Procter & Gamble Profit Rises; Increases Sales of Staples

October 25 2016 - 12:10PM

Dow Jones News

By Sharon Terlep and Anne Steele

Procter & Gamble Co. increased sales of staples from laundry

detergent to toothpaste in its most recent quarter, sending shares

higher despite a warning that growth will be spotty in the months

ahead.

The maker of Gillette razors and Pampers diapers on Tuesday

posted an unexpected rise in profit in the latest quarter and

reported organic sales -- a closely watched metric that strips out

currency moves, acquisitions and divestments -- grew 3%, the

biggest increase is more than a year.

"We're pleased with the progress we're making, but there is

still more work to do to get back to the levels of balanced top-

and bottom-line growth and cash generation," Chief Executive David

Taylor said. He pointed to organic sales growth across all product

categories as well as strong cost savings.

Shares of the company were up about 4.5% in morning trading to

$87.85.

P&G -- which has struggled for years to accelerate sales

growth and has underperformed smaller, nimbler rivals -- has been

slashing costs and commanding higher prices. The results come at a

time when consumer products companies are grappling with

uncertainty in emerging markets, currency swings, and rising

commodity prices.

P&G Chief Financial Officer Jon Moeller cautioned that the

sales bump doesn't change the company's forecast that organic sales

will grow just 2% for the fiscal year that ends next June.

"We continue to face a relatively slow-growth, volatile world,"

Mr. Moeller said. "Progress does not come in a straight line."

All five of P&G's segments recorded core volume improvement

-- 2% in beauty, 3% in grooming, 5% in health care, 4% in fabric

and home care and 4% in baby, feminine and family care.

Growth in health care was driven largely by sales of Oral-B

electric toothbrushes. Sales improved in the U.S. and China,

P&G's two biggest markets, while the company struggled in the

United Kingdom.

Overall pricing remained flat while volume improved 2%.

Excluding acquisitions and divestitures, core volume rose 3%.

In all for the latest quarter, P&G reported a 4.2% increase

in profit to $2.71 billion from a year ago. Revenue was essentially

flat at $16.5 billion.

The company backed its 2017 forecast for per-share earnings

growth in the mid-single digits from fiscal 2016 and sales growth

of about 1%.

Write to Sharon Terlep at sharon.terlep@wsj.com and Anne Steele

at Anne.Steele@wsj.com

(END) Dow Jones Newswires

October 25, 2016 11:55 ET (15:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

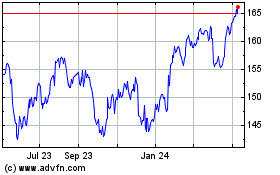

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

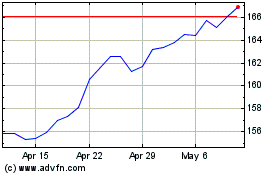

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024