, and are not soliciting an offer to buy these LIRNs from anyone, in any jurisdiction where the offer or sale is not permitted.

Certain capitalized terms used and not defined in this product supplement have the meanings ascribed to them in the prospectus supplement

and prospectus. Unless otherwise indicated or unless the context requires otherwise, all references in this product supplement to “we,” “us,” “our,” or similar references are to Wells Fargo.

You are urged to consult with your own attorneys and business and tax advisers before making a decision to purchase any LIRNs.

PS-5

RISK FACTORS

Your investment in LIRNs is subject to investment risks, many of which differ from those of a conventional debt security. Your decision

to purchase LIRNs should be made only after carefully considering the risks, including those discussed below, together with the risk information in the applicable term sheet, in light of your particular circumstances. LIRNs are not an appropriate

investment for you if you are not knowledgeable about the material terms of LIRNs or investments in equity or equity-based securities in general.

General Risks Relating to LIRNs

Your investment may result in a loss; there is no guaranteed return of principal.

There is no fixed principal repayment amount on

LIRNs at maturity. The return on LIRNs will be based on the performance of a Market Measure. If the Ending Value is less than the Threshold Value, then you will receive a Redemption Amount at maturity that will be less than, and possibly

significantly less than, the principal amount of your LIRNs. If the Threshold Value is equal to 100% of the Starting Value, the Redemption Amount could be zero.

Your return on the LIRNs may be less than the yield on a conventional fixed or floating rate debt security of comparable maturity.

There will be no periodic interest payments on LIRNs as there would be on a conventional fixed-rate or floating-rate debt security having the same maturity. Any return that you receive on LIRNs may be less than the return you would earn if you

purchased a conventional debt security with the same maturity date. As a result, your investment in LIRNs may not reflect the full opportunity cost to you when you consider factors, such as inflation, that affect the time value of money.

Any positive return on your investment is limited to the return represented by the Capped Value, if applicable, and may be less than a

comparable investment directly in the Market Measure.

The appreciation potential of Capped LIRNs is limited to the Capped Value. You will not receive a Redemption Amount greater than the Capped Value, regardless of the appreciation of the Market

Measure. In contrast, a direct investment in the Market Measure (or the securities included in the Market Measure) would allow you to receive the full benefit of any appreciation in the value of the Market Measure (or those underlying securities).

In addition, unless otherwise set forth in the applicable term sheet, the Ending Value will not reflect the value of dividends paid, or

distributions made, on the securities included in the Market Measure or any other rights associated with those securities. Thus, any return on the LIRNs will not reflect the return you would realize if you actually owned the securities underlying

the Market Measure.

Additionally, the Market Measure may consist of one or more equity indices that include components traded in a

non-U.S. currency. If the value of that currency strengthens against the U.S. dollar during the term of your LIRNs, you may not obtain the benefit of that increase, which you would have received if you had owned the securities included in the index

or indices.

The LIRNs are subject to our credit risk.

The LIRNs are our obligations and are not, either directly or indirectly,

an obligation of any third party. Any amounts payable under the LIRNs are subject to our creditworthiness, and you will have no ability to pursue the issuers of any securities represented by the Market Measure for payment. As a result, our actual

and perceived creditworthiness may affect the value of the LIRNs and, in the event we were to default on our obligations, you may not receive any amounts owed to you under the terms of the LIRNs.

PS-6

The estimated value of the LIRNs will be determined by our affiliate’s pricing models,

which may differ from those of MLPF&S or other dealers.

The estimated value of the LIRNs will be set forth in the applicable

term sheet and will be determined for us by our affiliate, Wells Fargo Securities, LLC (“

WFS

”), using its proprietary pricing models and related market inputs and assumptions. Based on these pricing models and related market inputs

and assumptions, WFS will determine an estimated value for the LIRNs by estimating the value of the combination of hypothetical financial instruments that would replicate the payout on the LIRNs, which combination will consist of a non-interest

bearing, fixed-income bond (the “

debt component

”) and one or more derivative instruments underlying the economic terms of the LIRNs (the “

derivative component

”).

The estimated value of the debt component will be based on a reference interest rate, determined by WFS as of a date near the time of

calculation, that will generally track our secondary market rates. The reference interest rate to be used in the calculation of the estimated value of the debt component may be higher or lower than our secondary market rates at the time of that

calculation. Because the reference interest rate is generally higher than the assumed funding rate that is used to determine the economic terms of the LIRNs, using the reference interest rate to value the debt component will generally result in a

lower estimated value of the LIRNs than if we had used the assumed funding rate. WFS will calculate the estimated value of the derivative component based on a proprietary derivative-pricing model, which will generate a theoretical price for the

derivative instruments that constitute the derivative component based on various inputs including, but not limited to, market measure performance; interest rates; volatility of the market measure; correlation among basket components (if applicable);

time remaining to maturity; dividend yields on the securities included in or held by the market measure; currency exchange rates (if applicable); volatility of currency exchange rates (if applicable); and correlation between currency exchange rates

and the market measure (if applicable). These inputs may be market-observable or may be based on assumptions made by WFS in its discretion.

The estimated value of the LIRNs will not be an independent third-party valuation and certain inputs to these models may be determined by

WFS in its discretion. WFS’s views on these inputs may differ from those of MLPF&S and other dealers, and WFS’s estimated value of the LIRNs may be higher, and perhaps materially higher, than the estimated value of the LIRNs that would

be determined by MLPF&S or other dealers in the market. WFS’s models and its inputs and related assumptions may prove to be wrong and therefore not an accurate reflection of the value of the LIRNs.

The estimated value of the LIRNs on the pricing date, based on WFS’s proprietary pricing models, will be less than the public

offering price.

The public offering price of the LIRNs will include certain costs that are borne by you. Because of these costs, the estimated value of the LIRNs on the pricing date will be less than the public offering price. The costs included

in the public offering price will relate to selling, structuring, hedging and issuing the LIRNs, as well as to our funding considerations for debt of this type. The costs related to selling, structuring, hedging and issuing the LIRNs will include

the underwriting discount, the projected profit that our hedge counterparty (which may be MLPF&S or one of its affiliates) will expect to realize for assuming risks inherent in hedging our obligations under the LIRNs and hedging and other costs

relating to the offering of the LIRNs. Our funding considerations will be reflected in the fact that we will determine the economic terms of the LIRNs based on an assumed funding rate that will generally be lower than our secondary market rates. If

the costs relating to selling, structuring, hedging and issuing the LIRNs were lower, or if the assumed funding rate we will use to determine the economic terms of the securities were higher, the economic terms of the LIRNs would be more favorable

to you and the estimated value would be higher.

PS-7

The public offering price you pay for the LIRNs will exceed the initial estimated value.

If you attempt to sell the LIRNs prior to maturity, their market value may be lower than the price you paid for them and lower than the initial estimated value. This is due to, among other things, the assumed funding rate used to determine the

economic terms of the notes, and the inclusion in the public offering price of the underwriting discount and the estimated cost of hedging our obligations under the notes (which includes a hedging related charge as described in the applicable term

sheet). These factors, together with customary bid ask spreads, other transaction costs and various credit, market and economic factors over the term of the LIRNs, including changes in the level of the Market Measure, are expected to reduce the

price at which you may be able to sell the LIRNs in any secondary market and will affect the value of the LIRNs in complex and unpredictable ways.

The initial estimated value does not represent the price at which we, MLPF&S or any of our respective affiliates would be willing to

purchase your LIRNs in any secondary market (if any exists) at any time. The value of your LIRNs at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Market Measure, our

creditworthiness and changes in market conditions. MLPF&S has advised us that any repurchases by them or their affiliates are expected to be made at prices determined by reference to their pricing models and at their discretion, and these prices

will include MLPF&S’s trading commissions and mark-ups. If you sell your LIRNs to a dealer other than MLPF&S in a secondary market transaction, the dealer may impose its own discount or commission.

We cannot assure you that there will be a trading market for your LIRNs.

If a secondary market exists, we cannot predict how the

LIRNs will trade, or whether that market will be liquid or illiquid. The development of a trading market for LIRNs will depend on various factors, including our financial performance and changes in the value of the Market Measure. The number of

potential buyers of your LIRNs in any secondary market may be limited. There is no assurance that any party will be willing to purchase your LIRNs at any price in any secondary market.

We anticipate that one or more of the agents will act as a market-maker for LIRNs, but none of them is required to do so and may cease to do

so at any time. Any price at which an agent may bid for, offer, purchase, or sell any LIRNs may be higher or lower than the applicable public offering price, and that price may differ from the values determined by pricing models that it may use,

whether as a result of dealer discounts, mark-ups, or other transaction costs. These bids, offers, or transactions may affect the prices, if any, at which the LIRNs might otherwise trade in the market. In addition, if at any time any agent were to

cease acting as a market-maker for any issue of LIRNs, it is likely that there would be significantly less liquidity in that secondary market. In such a case, the price at which those LIRNs could be sold likely would be lower than if an active

market existed.

Unless otherwise stated in the term sheet, we will not list LIRNs on any securities exchange. Even if an application

were made to list your LIRNs, we cannot assure you that the application will be approved or that your LIRNs will be listed and, if listed, that they will remain listed for their entire term. The listing of LIRNs on any securities exchange will not

necessarily ensure that a trading market will develop, and if a trading market does develop, that there will be liquidity in the trading market.

The Redemption Amount will not reflect changes in the value of the Market Measure that occur other than during the Maturity Valuation

Period.

Changes in the value of the Market Measure during the term of LIRNs other than during the Maturity Valuation Period will not be reflected in the calculation of the Redemption Amount. To calculate the Redemption Amount, the calculation

agent will compare only the Ending Value to the Starting Value or the Threshold Value, as applicable. No other values of the Market Measure will be taken into account. As a result, even if the value of the Market Measure has

PS-8

increased at certain times during the term of the LIRNs, you will receive a Redemption Amount that is less than the principal amount if the Ending Value is less than the Threshold Value.

If your LIRNs are linked to a Basket, changes in the levels of one or more of the Basket Components may be offset by changes in the

levels of one or more of the other Basket Components.

The Market Measure of your LIRNs may be a Basket. In such a case, changes in the levels of one or more of the Basket Components may not correlate with changes in the levels of one or more of

the other Basket Components. The levels of one or more Basket Components may increase, while the levels of one or more of the other Basket Components may decrease or not increase as much. Therefore, in calculating the value of the Market Measure at

any time, increases in the level of one Basket Component may be moderated or wholly offset by decreases or lesser increases in the levels of one or more of the other Basket Components. If the weightings of the applicable Basket Components are not

equal, adverse changes in the levels of the Basket Components which are more heavily weighted could have a greater impact upon your LIRNs.

The respective publishers of the applicable indices may adjust those indices in a way that affects their levels, and these publishers

have no obligation to consider your interests.

Unless otherwise specified in the term sheet, we have no affiliation with any publisher of an index to which your LIRNs are linked (each, an “

Index Publisher

”). Consequently, we

have no control of the actions of any Index Publisher. The Index Publisher can add, delete, or substitute the components included in that index or make other methodological changes that could change its level. A new security included in an index may

perform significantly better or worse than the replaced security, and the performance will impact the level of the applicable index. Additionally, an Index Publisher may alter, discontinue, or suspend calculation or dissemination of an index. Any of

these actions could adversely affect the value of your LIRNs. The Index Publishers will have no obligation to consider your interests in calculating or revising any index.

Exchange rate movements may impact the value of LIRNs.

If any security included in a Market Measure is traded in a currency other

than U.S. dollars and, for purposes of the applicable index, is converted into U.S. dollars, then the value of the Market Measure may depend in part on the relevant exchange rates. If the value of the U.S. dollar strengthens against the currencies

of that index, the level of the applicable index may be adversely affected and the Redemption Amount may be reduced. Exchange rate movements may be particularly impacted by existing and expected rates of inflation and interest rate levels;

political, civil or military unrest; the balance of payments between countries; and the extent of governmental surpluses or deficits in the countries relevant to the applicable index and the United States. All of these factors are in turn sensitive

to the monetary, fiscal, and trade policies pursued by the governments of those countries and the United States and other countries important to international trade and finance.

If you attempt to sell LIRNs prior to maturity, their market value, if any, will be affected by various factors that interrelate in

complex ways, and their market value may be less than the principal amount.

The limited protection against the risk of losses provided by the Threshold Value, if any, will only apply if you hold LIRNs to maturity. You have no right to have your

LIRNs redeemed prior to maturity. If you wish to liquidate your investment in LIRNs prior to maturity, your only option would be to sell them. At that time, there may be an illiquid market for your LIRNs or no market at all. Even if you were able to

sell your LIRNs, there are many factors outside of our control that may affect their market value, some of which, but not all, are stated below. The impact of any one factor may be offset or magnified by the effect of another factor. The following

paragraphs describe a specific factor’s expected impact on the market value of LIRNs,

assuming all other conditions remain constant

.

|

|

•

|

|

Value of the Market Measure.

We anticipate that the market value of LIRNs prior to

|

PS-9

|

|

maturity generally will depend to a significant extent on the value of the Market Measure. In general, it is expected that the market value of LIRNs will decrease as the value of the Market

Measure decreases, and increase as the value of the Market Measure increases. However, as the value of the Market Measure increases or decreases, the market value of LIRNs is not expected to increase or decrease at the same rate. If you sell your

LIRNs when the value of the Market Measure is less than, or not sufficiently above the applicable Starting Value, then you may receive less than the principal amount of your LIRNs.

|

In addition, because the Redemption Amount for Capped LIRNs will not exceed the applicable Capped Value, we do not expect that Capped LIRNs

will trade in any secondary market at a price that is greater than the Capped Value.

|

|

•

|

|

Volatility of the Market Measure.

Volatility is the term used to describe the size and frequency of market fluctuations. Increases or decreases in the volatility of the Market Measure may have an adverse impact

on the market value of LIRNs. Even if the value of the Market Measure increases after the applicable pricing date, if you are able to sell your LIRNs before their maturity date, you may receive substantially less than the amount that would be

payable at maturity based on that value because of the anticipation that the value of the Market Measure will continue to fluctuate until the Ending Value is determined.

|

|

|

•

|

|

Economic and Other Conditions Generally.

The general economic conditions of the capital markets in the United States, as well as geopolitical conditions and other financial, political, regulatory, and judicial

events and related uncertainties that affect stock markets generally, may affect the value of the Market Measure and the market value of LIRNs. If the Market Measure includes one or more indices that have returns that are calculated based upon

securities prices in one or more non-U.S. markets (a “

non-U.S. Market Measure

”), the value of your LIRNs may also be affected by similar events in the markets of the relevant foreign countries.

|

|

|

•

|

|

Interest Rates.

We expect that changes in interest rates will affect the market value of LIRNs. In general, if U.S. interest rates increase, we expect that the market value of LIRNs will decrease, and conversely,

if U.S. interest rates decrease, we expect that the market value of LIRNs will increase. In general, we expect that the longer the amount of time that remains until maturity, the more significant the impact of these changes will be on the value of

the LIRNs. In the case of non-U.S. Market Measures, the level of interest rates in the relevant foreign countries may also affect their economies and in turn the value of the non-U.S. Market Measure, and, thus, the market value of the LIRNs may be

adversely affected.

|

|

|

•

|

|

Dividend Yields.

In general, if cumulative dividend yields on the securities included in the Market Measure increase, we anticipate that the market value of LIRNs will decrease; conversely, if those dividend

yields decrease, we anticipate that the market value of your LIRNs will increase.

|

|

|

•

|

|

Exchange Rate Movements and Volatility.

If the Market Measure of your LIRNs includes any non-U.S. Market Measures, changes in, and the volatility of, the exchange rates between the U.S. dollar and the relevant

non-U.S. currency or currencies could have a negative impact on the value of your LIRNs, and the Redemption Amount may depend in part on the relevant exchange rates. In addition, the correlation between the relevant exchange rate and any applicable

non-U.S. Market Measure reflects the extent to which a percentage change in that exchange rate corresponds to a percentage change in the applicable non-U.S. Market Measure, and changes in these correlations may have a negative impact on the value of

your LIRNs.

|

PS-10

|

|

•

|

|

Our Creditworthiness.

Our actual and perceived creditworthiness may affect the value of the LIRNs.

|

|

|

•

|

|

Time to Maturity.

There may be a disparity between the market value of the LIRNs prior to maturity and their value at maturity. This disparity is often called a time “value,” “premium,” or

“discount,” and reflects expectations concerning the value of the Market Measure prior to the maturity date. As the time to maturity decreases, this disparity may decrease, such that the value of the LIRNs will approach the expected

Redemption Amount to be paid at maturity.

|

Trading and hedging activities by us, the agents, and our respective

affiliates may affect your return on the LIRNs and their market value.

We, the agents, and our respective affiliates may buy or sell the securities included in the Market Measure, or futures or options contracts on the Market Measure or its

component securities, or other listed or over the counter derivative instruments linked to the Market Measure or its component securities. We, the agents and our respective affiliates may execute such purchases or sales for our own or their own

accounts, for business reasons, or in connection with hedging our obligations under LIRNs. These transactions could affect the value of these securities and, in turn, the value of a Market Measure in a manner that could be adverse to your investment

in LIRNs. On or before the applicable pricing date, any purchases or sales by us, the agents, and our respective affiliates, or others on our or their behalf (including for the purpose of hedging anticipated exposure) may increase the value of a

Market Measure or its component securities. Consequently, the values of that Market Measure or the securities included in that Market Measure may decrease subsequent to the pricing date of an issue of LIRNs, adversely affecting the market value of

LIRNs.

We, the agents, or one or more of our respective affiliates may also engage in hedging activities that could increase the value

of the Market Measure on the applicable pricing date. In addition, these activities, including the unwinding of a hedge, may decrease the market value of your LIRNs prior to maturity, including during the Maturity Valuation Period, and may affect

the Redemption Amount. The agents, or one or more of their respective affiliates may purchase or otherwise acquire a long or short position in LIRNs, and may hold or resell LIRNs. For example, the agents may enter into these transactions in

connection with any market making activities in which they engage. We cannot assure you that these activities will not adversely affect the value of the Market Measure or the market value of your LIRNs prior to maturity or the Redemption Amount.

Our trading, hedging and other business activities, and those of the agents, may create conflicts of interest with you.

We, the

agents, or one or more of our respective affiliates may engage in trading activities related to the Market Measure and to securities included in the Market Measure that are not for your account or on your behalf. We, the agents, or one or more of

our respective affiliates also may issue or underwrite other financial instruments with returns based upon the applicable Market Measure. These trading and other business activities may present a conflict of interest between your interest in LIRNs

and the interests we, the agents and our respective affiliates may have in our proprietary accounts, in facilitating transactions, including block trades, for our or their other customers, and in accounts under our or their management. These trading

and other business activities, if they influence the value of the Market Measure or secondary trading in your LIRNs, could be adverse to your interests as a beneficial owner of LIRNs.

We, the agents, and our respective affiliates expect to enter into arrangements or adjust or close out existing transactions to hedge our

obligations under the LIRNs. We, the agents, or our respective affiliates also may enter into hedging transactions relating to other notes or instruments that we or they issue, some of which may have returns calculated in a manner related to that of

a particular issue of LIRNs. We may enter into such hedging

PS-11

arrangements with one or more of our subsidiaries or affiliates, or with one or more of the agents or their affiliates. Such a party may enter into additional hedging transactions with other

parties relating to LIRNs and the applicable Market Measure. This hedging activity is expected to result in a profit to those engaging in the hedging activity, which could be more or less than initially expected, or the hedging activity could also

result in a loss. We, the agents, and our respective affiliates will price these hedging transactions with the intent to realize a profit, regardless of whether the value of LIRNs increases or decreases. Any profit in connection with such hedging

activities will be in addition to any other compensation that we, the agents, and our respective affiliates receive for the sale of LIRNs, which creates an additional incentive to sell the LIRNs to you.

There may be potential conflicts of interest involving the calculation agent. We may appoint and remove the calculation agent.

We or

one of our affiliates may be the calculation agent or act as joint calculation agent for LIRNs and, as such, will determine the Starting Value, the Threshold Value, the Ending Value, and the Redemption Amount. Under some circumstances, these duties

could result in a conflict of interest between our status as issuer and our responsibilities as calculation agent. These conflicts could occur, for instance, in connection with the calculation agent’s determination as to whether a Market

Disruption Event has occurred, or in connection with judgments that the calculation agent would be required to make if the publication of an index is discontinued. See the sections entitled “Description of LIRNs—Market Disruption

Events,” “—Adjustments to an Index,” and “—Discontinuance of an Index.” The calculation agent will be required to carry out its duties in good faith and using its reasonable judgment. However, because we or one of

our affiliates may serve as the calculation agent, potential conflicts of interest could arise. In addition, we may appoint MLPF&S or one of its affiliates to act as the calculation agent or as joint calculation agent for LIRNs. As the

calculation agent or joint calculation agent, MLPF&S or one of its affiliates will have discretion in making various determinations that affect your LIRNs. The exercise of this discretion by the calculation agent could adversely affect the value

of your LIRNs and may present the calculation agent with a conflict of interest of the kind described under “—Trading and hedging activities by us, the agents, and our respective affiliates may affect your return on the LIRNs and their

market value” and “—Our trading, hedging and other business activities, and those of the agents, may create conflicts of interest with you” above.

The U.S. federal tax consequences of an investment in the LIRNs are unclear.

There is no direct legal authority regarding the proper

U.S. federal tax treatment of the LIRNs, and we do not plan to request a ruling from the Internal Revenue Service (the “

IRS

”). Consequently, significant aspects of the tax treatment of the LIRNs are uncertain, and the IRS or a court

might not agree with the treatment of the LIRNs as prepaid derivative contracts that are “open transactions” for U.S. federal income tax purposes. If the IRS were successful in asserting an alternative treatment of the LIRNs, the tax

consequences of ownership and disposition of the LIRNs might be materially and adversely affected. Even if the treatment of LIRNs as prepaid derivative contracts that are “open transactions” is respected, a LIRN that is linked to a Market

Measure that includes underlying equity interests in certain types of entities (including exchange-traded funds, real estate investment trusts and partnerships) may be subject to adverse treatment under the “constructive ownership” rules.

Section 871(m) of the Internal Revenue Code of 1986, as amended (the “

Code

”), imposes a withholding tax of up to

30% on “dividend equivalents” paid or deemed paid to non-U.S. investors with respect to certain financial instruments linked to U.S. equities. This withholding regime generally applies to financial instruments that substantially

replicate the economic performance of one or more underlying U.S. equities, as determined based on tests set forth in the applicable regulations. The Section 871(m) regime requires complex calculations to be made with respect to financial

instruments linked to U.S. equities, and its application to a specific issue of LIRNs may be uncertain. Accordingly, even if we determine that certain LIRNs are not subject to Section 871(m), the IRS could challenge our determination and

assert that

PS-12

withholding is required in respect of those LIRNs. Moreover, the application of Section 871(m) to a LIRN may be affected if a non-U.S. investor enters into other transactions relating

to an underlier. Non-U.S. investors should consult their tax advisers regarding the application of Section 871(m) in their particular circumstances. If withholding applies to the LIRNs, neither we nor our agents (including MLPF&S) will

be required to pay any additional amounts with respect to amounts withheld.

In addition, in 2007, the U.S. Treasury Department and the

IRS released a notice requesting comments on various issues regarding the U.S. federal income tax treatment of “prepaid forward contracts” and similar instruments. Any Treasury regulations or other guidance promulgated after consideration

of these issues could materially and adversely affect the tax consequences of an investment in the LIRNs, including the character and timing of income or loss and the degree, if any, to which income realized by non-U.S. persons should be subject to

withholding tax, possibly with retroactive effect; and whether these instruments are or should be subject to the “constructive ownership” regime as described below. Both U.S. and non-U.S. persons should read carefully the section of this

product supplement entitled “United States Federal Tax Considerations” and consult their tax advisers regarding the U.S. federal tax consequences of an investment in the LIRNs, as well as tax consequences arising under the laws of any

state, local or non-U.S. taxing jurisdiction.

Risks Relating to the Market Measures

You must rely on your own evaluation of the merits of an investment linked to the applicable Market Measure.

In the ordinary course

of business, we, the agents, and our respective affiliates may have expressed views on expected movements in a Market Measure or the securities included in the Market Measure, and may do so in the future. These views or reports may be communicated

to our clients and clients of these entities. However, these views are subject to change from time to time. Moreover, other professionals who deal in markets relating to a Market Measure may at any time have significantly different views from our

views and the views of these entities. For these reasons, you are encouraged to derive information concerning a Market Measure and its component securities from multiple sources, and you should not rely on our views or the views expressed by these

entities.

You will have no rights as a security holder, you will have no rights to receive any of the securities represented by the

Market Measure, and you will not be entitled to dividends or other distributions by the issuers of these securities.

LIRNs are our debt securities. They are not equity instruments, shares of stock, or securities of any other issuer. Investing in

LIRNs will not make you a holder of any of the securities represented by the Market Measure. You will not have any voting rights, any rights to receive dividends or other distributions, or any other rights with respect to those securities. As a

result, the return on your LIRNs may not reflect the return you would realize if you actually owned those securities and received the dividends paid or other distributions made in connection with them. Additionally, the levels of certain indices

reflect only the prices of the securities included in that index and do not take into consideration the value of dividends paid on those securities. Your LIRNs will be paid in cash and you have no right to receive delivery of any of these

securities.

If the Market Measure to which your LIRNs are linked includes equity securities traded on foreign exchanges, your return

may be affected by factors affecting international securities markets.

The value of securities traded outside of the U.S. may be adversely affected by a variety of factors relating to the relevant securities markets. Factors which could affect

those markets, and therefore the return on your LIRNs, include:

|

|

•

|

|

Market Volatility.

The relevant foreign securities markets may be more volatile than U.S. or other securities markets and may be affected by market developments in different ways than U.S. or other securities

markets.

|

PS-13

|

|

•

|

|

Political, Economic, and Other Factors.

The prices and performance of securities of companies in foreign countries may be affected by political, economic, financial, and social factors in those regions. Direct or

indirect government intervention to stabilize a particular securities market and cross-shareholdings in companies in the relevant foreign markets may affect prices and the volume of trading in those markets. In addition, recent or future changes in

government, economic, and fiscal policies in the relevant jurisdictions, the possible imposition of, or changes in, currency exchange laws, or other laws or restrictions, and possible fluctuations in the rate of exchange between currencies, are

factors that could negatively affect the relevant securities markets. The relevant foreign economies may differ from the U.S. economy in economic factors such as growth of gross national product, rate of inflation, capital reinvestment, resources,

and self-sufficiency.

|

In particular, many emerging nations are undergoing rapid change, involving the restructuring of

economic, political, financial and legal systems. Regulatory and tax environments may be subject to change without review or appeal, and many emerging markets suffer from underdevelopment of capital markets and tax systems. In addition, in some of

these nations, issuers of the relevant securities face the threat of expropriation of their assets, and/or nationalization of their businesses. The economic and financial data about some of these countries may be unreliable.

|

|

•

|

|

Publicly Available Information.

There is generally less publicly available information about foreign companies than about U.S. companies that are subject to the reporting requirements of the SEC. In addition,

accounting, auditing, and financial reporting standards and requirements in foreign countries differ from those applicable to U.S. reporting companies.

|

Unless otherwise set forth in the applicable term sheet, we and the agents do not control any company included in any Market Measure and

have not verified any disclosure made by any other company.

We, the agents, or our respective affiliates currently, or in the future, may engage in business with companies included in a Market Measure, and we, the agents, or our respective

affiliates may from time to time own securities of companies included in a Market Measure. However, none of us, the agents, or any of our respective affiliates has the ability to control the actions of any of these companies or has undertaken any

independent review of, or made any due diligence inquiry with respect to, any of these companies, unless (and only to the extent that) the securities of us, the agents, or our respective affiliates are represented by that Market Measure. In

addition, unless otherwise set forth in the applicable term sheet, none of us, the agents, or any of our respective affiliates is responsible for the calculation of any index represented by a Market Measure. You should make your own investigation

into the Market Measure.

Unless otherwise set forth in the applicable term sheet, none of the Index Publishers, their

affiliates, or any companies included in the Market Measure will be involved in any offering of LIRNs or will have any obligation of any sort with respect to LIRNs. As a result, none of those companies will have any obligation to take your interests

as holders of LIRNs into consideration for any reason, including taking any corporate actions that might affect the value of the securities represented by the Market Measure or the value of LIRNs.

Our business activities and those of the agents relating to the companies represented by a Market Measure or the LIRNs may create

conflicts of interest with you.

We, the agents, and our respective affiliates, at the time of any offering of LIRNs or in the future, may engage in business with the companies represented by a Market Measure, including making loans to, equity

investments in, or providing investment banking, asset management, or other services to those companies, their affiliates, and their competitors.

PS-14

In connection with these activities, any of these entities may receive information about those

companies that we will not divulge to you or other third parties. We, the agents, and our respective affiliates have published, and in the future may publish, research reports on one or more of these companies. The agents may also publish research

reports relating to our or our affiliates’ securities, including the LIRNs. This research is modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding your

LIRNs. Any of these activities may affect the value of the Market Measure and, consequently, the market value of your LIRNs. None of us, the agents, or our respective affiliates makes any representation to any purchasers of the LIRNs regarding any

matters whatsoever relating to the issuers of the securities included in a Market Measure. Any prospective purchaser of the LIRNs should undertake an independent investigation of the companies included in a Market Measure to a level that, in its

judgment, is appropriate to make an informed decision regarding an investment in the LIRNs. The composition of the Market Measure does not reflect any investment recommendations from us, the agents, or our respective affiliates.

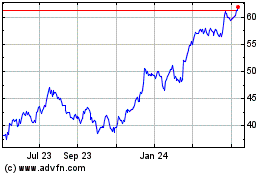

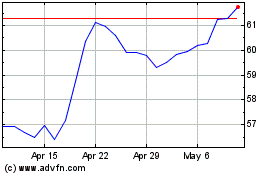

Historical levels of the Market Measure should not be taken as an indication of the future performance of the Market Measure during the

term of the LIRNs.

Accordingly, any historical or hypothetical values of the Market Measure do not provide an indication of the future performance of the Market Measure.

Other Risk Factors Relating to the Applicable Market Measure

The applicable term sheet may set forth additional risk factors as to the Market Measure that you should review prior to purchasing LIRNs.

PS-15

USE OF PROCEEDS AND HEDGING

We will use the net proceeds we receive from each sale of LIRNs for the purposes described in the accompanying prospectus under “Use of

Proceeds” and the prospectus supplement under “Supplemental Use of Proceeds.” In addition, we expect that we or our affiliates may use a portion of the net proceeds to hedge our obligations under LIRNs.

PS-16

DESCRIPTION OF LIRNS

General

Each issue of LIRNs will be

part of a series of medium-term notes entitled “Medium-Term Notes, Series K” that will be issued under the indenture, as amended and supplemented from time to time. The indenture is described more fully in the prospectus and

prospectus supplement. The following description of LIRNs supplements and, to the extent it is inconsistent with, supersedes the description of the general terms and provisions of the notes and debt securities set forth under the headings

“Description of Notes” in the prospectus supplement. These documents should be read in connection with the applicable term sheet.

The maturity date of the LIRNs and the aggregate principal amount of each issue of LIRNs will be stated in the term sheet. If the scheduled

maturity date is not a business day, we will make the required payment on the next business day, and no interest will accrue as a result of such delay.

We will not pay interest on LIRNs. LIRNs do not guarantee the return of principal at maturity. LIRNs will be payable only in U.S. dollars.

Prior to the maturity date, LIRNs are not redeemable by us or repayable at the option of any holder. LIRNs are not subject to any

sinking fund. LIRNs are not subject to the defeasance provisions described in the prospectus supplement under the caption “Description of Notes.”

We will issue LIRNs in denominations of whole units. Unless otherwise set forth in the applicable term sheet, each unit will have a

principal amount of $10. The CUSIP number for each issue of LIRNs will be set forth in the applicable term sheet. You may transfer LIRNs only in whole units.

Payment at Maturity

At

maturity, subject to our credit risk as issuer of LIRNs, you will receive a Redemption Amount, denominated in U.S. dollars. The “

Redemption Amount

” will be calculated as follows:

|

|

•

|

|

If the Ending Value is greater than the Starting Value, then the Redemption Amount will equal:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal Amount +

|

|

|

|

Principal Amount × Participation Rate ×

|

|

|

|

Ending Value

–

Starting Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Starting Value

|

|

|

|

|

|

|

|

If your LIRNs are Capped LIRNs, the Redemption Amount will not exceed a “

Capped Value

” set

forth in the term sheet.

|

|

•

|

|

If the Ending Value is equal to or less than the Starting Value, but is equal to or greater than the Threshold Value, then the Redemption Amount will equal the principal amount.

|

|

|

•

|

|

If the Ending Value is less than the Threshold Value, then the Redemption Amount will equal:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal Amount

–

|

|

|

|

Principal Amount ×

|

|

|

|

Threshold Value

–

Ending Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Starting Value

|

|

|

|

|

|

|

|

|

The Redemption Amount will not be less than zero.

PS-17

The “

Threshold Value

” will be a value of the Market Measure that equals

a specified percentage of the Starting Value, which will be less than or equal to 100%. The Threshold Value will be determined on the pricing date and set forth in the term sheet. If the Threshold Value is equal to 100% of the Starting Value, then

the Redemption Amount for LIRNs will be less than the principal amount if there is any decrease in the value of the Market Measure from the Starting Value to the Ending Value, and you may lose all of your investment in LIRNs.

Your participation in any upside potential of the Market Measure underlying your LIRNs will also be impacted by the Participation Rate. The

“

Participation Rate

” may be equal to or greater than 100%. The Participation Rate applicable to your LIRNs will be set forth in the term sheet. If the applicable term sheet specifies that the Participation Rate is 100%, your

participation in any upside performance of the Market Measure will not be leveraged.

Each term sheet will provide examples of

Redemption Amounts based on a range of hypothetical Ending Values.

The term sheet will set forth information as to the specific Market

Measure, including information as to the historical values of the Market Measure. However, historical values of the Market Measure are not indicative of its future performance or the performance of your LIRNs.

An investment in LIRNs does not entitle you to any ownership interest, including any voting rights, dividends paid, interest payments, or

other distributions, in the securities of any of the companies included in a Market Measure.

The Starting Value and the Ending Value

Starting Value

Unless otherwise specified in the term sheet, the “

Starting Value

” will equal the closing level of the Market Measure on the

pricing date.

Ending Value

Unless otherwise specified in the term sheet, the “

Ending Value

” will equal the average of the closing levels of the

Market Measure determined on each calculation day during the Maturity Valuation Period.

The “

Maturity Valuation

Period

” means the period consisting of one or more calculation days shortly before the maturity date. The timing and length of the period will be set forth in the term sheet.

A “

calculation day

” means any Market Measure Business Day during the Maturity Valuation Period on which a Market

Disruption Event has not occurred.

Unless otherwise specified in the applicable term sheet, a “

Market Measure

Business Day

” means a day on which (1) the New York Stock Exchange (the “

NYSE

”) and The NASDAQ Stock Market, or their successors, are open for trading and (2) the applicable index or any successor is calculated

and published.

If (i) a Market Disruption Event occurs on a scheduled calculation day during the Maturity Valuation

Period or (ii) any scheduled calculation day is determined by the calculation agent not to be a Market Measure Business Day by reason of an extraordinary event, occurrence, declaration, or otherwise (any such day in either (i) or

(ii) being a “

non-calculation day

”), the closing level of the Market Measure for the applicable non-calculation day will be the closing level of the Market Measure on the next calculation day that occurs during the Maturity

PS-18

Valuation Period. For example, if the first and second scheduled calculation days during the Maturity Valuation Period are non-calculation days, then the closing level of the Market Measure on

the next calculation day will also be the closing level for the Market Measure on the first and second scheduled calculation days during the Maturity Valuation Period. If no further calculation days occur after a non-calculation day, or if every

scheduled calculation day during the Maturity Valuation Period is a non-calculation day, then the closing level of the Market Measure for that non-calculation day and each following non-calculation day (or for all the scheduled calculation days

during the Maturity Valuation Period, if applicable) will be determined (or, if not determinable, estimated) by the calculation agent in a commercially reasonable manner on the last scheduled calculation day during the Maturity Valuation Period,

regardless of the occurrence of a Market Disruption Event on that last scheduled calculation day.

If the Market Measure consists of a

Basket, the Starting Value and the Ending Value of the Basket will be determined as described in “—Basket Market Measures.”

Market

Disruption Events

For an index, “

Market Disruption Event

” means one or more of the following events, as

determined by the calculation agent in its sole discretion:

|

|

(A)

|

the suspension of or material limitation on trading, in each case, for more than two consecutive hours of trading, or during the one-half hour period preceding the close of trading, on the primary exchange where the

securities included in an index trade (without taking into account any extended or after-hours trading session), in 20% or more of the securities which then compose the index or any successor index; and

|

|

|

(B)

|

the suspension of or material limitation on trading, in each case, for more than two consecutive hours of trading, or during the one-half hour period preceding the close of trading, on the primary exchange that trades

options contracts or futures contracts related to the index (without taking into account any extended or after-hours trading session), whether by reason of movements in price otherwise exceeding levels permitted by the relevant exchange or

otherwise, in options contracts or futures contracts related to the index, or any successor index.

|

|

|

For

|

the purpose of determining whether a Market Disruption Event has occurred:

|

|

|

(1)

|

a limitation on the hours in a trading day and/or number of days of trading will not constitute a Market Disruption Event if it results from an announced change in the regular business hours of the relevant exchange;

|

|

|

(2)

|

a decision to permanently discontinue trading in the relevant futures or options contracts related to the index, or any successor index, will not constitute a Market Disruption Event;

|

|

|

(3)

|

a suspension in trading in a futures or options contract on the index, or any successor index, by a major securities market by reason of (a) a price change violating limits set by that securities market,

(b) an imbalance of orders relating to those contracts, or (c) a disparity in bid and ask quotes relating to those contracts will constitute a suspension of or material limitation on trading in futures or options contracts related to the

index;

|

|

|

(4)

|

a suspension of or material limitation on trading on the relevant exchange will not include any time when that exchange is closed for trading under ordinary circumstances; and

|

PS-19

|

|

(5)

|

if applicable to indices with component securities listed on the NYSE, for the purpose of clause (A) above, any limitations on trading during significant market fluctuations under NYSE Rule 80B, or any applicable

rule or regulation enacted or promulgated by the NYSE or any other self-regulatory organization or the SEC of similar scope as determined by the calculation agent, will be considered “material.”

|

Adjustments to an Index

After the

applicable pricing date, an Index Publisher may make a material change in the method of calculating an index or in another way that changes the index such that it does not, in the opinion of the calculation agent, fairly represent the level of the

index had those changes or modifications not been made. In this case, the calculation agent will, at the close of business in New York, New York, on each date that the closing level is to be calculated, make adjustments to the index. Those

adjustments will be made in good faith as necessary to arrive at a calculation of a level of the index as if those changes or modifications had not been made, and calculate the closing level of the index, as so adjusted.

Discontinuance of an Index

After the pricing date, an Index Publisher may discontinue publication of an index to which an issue of LIRNs is linked. The Index

Publisher or another entity may then publish a substitute index that the calculation agent determines, in its sole discretion, to be comparable to the original index (a “

successor index

”). If this occurs, the calculation agent will

substitute the successor index as calculated by the relevant Index Publisher or any other entity and calculate the Ending Value as described under “—The Starting Value and the Ending Value” or “—Basket Market Measure,”

as applicable. If the calculation agent selects a successor index, the calculation agent will give written notice of the selection to the trustee, to us, and to the holders of the LIRNs.

If an Index Publisher discontinues publication of the index before the end of the Maturity Valuation Period and the

calculation agent does not select a successor index, then on each day that would have been a calculation day, until the earlier to occur of:

|

|

•

|

|

the determination of the Ending Value; and

|

|

|

•

|

|

a determination by the calculation agent that a successor index is available,

|

the

calculation agent will compute a substitute level for the index in accordance with the procedures last used to calculate the index before any discontinuance as if that day were a calculation day. The calculation agent will make available to holders

of the LIRNs information regarding those levels by means of Bloomberg L.P., Thomson Reuters, a website, or any other means selected by the calculation agent in its reasonable discretion.

If a successor index is selected or the calculation agent calculates a level as a substitute for an index, the successor index or level will

be used as a substitute for all purposes, including for the purpose of determining whether a Market Disruption Event exists.

Notwithstanding these alternative arrangements, any modification or discontinuance of the publication of any index to which your LIRNs are

linked may adversely affect trading in the LIRNs.

Basket Market Measures

If the Market Measure to which your LIRNs are linked is a Basket, the Basket Components will be set forth in the term sheet. We will assign

each Basket Component a

PS-20

weighting (the “

Initial Component Weight

”) so that each Basket Component represents a percentage of the Starting Value of the Basket on the pricing date. We may assign the

Basket Components equal Initial Component Weights, or we may assign the Basket Components unequal Initial Component Weights. The Initial Component Weight for each Basket Component will be stated in the term sheet.

Determination of the Component Ratio for Each Basket Component

The “

Starting Value

” of the Basket will be equal to 100. We will set a fixed factor (the “

Component

Ratio

”) for each Basket Component on the pricing date, based upon the weighting of that Basket Component. The Component Ratio for each Basket Component will be calculated on the pricing date and will equal:

|

|

•

|

|

the Initial Component Weight (expressed as a percentage) for that Basket Component, multiplied by 100;

divided by

|

|

|

•

|

|

the closing level of that Basket Component on the pricing date.

|

Each Component Ratio will

be rounded to eight decimal places.

The Component Ratios will be calculated in this way so that the Starting Value of the Basket will

equal 100 on the pricing date. The Component Ratios will not be revised subsequent to their determination on the pricing date, except that the calculation agent may in its good faith judgment adjust the Component Ratio of any Basket Component in the

event that Basket Component is materially changed or modified in a manner that does not, in the opinion of the calculation agent, fairly represent the value of that Basket Component had those material changes or modifications not been made.

PS-21

The following table is for illustration purposes only, and does not reflect the actual

composition, Initial Component Weights, or Component Ratios, which will be set forth in the term sheet.

Example: The

hypothetical

Basket Components are Index ABC, Index XYZ, and Index RST, with their Initial Component Weights being 50.00%, 25.00% and 25.00%, respectively, on a

hypothetical

pricing date:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basket Component

|

|

Initial

Component

Weight

|

|

|

Hypothetical

Closing

Level

(1)

|

|

|

Hypothetical

Component

Ratio

(2)

|

|

|

Initial Basket

Value

Contribution

|

|

|

|

|

|

|

|

|

Index ABC

|

|

|

50.00

|

%

|

|

|

500.00

|

|

|

|

0.10000000

|

|

|

|

50.00

|

|

|

|

|

|

|

|

|

Index XYZ

|

|

|

25.00

|

%

|

|

|

2,420.00

|

|

|

|

0.01033058

|

|

|

|

25.00

|

|

|

|

|

|

|

|

|

Index RST

|

|

|

25.00

|

%

|

|

|

1,014.00

|

|

|

|

0.02465483

|

|

|

|

25.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Starting Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100.00

|

|

|

(1)

|

This column sets forth the

hypothetical

closing level of each Basket Component on the

hypothetical

pricing date.

|

|

(2)

|

The

hypothetical

Component Ratio equals the Initial Component Weight (expressed as a percentage) of each Basket Component multiplied by 100, and then divided by the closing level of that Basket Component on

the

hypothetical

pricing date, with the result rounded to eight decimal places.

|

Unless otherwise stated in the

term sheet, if a Market Disruption Event occurs on the pricing date as to any Basket Component, the calculation agent will establish the closing level of that Basket Component (the “

Basket Component Closing Level

”), and thus its

Component Ratio, based on the closing level of that Basket Component on the first Market Measure Business Day following the pricing date on which no Market Disruption Event occurs for that Basket Component. In the event that a Market Disruption

Event occurs for that Basket Component on the pricing date and on each day to and including the second scheduled Market Measure Business Day following the pricing date, the calculation agent (not later than the close of business in New York, New

York on the second scheduled Market Measure Business Day following the pricing date) will estimate the Basket Component Closing Level, and thus the applicable Component Ratio, in a manner that the calculation agent considers commercially reasonable.

The final term sheet will provide the Basket Component Closing Level, a brief statement of the facts relating to the establishment of the Basket Component Closing Level (including the applicable Market Disruption Event(s)), and the applicable

Component Ratio.

For purposes of determining whether a Market Disruption Event has occurred as to any Basket Component, “Market

Disruption Event” will have the meaning stated above in “—Market Disruption Events.”

Ending Value of the Basket

The calculation agent will calculate the value of the Basket by summing the products of the Basket Component Closing Level on a

calculation day and the Component Ratio for each Basket Component. The value of the Basket will vary based on the increase or decrease in the level of each Basket Component. Any increase in the level of a Basket Component (assuming no change in the

level of the other Basket Component or Basket Components) will result in an

PS-22