Premier Oil PLC Operational update (8835Z)

September 23 2015 - 2:01AM

UK Regulatory

TIDMPMO

RNS Number : 8835Z

Premier Oil PLC

23 September 2015

PREMIER OIL PLC

("Premier" or "the Company")

Operational update

23 September 2015

Premier today provides an update on its recent operational

activities.

Production year-to-date has averaged 57.1 kboepd. Summer

maintenance activities have been successfully completed and

production has returned to previous levels. As a result, production

remains ahead of full year guidance of 55 kboepd, before any

contribution from Solan.

Premier has hedged approximately 60 per cent of its 2015 2H

liquids production at $92/bbl and 30 per cent of its expected

liquids production in 2016 at $68/bbl. Premier will continue to

seek to add to this position as market conditions allow. As a

result of significant cost savings, Premier continues to expect

full year opex of c. $16/boe.

Premier anticipates first oil from Solan in Q4 2015, as

previously guided. Good offshore productivity and 97 per cent

uptime has been achieved with the Regalia flotel. A number of the

critical path platform systems have now been successfully

commissioned including the firewater deluge system and other safety

related systems such as the gas detection system. 34,000 hours of

planned commissioning activity remains to first oil (down from

56,000 hours at the time of the company's Half-Yearly Results in

August) and these are being liquidated at a rate of 600-800 hours

per day. Completion of the commissioning of the subsea

infrastructure is also progressing well.

2015 full year capex guidance is unchanged and Premier continues

to forecast a significant reduction in year-on-year capex in

2016.

Premier continues to enjoy significant liquidity with $1.3

billion of cash and undrawn credit facilities. The company's long

term unsecured debt structure means that Premier is not subject to

borrowing base redeterminations and the company has no maturities

on any of its debt instruments until end 2017. Its principal $2.5

billion bank facility is not due for refinancing until mid-2019. As

announced at the Half-Yearly results, Premier has increased its

financial flexibility with the successful renegotiation of its

covenants out to mid-2017.

Enquiries

Premier Oil plc Tel: 020 7730 1111

Tony Durrant, CEO

Richard Rose, Finance

Director

Bell Pottinger Tel: 0203 772 2500

Gavin Davis

Henry Lerwill

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEWEFEFISEFU

(END) Dow Jones Newswires

September 23, 2015 02:01 ET (06:01 GMT)

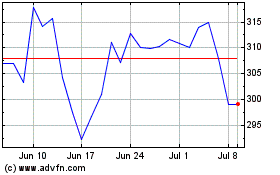

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Apr 2023 to Apr 2024