Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-198735

The information in this preliminary prospectus supplement

is not complete and may be changed. This preliminary prospectus supplement is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

|

|

|

|

|

|

|

Subject to Completion. Dated May 5,

2016.

The Goldman Sachs Group,

Inc.

$

Callable

Floating Rate Notes due

|

|

|

Subject to our redemption right described below, interest will be payable on the of each February,

May, August and November, commencing on August , 2016 to, and including, the stated maturity date (May , 2026). The interest rate for each quarterly interest period will be a floating rate equal

to the then-applicable 3-month USD LIBOR rate on the interest determination date for the interest period

plus

the spread of 1.60% per annum, subject to the minimum interest rate of 0.00% per annum. The notes will mature on the stated maturity

date. On the stated maturity date, you will receive $1,000, plus any accrued and unpaid interest, for each $1,000 of the face amount of your notes.

We may redeem the notes at our option, in whole but not in part, on any interest payment date on or after May , 2025, upon five business days’ prior notice, at a redemption

price equal to 100% of the outstanding face amount

plus

any accrued and unpaid interest to but excluding the redemption date.

Your investment in the notes involves certain risks, including our credit risk. See page S-5.

You should read the disclosure herein to better understand the terms and risks of your investment.

|

|

|

|

|

|

|

|

|

Original issue date:

|

|

May , 2016

|

|

Original issue price:

|

|

% of the face amount

|

|

Underwriting discount:

|

|

% of the face amount

|

|

Net proceeds to the issuer:

|

|

% of the face amount

|

Neither the Securities and Exchange

Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense. The notes are not bank deposits and are

not insured by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

Goldman, Sachs &

Co. Incapital LLC

Prospectus Supplement No. dated May , 2016.

The issue price, underwriting discount and net proceeds listed on the cover page hereof relate to

the notes we sell initially. We may decide to sell additional notes after the date of this prospectus supplement, at issue prices and with underwriting discounts and net proceeds that differ from the amounts set forth above. The return

(whether positive or negative) on your investment in notes will depend in part on the issue price you pay for such notes.

Goldman Sachs

may use this prospectus in the initial sale of the offered notes. In addition, Goldman, Sachs & Co., or any other affiliate of Goldman Sachs may use this prospectus in a market-making transaction in a note after its initial sale.

Unless Goldman Sachs or its agent informs the purchaser otherwise in the confirmation of sale, this prospectus is being used in a market-making transaction.

About Your Prospectus

The notes are part of the Medium-Term Notes, Series D program of The Goldman Sachs Group, Inc. This prospectus includes this prospectus supplement and the accompanying documents listed below. This prospectus

supplement constitutes a supplement to the documents listed below and should be read in conjunction with such documents:

The information in this prospectus supplement supersedes any conflicting

information in the documents listed above. In addition, some of the terms or features described in the listed documents may not apply to your notes.

SPECIFIC TERMS OF YOUR NOTES

|

|

|

|

|

We refer to the notes we are offering by this prospectus supplement as the “offered notes” or the

“notes”. Please note that in this prospectus supplement, references to “The Goldman Sachs Group, Inc.”, “we”, “our” and “us” mean only The Goldman Sachs Group, Inc. and do not include its

consolidated subsidiaries, while references to “Goldman Sachs” mean The Goldman Sachs Group, Inc., together with its consolidated subsidiaries. Also, references to the “accompanying prospectus” mean the accompanying prospectus,

dated December 22, 2015, as supplemented by the accompanying prospectus supplement, dated December 22, 2015, relating to Medium-Term Notes, Series D, of The Goldman Sachs Group, Inc. Please note that in this section entitled “Specific Terms of

Your Notes”, references to “holders” mean those who own notes registered in their own names, on the books that we or the trustee maintain for this purpose, and not those who own beneficial interests in notes registered in street name

or in notes issued in book-entry form through The Depository Trust Company. Please review the special considerations that apply to owners of beneficial interests in the accompanying prospectus, under “Legal Ownership and Book-Entry

Issuance”. References to the “indenture” in this prospectus supplement mean the senior debt indenture, dated July 16, 2008, between The Goldman Sachs Group, Inc. and The Bank of New York Mellon, as trustee.

|

|

|

Key Terms

Issuer:

The Goldman Sachs Group, Inc.

Specified currency:

U.S. dollars (“$”)

Face amount:

each note will have a face amount equal to $1,000, or integral multiples of $1,000 in excess thereof; $ in the

aggregate for all the offered notes; the aggregate face amount of the offered notes may be increased if the issuer, at its sole option, decides to sell an additional amount of the offered notes on a date subsequent to the date of this prospectus

supplement

Stated maturity date:

May , 2026

Trade date:

May , 2016

Original issue date (settlement date):

May , 2016

Form of

notes:

global form only

Supplemental discussion of U.S. federal income tax consequences

:

It is

the opinion of Sidley Austin

LLP

that interest on a note will be taxable to a U.S. holder as ordinary interest income at the time it accrues or is received in accordance with the U.S. holder’s normal method of accounting for tax

purposes. Upon the disposition of a note by sale, exchange, redemption, retirement or other disposition, a U.S. holder will generally recognize capital gain or loss equal to the difference, if any, between (i) the amount realized on the disposition

(other than amounts attributable to accrued but unpaid interest, which would be treated as such) and (ii) the U.S. holder’s adjusted tax basis in the note. Please see “United States Taxation” in the accompanying prospectus for a more

detailed discussion. Pursuant to Treasury regulations, Foreign Account Tax Compliance Act (FATCA) withholding (as described in “United States Taxation—Taxation of Debt Securities—Foreign Account Tax Compliance Act (FATCA)

Withholding” in the accompanying prospectus) will generally apply to obligations that are issued on or after July 1, 2014; therefore, the notes will generally be subject to FATCA withholding. However, according to published guidance, the

withholding tax described above will not apply to payments of gross proceeds from the sale, exchange or other disposition of the notes made before January 1, 2019.

Interest rate:

a rate per annum equal to the base rate

plus

the spread, subject to the minimum interest rate; for the initial interest period, the base rate shall be the

initial base rate

Minimum interest rate:

0.00% per annum

Base rate:

3-month USD LIBOR (as described in the accompanying prospectus supplement under “Description of the Notes We May Offer — Interest Rates — LIBOR Notes”)

Reuters screen LIBOR page:

LIBOR01

Index maturity:

3 months

Index currency:

U.S. dollar

S-2

Spread:

1.60% per annum

Initial base rate:

3-month USD LIBOR in effect on May , 2016

Interest payment dates:

the of each February, May, August and November, commencing on

August , 2016 and ending on the stated maturity date

Interest periods:

quarterly; the periods

from and including an interest payment date (or the original issue date, in the case of the first interest period) to but excluding the next succeeding interest payment date (or the stated maturity date, in the case of the final interest period)

Business day convention:

modified following; applicable to interest payment dates and interest reset dates

Interest determination dates:

for each interest period, the second London business day preceding the interest reset date

Interest reset dates:

the of each February, May, August and November, commencing on August

, 2016

Day count convention:

actual/360 (ISDA)

Regular record dates:

the day immediately prior to the day on which the interest payment is to be made (as such payment day may be

adjusted under the applicable business day convention)

Redemption at option of issuer before stated maturity date:

We

will be permitted to redeem the notes at our option before their stated maturity, as described below. The notes will not be entitled to the benefit of any sinking fund – that is, we will not deposit money on a regular basis into any separate

custodial account to repay your note. In addition, you will not be entitled to require us to buy your note from you before its stated maturity.

We will

have the right to redeem the notes at our option, in whole but not in part, on any interest payment date on or after May , 2025, at a redemption price equal to 100% of the outstanding face amount, plus accrued and unpaid

interest to but excluding the redemption date. We will provide not less than five business days’ prior notice in the manner described under “Description of Debt Securities We May Offer — Notices” in the attached prospectus. If

the redemption notice is given and funds deposited as required, then interest will cease to accrue on and after the redemption date on the notes. If any redemption date is not a business day, we will pay the redemption price on the next business day

without any interest or other payment due to the delay.

No listing:

the notes will not be listed or displayed on any

securities exchange or interdealer market quotation system

Business day:

New York business day and London business day

Calculation agent:

Goldman, Sachs & Co.

CUSIP no.:

38148TMM8

ISIN no.:

US38148TMM89

FDIC:

the notes are not bank deposits and are not insured by the Federal Deposit Insurance Corporation or any other

governmental agency; nor are they obligations of, or guaranteed by, a bank

S-3

HYPOTHETICAL EXAMPLES

The following table is provided for purposes of illustration only. It should not be taken as an indication or prediction of future investment

results and is intended merely to illustrate the method we will use to calculate the amount of interest accrued during each interest period.

The table below is based on 3-month USD LIBOR rates that are entirely hypothetical; no one can predict what the 3-month USD LIBOR rate will be on any day, and no one can predict the interest that will accrue on

your notes in any interest period.

For these reasons, the actual 3-month USD LIBOR rates, as well as the interest payable on each

interest payment date, may bear little relation to the hypothetical tables shown below or to the historical 3-month USD LIBOR rates shown elsewhere in this prospectus supplement. For information about the 3-month USD LIBOR rates during recent

periods, see “Historical 3-Month USD LIBOR Rates” on page S-9. Before investing in the offered notes, you should consult publicly available information to determine the 3-month USD LIBOR rates between the date of this prospectus supplement

and the date of your purchase of the offered notes.

The following table illustrates the method we will use to calculate the interest

rate at which interest will accrue on each day included in an interest period, subject to the key terms and assumptions below.

The

percentage amounts in the left column of the table below represent hypothetical 3-month USD LIBOR rates on a given interest determination date. The right column of the table below represents the hypothetical interest, as a percentage of the face

amount of each note, that would be payable on the applicable interest payment date, based on the corresponding hypothetical 3-month USD LIBOR rate. The information in the table also reflects the key terms and assumptions in the box below.

|

|

|

|

|

Key Terms and

Assumptions

|

|

|

|

|

Face amount

|

|

$1,000

|

|

Minimum interest rate

|

|

0.00% per annum

|

|

Spread

|

|

1.60% per annum

|

Also, the hypothetical examples shown below assume the notes are not called and do not take into account the

effects of applicable taxes.

|

|

|

|

|

Hypothetical 3-Month USD

LIBOR Rate

|

|

Hypothetical Interest Rate Payable on an Interest

Payment Date (Including the Applicable Spread)

|

|

-3.00%

|

|

0.00%*

|

|

-2.00%

|

|

0.00%*

|

|

-1.60%

|

|

0.00%*

|

|

-0.50%

|

|

1.10%

|

|

0.00%

|

|

1.60%

|

|

0.80%

|

|

2.40%

|

|

0.90%

|

|

2.50%

|

|

1.00%

|

|

2.60%

|

|

1.75%

|

|

3.35%

|

|

3.00%

|

|

4.60%

|

|

4.00%

|

|

5.60%

|

|

5.50%

|

|

7.10%

|

|

7.00%

|

|

8.60%

|

* Interest is floored at the minimum interest rate of 0.00% per annum.

Payments on the notes are economically equivalent to the amounts that would be paid on a combination of other instruments. For example, payments on

the notes are economically equivalent to the amounts that would be paid on a combination of an interest-bearing bond bought, and an option bought, by the holder (with an implicit option premium paid over time by the holder). The discussion in this

paragraph does not modify or affect the terms of the notes or the United States income tax treatment of the notes, as described elsewhere in this prospectus supplement.

|

|

|

|

|

We cannot predict the actual 3-month USD LIBOR rate on any day or the market value of your notes, nor can we predict the

relationship between the 3-month USD LIBOR rate and the market value of your notes at any time prior to the stated maturity date. The actual interest payment that a holder of the offered notes will receive on each interest payment date and the rate

of return on the offered notes will depend on the actual 3-month USD LIBOR rates determined by the calculation agent over the life of your notes. Moreover, the assumptions on which the hypothetical table is based may turn out to be inaccurate.

Consequently, the interest amount to be paid in respect of your notes on each interest payment date may be very different from the information reflected in the table above.

|

|

|

S-4

ADDITIONAL RISK FACTORS SPECIFIC TO YOUR NOTES

|

|

|

|

|

An investment in your notes is subject to the risks described below, as well as the risks and considerations described in

the accompanying prospectus, dated December 22, 2015 and in the accompanying prospectus supplement, dated December 22, 2015. Your notes are a riskier investment than ordinary debt securities. You should carefully review these risks and

considerations as well as the terms of the notes described herein and in the accompanying prospectus, dated December 22, 2015, as supplemented by the accompanying prospectus supplement, dated December 22, 2015, of The Goldman Sachs Group,

Inc. Your notes are a riskier investment than ordinary debt securities. You should carefully consider whether the offered notes are suited to your particular circumstances.

|

|

|

The Notes Are Subject to the Credit Risk of the Issuer

Although the return on the notes will be based, in part, on the performance of the 3-month USD LIBOR, the payment of any amount due on the notes is

subject to our credit risk. The notes are our unsecured obligations. Investors are dependent on our ability to pay all amounts due on the notes, and therefore investors are subject to our credit risk and to changes in the market’s view of our

creditworthiness. See “Description of the Notes We May Offer — Information About Our Medium-Term Notes, Series D Program — How the Notes Rank Against Other Debt” on page S-4 of the accompanying prospectus supplement.

We May Sell an Additional Aggregate Face Amount of the Notes at a Different Issue Price

At our sole option, we may decide to sell an additional aggregate face amount of the notes subsequent to the date of this prospectus supplement. The

issue price of the notes in the subsequent sale may differ substantially (higher or lower) from the issue price you paid as provided on the cover of this prospectus supplement.

The Amount of Interest Payable on Your Notes Will Not Be Affected by the 3-Month USD LIBOR Rate on Any Day Other Than an Interest Determination Date

For each interest period, the amount of interest payable on each interest payment date is calculated based on the

3-month

USD LIBOR rate on the applicable interest determination date plus the applicable spread. Although the actual

3-month

USD LIBOR rate on an interest payment date

or at other times during an interest period may be higher than the 3-month USD LIBOR rate on the applicable interest determination date, you will not benefit from the 3-month USD LIBOR rate at any time other than on the interest determination date

for such interest period.

Increased Regulatory Oversight and Changes in the Method Pursuant to Which the LIBOR Rates Are Determined

May Adversely Affect the Value of Your Notes

Beginning in 2008, concerns were raised that some of the member banks surveyed by the

British Bankers’ Association (the “BBA”) in connection with the calculation of LIBOR across a range of maturities and currencies may have been under-reporting or otherwise manipulating the inter-bank lending rate applicable to them. A

number of BBA member banks have entered into settlements with their regulators and law enforcement agencies with respect to alleged manipulation of LIBOR, and investigations were instigated by regulators and governmental authorities in various

jurisdictions (including in the United States, United Kingdom, European Union, Japan and Canada). If manipulation of LIBOR or another inter-bank lending rate occurred, it may have resulted in that rate being artificially lower (or higher) than it

otherwise would have been.

In September 2012, the U.K. government published the results of its review of LIBOR (commonly referred to as

the “Wheatley Review”). The Wheatley Review made a number of recommendations for changes with respect to LIBOR including the introduction of statutory regulation of LIBOR, the transfer of responsibility for LIBOR from the BBA to an

independent administrator, changes to the method of compilation of lending rates and new regulatory oversight and enforcement mechanisms for rate-setting. Based on the Wheatley Review, final rules for the regulation and supervision of LIBOR by the

Financial Conduct Authority (FCA) were published and came into effect on April 2, 2013 (the “FCA Rules”). In particular, the FCA Rules include requirements that (1) an independent LIBOR administrator monitor and survey LIBOR submissions to

identify breaches of practice standards and/or potentially manipulative behavior, and (2) firms submitting data to LIBOR establish and maintain a clear conflicts of interest policy and appropriate systems and controls. In addition, in response to

the Wheatley Review recommendations, ICE Benchmark Administration Limited (ICE Administration) has been appointed as the independent LIBOR administrator, effective February 1, 2014.

It is not possible to predict the effect of the FCA Rules, any changes in the methods pursuant to which the LIBOR rates are determined and any

other reforms to LIBOR that will be enacted in the U.K. and elsewhere, which may adversely affect the trading market for LIBOR-based securities. In addition, any changes announced by the FCA, the ICE Administration or any other successor

governance or oversight body, or future changes adopted by such body, in the method pursuant to which the LIBOR rates are determined may result in a sudden or prolonged increase or decrease in the reported LIBOR rates. If that were to occur and to

the extent that the value of your securities is affected by reported

S-5

LIBOR rates, the level of interest payments and the value of the securities may be affected. Further, uncertainty as to the extent and manner in which the Wheatley Review recommendations will

continue to be adopted and the timing of such changes may adversely affect the current trading market for LIBOR-based securities and the value of your notes.

We Are Able to Redeem Your Notes at Our Option

On any interest payment date on or after May

, 2025, we will be permitted to redeem your notes at our option. Even if we do not exercise our option to redeem your notes, our ability to do so may adversely affect the value of your notes. It is our sole option whether to

redeem your notes prior to maturity and we may or may not exercise this option for any reason. Because of this redemption option, the term of your notes will be between nine and ten years.

The Historical Levels of the 3-Month USD LIBOR Rate Are Not an Indication of the Future Levels of the 3-Month USD LIBOR Rate

In the past, the level of the 3-month USD LIBOR rate has experienced significant fluctuations. You should note that historical levels, fluctuations

and trends of the 3-month USD LIBOR rate are not necessarily indicative of future levels. Any historical upward or downward trend in the 3-month USD LIBOR rate is not an indication that the 3-month USD LIBOR rate is more or less likely to increase

or decrease at any time during an interest period, and you should not take the historical levels of the 3-month USD LIBOR rate as an indication of its future performance.

The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors

When we refer

to the market value of your notes, we mean the value that you could receive for your notes if you chose to sell it in the open market before the stated maturity date. A number of factors, many of which are beyond our control, will influence the

market value of your notes, including:

|

|

●

|

|

the 3-month USD LIBOR rate;

|

|

|

●

|

|

the volatility — i.e., the frequency and magnitude of changes — in the level of the 3-month USD LIBOR rate;

|

|

|

●

|

|

economic, financial, regulatory, political, military and other events that affect LIBOR rates generally;

|

|

|

●

|

|

other interest rates and yield rates in the market;

|

|

|

●

|

|

the time remaining until your notes mature; and

|

|

|

●

|

|

our creditworthiness, whether actual or perceived, and including actual or anticipated upgrades or downgrades in our credit ratings or changes in other credit

measures.

|

These factors, and many other factors, will influence the price you will receive if you sell your notes

before maturity, including the price you may receive for your notes in any market making transaction. If you sell your notes before maturity, you may receive less than the face amount of your notes.

You cannot predict the future performance of the 3-month USD LIBOR rate based on its historical performance. The actual performance of the 3-month

USD LIBOR rate, as well as the interest payable on each interest payment date, may bear little or no relation to the hypothetical levels of the 3-month USD LIBOR rate or to the hypothetical examples shown elsewhere in this prospectus supplement.

If the 3-Month USD LIBOR Rate Changes, the Market Value of Your Notes May Not Change in the Same Manner

The price of your notes may move differently than the 3-month USD LIBOR rate. Changes in the 3-month USD LIBOR rate may not result in a comparable

change in the market value of your notes. We discuss some of the reasons for this disparity under “— The Amount of Interest Payable on Your Notes Will Not Be Affected by the 3-Month USD LIBOR Rate on Any Day Other Than an Interest

Determination Date” and “— The Market Value of Your Notes May Be Influenced by Many Unpredictable Factors” above.

Anticipated Hedging Activities by Goldman Sachs or Our Distributors May Negatively Impact Investors in the Notes and Cause Our Interests and

Those of Our Clients and Counterparties to be Contrary to Those of Investors in the Notes

Goldman Sachs expects to hedge our

obligations under the notes by purchasing futures and/or other instruments linked to 3-month USD LIBOR. Goldman Sachs also expects to adjust the hedge by, among other things, purchasing or selling any of the foregoing, and perhaps other instruments

linked to 3-month USD LIBOR, at any time and from time to time, and to unwind the hedge by selling any of the foregoing on or before the final interest determination date for your notes. Alternatively, Goldman Sachs may hedge all or part of our

obligations under the notes with unaffilated distributors of the notes which we expect will undertake similar market activity. Goldman Sachs may also enter into, adjust and unwind hedging transactions relating to other 3-month USD LIBOR-linked notes

whose returns are linked to 3-month USD LIBOR.

S-6

In addition to entering into such transactions itself, or distributors entering into such

transactions, Goldman Sachs may structure such transactions for its clients or counterparties, or otherwise advise or assist clients or counterparties in entering into such transactions. These activities may be undertaken to achieve a variety of

objectives, including: permitting other purchasers of the notes or other securities to hedge their investment in whole or in part; facilitating transactions for other clients or counterparties that may have business objectives or investment

strategies that are inconsistent with or contrary to those of investors in the notes; hedging the exposure of Goldman Sachs to the notes including any interest in the notes that it reacquires or retains as part of the offering process, through its

market-making activities or otherwise; enabling Goldman Sachs to comply with its internal risk limits or otherwise manage firmwide, business unit or product risk; and/or enabling Goldman Sachs to take directional views as to relevant markets on

behalf of itself or its clients or counterparties that are inconsistent with or contrary to the views and objectives of the investors in the notes.

Any of these hedging or other activities may adversely affect the levels of 3-month USD LIBOR — and therefore the market value of your notes and the amount we will pay on your notes at maturity. In addition,

you should expect that these transactions will cause Goldman Sachs or its clients, counterparties or distributors to have economic interests and incentives that do not align with, and that may be directly contrary to, those of an investor in the

notes. Neither Goldman Sachs nor any distributor will have any obligation to take, refrain from taking or cease taking any action with respect to these transactions based on the potential effect on an investor in the notes, and may receive

substantial returns on hedging or other activities while the value of your notes declines. In addition, if the distributor from which you purchase notes is to conduct hedging activities in connection with the notes, that distributor may otherwise

profit in connection with such hedging activities and such profit, if any, will be in addition to the compensation that the distributor receives for the sale of the notes to you. You should be aware that the potential to earn fees in connection with

hedging activities may create a further incentive for the distributor to sell the notes to you in addition to the compensation they would receive for the sale of the notes.

As Calculation Agent, Goldman, Sachs & Co. Will Have the Authority to Make Determinations that Could Affect the Value of Your Notes and the Amount You May Receive On Any Interest Payment Date

As calculation agent for your notes, Goldman, Sachs & Co. will have discretion in making certain determinations that affect your notes,

including determining the 3-month USD LIBOR rate on any interest determination date, which we will use to determine the amount we will pay on any applicable interest payment date. The exercise of this discretion by Goldman, Sachs & Co. could

adversely affect the value of your notes and may present Goldman, Sachs & Co. with a conflict of interest. We may change the calculation agent at any time without notice and Goldman, Sachs & Co. may resign as calculation agent at any time

upon 60 days’ written notice to Goldman Sachs.

Your Notes May Not Have an Active Trading Market

Your notes will not be listed or displayed on any securities exchange or included in any interdealer market quotation system, and there may be

little or no secondary market for your notes. Even if a secondary market for your notes develops, it may not provide significant liquidity and we expect that transaction costs in any secondary market would be high. As a result, the difference

between bid and asked prices for your notes in any secondary market could be substantial.

Certain Considerations for Insurance

Companies and Employee Benefit Plans

Any insurance company or fiduciary of a pension plan or other employee benefit plan that is

subject to the prohibited transaction rules of the Employee Retirement Income Security Act of 1974, as amended, which we call “ERISA”, or the Internal Revenue Code of 1986, as amended, including an IRA or a Keogh plan (or a governmental

plan to which similar prohibitions apply), and that is considering purchasing the offered notes with the assets of the insurance company or the assets of such a plan, should consult with its counsel regarding whether the purchase or holding of the

offered notes could become a “prohibited transaction” under ERISA, the Internal Revenue Code or any substantially similar prohibition in light of the representations a purchaser or holder in any of the above categories is deemed to make by

purchasing and holding the offered notes. This is discussed in more detail under “Employee Retirement Income Security Act” below.

Foreign Account Tax Compliance Act (FATCA) Withholding May Apply to Payments on Your Notes, Including as a Result of the Failure of the Bank or

Broker Through Which You Hold the Notes to Provide Information to Tax Authorities

Please see the discussion under “United

States Taxation — Taxation of Debt Securities — Foreign Account Tax Compliance Act (FATCA) Withholding” in the accompanying prospectus for a description of the applicability of FATCA to payments made on your notes.

S-7

USE OF PROCEEDS

We expect to use the net proceeds we receive from the sale of the offered notes for the purposes we describe in the accompanying prospectus under

“Use of Proceeds”.

HEDGING

In anticipation of the sale of the offered notes, we and/or our affiliates expect to enter into hedging transactions involving purchases of

instruments linked to the 3-month USD LIBOR rate. In addition, from time to time, we and/or our affiliates expect to enter into additional hedging transactions and to unwind those we have entered into, in connection with the offered notes and

perhaps in connection with other notes we issue, some of which may have returns linked to the 3-month USD LIBOR rate. Consequently, with regard to your notes, from time to time, we and/or our affiliates:

|

|

●

|

|

expect to acquire or dispose of positions in over-the-counter options, futures or other instruments linked to the 3-month USD LIBOR rate, and/or

|

|

|

●

|

|

may take short positions in securities of the kind described above — i.e., we and/or our affiliates may sell securities of the kind that we do not own or

that we borrow for delivery to purchaser, and/or

|

|

|

●

|

|

may take or dispose of positions in interest rate swaps, options swaps and treasury bonds.

|

We and/or our affiliates may also acquire a long or short position in securities similar to your notes from time to time and may, in our or their

sole discretion, hold or resell those securities.

In the future, we and/or our affiliates expect to close out hedge positions relating

to the offered notes and perhaps relating to other notes with returns linked to the 3-month USD LIBOR rate. These steps may also involve sales and/or purchases of some or all of the listed or over-the-counter options, futures or other instruments

linked to the 3-month USD LIBOR.

|

|

|

The hedging activity discussed above may adversely affect the market value of your notes from time to time and the amount we will pay on your notes. See “Additional Risk Factors Specific to Your Notes”

above for a discussion of these adverse effects.

|

S-8

HISTORICAL 3-MONTH USD LIBOR RATES

The level of the 3-month USD LIBOR rate has fluctuated in the past and may, in the future, experience significant fluctuations. Any historical

upward or downward trend in the level of the 3-month USD LIBOR rate during the period shown below is not an indication that the 3-month USD LIBOR rate is more or less likely to increase or decrease at any time during the interest periods. See

“Additional Risk Factors Specific to Your Notes — Increased Regulatory Oversight and Changes in the Method Pursuant to Which the LIBOR Rates Are Determined May Adversely Affect the Value of Your Notes” for more information about the

3-month USD LIBOR.

You should not take the historical levels of the 3-month USD LIBOR rate as an indication of future levels of the

3-month USD LIBOR rates.

We cannot give you any assurance that the future levels of the 3-month USD LIBOR rate will result in your receiving a return on your notes that is greater than the return you would have realized if you invested in a debt

security of comparable maturity that bears interest at a prevailing market rate.

In light of current market conditions, the trends

reflected in the historical levels of the 3-month USD LIBOR rate may be less likely to be indicative of the levels of the 3-month USD LIBOR rate during the interest periods.

Neither we nor any of our affiliates make any representation to you as to the performance of the 3-month USD LIBOR. The actual levels of the 3-month USD LIBOR rate may bear little relation to the historical levels

of the 3-month USD LIBOR rate shown below.

The graph below shows the daily historical last levels of the 3-month USD LIBOR rate from May

4, 2006 through May 4, 2016. We obtained the last levels in the graph below from Reuters, without independent verification.

S-9

S-10

EMPLOYEE RETIREMENT INCOME SECURITY ACT

This section is only relevant to you if you are an insurance company or the fiduciary of a pension plan or an employee benefit plan (including a

governmental plan, an IRA or a Keogh Plan) proposing to invest in the notes.

The U.S. Employee Retirement Income Security Act of

1974, as amended (“ERISA”) and the U.S. Internal Revenue Code of 1986, as amended (the “Code”), prohibit certain transactions (“prohibited transactions”) involving the assets of an employee benefit plan that is subject

to the fiduciary responsibility provisions of ERISA or Section 4975 of the Code (including individual retirement accounts, Keogh plans and other plans described in Section 4975(e)(1) of the Code) (a “Plan”) and certain persons who are

“parties in interest” (within the meaning of ERISA) or “disqualified persons” (within the meaning of the Code) with respect to the Plan; governmental plans may be subject to similar prohibitions unless an exemption applies to the

transaction. The assets of a Plan may include assets held in the general account of an insurance company that are deemed “plan assets” under ERISA or assets of certain investment vehicles in which the Plan invests. Each of The Goldman

Sachs Group, Inc. and certain of its affiliates may be considered a “party in interest” or a “disqualified person” with respect to many Plans, and, accordingly, prohibited transactions may arise if the notes are acquired by or on

behalf of a Plan unless those notes are acquired and held pursuant to an available exemption. In general, available exemptions are: transactions effected on behalf of that Plan by a “qualified professional asset manager” (prohibited

transaction exemption 84-14) or an “in-house asset manager” (prohibited transaction exemption 96-23), transactions involving insurance company general accounts (prohibited transaction exemption 95-60), transactions involving insurance

company pooled separate accounts (prohibited transaction exemption 90-1), transactions involving bank collective investment funds (prohibited transaction exemption 91-38) and transactions with service providers under Section 408(b)(17) of ERISA and

Section 4975(d)(20) of the Code where the Plan receives no less and pays no more than “adequate consideration” (within the meaning of Section 408(b)(17) of ERISA and Section 4975(f)(10) of the Code). The person making the decision on

behalf of a Plan or a governmental plan shall be deemed, on behalf of itself and the plan, by purchasing and holding the notes, or exercising any rights related thereto, to represent that (a) the plan will receive no less and pay no more than

“adequate consideration” (within the meaning of Section 408(b)(17) of ERISA and Section 4975(f)(10) of the Code) in connection with the purchase and holding of the notes, (b) none of the purchase, holding or disposition of the notes or the

exercise of any rights related to the notes will result in a nonexempt prohibited transaction under ERISA or the Code (or, with respect to a governmental plan, under any similar applicable law or regulation), and (c) neither The Goldman Sachs Group,

Inc. nor any of its affiliates is a “fiduciary” (within the meaning of Section 3(21) of ERISA) or, with respect to a governmental plan, under any similar applicable law or regulation) with respect to the purchaser or holder in connection

with such person’s acquisition, disposition or holding of the notes, or as a result of any exercise by The Goldman Sachs Group, Inc. or any of its affiliates of any rights in connection with the notes, and no advice provided by The Goldman

Sachs Group, Inc. or any of its affiliates has formed a primary basis for any investment decision by or on behalf of such purchaser or holder in connection with the notes and the transactions contemplated with respect to the notes.

|

|

|

If you are an insurance company or the fiduciary of a pension plan or an employee benefit plan (including a governmental plan, an IRA or a Keogh plan), and propose to invest in the notes, you should consult your

legal counsel.

|

S-11

SUPPLEMENTAL PLAN OF DISTRIBUTION

The Goldman Sachs Group, Inc. and the underwriters for this offering named below have entered into a distribution agreement with respect to the

notes. Subject to certain conditions, each underwriter named below has severally agreed to purchase the principal amount of notes indicated in the following table.

|

|

|

|

|

|

|

Underwriters

|

|

Principal Amount

of Notes

|

|

|

Goldman, Sachs & Co.

|

|

$

|

|

|

|

Incapital LLC

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

Notes sold by the underwriters to the public will initially be offered at the initial price to public set forth on

the cover of this pricing supplement. The underwriters intend to purchase the notes from The Goldman Sachs Group, Inc. at a purchase price equal to the initial price to public less a discount of

% of the principal amount of the notes. Any notes sold by the underwriters to securities dealers may be sold at a discount from the initial price to public of up to

% of the principal amount of the notes. If all of the offered notes are not sold at the initial price to public, the underwriters may change the offering price and the other selling terms.

Please note that the information about the initial price to public and net proceeds to The Goldman Sachs Group, Inc. on the front cover page

relates only to the initial sale of the notes. If you have purchased a note in a market-making transaction by Goldman, Sachs & Co. or any other affiliate of The Goldman Sachs Group, Inc. after the initial sale, information about the price and

date of sale to you will be provided in a separate confirmation of sale.

Each underwriter has represented and agreed that it will not

offer or sell the notes in the United States or to United States persons except if such offers or sales are made by or through FINRA member broker-dealers registered with the U.S. Securities and Exchange Commission.

The Goldman Sachs Group, Inc. estimates that its share of the total offering expenses, excluding underwriting discounts and commissions, whether

paid to Goldman, Sachs & Co. or any other underwriter, will be approximately $ .

We expect to deliver the notes against payment therefor in New York, New York on May , 2016, which

is expected to be the third scheduled business day following the date of this prospectus supplement and of the pricing of the notes.

The notes are a new issue of securities with no established trading market. The Goldman Sachs Group, Inc. has been advised by Goldman, Sachs &

Co. and Incapital LLC that they may make a market in the notes. Goldman, Sachs & Co. and Incapital LLC are not obligated to do so and may discontinue market-making at any time without notice. No assurance can be given as to the liquidity of the

trading market for the notes.

The Goldman Sachs Group, Inc. has agreed to indemnify the several underwriters against certain

liabilities, including liabilities under the Securities Act of 1933.

Certain of the underwriters and their affiliates have in the past

provided, and may in the future from time to time provide, investment banking and general financing and banking services to The Goldman Sachs Group, Inc. and its affiliates, for which they have in the past received, and may in the future receive,

customary fees. The Goldman Sachs Group, Inc. and its affiliates have in the past provided, and may in the future from time to time provide, similar services to the underwriters and their affiliates on customary terms and for customary fees.

Goldman, Sachs & Co., one of the underwriters, is an affiliate of The Goldman Sachs Group, Inc. Please see “Plan of Distribution—Conflicts of Interest” on page 121 of the accompanying prospectus.

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member

State”) with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State (the “Relevant Implementation Date”) an offer of the offered notes which are the subject of the offering

contemplated by this prospectus supplement in relation thereto may not be made to the public in that Relevant Member State except that, with effect from and including the Relevant Implementation Date, an offer of such offered notes may be made to

the public in that Relevant Member State:

|

|

(a)

|

at any time to any legal entity which is a qualified investor as defined in the Prospectus Directive;

|

S-12

|

|

(b)

|

at any time to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), subject to obtaining the prior consent of the

relevant dealer or dealers nominated by the Issuer for any such offer; or

|

|

|

(c)

|

at any time in any other circumstances falling within Article 3(2) of the Prospectus Directive,

|

provided that no such offer of offered notes shall require us or any dealer to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

For the purposes of this provision, the expression “an offer of notes to the public” in relation to any notes in any Relevant Member State

means the communication in any form and by any means of sufficient information on the terms of the offer and the notes to be offered so as to enable an investor to decide to purchase or subscribe the notes, as the same may be varied in that Relevant

Member State by any measure implementing the Prospectus Directive in that Relevant Member State. The expression “Prospectus Directive” means Directive 2003/71/EC (as amended, including by Directive 2010/73/EU) and includes any relevant

implementing measure in each Relevant Member State.

Goldman, Sachs & Co. has represented and agreed that:

|

|

(a)

|

it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within

the meaning of Section 21 of the FSMA) received by it in connection with the issue or sale of the offered notes in circumstances in which Section 21(1) of the FSMA does not apply to The Goldman Sachs Group, Inc.; and

|

|

|

(b)

|

it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the notes in, from or otherwise involving the United

Kingdom.

|

No advertisement, invitation or document relating to the notes may be issued or may be in the possession of any

person for the purpose of issue (in each case whether in Hong Kong or elsewhere), if such advertisement, invitation or document is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if

permitted to do so under the securities laws of Hong Kong) other than with respect to the offered notes which are or are intended to be disposed of only to persons outside of Hong Kong or only to “professional investors” as defined in the

Securities and Futures Ordinance (Cap. 571, Laws of Hong Kong) and any rules made thereunder.

The offered notes have not been and will

not be registered under the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended), or the FIEA. The offered notes may not be offered or sold, directly or indirectly, in Japan or to or for the benefit of any resident of

Japan (including any person resident in Japan or any corporation or other entity organized under the laws of Japan) or to others for reoffering or resale, directly or indirectly, in Japan or to or for the benefit of any resident of Japan, except

pursuant to an exemption from the registration requirements of the FIEA and otherwise in compliance with any relevant laws and regulations of Japan.

This prospectus supplement, along with the accompanying prospectus supplement and prospectus have not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this prospectus

supplement, along with the accompanying prospectus supplement and prospectus and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the offered notes may not be circulated or

distributed, nor may the notes be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of

the Securities and Futures Act, Chapter 289 of Singapore (the “SFA”)) under Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1) of the SFA, or any person pursuant to

Section 275(1A) of the SFA, and in accordance with the conditions specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA, in each case subject to

conditions set forth in the SFA.

Where the offered notes are subscribed or purchased under Section 275 of the SFA by a relevant person

which is a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an

accredited investor, the securities (as defined in Section 239(1) of the SFA) of that corporation shall not be transferred except: (1) to an institutional investor under Section 274 of the SFA or to a relevant person (as defined in Section 275(2) of

the SFA), (2) where such transfer arises from an offer in that corporation’s securities pursuant to Section 275(1A) of the SFA, (3) where no consideration is or will be given for the transfer, (4) as specified in Section 276(7) of the SFA, or

(5) as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures) Regulations 2005 of Singapore (“Regulation 32”).

Where the offered notes are subscribed or purchased under Section 275 of the SFA by a relevant person which is a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and

each beneficiary of the trust is an accredited investor, the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferable for six months after that trust has acquired the offered notes under Section 275 of

the SFA except: (1) to an

S-13

institutional investor under Section 274 of the SFA or to a relevant person (as defined in Section 275(2) of the SFA, (2) where such transfer arises from an offer that is made on terms that such

rights or interest are acquired at a consideration of not less than S$200,000 (or its equivalent in a foreign currency) for each transaction (whether such amount is to be paid for in cash or by exchange of securities or other assets), (3) where no

consideration is or will be given for the transfer, (4) where the transfer is by operation of law, (5) as specified in Section 276(7) of the SFA, or (6) as specified in Regulation 32.

Conflicts of Interest

GS& Co. is an affiliate of The Goldman Sachs Group, Inc. and, as such, will have a “conflict of interest” in this offering of notes

within the meaning of Financial Industry Regulatory Authority, Inc. (FINRA) Rule 5121. Consequently, this offering of notes will be conducted in compliance with the provisions of FINRA Rule 5121. GS&Co. will not be permitted to sell notes in

this offering to an account over which it exercises discretionary authority without the prior specific written approval of the account holder.

S-14

We have not authorized anyone to provide any information or to make any representations other than those contained or

incorporated by reference in this prospectus supplement, the accompanying prospectus supplement or the accompanying prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others

may give you. This prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus is an offer to sell only the notes offered hereby, but only under the circumstances and in jurisdictions where it is lawful to do so.

The information contained in this prospectus supplement, the accompanying prospectus supplement and the accompanying prospectus is current only as of the respective dates of such documents.

TABLE OF CONTENTS

Prospectus Supplement

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

Specific Terms of Your Notes

|

|

|

S-2

|

|

|

Hypothetical Examples

|

|

|

S-4

|

|

|

Additional Risk Factors Specific to Your Notes

|

|

|

S-5

|

|

|

Use of Proceeds

|

|

|

S-8

|

|

|

Hedging

|

|

|

S-8

|

|

|

Historical 3-month USD LIBOR Rates

|

|

|

S-9

|

|

|

Employee Retirement Income Security Act

|

|

|

S-11

|

|

|

Supplemental Plan of Distribution

|

|

|

S-12

|

|

|

Conflicts of Interest

|

|

|

S-14

|

|

|

|

|

Prospectus Supplement dated December 22, 2015

|

|

|

|

|

|

Use of Proceeds

|

|

|

S-2

|

|

|

Description of Notes We May Offer

|

|

|

S-3

|

|

|

Considerations Relating to Indexed Notes

|

|

|

S-19

|

|

|

United States Taxation

|

|

|

S-22

|

|

|

Employee Retirement Income Security Act

|

|

|

S-23

|

|

|

Supplemental Plan of Distribution

|

|

|

S-24

|

|

|

Validity of the Notes

|

|

|

S-26

|

|

|

|

|

Prospectus dated December 22, 2015

|

|

|

|

|

|

Available Information

|

|

|

2

|

|

|

Prospectus Summary

|

|

|

4

|

|

|

Risks Relating to Regulatory Resolution Strategies and Long-Term Debt Requirements

|

|

|

8

|

|

|

Use of Proceeds

|

|

|

11

|

|

|

Description of Debt Securities We May Offer

|

|

|

12

|

|

|

Description of Warrants We May Offer

|

|

|

42

|

|

|

Description of Purchase Contracts We May Offer

|

|

|

59

|

|

|

Description of Units We May Offer

|

|

|

64

|

|

|

Description of Preferred Stock We May Offer

|

|

|

70

|

|

|

Description of Capital Stock of The Goldman Sachs Group, Inc.

|

|

|

78

|

|

|

Legal Ownership and Book-Entry Issuance

|

|

|

83

|

|

|

Considerations Relating to Floating Rate Securities

|

|

|

88

|

|

|

Considerations Relating to Indexed Securities

|

|

|

90

|

|

|

Considerations Relating to Securities Denominated or Payable in or Linked to a Non-U.S. Dollar Currency

|

|

|

91

|

|

|

United States Taxation

|

|

|

94

|

|

|

Plan of Distribution

|

|

|

118

|

|

|

Conflicts of Interest

|

|

|

121

|

|

|

Employee Retirement Income Security Act

|

|

|

122

|

|

|

Validity of the Securities

|

|

|

123

|

|

|

Experts

|

|

|

123

|

|

|

Review of Unaudited Condensed Consolidated Financial Statements by Independent Registered Public Accounting Firm

|

|

|

124

|

|

$

The Goldman Sachs Group, Inc.

Callable Floating Rate Notes due

Goldman, Sachs & Co.

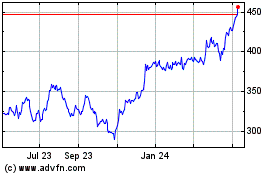

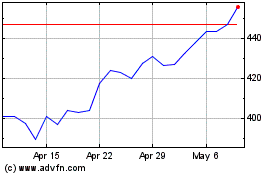

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Apr 2023 to Apr 2024