Promontory Settles With NY Regulator on Standard Chartered Investigation

August 18 2015 - 3:13PM

Dow Jones News

By Christopher M. Matthews

Promontory Financial Group entered into a settlement with New

York's top banking regulator Tuesday, agreeing to pay $15 million

and acknowledging that it didn't follow the regulator's

requirements while the firm investigated potential sanctions

violations by Standard Chartered PLC.

The settlement is a sudden about-face. As recently as Sunday,

Promontory was preparing to challenge the move by the New York

Department of Financial Services to block the firm from advising

New York-based banks in some cases.

The agency took that step after saying that Promontory watered

down reports about potential sanctions violations by Standard

Chartered.

As reported by The Wall Street Journal, Promontory was expected

to ask a New York state judge to put a stay on the DFS suspension

as early as Monday, according to the documents prepared for the

fight.

With Tuesday's settlement, Promontory relented on the main

sticking point blocking a settlement--an acknowledgment that the

firm had done something wrong.

According to a DFS news release, Promontory agreed that "in

certain instances, its actions during the Standard Chartered

engagement didn't meet the Department's current requirements for

consultants performing regulatory compliance work for entities

supervised by the Department."

In addition to the $15 million penalty, Promontory also agreed

to a voluntary six month abstention from new consulting engagements

that require DFS to authorize the disclosure of confidential

information under New York Banking Law.

Write to Christopher M. Matthews at

christopher.matthews@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 18, 2015 14:58 ET (18:58 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

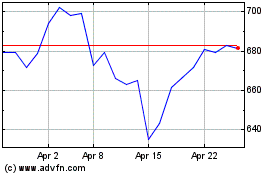

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

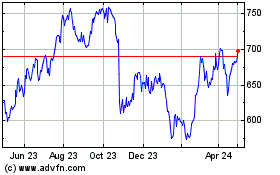

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024