|

PRICING SUPPLEMENT

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-203433

Dated June 25, 2015

|

|

Royal Bank of Canada Trigger Performance Securities

$8,518,420 Linked to the iShares® MSCI EAFE ETF due on June 30, 2020

|

Investment Description

|

|

Trigger Performance Securities are unconditional, unsecured and unsubordinated debt securities issued by Royal Bank of Canada with returns linked to the performance of the iShares® MSCI EAFE ETF (the “Underlying Equity”) (each, a “Security” and collectively, the “Securities”). If the Underlying Return is positive, Royal Bank of Canada will repay the principal amount at maturity plus a return equal to the Underlying Return multiplied by the Participation Rate. If the Underlying Return is zero or negative, and the Final Price is greater than or equal to the Trigger Price, we will pay you the principal amount at maturity. If the Final Price is less than the Trigger Price, we will pay less than the full principal amount at maturity, if anything, resulting in a loss on your initial investment that is proportionate to the negative performance of the Underlying Equity over the term of the Securities, and you may lose up to 100% of your initial investment. Investing in the Securities involves significant risks. The Securities do not pay dividends or interest. You may lose some or all of your principal amount. The contingent repayment of principal applies only if you hold the Securities to maturity. Any payment on the Securities, including any repayment of principal, is subject to our creditworthiness. If we were to default on our payment obligations, you may not receive any amounts owed to you under the Securities and you could lose your entire investment. The Securities will not be listed on any securities exchange.

|

|

Features

|

|

Key Dates

|

|

q Participation in Positive Underlying Returns— At maturity, if the Underlying Return is positive, we will pay you the principal amount plus a return equal to the Underlying Return times the Participation Rate of 146.64%. If the Underlying Return is negative, investors may be exposed to the negative Underlying Return at maturity.

q Contingent Repayment of Principal — If the Underlying Return is negative, and the Final Price is not below the Trigger Price, Royal Bank of Canada will repay your principal amount. However, if the Final Price is less than the Trigger Price, investors will be exposed to the full downside performance of the Underlying Equity and we will pay less than the principal amount, resulting in a loss of the principal amount that is proportionate to the percentage decline in the Underlying Equity. Accordingly, you may lose some or all of the principal amount of the Securities. The contingent repayment of principal applies only at maturity. Any payment on the Securities, including any repayment of principal, is subject our creditworthiness.

|

|

Trade Date June 25, 2015

Settlement Date June 30, 2015

Final Valuation Date1 June 24, 2020

Maturity Date1 June 30, 2020

1 Subject to postponement in the event of a market disruption event and as described under “General Terms of the Securities — Payment at Maturity” in the accompanying product prospectus supplement no. ES-TPS-1.

|

|

NOTICE TO INVESTORS: THE SECURITIES ARE SIGNIFICANTLY RISKIER THAN CONVENTIONAL DEBT INSTRUMENTS. THE ISSUER IS NOT NECESSARILY OBLIGATED TO REPAY THE FULL PRINCIPAL AMOUNT OF THE SECURITIES AT MATURITY, AND THE SECURITIES CAN HAVE THE FULL DOWNSIDE MARKET RISK OF THE UNDERLYING EQUITY. THIS MARKET RISK IS IN ADDITION TO THE CREDIT RISK INHERENT IN PURCHASING OUR DEBT OBLIGATION. YOU SHOULD NOT PURCHASE THE SECURITIES IF YOU DO NOT UNDERSTAND OR ARE NOT COMFORTABLE WITH THE SIGNIFICANT RISKS INVOLVED IN INVESTING IN THE SECURITIES.

YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER ‘‘KEY RISKS’’ BEGINNING ON PAGE 5 OF THIS PRICING SUPPLEMENT AND UNDER “RISK FACTORS” BEGINNING ON PAGE PS-3 OF THE ACCOMPANYING PRODUCT PROSPECTUS SUPPLEMENT NO. ES-TPS-1 BEFORE PURCHASING ANY SECURITIES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES, COULD ADVERSELY AFFECT THE MARKET VALUE OF, AND THE RETURN ON, YOUR SECURITIES. YOU COULD LOSE SOME OR ALL OF THE PRINCIPAL AMOUNT OF THE SECURITIES.

|

|

Security Offering

|

|

We are offering Trigger Performance Securities Linked to the iShares® MSCI EAFE ETF (“EFA”). The Securities are not subject to a predetermined maximum gain and, accordingly, any return at maturity will be determined by the performance of the Underlying Equity. The Securities are offered at a minimum investment of 100 Securities at the Price to Public described below.

|

|

Underlying Equity

|

Participation Rate

|

Initial Price

|

Trigger Price

|

CUSIP

|

ISIN

|

|

|

|

iShares® MSCI EAFE ETF (EFA)

|

146.64%

|

$65.77

|

$49.33, which is 75% of the Initial Price (rounded to two decimal places)

|

78013D219

|

US78013D2190

|

|

|

See “Additional Information About Royal Bank of Canada and the Securities” in this pricing supplement. The Securities will have the terms specified in the prospectus dated April 30, 2015, the prospectus supplement dated April 30, 2015, product prospectus supplement no. ES-TPS-1 dated May 18, 2015 and this pricing supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Securities or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying prospectus, prospectus supplement and product prospectus supplement no. ES-TPS-1. Any representation to the contrary is a criminal offense.

| |

Price to Public

|

Fees and Commissions(1)

|

Proceeds to Us

|

|

Offering of the Securities

|

Total

|

Per Security

|

Total

|

Per Security

|

Total

|

Per Security

|

|

Securities linked to iShares® MSCI EAFE ETF (EFA)

|

|

$10.00

|

|

$0.35

|

|

$9.65

|

(1) UBS Financial Services Inc., which we refer to as UBS, will receive a commission of $0.35 per $10 principal amount of the Securities. See “Supplemental Plan of Distribution (Conflicts of Interest)” on page 14 of this pricing supplement.

The initial estimated value of the Securities as of the date of this document is $9.5828 per $10 in principal amount, which is less than the price to public. The actual value of the Securities at any time will reflect many factors, cannot be predicted with accuracy, and may be less than this amount. We describe our determination of the initial estimated value under “Key Risks” beginning on page 5, “Supplemental Plan of Distribution (Conflicts of Interest)” on page 14 and “Structuring the Securities” on page 14 of this pricing supplement.

The Securities will not constitute deposits insured under the Canada Deposit Insurance Corporation Act or by the United States Federal Deposit Insurance Corporation or any other Canadian or United States government agency or instrumentality.

|

UBS Financial Services Inc.

|

RBC Capital Markets, LLC

|

|

Additional Information About Royal Bank of Canada and the Securities

|

You should read this pricing supplement together with the prospectus dated April 30, 2015, as supplemented by the prospectus supplement dated April 30, 2015, relating to our senior global medium-term notes. Series G, of which these Securities are a part, and the more detailed information contained in product prospectus supplement no. ES-TPS-1 dated May 18, 2015. This pricing supplement, together with the documents listed below, contains the terms of the Securities and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in the accompanying product prospectus supplement no. ES-TPS-1, as the Securities involve risks not associated with conventional debt securities.

If the terms discussed in this pricing supplement differ from those discussed in the product prospectus supplement no. ES-TPS-1, the prospectus supplement, or the prospectus, the terms discussed herein will control.

You may access these on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filing for the relevant date on the SEC website):

|

¨

|

Prospectus supplement dated April 30, 2015:

|

|

¨

|

Prospectus dated April 30, 2015:

|

As used in this pricing supplement, the “Company,” “we,” “us” or “our” refers to Royal Bank of Canada.

|

Investor Suitability

|

|

The Securities may be suitable for you if, among other considerations:

¨ You fully understand the risks inherent in an investment in the Securities, including the risk of loss of your entire initial investment.

¨ You can tolerate the loss of all or a substantial portion of the principal amount of the Securities and are willing to make an investment that may have the full downside market risk as a hypothetical investment in the Underlying Equity.

¨ You believe the price of the Underlying Equity will appreciate over the term of the Securities.

¨ You are willing to invest in the Securities based on the Participation Rate indicated on the cover page of this pricing supplement.

¨ You can tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the price of the Underlying Equity.

¨ You are willing to accept the risks of investing in Securities with a return based on the performance of companies in developed international markets.

¨ You do not seek current income from your investment and are willing to forgo dividends paid on the Underlying Equity.

¨ You are willing to hold the Securities to maturity and accept that there may be little or no secondary market for the Securities.

¨ You are willing to assume our credit risk for all payments under the Securities, and understand that if Royal Bank of Canada defaults on its obligations, you may not receive any amounts due to you, including any repayment of principal.

|

|

The Securities may not be suitable for you if, among other considerations:

¨ You do not fully understand the risks inherent in an investment in the Securities, including the risk of loss of your entire initial investment.

¨ You require an investment designed to provide a full return of principal at maturity.

¨ You cannot tolerate the loss of all or a substantial portion of the principal amount of the Securities, and you are not willing to make an investment that may have the full downside market risk as a hypothetical investment in the Underlying Equity.

¨ You believe that the price of the Underlying Equity will decline over the term of the Securities and is likely to close below the Trigger Price on the Final Valuation Date.

¨ You are unwilling to invest in the Securities based on the Participation Rate indicated on the cover page of this pricing supplement.

¨ You cannot tolerate fluctuations in the price of the Securities prior to maturity that may be similar to or exceed the downside fluctuations in the price of the Underlying Equity.

¨ You are unwilling to accept the risks of investing in Securities with a return based on the performance of companies in developed international markets.

¨ You seek current income from this investment or prefer to receive the dividends paid on the Underlying Equity.

¨ You are unable or unwilling to hold the Securities to maturity or you seek an investment for which there will be an active secondary market.

¨ You are not willing to assume our credit risk for all payments under the Securities, including any repayment of principal.

|

The suitability considerations identified above are not exhaustive. Whether or not the Securities are a suitable investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting, and other advisers have carefully considered the suitability of an investment in the Securities in light of your particular circumstances. You should also review carefully the “Key Risks” beginning on page 5 of this pricing supplement and “Risk Factors” in the accompanying product prospectus supplement no. ES-TPS-1 for risks related to an investment in the Securities.

|

Final Terms of the Securities1

|

|

Issuer:

|

|

Royal Bank of Canada

|

| |

|

|

|

Issue Price:

|

|

$10 per Security (subject to a minimum purchase of 100 Securities).

|

| |

|

|

|

Principal Amount:

|

|

$10 per Security.

|

| |

|

|

|

Term:

|

|

Approximately five years

|

| |

|

|

|

Underlying Equity:

|

|

iShares® MSCI EAFE ETF

|

| |

|

|

|

Participation Rate:

|

|

146.64%

|

| |

|

|

|

Payment at Maturity (per $10 Security):

|

|

If the Underlying Return is positive, we will pay you:

$10 + ($10 x Underlying Return x Participation Rate)

If the Underlying Return is zero or negative and the Final Price is greater than or equal to the Trigger Price, we will pay you:

$10

If the Final Price is less than the Trigger Price, we will pay you:

$10 + ($10 x Underlying Return)

In this scenario, you will lose some or all of the principal amount of the Securities in an amount proportionate to the negative Underlying Return.

|

| |

|

|

|

Underlying Return:

|

|

Final Price – Initial Price

Initial Price

|

| |

|

|

|

Initial Price:

|

|

$65.77, which was the Closing Price of the Underlying Equity on the Trade Date.

|

| |

|

|

|

Final Price:

|

|

The Closing Price of the Underlying Equity on the Final Valuation Date.

|

| |

|

|

|

Trigger Price:

|

|

$49.33, which is 75% of the Initial Price (rounded to two decimal places).

|

|

Investment Timeline

|

| |

|

|

|

| |

Trade Date:

|

|

The Participation Rate was set. The Initial Price was determined.

|

| |

|

|

|

| |

Maturity Date:

|

|

The Final Price and Underlying Return are determined.

If the Underlying Return is positive, we will pay you a cash payment per $10.00 Security that provides you with your principal amount plus a return equal to the Underlying Return times the Participation Rate. Your payment at maturity per $10.00 Security will be equal to:

$10 + ($10 x Underlying Return x Participation Rate)

If the Underlying Return is zero or negative and the Final Price is greater than or equal to the Trigger Price, we will pay you a cash payment of $10.00 per $10.00 Security.

If the Final Price is less than the Trigger Price, we will pay you a cash payment that is less than the principal amount of $10.00 per Security, resulting in a loss of principal that is proportionate to the percentage decline in the Underlying Equity, and equal to:

$10.00 + ($10.00 x Underlying Return)

In this scenario, you will lose some or all of the principal amount of the Securities, in an amount proportionate to the negative Underlying Return.

|

INVESTING IN THE SECURITIES INVOLVES SIGNIFICANT RISKS. YOU MAY LOSE SOME OR ALL OF YOUR PRINCIPAL AMOUNT. ANY PAYMENT ON THE SECURITIES, INCLUDING ANY REPAYMENT OF PRINCIPAL, IS SUBJECT TO OUR CREDITWORTHINESS. IF WE WERE TO DEFAULT ON OUR PAYMENT OBLIGATIONS, YOU MAY NOT RECEIVE ANY AMOUNTS OWED TO YOU UNDER THE SECURITIES AND YOU COULD LOSE YOUR ENTIRE INVESTMENT.

____________________

1 Terms used in this pricing supplement, but not defined herein, shall have the meanings ascribed to them in the product prospectus supplement.

An investment in the Securities involves significant risks. Investing in the Securities is not equivalent to investing directly in the Underlying Equity. These risks are explained in more detail in the “Risk Factors” section of the accompanying product prospectus supplement no. ES-TPS-1. Investing in the Securities is not equivalent to investing directly in the Underlying Equity or the securities held by the Underlying Equity. We also urge you to consult your investment, legal, tax, accounting and other advisors before investing in the Securities.

Risks Relating to the Securities Generally

|

|

¨

|

Your Investment in the Securities May Result in a Loss of Principal: The Securities differ from ordinary debt securities in that Royal Bank of Canada is not necessarily obligated to repay the full principal amount of the Securities at maturity. The return on the Securities at maturity is linked to the performance of the Underlying Equity and will depend on whether, and the extent to which, the Underlying Return is positive or negative. If the Underlying Return is negative and the Final Price is less than the Trigger Price, you will be fully exposed to any negative Underlying Return and Royal Bank of Canada will pay you less than your principal amount at maturity, resulting in a loss of principal of your Securities that is proportionate to the percentage decline in the Underlying Equity. Accordingly, you could lose the entire principal amount of the Securities. |

|

|

¨

|

The Contingent Repayment of Principal Applies Only if You Hold the Securities to Maturity: You should be willing to hold your Securities to maturity. If you are able to sell your Securities prior to maturity in the secondary market, you may have to sell them at a loss even if the price of the Underlying Equity is above the Trigger Price.

|

|

|

¨

|

The Participation Rate Applies Only if You Hold the Securities to Maturity: The application of the Participation Rate only applies at maturity. If you are able to sell your Securities prior to maturity in the secondary market, the price you receive will likely not reflect the full effect of the Participation Rate and the return you realize may be less than the Participation Rate times the return of the Underlying Equity even if such return is positive.

|

|

|

¨

|

No Interest Payments: Royal Bank of Canada will not pay any interest with respect to the Securities.

|

|

|

¨

|

An Investment in the Securities Is Subject to the Credit Risk of Royal Bank of Canada: The Securities are unsubordinated, unsecured debt obligations of the issuer, Royal Bank of Canada, and are not, either directly or indirectly, an obligation of any third party. Any payment to be made on the Securities, including any repayment of principal at maturity, depends on our ability to satisfy our obligations as they come due. As a result, our actual and perceived creditworthiness may affect the market value of the Securities and, in the event we were to default on its obligations, you may not receive any amounts owed to you under the terms of the Securities and you could lose your entire initial investment.

|

|

|

¨

|

Your Return on the Securities May Be Lower than the Return on a Conventional Debt Security of Comparable Maturity: The return that you will receive on the Securities, which could be negative, may be less than the return you could earn on other investments. Even if your return is positive, your return may be less than the return you could earn if you bought a conventional senior interest bearing debt security that we issued with the same maturity date or if you invested directly in the Underlying Equity or the securities held by the Underlying Equity. Your investment may not reflect the full opportunity cost to you when you take into account factors that affect the time value of money.

|

|

|

¨

|

The Initial Estimated Value of the Securities Is Less than the Price to the Public: The initial estimated value that is set forth on the cover page of this document, is less than the public offering price you pay for the Securities, does not represent a minimum price at which we, RBCCM or any of our other affiliates would be willing to purchase the Securities in any secondary market (if any exists) at any time. If you attempt to sell the Securities prior to maturity, their market value may be lower than the price you paid for them and the initial estimated value. This is due to, among other things, changes in the price of the Underlying Equity, the borrowing rate we pay to issue securities of this kind, and the inclusion in the price to the public of the underwriting discount, and our estimated profit and the costs relating to our hedging of the Securities. These factors, together with various credit, market and economic factors over the term of the Securities, are expected to reduce the price at which you may be able to sell the Securities in any secondary market and will affect the value of the Securities in complex and unpredictable ways. Assuming no change in market conditions or any other relevant factors, the price, if any, at which you may be able to sell your Securities prior to maturity may be less than the price to public, as any such sale price would not be expected to include the underwriting discount and our estimated profit and the costs relating to our hedging of the Securities. In addition, any price at which you may sell the Securities is likely to reflect customary bid-ask spreads for similar trades. In addition to bid-ask spreads, the value of the Securities determined for any secondary market price is expected to be based on the secondary market rate rather than the internal borrowing rate used to price the Securities and determine the initial estimated value. As a result, the secondary price will be less than if the internal borrowing rate was used. The Securities are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your Securities to maturity.

|

|

|

¨

|

Our Initial Estimated Value of the Securities Is an Estimate Only, Calculated as of the Time the Terms of the Securities Are Set: The initial estimated value of the Securities is based on the value of our obligation to make the payments on the Securities, together with the mid-market value of the derivative embedded in the terms of the Securities. See “Structuring the Securities” below. Our estimate is based on a variety of assumptions, including our credit spreads, expectations as to dividends, interest rates and volatility, and the expected term of the Securities. These assumptions are based on certain forecasts about future events, which may prove to be incorrect. Other entities may value the Securities or similar securities at a price that is significantly different than we do.

|

The value of the Securities at any time after the Trade Date will vary based on many factors, including changes in market conditions, and cannot be predicted with accuracy. As a result, the actual value you would receive if you sold the Securities in any secondary market, if any, should be expected to differ materially from the initial estimated value of your Securities and the amount that may be paid at maturity.

|

|

¨

|

Owning the Securities Is Not the Same as Owning the Underlying Equity or the Stocks Comprising the Underlying Equity or the MSCI EAFE Index (the “Underlying Index”): The return on your Securities may not reflect the return you would realize if you actually owned the Underlying Equity or stocks included in the Underlying Equity or the Underlying Index. As a holder of the Securities, you will not have voting rights or rights to receive dividends or other distributions or other rights that holders of the Underlying Equity or these stocks would have, and any such dividends will not be incorporated in the determination of the Underlying Return.

|

|

|

¨

|

The Policies of the Underlying Equity’s Investment Adviser Could Affect the Amount Payable on the Securities and Their Market Value: The policies of the Underlying Equity’s investment adviser concerning the management of the Underlying Equity, additions, deletions or substitutions of the securities held by the Underlying Equity could affect the market price of shares of the Underlying Equity and, therefore, the amount payable on the Securities on the maturity date and the market value of the Securities before that date. The amount payable on the Securities and their market value could also be affected if the Underlying Equity investment adviser changes these policies, for example, by changing the manner in which it manages the Underlying Equity, or if the Underlying Equity investment adviser discontinues or suspends maintenance of the Underlying Equity, in which case it may become difficult to determine the market value of the Securities. The Underlying Equity's investment adviser has no connection to the offering of the Securities and has no obligations to you as an investor in the Securities in making its decisions regarding the Underlying Equity.

|

|

|

¨

|

We Have No Affiliation with MSCI Inc. (the “Index Sponsor”) and Will Not be Responsible for Any Actions Taken by the Index Sponsor: MSCI is the Index Sponsor of the Underlying Index, the performance of which is intended to be tracked by the Underlying Equity. We have no affiliation with the Index Sponsor, and the Index Sponsor will not be involved in the offering of the Securities. Consequently, we have no control of the actions of the Index Sponsor, including any actions of the type that would affect the composition of the Underlying Equity’s underlying index, and therefore, the price of the Underlying Equity. The Index Sponsor has no obligation of any sort with respect to the Securities. Thus, the Index Sponsor has no obligation to take your interests into consideration for any reason, including in taking any actions that might affect the value of the Securities.

|

|

|

¨

|

The Historical Prices of the Underlying Equity Should Not Be Taken as an Indication of Its Future Prices During the Term of the Securities: The trading prices of the Underlying Equity will determine the value of the Securities at any given time. However, it is impossible to predict whether the price of the Underlying Equity will rise or fall, and trading prices of the common stocks held by the Underlying Equity will be influenced by complex and interrelated political, economic, financial and other factors that can affect the issuers of those stocks, and therefore, the value of the Underlying Equity.

|

|

|

¨

|

The Underlying Equity and its Underlying Index Are Different: The performance of the Underlying Equity may not exactly replicate the performance of its underlying index, because the Underlying Equity will reflect transaction costs and fees that are not included in the calculation of its underlying index. It is also possible that the performance of the Underlying Equity may not fully replicate or may in certain circumstances diverge significantly from the performance of its underlying index due to the temporary unavailability of certain securities in the secondary market, the performance of any derivative instruments contained in the Underlying Equity or due to other circumstances. The Underlying Equity may use futures contracts, options, swap agreements, currency forwards and repurchase agreements in seeking performance that corresponds to its underlying index and in managing cash flows.

|

|

|

¨

|

Management Risk: The Underlying Equity is not managed according to traditional methods of ‘‘active’’ investment management, which involve the buying and selling of securities based on economic, financial and market analysis and investment judgment. Instead, the Underlying Equity, utilizing a ‘‘passive’’ or indexing investment approach, attempts to approximate the investment performance of its underlying index by investing in a portfolio of securities that generally replicate the Underlying Index. Therefore, unless a specific security is removed from the underlying index, the Underlying Equity generally would not sell a security because the security’s issuer was in financial trouble. In addition, the Underlying Equity is subject to the risk that the investment strategy of the Underlying Equity’s investment advisor may not produce the intended results.

|

|

|

¨

|

Risks Associated with Foreign Securities Markets: Because foreign companies or foreign equity securities held by the Underlying Equity are publicly traded in the applicable foreign countries and trade in currencies other than U.S. dollars, investments in the Securities involve particular risks. For example, the foreign securities markets may be more volatile than the U.S. securities markets, and market developments may affect these markets differently from the United States or other securities markets. Direct or indirect government intervention to stabilize the securities markets outside the United States, as well as cross-shareholdings in certain companies, may affect trading prices and trading volumes in those markets. Also, the public availability of information concerning the foreign issuers may vary depending on their home jurisdiction and the reporting requirements imposed by their respective regulators. In addition, the foreign issuers may be subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to United States reporting companies.

|

Securities prices generally are subject to political, economic, financial and social factors that apply to the markets in which they trade and, to a lesser extent, foreign markets. Securities prices outside the United States are subject to political, economic, financial and social factors that apply in foreign countries. These factors, which could negatively affect foreign securities markets, include the possibility of changes in a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign companies or investments in foreign equity securities and the possibility of fluctuations in the rate of exchange between currencies. Moreover, foreign economies may differ favorably or unfavorably from the United States economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency.

|

|

¨

|

Exchange Rate Risk: The share price of the Underlying Equity will fluctuate based in large part upon its net asset value, which will in turn depend in part upon changes in the value of the currencies in which the stocks held by the Underlying Equity are traded. Accordingly, investors in the Securities will be exposed to currency exchange rate risk with respect to each of the currencies in which the stocks held by the Underlying Equity are traded. An investor’s net exposure will depend on the extent to which these currencies strengthen or weaken against the U.S. dollar. If the dollar strengthens against these currencies, the net asset value of the Underlying Equity will be adversely affected and the price of the Underlying Equity, and consequently, the market value of the Securities may decrease.

|

|

|

¨

|

Lack of Liquidity: The Securities will not be listed on any securities exchange. RBC Capital Markets, LLC (“RBCCM”) intends to offer to purchase the Securities in the secondary market, but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the Securities easily. Because other dealers are not likely to make a secondary market for the Securities, the price at which you may be able to trade your Securities is likely to depend on the price, if any, at which RBCCM is willing to buy the Securities.

|

|

|

¨

|

Potential Conflicts: We and our affiliates play a variety of roles in connection with the issuance of the Securities, including hedging our obligations under the Securities. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the Securities.

|

|

|

¨

|

Potentially Inconsistent Research, Opinions or Recommendations by RBCCM, UBS or Their Affiliates: RBCCM, UBS, and our respective affiliates may publish research, express opinions or provide recommendations that are inconsistent with investing in or holding the Securities, and which may be revised at any time. Any such research, opinions or recommendations could affect the value of the Underlying Equity or the securities held by the Underlying Equity, and therefore, the market value of the Securities.

|

|

|

¨

|

Uncertain Tax Treatment: Significant aspects of the tax treatment of an investment in the Securities are uncertain. You should consult your tax adviser about your tax situation.

|

|

|

¨

|

Potential Royal Bank of Canada and UBS Impact on Price: Trading or other transactions by Royal Bank of Canada, UBS and our respective affiliates in the securities included in the Underlying Equity, the Underlying Equity, its underlying index, or in futures, options, exchange-traded funds or other derivative products on the Underlying Equity or the securities held by the Underlying Equity, may adversely affect the market value of those securities or the price of the Underlying Equity and, therefore, the market value of the Securities.

|

|

|

¨

|

Many Economic and Market Factors Will Impact the Value of the Securities: In addition to the price of the Underlying Equity on any trading day, the value of the Securities will be affected by a number of economic and market factors that may either offset or magnify each other, including:

|

|

|

¨

|

the actual or expected volatility of the price of the Underlying Equity;

|

|

|

¨

|

the time remaining to maturity of the Securities;

|

|

|

¨

|

the dividend rates on the securities held by the Underlying Equity;

|

|

|

¨

|

interest and yield rates in the market generally, as well as in each of the markets of the securities held by the Underlying Equity;

|

|

|

¨

|

a variety of economic, financial, political, regulatory or judicial events;

|

|

|

¨

|

the occurrence of certain events with respect to the Underlying Equity that may or may not require an adjustment to the terms of the Securities; and

|

|

|

¨

|

our creditworthiness, including actual or anticipated downgrades in our credit ratings.

|

|

|

¨

|

The Anti-Dilution Protection for the Underlying Equity Is Limited: The calculation agent will make adjustments to the Initial Price and the Final Price for certain events affecting the shares of the Underlying Equity. However, the calculation agent will not be required to make an adjustment in response to all events that could affect the Underlying Equity. If an event occurs that does not require the calculation agent to make an adjustment, the value of the Securities and the Payment at Maturity may be materially and adversely affected.

|

|

Hypothetical Examples and Return Table at Maturity

|

The following table and hypothetical examples below illustrate the payment at maturity per $10 Security for a hypothetical range of Underlying Returns from -100.00% to +100.00% and assume a hypothetical Initial Price of $100.00, a hypothetical Trigger Price of $75.00, and reflect the Participation Rate of 146.64%.The actual Initial Price and Trigger Price are set forth in “Final Terms of the Securities” and on the cover page of this pricing supplement. The hypothetical Payment at Maturity examples set forth below are for illustrative purposes only and may not be the actual returns applicable to a purchaser of the Securities. The actual payment at maturity will be determined based on the Final Price on the Final Valuation Date. You should consider carefully whether the Securities are suitable to your investment goals. The numbers appearing in the table below have been rounded for ease of analysis.

Example 1 - On the Final Valuation Date, the Underlying Equity closes 10% above the Initial Price. Because the Underlying Return is 10%, Royal Bank of Canada will pay you an amount based upon the Underlying Return times the Participation Rate. The payment at maturity per $10 principal amount Security will be calculated as follows:

$10 + ($10 x 10% x 146.64%) = $10 + $1.4664 = $11.4664

Example 2 - On the Final Valuation Date, the Underlying Equity closes 10% below the Initial Price. Because the Underlying Return is negative, but the Final Price is greater than the Trigger Price, Royal Bank of Canada will pay you at maturity the principal amount of $10 per $10 principal amount Security.

Example 3 - On the Final Valuation Date, the Underlying Equity closes 50% below the Initial Price. Because the Underlying Return is negative and the Final Price is less than the Trigger Price, Royal Bank of Canada will pay you at maturity a cash payment of $5.00 per $10 principal amount Security (a 50% loss on the principal amount), calculated as follows:

$10 + ($10 x -50.00%) = $10 - $5.00 = $5.00

|

Hypothetical Final Price ($)

|

Hypothetical

Underlying Return1

|

Hypothetical Payment at

Maturity ($)

|

Return on Securities2 (%)

|

|

$200.00

|

100.00%

|

$24.664

|

146.64%

|

|

$175.00

|

75.00%

|

$20.998

|

109.98%

|

|

$150.00

|

50.00%

|

$17.332

|

73.32%

|

|

$140.00

|

40.00%

|

$15.866

|

58.66%

|

|

$130.00

|

30.00%

|

$14.399

|

43.99%

|

|

$120.00

|

20.00%

|

$12.933

|

29.33%

|

|

$110.00

|

10.00%

|

$11.466

|

14.66%

|

|

$105.00

|

5.00%

|

$10.733

|

7.33%

|

|

$102.00

|

2.00%

|

$10.293

|

2.93%

|

|

|

|

|

|

|

$95.00

|

-5.00%

|

$10.000

|

0.00%

|

|

$90.00

|

-10.00%

|

$10.000

|

0.00%

|

|

$80.00

|

-20.00%

|

$10.000

|

0.00%

|

|

|

|

|

|

|

$70.00

|

-30.00%

|

$7.000

|

-30.00%

|

|

$50.00

|

-50.00%

|

$5.000

|

-50.00%

|

|

$40.00

|

-60.00%

|

$4.000

|

-60.00%

|

|

$25.00

|

-75.00%

|

$2.500

|

-75.00%

|

|

$0.00

|

-100.00%

|

$0.000

|

-100.00%

|

1 The Underlying Return excludes any cash dividend payments.

2 The “total return” is the number, expressed as a percentage, that results from comparing the payment at maturity per $10 principal amount Security to the purchase price of $10 per Security.

|

What Are the Tax Consequences of the Securities?

|

U.S. Federal Income Tax Consequences

Set forth below, together with the discussion of U.S. federal income tax in the accompanying product prospectus supplement, prospectus supplement, and prospectus, is a summary of the material U.S. federal income tax consequences relating to an investment in the Securities. The following summary is not complete and is qualified in its entirety by the discussion under the section entitled “Supplemental Discussion of U.S. Federal Income Tax Consequences” in the accompanying product prospectus supplement, the section entitled “Certain Income Tax Consequences” in the accompanying prospectus supplement, and the section entitled “Tax Consequences” in the accompanying prospectus, which you should carefully review prior to investing in the Securities.

In the opinion of our counsel, Morrison & Foerster LLP, it would generally be reasonable to treat the Securities as pre-paid cash-settled derivative contracts in respect of the Underlying Equity for U.S. federal income tax purposes, and the terms of the Securities require a holder and us (in the absence of a change in law or an administrative or judicial ruling to the contrary) to treat the Securities for all tax purposes in accordance with such characterization. If the Securities are so treated, subject to the potential application of the “constructive ownership” rules under Section 1260 of the Internal Revenue Code, a U.S. holder should generally recognize capital gain or loss upon the sale or maturity of the Securities in an amount equal to the difference between the amount a holder receives at such time and the holder’s tax basis in the Securities. While the matter is not entirely clear, there exists a substantial risk that an investment in the Securities is a “constructive ownership transaction” to which Section 1260 of the Internal Revenue Code applies. If Section 1260 of the Internal Revenue Code applies, all or a portion of any long-term capital gain recognized by a U.S. holder in respect of the Securities will be recharacterized as ordinary income (the “Excess Gain”). In addition, an interest charge will also apply to any deemed underpayment of tax in respect of any Excess Gain to the extent such gain would have resulted in gross income inclusion for the U.S. holder in taxable years prior to the taxable year of the sale or maturity (assuming such income accrued at a constant rate equal to the applicable federal rate as of the date of sale or maturity). To the extent any gain is treated as long-term capital gain after application of the recharacterization rules of Section 1260 of the Internal Revenue Code, such gain would be subject to U.S. federal income tax at the rates that would have been applicable to the net underlying long-term capital gain. U.S. holders should consult their tax advisors regarding the potential application of Section 1260 of the Internal Revenue Code to an investment in the Securities.

Alternative tax treatments are also possible and the Internal Revenue Service might assert that a treatment other than that described above is more appropriate. In addition, the Internal Revenue Service has released a notice that may affect the taxation of holders of the Securities. According to the notice, the Internal Revenue Service and the Treasury Department are actively considering whether the holder of an instrument such as the Securities should be required to accrue ordinary income on a current basis, and they are seeking taxpayer comments on the subject. It is not possible to determine what guidance they will ultimately issue, if any. It is possible, however, that under such guidance, holders of the Securities will ultimately be required to accrue income currently and this could be applied on a retroactive basis. The Internal Revenue Service and the Treasury Department are also considering other relevant issues, including whether additional gain or loss from such instruments should be treated as ordinary or capital and whether the special "constructive ownership rules" of Section 1260 of the Internal Revenue Code might be applied to such instruments. Holders are urged to consult their tax advisors concerning the significance, and the potential impact, of the above considerations.

Individual holders that own “specified foreign financial assets” may be required to include certain information with respect to such assets with their U.S. federal income tax return. You are urged to consult your own tax advisor regarding such requirements with respect to the Securities.

Canadian Federal Income Tax Consequences

For a discussion of the material Canadian federal income tax consequences relating to an investment in the Securities, please see the section entitled “Tax Consequences—Canadian Taxation” in the accompanying prospectus, which you should carefully review prior to investing in the Securities.

|

The iShares® MSCI EAFE ETF

|

iShares® consists of numerous separate investment portfolios (the “iShares® Funds”), including the Underlying Equity. The Underlying Equity seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Underlying Index. The Underlying Equity typically earns income dividends from securities included in the Underlying Index. These amounts, net of expenses and taxes (if applicable), are passed along to the Underlying Equity’s shareholders as “ordinary income.” In addition, the Underlying Equity realizes capital gains or losses whenever it sells securities. Net long-term capital gains are distributed to shareholders as “capital gain distributions.” However, because the Securities are linked only to the share price of the Underlying Equity, you will not be entitled to receive income, dividend, or capital gain distributions from the Underlying Equity or any equivalent payments.

Information provided to or filed with the SEC by iShares® under the Securities Exchange Act of 1934 and the Investment Company Act of 1940 can be located at the SEC’s facilities or through the SEC’s Website by reference to SEC file numbers 033-97598 and 811-09102, respectively. We have not independently verified the accuracy or completeness of the information or reports prepared by iShares®.

The selection of the Underlying Equity is not a recommendation to buy or sell the shares of the Underlying Equity. Neither we nor any of our affiliates make any representation to you as to the performance of the shares of the Underlying Equity.

“iShares®” and BlackRock® are registered trademarks of BlackRock®. BlackRock® has licensed certain trademarks and trade names of BlackRock® for our use. The Securities are not sponsored, endorsed, sold, or promoted by BlackRock®, or by any of the iShares® Funds. Neither BlackRock® nor the iShares® Funds make any representations or warranties to the owners of the Securities or any member of the public regarding the advisability of investing in the Securities. Neither BlackRock® nor the iShares® Funds shall have any obligation or liability in connection with the registration, operation, marketing, trading, or sale of the Securities or in connection with our use of information about the iShares® Funds.

The iShares® MSCI EAFE ETF

The EFA seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI EAFE Index. The MSCI EAFE Index is intended to measure equity market performance in developed market countries, excluding the U.S. and Canada. The shares of this Fund trade on the NYSE Arca under the symbol “EFA.”

The MSCI EAFE Index

We have derived all information contained in this pricing supplement regarding the MSCI EAFE Index, including, without limitation, its make-up, method of calculation and changes in its components, from publicly available information. The MSCI EAFE Index is a stock index calculated, published and disseminated daily by MSCI, a majority-owned subsidiary of Morgan Stanley, through numerous data vendors, on the MSCI website and in real time on Bloomberg Financial Markets and Reuters Limited. Neither MSCI nor Morgan Stanley has any obligation to continue to calculate and publish, and may discontinue calculation and publication of the MSCI EAFE Index.

The MSCI EAFE Index is a free float-adjusted market capitalization index with a base date of December 31, 1969 and an initial value of 100. The MSCI EAFE Index is calculated daily in U.S. dollars and published in real time every 60 seconds during market trading hours. The MSCI EAFE Index currently consists of the following 21 developed countries: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, The Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. The MSCI EAFE Index is comprised of companies in both the Large Cap Index and Mid Cap Index, as discussed in the section “—Defining Market Capitalization Size Segments for Each Market” below. The MSCI EAFE Index is part of the MSCI Regional Equity Indices series and is an MSCI Global Investable Market Index, which is a family within the MSCI International Equity Indices.

General - MSCI Indices

MSCI provides global equity indices intended to measure equity performance in international markets and the MSCI International Equity Indices are designed to serve as global equity performance benchmarks. In constructing these indices, MSCI applies its index construction and maintenance methodology across developed, emerging, and frontier markets.

MSCI enhanced the methodology used in its MSCI International Equity Indices. The MSCI Standard and MSCI Small Cap Indices, along with the other MSCI equity indices based on them, transitioned to the global investable market indices methodology described below. The transition was completed at the end of May 2008. The Enhanced MSCI Standard Indices are composed of the MSCI Large Cap and Mid Cap Indices. The MSCI Global Small Cap Index transitioned to the MSCI Small Cap Index resulting from the Global Investable Market Indices methodology and contains no overlap with constituents of the transitioned MSCI Standard Indices. Together, the relevant MSCI Large Cap, Mid Cap, and Small Cap Indices will make up the MSCI investable market index for each country, composite, sector, and style index that MSCI offers.

Constructing the MSCI Global Investable Market Indices. MSCI undertakes an index construction process, which involves:

|

|

·

|

defining the equity universe;

|

|

|

·

|

determining the market investable equity universe for each market;

|

|

|

·

|

determining market capitalization size segments for each market;

|

|

|

·

|

applying index continuity rules for the MSCI Standard Index;

|

|

|

·

|

creating style segments within each size segment within each market; and

|

|

|

·

|

classifying securities under the Global Industry Classification Standard (the “GICS”).

|

Defining the Equity Universe. The equity universe is defined by:

|

|

·

|

Identifying Eligible Equity Securities: the equity universe initially looks at securities listed in any of the countries in the MSCI Global Index Series, which will be classified as either Developed Markets (“DM”) or Emerging Markets (“EM”). All listed equity securities, or listed securities that exhibit characteristics of equity securities, except mutual funds, ETFs, equity derivatives, limited partnerships, and most investment trusts, are eligible for inclusion in the equity universe. Real Estate Investment Trusts in some countries and certain income trusts in Canada are also eligible for inclusion.

|

|

|

·

|

Classifying Eligible Securities into the Appropriate Country: each company and its securities (i.e., share classes) are classified in only one country.

|

Determining the Market Investable Equity Universes. A market investable equity universe for a market is derived by applying investability screens to individual companies and securities in the equity universe that are classified in that market. A market is equivalent to a single country, except in DM Europe, where all DM countries in Europe are aggregated into a single market for index construction purposes. Subsequently, individual DM Europe country indices within the MSCI Europe Index are derived from the constituents of the MSCI Europe Index under the global investable market indices methodology.

The investability screens used to determine the investable equity universe in each market are as follows:

|

|

·

|

Equity Universe Minimum Size Requirement: this investability screen is applied at the company level. In order to be included in a market investable equity universe, a company must have the required minimum full market capitalization.

|

|

|

·

|

Equity Universe Minimum Free Float−Adjusted Market Capitalization Requirement: this investability screen is applied at the individual security level. To be eligible for inclusion in a market investable equity universe, a security must have a free float−adjusted market capitalization equal to or higher than 50% of the equity universe minimum size requirement.

|

|

|

·

|

DM and EM Minimum Liquidity Requirement: this investability screen is applied at the individual security level. To be eligible for inclusion in a market investable equity universe, a security must have adequate liquidity. The twelve-month and three-month Annual Traded Value Ratio (“ATVR”), a measure that screens out extreme daily trading volumes and takes into account the free float−adjusted market capitalization size of securities, together with the three-month frequency of trading are used to measure liquidity. In the calculation of the ATVR, the trading volumes in depository receipts associated with that security, such as ADRs or GDRs, are also considered. A minimum liquidity level of 20% of three- and twelve-month ATVR and 90% of three-month frequency of trading over the last four consecutive quarters are required for inclusion of a security in a market investable equity universe of a DM, and a minimum liquidity level of 15% of three- and twelve-month ATVR and 80% of three-month frequency of trading over the last four consecutive quarters are required for inclusion of a security in a market investable equity universe of an EM.

|

|

|

·

|

Global Minimum Foreign Inclusion Factor Requirement: this investability screen is applied at the individual security level. To be eligible for inclusion in a market investable equity universe, a security’s Foreign Inclusion Factor (“FIF”) must reach a certain threshold. The FIF of a security is defined as the proportion of shares outstanding that is available for purchase in the public equity markets by international investors. This proportion accounts for the available free float of and/or the foreign ownership limits applicable to a specific security (or company). In general, a security must have an FIF equal to or larger than 0.15 to be eligible for inclusion in a market investable equity universe.

|

|

|

·

|

Minimum Length of Trading Requirement: this investability screen is applied at the individual security level. For an initial public offering (“IPO”) to be eligible for inclusion in a market investable equity universe, the new issue must have started trading at least four months before the implementation of the initial construction of the index or at least three months before the implementation of a semi−annual index review (as described below). This requirement is applicable to small new issues in all markets. Large IPOs are not subject to the minimum length of trading requirement and may be included in a market investable equity universe and the Standard Index outside of a Quarterly or Semi−Annual Index Review.

|

Defining Market Capitalization Size Segments for Each Market. Once a market investable equity universe is defined, it is segmented into the following size−based indices:

|

|

·

|

Investable Market Index (Large + Mid + Small);

|

|

|

·

|

Standard Index (Large + Mid);

|

Creating the size segment indices in each market involves the following steps:

|

|

·

|

defining the market coverage target range for each size segment;

|

|

|

·

|

determining the global minimum size range for each size segment;

|

|

|

·

|

determining the market size−segment cutoffs and associated segment number of companies;

|

|

|

·

|

assigning companies to the size segments; and

|

|

|

·

|

applying final size−segment investability requirements.

|

Index Continuity Rules for the Standard Indices. In order to achieve index continuity, as well as to provide some basic level of diversification within a market index, and notwithstanding the effect of other index construction rules described in this section, a minimum number of five constituents will be maintained for a DM Standard Index and a minimum number of three constituents will be maintained for an EM Standard Index.

Creating Style Indices within Each Size Segment. All securities in the investable equity universe are classified into value or growth segments using the MSCI Global Value and Growth methodology.

Classifying Securities under the Global Industry Classification Standard. All securities in the global investable equity universe are assigned to the industry that best describes their business activities. To this end, MSCI has designed, in conjunction with Standard & Poor’s, the GICS. Under the GICS, each company is assigned to one sub−industry according to its principal business activity. Therefore, a company can belong to only one industry grouping at each of the four levels of the GICS.

Index Maintenance

The MSCI Global Investable Market Indices are maintained with the objective of reflecting the evolution of the underlying equity markets and segments on a timely basis, while seeking to achieve index continuity, continuous investability of constituents and replicability of the indices, index stability and low index turnover. In particular, index maintenance involves:

|

|

(i)

|

Semi−Annual Index Reviews (“SAIRs”) in May and November of the Size Segment and Global Value and Growth Indices which include:

|

|

|

·

|

updating the indices on the basis of a fully refreshed equity universe;

|

|

|

·

|

taking buffer rules into consideration for migration of securities across size and style segments; and

|

|

|

·

|

updating FIFs and Number of Shares (“NOS”).

|

| |

(ii)

|

Quarterly Index Reviews in February and August of the Size Segment Indices aimed at:

|

|

|

·

|

including significant new eligible securities (such as IPOs that were not eligible for earlier inclusion) in the index;

|

|

|

·

|

allowing for significant moves of companies within the Size Segment Indices, using wider buffers than in the SAIR; and

|

|

|

·

|

reflecting the impact of significant market events on FIFs and updating NOS.

|

(iii) Ongoing Event−Related Changes: changes of this type are generally implemented in the indices as they occur. Significantly large IPOs are included in the indices after the close of the company’s tenth day of trading.

Historical Information

The following table sets forth the quarterly high, low and period-end closing prices for the Underlying Equity, based on daily closing prices, as reported by Bloomberg. The closing price of the Underlying Equity on June 25, 2015 was $65.77. The historical performance of the Underlying Equity should not be taken as an indication of its future performance during the term of the Securities.

|

|

|

|

|

Quarterly Period-End Close

|

|

1/04/2010

|

3/31/2010

|

57.96

|

50.45

|

56.00

|

|

4/01/2010

|

6/30/2010

|

58.03

|

46.29

|

46.51

|

|

7/01/2010

|

9/30/2010

|

55.42

|

47.09

|

54.92

|

|

10/01/2010

|

12/31/2010

|

59.46

|

54.25

|

58.23

|

|

1/03/2011

|

3/31/2011

|

61.91

|

55.31

|

60.09

|

|

4/01/2011

|

6/30/2011

|

63.87

|

57.10

|

60.14

|

|

7/01/2011

|

9/30/2011

|

60.80

|

46.66

|

47.75

|

|

10/03/2011

|

12/31/2011

|

55.57

|

46.45

|

49.53

|

|

1/03/2012

|

3/31/2012

|

55.80

|

49.15

|

54.90

|

|

4/02/2012

|

6/30/2012

|

55.51

|

46.55

|

49.96

|

|

7/02/2012

|

9/30/2012

|

55.15

|

47.62

|

53.00

|

|

10/01/2012

|

12/31/2012

|

56.88

|

51.96

|

56.82

|

|

1/02/2013

|

3/31/2013

|

59.89

|

56.90

|

58.98

|

|

4/01/2013

|

6/30/2013

|

63.53

|

57.03

|

57.38

|

|

7/01/2013

|

9/30/2013

|

65.05

|

57.55

|

63.79

|

|

10/01/2013

|

12/31/2013

|

67.06

|

62.71

|

67.06

|

|

1/02/2014

|

3/31/2014

|

68.03

|

62.31

|

67.17

|

|

4/01/2014

|

6/30/2014

|

70.67

|

66.26

|

68.37

|

|

7/01/2014

|

9/30/2014

|

69.25

|

64.12

|

64.12

|

|

10/01/2014

|

12/31/2014

|

64.51

|

59.53

|

60.84

|

|

1/02/2015

|

3/31/2015

|

65.99

|

58.48

|

64.17

|

|

4/01/2015

|

6/25/2015*

|

68.42

|

64.63

|

65.77

|

* This pricing supplement includes information for the second calendar quarter of 2015 only for the period from April 1, 2015 through June 25, 2015. Accordingly, the “Quarterly Closing High,” “Quarterly Closing Low” and “Quarterly Period-End Close” data indicated are for this shortened period only and do not reflect complete data for the second calendar quarter of 2015.

The graph below illustrates the performance of the Underlying Equity from January 1, 2010 to June 25, 2015, based on the Initial Price of $65.77, which was the closing price of the Underlying Equity on June 25, 2015, and a Trigger Price equal to 75% of the Initial Price (rounded to two decimal places).

HISTORIC PERFORMANCE IS NOT AN INDICATION OF FUTURE PERFORMANCE.

Source: Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg Financial Markets.

|

Supplemental Plan of Distribution (Conflicts of Interest)

|

We have agreed to indemnify UBS and RBCCM against liabilities under the Securities Act of 1933, as amended, or to contribute payments that UBS and RBCCM may be required to make relating to these liabilities as described in the prospectus supplement and the prospectus. We have agreed that UBS may sell all or a part of the Securities that it will purchase from us to investors at the price to public listed on the cover hereof, or its affiliates at the price indicated on the cover of this pricing supplement

UBS may allow a concession not in excess of the underwriting discount set forth on the cover of this pricing supplement to its affiliates for distribution of the Securities. Subject to regulatory constraints and market conditions, RBCCM intends to offer to purchase the Securities in the secondary market, but it is not required to do so.

We or our affiliates may enter into swap agreements or related hedge transactions with one of our other affiliates or unaffiliated counterparties in connection with the sale of the Securities and RBCCM and/or an affiliate may earn additional income as a result of payments pursuant to the swap or related hedge transactions. See “Use of Proceeds and Hedging” beginning on page PS-14 of the accompanying product prospectus supplement no. ES-TPS-1.

The value of the Securities shown on your account statement may be based on RBCCM’s estimate of the value of the Securities if RBCCM or another of our affiliates were to make a market in the Securities (which it is not obligated to do). That estimate will be based upon the price that RBCCM may pay for the Securities in light of then prevailing market conditions, our creditworthiness and transaction costs. For a period of approximately 16 months after the issue date of the Securities, the value of the Securities that may be shown on your account statement may be higher than RBCCM’s estimated value of the Securities at that time. This is because the estimated value of the Securities will not include the underwriting discount and our hedging costs and profits; however, the value of the Securities shown on your account statement during that period may be a higher amount, reflecting the addition of the underwriting discount and our estimated costs and profits from hedging the Securities. Any such excess is expected to decrease over time until the end of this period. After this period, if RBCCM repurchases your Securities, it expects to do so at prices that reflect their estimated value. This period may be reduced at RBCCM’s discretion based on a variety of factors, including but not limited to, the amount of the Securities that we repurchase and our negotiated arrangements from time to time with UBS.

For additional information as to the relationship between us and RBCCM, please see the section “Plan of Distribution—Conflicts of Interest” in the prospectus dated April 30, 2015.

|

Structuring the Securities

|

The Securities are our debt securities, the return on which is linked to the performance of the Underlying Equity. As is the case for all of our debt securities, including our structured notes, the economic terms of the Securities reflect our actual or perceived creditworthiness at the time of pricing. In addition, because structured notes result in increased operational, funding and liability management costs to us, we typically borrow the funds under these Securities at a rate that is more favorable to us than the rate that we might pay for a conventional fixed or floating rate debt security of comparable maturity. Using this relatively lower implied borrowing rate rather than the secondary market rate is a factor that resulted in a higher initial estimated value of the Securities at the time their terms are set than if the secondary market rate was used. Unlike the estimated value included on the cover of this document, any value of the Securities determined for purposes of a secondary market transaction may be based on a different borrowing rate, which may result in a lower value for the Securities than if our initial internal borrowing rate were used.

In order to satisfy our payment obligations under the Securities, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) on the issue date with RBCCM or one of our other subsidiaries. The terms of these hedging arrangements take into account a number of factors, including our creditworthiness, interest rate movements, the volatility of the Underlying Equity, and the tenor of the Securities. The economic terms of the Securities and their initial estimated value depend in part on the terms of these hedging arrangements.

The lower implied borrowing rate is a factor that reduced the economic terms of the Securities to you. The initial offering price of the Securities also reflects the underwriting commission and our estimated hedging costs. These factors resulted in the initial estimated value for the Securities on the Trade Date being less than their public offering price. See “Key Risks—The Initial Estimated Value of the Securities Is Less than the Price to the Public” above.

|

Terms Incorporated in Master Note

|

The terms appearing above under the caption “Final Terms of the Securities” and the provisions in the accompanying product prospectus supplement no. ES-TPS-1 dated May 18, 2015 under the caption “General Terms of the Securities,” are incorporated into the master note issued to DTC, the registered holder of the Securities.

|

Validity of the Securities

|

In the opinion of Norton Rose Fulbright Canada LLP, the issue and sale of the Securities has been duly authorized by all necessary corporate action of the Bank in conformity with the Indenture, and when the Securities have been duly executed, authenticated and issued in accordance with the Indenture and delivered against payment therefor, the Securities will be validly issued and, to the extent validity of the Securities is a matter governed by the laws of the Province of Ontario or Québec, or the laws of Canada applicable therein, and will be valid obligations of the Bank, subject to equitable remedies which may only be granted at the discretion of a court of competent authority, subject to applicable bankruptcy, insolvency and other laws of general application affecting creditors’ rights, and subject to limitations as to the currency in which judgments in Canada may be rendered, as prescribed by the Currency Act (Canada). This opinion is given as of the date hereof and is limited to the laws of the Provinces of Ontario and Quebec and the federal laws of Canada applicable thereto. In addition, this opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and certain factual matters, all as stated in the letter of such counsel dated April 30, 2015, which has been filed as Exhibit 5.1 to Royal Bank’s Form 6-K filed with the SEC on April 30, 2015.

In the opinion of Morrison & Foerster LLP, when the Securities have been duly completed in accordance with the Indenture and issued and sold as contemplated by the prospectus supplement and the prospectus, the Securities will be valid, binding and enforceable obligations of Royal Bank, entitled to the benefits of the Indenture, subject to applicable bankruptcy, insolvency and similar laws affecting creditors’ rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith). This opinion is given as of the date hereof and is limited to the laws of the State of New York. This opinion is subject to customary assumptions about the Trustee’s authorization, execution and delivery of the Indenture and the genuineness of signatures and to such counsel’s reliance on the Bank and other sources as to certain factual matters, all as stated in the legal opinion dated April 30, 2015, which has been filed as Exhibit 5.2 to the Bank’s Form 6-K dated April 30, 2015.

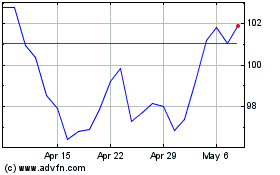

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024