TIDMPMO

RNS Number : 8728D

Premier Oil PLC

12 July 2016

PREMIER OIL PLC

("Premier" or "the Company")

Trading and Operations Update

12 July 2016

Premier today provides an update on recent operational

activities and guidance in respect of its half year financials to

30 June 2016. The Group's Half-Yearly Results will be published on

Thursday 18 August 2016.

-- Strong production of 61.0 kboepd, with recent

record rates above 80 kboepd; full year production

expected to be at or above the upper end

of earlier guidance of 65-70 kboepd

-- Solan ramping up to 14 kbopd from P1, currently

at 11 kbopd; P2 completed, successfully tested

and will be tied in shortly

-- Integration of E.ON UK assets completed;

portfolio performing strongly

-- Catcher on schedule with the FPSO hull now

in Singapore; further cost reductions secured,

with capex now 20 per cent lower than at

sanction

-- Opex for the period of $16/boe, 14 per cent

below budget; weaker sterling exchange rate

will reduce cost of sterling denominated

opex, capex and debt

-- Net debt of c. $2.6 billion at period end,

flat on end Q1 2016 position; as previously

announced, negotiations with lenders are

progressing well with the main covenant test

deferred while discussions are finalised

Tony Durrant, Chief Executive, commented:

"Over the period, we have delivered a robust production

performance, achieved first oil from Solan, completed the E.ON

acquisition and reached key milestones on the Catcher project. We

have continued to secure cost reductions across the business and

are set to benefit from recent foreign exchange movements. We now

look forward to a rising production profile and, with Solan

on-stream, significantly lower committed capital expenditure. At

current oil prices, we start to generate free cash flow later this

year which positions us well to manage the balance sheet whilst

retaining some optionality for future growth projects."

Enquiries

Premier Oil plc Tel: 020 7730 1111

Tony Durrant, Chief

Executive

Richard Rose, Finance

Director

Bell Pottinger Tel: 020 3772 2570

Gavin Davis

Henry Lerwill

Production operations

Production averaged 61.0 kboepd for the first six months of the

year with a record rate of over 80 kboepd achieved post period end.

The newly acquired E.ON assets have continued to perform well and

the summer maintenance programme has been largely completed. With

Solan ramping up, Premier continues to expect full year production

to be at or above the upper end of its guidance of 65-70

kboepd.

Estimated 1H

kboepd 2016 1H 2015

------------- ------------- --------

Indonesia 13.8 13.2

Pakistan &

Mauritania 8.3 10.7

UK 22.2 16.9

Vietnam 16.7 19.6

------------- ------------- --------

Total 61.0 60.4

------------- ------------- --------

During the first six months of the year, production from

Indonesia averaged 13.8 kboepd, up 5 per cent on the prior period

driven by strong gas sales from Premier's operated Natuna Sea Block

A into Singapore and continued high market share (44 per cent)

within its principal gas sales agreement (GSA1). Production from

Premier's Pakistan and Vietnam assets remains in line with

expectations, supported by continued high operating efficiency and

good reservoir performance with the reduction from the prior

corresponding period reflecting some natural decline.

UK production was strong over the period, averaging 22.2 kboepd,

including a contribution from the newly acquired E.ON UK assets

from 28 April. The Huntington field has outperformed, producing at

consistent rates of c. 14 kboepd (gross) in H1 when not restricted

by summer maintenance, achieved by high uptime and lower than

predicted decline. The newly acquired E.ON UK assets are also

performing well. The Glenelg field (Premier 18.57 per cent) came

back on-stream at the end of May following a successful well

workover and has been producing over 20 kboepd (gross). The E.ON UK

portfolio is forecast to contribute over 17 kboepd during the

second half of the year.

First oil was achieved from the Solan field on 12 April. Premier

subsequently carried out a planned production shut down focused on

the final commissioning of the electrical systems, the control and

shut down systems and the water injection plant, taking advantage

of the availability of the flotel. The flotel has since departed

the field and production from the Solan field recommenced on 22

June. The field, which is currently producing at 11 kbopd, is

ramping up to 14 kbopd from the first production well with water

injection providing reservoir support. The drilling activities on

the second production well (P2Y) have been completed. A DSV is

scheduled to tie P2Y into production later this month after which

production from the field will build up to an anticipated plateau

rate of 20-25 kboepd.

Development projects

The Premier-operated Catcher project remains scheduled to

deliver first oil in the second half of 2017. Further cost savings

have been secured against the project estimates, with the release

of contingencies as work scopes are finished and drilling

activities are completed below budget. Premier now forecasts capex

to first oil of $1.3 billion and total project capex of $1.8

billion, a c. 20 per cent reduction on the original sanctioned

estimates. Further reductions in capex in dollar terms are

anticipated if the weak sterling dollar exchange rate persists with

c. 60 per cent of the project's remaining capex denominated in

sterling.

The subsea installation campaign continues apace and remains on

schedule for completion by Q4 2016: the flowline bundles, towhead

and midwater arches have all been installed while installation of

the buoy and mooring system is underway. Risers and umbilicals will

be installed this year. Five wells have now been drilled, including

the first Burgman production well, with all meeting or exceeding

pre-drill expectations. Well sequencing has also been modified to

avoid more costly winter rig moves and work continues to evaluate

the potential to reduce overall well count without impacting

production. The FPSO hull has now been delivered to the Keppel yard

in Singapore while fabrication of the topsides modules is

progressing well. The sail-away date of the FPSO from Singapore for

a 2017 field start up remains on track.

Premier continues to progress its pre-development projects. In

Indonesia, FEED has been completed on the Bison, Iguana and Gajah

Puteri gas fields and an investment decision on these projects is

targeted for the fourth quarter of this year. Work is ongoing on

the Tolmount gas field development project in which Premier

acquired a 50 per cent operated interest through its acquisition of

E.ON in April. Concept selection is targeted for the second half of

the year. In the Falklands, FEED on the Premier operated Sea Lion

project is progressing well and identified cost reductions continue

to lower the break-even oil price for the project.

Exploration and appraisal

Premier plans to spud the Bagpuss heavy oil exploration prospect

in the Moray Firth in the UK North Sea in July. The well will be

drilled using the Ocean Valiant rig, which is currently preparing

to move off location at the Solan field following completion of

drilling activities. The results of the Bagpuss well are expected

in early August.

In Brazil, interpretation of the new 3D seismic survey covering

Premier's licences in the Ceara Basin is progressing while in

Mexico Premier is undertaking a detailed technical evaluation of

its Block 2 and Block 7 acreage, ahead of the first well on Block 7

planned for next year.

During the period, Premier exited its licence position in the

Saharawi Arab Democratic Republic and is in the process of

finalising its exit from its Iraq licence. Premier expects to high

grade and rationalise the exploration portfolio acquired with the

E.ON portfolio during the course of the second half of the

year.

Portfolio Management

Premier completed the acquisition of E.ON's UK North Sea assets

on 28 April. Management of E.ON's UK portfolio transferred to

Premier's UK business unit in Aberdeen with effect from 1 July.

Elsewhere, Premier has agreed terms with a preferred bidder for the

sale of its Pakistan business. Completion of the transaction

remains subject to the purchaser putting in place necessary funding

arrangements.

Finance

Total revenues for the first six months of the year will be in

the order of $390 million (2015: $577.0). The estimated average oil

price realised for the first half of 2016 was $47.5/bbl (2015 1H:

$83.7/bbl) (post hedge) compared with an average spot Brent crude

price of $39.8/bbl. Estimated average gas prices (post-hedge)

realised from our Indonesia and Pakistan assets for the period were

$5.8/mscf (2015 1H: $12.3/mscf) and $3.1/mscf (2015 1H: $4.4/mscf)

respectively. Estimated average gas price (post hedge) realised

from our southern North Sea gas assets was 41 pence/therm.

Operating costs are expected to be c. $180 million for the first

half (2015: $149.8 million), 14 per cent under budget, and equating

to c. $16/boe across the group. The increase in absolute operating

costs on the prior period reflects the operating costs associated

with the E.ON UK assets, the Solan field and the Company's higher

equity interest in the Huntington field partially offset by c. $20

million of savings in underlying opex.

On 1 July, Ezra Holdings announced the sale of its 80 per cent

stake in the Chim Sao FPSO, to PetroFirst Infrastructure. Premier,

in its capacity as Block 12W operator, is in advanced discussions

with PetroFirst regarding revised terms, including reductions in

the cost of the FPSO lease rate. Negotiations are expected to

conclude during the third quarter.

Premier's exploration and development capital expenditure for

the period will be of the order of $310 million. 2016 full year

guidance remains unchanged at $730 million. Premier has taken

advantage of the recent weakness in the sterling dollar exchange

rate to lock in GBP110 million of forward expenditure in the second

half of the year at an average rate of 1.31. Premier expects

reductions in its operating costs and capital expenditure if the

current sterling dollar exchange rate weakness persists with over

half of the company's remaining 2016 capex and opex denominated in

sterling.

Expenditure related to decommissioning in the first half was

$56.8 million and included a one off $53 million catch up payment

into escrow for future decommissioning of Chim Sao.

Premier will report a deferred tax credit for the period in

relation to the expected recognition of its UK tax losses as a

result of anticipated future profitability from the acquisition of

E.ON's UK North Sea assets. Premier also expects to recognise

negative goodwill in relation to the acquisition of E.ON's UK North

Sea assets.

Premier retains cash and undrawn facilities of c. $800 million

as at 30 June with net debt of c. $2.6 billion at period end and

flat on end Q1 2016 position. The lower sterling exchange rate also

reduces the dollar value of Premier's GBP510 million sterling

denominated debt and Letters of Credit.

Negotiations with Premier's lenders continue to progress well.

The previously announced deferral of the covenant test to 31 July

2016 allows further time for Premier and its lender group to

finalise discussions around amendments to Premier's medium term

covenant profile and the extension of debt maturities. In return

for the proposed amendments, it is anticipated that Premier will

provide additional security for existing debt holders. Premier

expects negotiations to conclude during Q3 2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFEDDFILLIR

(END) Dow Jones Newswires

July 12, 2016 02:00 ET (06:00 GMT)

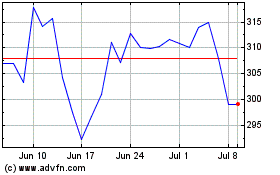

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Apr 2023 to Apr 2024