Premier Oil Shares Surge On Lower Payment for E.On UK Gas Assets--Update

February 01 2016 - 6:41AM

Dow Jones News

(Adds detail, analyst comment.)

By Alex MacDonald

LONDON--Premier Oil PLC (PMO.LN) shares more than doubled Monday

after they resumed trading following a near three-week suspension

related to the announcement of the company's proposed purchase of

E.ON SE's (EONGY) U.K. North Sea oil and gas assets.

The U.K.-listed oil firm's shares were suspended on Jan. 13 by

the U.K.'s Listing Authority to determine whether the $120 million

deal, which includes working capital adjustments, should be

classified as a reverse takeover.

Premier and E.ON have now agreed that Premier will pay a total

of $135 million to complete the deal: the original $120 million

plus $15 million to compensate E.ON for cash that will remain in

the assets. This compares to previous expectations that the company

would have to pay $120 million plus another $47 million for the

cash that was due to remain in the assets, a Premier spokesman

said.

Premier Oil's shares soared to 38.5 pence from 19 pence a share

when the shares were suspended.

Premier said E.ON is taking cash out of the assets more quickly

than previously expected by accelerating dividend payments from the

assets. This has reduced Premier's purchase price below its market

value, thus allowing its shares to resume trading since the UKLA

has now classified the deal as a class 1 transaction rather than a

reverse takeover.

The transaction is now subject to approval by Premier's

shareholders, who are due to vote on the deal in March or April. It

is also subject to approval by Premier's U.S. Private Placement

note holders and lending banks, Premier said.

Numis Securities said in a note that the deal "appears sensible"

given its quick payback, and should boost Premier's covenant

headroom. However, the broker notes that it does not provide a

solution to Premier's problems.

"Premier remains heavily indebted and without a substantial

increase in oil prices there remains the potential for future debt

restructuring," Numis added.

The broker noted that the company is still grappling with the

consequences of cost overruns at its Solan project in the North Sea

that have cost the company more than $1 billion. Premier's shares

are down 74% over the past year due to tumbling oil prices and its

hefty debt burden. By contrast, the U.K.'s FTSE 350 oil and gas

producers' index is down 17% over the same period.

The E.ON assets are concentrated in the Central North Sea, West

of Shetlands and the Southern Gas Basin and include stakes in

flagship assets such as the Elgin-Franklin, Huntington, Babbage and

Tolmount fields. The acquisition will add about 15,000 barrels of

oil equivalent a day of production to Premier's production profile

this year, accounting for at least a fifth of its 2016 forecast

output of about 65,000 to 70,000 barrels of oil equivalent a

day.

Write to Alex MacDonald at alex.macdonald@wsj.com

(END) Dow Jones Newswires

February 01, 2016 06:26 ET (11:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

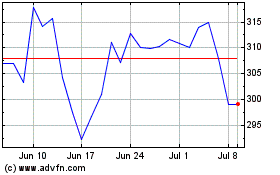

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Apr 2023 to Apr 2024