NetworkNewsWire Editorial

Coverage: Zinc is used for various

applications in many industries, including construction, oil &

gas, power generation, automotive and shipbuilding. It is also used

to produce zinc oxide, a constituent of many diverse products

including nuclear reactors, solar cells, sunscreen, multivitamins

and fertilizer. Fully 50 percent of the world’s zinc is used in

galvanizing steel to prevent corrosion, which makes it highly

prized by countries engaged in infrastructure development. Amid

heightened demand, Mining.com (http://nnw.fm/9jaWx) reports that zinc prices have

surged by 78 percent since 2016, have increased 286 percent in the

last two years, and currently stand at over $3,200. This remarkable

surge has created a deficit in the zinc market, with producers like

Canadian-based Zinc One Resources, Inc. (OTC: ZZZOF)

(Z.CA) (Zinc One

Profile) poised to capitalize on the increased demand

for the base metal. Other established zinc producers preparing to

take up the slack include Hudbay Minerals, Inc. (NYSE: HBM)

(TSX: HBM), Ivanhoe Mines Ltd. (OTCQX: IVPAF) (TSX: IVN), Lundin

Mining Corp. (OTC: LUNMF) (TSX: LUN) and Trevali

Mining Corp. (OTCQX: TREVF) (TSX: TV).

China is foremost in the drive for improved infrastructure, and

zinc demand is likely to continue in line with the demand for

structural steel for construction projects. Furthermore, the Trump

Administration has announced its intention to spend $1 trillion on

upgrading infrastructure in America. As such, industry projections

are that China and the United States will contribute significantly

to an annual growth in zinc demand of 2.4 percent over the next few

years. This growth will follow a decade-long lag in demand, which

triggered a corresponding drop in the zinc price. As a result, many

companies cut back on production, resulting in the current market

deficit.

Investing News reports a prediction from analysts at Bloomberg

Markets that supply will continue to trail demand over the coming

years (http://nnw.fm/7F1wa), enabling companies like

Vancouver-based Zinc One

Resources (OTC: ZZZOF) (Z.CA) to capture their share

of market opportunity. With a strong focus on the acquisition,

exploration and development of advanced zinc assets, Zinc One’s

primary projects are located in Peru, the country with the

third-highest zinc reserves in the world. Peru has a mature and

stable mining industry that provides half of the country’s GDP.

In June 2017, Zinc One acquired Forrester Metals, Inc., and

through this the Bongara Mine zinc-oxide project and

Charlotte-Bongara Projects. On par with broader industry trends,

the Bongara Mine was in full production from 2007 through 2008, but

was shut down when the zinc price collapsed in the wake of the

global financial crisis. Historical resource data shows a measured

indicated and inferred resource of over 1.2 million tons of high

grade (20%+), near-surface zinc. With a history of mining on the

concessions, Zinc One enjoys positive and productive community

relations in the area, which is of significant value for any mining

company.

The Bongara Mine’s high-grade zinc mineralization is a rare

find, and Zinc One intends to leverage the zinc-rich soil to bring

Bongara back into production.

Zinc One in August received approval from Peru’s Ministry of

Energy and Mines to suspend the mine closure at the Bongara Mine

location, which allows the company to utilize the current

Environmental Impact Assessment attached to the project for current

and future permitting (http://nnw.fm/mZa3r). This approval allows the company

to take another vital step toward its plans to reopen production at

the Bongara Mine. Notably, at Bongara, open pit mining can be used

to extract the zinc, which can reduce the costs associated with

underground mining.

On November 1 the company announced another advancement,

publishing positive results from an ongoing surface-sampling

program at the Bongarita and Mina Chica areas. The company reported

highest grades that include a surface channel sample (#38) with

47.73% zinc over 8.1 meters from a dolomite, a surface channel

sample (#72) that yielded 25.65% zinc over 19.7 meters from a

dolomite breccia, and 32.50% zinc over a 3.8-metre depth from a

dolomite breccia in an exploration pit (#425).

"As expected, the high-grade zinc grades from this current

sampling program are very encouraging and augments our opinion that

the Bongarita and Mina Chica areas hold significant potential. In

particular, these areas have not been drilled and that the base

(footwall), outlining the depth extent of mineralization, is not

well defined. The upcoming drill program should help to better

define the footwall of mineralization as well as better determine

the magnitude of mineralization left behind by past mining in the

Mina Grande area. Overall, we anticipate that the drill program

will better delineate and expand the known mineralization at the

Bongara Zinc Mine Project,” Zinc One president and CEO Jim Walchuck

stated in the press release announcing the results (http://nnw.fm/lY23V).

Zinc One’s neighboring Charlotte-Bongara Zinc-Oxide Project also

shows potential, with multiple at-surface, high-grade drill

intercepts providing numerous drill targets.

The Bongara Mine Project mineralization lies on surface with

simple metallurgy and greater than 90 percent recovery, as

demonstrated in past production. The Charlotte-Bongara Project will

require exploration to determine the extent of the mineralization;

near-surface drill intercepts conducted over a stretch of 8

kilometers (4.9 miles) at this location by Rio Cristal Zinc in 2008

showed extremely high-grades of 29.5 percent zinc at 15.5 meters,

26.1 percent at 12.5 meters, and 29.7 percent zinc at 11.5

meters.

As it stands, Zinc One is one of the few new zinc focused

companies with near-term production potential, allowing the company

to occupy a position alongside its large-cap, older peers like

Hudbay Minerals (NYSE: HBM) (TSX: HBM). With

interests principally in mining operations and exploration, Hudbay

focuses on reserves of base and precious metals including copper,

zinc, gold and silver. The company operates three mines in the Flin

Flon Greenstone Belt in Manitoba, another in southern Peru and is

busy with a development project in Arizona. The company has just

released its third quarter results for 2017, which show operating

cash flow of USD$154 million, an increase of 24 percent over the

previous quarter. Copper production for the quarter was over 40,000

tons, with zinc production of almost 37,000 tons.

Ivanhoe Mines (OTCQX: IVPAF) (TSX: IVN) is a

mining company that has been operating in sub-Saharan Africa for

more than 24 years. Its Kipushi mine, located in the Democratic

Republic of Congo (DRC), produces silver, germanium, copper and

zinc. The company also has the Kamoa-Kakula copper mine located in

Congo’s copper belt. A new exploration project in Kakula West

returned Ivanhoe operates the Platreef mine in South Africa that

produces both base and precious metals, including copper, nickel,

gold and platinum group metals.

Another larger and older peer, Trevali Mining (OTCQX:

TREVF) (TSX: TV) has mining interests in the Americas and

Africa. Its presence in New Brunswick, Canada extends to the 100

percent owned Caribou Mine in the north of the province, while it

also owns the Halfmile and Stratmat concessions of base metal

deposits that are under review for potential development. The

company also has controlling interests in three other mines; the

wholly-owned Santander mine in Peru, a 90 percent share in the

Perkoa mine in Burkina Faso and 80 percent ownership of the Rosh

Pinah mine in Namibia.

Also enjoying uptrends in zinc is Lundin Mining (OTC:

LUNMF) (TSX: LUN), a diversified Canadian-based metals

mining company with operations in the United States, Chile,

Portugal and Sweden. In addition to its production of zinc, copper

and nickel, the company has a 24 percent stake in a cobalt

refinery, Freeport Cobalt Coy, located in Kokkola, Finland. For

2019, Lundin provides outlook for zinc production between

152,000-162,000, its same forecast for 2017 (http://nnw.fm/ioaR1).

Zinc is an invaluable base metal and a strategic priority for

many industries, and all indications are that the price of zinc

will continue to increase over the next few years while producers

scale-up their operations in an effort to meet market demands. The

sudden surge in the demand for zinc has caught some producers

unprepared, but with three c-level managers totaling 100 years of

combined mining experience putting projects into production, Zinc

One has the resources and expertise to meet demand.

For more information on Zinc One Resources,

visit Zinc One

Resources (OTC: ZZZOF) (Z.CA)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

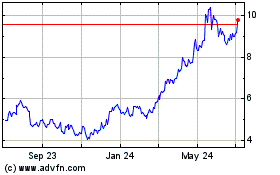

HudBay Minerals (NYSE:HBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

HudBay Minerals (NYSE:HBM)

Historical Stock Chart

From Apr 2023 to Apr 2024