TIDMPMO

RNS Number : 8550X

Premier Oil PLC

11 May 2016

PREMIER OIL PLC

("Premier" or "the Company")

Trading and Operations Update

11 May 2016

Premier today provides the following trading update for the

period 1 January to 30 April 2016. This update is issued in advance

of the Company's Annual General Meeting which is being held today

at 11 Cavendish Square, London at 11.00 am.

Highlights

-- Strong production to 30 April of 57.3 kboepd;

on track to deliver at or above upper end of

2016 guidance of 65-70 kboepd for the full

year

-- Completed acquisition of E.ON's UK North Sea

assets on 28 April

-- Oil production from the Solan field commenced

on 12 April; rates of over 14 kbopd achieved

from the first producer well; second well due

on-stream by mid-year

-- The Catcher project remains on schedule and

below budget; pre-first oil capex forecast

is 15 per cent lower due to significant cost

savings

-- Operating costs and gross G&A tracking 10-20

per cent below 2016 budget, year-to-date

-- Significant liquidity with cash and undrawn

bank facilities of c. $750 million; discussions

ongoing with lenders to secure financial covenant

waiver if required

Tony Durrant, Chief Executive, commented:

"Strong production performance from our existing assets,

together with the contribution from the E.ON assets and the Solan

field means that we now expect production for the year to be better

than we originally anticipated. This, along with continued cost

savings, positions us well to maximise our current cash flow as we

remain focused on managing our balance sheet in the current oil

price environment."

Premier Oil plc Tel: 020 7730 1111

Tony Durrant

Richard Rose

Bell Pottinger Tel: 020 3772 2570

Gavin Davis

Henry Lerwill

Production operations

Premier delivered a robust production performance of 57.3 kboepd

in the period, driven by further improvements in operating

efficiency across the portfolio and strong gas sales into

Singapore. The reduction from the prior corresponding period

reflects some natural decline in Pakistan and Vietnam, although the

Chim Sáo field in Vietnam continues to deliver ahead of

expectations, with high uptime and good reservoir performance.

Kboepd 1 January - 30 April 1 January - 30 April

2016 2015

------------- --------------------- ---------------------

Indonesia 14.0 13.2

Pakistan &

Mauritania 8.3 10.9

UK 17.6 16.1

Vietnam 17.4 20.0

------------- --------------------- ---------------------

Total 57.3 60.2

------------- --------------------- ---------------------

In the UK, excellent operating efficiency and lower than

anticipated decline levels at the Huntington field more than offset

the later than expected start-up of the Solan field and an

unplanned shut down on B block earlier in the period. In Indonesia,

production from the Premier-operated Natuna Sea Block A is ahead of

expectations due to continued strong gas demand from Singapore and

high market share of GSA1 of 44 per cent.

The UK assets acquired from E.ON performed well over the period,

delivering 17 kboepd which will be consolidated from completion.

This, combined with the robust production performance of the

existing portfolio and new production from the Solan field, means

that Premier now expects to be at or above the upper end of its

2016 production guidance of 65-70 kboepd for the full year.

Development projects

First oil from the Solan P1 production well was achieved on 12

April. The well achieved rates of 8 kbopd on natural flow before

rising to 14 kbopd following the successful commissioning of the

down hole pump ("ESP"). As planned, production was subsequently

shut down to complete the additional works required for second oil:

the tie-in of the second water injector was completed with final

commissioning of the water injection system underway, while the ESP

completion for P2 is being installed with tie in of the well

planned for early June. Resumption of production is scheduled

shortly after, with the Solan field expected to reach production

rates of 20-25 kbopd in the third quarter when both pairs of

producer-injector wells will be on stream.

The Premier-operated Catcher project is progressing under budget

and is scheduled to deliver first oil in the second half of 2017.

Forecast gross capex to first oil is now anticipated to be c.

$1.35bn, a reduction of c. 15 per cent below that original

sanctioned. Cost savings secured include reductions negotiated on

contracts, the release of contingencies as work programmes are

completed, and the re-phasing of some contractor payments and work

scopes, given the good progress made to date in the subsea

installation campaign and the drilling results.

The 2016 subsea installation campaign is progressing well. The

four remaining drilling templates are now in place while

installation of the flowline bundles, towheads and mid water arches

is in progress. The dynamic risers and umbilicals are on track for

delivery in June. Premier is targeting completion of subsea work in

2016 ahead of schedule. Meanwhile, the Buoy is transiting to North

East Scotland and, together with the mooring system, is on track

for installation this summer. Drilling on the first Catcher

template has been completed and all four wells have met or exceeded

pre-drill expectations. Drilling on the Burgman template is

expected to commence shortly, following the completion of drilling

at the Laverda/Slough exploration prospects.

Delivery of the FPSO hull to Singapore is expected by July and

progress in manufacturing of the topside units has been good.

Following integration and commissioning, the sail-away date of the

FPSO from Singapore for a 2017 field start up remains on track.

On the Sea Lion Phase 1 project in the Falkland Islands, the 18

month FEED programme, which commenced in January, is ongoing. The

draft Field Development Plan has been submitted to the Falkland

Islands Government and detailed discussions are progressing well.

Premier still intends to bring in an additional partner and further

cost savings are targeted - especially in light of the downturn in

the markets for production facilities, well construction and

offtake services - to further reduce the break-even oil price for

the project. The timing of the final investment decision remains

dependent on the evolution of project economics and the oil price

outlook.

Exploration and appraisal

The Ensco 100 rig spudded the Laverda/Slough prospect, near the

Catcher area in the UK North Sea, in April. The commitment well

encountered 13 feet of net oil bearing Tay sands at Laverda, in

line with pre-drill expectations, but did not encounter any

indications of hydrocarbons in the deeper, high risk Slough

prospect. The well is now being plugged and abandoned ahead of the

rig continuing development drilling at the Catcher area.

Premier plans to drill the Bagpuss heavy oil exploration

prospect in the Moray Firth in the UK North Sea in June, using the

Ocean Valiant rig, which is currently operating at Solan.

Premier will continue to high grade and rationalise its UK North

Sea exploration portfolio including those licences acquired as part

of the acquisition of E.ON's UK North Sea assets.

In Brazil, interpretation of the recently acquired 3D seismic

survey covering our licences in the Ceara Basin is ongoing while in

Mexico Premier is undertaking a detailed technical evaluation of

its Blocks 2 and 7 acreage, ahead of the first well on Block 7

expected next year.

Portfolio Management

Premier completed the acquisition of E.ON's UK North Sea assets

on 28 April. The integration process has commenced which will see

the transition of the assets into Premier's existing UK business

unit. In addition, the formal sales process for the Pakistan

business, initiated after an unsolicited approach, is ongoing. A

number of bids have been received which continue to be progressed.

In the exploration portfolio, Premier has now exited its licence

positions in the Saharawi Arab Democratic Republic.

Finance

In order to plan and protect future cash flows Premier continues

with its hedging programme. At 30 April the Company's hedge

position to the end of 2017 was as follows:

Hedge position 2016 2017

---------------- -------------------------- --------------------------

Oil hedges Volume Average Volume Average

(mbbls) price ($/bbl) (mbbls) price ($/bbl)

---------------- --------- --------------- --------- ---------------

Premier 4.76 62.0 1.53 45.8

E.ON 0.77 97.4 0 0

---------------- --------- --------------- --------- ---------------

Total 5.53 67.0 1.53 45.8

---------------- --------- --------------- --------- ---------------

For 2016, Premier has hedged 72,000 metric tonnes (mt) of high

sulphur fuel oil through forward sales at an average price of

$400/mt. In addition, 64.0 million therms of the E.ON assets 2016

gas production and 36.6 million therms of the 2017 gas production

has been sold forward at 63 pence per therm and 57 pence per therm,

respectively.

Operating costs continue to fall and are tracking 10-20 per cent

under budget, year-to-date. Operating cost per barrel for 2016

after taking these cost savings into account together with the

operating costs associated with the acquired E.ON UK assets and the

Solan field, are expected to be around $17/boe. Gross G&A costs

are also under budget and are on track to deliver previous guidance

of a 10 per cent reduction on 2015 excluding the impact of the E.ON

acquisition.

Capital expenditure for development and exploration for 2016 is

now expected to be c. $730 million, reflecting capex associated

with E.ON's UK assets.

Premier retains significant cash and undrawn facilities of c.

$750 million as at 30 April with net debt of $2.68 billion. Premier

does not have any significant debt maturity until late 2017 and the

nature of its corporate unsecured facility means that it is not

subject to any reserve base redeterminations. However, due to the

weak oil prices experienced year-to-date, it is possible that a

relaxation of our main financial covenants may be required in

respect of the testing periods ending 30 June 2016 and 31 December

2016. Premier continues to explore mitigating actions that can

improve its forecast financial covenant position and, in addition,

has entered into discussions with its lending group with a view to

agreeing amendments to its financial covenants.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFVAEVIILIR

(END) Dow Jones Newswires

May 11, 2016 02:00 ET (06:00 GMT)

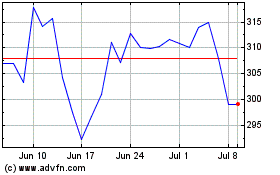

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Apr 2023 to Apr 2024