Primark Plans Expansion as Operating Profit Beats Views

November 08 2016 - 7:50AM

Dow Jones News

LONDON—Primark owner Associated British Foods PLC said it plans

to expand the fast-fashion retailer's selling space across all its

major markets, including the U.S., as it reported annual operating

profit for the chain that beat expectations.

The company said awareness of the Primark brand has grown in the

U.S. It launched there last year in Boston and now has five stores,

most recently opening in regional malls in Connecticut, New Jersey

and Pennsylvania. A spokeswoman said Primark plans to open three

new U.S. stores, in Burlington, Mass., Braintree, Mass., and New

York's Staten Island borough, and will expand its Boston store by

31%, to 92,400 square feet.

The U.S. expansion is part of a steady rollout of new stores by

Primark, which now has stores in nine countries outside the U.K.

and Ireland and doesn't sell clothing online. Overall, the company

said it plans to open a further 1.3 million square feet of space in

fiscal 2017, an acceleration from last year, when it opened 1.2

million square feet.

"That new store openings are still greeted with enthusiasm by

our customers says much for the capability of our buyers and

merchandisers, who ensure that Primark remains at the forefront of

fashion, but is also the result of our store designers making

Primark an attractive and fun place to shop," said ABF Chairman

Charles Sinclair.

For the 53 weeks ended Sept. 17, ABF reported pretax profit of £

1.04 billion ($1.29 billion) on revenue of £ 13.39 billion, up from

£ 707 million on revenue of £ 12.80 billion a year earlier.

Primark's sales climbed 9% at constant currency, driven by store

openings. Same-store sales declined 2%, which the company blamed on

unseasonable weather and cautious consumer sentiment in key markets

like the U.K. and Germany. Adjusted operating profit ticked up to £

689 million from £ 673 million, although the margin dropped to

11.6% from 12.6%.

ABF warned that following the pound's slide in the wake of

Brexit, Primark's operating margins will be squeezed because the

company pays for much of the clothing it sources from Asia in

dollars. Still, Primark, whose success so far has hinged on its

ability to offer bargain-basement prices, said it remains committed

to maintaining its price leadership.

Primark's plans contrast with those of fellow retailer Marks

& Spencer Group PLC, which on Tuesday reported a sharp drop in

half-year underlying profit and said it would exit 10 international

markets—including China and Belgium—and close 60 of its clothing

and home stores in the U.K. As customers increasingly shop online,

retailers from supermarkets to apparel chains have struggled to

find the right number of physical stores to maximize

profitability.

M&S—a U.K. retail mainstay—said underlying pretax profit,

which strips out one-time charges, fell 19% to £ 231.1 million for

the six months ended Oct. 1. M&S's performance has been mixed

for a string of quarters now, with higher-performing food stores

and a struggling clothing and home business.

The company said it would close 60 of its clothing and home

stores in the U.K. over the next five years but would continue to

increase its food stores.

"This isn't about removing or reducing our clothing sales, it's

about making sure we have the right estate for how our customers

shop," said M&S Chief Executive Steve Rowe on a call with

reporters.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

November 08, 2016 07:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

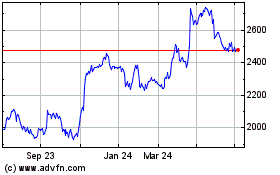

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Associated British Foods (LSE:ABF)

Historical Stock Chart

From Apr 2023 to Apr 2024