Procter & Gamble, Activist Spar Over Latest Results -- 6th Update

July 27 2017 - 2:47PM

Dow Jones News

By Sharon Terlep

Procter & Gamble Co. sparred with activist investor Nelson

Peltz on Thursday, with the two sides debating whether the

company's latest results prove a turnaround is taking hold.

P&G executives argued the company's higher profit and sales

showed progress on multiyear efforts to cut costs and refocus on

its biggest brands, building their case against Mr. Peltz's demand

for a board seat.

But soon after Thursday's report, Mr. Peltz's Trian Fund

Management issued a statement saying the maker of Tide, Crest and

Gillette continues to lose market share and is saddled with

"excessive costs and bureaucracy."

In an interview, P&G Chief Executive David Taylor said he

would listen to Mr. Peltz but there was no reason to revisit the

company's strategy or give the activist a board seat. "I want to

stay focused on delivering the plan," he said. "We have done a

tremendous amount of work -- redoing it is not needed."

Mr. Peltz "hasn't offered incremental thoughts that we haven't

considered," Mr. Taylor said, "and there's a history of

establishing a shadow management team which we believe firmly would

derail the work that is already delivering improvement."

Mr. Taylor said Mr. Peltz had offered to have Trian researchers

do additional analysis on the company, something the CEO considered

unnecessary. DuPont Co., which won a proxy fight against Mr. Peltz

in 2015, had accused Trian of seeking to establish a "shadow

management" team focused on short-term results.

P&G said organic sales increased 2% for the quarter and full

year ended June 30. The closely watched metric, which strips out

currency moves, acquisitions and divestitures, remains well below

prerecession levels and lags behind some rivals. P&G forecast

growth of 2% to 3% next year.

Shares of P&G rose 1% to $90.21 in afternoon trading. The

shares are up about 7% this year compared with the S&P 500's

11% rise.

Trian is arguing that P&G remains bogged down by bureaucracy

and failed to capitalize on a recently completed five-year, $10

billion cost-cutting plan. P&G last year launched a second $10

billion savings plan and Mr. Peltz said giving him a seat on the

board will help ensure that money is well-spent.

On Thursday, Mr. Taylor said men's razors in the U.S. and

diapers in China will be two major areas of focus as P&G, which

has dropped hundreds of brands in recent years, looks to use its

smaller size to win back share in key markets. Mr. Taylor said that

turning around the Gillette razor brand, which has ceded market

share in recent years to cheaper online upstarts, is P&G's

biggest challenge.

In the final quarter of the company's fiscal year, P&G

reported a profit of $2.2 billion, or 82 cents a share, compared

with $1.96 billion, or 69 cents a share, a year ago.

Total revenue fell 0.1% in the quarter to $16.07 billion, and

slipped 0.4% in the full year. The revenue figures were depressed

by currency swings, since P&G generates much of its sales

outside the U.S.

Organic sales of beauty products and fabric and home-care

products both rose 5% in the quarter. Still, concerns remain about

the company's grooming and health-care lines, where organic sales

fell 1% each. Customers have increasingly turned to online sellers

for things such as razors and over-the-counter medications.

P&G fared better than some rivals in the most recent

quarter. Colgate-Palmolive Co.'s organic sales for the quarter were

flat and Kimberly-Clark saw a 1% decline. Unilever PLC reported a

3% organic sales increase, a decline from 4.7% growth a year

ago.

One analyst questioned whether heavy discounting by P&G is

in part responsible for the sluggish market. "You are taking prices

down more and raising prices less than competitors," Bernstein

analyst Ali Dibaj said on the call with executives.

P&G's Mr. Moeller said discounting by retailers has

contributed to lower pricing on consumer goods. "The ultimate price

consumers pay is at the discretion of retail partners and that's at

their sole discretion," he said.

--Cara Lombardo contributed to this article.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

July 27, 2017 14:32 ET (18:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

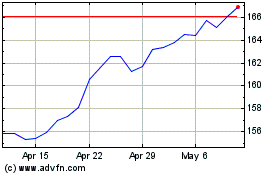

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

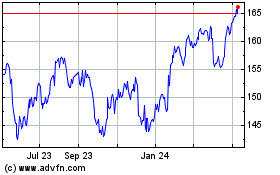

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024