|

|

RBC Capital Markets® |

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-208507

|

| |

|

|

|

|

|

|

|

|

| |

|

|

Pricing Supplement

Dated February 3, 2016

To the Product Prospectus Supplement Dated January 21, 2016,

Prospectus Dated January 8, 2016 and Prospectus Supplement

Dated January 8, 2016

|

|

$8,342,000

Direct Investment Notes Linked to

the EquityCompass Equity Risk Management

Strategy, Due March 8, 2017

Royal Bank of Canada

|

|

|

|

|

|

Royal Bank of Canada is offering the Direct Investment Notes (the “notes”) linked to the performance of the EquityCompass Equity Risk Management Strategy (the “Strategy”). The Strategy is a set of rules used to construct a hypothetical portfolio (the “Portfolio”) of different combinations of cash and long/short positions in the S&P 500® Total Return Index (the “Index”).

The CUSIP number for the notes is 78012KKQ9. The notes will be automatically called for an amount based on the Final Value of the Portfolio on the Early Valuation Date (as defined below) if the value of the Portfolio is less than or equal to 50% of the Initial Investment (as defined below) on any trading day. If the notes are not called, the notes will pay an amount at maturity based on the Final Value of the Portfolio on the Valuation Date. Investors are subject to potential loss of the principal amount of the notes if the Final Value of the Portfolio is less than $1,000. The notes do not pay interest. Any payments on the notes are subject to our credit risk.

Issue Date: February 8, 2016

Maturity Date: March 8, 2017

The notes will not be listed on any U.S. securities exchange.

Investing in the notes involves a number of risks. See “Risk Factors” beginning on page P-6 of this pricing supplement, page S-1 of the prospectus supplement dated January 8, 2016, and page PS-3 of the product prospectus supplement dated January 21, 2016.

The notes will not constitute deposits insured by the Canada Deposit Insurance Corporation, the U.S. Federal Deposit Insurance Corporation (the “FDIC”) or any other Canadian or U.S. government agency or instrumentality.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined that this pricing supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Note

|

|

Total

|

|

Price to public for notes sold to brokerage accounts

|

100.00%

|

|

$6,096,000

|

|

Underwriting discounts and commissions

|

1.40%

|

|

$85,344

|

|

Proceeds to Royal Bank of Canada

|

98.60%

|

|

$6,010,656

|

| |

|

|

|

| |

Per Note(1)

|

|

Total(1)

|

|

Price to public for notes sold to fee-based advisory accounts

|

98.60%

|

|

$2,214,556

|

|

Underwriting discounts and commissions

|

0.00%

|

|

$0

|

|

Proceeds to Royal Bank of Canada

|

98.60%

|

|

$2,214,556

|

(1) For $2,246,000 in principal amount of the notes sold to certain fee-based advisory accounts, the price to public and the underwriting discount were 98.60% per unit and 0.00%, respectively.

The initial estimated value of the notes as of the date of this pricing supplement is $975.79 per $1,000 in principal amount, which is less than the price to public. The actual value of the notes at any time will reflect many factors, cannot be predicted with accuracy, and may be less than this amount. We describe our determination of the estimated initial value in more detail below.

RBC Capital Markets, LLC, which we refer to as RBCCM, acting as agent for Royal Bank of Canada, received a commission of $14 per $1,000 in principal amount of the notes for sales of the notes to brokerage accounts and used a portion of that commission to allow selling concessions to other dealers of $14 per $1,000 in principal amount of the notes. The other dealers may forgo, in their sole discretion, some or all of their selling concessions. See “Supplemental Plan of Distribution (Conflicts of Interest).”

With respect to sales to certain fee-based advisory accounts, RBCCM offered the notes at a purchase price of $986 per $1,000 principal amount, and will not receive a commission with respect to such sales.

We may use this pricing supplement in the initial sale of the notes. In addition, RBCCM or another of our affiliates may use this pricing supplement in a market-making transaction in the notes after their initial sale. Unless we or our agent informs the purchaser otherwise in the confirmation of sale, this pricing supplement is being used in a market-making transaction.

RBC Capital Markets, LLC

SUMMARY

The information in this “Summary” section is qualified by the more detailed information set forth in this pricing supplement, the product prospectus supplement, the prospectus supplement, and the prospectus.

|

Issuer:

|

Royal Bank of Canada (“Royal Bank”)

|

|

Issue:

|

Senior Global Medium-Term Notes, Series G

|

|

Underwriter:

|

RBC Capital Markets, LLC (“RBCCM”)

|

|

Currency:

|

U.S. Dollars

|

|

Minimum Investment:

|

$1,000 and minimum denominations of $1,000 in excess thereof

|

|

Pricing Date:

|

February 3, 2016

|

|

Issue Date:

|

February 8, 2016

|

|

CUSIP:

|

78012KKQ9

|

|

Valuation Date:

|

March 3, 2017, subject to extension for market and other disruptions, as described in the product prospectus supplement.

|

|

Interest Payable:

|

None

|

|

Initial Investment:

|

The Initial Investment will equal the product of (a) $1,000 and (b) the Participation Rate, or $981.

|

|

Participation Rate:

|

98.10%

|

|

Payment at Maturity (if

held to maturity):

|

At maturity, for each $1,000 principal amount of your notes, you will receive a cash payment equal to the Final Value of the Portfolio. This amount will not be less than zero.

|

|

Final Value:

|

The value of the Portfolio on the Valuation Date or the Early Valuation Date, as applicable, after giving effect to the Adjustment Amounts, as described below.

|

|

Adjustment Amount:

|

On the pricing date, at each time that the Portfolio is reallocated on a Portfolio Calculation Day and on the Valuation Date or the Early Valuation Date, as applicable, the calculation agent will calculate an Adjustment Amount that will reduce the value of the Portfolio. See the section “The Value of the Portfolio—Adjustment Amounts” in the product prospectus supplement for additional information regarding how the Adjustment Amount will be calculated and its impact on the value of the Portfolio.

|

|

Adjustment Rate:

|

0.15%

|

|

Composition of the

Portfolio:

|

The hypothetical Portfolio to which the notes are linked consists of a combination of (a) cash and/or (b) a long position or a short position in the Index. The Portfolio will be reallocated on a monthly basis as of each Portfolio Calculation Day, based upon the Recommended Equity Allocation (“REA”) Percentage produced by the Strategy each month as described in the product prospectus supplement. See the sections “The EquityCompass Equity Risk Management Strategy” and “The Value of the Portfolio” in the product prospectus supplement for additional information regarding the Strategy and the composition of the Portfolio.

|

|

S&P 500® Total Return

Index:

|

The closing level of the Index on the pricing date was 3,851.529.

|

|

Initial REA

Percentage:

|

The REA Percentage as of the pricing date is a 90% short position in the Index and a 10% cash position. Therefore, the Initial Investment of $981.00 will be deemed to be allocated as follows:

· $882.90 representing a short position in the Index (90% of the Initial Investment)

|

|

· $98.10 in cash (10% of the Initial Investment)

· $0 representing a long position in the Index (0% of the Initial Investment)

|

|

Automatic Call:

|

If, on any trading day before the Valuation Date, the calculation agent determines that the value of the Portfolio is less than or equal to 50% of the Initial Investment (the “Call Trigger Date”), then we will automatically redeem the notes on the Call Date. The amount payable on the notes on the Call Date will equal the Final Value of the Portfolio on the Early Valuation Date.

|

|

Call Date:

|

The fourth business day following the Call Trigger Date, subject to extension for market and other disruptions, as described in the product prospectus supplement.

|

|

Early Valuation Date:

|

The first trading day following the Call Trigger Date, subject to extension for market and other disruptions, as described in the product prospectus supplement.

|

|

Maturity Date:

|

March 8, 2017, subject to extension for market and other disruptions, as described in the product prospectus supplement.

|

|

Term:

|

Approximately thirteen (13) months

|

|

Calculation Agent:

|

RBCCM

|

|

Principal at Risk:

|

The notes are NOT principal protected. You may lose all or a substantial portion of your principal amount at maturity if the Final Value of the Portfolio is less than $1,000.

|

|

U.S. Tax Treatment:

|

By purchasing a note, each holder agrees (in the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to treat the notes as a pre-paid cash-settled derivative contract for U.S. federal income tax purposes. However, the U.S. federal income tax consequences of your investment in the notes are uncertain and the Internal Revenue Service could assert that the notes should be taxed in a manner that is different from that described in the preceding sentence. Please see the discussion (including the opinion of our counsel Morrison & Foerster LLP) in the product prospectus supplement under “Supplemental Discussion of U.S. Federal Income Tax Consequences,” which applies to the notes.

|

|

Distribution:

|

The notes are not intended for purchase by any investor that is not a United States person, as that term is defined for U.S. federal income tax purposes, and RBCCM will not make offers of the notes to any such investor.

|

|

Secondary Market:

|

RBCCM (or one of its affiliates), though not obligated to do so, plans to maintain a secondary market in the notes after the Issue Date. The amount that you may receive upon sale of your notes prior to maturity may be less than the principal amount of your notes.

|

|

Listing:

|

The notes will not be listed on any securities exchange.

|

|

Clearance and

Settlement:

|

DTC global (including through its indirect participants Euroclear and Clearstream, Luxembourg as described under “Description of Debt Securities—Ownership and Book-Entry Issuance” in the prospectus).

|

|

Terms Incorporated in

the Master Note:

|

All of the terms appearing above the item captioned “Secondary Market” on pages P-2, P-3 and P-4 of this pricing supplement and the terms appearing under the caption “General Terms of the Notes” in the product prospectus supplement, as modified by this pricing supplement.

|

ADDITIONAL TERMS OF YOUR NOTES

You should read this pricing supplement together with the prospectus dated January 8, 2016, as supplemented by the prospectus supplement dated January 8, 2016 and the product prospectus supplement dated January 21, 2016, relating to our Senior Global Medium-Term Notes, Series G, of which these notes are a part. Capitalized terms used but not defined in this pricing supplement will have the meanings given to them in the product prospectus supplement. In the event of any conflict, this pricing supplement will control.

This pricing supplement, together with the documents listed below, contains the terms of the notes and supersedes all prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the prospectus supplement dated January 8, 2016 and in the product prospectus supplement dated January 21, 2016, as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the notes. You may access these documents on the Securities and Exchange Commission (the “SEC”) website at www.sec.gov as follows (or if that address has changed, by reviewing our filings for the relevant date on the SEC website):

Prospectus dated January 8, 2016:

Prospectus Supplement dated January 8, 2016:

Product Prospectus Supplement dated January 21, 2016:

Our Central Index Key, or CIK, on the SEC website is 1000275. As used in this pricing supplement, the “Company,” “we,” “us,” or “our” refers to Royal Bank of Canada.

HYPOTHETICAL RETURNS

The examples set out below are included for illustration purposes only. The hypothetical values of the Portfolio are not estimates or forecasts of the Final Value or the value of the Portfolio on any trading day prior to the Valuation Date. Each example is based on the Participation Rate of 98.10% and the Initial Investment of $981 and assumes that a holder has purchased the notes with an aggregate principal amount of $1,000 and that no market disruption event has occurred on the Valuation Date or the Early Valuation Date.

Example 1 — The hypothetical Final Value of the Portfolio on the Valuation Date is $762.85.

In this example, the value of the Portfolio decreased by 22.24% from the Initial Investment and the Payment at Maturity equals $762.85. The investor’s return would be -23.72%.

Example 2 — The hypothetical Final Value of the Portfolio on the Valuation Date is $981.00.

In this example, the value of the Portfolio increased by 0.00% from the Initial Investment and the Payment at Maturity equals $981.00. The investor’s return would be -1.90%.

Example 3 — The hypothetical Final Value of the Portfolio on the Valuation Date is $1,209.08.

In this example, the value of the Portfolio increased by 23.25% from the Initial Investment and the Payment at Maturity equals $1,209.08. The investor’s return would be 20.91%.

Example 4 — The hypothetical value of the Portfolio on a trading day prior to the Valuation Date is $484.52, which is less than 50% of the Initial Investment, resulting in an Automatic Call.

The hypothetical Final Value of the Portfolio on the Early Valuation Date, which is one trading day after the Call Trigger Date, is $474.38.

In this example, the value of the Portfolio decreased by 51.64% and the payment on the Call Date equals $474.38. The investor’s return would be -52.56%.

RISK FACTORS

An investment in the notes entails other risks not associated with an investment in conventional debt securities. You should carefully review the detailed explanation of the risks relating to the notes under the section “Risk Factors” in the product prospectus supplement, prospectus supplement and prospectus. In light of the complexity of the transaction described in this pricing supplement, you are urged to consult with your own attorneys and business and tax advisors before making a decision to purchase any of the notes.

|

· |

Your investment in the notes will result in a loss if the Final Value of the Portfolio is less than $1,000. As a result, the value of the Portfolio must increase after the pricing date in order for you to receive a positive return on the notes. |

|

· |

An automatic call will result in a loss of your principal. |

|

· |

The return on the notes may be less than the yield on a conventional debt security of comparable maturity. |

|

· |

The value of the Portfolio will decrease if the REA Percentage does not properly reflect the percentage increase or decrease of the level of the Index after the applicable Portfolio Calculation Day. |

|

· |

The value of the Portfolio will depend upon the success of the Strategy. |

|

· |

Because the Portfolio may be allocated to cash or to a short position in the Index, your return on the notes is not expected to correspond with increases and decreases in the level of the Index. |

|

· |

The amount deemed to be applied to the Portfolio (the “Initial Investment”) will be less than your principal amount of the notes, which will reduce your return on the notes. |

|

· |

The value of the Portfolio will be reduced based upon the applicable Adjustment Amount. |

|

· |

An investment based upon the Portfolio is not actively managed. |

|

· |

There may not be an active trading market for the notes—sales in the secondary market, if any, may result in significant losses. |

|

· |

The market value of the notes may be influenced by many unpredictable factors. |

|

· |

The historical performance of the Portfolio and the Index is not an indication of their future performance. |

|

· |

You must independently evaluate the merits of an investment in the notes. |

|

· |

Payments on the notes are subject to our credit risk, and changes in our credit ratings are expected to affect the market value of the notes. |

|

· |

Hedging activities may affect the value of the notes. |

|

· |

The initial estimated value of the notes is less than the price to the public. The initial estimated value set forth on the cover page does not represent a minimum price at which we, RBCCM or any of our affiliates would be willing to purchase the notes in any secondary market (if any exists) at any time. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for them and the initial estimated value. This is due to, among other things, changes in the performance of the Strategy, the borrowing rate we pay to issue securities of this kind, and the inclusion in the price to the public of the underwriting discount and the estimated costs relating to our hedging of the notes. These factors, together with various credit, market and economic factors over the term of the notes, are expected to reduce the price at which you may be able to sell the notes in |

any secondary market and will affect the value of the notes in complex and unpredictable ways. Assuming no change in market conditions or any other relevant factors, the price, if any, at which you may be able to sell your notes prior to maturity may be less than your original purchase price, as any such sale price would not be expected to include the underwriting discount and the hedging costs relating to the notes. In addition to bid-ask spreads, the value of the notes determined for any secondary market price is expected to be based on the secondary rate rather than the internal funding rate used to price the notes and determine the initial estimated value. As a result, the secondary price will be less than if the internal funding rate was used. The notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your notes to maturity.

|

· |

The initial estimated value of the notes on the cover page is an estimate only, calculated as of the time the terms of the notes were set. The initial estimated value of the notes is based on the value of our obligation to make the payments on the notes, together with the mid-market value of the derivative embedded in the terms of the notes. See “Structuring the Notes” below. Our estimate is based on a variety of assumptions, including our credit spreads, expectations as to dividends, interest rates and volatility, and the expected term of the notes. These assumptions are based on certain forecasts about future events, which may prove to be incorrect. Other entities may value the notes or similar securities at a price that is significantly different than we do. |

|

· |

The business activities of Royal Bank or its affiliates may create conflicts of interest. |

|

· |

There are potential conflicts of interest between you and the calculation agent. |

|

· |

EquityCompass Strategies’ use of its discretion to make certain judgments in connection with the REA Percentage may create conflicts of interest and may affect the value of the Portfolio and amount payable of the notes. |

|

· |

Significant aspects of the tax treatment of the notes may be uncertain. |

ADDITIONAL INFORMATION REGARDING THE STRATEGY AND THE INDEX

We have derived all information regarding the Strategy, the Portfolio and the Index from publicly available sources. We describe the Strategy and the Portfolio in more detail in the section entitled “The EquityCompass Equity Risk Management Strategy” beginning on page PS-19 of the product prospectus supplement, and we describe the Index in more detail in the section entitled “The S&P 500® Total Return Index” beginning on page PS-31 of the product prospectus supplement.

General

The Strategy seeks to offer exposure to U.S. large-cap stocks, while reducing the downside risk of such an investment. The Strategy consists of a set of rules used to construct the Portfolio of different combinations of (a) cash and/or (b) a long or short position in the Index (each, a “Portfolio Component,” and together, the “Portfolio Components”). The Strategy uses a short position in the Index to reduce the risk associated with a decline in the Index.

The Strategy allocates the Portfolio among the Portfolio Components by reference to a REA Percentage that is updated on a monthly basis. The REA Percentage represents the average of:

|

· |

a calculation called the “Directional Earnings Model”, which is based upon the monthly changes in earnings-per-share estimates for the components of the Index, with increases in such estimates resulting in an increased percentage allocation of the Portfolio to a long position in the Index; and |

|

· |

a calculation called the “Technical Price Model”, which compares recent levels of the DJIASM to (a) its all-time highest level and (b) the lowest level of the DJIASM after that all-time high. |

EquityCompass Strategies (the “Sponsor”) first published the Strategy in January 2009. The Sponsor is a wholly-owned subsidiary and affiliated SEC-registered investment adviser of Stifel Financial Corp., and an affiliate of Stifel, Nicolaus & Company, Incorporated. The Sponsor calculates the allocation of the Portfolio among cash and/or long and short positions in the Index at or around the close of business, New York time, on each Portfolio Calculation Day. The Sponsor publishes that allocation shortly thereafter on its website www.equitycompass.com. We have included that website (and the additional websites below) in this pricing supplement as inactive textual references only. Information on those websites is not part of this pricing supplement. We provide no assurance that the Sponsor will continue to publish this information, or with what frequency it will do so.

HISTORICAL INFORMATION

The table below sets forth the following information with respect to the Index and the Portfolio, for each calendar month from January 2007 to January 2016:

|

· |

the REA Percentage that was in effect with respect to the Strategy for the applicable month; |

|

· |

the level of the Index as of the last trading day of the applicable month, based on data provided by Bloomberg; |

|

· |

the percentage increase or decrease in the level of the Index from the beginning of the applicable month until the last trading day of the applicable month, based on data provided by Bloomberg; |

|

· |

the value of the Portfolio (based on a hypothetical value of $1,000 as of December 29, 2006), based on data provided by the Sponsor; and |

|

· |

the percentage increase or decrease in the value of the Portfolio from the beginning until the end of the applicable month, based on data provided by the Sponsor. |

In addition to the information set forth in the table below, the term of the notes is 13 months. A hypothetical investment in the Strategy from December 31, 2014 to January 29, 2016 (a term corresponding to the approximate term of the notes) would have generated a return of approximately -0.4%. The return of the Index during that period was -3.6%.

The historical levels and returns of the Index and the Portfolio should not be taken as an indication of their future performance, and no assurance can be given as to the Final Value or the value of the Portfolio on any trading day prior to the Valuation Date. We cannot give you assurance that the performance of the Index or the Portfolio will result in any return on your investment in the notes, or that you will not lose any portion of your investment.

In particular, we note that the amounts above and below relating to the Portfolio and the Strategy do not reflect the accrual of any interest on the cash portion of the Portfolio, or the impact of the Participation Rate and the Adjustment Amounts, as would apply to an investment in the notes. The amounts shown are intended solely to provide an indication of movements in the Portfolio during the indicated periods, and should not be construed to be indicative of the future performance of the Portfolio, or the amount that you will receive on the notes.

| |

|

|

|

The Index

|

|

EquityCompass Equity Risk

Management Portfolio

|

|

Date

|

|

REA %

|

|

Index Level

|

|

% Change

|

|

|

|

% Change

|

|

12/29/2006

|

|

100%

|

|

2,186.13

|

|

|

|

1,000.00

|

|

|

|

1/31/2007

|

|

100%

|

|

2,219.19

|

|

1.51%

|

|

1,015.12

|

|

1.51%

|

|

2/28/2007

|

|

100%

|

|

2,175.79

|

|

-1.96%

|

|

995.27

|

|

-1.96%

|

|

3/30/2007

|

|

100%

|

|

2,200.12

|

|

1.12%

|

|

1,006.40

|

|

1.12%

|

|

4/30/2007

|

|

100%

|

|

2,297.58

|

|

4.43%

|

|

1,050.98

|

|

4.43%

|

|

5/31/2007

|

|

100%

|

|

2,377.75

|

|

3.49%

|

|

1,087.65

|

|

3.49%

|

|

6/29/2007

|

|

100%

|

|

2,338.25

|

|

-1.66%

|

|

1,069.58

|

|

-1.66%

|

|

7/31/2007

|

|

100%

|

|

2,265.75

|

|

-3.10%

|

|

1,036.42

|

|

-3.10%

|

|

8/31/2007

|

|

100%

|

|

2,299.75

|

|

1.50%

|

|

1,051.96

|

|

1.50%

|

|

9/28/2007

|

|

100%

|

|

2,385.72

|

|

3.74%

|

|

1,091.30

|

|

3.74%

|

|

10/31/2007

|

|

100%

|

|

2,423.67

|

|

1.59%

|

|

1,108.66

|

|

1.59%

|

|

11/30/2007

|

|

100%

|

|

2,322.34

|

|

-4.18%

|

|

1,062.31

|

|

-4.18%

|

|

12/31/2007

|

|

50%

|

|

2,306.23

|

|

-0.69%

|

|

1,054.94

|

|

-0.69%

|

|

1/31/2008

|

|

10%

|

|

2,167.90

|

|

-6.00%

|

|

1,054.94

|

|

0.00%

|

|

2/29/2008

|

|

10%

|

|

2,097.48

|

|

-3.25%

|

|

1,083.66

|

|

2.72%

|

|

3/31/2008

|

|

10%

|

|

2,088.42

|

|

-0.43%

|

|

1,081.72

|

|

-0.18%

|

|

4/30/2008

|

|

50%

|

|

2,190.13

|

|

4.87%

|

|

1,033.81

|

|

-4.43%

|

|

5/30/2008

|

|

10%

|

|

2,218.50

|

|

1.30%

|

|

1,033.81

|

|

0.00%

|

|

6/30/2008

|

|

60%

|

|

2,031.47

|

|

-8.43%

|

|

1,116.02

|

|

7.95%

|

|

7/31/2008

|

|

60%

|

|

2,014.39

|

|

-0.84%

|

|

1,110.40

|

|

-0.50%

|

|

8/29/2008

|

|

10%

|

|

2,043.53

|

|

1.45%

|

|

1,120.03

|

|

0.87%

|

|

9/30/2008

|

|

10%

|

|

1,861.44

|

|

-8.91%

|

|

1,192.56

|

|

6.48%

|

|

10/31/2008

|

|

50%

|

|

1,548.81

|

|

-16.79%

|

|

1,336.21

|

|

12.05%

|

|

11/28/2008

|

|

50%

|

|

1,437.68

|

|

-7.18%

|

|

1,336.21

|

|

0.00%

|

|

12/31/2008

|

|

50%

|

|

1,452.98

|

|

1.06%

|

|

1,336.21

|

|

0.00%

|

|

1/30/2009

|

|

10%

|

|

1,330.51

|

|

-8.43%

|

|

1,336.21

|

|

0.00%

|

|

2/27/2009

|

|

10%

|

|

1,188.84

|

|

-10.65%

|

|

1,466.21

|

|

9.73%

|

|

3/31/2009

|

|

50%

|

|

1,292.98

|

|

8.76%

|

|

1,335.37

|

|

-8.92%

|

|

4/30/2009

|

|

10%

|

|

1,416.73

|

|

9.57%

|

|

1,335.37

|

|

0.00%

|

|

5/29/2009

|

|

10%

|

|

1,495.97

|

|

5.59%

|

|

1,265.80

|

|

-5.21%

|

|

6/30/2009

|

|

10%

|

|

1,498.94

|

|

0.20%

|

|

1,258.32

|

|

-0.59%

|

|

7/31/2009

|

|

60%

|

|

1,612.31

|

|

7.56%

|

|

1,315.43

|

|

4.54%

|

|

8/31/2009

|

|

60%

|

|

1,670.52

|

|

3.61%

|

|

1,343.92

|

|

2.17%

|

|

9/30/2009

|

|

100%

|

|

1,732.86

|

|

3.70%

|

|

1,394.07

|

|

3.73%

|

|

10/30/2009

|

|

100%

|

|

1,700.67

|

|

-1.86%

|

|

1,368.18

|

|

-1.86%

|

|

11/30/2009

|

|

100%

|

|

1,802.68

|

|

6.00%

|

|

1,450.24

|

|

6.00%

|

|

12/31/2009

|

|

95%

|

|

1,837.50

|

|

1.93%

|

|

1,476.85

|

|

1.83%

|

|

1/29/2010

|

|

95%

|

|

1,771.40

|

|

-3.60%

|

|

1,426.38

|

|

-3.42%

|

|

2/26/2010

|

|

95%

|

|

1,826.27

|

|

3.10%

|

|

1,468.36

|

|

2.94%

|

|

3/31/2010

|

|

95%

|

|

1,936.48

|

|

6.03%

|

|

1,552.54

|

|

5.73%

|

|

4/30/2010

|

|

95%

|

|

1,967.05

|

|

1.58%

|

|

1,575.82

|

|

1.50%

|

|

5/28/2010

|

|

95%

|

|

1,809.98

|

|

-7.99%

|

|

1,456.28

|

|

-7.59%

|

|

6/30/2010

|

|

95%

|

|

1,715.23

|

|

-5.23%

|

|

1,383.86

|

|

-4.97%

|

|

7/30/2010

|

|

95%

|

|

1,835.40

|

|

7.01%

|

|

1,475.97

|

|

6.66%

|

|

8/31/2010

|

|

95%

|

|

1,752.55

|

|

-4.51%

|

|

1,412.67

|

|

-4.29%

|

|

9/30/2010

|

|

95%

|

|

1,908.95

|

|

8.92%

|

|

1,532.44

|

|

8.48%

|

|

10/29/2010

|

|

95%

|

|

1,981.59

|

|

3.80%

|

|

1,587.83

|

|

3.61%

|

|

11/30/2010

|

|

95%

|

|

1,981.84

|

|

0.01%

|

|

1,588.02

|

|

0.01%

|

|

12/31/2010

|

|

95%

|

|

2,114.29

|

|

6.68%

|

|

1,688.85

|

|

6.35%

|

|

1/31/2011

|

|

100%

|

|

2,164.40

|

|

2.37%

|

|

1,728.88

|

|

2.37%

|

|

2/28/2011

|

|

100%

|

|

2,238.55

|

|

3.43%

|

|

1,788.11

|

|

3.43%

|

|

3/31/2011

|

|

100%

|

|

2,239.44

|

|

0.04%

|

|

1,788.82

|

|

0.04%

|

|

4/29/2011

|

|

100%

|

|

2,305.76

|

|

2.96%

|

|

1,841.79

|

|

2.96%

|

|

5/31/2011

|

|

100%

|

|

2,279.66

|

|

-1.13%

|

|

1,820.95

|

|

-1.13%

|

|

6/30/2011

|

|

100%

|

|

2,241.66

|

|

-1.67%

|

|

1,790.59

|

|

-1.67%

|

|

7/29/2011

|

|

100%

|

|

2,196.08

|

|

-2.03%

|

|

1,754.18

|

|

-2.03%

|

|

8/31/2011

|

|

100%

|

|

2,076.78

|

|

-5.43%

|

|

1,658.89

|

|

-5.43%

|

|

9/30/2011

|

|

50%

|

|

1,930.79

|

|

-7.03%

|

|

1,658.89

|

|

0.00%

|

|

10/31/2011

|

|

45%

|

|

2,141.81

|

|

10.93%

|

|

1,562.91

|

|

-5.79%

|

|

11/30/2011

|

|

50%

|

|

2,137.08

|

|

-0.22%

|

|

1,562.91

|

|

0.00%

|

|

12/30/2011

|

|

50%

|

|

2,158.94

|

|

1.02%

|

|

1,562.91

|

|

0.00%

|

|

1/31/2012

|

|

100%

|

|

2,255.69

|

|

4.48%

|

|

1,632.95

|

|

4.48%

|

|

2/29/2012

|

|

100%

|

|

2,353.23

|

|

4.32%

|

|

1,703.56

|

|

4.32%

|

|

3/31/2012

|

|

100%

|

|

2,430.68

|

|

3.29%

|

|

1,759.62

|

|

3.29%

|

|

4/30/2012

|

|

100%

|

|

2,415.42

|

|

-0.63%

|

|

1,748.58

|

|

-0.63%

|

|

5/31/2012

|

|

100%

|

|

2,270.25

|

|

-6.01%

|

|

1,643.49

|

|

-6.01%

|

|

6/29/2012

|

|

100%

|

|

2,363.79

|

|

4.12%

|

|

1,711.20

|

|

4.12%

|

|

7/31/2012

|

|

100%

|

|

2,396.62

|

|

1.39%

|

|

1,734.97

|

|

1.39%

|

|

8/31/2012

|

|

50%

|

|

2,450.60

|

|

2.25%

|

|

1,734.97

|

|

0.00%

|

|

9/28/2012

|

|

50%

|

|

2,513.93

|

|

2.58%

|

|

1,734.97

|

|

0.00%

|

|

10/31/2012

|

|

100%

|

|

2,467.51

|

|

-1.85%

|

|

1,702.94

|

|

-1.85%

|

|

11/30/2012

|

|

100%

|

|

2,481.82

|

|

0.58%

|

|

1,712.81

|

|

0.58%

|

|

12/31/2012

|

|

100%

|

|

2,504.44

|

|

0.91%

|

|

1,728.43

|

|

0.91%

|

|

1/31/2013

|

|

100%

|

|

2,634.16

|

|

5.18%

|

|

1,817.95

|

|

5.18%

|

|

2/28/2013

|

|

100%

|

|

2,669.92

|

|

1.36%

|

|

1,842.63

|

|

1.36%

|

|

3/28/2013

|

|

100%

|

|

2,770.05

|

|

3.75%

|

|

1,911.73

|

|

3.75%

|

|

4/30/2013

|

|

100%

|

|

2,823.42

|

|

1.93%

|

|

1,948.57

|

|

1.93%

|

|

5/31/2013

|

|

100%

|

|

2,889.46

|

|

2.34%

|

|

1,994.15

|

|

2.34%

|

|

6/28/2013

|

|

100%

|

|

2,850.66

|

|

-1.34%

|

|

1,967.37

|

|

-1.34%

|

|

7/31/2013

|

|

100%

|

|

2,995.72

|

|

5.09%

|

|

2,067.48

|

|

5.09%

|

|

8/30/2013

|

|

100%

|

|

2,908.96

|

|

-2.90%

|

|

2,007.60

|

|

-2.90

|

|

9/30/2013

|

|

100%

|

|

3,000.18

|

|

3.14%

|

|

2,070.56

|

|

3.14%

|

|

10/31/2013

|

|

100%

|

|

3,138.09

|

|

4.60%

|

|

2,165.73

|

|

4.60%

|

|

11/29/2013

|

|

100%

|

|

3,233.72

|

|

3.05%

|

|

2,231.73

|

|

3.05%

|

|

12/31/2013

|

|

100%

|

|

3,315.59

|

|

2.53%

|

|

2,288.23

|

|

2.53%

|

|

1/31/2014

|

|

100%

|

|

3,200.95

|

|

-3.46%

|

|

2,209.12

|

|

-3.46%

|

|

2/28/2014

|

|

100%

|

|

3,347.38

|

|

4.57%

|

|

2,310.17

|

|

4.57%

|

|

3/31/2014

|

|

100%

|

|

3,375.51

|

|

0.84%

|

|

2,329.59

|

|

0.84%

|

|

4/30/2014

|

|

100%

|

|

3,400.47

|

|

0.74%

|

|

2,346.81

|

|

0.74%

|

|

5/30/2014

|

|

100%

|

|

3,480.29

|

|

2.35%

|

|

2,401.90

|

|

2.35%

|

|

6/30/2014

|

|

100%

|

|

3,552.18

|

|

2.07%

|

|

2,451.52

|

|

2.07%

|

|

7/31/2014

|

|

100%

|

|

3,503.19

|

|

-1.38%

|

|

2,417.71

|

|

-1.38%

|

|

8/29/2014

|

|

100%

|

|

3,643.34

|

|

4.00%

|

|

2,514.43

|

|

4.00%

|

|

9/30/2014

|

|

100%

|

|

3,592.25

|

|

-1.40%

|

|

2,479.17

|

|

-1.40%

|

|

10/31/2014

|

|

100%

|

|

3,679.99

|

|

2.44%

|

|

2,539.72

|

|

2.44%

|

|

11/28/2014

|

|

100%

|

|

3,778.96

|

|

2.69%

|

|

2,608.03

|

|

2.69%

|

|

12/31/2014

|

|

50%

|

|

3,769.44

|

|

-0.25%

|

|

2,608.03

|

|

0.00%

|

|

1/30/2015

|

|

50%

|

|

3,656.28

|

|

-3.00%

|

|

2,608.03

|

|

0.00%

|

|

2/27/2015

|

|

50%

|

|

3,866.42

|

|

5.75%

|

|

2,608.03

|

|

0.00%

|

|

3/31/2015

|

|

50%

|

|

3,805.27

|

|

-1.58%

|

|

2,608.03

|

|

0.00%

|

|

4/30/2015

|

|

100%

|

|

3,841.78

|

|

0.96%

|

|

2,633.05

|

|

0.96%

|

|

5/29/2015

|

|

100%

|

|

3,891.18

|

|

1.29%

|

|

2,666.90

|

|

1.29%

|

|

6/30/2015

|

|

100%

|

|

3,815.85

|

|

-1.94%

|

|

2,615.28

|

|

-1.94%

|

|

7/31/2015

|

|

100%

|

|

3,895.80

|

|

2.10%

|

|

2,670.07

|

|

2.10%

|

|

8/31/2015

|

|

100%

|

|

3,660.75

|

|

-6.03%

|

|

2,508.98

|

|

-6.03%

|

|

9/30/2015

|

|

60%

|

|

3,570.17

|

|

-2.47%

|

|

2,471.73

|

|

-1.48%

|

|

10/30/2015

|

|

60%

|

|

3,871.33

|

|

8.44%

|

|

2,596.83

|

|

5.06%

|

|

11/30/2015

|

|

50%

|

|

3,882.84

|

|

0.30%

|

|

2,596.83

|

|

0.00%

|

|

12/30/2015

|

|

50%

|

|

3,821.60

|

|

-1.58%

|

|

2,596.83

|

|

0.00%

|

|

1/29/2016

|

|

50%

|

|

3,631.96

|

|

-4.96%

|

|

2,596.83

|

|

0.00%

|

SUPPLEMENTAL PLAN OF DISTRIBUTION (CONFLICTS OF INTEREST)

Delivery of the notes will be made against payment for the notes on February 8, 2016, which is the third (3rd) business day following the pricing date (this settlement cycle being referred to as “T+3”). See “Plan of Distribution” in the prospectus dated January 8, 2016. For additional information as to the relationship between us and RBCCM, please see the section “Plan of Distribution—Conflicts of Interest” in the prospectus dated January 8, 2016.

In the initial offering of the notes, RBCCM offered the notes at a purchase price equal to par, except with respect to certain accounts as indicated on the cover page of this document.

The value of the notes shown on your account statement may be based on RBCCM’s estimate of the value of the notes if RBCCM or another of our affiliates were to make a market in the notes (which it is not obligated to do). That estimate will be based upon the price that RBCCM may pay for the notes in light of then prevailing market conditions, our creditworthiness and transaction costs. For a period of no longer than three months after the issue date of the notes, the value of the notes that may be shown on your account statement may be higher than RBCCM’s estimated value of the notes at that time. This is because the estimated value of the notes will not include the underwriting discount and our hedging costs and profits; however, the value of the notes shown on your account statement during that period is initially expected to be a higher amount, reflecting the addition of RBCCM’s underwriting discount and our estimated costs and profits from hedging the notes. This excess is expected to decrease over time until the end of this period. After this period, if RBCCM repurchases your notes, it expects to do so at prices that reflect their estimated value.

STRUCTURING THE NOTES

The notes are our debt securities, the return on which is linked to the performance of the Strategy. As is the case for all of our debt securities, including our structured notes, the economic terms of the notes reflect our actual or perceived creditworthiness at the time of pricing. In addition, because structured notes result in increased operational, funding and liability management costs to us, we typically borrow the funds under these notes at a rate that is more favorable to us than the rate that we might pay for a conventional fixed or floating rate debt security of comparable maturity. Using this relatively lower implied borrowing rate rather than the secondary market rate, is a factor that reduced the initial estimated value of the notes at the time their terms were set. Unlike the estimated value included in this pricing supplement, any value of the notes determined for purposes of a secondary market transaction may be based on a different funding rate, which may result in a lower value for the notes than if our initial internal funding rate were used.

In order to satisfy our payment obligations under the notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) on the issue date with RBCCM or one of our other subsidiaries. The terms of these hedging arrangements take into account a number of factors, including our creditworthiness, interest rate movements, the volatility of the Strategy, and the tenor of the notes. The economic terms of the notes and their initial estimated value depend in part on the terms of these hedging arrangements.

The lower implied borrowing rate is a factor that reduces the economic terms of the notes to you. The initial offering price of the notes also reflects the underwriting commission and our estimated hedging costs. These factors resulted in the initial estimated value for the notes on the pricing date being less than their public offering price. See “Risk Factors — The initial estimated value of the notes is less than the price to the public” above.

VALIDITY OF THE NOTES

In the opinion of Norton Rose Fulbright Canada LLP, the issue and sale of the notes has been duly authorized by all necessary corporate action of the Bank in conformity with the Indenture, and when the notes have been duly executed, authenticated and issued in accordance with the Indenture and delivered against payment therefor, the notes will be validly issued and, to the extent validity of the notes is a matter governed by the laws of the Province of Ontario or Québec, or the laws of Canada applicable therein, and will be valid obligations of the Bank, subject to equitable remedies which may only be granted at the discretion of a court of competent authority, subject to applicable bankruptcy, to rights to indemnity and contribution under the notes or the Indenture which may be limited by applicable law, to insolvency and other laws of general application affecting creditors’ rights, to limitations under applicable limitations statutes, and subject to limitations as to the currency in which judgments in Canada may be rendered, as prescribed by the Currency Act (Canada). This opinion is given as of the date hereof and is limited to the laws of the Provinces of Ontario and Quebec and the federal laws of Canada applicable thereto. In addition, this opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and certain factual matters, all as stated in the letter of such counsel dated January 8, 2016, which has been filed as Exhibit 5.1 to Royal Bank’s Form 6-K filed with the SEC dated January 8, 2016.

In the opinion of Morrison & Foerster LLP, when the notes have been duly completed in accordance with the Indenture and issued and sold as contemplated by the prospectus supplement and the prospectus, the notes will be valid, binding and enforceable obligations of Royal Bank, entitled to the benefits of the Indenture, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith). This opinion is given as of the date hereof and is limited to the laws of the State of New York. This opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain factual matters, all as stated in the legal opinion dated January 8, 2016, which has been filed as Exhibit 5.2 to the Bank’s Form 6-K dated January 8, 2016.

| |

P-14

|

RBC Capital Markets, LLC

|

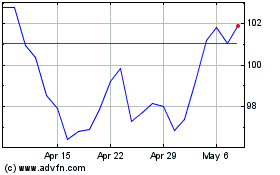

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024