TIDMPMO

RNS Number : 5868S

Premier Oil PLC

09 July 2015

PREMIER OIL PLC

("Premier", "Company" or "Group")

Trading and Operations Update

9 July 2015

Premier today provides an update summarising recent operational

activities and guidance in respect of its half year financials to

30 June 2015. This is in advance of the Group's 2015 Half-Yearly

Results which will be published on Thursday 20 August 2015.

Tony Durrant, Chief Executive, commented:

"We have delivered a strong production performance in the first

half while further progressing our sanctioned developments and

achieving significant exploration success in the Falklands. We have

remained focused on minimising our cost base with forecast full

year operating expenditure below our already considerably reduced

budgets. Consequently, net debt during the first half has remained

flat despite our continuing investment programme. We remain

well-placed to generate long term cash flows to fund both our

committed developments and to manage our balance sheet, even in a

sustained low oil price environment."

Production

Premier delivered a robust production performance in the first

six months of the year, with production averaging 60.3 kboepd. Full

year guidance is reiterated at 55 kboepd (excluding new production

from Solan), taking into account planned maintenance work in the

second half and natural decline in a number of our fields.

Country Estimated 1H 2015 1H 2014

kboepd kboepd

----------------------- ------------------ ----------

Indonesia 13.1 14.0

Pakistan & Mauritania 10.8 13.8

UK 16.8 21.3(*)

Vietnam 19.6 15.8

----------------------- ------------------ ----------

Total 60.3 64.9

----------------------- ------------------ ----------

(*Includes assets sold in 2014)

The Premier-operated Chim Sáo field in Vietnam continues to

outperform, driven by high operating efficiency and better than

predicted reservoir performance. This was offset by lower

production from the Huntington field, caused by constraints on the

gas export route during the first quarter. Huntington resumed

unrestricted production on 15 April. Amendments to the gas

transportation agreement have now been finalised providing improved

certainty of Huntington gas export volumes going forward. Premier's

other production assets continue to perform in line with

expectations.

Development projects

Work on the Premier-operated Solan facilities continues. With

the Victory flotel on location in the second quarter, Premier was

able to make significant progress towards achieving habitation of

the facilities. Increased offshore productivity was realised,

partly due to improvement in the weather but also due to

organisational changes in the project execution team. The Victory

flotel went off contract as planned in mid-May and was replaced

with the Siem Spearfish 'walk-to-work' vessel, providing continuity

of resources on the platform until the larger Regalia flotel

arrives in early August. These two campaigns will enable habitation

of the platform and completion of the commissioning of the

production systems to allow first oil. Following the successful

tie-in of the first pair of producer-injector wells, commissioning

of the subsea infrastructure commenced in June and remains on-track

for completion in September. In parallel, drilling of the second

pair of producer-injector wells has commenced. First oil continues

to be targeted for the fourth quarter this year. Cash spend to 30

June on the Solan project stood at $1.6 billion.

In May, Premier successfully acquired Chrysaor's 40 per cent

interest in the Solan field for nil upfront consideration and

entered into an agreement with FlowStream whereby a US$100 million

payment was received in return for the proceeds from 15 per cent of

production from the field for a period of time. As a result,

partner funding concerns around the Solan project have been removed

while, at the same time, the Group's balance sheet exposure to the

project has been reduced.

The Premier-operated Catcher project remains within budget and

on schedule for first oil in 2017. Subsea installation work has

commenced with two templates already installed and gas export pipe

lay underway. The Ensco rig is now on hire and is on track to

commence development drilling shortly. Construction of the FPSO

remains on-going with the mating cone module completed and

delivered to the hull fabrication yard.

At the Premier-operated Vette development, alternative

lower-cost production facilities to a new build FPSO are being

evaluated while Premier is continuing to progress pre-FEED

activities and contractor selection on its Sea Lion project in the

Falkland Islands. A 2016 sanction decision is still targeted for

both developments.

Exploration and appraisal

Premier has had a successful start to its Falkland Islands

exploration campaign with discoveries at both Zebedee and Isobel

Deep. The Isobel Deep well encountered oil bearing sandstone at the

prognosed depth but was suspended due to unexpected overpressure.

Pre-drill, the un-risked Pmean resources of the Elaine/Isobel

complex were 400 mmbbls of oil and while this has not changed as a

result of the well, the risk has reduced. The Eirik Raude rig is

expected to return to the North Falklands basin in August to drill

the Jayne East and Chatham wells. Consideration is being given to

performing more drilling at Isobel Deep as part of the programme,

possibly replacing the Jayne East well.

In Indonesia, the Anoa Deep appraisal well spudded in April and

reached total depth in June. Following encouraging logging results,

preparations are now being made to test the well with results

expected later this month. Meanwhile, the Myrhauk well on the

eastern flank of the Mandal High offshore Norway is expected to

spud in mid-July with results anticipated in September.

During the period, Premier continued to re-shape its exploration

portfolio with 21 further licence relinquishments and disposals in

mature areas. At the same time, Premier is continuing to pursue its

strategy of adding acreage in emerging plays. Accordingly, Premier

has farmed into Block 661 in the Ceara basin in Brazil, subject to

government approval, and joined a consortium to evaluate Mexico's

Round 1 opportunities, with bidding scheduled for 15 July.

Premier's 2015 exploration & appraisal programme

--------------------------------------------------------------------------------------------

Country Well name Timing Licence Gross prospective Risk

interest resource (mmboe)

(%)

----------- ------------------------ --------- ---------- ------------------ ------------

Indonesia Anoa Deep appraisal(*) Q2 2015 28.67 8-13-40 Low

----------- ------------------------ --------- ---------- ------------------ ------------

Norway Myrhauk Q3 2015 40.00 10-50-135 Moderate

----------- ------------------------ --------- ---------- ------------------ ------------

Falklands Jayne East(**) Q3 2015 36.00 23-73-232 Low

----------- ------------------------ --------- ---------- ------------------ ------------

Falklands Chatham(**) Q3 2015 60.00 4-19-80 High

----------- ------------------------ --------- ---------- ------------------ ------------

(*) The Anoa Deep appraisal well will appraise the initial Anoa

Deep discovery as well as test the upside within the deeper part of

the Lama play

(**) Volumes quoted are unrisked prospective resources and

excludes volumes associated with appraisal of the main Sea Lion

field

Portfolio management

Following the receipt of an offer for Premier's Pakistan

business, the Company is initiating a process among interested

parties with a view to a possible disposal of Premier's Pakistan

interests.

Financials

Total revenues for the first six months of the year will be in

the order of $580million (2014 H1: $885 million), reflecting the

lower oil price environment and lower production year-on-year as a

result of the Scott area disposal. Premier continues to protect its

2015 revenues through an active hedging programme with 5.6 mmbbls

of dated Brent and 120 kmt of high sulphur fuel oil sold forward at

an average price of $97.6/bbl and $532.6/mt, respectively. Premier

has also hedged a portion of its 2016 forecast production with 3.5

mmbbls of dated Brent and 48 kmt of high sulphur fuel oil sold

forward at an average price of $68.7/bbl and $400.1/mt,

respectively.

The estimated average oil price realised for the first half of

2015 was $83.7/bbl (1H 2014: $110.2/bbl) (post hedge) compared with

an average spot Brent crude price of $57.8/bbl. Estimated average

gas prices (post-hedge) realised from our Indonesia and Pakistan

assets for the period were $11.8/mscf (2014: $16.9/mscf) and

$4.4/mscf (2014: $4.7 mmscf) respectively.

Operating costs are expected to be around 30 per cent lower at

circa $150 million (2014: $216.9 million) for the first half,

equating to around $14/boe across the group. This reflects the sale

of the high cost Scott area in the UK as well as significant

savings realised in on-going operations across the group. Group

G&A costs on a gross basis for the first half were

approximately 20 per cent lower at $115 million (2014: $140

million), with savings in contractor rates and reduced

headcount.

Premier's development capital expenditure forecast for 2015

remains unchanged. For accounting purposes, the loan to Chrysaor to

fund their share of Solan development costs was treated separately

to the Company's own expenditure. Now the acquisition of Chrysaor's

interest in Solan has completed, this will be consolidated into

Premier's capex forecast, resulting in anticipated full year

expenditure of around $900 million, previously guided as $750

million of development capex and $150 million loan to Chrysaor.

Planned exploration expenditure for 2015 has increased by $20

million to around $240 million primarily due to additional

expenditure on the Isobel Deep well in the Falklands.

As at 30 June, net debt was flat on the year-end position at

$2.1 billion, despite the continuing period of development

investment and the exploration campaign in the Falkland Islands.

This is primarily due to a combination of Premier's strong

production performance, lower operating costs, proceeds received

from disposals and the benefit of the company's hedging

programme.

Premier retains significant cash and undrawn facilities. As at

30 June, these were approximately $350 million and $1.1 billion

respectively. During the period, Premier bought back $148 million

and EUR40 million of its US private placement notes at a discount

to par and repaid a $300 million term loan maturing in the first

quarter of 2015.

The Group also continues to benefit economically from its

substantial UK tax loss and allowance position with estimated

losses and allowances of $3.3 billion carried forward at 30 June.

This includes the 2015 RFES claim and certain tax allowances

acquired as part of the Chrysaor transaction. The reduction in the

Supplementary Charge Tax rate from 32 per cent to 20 per cent as at

1 January 2015 has resulted in a reduction in the rate at which we

can value our tax losses and allowances for deferred tax asset

purposes. As a result, Premier expects to book a deferred tax

charge to its income statement in respect of this rate

reduction.

Management responsibility changes

As previously announced, Andrew Lodge retired as Exploration

Director on 30 June. Dean Griffin, previously Premier's Exploration

Geoscience Manager, has been appointed Head of Exploration and will

report to Robin Allan, who retains responsibility for the North Sea

and Pakistan business units. Responsibility for the South East Asia

business units has transferred from Robin to Neil Hawkings, who

retains responsibility for the Falkland Islands business unit.

Enquiries

Premier Oil plc Tel: 020 7730 1111

Tony Durrant, Chief Executive

Richard Rose, Finance Director

Bell Pottinger Tel: 020 3772 2570

Gavin Davis

Henry Lerwill

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLIFSEDEIAIIE

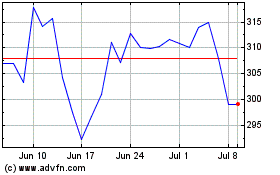

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Apr 2023 to Apr 2024