Procter & Gamble Reports Organic-Sales Growth---2nd Update

January 20 2017 - 12:45PM

Dow Jones News

By Sharon Terlep

Procter & Gamble Co.'s years-long turnaround is starting to

show some results.

The maker of Gillette razors and Pampers diapers on Friday

offered a more upbeat outlook for sales growth this year as it

posted better-than-expected organic sales for the latest quarter.

The closely watched metric, which strips out currency moves,

acquisitions and divestments, increased 2% from a year earlier.

"We are essentially on track with where we hoped we would be,"

finance chief Jon Moeller said in a call with analysts. The

results, he said, were better than the company anticipated and "a

pretty good number that's representative of the general strength of

the business."

Shares were up 3.5% to $87.71 in morning trading Friday.

P&G for years has been slashing costs and reworking how it

develops, markets and sells consumer staples as the company has

struggled to accelerate sales growth amid increased competition

from new smaller and nimbler rivals.

Progress has been slow as the company's organic sales growth of

1%-3% in recent years remains below prerecession levels. The

company now expects organic sales growth of 2%-3% for the fiscal

year ending in June, up from its previous 2% forecast.

P&G still faces long-term currency woes, stagnating growth

in developing markets and price wars with rivals. But the

Cincinnati giant made progress in key areas in the last three

months.

More consumers were willing to pay for high-end consumer

staples, from laundry detergent pods in the U.S. to premium

skin-care products in China. A $200 electric toothbrush, for

instance, helped deliver a surprising 7% jump in organic sales for

the company's health-care unit, which includes oral-care

products.

Sales rose in China, P&G's second-largest market and a key

area of focus for Chief Executive David Taylor since he took over

in late 2015.

The results were the first glimpse at its operations since

P&G shed the bulk of its beauty brands. P&G had long said

those brands, including CoverGirl makeup and Clairol hair dye, were

pulling resources while returning little in the way of profit or

growth. The $11.4 billion deal closed last fall, shrinking P&G

by more than 10,000 employees and 40 brands.

P&G reported fiscal second quarter net income of $7.88

billion, or $2.88 a share, compared with year-ago earnings of $3.21

billion, or $1.12 a share. On an adjusted basis, which excludes

gains from the beauty sale, the company said it earned $1.08 a

share, slightly above analysts' projections for $1.06 a share.

Sales fell 0.3% to $16.86 billion from $16.92 billion a year

ago.

--Joshua Jamerson contributed to this article

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

January 20, 2017 12:30 ET (17:30 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

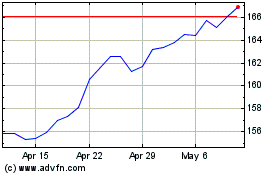

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

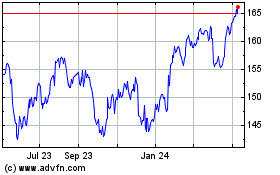

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024